Report of Foreign Issuer (6-k)

May 18 2015 - 11:20AM

Edgar (US Regulatory)

FORM 6 - K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

As of 5/18/2015

Ternium S.A.

(Translation of Registrant's name into English)

Ternium S.A.

29 Avenue de la Porte-Neuve

L-2227 Luxembourg

(352) 2668-3152

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F.

Form 20-F Ö Form 40-F ___

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12G3-2(b) under the Securities Exchange Act of 1934.

Yes ___ No Ö

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Not applicable

The attached material is being furnished to the Securities and Exchange Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended.

This report contains Ternium S.A.’s press release informing Ternium will restate the carrying value of Usiminas investment.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TERNIUM S.A.

| By: /s/ Pablo Brizzio |

|

| Name: Pablo Brizzio |

|

| Title: Chief Financial Officer |

|

| |

|

| Dated: May 18, 2015 |

|

Exhibit 99.1

Sebastián Martí

Ternium - Investor Relations

+1 (866) 890 0443

+54 (11) 4018 2389

www.ternium.com

Ternium Restates Carrying Value of Usiminas Investment

Luxembourg, May 18, 2015 – Ternium S.A. (the “Company”) (NYSE: TX) has revised its value in use calculation for its investment in Usinas Siderúrgicas de Minas Gerais S.A. – Usiminas (“Usiminas”) and will restate its financial statements to reduce the carrying amount of the Usiminas investment to USD561.8 million as of September 30, 2014. As a result of this restatement, the financial statements at December 31, 2014 and March 31, 2015 will also be restated to reflect the lower carrying value of the Usiminas investment. Ternium’s cash flows are not affected.

These actions follow the conclusion of previously disclosed discussions with the Staff of the U.S. Securities and Exchange Commission regarding Staff comments relating to the carrying value of the Company’s investment in Usiminas under IFRS as of September 30, 2014 and subsequent periods. The Staff had requested information regarding Ternium’s value in use calculations and the differences between the value in use carrying amounts and certain fair value indicators, including in particular the purchase price of BRL12 (approximately USD4.8) per share which the Company paid in October 2014 for the acquisition of 51.4 million additional Usiminas ordinary shares from Caixa de Previdência dos Funcionários do Banco do Brazil – PREVI (“PREVI”). In connection with these discussions, the Company revised the assumptions used to calculate the carrying value of the Usiminas investment at September 30, 2014 in light of the Staff’s comment that the PREVI transaction price provided objective evidence of the value of the Usiminas investment. The restated carrying value as of September 30, 2014 has been revised to reflect a per share value equal to the PREVI transaction price.

The expected impact of this restatement on the Company’s previously issued financial statements will be as follows:

Consolidated Income Statement

|

(all amounts in millions of U.S. dollars, unless otherwise stated)

|

|

Nine-months period ended September 30, 2014

|

|

Year ended December 31, 2014

|

|

Three-months period ended March 31, 2015

|

| |

|

Issued

|

Adj.

|

Restated

|

|

Issued

|

Adj.

|

Restated

|

|

Issued

|

Adj.

|

Restated

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity in (losses) earnings of non-consolidated companies

|

|

(6.7)

|

(739.8)

|

(746.5)

|

|

(34.2)

|

(717.6)

|

(751.8)

|

|

(132.7)

|

123.2

|

(9.5)

|

|

(Loss) Profit for the period

|

|

528.7

|

(704.3)

|

(175.6)

|

|

588.8

|

(693.0)

|

(104.2)

|

|

(22.2)

|

118.0

|

95.8

|

|

Attributable to owners of the parent

|

|

390.8

|

(642.6)

|

(251.8)

|

|

452.4

|

(651.2)

|

(198.8)

|

|

(42.8)

|

111.2

|

68.5

|

|

Earnings (loss) per share (U.S. dollars per share)

|

|

0.20

|

(0.33)

|

(0.13)

|

|

0.23

|

(0.33)

|

(0.10)

|

|

(0.02)

|

0.06

|

0.03

|

Consolidated Statement of Comprehensive Income

|

(all amounts in millions of U.S. dollars)

|

|

Year ended December 31, 2014

|

|

Three-months period ended March 31, 2015

|

| |

|

Issued

|

Adj.

|

Restated

|

|

Issued

|

Adj.

|

Restated

|

| |

|

|

|

|

|

|

|

|

|

Currency translation adjustment from participation in non-consolidated companies

|

|

(189.0)

|

69.2

|

(119.8)

|

|

(236.8)

|

110.1

|

(126.7)

|

Other comprehensive loss for the period, net of tax

|

|

(487.5)

|

69.2

|

(418.3)

|

|

(277.5)

|

110.1

|

(167.4)

|

| |

|

|

|

|

|

|

|

|

|

Total comprehensive (loss) income for the period

|

|

101.3

|

(623.8)

|

(522.5)

|

|

(299.7)

|

228.1

|

(71.6)

|

| |

|

|

|

|

|

|

|

|

|

Attributable to owners of the parent

|

|

92.2

|

(587.8)

|

(495.6)

|

|

(287.9)

|

213.6

|

(74.3)

|

Consolidated Statement of Financial Position

|

(all amounts in millions of U.S. dollars)

|

|

As of September 30, 2014

|

|

As of December 31, 2014

|

|

As of March 31, 2015

|

| |

|

Issued

|

Adj.

|

Restated

|

|

Issued

|

Adj.

|

Restated

|

|

Issued

|

Adj.

|

Restated

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments in non-consolidated companies

|

|

1,308.3

|

(739.8)

|

568.6

|

|

1,396.6

|

(648.4)

|

748.2

|

|

1,025.8

|

(415.1)

|

610.7

|

|

Total Assets

|

|

10,500.4

|

(739.8)

|

9,760.7

|

|

10,254.5

|

(648.4)

|

9,606.2

|

|

9,860.2

|

(415.1)

|

9,445.1

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital and reserves attributable to the owners of the parent

|

|

5,373.1

|

(642.6)

|

4,730.5

|

|

5,285.0

|

(587.8)

|

4,697.2

|

|

4,997.1

|

(374.2)

|

4,622.9

|

|

Total Equity

|

|

6,367.5

|

(704.3)

|

5,663.3

|

|

6,258.5

|

(623.8)

|

5,634.7

|

|

5,958.4

|

(395.7)

|

5,562.7

|

This revision of the carrying value of the Usiminas investment for accounting purposes does not change the Company’s view of the strategic value of Usiminas.

The following chart shows the Company’s carrying values of the Usiminas investment on a per-share basis, compared to the book value resulting from Usiminas’ financial statements under IFRS and the quoted market price of the Usiminas ordinary shares, at each of September 30 and December 31, 2014, and March 31, 2015:

| |

|

Amounts in USD per share

|

| |

|

Ternium issued carrying value

|

|

Ternium restated carrying value

|

|

Usiminas book value

|

|

Quoted market value

|

| |

|

|

|

|

|

|

|

|

|

September 30,2014

|

|

11.3

|

|

4.9

|

|

7.0

|

|

2.7

|

|

December 31,2014

|

|

8.4

|

|

4.5

|

|

6.4

|

|

4.6

|

|

March 31, 2015

|

|

6.1

|

|

3.6

|

|

5.2

|

|

6.7

|

The Company will file its Annual Report on Form 20-F for the year ended December 31, 2014 as soon as practicable upon the issuance of the restated financial statements and the completion of the audit of such financial statements by its registered public accounting firm, PricewaterhouseCoopers, Société Cooperative. The Company also expects that its revision of the carrying value of the Usiminas investment will be treated as a material weakness in its internal control over financial reporting. It is currently expected that the filing of the Form 20-F will occur on or before June 1, 2015.

Forward Looking Statements

Some of the statements contained in this press release are “forward-looking statements”. Forward-looking statements are based on management’s current views and assumptions and involve known and unknown risks that could cause actual results, performance or events to differ materially from those expressed or implied by those statements. These risks include but are not limited to risks arising from uncertainties as to gross domestic product, related market demand, global production capacity, tariffs, cyclicality in the industries that purchase steel products and other factors beyond Ternium’s control.

About Ternium

Ternium is a leading steel producer in Latin America, with an annual production capacity of approximately 11.0 million tons of finished steel products. The company manufactures and processes a broad range of value-added steel products for customers active in the construction, automotive, home appliances, capital goods, container, food and energy industries. With production facilities located in Mexico, Argentina, Colombia, the southern United States and Guatemala, Ternium serves markets in the Americas through its integrated manufacturing system and extensive distribution network. In addition, Ternium participates in the control group of Usiminas, a Brazilian steel company. More information about Ternium is available at www.ternium.com.

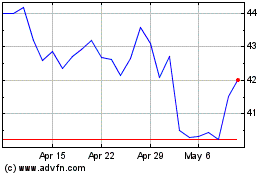

Ternium (NYSE:TX)

Historical Stock Chart

From Mar 2024 to Apr 2024

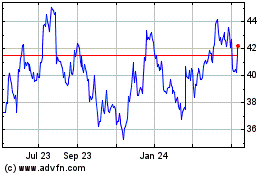

Ternium (NYSE:TX)

Historical Stock Chart

From Apr 2023 to Apr 2024