FORM 6 - K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

As of 4/26/2016

Ternium S.A.

(Translation of Registrant's name into English)

Ternium S.A.

29, Avenue de la Porte-Neuve

L-2227 Luxembourg

(352) 2668-3152

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F.

Form 20-F

Ö

Form 40-F

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12G3-2(b) under the Securities Exchange Act of 1934.

Yes

No

Ö

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Not applicable

The attached material is being furnished to the Securities and Exchange Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended.

This report contains Ternium S.A.’s consolidated financial statements as of March 31, 2016.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TERNIUM S.A.

By:

/s/ Pablo Brizzio

By:

/s/ Daniel Novegil

Name: Pablo Brizzio Name: Daniel Novegil

Title: Chief Financial Officer Title: Chief Executive Officer

Dated: April 26, 2016

|

TERNIUM S.A.

Consolidated Condensed Interim Financial Statements

as of March 31, 2016

and for the three-month periods

ended on March 31, 2016 and 2015

29 Avenue de la Porte-Neuve, 3

rd

floor

L – 2227

R.C.S. Luxembourg: B 98 668

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

|

INDEX

|

|

Page

|

|

|

|

|

Consolidated Condensed Interim Income Statements

|

2

|

|

Consolidated Condensed Interim Statements of Comprehensive Income

|

3

|

|

Consolidated Condensed Interim Statements of Financial Position

|

4

|

|

Consolidated Condensed Interim Statements of Changes in Equity

|

5

|

|

Consolidated Condensed Interim Statements of Cash Flows

|

7

|

|

Notes to the Consolidated Condensed Interim Financial Statements

|

|

|

1

|

General information and basis of presentation

|

8

|

|

2

|

Accounting policies

|

9

|

|

3

|

Segment information

|

10

|

|

4

|

Cost of sales

|

12

|

|

5

|

Selling, general and administrative expenses

|

13

|

|

6

|

Finance expense, Finance income and Other financial income (expenses), net

|

13

|

|

7

|

Property, plant and equipment, net

|

13

|

|

8

|

Intangible assets, net

|

14

|

|

9

|

Investments in non-consolidated companies

|

14

|

|

10

|

Distribution of dividends

|

16

|

|

11

|

Contingencies, commitments and restrictions on the distribution of profits

|

16

|

|

12

|

Related party transactions

|

21

|

|

13

|

Fair value measurement

|

23

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

All amounts in USD thousands

|

Consolidated Condensed Interim Income Statements

|

|

|

|

Three-month period ended

March 31,

|

|

|

Notes

|

|

2016

|

|

2015

|

|

|

|

|

(Unaudited)

|

|

Net sales

|

3

|

|

1,655,502

|

|

2,126,075

|

|

Cost of sales

|

3 & 4

|

|

(1,286,809)

|

|

(1,728,303)

|

|

|

|

|

|

|

|

|

Gross profit

|

3

|

|

368,693

|

|

397,772

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

3 & 5

|

|

(164,016)

|

|

(197,366)

|

|

Other operating income (expenses), net

|

3

|

|

(2,321)

|

|

3,740

|

|

|

|

|

|

|

|

|

Operating income

|

3

|

|

202,356

|

|

204,146

|

|

|

|

|

|

|

|

|

Finance expense

|

6

|

|

(12,656)

|

|

(24,049)

|

|

Finance income

|

6

|

|

3,019

|

|

2,127

|

|

Other financial income (expenses), net

|

6

|

|

(12,206)

|

|

16,123

|

|

|

|

|

|

|

|

|

Equity in earnings (losses) of non-consolidated companies

|

|

|

2,442

|

|

(9,520)

|

|

|

|

|

|

|

|

|

Profit before income tax expense

|

|

|

182,955

|

|

188,827

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

|

(59,373)

|

|

(93,036)

|

|

|

|

|

|

|

|

|

Profit for the period

|

|

|

123,582

|

|

95,791

|

|

|

|

|

|

|

|

|

Attributable to:

|

|

|

|

|

|

|

Owners of the parent

|

|

|

94,389

|

|

68,455

|

|

Non-controlling interest

|

|

|

29,193

|

|

27,336

|

|

|

|

|

|

|

|

|

Profit for the period

|

|

|

123,582

|

|

95,791

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding

|

|

|

1,963,076,776

|

|

1,963,076,776

|

|

|

|

|

|

|

|

|

Basic and diluted earnings (losses) per share for profit (loss) attributable to the equity holders of the company (expressed in USD per share)

|

|

|

0.05

|

|

0.03

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the fiscal year ended December 31, 2015.

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

All amounts in USD thousands

|

Consolidated Condensed Interim Statements of Comprehensive Income

|

|

|

Three-month period ended

March 31,

|

|

|

|

2016

|

|

2015

|

|

|

|

(Unaudited)

|

|

Profit for the period

|

|

123,582

|

|

95,791

|

|

|

|

|

|

|

|

Items that may be reclassified subsequently to profit or loss:

|

|

|

|

|

|

Currency translation adjustment

|

|

(88,407)

|

|

(34,257)

|

|

Currency translation adjustment from participation in non-consolidated companies

|

|

(271)

|

|

(126,687)

|

|

Changes in the fair value of derivatives classified as cash flow hedges and others

|

|

(1,225)

|

|

(7,817)

|

|

Income tax relating to cash flow hedges

|

|

367

|

|

2,626

|

|

Others from participation in non-consolidated companies

|

|

(1,346)

|

|

(1,620)

|

|

Items that will not be reclassified subsequently to profit or loss:

|

|

|

|

|

|

Remeasurement of post-employment benefit obligations

|

|

(24)

|

|

343

|

|

|

|

|

|

|

|

Other comprehensive loss for the period, net of tax

|

|

(90,906)

|

|

(167,412)

|

|

|

|

|

|

|

|

Total comprehensive income (loss) for the period

|

|

32,676

|

|

(71,621)

|

|

|

|

|

|

|

|

Attributable to:

|

|

|

|

|

|

Owners of the parent

|

|

38,329

|

|

(74,273)

|

|

Non-controlling interest

|

|

(5,653)

|

|

2,652

|

|

|

|

|

|

|

|

Total comprehensive income (loss) for the period

|

|

32,676

|

|

(71,621)

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the fiscal year ended December 31, 2015.

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

All amounts in USD thousands

|

Consolidated Condensed Interim Statements of Financial Position

|

|

|

|

|

Balances as of

|

|

|

|

Notes

|

|

March 31, 2016

|

|

December 31, 2015

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net

|

|

7

|

|

4,134,050

|

|

|

|

4,207,566

|

|

|

|

Intangible assets, net

|

|

8

|

|

873,950

|

|

|

|

888,206

|

|

|

|

Investments in non-consolidated companies

|

|

9

|

|

251,155

|

|

|

|

250,412

|

|

|

|

Deferred tax assets

|

|

|

|

101,925

|

|

|

|

98,058

|

|

|

|

Receivables, net

|

|

|

|

52,712

|

|

5,413,792

|

|

36,147

|

|

5,480,389

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

|

|

Receivables

|

|

|

|

95,647

|

|

|

|

89,484

|

|

|

|

Derivative financial instruments

|

|

|

|

-

|

|

|

|

1,787

|

|

|

|

Inventories, net

|

|

|

|

1,455,321

|

|

|

|

1,579,120

|

|

|

|

Trade receivables, net

|

|

|

|

618,477

|

|

|

|

511,464

|

|

|

|

Other investments

|

|

|

|

234,718

|

|

|

|

237,191

|

|

|

|

Cash and cash equivalents

|

|

|

|

183,618

|

|

2,587,781

|

|

151,491

|

|

2,570,537

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets classified as held for sale

|

|

|

|

|

|

12,758

|

|

|

|

11,667

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,600,539

|

|

|

|

2,582,204

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

|

|

|

|

8,014,331

|

|

|

|

8,062,593

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

Capital and reserves attributable to the owners of the parent

|

|

|

|

|

|

4,071,477

|

|

|

|

4,033,148

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest

|

|

|

|

|

|

713,367

|

|

|

|

769,849

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Equity

|

|

|

|

|

|

4,784,844

|

|

|

|

4,802,997

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

Provisions

|

|

|

|

6,875

|

|

|

|

8,142

|

|

|

|

Deferred tax liabilities

|

|

|

|

568,790

|

|

|

|

609,514

|

|

|

|

Other liabilities

|

|

|

|

319,826

|

|

|

|

320,673

|

|

|

|

Trade payables

|

|

|

|

13,413

|

|

|

|

13,413

|

|

|

|

Borrowings

|

|

|

|

595,190

|

|

1,504,094

|

|

607,237

|

|

1,558,979

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

Current income tax liabilities

|

|

|

|

72,631

|

|

|

|

41,064

|

|

|

|

Other liabilities

|

|

|

|

228,927

|

|

|

|

156,654

|

|

|

|

Trade payables

|

|

|

|

575,166

|

|

|

|

568,478

|

|

|

|

Derivative financial instruments

|

|

|

|

14,823

|

|

|

|

20,635

|

|

|

|

Borrowings

|

|

|

|

833,846

|

|

1,725,393

|

|

913,786

|

|

1,700,617

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

|

|

|

3,229,487

|

|

|

|

3,259,596

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Equity and Liabilities

|

|

|

|

|

|

8,014,331

|

|

|

|

8,062,593

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the fiscal year ended December 31, 2015.

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

All amounts in USD thousands

|

Consolidated Condensed Interim Statements of Changes in Equity

|

|

Attributable to the owners of the parent (1)

|

|

|

|

|

|

Capital stock (2)

|

Treasury shares

(2)

|

Initial public offering expenses

|

Reserves

(3)

|

Capital stock issue discount (4)

|

Currency translation adjustment

|

Retained earnings

|

Total

|

Non-controlling interest

|

Total Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of January 1, 2016

|

2,004,743

|

(150,000)

|

(23,295)

|

1,444,394

|

(2,324,866)

|

(2,300,335)

|

5,382,507

|

4,033,148

|

769,849

|

4,802,997

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit for the period

|

|

|

|

|

|

|

94,389

|

94,389

|

29,193

|

123,582

|

|

|

Other comprehensive income (loss) for the period

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency translation adjustment

|

|

|

|

|

|

(54,356)

|

|

(54,356)

|

(34,322)

|

(88,678)

|

|

|

Remeasurement of post-employment benefit obligations

|

|

|

|

(15)

|

|

|

|

(15)

|

(9)

|

(24)

|

|

|

Cash flow hedges and others, net of tax

|

|

|

|

(438)

|

|

|

|

(438)

|

(420)

|

(858)

|

|

|

Others

|

|

|

|

(1,251)

|

|

|

|

(1,251)

|

(95)

|

(1,346)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) for the period

|

-

|

-

|

-

|

(1,704)

|

-

|

(54,356)

|

94,389

|

38,329

|

(5,653)

|

32,676

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends to be paid in cash to non-controlling interest

|

|

|

|

|

|

|

|

-

|

(50,829)

|

(50,829)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of March 31, 2016 (unaudited)

|

2,004,743

|

(150,000)

|

(23,295)

|

1,442,690

|

(2,324,866)

|

(2,354,691)

|

5,476,896

|

4,071,477

|

713,367

|

4,784,844

|

|

(1) Shareholders’ equity determined in accordance with accounting principles generally accepted in Luxembourg is disclosed in Note 11 (iii).

(2) The Company has an authorized share capital of a single class of 3.5 billion shares having a nominal value of USD 1.00 per share. As of March 31, 2016, there were 2,004,743,442 shares issued. All issued shares are fully paid. Also, as of March 31, 2016, the Company held 41,666,666 shares as treasury shares.

(3) Include legal reserve under Luxembourg law for USD 200.5 million, undistributable reserves under Luxembourg law for USD 1.4 billion, hedge accounting reserve, net of tax effect, for USD (1.3) million and reserves related to the acquisition of non-controlling interest in subsidiaries for USD (88.5) million.

(4) Represents the difference between book value of non-monetary contributions received from shareholders under Luxembourg GAAP and IFRS.

Dividends may be paid by Ternium to the extent distributable retained earnings calculated in accordance with Luxembourg law and regulations exist. Therefore, retained earnings included in these consolidated condensed interim financial statements may not be wholly distributable. See Note 11 (iii).

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the fiscal year ended December 31, 2015.

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

All amounts in USD thousands

|

Consolidated Condensed Interim Statements of Changes in Equity

|

|

Attributable to the owners of the parent (1)

|

|

|

|

|

|

Capital stock (2)

|

Treasury shares

(2)

|

Initial public offering expenses

|

Reserves (3)

|

Capital stock issue discount (4)

|

Currency translation adjustment

|

Retained earnings

|

Total

|

Non-controlling interest

|

Total Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of January 1, 2015

|

2,004,743

|

(150,000)

|

(23,295)

|

1,475,619

|

(2,324,866)

|

(1,836,057)

|

5,551,057

|

4,697,201

|

937,502

|

5,634,703

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit for the period

|

|

|

|

|

|

|

68,455

|

68,455

|

27,336

|

95,791

|

|

|

Other comprehensive (loss) income for the period

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency translation adjustment

|

|

|

|

|

|

(138,375)

|

|

(138,375)

|

(22,569)

|

(160,944)

|

|

|

Remeasurement of post- employment benefit obligations

|

|

|

|

209

|

|

|

|

209

|

134

|

343

|

|

|

Cash flow hedges, net of tax

|

|

|

|

(3,056)

|

|

|

|

(3,056)

|

(2,135)

|

(5,191)

|

|

|

Others

|

|

|

|

(1,506)

|

|

|

|

(1,506)

|

(114)

|

(1,620)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive (loss) income for the period

|

-

|

-

|

-

|

(4,353)

|

-

|

(138,375)

|

68,455

|

(74,273)

|

2,652

|

(71,621)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends to be paid in cash to non-controlling interest

|

|

|

|

|

|

|

-

|

-

|

(32,743)

|

(32,743)

|

|

|

Contributions from non-controlling shareholders in consolidated subsidiaries (5)

|

|

|

|

|

|

|

|

-

|

30,870

|

30,870

|

|

|

Sale of participation in subsidiary companies (6)

|

|

|

|

|

|

|

|

-

|

1,509

|

1,509

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of March 31, 2015 (unaudited)

|

2,004,743

|

(150,000)

|

(23,295)

|

1,471,266

|

(2,324,866)

|

(1,974,432)

|

5,619,512

|

4,622,928

|

939,790

|

5,562,718

|

|

(1) Shareholders’ equity determined in accordance with accounting principles generally accepted in Luxembourg is disclosed in Note 11 (iii).

(2) The Company has an authorized share capital of a single class of 3.5 billion shares having a nominal value of USD 1.00 per share. As of March 31, 2015, there were 2,004,743,442 shares issued. All issued shares are fully paid. Also, as of March 31, 2015, the Company held 41,666,666 shares as treasury shares.

(3) Include legal reserve under Luxembourg law for USD 200.5 million, undistributable reserves under Luxembourg law for USD 1.4 billion, hedge accounting reserve, net of tax effect, for USD (1.0) million and reserves related to the acquisition of non-controlling interest in subsidiaries for USD (58.9) million.

(4) Represents the difference between book value of non-monetary contributions received from shareholders under Luxembourg GAAP and IFRS.

(5) Corresponds to the contribution made by Nippon Steel Corporation in Tenigal, S.R.L. de C.V.

(6) Corresponds to the sale of the participation in Ferrasa Panamá S.A.

Dividends may be paid by Ternium to the extent distributable retained earnings calculated in accordance with Luxembourg law and regulations exist. Therefore, retained earnings included in these consolidated condensed interim financial statements may not be wholly distributable. See Note 11 (iii).

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the fiscal year ended December 31, 2015.

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

All amounts in USD thousands

|

Consolidated Condensed Interim Statements of Cash Flows

|

|

|

|

|

Three-month period ended

March 31,

|

|

|

|

Notes

|

|

2016

|

|

2015

|

|

|

|

|

|

(Unaudited)

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

Profit for the period

|

|

|

|

123,582

|

|

95,791

|

|

Adjustments for:

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

7 & 8

|

|

100,668

|

|

109,295

|

|

Income tax accruals less payments

|

|

|

|

(2,928)

|

|

31,379

|

|

Equity in (earnings) losses of non-consolidated companies

|

|

|

|

(2,442)

|

|

9,520

|

|

Interest accruals less payments

|

|

|

|

2,633

|

|

(1,945)

|

|

Changes in provisions

|

|

|

|

135

|

|

666

|

|

Changes in working capital (1)

|

|

|

|

(1,920)

|

|

69,929

|

|

Results on the sale of participation in subsidiary company

|

|

|

|

-

|

|

1,739

|

|

Net foreign exchange results and others

|

|

|

|

17,690

|

|

7,417

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities

|

|

|

|

237,418

|

|

323,791

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

Capital expenditures

|

|

7 & 8

|

|

(97,817)

|

|

(83,828)

|

|

Loans to non-consolidated companies

|

|

|

|

(22,656)

|

|

-

|

|

Sale of participation in subsidiary company, net of cash disposed

|

|

|

|

-

|

|

(673)

|

|

Decrease (Increase) in other investments

|

|

|

|

2,473

|

|

(27,692)

|

|

Proceeds from the sale of property, plant and equipment

|

|

|

|

214

|

|

360

|

|

Dividends received from non-consolidated companies

|

|

|

|

60

|

|

-

|

|

Net cash used in investing activities

|

|

|

|

(117,726)

|

|

(111,833)

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

Contributions from non-controlling shareholders in consolidated subsidiaries

|

|

|

|

-

|

|

30,870

|

|

Proceeds from borrowings

|

|

|

|

207,350

|

|

128,013

|

|

Repayments of borrowings

|

|

|

|

(292,854)

|

|

(318,317)

|

|

|

|

|

|

|

|

|

|

Net cash used in financing activities

|

|

|

|

(85,504)

|

|

(159,434)

|

|

|

|

|

|

|

|

|

|

Increase in cash and cash equivalents

|

|

|

|

34,188

|

|

52,524

|

|

|

|

|

|

|

|

|

|

Movement in cash and cash equivalents

|

|

|

|

|

|

|

|

At January 1,

|

|

|

|

151,491

|

|

213,303

|

|

Effect of exchange rate changes

|

|

|

|

(2,061)

|

|

(304)

|

|

Increase in cash and cash equivalents

|

|

|

|

34,188

|

|

52,524

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents as of March 31, (2)

|

|

|

|

183,618

|

|

265,523

|

(1) The working capital is impacted by non-cash movement of USD (37.2) million as of March 31, 2016 (USD (24.4) million as of March 31, 2015) due to the variations in the exchange rates used by subsidiaries with functional currencies different from the US dollar.

(2) It includes restricted cash of USD 86 and USD 91 as of March 31, 2016 and 2015, respectively. In addition, the Company had other investments with a maturity of more than three months for USD 234,717 and USD 170,682 as of March 31, 2016 and 2015, respectively.

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited onsolidated Financial Statements and notes for the fiscal year ended December 31, 2015.

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

|

Notes to the Consolidated Condensed Interim Financial Statements

1.

GENERAL INFORMATION AND BASIS OF PRESENTATION

a)

General information and basis of presentation

Ternium S.A. (the “Company” or “Ternium”), was incorporated on December 22, 2003 to hold investments in flat and long steel manufacturing and distributing companies. The Company has an authorized share capital of a single class of 3.5 billion shares having a nominal value of USD 1.00 per share. As of March 31, 2016, there were 2,004,743,442 shares issued. All issued shares are fully paid.

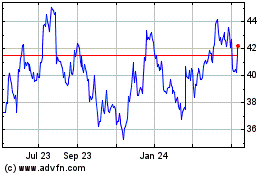

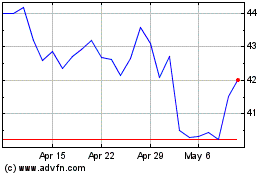

Following a corporate reorganization carried out during fiscal year 2005, in January 2006 the Company successfully completed its registration process with the United States Securities and Exchange Commission (“SEC”). Ternium’s ADSs began trading on the New York Stock Exchange under the symbol “TX” on February 1, 2006. The Company’s initial public offering was settled on February 6, 2006.

The Company was initially established as a public limited liability company (société anonyme) under Luxembourg’s 1929 holding company regime. Until termination of such regime on December 31, 2010, holding companies incorporated under the 1929 regime (including the Company) were exempt from Luxembourg corporate and withholding tax over dividends distributed to shareholders.

On January 1, 2011, the Company became an ordinary public limited liability company (société anonyme) and, effective as from that date, the Company is subject to all applicable Luxembourg taxes (including, among others, corporate income tax on its worldwide income) and its dividend distributions will generally be subject to Luxembourg withholding tax. However, dividends received by the Company from subsidiaries in high income tax jurisdictions, as defined under Luxembourg law, will continue to be exempt from corporate income tax in Luxembourg under Luxembourg’s participation exemption.

As part of the Company’s corporate reorganization in connection with the termination of Luxembourg’s 1929 holding company regime, on December 6, 2010, the Company contributed its equity holdings in all its subsidiaries and all its financial assets to its Luxembourg wholly-owned subsidiary Ternium Investments S.à r.l., or Ternium Investments, in exchange for newly issued corporate units of Ternium Investments. As the assets contributed were recorded at their historical carrying amount in accordance with Luxembourg GAAP, the Company’s December 2010 contribution of such assets to Ternium Investments resulted in a non-taxable revaluation of the accounting value of the Company’s assets under Luxembourg GAAP. The amount of the December 2010 revaluation was equal to the difference between the historical carrying amounts of the assets contributed and the value at which such assets were contributed and amounted to USD 4.0 billion. However, for the purpose of these consolidated condensed interim financial statements, the assets contributed by Ternium to its wholly-owned subsidiary Ternium Investments were recorded based on their historical carrying amounts in accordance with IFRS, with no impact on the financial statements.

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

|

1.

GENERAL INFORMATION AND BASIS OF PRESENTATION (continued)

Following the completion of the corporate reorganization, and upon its conversion into an ordinary Luxembourg holding company, the Company voluntarily recorded a special reserve exclusively for tax-basis purposes. As of December 31, 2015 and 2014, this special reserve amounted to USD 7.1 billion and USD 7.3 billion, respectively. The Company expects that, as a result of its corporate reorganization, its current overall tax burden will not increase, as all or substantially all of its dividend income will come from high income tax jurisdictions. In addition, the Company expects that dividend distributions for the foreseeable future will be imputed to the special reserve and therefore should be exempt from Luxembourg withholding tax under current Luxembourg law.

The name and percentage of ownership of subsidiaries that have been included in consolidation in these Consolidated Condensed Interim Financial Statements is disclosed in Note 2 to the audited Consolidated Financial Statements for the year ended December 31, 2015.

Certain comparative amounts have been reclassified to conform to changes in presentation in the current period. These reclassifications do not have a material effect on the Company’s consolidated financial statements.

The preparation of Consolidated Condensed Interim Financial Statements requires management to make estimates and assumptions that might affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities as of the date of the statement of financial position, and also the reported amounts of revenues and expenses for the reported periods. Actual results may differ from these estimates.

Material intercompany transactions and balances have been eliminated in consolidation. However, the fact that the functional currency of the Company’s subsidiaries differ, results in the generation of foreign exchange gains and losses that are included in the Consolidated Condensed Interim Income Statement under “Other financial income (expenses), net”.

These Consolidated Condensed Interim Financial Statements have been approved for issue by the

Board of Directors of Ternium on April 26, 2016.

2. ACCOUNTING POLICIES

These Consolidated Condensed Interim Financial Statements have been prepared in accordance with IAS 34, “Interim Financial Reporting” and are unaudited. These Consolidated Condensed Interim Financial Statements should be read in conjunction with the audited Consolidated Financial Statements for the year ended December 31, 2015, which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and in conformity with International Financial Reporting Standards as adopted by the European Union (“EU”). Recently issued accounting pronouncements were applied by the Company as from their respective dates.

These Consolidated Condensed Interim Financial Statements have been prepared following the same accounting policies used in the preparation of the audited Consolidated Financial Statements for the year ended December 31, 2015.

None of the accounting pronouncements issued after December 31, 2015, and as of the date of these Consolidated Condensed Interim Financial Statements have a material effect on the Company’s financial condition or result or operations.

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

|

3.

SEGMENT INFORMATION

REPORTABLE OPERATING SEGMENTS

The Company is organized in two reportable segments: Steel and Mining.

The Steel segment includes the sales of steel products, which comprises slabs, hot rolled coils and sheets, cold rolled coils and sheets, tin plate, welded pipes, hot dipped galvanized and electro-galvanized sheets, pre-painted sheets, billets (steel in its basic, semi-finished state), wire rod and bars and other tailor-made products to serve its customers’ requirements.

The Steel segment comprises three operating segments: Mexico, Southern Region and Other markets. These three segments have been aggregated considering the economic characteristics and financial effects of each business activity in which the entity engages; the related economic environment in which it operates; the type or class of customer for the products; the nature of the products; and the production processes. The Mexico operating segment comprises the Company’s businesses in Mexico. The Southern region operating segment manages the businesses in Argentina, Paraguay, Chile, Bolivia and Uruguay. The Other markets operating segment includes businesses mainly in United States, Colombia, Guatemala, Costa Rica, El Salvador, Nicaragua and Honduras.

The Mining segment includes the sales of mining products, mainly iron ore and pellets, and comprises the mining activities of Las Encinas, an iron ore mining company in which Ternium holds a 100% equity interest and the 50% of the operations and results performed by Peña Colorada, another iron ore mining company in which Ternium maintains that same percentage over its equity interest. Both mining operations are located in Mexico.

Ternium’s Chief Operating Decision Maker (CEO) holds monthly meetings with senior management, in which operating and financial performance information is reviewed, including financial information that differs from IFRS principally as follows:

- The use of direct cost methodology to calculate the inventories, while under IFRS is at full cost, including absorption of production overheads and depreciation.

- The use of costs based on previously internally defined cost estimates, while, under IFRS, costs are calculated at historical cost (with the FIFO method).

- Other timing and non-significant differences.

Most information on segment assets is not disclosed as it is not reviewed by the CODM (CEO).

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

|

3.

SEGMENT INFORMATION (continued)

|

|

Three-month period ended March 31, 2016 (Unaudited)

|

|

|

Steel

|

Mining

|

Inter-segment eliminations

|

Total

|

|

|

|

|

|

|

|

IFRS

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

1,655,060

|

43,841

|

(43,399)

|

1,655,502

|

|

Cost of sales

|

(1,282,999)

|

(48,008)

|

44,198

|

(1,286,809)

|

|

Gross profit

|

372,061

|

(4,167)

|

799

|

368,693

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

(161,287)

|

(2,729)

|

-

|

(164,016)

|

|

Other operating income, net

|

(961)

|

(1,360)

|

-

|

(2,321)

|

|

|

|

|

|

|

|

Operating income - IFRS

|

209,813

|

(8,256)

|

799

|

202,356

|

|

|

|

|

|

|

|

Management view

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

1,655,060

|

46,545

|

(46,103)

|

1,655,502

|

|

Operating income

|

218,044

|

(3,747)

|

2,730

|

217,027

|

|

|

|

|

|

|

|

Reconciliation items:

|

|

|

|

|

|

|

|

|

|

|

|

Differences in Cost of sales

|

|

|

|

(14,670)

|

|

|

|

|

|

|

|

Operating income - IFRS

|

|

|

|

202,356

|

|

|

|

|

|

|

|

Financial income (expense), net

|

|

|

|

(21,843)

|

|

Equity in losses of non-consolidated companies

|

|

|

|

2,442

|

|

|

|

|

|

|

|

Income before income tax expense - IFRS

|

|

|

|

182,955

|

|

|

|

|

|

|

|

Depreciation and amortization - IFRS

|

(89,042)

|

(11,626)

|

-

|

(100,668)

|

|

|

|

|

|

|

|

|

Three-month period ended March 31, 2015 (Unaudited)

|

|

|

Steel

|

Mining

|

Inter-segment eliminations

|

Total

|

|

|

|

|

|

|

|

IFRS

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

2,125,493

|

56,985

|

(56,403)

|

2,126,075

|

|

Cost of sales

|

(1,720,184)

|

(57,957)

|

49,838

|

(1,728,303)

|

|

Gross profit

|

405,309

|

(972)

|

(6,565)

|

397,772

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

(193,962)

|

(3,404)

|

-

|

(197,366)

|

|

Other operating income, net

|

4,000

|

(260)

|

-

|

3,740

|

|

|

|

|

|

|

|

Operating income - IFRS

|

215,347

|

(4,636)

|

(6,565)

|

204,146

|

|

|

|

|

|

|

|

Management view

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

2,125,493

|

64,025

|

(63,443)

|

2,126,075

|

|

Operating income

|

283,524

|

5,135

|

(1,475)

|

287,184

|

|

|

|

|

|

|

|

Reconciliation items:

|

|

|

|

|

|

|

|

|

|

|

|

Differences in Cost of sales

|

|

|

|

(83,038)

|

|

|

|

|

|

|

|

Operating income - IFRS

|

|

|

|

204,146

|

|

|

|

|

|

|

|

Financial income (expense), net

|

|

|

|

(5,799)

|

|

Equity in losses of non-consolidated companies

|

|

|

|

(9,520)

|

|

|

|

|

|

|

|

Income before income tax expense - IFRS

|

|

|

|

188,827

|

|

|

|

|

|

|

|

Depreciation and amortization - IFRS

|

(96,694)

|

(12,601)

|

-

|

(109,295)

|

|

|

|

|

|

|

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

|

3.

SEGMENT INFORMATION (continued)

GEOGRAPHICAL INFORMATION

There are no revenues from external customers attributable to the Company’s country of incorporation (Luxembourg).

For purposes of reporting geographical information, net sales are allocated based on the customer’s location. Allocation of non-current assets is based on the geographical location of the underlying assets.

|

|

Three-month period ended March 31, 2016 (Unaudited)

|

|

|

Mexico

|

Southern region

|

Other markets

|

Total

|

|

|

|

|

|

|

|

Net sales

|

994,923

|

464,553

|

196,026

|

1,655,502

|

|

|

|

|

|

|

|

Non-current assets (1)

|

4,145,906

|

617,155

|

244,939

|

5,008,000

|

|

|

|

|

|

|

|

|

Three-month period ended March 31, 2015 (Unaudited)

|

|

|

Mexico

|

Southern region

|

Other markets

|

Total

|

|

|

|

|

|

|

|

Net sales

|

1,251,589

|

632,789

|

241,697

|

2,126,075

|

|

|

|

|

|

|

|

Non-current assets (1)

|

4,196,845

|

912,282

|

262,485

|

5,371,612

|

|

(1) Includes propery, plant and equipament and intangible assets.

|

|

|

|

|

4.

COST OF SALES

|

|

Three-month period ended

March 31,

|

|

|

2016

|

|

2015

|

|

|

(Unaudited)

|

|

|

|

|

|

|

Inventories at the beginning of the year

|

1,579,120

|

|

2,134,034

|

|

Translation differences

|

(46,419)

|

|

(18,748)

|

|

Plus: Charges for the period

|

|

|

|

|

Raw materials and consumables used and

other movements

|

871,255

|

|

1,282,221

|

|

Services and fees

|

20,582

|

|

22,058

|

|

Labor cost

|

122,186

|

|

148,337

|

|

Depreciation of property, plant and equipment

|

79,018

|

|

85,454

|

|

Amortization of intangible assets

|

9,026

|

|

11,587

|

|

Maintenance expenses

|

100,822

|

|

113,175

|

|

Office expenses

|

1,467

|

|

1,500

|

|

Insurance

|

2,208

|

|

2,504

|

|

Change of obsolescence allowance

|

2,059

|

|

8,135

|

|

Recovery from sales of scrap and by-products

|

(5,356)

|

|

(6,722)

|

|

Others

|

6,162

|

|

4,931

|

|

|

|

|

|

|

Less: Inventories at the end of the period

|

(1,455,321)

|

|

(2,060,163)

|

|

Cost of Sales

|

1,286,809

|

|

1,728,303

|

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

|

5.

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

|

|

Three-month period ended

March 31,

|

|

|

2016

|

|

2015

|

|

|

(Unaudited)

|

|

Services and fees

|

13,419

|

|

17,039

|

|

Labor cost

|

44,960

|

|

56,481

|

|

Depreciation of property, plant and equipment

|

3,335

|

|

3,459

|

|

Amortization of intangible assets

|

9,289

|

|

8,795

|

|

Maintenance and expenses

|

868

|

|

1,218

|

|

Taxes

|

24,381

|

|

32,861

|

|

Office expenses

|

7,685

|

|

10,641

|

|

Freight and transportation

|

56,352

|

|

64,332

|

|

Increase (decrease) of allowance for doubtful accounts

|

237

|

|

(353)

|

|

Others

|

3,490

|

|

2,893

|

|

Selling, general and administrative expenses

|

164,016

|

|

197,366

|

6.

FINANCE EXPENSE, FINANCE INCOME AND OTHER FINANCIAL INCOME (EXPENSES) , NET

|

|

Three-month period ended

March 31,

|

|

|

2016

|

|

2015

|

|

|

(Unaudited)

|

|

Interest expense

|

(12,008)

|

|

(23,541)

|

|

Debt issue costs

|

(648)

|

|

(508)

|

|

|

|

|

|

|

Finance expense

|

(12,656)

|

|

(24,049)

|

|

|

|

|

|

|

Interest income

|

3,019

|

|

2,127

|

|

|

|

|

|

|

Finance income

|

3,019

|

|

2,127

|

|

|

|

|

|

|

Net foreign exchange (loss) gain

|

(19,113)

|

|

9,121

|

|

Change in fair value of financial assets

|

4,999

|

|

(401)

|

|

Derivative contract results

|

2,526

|

|

8,066

|

|

Others

|

(618)

|

|

(663)

|

|

|

|

|

|

|

Other financial (expenses) income, net

|

(12,206)

|

|

16,123

|

7.

PROPERTY, PLANT AND EQUIPMENT, NET

|

|

Three-month period ended

March 31,

|

|

|

2016

|

|

2015

|

|

|

(Unaudited)

|

|

At the beginning of the year

|

4,207,566

|

|

4,481,027

|

|

|

|

|

|

|

Currency translation differences

|

(75,151)

|

|

(28,314)

|

|

Additions

|

93,061

|

|

75,822

|

|

Disposals

|

(4,282)

|

|

(4,246)

|

|

Depreciation charge

|

(82,353)

|

|

(88,913)

|

|

Transfers and reclassifications

|

(4,791)

|

|

-

|

|

At the end of the period

|

4,134,050

|

|

4,435,376

|

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

|

8.

INTANGIBLE ASSETS, NET

|

|

Three-month period ended

March 31,

|

|

|

2016

|

|

2015

|

|

|

(Unaudited)

|

|

At the beginning of the year

|

888,206

|

|

948,886

|

|

|

|

|

|

|

Currency translation differences

|

(697)

|

|

(274)

|

|

Additions

|

4,756

|

|

8,006

|

|

Amortization charge

|

(18,315)

|

|

(20,382)

|

|

At the end of the period

|

873,950

|

|

936,236

|

9.

INVESTMENTS IN NON-CONSOLIDATED COMPANIES

|

Company

|

|

Country of incorporation

|

|

Main activity

|

|

Voting rights as of

|

|

Value as of

|

|

|

|

|

March 31, 2016

|

|

December 31, 2015

|

|

March 31, 2016

|

|

December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Usinas Siderurgicas de Minas Gerais S.A. - USIMINAS

|

|

Brazil

|

|

Manufacturing and selling of steel products

|

|

32.88%

|

|

32.88%

|

|

240,998

|

|

239,960

|

|

Other non-consolidated companies (1)

|

|

|

|

|

|

|

|

|

|

10,157

|

|

10,452

|

|

|

|

|

|

|

|

|

|

|

|

251,155

|

|

250,412

|

(1)

It includes the investments held in Techgen S.A. de C.V., Finma S.A.I.F., Arhsa S.A., Techinst S.A., Recrotek S.R.L. de C.V. and Gas Industrial de Monterrey S.A. de C.V.

(a)

Usinas Siderurgicas de Minas Gerais S.A. - USIMINAS

On January 16, 2012, the Company’s wholly-owned Luxembourg subsidiary Ternium Investments S.à r.l. (“Ternium Investments”), together with the Company’s Argentine majority-owned subsidiary Siderar S.A.I.C., Siderar’s wholly-owned Uruguayan subsidiary Prosid Investments S.A., and Confab Industrial S.A., a Brazilian subsidiary of Tenaris S.A. (“TenarisConfab”), joined Usiminas’ existing control group through the acquisition of 84.7, 30.0, and 25.0 million ordinary shares, respectively. The rights and obligations of the control group members are governed under a shareholders agreement. As a result of these transactions, the control group, which holds 322.7 million ordinary shares representing the majority of Usiminas’ voting rights, is formed as follows: Nippon Steel & Sumitomo Metal Corporation Group (“NSSMC”, formerly Nippon Group) 46.1%, Ternium/Tenaris Group 43.3%, and CEU 10.6%.

On October 2, 2014, Ternium Investments entered into a purchase agreement with Caixa de Previdência dos Funcionários do Banco do Brasil – PREVI for the acquisition of 51.4 million ordinary shares of Usiminas at a price of BRL 12 per share, for a total amount of BRL 616.7 million. On October 30, 2014, Ternium Investments completed the acquisition. These additional shares are not subject to the Usiminas shareholders agreement, but must be voted in accordance with the control group decisions.

Following the acquisition of these additional shares, Ternium (through Ternium Investments, Siderar and Prosid) owns 166.1 million ordinary shares, representing 32.9% of Usiminas’ ordinary shares (114.7 of which are subject to the Usiminas shareholders agreement). Ternium continues to hold 35.6% of Usiminas’ voting rights over the control group and has a participation in Usiminas’ results of 16.82%.

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

|

9. INVESTMENTS IN NON-CONSOLIDATED COMPANIES (continued)

Usiminas’ financial statements as of and for the quarter ended March 31, 2016, described a downgraded economic scenario for the company that caused a significant impact on its financial leverage and cash generation. In addition, KPMG, Usiminas’ external auditors reiterated in their report on the financial statements the emphasis of matter paragraph that indicated the existence of “a material uncertainty that may cast significant doubt about the Company’s ability to continue as a going concern”, as they had done in their report on Usiminas’ financial statements as of and for the year then ended December 31, 2015.

On March 17, 2016, Usiminas entered into a standstill agreement with its financial creditors with a term of 120 days. On April 18, 2016, Usiminas’ shareholders’ meeting approved an issuance of ordinary shares in an amount of up to BRL 1.0 billion (approximately USD 285.7 million). Existing shareholders, including Ternium and NSSMC, have preemptive rights to subscribe the proposed capital increase at any time prior to May 23, 2016. Ternium has not yet decided whether or not it will participate in the capital increase; NSSMC, in turn, has undertaken to subscribe the capital increase in its entirety; however, NSSMC has conditioned its undertaking to the completion of a restructuring of Usiminas’ financial debt. Ternium’s subscription rights, if exercised, entitle it to subscribe up to 33.6 million ordinary shares at a price of BRL 5.0 per share for a total amount of up to BRL 168.2 million (approximately USD 48.1 million), and to subscribe (pro rata with other subscribing shareholders) any ordinary shares not subscribed by Usiminas’ current shareholders, also at BRL 5.0 per share. On April 20, 2016, Ternium subscribed 8.5 million preferred shares of Usiminas for a total consideration of USD 3.1 million. On April 26, 2016, Usiminas’ CEO mentioned in an investor conference call that a restructuring of Usiminas financial debt is in an advanced stage.

Based on the foregoing developments, management believes the above mentioned capital increase and financial debt restructuring are likely to contribute to improve Usiminas’ financial situation and that, following the USD 191.9 million impairment of the Company’s investment in Usiminas recorded in the fourth quarter of 2015 (which reduced the investment’s book value as of December 31, 2015 to USD 240.0 million), no additional impairment is required to be recorded. The Company has decided to maintain the carrying value at USD 241.0 million.

The Company reviews periodically the recoverability of its investment in Usiminas. To determine the recoverable value, the Company estimates the value in use of the investment by calculating the present value of the expected cash flows or its fair value less costs of disposal.

As of March 31, 2016, the value of the investment in Usiminas is comprised as follows:

|

Value of investment

|

|

USIMINAS

|

|

|

|

|

|

As of January 1, 2016

|

|

239,960

|

|

Share of results

|

|

2,384

|

|

Other comprehensive income

|

|

(1,346)

|

|

|

|

|

|

As of March 31, 2016

|

|

240,998

|

At March 31, 2016, the closing price of the Usiminas’ ordinary shares as quoted on the BM&FBovespa Stock Exchange was BRL 4.09 (approximately USD 1.15) per share, giving Ternium’s ownership stake a market value of approximately USD 190.9 million.

On April 25, 2016, Usiminas approved its consolidated interim accounts as of and for the three-months ended March 31, 2016, which state that revenues, post-tax loss from continuing operations and shareholders’ equity amounted to USD 523 million, USD 38 million and USD 3,716 million, respectively.

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

|

9.

INVESTMENTS IN NON-CONSOLIDATED COMPANIES (continued)

|

|

|

USIMINAS

|

|

Summarized balance sheet (in million USD)

|

|

As of March 31, 2016

|

|

Assets

|

|

|

|

Non-current

|

|

5,765

|

|

Current

|

|

1,714

|

|

Total Assets

|

|

7,479

|

|

Liabilities

|

|

|

|

Non-current

|

|

1,945

|

|

Current

|

|

1,372

|

|

Total Liabilities

|

|

3,317

|

|

|

|

|

|

Minority interest

|

|

446

|

|

|

|

|

|

Shareholders' equity

|

|

3,716

|

|

|

|

|

|

|

|

USIMINAS

|

|

Summarized income statement (in million USD)

|

|

Three-month period ended

March 31, 2016

|

|

Net sales

|

|

523

|

|

Cost of sales

|

|

(533)

|

|

Gross Profit

|

|

(10)

|

|

Selling, general and administrative expenses

|

|

(43)

|

|

Other operating income, net

|

|

(28)

|

|

Operating income

|

|

(81)

|

|

Financial expenses, net

|

|

26

|

|

Equity in earnings of associated companies

|

|

13

|

|

Loss before income tax

|

|

(42)

|

|

Income tax expense

|

|

4

|

|

Net loss before minority interest

|

|

(38)

|

|

Minority interest in other subsidiaries

|

|

-

|

|

Net loss for the period

|

|

(38)

|

(b)

Techgen S.A. de C.V.

Techgen is a Mexican project company currently undertaking the construction and operation of a natural gas-fired combined cycle electric power plant in the Pesquería area of the State of Nuevo León, Mexico. As of February 2014, Ternium, Tenaris, and Tecpetrol International S.A. (a wholly-owned subsidiary of San Faustin S.A., the controlling shareholder of both Ternium and Tenaris) completed their initial investments in Techgen. Techgen is currently owned 48% by Ternium, 30% by Tecpetrol and 22% by Tenaris. Ternium and Tenaris also agreed to enter into power supply and transportation agreements with Techgen, pursuant to which Ternium and Tenaris will contract 78% and 22%, respectively, of Techgen’s power capacity of between 850 and 900 megawatts. During 2015, each of Techgen’s shareholders made additional investments in Techgen, primarily in the form of cash contributions and subordinated loans. During 2015 and 2016, Ternium made cash contributions of USD 9.6 million and granted a subordinated loan which amounted to USD 33.5 million. For commitments from Ternium in connection with Techgen, see note 11.

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

|

10.

DISTRIBUTION OF DIVIDENDS

On February 23, 2016, the Board of Directors proposed a dividend distribution of USD 0.09 per share (USD 0.90 per ADS), or approximately USD 180.4 million in the aggregate, which is subject to shareholders’ approval at the Company’s annual general shareholders’ meeting to be held on May 4,

2016. If the annual dividend is approved at the shareholders’ meeting, it will be paid on May 13, 2016, with record-date of May 10, 2016.

11.

CONTINGENCIES, COMMITMENTS AND RESTRICTIONS ON THE DISTRIBUTION OF PROFITS

This note should be read in conjunction with Note 24 to the Company’s audited Consolidated Financial Statements for the year ended December 31, 2015. Significant changes or events since the date of issue of such financial statements are as follows:

(i) Tax claims and other contingencies

(a)

Siderar. AFIP – Income tax claim for fiscal years 1995 to 1999

The Argentine tax authority (Administración Federal de Ingresos Públicos, or “AFIP”) has challenged the deduction from income of certain disbursements treated by Siderar as expenses necessary to maintain industrial installations, alleging that these expenses should have been treated as investments or improvements subject to capitalization. Accordingly, AFIP made income tax assessments against Siderar with respect to fiscal years 1995 through 1999.

As of March 31, 2016, Siderar’s aggregate exposure under these assessments (including principal, interest and fines) amounts to approximately USD 1.5 million. Siderar appealed each of these assessments before the National Tax Court, which, in successive rulings, reduced the amount of each of the assessments made by AFIP; the National Tax Court decisions were, however, further appealed by both Siderar and AFIP.

Based on recent National Tax Court decisions, management believes that there could be an additional potential cash outflow in connection with this assessment and, as a result, Siderar recognized a provision which, as of March 31, 2016, amounts to USD 0.4 million.

(b) Companhia Siderúrgica Nacional (CSN) – Tender offer litigation

In 2013, the Company was notified of a lawsuit filed in Brazil by Companhia Siderúrgica Nacional (CSN) and various entities affiliated with CSN against Ternium Investments S.à r.l., its subsidiary Siderar, and Confab Industrial S.A., a Brazilian subsidiary of Tenaris S.A. The entities named in the CSN lawsuit had acquired a participation in Usinas Siderúrgicas de Minas Gerais S.A. – USIMINAS (Usiminas) in January 2012. The CSN lawsuit alleges that, under applicable Brazilian laws and rules, the acquirers were required to launch a tag-along tender offer to all non-controlling holders of Usiminas ordinary shares for a price per share equal to 80% of the price per share paid in such acquisition, or BRL 28.8, and seeks an order to compel the acquirers to launch an offer at that price plus interest. If so ordered, the offer would need to be made to 182,609,851 ordinary shares of Usiminas not belonging to Usiminas’ control group; Ternium Investments and Siderar’s respective shares in the offer would be 60.6% and 21.5%.

On September 23, 2013, the first instance court issued its decision finding in favor of the defendants and dismissing the CSN lawsuit. The claimants appealed the court decision and the defendants filed their response to the appeal. It is currently expected that the court of appeals will issue its judgment on the appeal in 2016.

|

TERNIUM S.A.

|

|

Consolidated Condensed Interim Financial Statements as of March 31, 2016

and for the three-month periods ended March 31, 2016 and 2015

|

11.

CONTINGENCIES, COMMITMENTS AND RESTRICTIONS ON THE DISTRIBUTION OF PROFITS (continued)

Ternium is aware that on November 10, 2014, CSN filed a separate complaint with Brazil’s securities regulator Comissão de Valores Mobiliários (CVM) on the same grounds and with the same purpose as the lawsuit referred to above. The CVM proceeding is underway and the Company has not yet been served with process or requested to provide its response.

Finally, on December 11, 2014, CSN filed a claim with Brazil’s antitrust regulator Consejo Administrativo de Defesa Econômica (CADE). In its claim, CSN alleges that the antitrust clearance request related to the January 2012 acquisition, which was approved by CADE without restrictions in August 2012, contained a false and deceitful description of the acquisition aimed at frustrating the minority shareholders’ right to a tag-along tender offer, and requests that CADE investigate and reopen the antitrust review of the acquisition and suspend the Company’s voting rights in Usiminas until the review is completed. On May 6, 2015, CADE rejected CSN’s claim. CSN did not appeal the decision and, on May 19, 2015 CADE formally closed the file.

Ternium believes that all of CSN's claims and allegations are groundless and without merit, as confirmed by several opinions of Brazilian legal

counsels and previous decisions by CVM, including a February 2012 decision determining that the above mentioned acquisition did not trigger any tender offer requirement, and, more recently, the first instance court decision on this matter first referred to above. Accordingly, no provision was recorded in these Consolidated Condensed Interim Financial Statements.

(c) Shareholder claims relating to the October 2014 acquisition of Usiminas shares