GE Business Aircraft Finance Says Worst Is Over

October 20 2009 - 4:24PM

Dow Jones News

The sharpest downturn on record for the corporate jet market

appears to be leveling off, said Dave Labrozzi, president of

Corporate Aircraft Finance at GE Capital, a unit of General

Electric Co. (GE), and one of world's biggest business aircraft

lenders.

The first sign of a market recovery will be when prices

stabilize for used business aircraft, Labrozzi said in an

interview. Some aircraft prices have dropped as much as 30% to 45%

from their peak 15 months ago, he said. At that time, some

companies were willing to pay a premium to get earlier delivery on

the hottest models of corporate planes.

But, when the financial crisis hit, companies in industries like

real estate and finance rushed to raise cash from valuable assets,

flooding the market with used aircraft. For GE Corporate Aircraft

Finance, which lends to small, medium and large businesses, it was

the worst downturn in 30 years of working in the cyclical aircraft

business. "In a typical downturn - such as after Sept. 11, 2001 -

prices fall 15% in 20% in two years. This time, that happened in

one quarter," he said. Even with a glut of planes on the market,

Labrozzi said, "we've recently taken back some aircraft and have

been able to place them with other customers."

The business aircraft market is "92% correlated with corporate

profits," Labrozzi said. As corporate profits rise, he expects

money to go back in the budget for a company plane. But, he said he

anticipates a lasting effect from recent negative publicity that

linked corporate aircraft ownership to spending excesses.

Honeywell International Inc. (HON) on Monday said in its annual

forecast for the business jet market that it doesn't expect a

recovery to get under way until 2011, and it will be many years

before annual deliveries approach last year's levels. The U.S. will

make up 48% of the market in the next few years, down from the 55%

that Honeywell forecast just a year ago.

About 30% to 40% of the GE unit's financing business is outside

the U.S. The best growth opportunities are in emerging markets in

Latin America and Asia, Labrozzi said, although some countries are

behind in building the infrastructure needed for business flying.

"China has done a good job" of building airports related facilities

for business travel, Labrozzi said. "We would certainly like to

have a bigger footprint there," he added.

There's no typical business jet, Labrozzi said. The planes, made

by many manufacturers, range from simple six-seaters to luxury

models with sleeping quarters.

Corporate jet-makers like Bombardier Inc. (BBD.A.T.), General

Dynamics Corp.'s (GD) Gulfstream, and Cessna, a unit of Textron

Inc. (TXT) have scrambled to downsize their businesses. Gulfstream

recently unveiled its new G650, a larger, faster model that can

carry up to 18 passengers. The company said that will position it

well when the market recovers.

But Cessna last summer canceled its Columbus program, for the

largest version of its Citation model. The company had taken orders

for about 70 of the aircraft, with list prices of $27 million, to

be delivered beginning in 2014. Cessna chief Jack Pelton said in a

recent interview that Cessna will restart the program when the

market regains its health. "In a typical recession, business jet

sales lag the return of economic growth by about eight quarters,"

Pelton said.

The 62nd National Business Aviation Association convention,

which opens in Orlando Tuesday, is working to put a positive face

on corporate aircraft ownership, as well as to energize a

beleaguered industry.

Brian Foley, a consultant to the business jet industry, said

that "some participants are predicting the NBAA convention will be

a resume job fair. In my view, it will be a showcase of the

companies who are the long-term players, and will prosper from an

eventual uptick."

-By Ann Keeton; Dow Jones Newswires; 312-750-4120;

ann.keeton@dowjones.com

Textron (NYSE:TXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

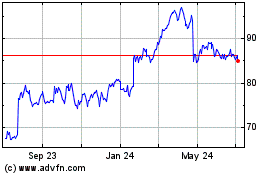

Textron (NYSE:TXT)

Historical Stock Chart

From Apr 2023 to Apr 2024