UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 27, 2015

TEXTRON INC.

(Exact name of Registrant as specified in its charter)

|

Delaware |

|

1-5480 |

|

05-0315468 |

|

(State of |

|

(Commission File Number) |

|

(IRS Employer |

|

Incorporation) |

|

|

|

Identification Number) |

40 Westminster Street, Providence, Rhode Island 02903

(Address of principal executive offices)

Registrant’s telephone number, including area code: (401) 421-2800

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c)) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On October 27, 2015, Textron Inc. (“Textron”) issued a press release announcing its financial results for the fiscal quarter ended October 3, 2015. This press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

A discussion of the reasons why management believes that the presentation of non-GAAP financial measures provides useful information to investors regarding Textron’s financial condition and results of operations is attached to the press release attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following exhibit is filed herewith:

|

Exhibit |

|

|

|

Number |

|

Description |

|

|

|

|

|

99.1 |

|

Press release dated October 27, 2015 related to earnings. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

TEXTRON INC. |

|

|

(Registrant) |

|

|

|

|

|

|

|

|

|

By: |

/s/ Mark S. Bamford |

|

|

|

Mark S. Bamford |

|

|

|

Vice President and Corporate Controller |

|

|

|

Date: October 27, 2015

3

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press release dated October 27, 2015 related to earnings. |

4

Exhibit 99.1

|

|

|

|

|

|

Corporate Communications Department |

NEWS Release |

|

Investor Contacts:

Douglas Wilburne — 401-457-2288

Robert Bridge — 401-457-2288 |

FOR IMMEDIATE RELEASE |

|

|

|

|

Media Contact:

David Sylvestre — 401-457-2362 |

|

Textron Reports Third Quarter 2015 Income from Continuing Operations

of $0.63 per Share, up 10.5%

Providence, Rhode Island — October 27, 2015 — Textron Inc. (NYSE: TXT) today reported third quarter 2015 income from continuing operations of $0.63 per share, up 10.5 percent from $0.57 per share in the third quarter of 2014.

Revenues in the quarter were $3.2 billion, down 7.3 percent compared to $3.4 billion in the third quarter of 2014. Textron segment profit in the quarter was $312 million, up $19 million from the third quarter of 2014. Third quarter manufacturing cash flow before pension contributions was $116 million compared to $144 million during last year’s third quarter.

“Revenues were down in the quarter, primarily driven by lower deliveries of V-22s at Bell, but we had solid revenue growth at Textron Aviation, Textron Systems and Industrial, reflecting our investments in new products and sales capabilities,” said Textron Chairman and CEO Scott C. Donnelly. “Furthermore, good margin results across our segments contributed to solid overall financial performance in the quarter, despite the decrease in revenues.”

Outlook

Textron revised its 2015 earnings per share from continuing operations guidance to a range of $2.40 to $2.50 from $2.30 to $2.50 and confirmed its expectation for cash flow from continuing operations of the manufacturing group before pension contributions of $550 to $650 million with planned pension contributions of about $70 million.

Third Quarter Segment Results

Textron Aviation

Revenues at Textron Aviation were up $79 million, primarily reflecting higher jet and military volumes. Textron Aviation delivered 37 new Citation jets and 29 King Air turboprops in the quarter, compared to 33 Citations and 30 King Airs in last year’s third quarter.

Textron Aviation recorded a segment profit of $107 million in the third quarter compared to $62 million a year ago. The increase is primarily due to the higher volumes and mix and improved

performance, which included lower amortization of $9 million related to fair value step-up adjustments.

Textron Aviation backlog at the end of the third quarter was $1.4 billion, approximately flat with the end of the second quarter.

Bell

Bell revenues decreased $426 million, primarily the result of lower V-22 aircraft deliveries, lower commercial aftermarket volume and a change in mix of commercial aircraft. Bell delivered 4 V-22’s and 5 H-1’s in the quarter, compared to 12 V-22’s and 4 H-1’s in last year’s third quarter and 45 commercial helicopters, compared to 41 units last year.

Segment profit decreased $47 million primarily due to the lower volumes partially offset by favorable performance.

Bell backlog at the end of the third quarter was $5.1 billion, up $338 million from the end of the second quarter.

Textron Systems

Revenues at Textron Systems increased $62 million, primarily due to higher Weapons and Sensors and Unmanned Systems volumes.

Segment profit was up $12 million, reflecting the impact of the higher volumes.

Textron Systems’ backlog at the end of the third quarter was $2.6 billion, down $142 million from the end of the second quarter.

Industrial

Industrial revenues increased $43 million due to higher overall volumes, partially offset by a $59 million unfavorable impact from foreign exchange.

Segment profit increased $8 million reflecting the impact of the higher volumes.

Finance

Finance segment revenues decreased $8 million and segment profit increased $1 million.

Conference Call Information

Textron will host its conference call today, October 27, 2015 at 8:00 a.m. (Eastern) to discuss its results and outlook. The call will be available via webcast at www.textron.com or by direct dial at (800) 700-7860 in the U.S. or (612) 332-1210 outside of the U.S. (request the Textron Earnings Call).

In addition, the call will be recorded and available for playback beginning at 10:30 a.m. (Eastern) on Tuesday, October 27, 2015 by dialing (320) 365-3844 ; Access Code: 337221.

A package containing key data that will be covered on today’s call can be found in the Investor Relations section of the company’s website at www.textron.com.

2

About Textron Inc.

Textron Inc. is a multi-industry company that leverages its global network of aircraft, defense, industrial and finance businesses to provide customers with innovative solutions and services. Textron is known around the world for its powerful brands such as Bell Helicopter, Cessna, Beechcraft, Hawker, Jacobsen, Kautex, Lycoming, E-Z-GO, Greenlee, Textron Systems, and TRU Simulation + Training. For more information visit: www.textron.com.

###

Non-GAAP Measures

Manufacturing cash flow before pension contributions is a non-GAAP measure that is defined and reconciled to GAAP in an attachment to this release.

Forward-looking Information

Certain statements in this release and other oral and written statements made by us from time to time are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, which may describe strategies, goals, outlook or other non-historical matters, or project revenues, income, returns or other financial measures, often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “guidance,” “project,” “target,” “potential,” “will,” “should,” “could,” “likely” or “may” and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements. In addition to those factors described under “RISK FACTORS” in our Annual Report on Form 10-K, among the factors that could cause actual results to differ materially from past and projected future results are the following: interruptions in the U.S. Government’s ability to fund its activities and/or pay its obligations; changing priorities or reductions in the U.S. Government defense budget, including those related to military operations in foreign countries; our ability to perform as anticipated and to control costs under contracts with the U.S. Government; the U.S. Government’s ability to unilaterally modify or terminate its contracts with us for the U.S. Government’s convenience or for our failure to perform, to change applicable procurement and accounting policies, or, under certain circumstances, to withhold payment or suspend or debar us as a contractor eligible to receive future contract awards; changes in foreign military funding priorities or budget constraints and determinations, or changes in government regulations or policies on the export and import of military and commercial products; volatility in the global economy or changes in worldwide political conditions that adversely impact demand for our products; volatility in interest rates or foreign exchange rates; risks related to our international business, including establishing and maintaining facilities in locations around the world and relying on joint venture partners, subcontractors, suppliers, representatives, consultants and other business partners in connection with international business, including in emerging market countries; our Finance segment’s ability to maintain portfolio credit quality or to realize full value of receivables; performance issues with key suppliers or subcontractors; legislative or regulatory actions, both domestic and foreign, impacting our operations or demand for our products; our ability to control costs and successfully implement various cost-reduction activities; the efficacy of research and development investments to develop new products or unanticipated expenses in connection with the launching of significant new products or programs; the timing of our new product launches or certifications of our new aircraft products; our ability to keep pace with our competitors in the introduction of new products and upgrades with features and technologies desired by our customers; pension plan assumptions and future contributions; demand softness or volatility in the markets in which we do business;

3

cybersecurity threats, including the potential misappropriation of assets or sensitive information, corruption of data or operational disruption; difficulty or unanticipated expenses in connection with integrating acquired businesses; and the risk that anticipated synergies and opportunities as a result of acquisitions will not be realized or the risk that acquisitions do not perform as planned, including, for example, the risk that acquired businesses will not achieve revenue and profit projections.

4

TEXTRON INC.

Revenues by Segment and Reconciliation of Segment Profit to Net Income

Three and Nine Months Ended October 3, 2015 and September 27, 2014

(Dollars in millions, except per share amounts)

(Unaudited)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

October 3,

2015 |

|

September 27,

2014 |

|

October 3,

2015 |

|

September 27,

2014 |

|

|

REVENUES |

|

|

|

|

|

|

|

|

|

|

MANUFACTURING: |

|

|

|

|

|

|

|

|

|

|

Textron Aviation |

|

$ |

1,159 |

|

$ |

1,080 |

|

$ |

3,334 |

|

$ |

3,048 |

|

|

Bell |

|

756 |

|

1,182 |

|

2,419 |

|

3,174 |

|

|

Textron Systems |

|

420 |

|

358 |

|

1,057 |

|

1,003 |

|

|

Industrial |

|

828 |

|

785 |

|

2,627 |

|

2,476 |

|

|

|

|

3,163 |

|

3,405 |

|

9,437 |

|

9,701 |

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCE |

|

17 |

|

25 |

|

63 |

|

81 |

|

|

Total revenues |

|

$ |

3,180 |

|

$ |

3,430 |

|

$ |

9,500 |

|

$ |

9,782 |

|

|

|

|

|

|

|

|

|

|

|

|

|

SEGMENT PROFIT |

|

|

|

|

|

|

|

|

|

|

MANUFACTURING: |

|

|

|

|

|

|

|

|

|

|

Textron Aviation (a) |

|

$ |

107 |

|

$ |

62 |

|

$ |

262 |

|

$ |

104 |

|

|

Bell |

|

99 |

|

146 |

|

276 |

|

383 |

|

|

Textron Systems |

|

39 |

|

27 |

|

88 |

|

100 |

|

|

Industrial |

|

61 |

|

53 |

|

229 |

|

213 |

|

|

|

|

306 |

|

288 |

|

855 |

|

800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCE |

|

6 |

|

5 |

|

22 |

|

16 |

|

|

Segment Profit |

|

312 |

|

293 |

|

877 |

|

816 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate expenses and other, net |

|

(27 |

) |

(22 |

) |

(102 |

) |

(103 |

) |

|

Interest expense, net for Manufacturing group |

|

(33 |

) |

(37 |

) |

(98 |

) |

(108 |

) |

|

Acquisition and restructuring costs (b) |

|

— |

|

(3 |

) |

— |

|

(39 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations before income taxes |

|

252 |

|

231 |

|

677 |

|

566 |

|

|

Income tax expense |

|

(76 |

) |

(71 |

) |

(204 |

) |

(174 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations |

|

176 |

|

160 |

|

473 |

|

392 |

|

|

Discontinued operations, net of income taxes |

|

— |

|

(1 |

) |

(2 |

) |

(4 |

) |

|

Net income |

|

$ |

176 |

|

$ |

159 |

|

$ |

471 |

|

$ |

388 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

Income from continuing operations |

|

$ |

0.63 |

|

$ |

0.57 |

|

$ |

1.69 |

|

$ |

1.39 |

|

|

Discontinued operations, net of income taxes |

|

— |

|

— |

|

(0.01 |

) |

(0.02 |

) |

|

Net income |

|

$ |

0.63 |

|

$ |

0.57 |

|

$ |

1.68 |

|

$ |

1.37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted average shares outstanding |

|

278,039,000 |

|

281,030,000 |

|

279,400,000 |

|

282,424,000 |

|

(a) Textron Aviation’s segment profit includes $1 million and $12 million, for the three and nine months ended October 3, 2015, respectively, and $10 million and $55 million for the three and nine months ended September 27, 2014, respectively, related to fair value step-up adjustments of acquired inventories sold during the periods.

(b) Acquisition and restructuring costs for the three and nine months ended September 27, 2014 includes $3 million and $28 million, respectively, of restructuring costs incurred related to the acquisition of Beech Holdings, LLC, the parent of Beechcraft Corporation, which was completed on March 14, 2014. Transaction costs of $11 million related to the Beechcraft acquisition are also included in the nine months ended September 27, 2014.

Textron Inc.

Condensed Consolidated Balance Sheets

(In millions)

(Unaudited)

|

|

|

October 3,

2015 |

|

January 3,

2015 |

|

|

Assets |

|

|

|

|

|

|

Cash and equivalents |

|

$ |

497 |

|

$ |

731 |

|

|

Accounts receivable, net |

|

1,159 |

|

1,035 |

|

|

Inventories |

|

4,574 |

|

3,928 |

|

|

Other current assets |

|

507 |

|

579 |

|

|

Net property, plant and equipment |

|

2,488 |

|

2,497 |

|

|

Goodwill |

|

2,026 |

|

2,027 |

|

|

Other assets |

|

2,234 |

|

2,279 |

|

|

Finance group assets |

|

1,413 |

|

1,529 |

|

|

Total Assets |

|

$ |

14,898 |

|

$ |

14,605 |

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

Short-term debt and current portion of long-term debt |

|

$ |

414 |

|

$ |

8 |

|

|

Other current liabilities |

|

3,775 |

|

3,630 |

|

|

Other liabilities |

|

2,426 |

|

2,587 |

|

|

Long-term debt |

|

2,391 |

|

2,803 |

|

|

Finance group liabilities |

|

1,196 |

|

1,305 |

|

|

Total Liabilities |

|

10,202 |

|

10,333 |

|

|

|

|

|

|

|

|

|

Total Shareholders’ Equity |

|

4,696 |

|

4,272 |

|

|

Total Liabilities and Shareholders’ Equity |

|

$ |

14,898 |

|

$ |

14,605 |

|

TEXTRON INC.

MANUFACTURING GROUP

Condensed Schedule of Cash Flows and Manufacturing Cash Flow GAAP to Non-GAAP Reconciliations

(In millions)

(Unaudited)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

October 3, |

|

September 27, |

|

October 3, |

|

September 27, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

Income from continuing operations |

|

$ |

173 |

|

$ |

157 |

|

$ |

460 |

|

$ |

382 |

|

|

Depreciation and amortization |

|

109 |

|

108 |

|

324 |

|

315 |

|

|

Changes in working capital |

|

(149 |

) |

(67 |

) |

(555 |

) |

(205 |

) |

|

Changes in other assets and liabilities and non-cash items |

|

78 |

|

10 |

|

98 |

|

(1 |

) |

|

Dividends received from TFC |

|

20 |

|

— |

|

20 |

|

— |

|

|

Net cash from operating activities of continuing operations |

|

231 |

|

208 |

|

347 |

|

491 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

(113 |

) |

(83 |

) |

(286 |

) |

(255 |

) |

|

Net cash used in acquisitions |

|

(47 |

) |

(30 |

) |

(81 |

) |

(1,580 |

) |

|

Proceeds from the sale of property, plant and equipment |

|

2 |

|

2 |

|

6 |

|

7 |

|

|

Other investing activities, net |

|

— |

|

(9 |

) |

(4 |

) |

(19 |

) |

|

Net cash from investing activities |

|

(158 |

) |

(120 |

) |

(365 |

) |

(1,847 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in short-term debt |

|

(105 |

) |

25 |

|

— |

|

25 |

|

|

Proceeds from long-term debt |

|

— |

|

— |

|

— |

|

1,093 |

|

|

Principal payments on long-term |

|

— |

|

(200 |

) |

— |

|

(201 |

) |

|

Purchases of Textron common stock |

|

(124 |

) |

(152 |

) |

(211 |

) |

(302 |

) |

|

Other financing activities, net |

|

(2 |

) |

(3 |

) |

8 |

|

16 |

|

|

Net cash from financing activities |

|

(231 |

) |

(330 |

) |

(203 |

) |

631 |

|

|

Total cash flows from continuing operations |

|

(158 |

) |

(242 |

) |

(221 |

) |

(725 |

) |

|

Total cash flows from discontinued operations |

|

(1 |

) |

(1 |

) |

(4 |

) |

(3 |

) |

|

Effect of exchange rate changes on cash and equivalents |

|

(5 |

) |

(7 |

) |

(9 |

) |

(5 |

) |

|

Net change in cash and equivalents |

|

(164 |

) |

(250 |

) |

(234 |

) |

(733 |

) |

|

Cash and equivalents at beginning of period |

|

661 |

|

680 |

|

731 |

|

1,163 |

|

|

Cash and equivalents at end of period |

|

$ |

497 |

|

$ |

430 |

|

$ |

497 |

|

$ |

430 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing Cash Flow GAAP to Non-GAAP Reconciliations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash from operating activities of continuing operations - GAAP |

|

$ |

231 |

|

$ |

208 |

|

$ |

347 |

|

$ |

491 |

|

|

Less: |

Capital expenditures |

|

(113 |

) |

(83 |

) |

(286 |

) |

(255 |

) |

|

|

Dividends received from TFC |

|

(20 |

) |

— |

|

(20 |

) |

— |

|

|

Plus: |

Total pension contributions |

|

16 |

|

17 |

|

50 |

|

61 |

|

|

|

Proceeds from the sale of property, plant and equipment |

|

2 |

|

2 |

|

6 |

|

7 |

|

|

Manufacturing cash flow before pension contributions- Non-GAAP |

|

$ |

116 |

|

$ |

144 |

|

$ |

97 |

|

$ |

304 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015 Outlook |

|

|

Net cash from operating activities of continuing operations - GAAP |

|

|

|

$969 - $1,069 |

|

|

Less: |

Capital expenditures |

|

|

|

(475) |

|

|

|

Dividends received from TFC |

|

|

|

(20) |

|

|

Plus: |

Total pension contributions |

|

|

|

70 |

|

|

|

Proceeds from the sale of property, plant and equipment |

|

|

|

6 |

|

|

Manufacturing cash flow before pension contributions- Non-GAAP |

|

|

|

$550 - $650 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free cash flow is a measure generally used by investors, analysts and management to gauge a company’s ability to generate cash from operations in excess of that necessary to be reinvested to sustain and grow the business and fund its obligations. Our definition of Manufacturing free cash flow adjusts net cash from operating activities of continuing operations for dividends received from TFC, capital contributions provided under the Support Agreement and debt agreements, capital expenditures, proceeds from the sale of property, plant and equipment and contributions to our pension plans. We believe that our calculation provides a relevant measure of liquidity and is a useful basis for assessing our ability to fund operations and obligations. This measure is not a financial measure under GAAP and should be used in conjunction with GAAP cash measures provided in our Consolidated Statements of Cash Flows.

TEXTRON INC.

Condensed Consolidated Schedule of Cash Flows

(In millions)

(Unaudited)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

October 3, |

|

September 27, |

|

October 3, |

|

September 27, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

Income from continuing operations |

|

$ |

176 |

|

$ |

160 |

|

$ |

473 |

|

$ |

392 |

|

|

Depreciation and amortization |

|

112 |

|

111 |

|

332 |

|

325 |

|

|

Changes in working capital |

|

(157 |

) |

(51 |

) |

(492 |

) |

(128 |

) |

|

Changes in other assets and liabilities and non-cash items |

|

83 |

|

(4 |

) |

106 |

|

(20 |

) |

|

Net cash from operating activities of continuing operations |

|

214 |

|

216 |

|

419 |

|

569 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

(113 |

) |

(83 |

) |

(286 |

) |

(255 |

) |

|

Net cash used in acquisitions |

|

(47 |

) |

(30 |

) |

(81 |

) |

(1,580 |

) |

|

Finance receivables repaid |

|

20 |

|

19 |

|

66 |

|

77 |

|

|

Other investing activities, net |

|

5 |

|

17 |

|

31 |

|

33 |

|

|

Net cash from investing activities |

|

(135 |

) |

(77 |

) |

(270 |

) |

(1,725 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

Principal payments on long-term and nonrecourse debt |

|

(66 |

) |

(341 |

) |

(196 |

) |

(462 |

) |

|

Proceeds from long-term debt |

|

46 |

|

36 |

|

55 |

|

1,187 |

|

|

Increase (decrease) in short-term debt |

|

(105 |

) |

25 |

|

— |

|

25 |

|

|

Purchases of Textron common stock |

|

(124 |

) |

(152 |

) |

(211 |

) |

(302 |

) |

|

Other financing activities, net |

|

(2 |

) |

(3 |

) |

8 |

|

16 |

|

|

Net cash from financing activities |

|

(251 |

) |

(435 |

) |

(344 |

) |

464 |

|

|

Total cash flows from continuing operations |

|

(172 |

) |

(296 |

) |

(195 |

) |

(692 |

) |

|

Total cash flows from discontinued operations |

|

(1 |

) |

(1 |

) |

(4 |

) |

(3 |

) |

|

Effect of exchange rate changes on cash and equivalents |

|

(5 |

) |

(7 |

) |

(9 |

) |

(5 |

) |

|

Net change in cash and equivalents |

|

(178 |

) |

(304 |

) |

(208 |

) |

(700 |

) |

|

Cash and equivalents at beginning of period |

|

792 |

|

815 |

|

822 |

|

1,211 |

|

|

Cash and equivalents at end of period |

|

$ |

614 |

|

$ |

511 |

|

$ |

614 |

|

$ |

511 |

|

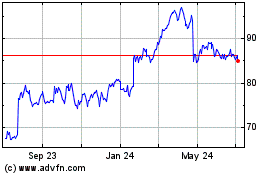

Textron (NYSE:TXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Textron (NYSE:TXT)

Historical Stock Chart

From Apr 2023 to Apr 2024