UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) June 9, 2015

TUPPERWARE BRANDS CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-11657 |

|

36-4062333 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 14901 South Orange Blossom Trail,

Orlando, Florida |

|

32837 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code 407-826-5050

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

Amendment No. 2 to Credit Agreement

On June 9,

2015, Tupperware Brands Corporation (the “Company”) and its wholly owned subsidiary Tupperware International Holdings B.V. (the “Subsidiary Borrower”), entered into Amendment No. 2 (“Amendment

No. 2”) to their multicurrency Amended and Restated Credit Agreement dated as of September 11, 2013, as amended by Amendment No. 1 dated as of June 2, 2014 (as so amended, the “Credit Agreement”), with

JPMorgan Chase Bank, N.A. as administrative agent (the “Administrative Agent”), swingline lender and issuing bank, and certain banks from time to time named therein, as syndication agents, joint book runners and joint lead

arrangers. Amendment No. 2 (i) reduces the aggregate amount available to the Company and the Subsidiary Borrower under the Credit Agreement from $650 million to $600 million (the “Facility Amount”), (ii) extends the

revolving maturity date of the Credit Agreement from September 11, 2018 to June 9, 2020, and (iii) amends the applicable margins for borrowings and the commitment fee to be generally more favorable for the Company. The Credit

Agreement provides (a) a revolving credit facility, available up to the full amount of the Facility Amount, (b) a letter of credit facility, available up to $50 million of the Facility Amount, and (c) a swingline facility, available

up to $100 million of the Facility Amount. Each of such facilities is fully available to the Company and is available to the Subsidiary Borrower up to an aggregate amount not to exceed $325 million. The Company is permitted to increase, on up to

three occasions, the Facility Amount by a total of up to $200 million (for a maximum aggregate Facility Amount of $800 million), subject to certain conditions.

Loans made under the Credit Agreement will comprise either (i) “Eurocurrency Borrowings”, bearing interest determined in reference to the

London interbank offered rate for the applicable currency and interest period, plus a margin or (ii) “ABR Borrowings”, bearing interest at the sum of (A) the greatest of (x) the rate of interest publicly announced from time

to time by JPMorgan Chase Bank, N.A. as its prime rate, (y) the Federal funds rate plus 0.5% and (z) adjusted LIBOR for one month plus 1%, and (B) a margin. The applicable margin in each case will be determined by reference to a

pricing schedule and will be based upon the better for the Company of (a) the ratio at any time of the consolidated funded indebtedness of the Company and its subsidiaries to the consolidated EBITDA (as defined in the Credit Agreement) of the

Company and its subsidiaries for the four (4) fiscal quarters then most recently ended, or (b) the Company’s then existing long-term debt securities rating by Moody’s Investor Service, Inc. or Standard and Poor’s Financial

Services, Inc. After giving effect to Amendment No. 2, the applicable margin for ABR Borrowings ranges from 0.375% to 0.875%, the applicable margin for Eurocurrency Borrowings ranges from 1.375% to 1.875%, and the applicable margin for the

commitment fee ranges from 0.175% to 0.300%. Loans made under the swingline facility will bear interest, if denominated in U.S. Dollars, at the same rate as an ABR Borrowing and, if denominated in another currency, at a rate to be agreed between the

Company and the swingline lender prior to the extension of such loan.

A copy of Amendment No. 2 is attached hereto as Exhibit 10.1 and incorporated

herein by reference. The foregoing description of Amendment No. 2 is qualified in its entirety by reference to such exhibit.

Item 9.01

Financial Statements and Exhibits.

|

|

|

|

|

| Item No. |

|

Exhibit |

|

|

| 10.1 |

|

Amendment No. 2, dated as of June 9, 2015, to Amended and Restated Credit Agreement, as amended through June 2, 2014, among Tupperware Brands Corporation, Tupperware International Holdings B.V., the lenders party thereto, JPMorgan

Chase Bank, N.A., Crédit Agricole Corporate and Investment Bank, HSBC Bank USA, N.A., Keybank National Association and Mizuho Bank (USA). |

2

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report

to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

TUPPERWARE BRANDS CORPORATION |

|

|

|

|

| Date: June 12, 2015 |

|

|

|

By: |

|

/s/ Thomas M. Roehlk |

|

|

|

|

Thomas M. Roehlk |

|

|

|

|

Executive Vice President, Chief Legal

Officer and Secretary |

3

Exhibit 10.1

EXECUTION VERSION

AMENDMENT NO. 2

Dated as of

June 9, 2015

to

AMENDED AND RESTATED CREDIT AGREEMENT

dated as of

September 11,

2013

among

TUPPERWARE

BRANDS CORPORATION,

as the Borrower,

TUPPERWARE INTERNATIONAL HOLDINGS B.V.

as the Subsidiary Borrower,

The

Lenders Party Hereto,

JPMORGAN CHASE BANK, N.A.,

as Administrative Agent, Swingline Lender and Issuing Bank,

and

CRÉDIT AGRICOLE

CORPORATE AND INVESTMENT BANK, HSBC BANK USA, N.A.,

KEYBANK NATIONAL ASSOCIATION and MIZUHO BANK (USA),

as Syndication Agents

J.P. MORGAN SECURITIES LLC, CRÉDIT AGRICOLE CORPORATE AND INVESTMENT BANK,

HSBC BANK USA, N.A., KEYBANK NATIONAL ASSOCIATION and MIZUHO BANK (USA),

as Joint Bookrunners and Joint Lead Arrangers

AMENDMENT NO. 2

Dated as of June 9, 2015

to

AMENDED AND RESTATED CREDIT AGREEMENT

Dated as of September 11, 2013

THIS AMENDMENT NO. 2 (this “Amendment”) is made as of June 9, 2015 by and among Tupperware Brands Corporation, a

Delaware corporation (the “Borrower”), Tupperware International Holdings B.V. (the “Subsidiary Borrower”), the financial institutions listed on the signature pages hereof and JPMorgan Chase Bank, N.A., as

administrative agent (the “Administrative Agent”), under that certain Amended and Restated Credit Agreement dated as of September 11, 2013 by and among the Borrower, the Subsidiary Borrower, the Lenders and the Administrative

Agent (as amended, restated, supplemented or otherwise modified from time to time, the “Credit Agreement”). Capitalized terms used herein and not otherwise defined herein shall have the respective meanings given to them in the

Credit Agreement.

WHEREAS, the Borrower and the Subsidiary Borrower have requested that the Lenders and the Administrative Agent agree to

certain amendments to the Credit Agreement;

WHEREAS, the Borrower, the Subsidiary Borrower, the Lenders and the Administrative Agent have

so agreed on the terms and conditions set forth herein;

NOW, THEREFORE, in consideration of the premises set forth above, the terms and

conditions contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Borrower, the Subsidiary Borrower, the Lenders party hereto and the Administrative Agent hereby agree to enter

into this Amendment.

1. Amendments to the Credit Agreement. Effective as of the date first written above (the “Amendment

No. 2 Effective Date”) but subject to the satisfaction of the conditions precedent set forth in Section 2 below, the parties hereto agree that the Credit Agreement is hereby amended as follows:

(a) The defined term “Business Day” set forth in Section 1.01 of the Credit Agreement is hereby amended and restated in its

entirety to read as follows:

“Business Day” means any day that is not a Saturday, Sunday or other day on

which commercial banks in New York City are authorized or required by law to remain closed; provided that, when used in connection with a Eurodollar Loan, the term “Business Day” shall also exclude any day on which banks are not

open for dealings in dollar deposits in the London interbank market.

(b) The defined term “Fee Letter” set forth in

Section 1.01 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Fee

Letter” means the administrative agent fee letter agreement, dated as of the Second Amendment Effective Date, among the Borrower, JPMCB and J.P. Morgan Securities LLC, as amended, restated, supplemented or otherwise modified from time to

time.

1

(c) The defined term “LIBO Rate” set forth in Section 1.01 of the Credit Agreement

is hereby amended by amending and restating the last sentence of such defined term to read as follows:

“LIBO

Rate” means, with respect to any Eurodollar Borrowing for any applicable currency and for any Interest Period, the London interbank offered rate as administered by ICE Benchmark Administration (or any other Person that takes over the

administration of such rate for the relevant currency for a period equal in length to such Interest Period as displayed on pages LIBOR01 or LIBOR02 of the Reuters screen that displays such rate (or, in the event such rate does not appear on a

Reuters page or screen, on any successor or substitute page on such screen that displays such rate, or on the appropriate page of such other information service that publishes such rate from time to time as selected by the Administrative Agent in

its reasonable discretion, in each case the “LIBO Screen Rate”) at approximately 11:00 a.m., London time, two Business Days prior to the commencement of such Interest Period; provided that if the LIBO Screen Rate shall be

less than zero, such rate shall be deemed to be zero for the purposes of this Agreement; provided further that if the Screen Rate shall not be available at such time for such Interest Period (an “Impacted Interest Period”)

with respect to the applicable currency then the LIBO Rate shall be the Interpolated Rate; provided that if any Interpolated Rate shall be less than zero, such rate shall be deemed to be zero for purposes of this Agreement.

(d) The defined term “Revolving Commitment” set forth in Section 1.01 of the Credit Agreement is hereby amended by amending and

restating the last sentence of such defined term to read as follows:

As of the Second Amendment Effective Date, the

aggregate amount of the Lenders’ Revolving Commitments is $600,000,000.

(e) The defined term “Revolving Maturity Date” set

forth in Section 1.01 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Revolving Maturity Date” means June 9, 2020.

(f) The defined term “Swingline Exposure” set forth in Section 1.01 of the Credit Agreement is hereby amended and restated in

its entirety to read as follows:

“Swingline Exposure” means, at any time, the aggregate principal amount

of all Swingline Loans outstanding at such time. The Swingline Exposure of any Lender at any time shall be the sum of (a) its Applicable Percentage of the total Swingline Exposure at such time other than with respect to any Swingline Loans made

by such Lender in its capacity as a Swingline Lender and (b) the aggregate principal amount of all Swingline Loans made by such Lender as a Swingline Lender outstanding at such time less the amount of participations funded by the other Lenders

in such Swingline Loans.

2

(g) Section 1.01 of the Credit Agreement is hereby amended by adding the following new

definitions therein in the appropriate alphabetical order for each such new definition:

“Impacted Interest

Period” has the meaning assigned to it in the definition of “LIBO Rate.”

“Interpolated

Rate” means, at any time, for any Interest Period, the rate per annum (rounded to the same number of decimal places as the LIBO Screen Rate) determined by the Administrative Agent (which determination shall be conclusive and binding absent

manifest error) to be equal to the rate that results from interpolating on a linear basis between: (a) the LIBO Screen Rate for the longest period for which the LIBO Screen Rate is available for the applicable currency) that is shorter than the

Impacted Interest Period; and (b) the LIBO Screen Rate for the shortest period (for which that LIBO Screen Rate is available for the applicable currency) that exceeds the Impacted Interest Period, in each case, at such time.

“LIBO Screen Rate” has the meaning assigned to it in the definition of “LIBO Rate.”

“Second Amendment Effective Date” means June 9, 2015.

(h) Section 1.01 of the Credit Agreement is hereby amended by deleting in their entirety the defined terms “Quotation Day”,

“TARGET2” and “TARGET Day” set forth therein.

(i) Section 1.04 of the Credit Agreement is hereby amended by

adding the following sentence to the end of such Section:

Notwithstanding any other provision contained herein, all terms

of an accounting or financial nature used herein shall be construed, and all computations of amounts and ratios referred to herein shall be made, in a manner such that any obligations relating to a lease that, in accordance with GAAP as in effect on

the Second Amendment Effective Date, would be accounted for by the Borrower as an operating lease shall be accounted for as obligations relating to an operating lease and not as obligations relating to a Capitalized Lease (and shall not constitute

Indebtedness hereunder).

(j) Section 2.05(a) of the Credit Agreement is hereby amended and restated in its entirety to read as

follows:

(a) Subject to the terms and conditions set forth herein, the Swingline Lender may, in its sole discretion, make

Swingline Loans denominated in Dollars, Euro or Sterling to the Borrowers from time to time during the Availability Period, in an aggregate principal amount at any time outstanding that will not result in (i) the Dollar Equivalent of the

aggregate principal amount of outstanding Swingline Loans exceeding $100,000,000, (ii) the sum of the total Revolving Credit Exposures exceeding the total Revolving Commitments, (iii) the Swingline Lender’s Revolving Credit Exposure

exceeding its Revolving Commitment or (iv) the sum of the total Revolving Credit Exposures as to which the Subsidiary Borrower is the Applicable Borrower exceeding $325,000,000; provided that the Swingline Lender shall not be required to

make a Swingline Loan to refinance an outstanding Swingline Loan and no more than four Swingline Loans may be outstanding at any time. Within the foregoing limits and subject to the terms and conditions set forth herein, the Borrowers may borrow,

prepay and reborrow Swingline Loans.

(k) Section 2.09(d) of the Credit Agreement is hereby amended by deleting the reference to

“$850,000,000” set forth therein and replacing such deletion with a reference to “$800,000,000”.

3

(l) Schedule 1.01 (“Pricing Schedule”) to the Credit Agreement is hereby amended and

restated in its entirety to read as set forth on Annex A attached hereto.

(m) Schedule 2.01 (“Revolving Commitments”) to

the Credit Agreement is hereby amended and restated in its entirety to read as set forth on Annex B attached hereto.

2.

Conditions of Effectiveness. The effectiveness of this Amendment on the Amendment No. 2 Effective Date is subject to the conditions precedent that the Administrative Agent shall have received the following:

(a) counterparts of (A) this Amendment duly executed by the Borrower and the Subsidiary Borrower, Lenders constituting Required Lenders

and the Administrative Agent, (B) a Reaffirmation in the form of Attachment A attached hereto duly executed by Dart and (C) the Fee Letter;

(b) payment and/or reimbursement of the Administrative Agent’s reasonable and documented out-of-pocket expenses (including, to the extent

invoiced, the reasonable fees and expenses of counsel for the Administrative Agent) and payment of the fees set forth in the Fee Letter, in each case, in connection with this Amendment;

(c) payment in full of all outstanding principal and accrued interest and fees, it being understood that such repayment may be made out of the

proceeds of Revolving Loans made on the Second Amendment Effective Date; and

(d) such other documents, instruments and agreements as the

Administrative Agent may reasonably request.

3. Representations and Warranties of the Borrower. The Borrower hereby represents and

warrants as follows:

(a) This Amendment and the Credit Agreement as modified hereby constitute legal, valid and binding obligations of

the Borrower and the Subsidiary Borrower, enforceable against the Borrower and the Subsidiary Borrower in accordance with their terms, except as such enforceability may be limited by (i) applicable bankruptcy, insolvency, examinership, court

protection, reorganization, moratorium or similar laws affecting the enforceability of creditors’ rights generally and (ii) general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or

at law).

(b) As of the date hereof and after giving effect to the terms of this Amendment, (i) no Default or Event of Default has

occurred and is continuing and (ii) the representations and warranties contained in Article III of the Credit Agreement are true and correct in all material respects (other than in respect of representations and warranties that are

subject to a Material Adverse Effect qualifier, in which case such representations and warranties are true and correct as stated and so qualified), except to the extent that such representations and warranties specifically refer to an earlier date,

in which case they were true and correct in all material respects (other than in respect of representations and warranties that are subject to a Material Adverse Effect qualifier, in which case such representations and warranties were true and

correct as stated and so qualified) as of such earlier date.

4

4. Reference to and Effect on the Credit Agreement.

(a) Upon the effectiveness hereof, each reference in the Credit Agreement (including any reference to “this Agreement,”

“hereunder,” “herein” or words of like import referring thereto) or in any other Loan Document shall mean and be a reference to the Credit Agreement as amended hereby.

(b) Except as specifically amended above, each Loan Document and all other documents, instruments and agreements executed and/or delivered in

connection therewith shall remain in full force and effect and are hereby ratified and confirmed.

(c) Except with respect to the subject

matter hereof, the execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of the Administrative Agent or the Lenders, nor constitute a waiver of any provision of the Credit Agreement, the

Loan Documents or any other documents, instruments and agreements executed and/or delivered in connection therewith.

5. GOVERNING

LAW. THIS AMENDMENT SHALL BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAWS OF THE STATE OF NEW YORK.

6. Headings.

Section headings use herein are for convenience of reference only, are not part of this Amendment for any other purpose and shall not affect the construction of, or be taken into consideration in interpreting, this Agreement.

7. Counterparts. Delivery of an executed counterpart of a signature page of this Amendment by telecopy, emailed pdf. or any other

electronic means that reproduces an image of the actual executed signature page shall be effective as delivery of a manually executed counterpart of this Amendment. The words “execution,” “signed,” “signature,”

“delivery,” and words of like import in or relating to any document to be signed in connection with this Amendment and the transactions contemplated hereby shall be deemed to include Electronic Signatures, deliveries or the keeping of

records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be, to the extent

and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act or any other similar state laws based on the Uniform Electronic

Transactions Act.

8. Costs and Expenses. The Borrower hereby affirms its obligation under Section 9.03 of the Credit

Agreement to reimburse the Administrative Agent for all reasonable expenses incurred by the Administrative Agent in connection with the preparation, negotiation, execution and delivery of this Amendment, including but not limited to the reasonable

fees, charges and disbursements of attorneys for the Administrative Agent with respect thereto.

[Signature Pages Follow]

5

IN WITNESS WHEREOF, this Amendment has been duly executed as of the day and year first above

written.

|

|

|

| TUPPERWARE BRANDS CORPORATION |

|

|

| By: |

|

/s/ Edward R. Davis III |

| Name: |

|

Edward R. Davis III |

| Title: |

|

VP and Treasurer |

|

| TUPPERWARE INTERNATIONAL HOLDINGS B.V. |

|

|

| By: |

|

/s/ Edward R. Davis III |

| Name: |

|

Edward R. Davis III |

| Title: |

|

Authorized Signatory |

Signature Page to Amendment No. 2 to Amended and Restated Credit Agreement

TUPPERWARE BRANDS CORPORATION

|

|

|

| JPMORGAN CHASE BANK, N.A., individually and as Administrative Agent, Swingline Lender and Issuing Bank |

|

|

| By: |

|

/s/ Antje Focke |

| Name: |

|

Antje Focke |

| Title: |

|

Vice President |

Signature Page to Amendment No. 2 to Amended and Restated Credit Agreement

TUPPERWARE BRANDS CORPORATION

|

|

|

| KEY BANK NATIONAL ASSOCIATION, as a Lender |

|

|

| By: |

|

/s/ Marianne T. Meil |

| Name: |

|

Marianne T. Meil |

| Title: |

|

Senior Vice President |

Signature Page to Amendment No. 2 to Amended and Restated Credit Agreement

TUPPERWARE BRANDS CORPORATION

|

|

|

| CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK, as a Lender |

|

|

| By: |

|

/s/ Blake Wright |

| Name: |

|

Blake Wright |

| Title: |

|

Managing Director |

|

|

| By: |

|

/s/ James Austin |

| Name: |

|

James Austin |

| Title: |

|

Director |

Signature Page to Amendment No. 2 to Amended and Restated Credit Agreement

TUPPERWARE BRANDS CORPORATION

|

|

|

| HSBC BANK USA NA, as a Lender |

|

|

| By: |

|

/s/ Santiago A. Riviere |

| Name: |

|

Santiago A. Riviere |

| Title: |

|

Senior Vice President |

Signature Page to Amendment No. 2 to Amended and Restated Credit Agreement

TUPPERWARE BRANDS CORPORATION

|

|

|

| WELLS FARGO BANK, N.A., as a Lender |

|

|

| By: |

|

/s/ Karen Harrington Martorelli |

| Name: |

|

Karen Harrington Martorelli |

| Title: |

|

SVP and Relationship Manager Commercial

Banking |

Signature Page to Amendment No. 2 to Amended and Restated Credit Agreement

TUPPERWARE BRANDS CORPORATION

|

|

|

| MIZUHO BANK (USA), as a Lender |

|

|

| By: |

|

/s/ David Lim |

| Name: |

|

David Lim |

| Title: |

|

Senior Vice President |

Signature Page to Amendment No. 2 to Amended and Restated Credit Agreement

TUPPERWARE BRANDS CORPORATION

|

|

|

| THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., as a Lender |

|

|

| By: |

|

/s/ Adrienne Young |

| Name: |

|

Adrienne Young |

| Title: |

|

Vice-President |

Signature Page to Amendment No. 2 to Amended and Restated Credit Agreement

TUPPERWARE BRANDS CORPORATION

|

|

|

| SUNTRUST BANK, as a Lender |

|

|

| By: |

|

/s/ James R. Spaulding |

| Name: |

|

James R. Spaulding |

| Title: |

|

FVP |

Signature Page to Amendment No. 2 to Amended and Restated Credit Agreement

TUPPERWARE BRANDS CORPORATION

|

|

|

| U.S. BANK NATIONAL ASSOCIATION, as a Lender |

|

|

| By: |

|

/s/ Kenneth R. Fieler |

| Name: |

|

Kenneth R. Fieler |

| Title: |

|

Vice President |

Signature Page to Amendment No. 2 to Amended and Restated Credit Agreement

TUPPERWARE BRANDS CORPORATION

|

|

|

| BNP PARIBAS, as a Lender |

|

|

| By: |

|

/s/ Emma Petersen |

| Name: |

|

Emma Petersen |

| Title: |

|

Vice President |

|

|

| By: |

|

/s/ Michael Hoffman |

| Name: |

|

Michael Hoffman |

| Title: |

|

Vice President |

Signature Page to Amendment No. 2 to Amended and Restated Credit Agreement

TUPPERWARE BRANDS CORPORATION

ATTACHMENT A

REAFFIRMATION

The

undersigned hereby acknowledges receipt of a copy of Amendment No. 2 to the Amended and Restated Credit Agreement dated as of June 9, 2015 by and among Tupperware Brands Corporation, a Delaware corporation (the

“Borrower”), Tupperware International Holdings B.V. (the “Subsidiary Borrower”), listed on the signature pages hereof and JPMorgan Chase Bank, N.A., as administrative agent (the “Administrative

Agent”), under that certain Amended and Restated Credit Agreement dated as of September 11, 2013 (the “Amendment”). Capitalized terms used in this Reaffirmation and not defined herein shall have the meanings given to

them in the Credit Agreement.

The undersigned reaffirms the terms and conditions of the Dart Guaranty and any other Loan Document

executed by it and acknowledges and agrees that such agreement and each and every such Loan Document executed by the undersigned in connection with the Credit Agreement remains in full force and effect and is hereby reaffirmed, ratified and

confirmed. All references to the Credit Agreement contained in the above-referenced documents shall be a reference to the Credit Agreement as so modified by the Amendment and as the same may from time to time hereafter be amended, modified or

restated.

Dated: June 9, 2015

|

|

|

| DART INDUSTRIES INC. |

|

|

| By: |

|

/s/ Edward R. Davis III |

| Name: |

|

Edward R. Davis III |

| Title: |

|

VP and Treasurer |

ANNEX A

Schedule 1.01

PRICING

SCHEDULE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| APPLICABLE RATE |

|

LEVEL I

STATUS |

|

|

LEVEL II

STATUS |

|

|

LEVEL III

STATUS |

|

|

LEVEL IV

STATUS |

|

| Eurocurrency Spread |

|

|

1.375 |

% |

|

|

1.50 |

% |

|

|

1.625 |

% |

|

|

1.875 |

% |

| ABR Spread |

|

|

.375 |

% |

|

|

.50 |

% |

|

|

.625 |

% |

|

|

.875 |

% |

| Commitment Fee Rate |

|

|

.175 |

% |

|

|

.20 |

% |

|

|

.25 |

% |

|

|

.30 |

% |

For the purposes of this Schedule, the following terms have the following meanings, subject to the final

paragraph of this Schedule:

“Financials” means the annual or quarterly financial statements of the Borrower delivered pursuant

to this Agreement.

“Level I Status” exists at any date if either (a) as of the last day of the fiscal quarter of the

Borrower referred to in the most recent Financials, the Consolidated Leverage Ratio is less than or equal to 1.25 to 1.00 or (b) as of such date (i) the Borrower’s S&P Rating is BBB or better or (ii) the Borrower’s

Moody’s Rating is Baa2 or better so long as the lower of the S&P Rating and the Moody’s Rating is not more than one level below the other rating.

“Level II Status” exists at any date if either (a) as of the last day of the fiscal quarter of the Borrower referred to in the

most recent Financials, (i) the Borrower has not qualified for Level I Status and (ii) the Consolidated Leverage Ratio is less than or equal to 2.00 to 1.00 or (b) as of such date (i) the Borrower’s S&P Rating is BBB- or

better or (ii) the Borrower’s Moody’s Rating is Baa3 or better so long as the lower of the S&P Rating and the Moody’s Rating is not more than one level below the other rating.

“Level III Status” exists at any date if either (a) as of the last day of the fiscal quarter of the Borrower referred to in the

most recent Financials, (i) the Borrower has not qualified for Level I Status or Level II Status and (ii) the Consolidated Leverage Ratio is less than or equal to 2.75 to 1.00 or (b) as of such date (i) the Borrower’s

S&P Rating is BB+ or better or (ii) the Borrower’s Moody’s Rating is Ba1 or better so long as the lower of the S&P Rating and the Moody’s Rating is not more than one level below the other rating.

“Level IV Status” exists at any date if the Borrower has not qualified for Level I Status, Level II Status or Level III Status.

“Moody’s Rating” means, at any time, the rating issued by Moody’s Investors Service, Inc. and then in effect with respect

to the Borrower’s senior unsecured long-term debt securities without third-party credit enhancement.

“Rating” means a Moody’s Rating or S&P Rating.

“S&P Rating” means, at any time, the rating issued by Standard and Poor’s Financial Services, Inc. and then in effect with

respect to the Borrower’s senior unsecured long-term debt securities without third-party credit enhancement.

“Status”

means Level I Status, Level II Status, Level III Status or Level IV Status.

The Applicable Rate shall be determined in accordance with the foregoing

table based on the Borrower’s Status as reflected in the then most recent Financials. Adjustments, if any, to the Applicable Rate shall be effective five Business Days after the Administrative Agent has received the applicable Financials;

provided, however, that if the Status as of any date is determined by reference to a Rating, the Rating in effect on such date for the purposes of this Schedule is that in effect at the close of business on such date If the Borrower fails to deliver

the Financials to the Administrative Agent at the time required pursuant to this Agreement, then the Applicable Rate shall be the highest Applicable Rate set forth in the foregoing table until five days after such Financials are so delivered unless

the Borrower qualifies for a lower Applicable Rate based on a Rating. Until adjusted after the Second Amendment Effective Date, Level II Status shall be deemed to exist.

ANNEX B

Schedule 2.01

REVOLVING

COMMITMENTS

|

|

|

|

|

| Lender |

|

Revolving Commitments |

|

| JPMorgan Chase Bank, N.A. |

|

$ |

70,000,000 |

|

| KeyBank National Association |

|

$ |

70,000,000 |

|

| Crédit Agricole Corporate and Investment Bank |

|

$ |

70,000,000 |

|

| HSBC Bank USA, N.A. |

|

$ |

70,000,000 |

|

| Mizuho Bank (USA) |

|

$ |

70,000,000 |

|

| Wells Fargo Bank, N.A. |

|

$ |

50,000,000 |

|

| The Bank of Tokyo-Mitsubishi UFJ, Ltd. |

|

$ |

50,000,000 |

|

| SunTrust Bank |

|

$ |

50,000,000 |

|

| U.S. Bank National Association |

|

$ |

50,000,000 |

|

| BNP Paribas |

|

$ |

50,000,000 |

|

|

|

|

|

|

| Total |

|

$ |

600,000,000 |

|

|

|

|

|

|

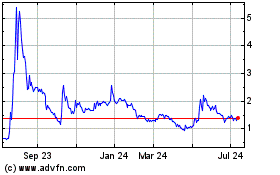

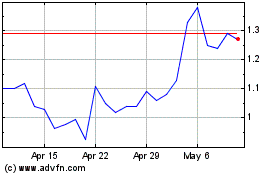

Tupperware Brands (NYSE:TUP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tupperware Brands (NYSE:TUP)

Historical Stock Chart

From Apr 2023 to Apr 2024