FORM 6 - K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

As of 7/30/2014

Ternium S.A.

(Translation of Registrant's name into English)

Ternium S.A.

29, Avenue de la Porte-Neuve

L-2227 Luxembourg

(352) 2668-3152

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F.

Form 20-F

Ö

Form 40-F

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12G3-2(b) under the Securities Exchange Act of 1934.

Yes

No

Ö

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Not applicable

The attached material is being furnished to the Securities and Exchange Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended.

This report contains Ternium S.A.’s press release announcing second quarter and first half 2014 results.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TERNIUM S.A.

|

By:

/s/ Pablo Brizzio

Name: Pablo Brizzio

Title: Chief Financial Officer

|

By:

/s/ Daniel Novegil

Name: Daniel Novegil

Title: Chief Executive Officer

|

Dated: July 30, 2014

Sebastián Martí

Ternium - Investor Relations

+1 (866) 890 0443

+54 (11) 4018 2389

www.ternium.com

Ternium Announces Second Quarter and First Half 2014 Results

Luxembourg, July 29, 2014 – Ternium S.A. (NYSE: TX) today announced its results for the second quarter and first half ended June 30, 2014.

The financial and operational information contained in this press release is based on Ternium S.A.’s operational data and consolidated financial statements prepared in accordance with International Financial Reporting Standards (IFRS) and presented in U.S. dollars (USD) and metric tons.

Summary of Second Quarter 2014 Results

|

|

2Q 2014

|

|

1Q 2014

|

|

2Q 2013

|

|

|

|

|

|

|

|

|

|

|

Steel Shipments (tons)

|

2,357,000

|

|

2,335,000

|

1%

|

|

2,213,000

|

7%

|

|

Iron Ore Shipments (tons)

|

944,000

|

|

884,000

|

7%

|

|

1,218,000

|

-22%

|

|

Net Sales (USD million)

|

2,203.7

|

|

2,149.4

|

3%

|

|

2,134.4

|

3%

|

|

Operating Income (USD million)

|

231.3

|

|

319.0

|

-27%

|

|

276.0

|

-16%

|

|

EBITDA

[1]

(USD million)

|

330.1

|

|

416.9

|

-21%

|

|

370.5

|

-11%

|

|

EBITDA per Ton

[2]

(USD)

|

140.1

|

|

178.5

|

|

|

167.4

|

|

|

EBITDA Margin (% of net sales)

|

15.0%

|

|

19.4%

|

|

|

17.4%

|

|

|

Equity in Results of Non-Consolidated Companies

|

(0.4)

|

|

2.6

|

|

|

(10.3

)

|

|

|

Net Income (USD million)

|

180.3

|

|

188.2

|

|

|

134.4

|

|

|

Equity Holders' Net Income (USD million)

|

129.1

|

|

150.0

|

|

|

102.7

|

|

|

Earnings per ADS (USD)

|

0.66

|

|

0.76

|

|

|

0.52

|

|

-

EBITDA of USD330.1 million in the second quarter 2014, 21% lower than EBITDA in the first quarter 2014 mainly as a result of lower EBITDA per ton due to higher steel operating cost per ton

[3]

, partially offset by higher steel revenue per ton.

-

Earnings per American Depositary Share (ADS)

[4]

of USD0.66 in the second quarter 2014, a decrease of USD0.10 per ADS compared to the first quarter 2014 mainly due to lower operating income, partially offset by lower income tax expense.

-

Capital expenditures of USD136.4 million in the second quarter 2014, up from USD103.6 million in the first quarter 2014.

-

Net debt position of USD2.0 billion at the end of June 2014,

up from USD1.6 billion at the end of March 2014. Of note in the second quarter 2014 were USD180.9 million dividend payments and an increase of USD135.5 million in working capital.

[1]

EBITDA in the second quarter 2014 equals operating income of USD231.3 million adjusted to exclude depreciation and amortization of USD98.8 million.

[2]

Consolidated EBITDA divided by steel shipments.

[3]

Operating cost per ton is equal to cost of sales plus SG&A, divided by shipments.

[4]

Each American Depositary Share (ADS) represents 10 shares of Ternium’s common stock. Results are based on a weighted average number of shares of common stock outstanding (net of treasury shares) of 1,963,076,776.

1

Ternium’s operating income in the second quarter 2014 was USD231.3 million, USD87.6 million lower than in the first quarter 2014 mainly as a result of lower operating margin. Operating margin decreased sequentially as a result of USD57 higher steel operating cost per ton, partially offset by USD15 higher steel revenue per ton. Operating cost per ton increased mainly due to higher raw material and purchased slabs costs and higher maintenance expenses, principally related to planned stoppages performed during the second quarter 2014 at Ternium’s Mexican facilities. Operating cost per ton was higher in Siderar, Ternium’s Argentine subsidiary, as a result of an increase in costs, in Argentine Peso terms, that was not mitigated by the devaluation of the local currency against the US Dollar, as the Argentine Peso devalued only 2% against the US Dollar in the second quarter 2014. Steel revenue per ton increased 2% in Mexico and 1% in the Southern Region.

Compared to the second quarter 2013, the company’s operating income in the second quarter 2014 decreased by USD44.7 million, mainly as a result of lower operating margin, partially offset by higher shipments. Operating margin decreased principally due to 6% lower revenue per ton in the Southern Region. Shipments increased by 144,000 tons year-over-year, mainly as a result of a 220,000 ton increase in Mexico, partially offset by a combined 76,000 ton decrease in the Southern Region and Other Markets.

Net income in the second quarter 2014 was USD180.3 million, a decrease of USD7.9 million compared to net income in the first quarter 2014 mainly due to the above-mentioned lower operating income, partially offset by lower income tax expense. Income tax expense in the second quarter 2014 included a net gain related to a non-cash reduction of deferred tax liabilities at one of Ternium’s subsidiaries, partially offset by higher taxes on dividends in connection to Siderar dividend payment in April 2014. Income tax expense in the first quarter 2014 included a net non-recurrent loss mainly related to the settlement of a claim from the Mexican tax authorities related to fiscal year 2006 and to changes in Mexican tax regulations in connection with new mining laws.

Relative to the prior-year period, net income in the second quarter 2014 increased by USD45.9 million, mainly due to the above mentioned lower income tax expense, better results from Usiminas and lower net financial expenses, partially offset by lower operating income.

Summary of First Half 2014 Results

|

|

1H 2014

|

|

1H 2013

|

|

|

|

|

|

|

|

Steel Shipments (tons)

|

4,692,000

|

|

4,454,000

|

5%

|

|

Iron Ore Shipments (tons)

|

1,829,000

|

|

2,319,000

|

-21%

|

|

Net Sales (USD million)

|

4,353.1

|

|

4,270.2

|

2%

|

|

Operating Income (USD million)

|

550.3

|

|

547.8

|

0%

|

|

EBITDA (USD million)

|

747.0

|

|

738.2

|

1%

|

|

EBITDA per Ton (USD)

|

159.2

|

|

165.7

|

|

|

EBITDA Margin (% of net sales)

|

17.2%

|

|

17.3%

|

|

|

Equity in Results of Non-Consolidated Companies

|

2.3

|

|

(26.2)

|

|

|

Net Income (USD million)

|

368.5

|

|

285.8

|

|

|

Equity Holders' Net Income (USD million)

|

279.1

|

|

232.0

|

|

|

Earnings per ADS (USD)

|

1.42

|

|

1.18

|

|

|

|

|

|

|

|

-

EBITDA

[5]

of USD747.0 million in the first half 2014, relatively stable compared to EBITDA in the first half 2013 as a result of an increase in steel shipments, offset by a decrease in iron ore shipments to third parties.

-

Earnings per ADS

[6]

of USD1.42 in the first half 2014, USD0.24 higher than in the first half 2013.

-

Capital expenditures of USD240.0 million in the first half 2014, down from USD507.7 million in the first half 2013.

Operating income in the first half 2014 was USD550.3 million, compared to operating income of USD547.8 million in the first half 2013 as a result of a 238,000 ton increase in steel shipments offset by a decrease in iron ore shipments to third parties. Steel operating margin was relatively stable year-over-year, as a result of USD21 lower revenue per ton offset by USD19 lower operating cost per ton. Steel revenue per ton decreased 7% in the Southern Region and was steady in Mexico. The decrease in steel operating cost per ton was mainly due to lower raw material costs partially offset by higher purchased slabs and energy costs. Steel shipments increased 386,000 tons in Mexico, and decreased a combined 148,000 tons in the Southern Region and Other Markets.

Net income in the first half 2014 was USD368.5 million, USD82.7 million higher than net income in the first half 2013 mainly as a result of better results from Usiminas, lower net financial expenses and lower income tax expenses mainly as a result of the above mentioned factors.

Outlook

During the second quarter 2014, Ternium sustained its strong first quarter shipment activity in Mexico. Shipments in the country increased 386,000 tons, or 16%, in the first half of 2014 over the first half of 2013. The company expects these healthy shipment levels to continue in the third quarter 2014. In

addition, North American steel prices remained attractive during the second quarter 2014. An active manufacturing sector in the region continues to generate demand for steel products and steel inventories remain at reasonable levels. As a result, Ternium expects a slight increase in revenue per ton in Mexico in the third quarter 2014 compared to the second quarter 2014.

[5]

EBITDA in the first half 2014 equals operating income of USD747.0 million adjusted to exclude depreciation and amortization of USD196.7 million.

[6]

Each American Depositary Share (ADS) represents 10 shares of Ternium’s common stock. Results are based on a weighted average number of shares of common stock outstanding (net of treasury shares) of 1,963,076,776.

The company’s shipments in the Southern Region did not recover as anticipated during the second quarter 2014 after the seasonally lower first quarter of the year. Ternium expects shipments in this region to remain relatively stable in the third quarter 2014, with average prices not changing significantly.

Ternium anticipates a slightly higher operating income in the third quarter 2014 compared to the second quarter 2014, with stable shipments and an increase in operating margin as a result of higher revenue per ton partially offset by higher cost per ton.

Analysis of Second Quarter 2014 Results

Net income

attributable to Ternium’s equity holders

in the second quarter 2014 was USD129.1 million, compared to net income of USD102.7 million in the second quarter 2013

.

Including non-controlling interest, net income for the second quarter 2014 was USD180.3 million, USD45.9 million higher in comparison to the second quarter 2013. Earnings per ADS in the second quarter 2014 were USD0.66 compared to Earnings per ADS of USD0.52 in the second quarter 2013.

Net sales

in the

second

quarter 2014 were USD2.2 billion, 3% higher than net sales in the

second

quarter 2013, mainly as a result of higher steel products net sales in Mexico, partially offset by lower steel product net sales in the Southern Region and Other Markets. The following table outlines Ternium’s consolidated net sales for the

second

quarter 2014 and

second

quarter 2013:

|

|

|

Net Sales (million USD)

|

|

|

|

|

2Q 2014

|

2Q 2013

|

Dif.

|

|

|

Mexico

|

|

1,222.0

|

1,028.2

|

19%

|

|

|

Southern Region

|

|

664.8

|

741.9

|

-10%

|

|

|

Other Markets

|

|

301.7

|

324.1

|

-7%

|

|

|

Total steel products net sales

|

|

2,188.5

|

2,094.1

|

5%

|

|

|

Other products

1

|

|

13.6

|

6.4

|

112%

|

|

|

Steel segment net sales

|

|

2,202.1

|

2,100.6

|

5%

|

|

|

|

|

|

|

|

|

|

Mining segment net sales

|

|

83.3

|

101.8

|

-18%

|

|

|

Intersegment eliminations

|

|

(81.7)

|

(68.0)

|

20%

|

|

|

Net sales

|

|

2,203.7

|

2,134.4

|

3%

|

|

1

The item “Other products” primarily includes pig iron and pre-engineered metal building systems.

Cost of sales

was USD1.8 billion in the

second

quarter 2014, an increase of USD109.2 million compared to the

second

quarter 2013. This was principally due to a 7% increase in shipment volumes, a USD75.8 million, or 6%, increase in raw material and consumables used, mainly reflecting an increase in purchased slabs costs and higher energy costs; and a USD33.5 million increase in other costs, including a USD26.9

million increase in maintenance expenses and a USD2.9 million increase in depreciation of property, plant and equipment.

Selling, General & Administrative (SG&A) expenses

in the

second

quarter 2014 were USD213.0 million, or 9.7% of net sales, relatively stable compared to the

second

quarter 2013, mainly due to lower taxes and contributions (others than income tax), freight and transportation expenses and maintenance expenses, offset by higher general expenses and labor costs.

Operating income

in the

second

quarter 2014 was USD231.3 million, or 10.5% of net sales, compared to operating income of USD276.0 million, or 12.9% of net sales, in the

second

quarter 2013. The following table outlines Ternium’s operating income by segment for the

second

quarter 2014 and

second

quarter 2013.

|

|

|

Steel segment

|

|

Mining segment

|

|

Intersegment eliminations

|

|

Total

|

|

USD million

|

|

2Q 2014

|

|

2Q 2013

|

|

2Q 2014

|

|

2Q 2013

|

|

2Q 2014

|

|

2Q 2013

|

|

2Q 2014

|

|

2Q 2013

|

|

Net Sales

|

|

2,202.1

|

|

2,100.6

|

|

83.3

|

|

101.8

|

|

(81.7)

|

|

(68.0)

|

|

2,203.7

|

|

2,134.4

|

|

Cost of sales

|

|

(1,781.8)

|

|

(1,652.7)

|

|

(62.8)

|

|

(76.3)

|

|

81.6

|

|

75.3

|

|

(1,763.0)

|

|

(1,653.8)

|

|

SG&A expenses

|

|

(208.6)

|

|

(210.8)

|

|

(4.4)

|

|

(5.0)

|

|

-

|

|

-

|

|

(213.0)

|

|

(215.8)

|

|

Other operating income, net

|

|

3.3

|

|

10.9

|

|

0.3

|

|

0.3

|

|

-

|

|

-

|

|

3.6

|

|

11.1

|

|

Operating income (expense)

|

|

215.0

|

|

247.9

|

|

16.4

|

|

20.8

|

|

(0.1)

|

|

7.3

|

|

231.3

|

|

276.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

|

304.6

|

|

336.9

|

|

25.6

|

|

26.2

|

|

(0.1)

|

|

7.3

|

|

330.1

|

|

370.5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steel reporting segment

The steel segment’s operating income was USD215.0 million in the

second

quarter 2014, a decrease of USD32.8 million compared to the

second

quarter 2013, reflecting higher sales and higher operating cost.

Net sales of steel products in the

second

quarter 2014 increased 5% compared to the

second

quarter 2013, reflecting a 144,000 ton, or 7%, increase in shipments, mainly due to higher sales volume in Mexico, partially offset by lower sales volume in the Southern Region and in Others Markets. Revenue per ton decreased USD18, or 2%, mainly due to lower steel prices in the Southern Region partially offset by higher steel prices in Other Markets.

|

|

|

Net Sales (million USD)

|

|

Shipments (thousand tons)

|

|

Revenue / ton (USD/ton)

|

|

|

|

2Q 2014

|

2Q 2013

|

Dif.

|

|

2Q 2014

|

2Q 2013

|

Dif.

|

|

2Q 2014

|

2Q 2013

|

Dif.

|

|

Mexico

|

|

1,222.0

|

1,028.2

|

19%

|

|

1,411.2

|

1,191.4

|

18%

|

|

866

|

863

|

0%

|

|

Southern Region

|

|

664.8

|

741.9

|

-10%

|

|

632.5

|

662.6

|

-5%

|

|

1,051

|

1,120

|

-6%

|

|

Other Markets

|

|

301.7

|

324.1

|

-7%

|

|

313.1

|

358.9

|

-13%

|

|

964

|

903

|

7%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total steel products

|

|

2,188.5

|

2,094.1

|

5%

|

|

2,356.8

|

2,212.9

|

7%

|

|

929

|

946

|

-2%

|

|

Other products

1

|

|

13.6

|

6.4

|

112%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steel segment

|

|

2,202.1

|

2,100.6

|

5%

|

|

|

|

|

|

|

|

|

|

1

The item "Other products" primarily includes pig iron and pre-engineered metal building systems.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating cost increased 7% due to a 7% increase in shipment volumes and cost per ton remained stable in comparison to cost per ton in the second quarter 2013.

Mining reporting segment

The mining segment’s operating income was USD16.4 million in the

second

quarter 2014, a decrease of USD4.4 million compared to the

second

quarter 2013, mainly reflecting lower sales of iron ore and lower operating cost.

Net Sales of mining products in the

second

quarter 2014 were 18% lower than net sales in the

second

quarter 2013, reflecting lower shipments and a USD5 increase in revenue per ton. Shipments were 944,000 tons, 22% lower than in the

second

quarter 2013 as a result of lower sales to third parties mainly due to a decrease in production at Peña Colorada.

|

|

|

Mining segment

|

|

|

|

|

2Q 2014

|

2Q 2013

|

Dif.

|

|

|

Net Sales (million USD)

|

|

83.3

|

101.8

|

-18%

|

|

|

Shipments (thousand tons)

|

|

944.4

|

1,217.6

|

-22%

|

|

|

Revenue per ton (USD/ton)

|

|

88

|

84

|

6%

|

|

Operating cost decreased 17% year-over-year, due to the above mentioned 22% decrease in shipment volumes partially offset by a 7% increase in operating cost per ton.

EBITDA

in the

second

quarter 2014 was USD330.1 million, or 15.0% of net sales, compared to USD370.5 million, or 17.4% of net sales, in the

second

quarter 2013.

Net financial results

were a USD31.2 million loss in the

second

quarter 2014, compared to a USD38.5 million loss in the

second

quarter 2013. During the

second

quarter 2014, Ternium’s net interest results totaled a loss of USD27.2 million, stable compared to net interest results in the second quarter 2013.

Equity in results of non-consolidated companies

was a loss of USD0.4 million in the

second

quarter 2014, compared to a loss of USD10.3 million in the

second

quarter 2013, mainly due to an improved result in Usiminas.

Income tax expense

in the

second quarter

2014 was USD19.4 million, or 10% of income before income tax expense, compared with an income tax expense of USD92.8 million in the second quarter 2013, or 41% of income before income tax expense. Income tax expense in the second quarter 2014 included a net gain related to a non-cash reduction of deferred tax liabilities at one of Ternium’s subsidiaries, partially offset by higher taxes on dividends in connection to Siderar dividend payment in April 2014. Income tax expense in the second quarter 2013 included a loss in connection to the settlement of a claim from the Mexican tax authorities related to fiscal year 2004.

Net gain attributable to non-controlling interest

in the

second

quarter 2014 was USD51.2 million, compared to net gain of USD31.7 million in the same period in 2013, mainly due to a higher result attributable to non-controlling interest in Siderar.

Analysis of First Half 2014 Results

Net income

attributable to Ternium’s equity holders

in the first half 2014 was USD279.1 million, compared to a net income of USD232.0 million in the first half 2013

.

Including non-controlling interest, net income for the first half 2014 was USD368.5 million, compared to net income of USD285.8 million in the first half 2013. Earnings per ADS in the first half 2014 were USD1.42, compared to earnings of USD1.18 in the first half 2013.

Net sales

in the first half 2014 were USD4.4 billion, 2% higher than net sales in the first half 2013, mainly as a result of higher steel products sales in Mexico, partially offset by lower steel products sales in the Southern Region and Other Markets, and lower iron ore sales to third parties. The following table shows Ternium’s consolidated net sales for the first half 2014 and 2013:

|

|

|

Net Sales (million USD)

|

|

|

|

|

1H 2014

|

1H 2013

|

Dif.

|

|

|

Mexico

|

|

2,429.0

|

2,092.9

|

16%

|

|

|

Southern Region

|

|

1,303.3

|

1,430.6

|

-9%

|

|

|

Other Markets

|

|

588.6

|

670.8

|

-12%

|

|

|

Total steel products net sales

|

|

4,320.9

|

4,194.2

|

3%

|

|

|

Other products

1

|

|

18.9

|

13.5

|

40%

|

|

|

Steel segment net sales

|

|

4,339.8

|

4,207.8

|

3%

|

|

|

|

|

|

|

|

|

|

Mining segment net sales

|

|

159.6

|

201.6

|

-21%

|

|

|

Intersegment eliminations

|

|

(146.2)

|

(139.2)

|

5%

|

|

|

Net sales

|

|

4,353.1

|

4,270.2

|

2%

|

|

1

The item “Other products” primarily includes pig iron and pre-engineered metal building systems.

Cost of sales

was USD3.4 billion in the first half 2014, an increase of USD89.5 million compared to the first half 2013. This was principally due to a 5% increase in shipment volumes, a USD51.0 million, or 2%, increase in raw material and consumables used and higher energy costs; and a USD38.5 million increase in other costs, including a USD32.4 million increase in maintenance expenses, a USD4.7 million increase in services and fees, a USD4.4 increase in depreciation of property, plant and equipment partially offset by a USD4.3 million decrease in labor costs.

Selling, General & Administrative (SG&A) expenses

in the first half 2014 were USD408.6 million, or 9.4% of net sales, a decrease of USD14.4 million compared to the first half 2013, mainly as a result of lower freight and transportation expenses, taxes and contributions (other than income tax) and maintenance expenses, partially offset by higher labor and general expenses.

Operating income

in the first half 2013 was USD550.3 million, or 12.6% of net sales, compared to operating income of USD547.8 million, or 12.8% of net sales, in the first half 2013. The following table shows Ternium’s operating income by segment for the first half 2014 and the first half 2013.

|

|

|

Steel segment

|

|

Mining segment

|

|

Intersegment eliminations

|

|

Total

|

|

USD million

|

|

1H 2014

|

|

1H 2013

|

|

1H 2014

|

|

1H 2013

|

|

1H 2014

|

|

1H 2013

|

|

1H 2014

|

|

1H 2013

|

|

Net Sales

|

|

4,339.8

|

|

4,207.8

|

|

159.6

|

|

201.6

|

|

(146.2)

|

|

(139.2)

|

|

4,353.1

|

|

4,270.2

|

|

Cost of sales

|

|

(3,428.1)

|

|

(3,308.6)

|

|

(117.9)

|

|

(142.3)

|

|

145.6

|

|

140.0

|

|

(3,400.4)

|

|

(3,310.9)

|

|

SG&A expenses

|

|

(400.7)

|

|

(408.9)

|

|

(7.9)

|

|

(14.0)

|

|

-

|

|

-

|

|

(408.6)

|

|

(422.9)

|

|

Other operating income (expenses), net

|

|

5.6

|

|

11.5

|

|

0.6

|

|

(0.0)

|

|

-

|

|

-

|

|

6.2

|

|

11.5

|

|

Operating income (expense)

|

|

516.5

|

|

501.8

|

|

34.4

|

|

45.2

|

|

(0.6)

|

|

0.8

|

|

550.3

|

|

547.8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

|

694.1

|

|

676.6

|

|

53.5

|

|

60.7

|

|

(0.6)

|

|

0.8

|

|

747.0

|

|

738.2

|

Steel reporting segment

The steel segment’s operating income was USD516.5 million in the first half 2014, an increase of USD14.8 million compared to the first half 2013, reflecting higher sales partially offset by higher operating cost.

Net sales of steel products in the first half 2014 increased 3% compared to the first half 2013, reflecting a USD21 decrease in revenue per ton, mainly due to lower steel prices in the Southern Region partially offset by higher steel prices in Others Markets. Shipments increased 238,000 tons, or 5%, compared to the first half 2013, mainly due to higher sales volume in Mexico partially offset by lower sales volume in the Southern Region and Other Markets.

|

|

|

Net Sales (million USD)

|

|

Shipments (thousand tons)

|

|

Revenue / ton (USD/ton)

|

|

|

|

1H 2014

|

1H 2013

|

Dif.

|

|

1H 2014

|

1H 2013

|

Dif.

|

|

1H 2014

|

1H 2013

|

Dif.

|

|

Mexico

|

|

2,429.0

|

2,092.9

|

16%

|

|

2,826.3

|

2,440.6

|

16%

|

|

859

|

858

|

0%

|

|

Southern Region

|

|

1,303.3

|

1,430.6

|

-9%

|

|

1,245.1

|

1,271.3

|

-2%

|

|

1,047

|

1,125

|

-7%

|

|

Other Markets

|

|

588.6

|

670.8

|

-12%

|

|

620.5

|

742.4

|

-16%

|

|

948

|

904

|

5%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total steel products

|

|

4,320.9

|

4,194.2

|

3%

|

|

4,692.0

|

4,454.3

|

5%

|

|

921

|

942

|

-2%

|

|

Other products

1

|

|

18.9

|

13.5

|

40%

|

|

|

|

|

|

|

|

|

|

|

|

4,207.8

|

4,207.8

|

-3%

|

|

|

|

|

|

|

|

|

|

Steel segment

|

|

4,339.8

|

4,207.8

|

3%

|

|

|

|

|

|

|

|

|

|

1

Primarily includes pig iron and pre-engineered metal building systems.

|

|

|

|

|

|

|

Operating cost increased 3%, due to the above-mentioned 5% increase in shipment volumes partially offset by a 2% decrease in operating cost per ton. The decrease in operating cost per ton was mainly due to lower raw material costs partially offset by higher purchased slabs costs, energy costs and maintenance expenses.

Mining reporting segment

The mining segment’s operating income was USD34.4 million in the first half 2014, a decrease of USD10.9 million compared to the first half 2013 mainly reflecting lower iron ore sales and lower operating cost.

Net Sales of mining products in the first half 2014 were 21% lower than in the first half 2013, reflecting lower shipments and a stable revenue per ton. Shipments were 1.8 million tons, 21% lower than in the first half 2013 as a result of lower production at Peña Colorada.

|

|

|

Mining segment

|

|

|

|

|

1H 2014

|

1H 2013

|

Dif.

|

|

|

Net Sales (million USD)

|

|

159.6

|

201.6

|

-21%

|

|

|

Shipments (thousand tons)

|

|

1,828.8

|

2,318.9

|

-21%

|

|

|

Revenue per ton (USD/ton)

|

|

87

|

87

|

0%

|

|

Operating cost decreased 20% year-over-year, due to the above mentioned 21% decrease in shipment volumes, partially offset by a 2% increase in operating cost per ton.

EBITDA

in the first half 2014 was USD747.0 million, or 17.2% of net sales, compared with USD738.2 million, or 17.3% of net sales, in the first half 2013.

Net financial results

were a USD55.5 million loss in the first half 2014, compared with a USD79.3 million loss in the first half 2013.

During the first half 2014, Ternium’s net interest results totaled a loss of USD46.7 million, compared to a loss of USD57.1 million in the first half 2013, reflecting lower average indebtedness and weighted average interest rates.

Change in fair value of financial instruments included in net financial results in the first half 2014 was a USD3.5 million gain, mainly related to results from changes in the fair value of financial assets, compared with a USD9.9 million loss in the first half 2013.

Equity in results of non-consolidated companies

was a gain of USD2.3 million in the first half 2014, compared to a loss of USD26.2 million in the first half 2013, mainly as a result of better results from Usiminas.

Income tax expense

in the first half 2014 was USD128.5 million, or 26% of income before income tax, compared with an income tax expense of USD156.6 million, or 35% of income before income tax, in the same period in 2013. Income tax expense in the first half 2014 included a net gain related to a non-cash reduction of deferred tax liabilities at one of Ternium’s subsidiaries, partially offset by higher taxes on dividends in connection to Siderar dividend payment in April 2014 and non-recurrent losses mainly related to the settlement of a claim from the Mexican tax authorities related to fiscal year 2006 and to changes in Mexican tax regulations in connection with new mining laws. Income tax expense in the first half 2013 included a loss in connection to the settlement of a claim from the Mexican tax authorities related to fiscal year 2004.

Net gain attributable to non-controlling interest

in the

first half

2014 was USD89.4 million, compared to a net gain of USD53.9 million in the same period in 2013, mainly due to a higher result attributable to non-controlling interest in Siderar.

Cash Flow and Liquidity

Net cash provided by operating activities in the first half 2014 was USD9.7 million. Working capital increased USD504.5 million in the first half 2014 as a result of a USD304.8 million increase in inventories and an aggregate USD211.5 million increase in trade and other receivables, partially offset by an

aggregate USD11.8 million net increase in accounts payable and other liabilities. Trade receivables increased as a result of higher sales volume and collection period. Inventories increased in the first half 2014 mainly reflecting higher inventory volumes, in a context of ramped-up production, and higher costs of goods in process and finished goods. The above mentioned increase in working capital in the first half 2014 included a negative non-cash effect of USD97.1 million reflecting variations in the exchange rates used by subsidiaries with functional currencies other than the U.S. dollar, mainly related to inventories.

Capital expenditures in the first half 2014 were USD240.0 million, down from USD507.7 million in the first half 2013. The main investments carried out during the period included, in Mexico, those made in the new cold rolling mill (Pesquería facility) and for the expansion of service center capacity and, in Argentina, those made for the expansion of specialty steel production capacity (including a new continuous caster in the steel shop, inaugurated during the first quarter) and for the expansion and enhancement of the coking facilities.

In the first half 2014, Ternium had negative free cash flow of USD230.3 million

[7]

. Cash transfers to Techgen in the first half 2014 were USD65.5 million. The company’s net proceeds from borrowings in the first half 2014 were USD345.6 million. In addition, net dividends paid to shareholders were USD147.2 million and net dividends paid to minority shareholders were USD33.6 million. As of June 30, 2014, Ternium’s net debt position was USD2.0 billion

[8]

.

Net cash provided by operating activities in the second quarter 2014 was USD33.6 million. Working capital increased USD135.5 million in the second quarter 2014 as a result of a USD30.7 million increase in inventories, an aggregate USD43.1 million increase in trade and other receivables, and an aggregate USD61.7 million net decrease in accounts payable and other liabilities.

Inventories increased in the second quarter 2014 mainly reflecting higher costs of goods in process and finished goods, and higher volumes of raw materials, partially offset by lower volumes of purchased steel and goods in process. Capital expenditures were USD136.4 million in the second quarter 2014, compared to USD289.6 million in the second quarter 2013. Ternium had negative free cash flow of USD102.8 million

[9]

in the period.

[7]

Free cash flow in the first half 2014 equals net cash provided by operating activities of $9.7 million less capital expenditures of $240.0 million.

[8]

Net debt position at June 30, 2014 equals borrowings of $2.3 billion less cash and equivalents plus other investments of $0.3 billion.

[9]

Free cash flow in the second quarter 2014 equals net cash provided by operating activities of $33.6 million less capital expenditures of $136.4 million.

Forward Looking Statements

Some of the statements contained in this press release are “forward-looking statements”. Forward-looking statements are based on management’s current views and assumptions and involve known and unknown risks that could cause actual results, performance or events to differ materially from those expressed or implied by those statements. These risks include but are not limited to risks arising from uncertainties as to gross domestic product, related market demand, global production capacity, tariffs, cyclicality in the industries that purchase steel products and other factors beyond Ternium’s control.

About Ternium

Ternium is a leading steel producer in Latin America, with an annual production capacity of approximately 10.9 million tons of finished steel products. The company manufactures and processes a broad range of value-added steel products for customers active in the construction, automotive, home appliances, capital goods, container, food and energy industries. With production facilities located in

Mexico, Argentina, Colombia, the southern United States and Guatemala, Ternium serves markets in the Americas through its integrated manufacturing system and extensive distribution network. In addition, Ternium participates in the control group of Usiminas, a Brazilian steel company. More information about Ternium is available at www.ternium.com.

Consolidated Income Statement

|

USD million

|

|

2Q 2014

|

2Q 2013

|

|

1H 2014

|

1H 2013

|

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

|

Net sales

|

|

2,203.7

|

|

2,134.4

|

|

4,353.1

|

|

4,270.2

|

|

|

Cost of sales

|

|

(1,763.0)

|

|

(1,653.8)

|

|

(3,400.4)

|

|

(3,310.9)

|

|

|

Gross profit

|

|

440.7

|

|

480.7

|

|

952.7

|

|

959.3

|

|

|

Selling, general and administrative expenses

|

|

(213.0)

|

|

(215.8)

|

|

(408.6)

|

|

(422.9)

|

|

|

Other operating income, net

|

|

3.6

|

|

11.1

|

|

6.2

|

|

11.5

|

|

|

Operating income

|

|

231.3

|

|

276.0

|

|

550.3

|

|

547.8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

(29.4)

|

|

(30.4)

|

|

(52.8)

|

|

(63.7)

|

|

|

Interest income

|

|

2.3

|

|

2.9

|

|

6.1

|

|

6.6

|

|

|

Other financial expenses, net

|

|

(4.0)

|

|

(11.1)

|

|

(8.8)

|

|

(22.2)

|

|

|

Equity in (losses) earnings of non-consolidated

|

|

(0.4)

|

|

(10.3)

|

|

2.3

|

|

(26.2)

|

|

|

Income before income tax expense

|

|

199.8

|

|

227.2

|

|

497.1

|

|

442.4

|

|

|

Income tax expense

|

|

(19.4)

|

|

(92.8)

|

|

(128.5)

|

|

(156.6)

|

|

|

Profit for the period

|

|

180.3

|

|

134.4

|

|

368.5

|

|

285.8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to:

|

|

|

|

|

|

|

|

|

|

|

Equity holders of the Company

|

|

129.1

|

|

102.7

|

|

279.1

|

|

232.0

|

|

|

Non-controlling interest

|

|

51.2

|

|

31.7

|

|

89.4

|

|

53.9

|

|

|

Profit for the period

|

|

180.3

|

|

134.4

|

|

368.5

|

|

285.8

|

|

Consolidated Statement of Financial Position

|

USD million

|

|

June 30,

2014

|

|

December 31,

2013

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net

|

|

|

4,528.7

|

|

|

|

4,708.9

|

|

|

Intangible assets, net

|

|

|

963.2

|

|

|

|

961.5

|

|

|

Investments in non-consolidated companies

|

|

|

1,464.6

|

|

|

|

1,375.2

|

|

|

Derivative financial instruments

|

|

|

-

|

|

|

|

1.5

|

|

|

Deferred tax assets

|

|

|

49.3

|

|

|

|

24.9

|

|

|

Receivables, net

|

|

|

107.0

|

|

|

|

79.4

|

|

|

Trade receivables, net

|

|

|

0.8

|

|

|

|

1.8

|

|

|

Total non-current assets

|

|

|

7,113.6

|

|

|

|

7,153.2

|

|

|

|

|

|

|

|

|

|

|

|

|

Receivables

|

|

|

157.6

|

|

|

|

112.4

|

|

|

Derivative financial instruments

|

|

|

1.6

|

|

|

|

-

|

|

|

Inventories, net

|

|

|

2,116.0

|

|

|

|

1,941.1

|

|

|

Trade receivables, net

|

|

|

863.7

|

|

|

|

671.5

|

|

|

Other investments

|

|

|

108.4

|

|

|

|

169.5

|

|

|

Cash and cash equivalents

|

|

|

229.7

|

|

|

|

307.2

|

|

|

Total current assets

|

|

|

3,477.0

|

|

|

|

3,201.7

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets classified as held for sale

|

|

|

17.2

|

|

|

|

17.8

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

10,607.8

|

|

|

|

10,372.6

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital and reserves attributable to the company's equity holders

|

|

|

5,413.6

|

|

|

|

5,340.0

|

|

|

Non-controlling interest

|

|

|

974.1

|

|

|

|

998.0

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Equity

|

|

|

6,387.7

|

|

|

|

6,338.0

|

|

|

|

|

|

|

|

|

|

|

|

|

Provisions

|

|

|

11.3

|

|

|

|

14.0

|

|

|

Deferred tax liabilities

|

|

|

555.1

|

|

|

|

605.9

|

|

|

Other liabilities

|

|

|

358.6

|

|

|

|

345.4

|

|

|

Trade payables

|

|

|

13.6

|

|

|

|

15.2

|

|

|

Borrowings

|

|

|

1,047.8

|

|

|

|

1,204.9

|

|

|

Total non-current liabilities

|

|

|

1,986.4

|

|

|

|

2,185.4

|

|

|

|

|

|

|

|

|

|

|

|

|

Current income tax liabilities

|

|

|

47.8

|

|

|

|

92.0

|

|

|

Other liabilities

|

|

|

226.9

|

|

|

|

203.3

|

|

|

Trade payables

|

|

|

717.4

|

|

|

|

755.9

|

|

|

Derivative financial instruments

|

|

|

0.6

|

|

|

|

-

|

|

|

Borrowings

|

|

|

1,241.1

|

|

|

|

797.9

|

|

|

Total current liabilities

|

|

|

2,233.8

|

|

|

|

1,849.2

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

4,220.2

|

|

|

|

4,034.6

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity and liabilities

|

|

|

10,607.8

|

|

|

|

10,372.6

|

|

Consolidated Statement of Cash Flows

|

USD million

|

|

2Q 2014

|

|

2Q 2013

|

|

1H 2014

|

|

1H 2013

|

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Profit for the period

|

|

180.3

|

|

134.4

|

|

368.5

|

|

285.8

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments for:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

98.8

|

|

94.5

|

|

196.7

|

|

190.3

|

|

Equity in losses (earnings) of non-consolidated companies

|

|

0.4

|

|

10.3

|

|

(2.3)

|

|

26.2

|

|

Changes in provisions

|

|

0.7

|

|

5.6

|

|

1.2

|

|

8.0

|

|

Net foreign exchange results and others

|

|

14.8

|

|

4.7

|

|

25.5

|

|

24.1

|

|

Interest accruals less payments

|

|

0.8

|

|

(20.4)

|

|

2.5

|

|

(15.2)

|

|

Income tax accruals less payments

|

|

(126.6)

|

|

(92.0)

|

|

(78.0)

|

|

(85.1)

|

|

Changes in working capital

|

|

(135.5)

|

|

70.7

|

|

(504.5)

|

|

121.5

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities

|

|

33.6

|

|

207.8

|

|

9.7

|

|

555.5

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures

|

|

(136.4)

|

|

(289.6)

|

|

(240.0)

|

|

(507.7)

|

|

Proceeds from the sale of property, plant & equipment

|

|

0.4

|

|

0.7

|

|

0.7

|

|

1.0

|

|

Investment in non-consolidated companies

|

|

-

|

|

-

|

|

(3.0)

|

|

-

|

|

Acquisition of non-controlling interest

|

|

-

|

|

(0.9)

|

|

-

|

|

(0.9)

|

|

Loans to non-consolidated companies

|

|

(21.6)

|

|

-

|

|

(62.5)

|

|

-

|

|

Decrease in other investments

|

|

30.3

|

|

28.4

|

|

61.0

|

|

56.1

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities

|

|

(127.3)

|

|

(261.5)

|

|

(243.9)

|

|

(451.5)

|

|

|

|

|

|

|

|

|

|

|

|

Dividends paid in cash to company's shareholders

|

|

(147.2)

|

|

(127.6)

|

|

(147.2)

|

|

(127.6)

|

|

Dividends paid in cash by subsidiary companies

|

|

(33.6)

|

|

(27.4)

|

|

(33.6)

|

|

(27.4)

|

|

Proceeds from borrowings

|

|

346.3

|

|

339.6

|

|

594.3

|

|

529.1

|

|

Repayments of borrowings

|

|

(57.1)

|

|

(199.2)

|

|

(248.7)

|

|

(662.8)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) financing activities

|

|

108.3

|

|

(14.7)

|

|

164.8

|

|

(288.8)

|

|

|

|

|

|

|

|

|

|

|

|

Increase (Decrease) in cash and cash equivalents

|

|

14.6

|

|

(68.3)

|

|

(69.4)

|

|

(184.7)

|

|

Shipments

|

|

Thousand tons

|

|

2Q 2014

|

2Q 2013

|

1Q 2014

|

|

1H 2014

|

1H 2013

|

|

|

|

|

|

|

|

|

|

|

Mexico

|

|

1,411.2

|

1,191.4

|

1,415.2

|

|

2,826.3

|

2,440.6

|

|

Southern Region

|

|

632.5

|

662.6

|

612.7

|

|

1,245.1

|

1,271.3

|

|

Other Markets

|

|

313.1

|

358.9

|

307.4

|

|

620.5

|

742.4

|

|

Total steel segment

|

|

2,356.8

|

2,212.9

|

2,335.2

|

|

4,692.0

|

4,454.3

|

|

|

|

|

|

|

|

|

|

|

Total mining segment

|

|

944.4

|

1,217.6

|

884.4

|

|

1,828.8

|

2,318.9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue / ton

|

|

USD/ton

|

|

2Q 2014

|

2Q 2013

|

1Q 2014

|

|

1H 2014

|

1H 2013

|

|

|

|

|

|

|

|

|

|

|

Mexico

|

|

866

|

863

|

853

|

|

859

|

858

|

|

Southern Region

|

|

1,051

|

1,120

|

1,042

|

|

1,047

|

1,125

|

|

Other Markets

|

|

964

|

903

|

933

|

|

948

|

904

|

|

Total steel segment

|

|

929

|

946

|

913

|

|

921

|

942

|

|

|

|

|

|

|

|

|

|

|

Total mining segment

|

|

88

|

84

|

86

|

|

87

|

87

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales

|

|

USD million

|

|

2Q 2014

|

2Q 2013

|

1Q 2014

|

|

1H 2014

|

1H 2013

|

|

|

|

|

|

|

|

|

|

|

Mexico

|

|

1,222.0

|

1,028.2

|

1,206.9

|

|

2,429.0

|

2,092.9

|

|

Southern Region

|

|

664.8

|

741.9

|

638.5

|

|

1,303.3

|

1,430.6

|

|

Other Markets

|

|

301.7

|

324.1

|

286.9

|

|

588.6

|

670.8

|

|

Total steel products

|

|

2,188.5

|

2,094.1

|

2,132.4

|

|

4,320.9

|

4,194.2

|

|

Other products

1

|

|

13.6

|

6.4

|

5.3

|

|

18.9

|

13.5

|

|

Total steel segment

|

|

2,202.1

|

2,100.6

|

2,137.7

|

|

4,339.8

|

4,207.8

|

|

|

|

|

|

|

|

|

|

|

Total mining segment

|

|

83.3

|

101.8

|

76.2

|

|

159.6

|

201.6

|

|

|

|

|

|

|

|

|

|

|

Total steel and mining segments

|

|

2,285.4

|

2,202.4

|

2,213.9

|

|

4,499.3

|

4,409.4

|

|

|

|

|

|

|

|

|

|

|

Intersegment eliminations

|

|

(81.7)

|

(68.0)

|

(64.5)

|

|

(146.2)

|

(139.2)

|

|

|

|

|

|

|

|

|

|

|

Total net sales

|

|

2,203.7

|

2,134.4

|

2,149.4

|

|

4,353.1

|

4,270.2

|

1

The item “Other products” primarily includes pig iron and pre-engineered metal building systems.

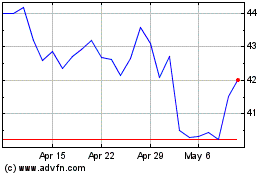

Ternium (NYSE:TX)

Historical Stock Chart

From Mar 2024 to Apr 2024

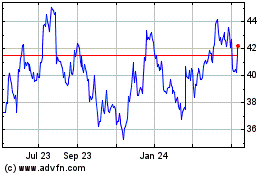

Ternium (NYSE:TX)

Historical Stock Chart

From Apr 2023 to Apr 2024