FORM 6 - K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16

of

the Securities Exchange Act of 1934

As of 6/18/2015

Ternium S.A.

(Translation of Registrant's name into English)

Ternium

S.A.

29 Avenue de la Porte-Neuve

L-2227 Luxembourg

(352) 2668-3152

(Address of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover

Form 20-F or 40-F.

Form 20-F Ö

Form 40-F__

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12G3-2(b) under the Securities Exchange Act of 1934.

Yes__

No Ö

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection

with Rule 12g3-2(b):

Not applicable

The attached material is being furnished

to the Securities and Exchange Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended.

This report contains Ternium S.A.’s presentation during

its 2015 investor day.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TERNIUM S.A.

By: /s/ Pablo Brizzio

Name: Pablo Brizzio

Title: Chief Financial Officer

Dated: June 18, 2015

TERNIUM lInvestor Day –June 18, 2015 TERNIUM INVESTOR DAY 2015 Solomon R. Guggenheim Museum June 18, 2015

TERNIUM lInvestor Day –June 18, 2015 2 Forward-Looking Statements This presentation contains certain forward-looking statements and information relating to Ternium S.A. andits subsidiaries (collectively, “Ternium”) that are based on the current beliefs of its management as well as assumptionsmadebyandinformationcurrentlyavailabletoTernium. Suchstatementsreflectthecurrentviews ofTerniumwithrespecttofutureeventsandaresubjecttocertainrisks,uncertaintiesandassumptions. Many factorscouldcausetheactualresults,performanceorachievementsofTerniumtobemateriallydifferentfrom any future results, performance or achievements that may be expressed or implied by such forward-looking statements,including,amongothers,changesingeneraleconomic,politicalconditionsinthecountriesinwhich TerniumdoesbusinessorothercountrieswhichhaveanimpactonTernium’sbusinessactivitiesandinvestments, changesininterestrates,changesininflation rates,changesinexchangerates,thedegreeofgrowthandthe numberofconsumersinthemarketsinwhichTerniumoperatesandsellsitsproducts,changesinsteeldemand andprices,changesinrawmaterialandenergypricesordifficultiesinacquiringrawmaterialsorenergysupply cut-offs, changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual resultsmay vary materially fromthosedescribedhereinasanticipated,believed,estimated,expectedortargeted.Terniumdoesnotintend, anddoesnotassumeanyobligation,toupdatetheseforward-lookingstatements.

TERNIUM lInvestor Day –June 18, 2015 3 8:30am Registration and breakfast 9:15am Presentation by Daniel Novegil, CEO 10:00am Q&A session with Ternium management 11:00am Closing remarks Event Schedule

TERNIUM lInvestor Day –June 18, 2015 4 Daniel Novegil, Chief Executive Officer Mr.Novegil, who has been Ternium’s CEO since 2005, is an Industrial Engineer. He graduated from Universidad de Buenos Aires and has a Master of Science in Management degree from Stanford University. Mr.Novegil is a member of the Board of the World Steel Association. He is also a member of the Advisory Board of the Sloan Master Program of the Stanford University School of Business. Pablo Brizzio, Chief Financial Officer Máximo Vedoya, Mexico Area Manager Martín Berardi, Siderar Executive Vice President Oscar Montero, Planning and Operations General Director Sebastián Martí, IR Director Speakers

TERNIUM lInvestor Day –June 18, 2015 5 Safety Steel Markets Competitive Positioning Usiminas Performance Conclusion

TERNIUM lInvestor Day –June 18, 2015 6 • Safety program launched in 2010 • Main ongoing initiatives: oDuPont technical assistance to address potential process hazards oOHSAS18001 certification oIntegral safety and environmental investment plan • Health & Safety excellence recognition by worldsteelin 2014 Lost time injuries frequency rate (LTIFR) Safety Significant improvement in safety performance 3.6 2.2 1.2 0.9 1.1 0.8 0.6 '09 '10 '11 '12 '13 '14 1Q15 LTIFR = Lost time injuries per million hours worked Worldsteel average

TERNIUM lInvestor Day –June 18, 2015 7 Safety Steel Markets Competitive Positioning Usiminas Performance Conclusion

TERNIUM lInvestor Day –June 18, 2015 Ref: (million tons) Crude steel capacity Nafta Europe CIS China Japan RoW South America 162 82 49 93 60 Crude steel use Overcapacity 417 20 287 72 426 152 1154 131 Apparent steel use (ASU) ASU/capita y-o-y growth rate (kg) 2014 2015 2016 2016 China -3.3% -0.5% -0.5% 509 World ex-China 4.2% 1.3% 2.9% 144 USA 11.7% -0.4% 0.7% 331 Mexico 11.7% 2.6% 3.9% 189 Brazil -6.8% -7.8% 3.1% 114 Argentina -1.1% -2.8% 2.1% 117 Other 3.1% -3.3% 3.3% 113 World Americas 8 Steel Markets World ex-China outlook for 2016 improving • Improvement in steel consumption expected in Latam in 2016 • Low steel use per capita in Latam represents an opportunity for TX • China and CIS are the main steel exporters in the world Source: worldsteel Steel nominal overcapacity (million tons)

TERNIUM lInvestor Day –June 18, 2015 9 Steel Markets Increasing unfair trade cases • Trade remedy case initiations at highest levels since 2001 • The US and Eurozone governments showing concern about unfair trade • AISI, Eurofer and Alacero highlighted the importance of a level playing field for the health of the global steel industry • Latest developments in Ternium’s main markets: oMexico: AD investigation of hot-rolled from China, Germany and France oUSA: AD investigation of corrosion resistant products from China Source: OCDE Antidumping (AD) and Countervailing duties (CVD) initiations 6 7 5 6 15 13 16 13 25 26 22 2004 2014

TERNIUM lInvestor Day –June 18, 2015 10 LatamSteel Market Mexico is the most promising steel market in the region • Latam’s four largest markets (MEX, BRA, ARG, COL) account for: o67% of population o71% of GDP o77% of steel use • Import substitution potential (direct and indirect) • Mexico is one of the most dynamic manufacturing hubs in the world Steel consumption (million tons) Mexico Brazil Argentina Colombia 15.3 23.0 2005 2015 Import share (%) CAGR 4.2% 35% 16.8 22.7 2005 2015 CAGR 3.1% 15% 3.7 4.9 2005 2015 CAGR 2.8% 16% 2.4 4.2 2005 2015 CAGR 5.8% 60% Source: worldsteel, Alacero

TERNIUM lInvestor Day –June 18, 2015 11 Safety Steel Markets Competitive Positioning Usiminas Performance Conclusion

TERNIUM lInvestor Day –June 18, 2015 12 • TX is a leading steel company in Latin America • 9.4 million tons of steel products shipped in 2014 • NAFTA is driving TX’s growth and accounted for 64% of shipments in 2014 • Ternium participates in Usiminas’ control group Competitive Positioning Footprint in the Americas TX steel shipments in 2014 Mexico 60% Argentina 24% Colombia 7% Other Latam5% USA 4% TX sales mix in 2014 Building & infrastructure 51% Home appliances 9% Automotive 16% Energy 6% Other industries 18%

TERNIUM lInvestor Day –June 18, 2015 13 Competitive Positioning Flexible and diversified production configuration • Diversified raw material base supports margin stability • TX’s mix of technologies provides production flexibility 34% 28% 38% Iron ore DRI EAF CC Iron ore Coking coal BF BOF CC Purchased Slabs Slab processing BF/BOF DRI/EAFNatural gas Notes: DRI: Direct reduced iron EAF: Electric arc furnace BF: Blast furnace BOF: Basic oxygen furnace CC: Continuous caster Electricity

TERNIUM lInvestor Day –June 18, 2015 10.3 11.5 12.7 12.6 14.2 2010 2011 2012 2013 2014 Industrial Commercial 14 Competitive Positioning –Mexico Solid growth in the Mexican market • Highest ASU per capita in the region (189 kg) • Strong link to the US manufacturing industry • Substantial opportunities for import substitution • Largest automotive industry in Latam • National Infrastructure Plan to boost steel consumption Mexican Flat Steel Market (mt) Source: Canacero ASU per capita (kg) 86 189 1996 2006 2016 CAGR 4.1%

TERNIUM lInvestor Day –June 18, 2015 15 Competitive Positioning –Mexican Industrial Market Ternium’s differentiation based on products and services • Strengthened positioning in Mexican industrial market through: oNew products development oCertification of new steel grades oConsolidation of operations in Pesqueríaand Tenigalfacilities oEnhanced IT tools • Increasing demand for high-end steel products • Increasing shipments to industrial customers through import substitution • Regional commercial approach to leading industrial customers Shipments to industrial customers (million tons) 1.8 2.0 2.0 2.1 2.6 3.0 2010 2011 2012 2013 2014 2015f TX’s automotive certifications Note: number of product certification by process and customer (accumulated) 31 69 134 251 170 2012 2013 2014 2015f Ongoing Certified

TERNIUM lInvestor Day –June 18, 2015 16 Competitive Positioning –Mexican Auto Industry Ternium is the largest supplier to the auto industry in Mexico Light vehicle production in Mexico (million units) • Among the fastest growing auto industries in the world • Growth coming from competitive labor cost and free trade agreements • Production of 5 million units per year expected by 2020 • Investments encompass all the automotive value chain • Growing local research and development capabilities • Opportunities for import substitution in the automotive coated steel market Source: IHS 2.3 3.3 5.1 2010 2015 2020

TERNIUM lInvestor Day –June 18, 2015 17 Competitive Positioning –Commercial Market Enhancing our service offering in Mexico TX distribution network in Mexico • High-margin market resulting from customization and service • Value coming from branding, local presence & logistics management • High entry barrier against imports • Full product range • Nationwide coverage through regional distributors • Positive momentum in the construction market • Enhancing service through IT developments Shipments (mt) Active customers 1.1 1.3 2010 2015f +17% 780 980 2010 2015f +26% -6% -3% 0% 3% 6% 2010 2015 Construction GDP in Mexico (q-o-q growth) Source: Inegi Ternium’s distribution network

TERNIUM lInvestor Day –June 18, 2015 18 Competitive Positioning –Argentina Resilient steel market with a positive outlook • Shipments remain stable at relatively high levels • Mixed performance of end markets oConstruction improving and becoming more steel intensive oOil & gas investments growing oAuto industry impacted by softening demand and exports to Brazil • Positive outlook in the medium term oInfrastructure development oCredit availability oEnergy imports substitution oAgricultural sector Source: Oil & Gas Argentine Institute Coated steel shipments in Argentina (mt) Well drilling activity (number of wells) 0.6 0.8 2010 2015f 1540 1407 2010 2015f Shale Conventional

TERNIUM lInvestor Day –June 18, 2015 19 Competitive Positioning TX service differentiation • TX developed a technology infrastructure to support its service differentiation oMain characteristics: full coverage, real-time processing, reliability and highest security standards oBenchmarking from innovative companies in different industries (automotive, banking) • Ternium’s IT solutions: oDigital Marketplace (WebService, WebLink, WebContractor) oTracking Platform for information analytics oReal time integration oDemand planning platform

TERNIUM lInvestor Day –June 18, 2015 20 Safety Steel Markets Competitive Positioning Usiminas Performance Conclusion

TERNIUM lInvestor Day –June 18, 2015 21 Usiminas A leading player in the Brazilian steel market • Usiminas is the leader in the Brazilian flat steel market oLargest supplier of steel to the automotive industry oIntegrated producer from iron ore to high-end products • Brazil’s potential oLargest economy in Latam oGrowing middle class oAbundant natural resources • Opportunities to regain a growth path oInfrastructure development oTax reform to boost investment and industrialization oCompetitiveness of energy costs 4 11 0 2 4 6 8 10 12 14 2000 2007 2014 Brazilian GDP per capita (‘000 $) Source: Global Insight

TERNIUM lInvestor Day –June 18, 2015 22 Usiminas Latest developments • Investment in Usiminas not performing as initially expected, leading to carrying value impairment oRecession of Brazilian economy oWeakening of steel consumption oDecrease of iron ore prices • Brazilian steel market under pressure oIncrease in steel imports oLow competitiveness of cost structure oDe-industralization • Usiminas facing a challenging competitive scenario • Controversy within Usiminas’ Control Group oInterruption of Usiminas turnaround process oOngoing discussions among the Control Group members 26.1 26.4 22.7 2010 2015f -14% Brazilian steel use (mt)

TERNIUM lInvestor Day –June 18, 2015 23 Safety Steel Markets Competitive Positioning Usiminas Performance Conclusion

TERNIUM lInvestor Day –June 18, 2015 24 • Strong market share in growing markets • Focus on value-added, high-end products and service differentiation • Flexible and diversified production configuration • Innovation, industrial expertise and long-term view EBITDA margin (%) Performance TX is executing its strategic plan Source: Bloomberg 19% 18% 15% 17% 17% 12% 10% 6% 2010 2011 2012 2013 2014 Ternium Long steel Americas Global Player USA Minimill USA Integrated

TERNIUM lInvestor Day –June 18, 2015 • Streamlining of the supply chain, from raw material procurement to steel product distribution • Main savings achieved in: oFreight services optimization oFreight rates negotiations based on productivity gains oReduction of external warehousing oNew centralized traffic operations base • Expected annual savings of $40 million 25 Logistics management program Performance Cost cutting initiatives Annual savings progress ($ million) 15 33 40 2014 2015f Target

TERNIUM lInvestor Day –June 18, 2015 • Innovative program to improve productivity of Ternium’s services suppliers • Main savings achieved in: oLabor productivity of maintenance services oPackaging services and materials costs oOptimization of mobile equipment rental oConsolidation of contractors’ frame agreements in Mexico • Expected annual savings of $30 million 26 Contractors management program Performance Cost cutting initiatives 9 23 30 2014 2015f Target Annual savings progress ($ million)

TERNIUM lInvestor Day –June 18, 2015 27 Energy saving program Performance Cost cutting initiatives • Program aimed at reducing consumption of natural gas, electricity, steam and industrial gases • Program based on: oEnergy audits in main facilities oTechnical assistance (Innowatio) oShared best practices • More than 130 initiatives identified requiring a total capexof $75 million (payback <3 years) • Expected annual savings of $30 million starting in 2016 Annual savings breakdown (%) 30% 48% 13% 10% Variable speed drives Energy recovery Combustion efficiency Continuous improvement

TERNIUM lInvestor Day –June 18, 2015 1.3x 1.0x 1.2x 1.1x Dec12 Dec13 Dec14 Mar15 577 1023 883 444 ˜500 2011 2012 2013 2014 2015f 28 Performance Solid financial position • Low indebtedness gives TX flexibility in a challenging environment • End of capex cycle reinforces net debt reduction • 20% increase in dividends in 2014 (dividend yield of 4.8%) Capital expenditures ($ million) Net debt to EBITDA ratio 0.75 0.65 0.75 0.90 2011 2012 2013 2014 Dividends ($ per ADS)

TERNIUM lInvestor Day –June 18, 2015 29 Safety Steel Markets Competitive Positioning Usiminas Performance Conclusion

TERNIUM lInvestor Day –June 18, 2015 30 Conclusion TX’s Strategic Agenda Our Focus •Leader in attractive markets, high market share •Focus on value-added products •Differentiation •Profit sustainability •Growth Our Objectives •Expansion in North America, mainly Mexico •Increase high-end product offering •Slabs supply strategy •Operational excellence •Shareholder value

TERNIUM lInvestor Day –June 18, 2015 31

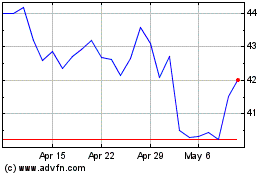

Ternium (NYSE:TX)

Historical Stock Chart

From Mar 2024 to Apr 2024

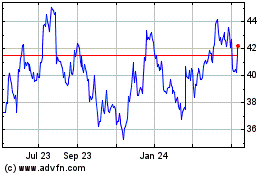

Ternium (NYSE:TX)

Historical Stock Chart

From Apr 2023 to Apr 2024