Current Report Filing (8-k)

May 25 2016 - 5:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported):

May 25, 2016

TETRA Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

1-13455

|

74-2148293

|

|

(State or other jurisdiction

|

(Commission File Number)

|

(IRS Employer

|

|

of incorporation)

|

|

Identification No.)

|

|

|

|

|

|

24955 Interstate 45 North

|

|

The Woodlands, Texas 77380

|

|

(Address of Principal Executive Offices and Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

(281) 367-1983

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

On May 25, 2016, CSI Compressco LP, a Delaware limited partnership (the “Partnership”) and a consolidated subsidiary of TETRA Technologies, Inc., a Delaware corporation (“TETRA”), and CSI Compressco Sub Inc., a Delaware corporation and wholly-owned subsidiary of the Partnership (“CSI Compressco Sub”), as borrowers, entered into the Third Amendment to Credit Agreement (the “Amendment”) amending the Credit Agreement dated August 4, 2014 (as previously amended by that certain First Amendment to Credit Agreement dated as of December 18, 2014 and that certain Second Amendment to Credit Agreement dated as of April 1, 2015, as so amended, the “Credit Agreement”) by and among the Partnership, CSI Compressco Sub, Bank of America, N.A., in its capacity as administrative agent, collateral agent, lender, letter of credit issuer and swing line issuer, and the other lenders and loan parties a party thereto.

The Amendment modified certain financial covenants in the Credit Agreement, as follows:

|

|

|

|

(i)

|

the consolidated total leverage ratio may not exceed (a) 5.50 to 1 as of June 30, 2016 and September 30, 2016; (b) 5.75 to 1 as of December 31, 2016, March 31, 2017, June 30, 2017 and September 30, 2017; (c) 5.50 to 1 as December 31, 2017 and March 31, 2018; (d) 5.25 to 1 as of June 30, 2018 and September 30, 2018, and (e) 5.00 to 1 as of December 31, 2018 and thereafter; and

|

|

|

|

|

(ii)

|

the consolidated secured leverage ratio was reduced from 4.0 to 1 to 3.50 to 1.

|

In addition, the Amendment provides for the following other changes related to the Credit Agreement: (i) reduced the maximum aggregate lender commitments from $400.0 million to $340.0 million; (ii) increased the applicable margin by 0.25% with a range between 2.00% and 3.00% per annum for LIBOR-based loans and 1.00% to 2.00% per annum for base-rate loans, according to the consolidated total leverage ratio; (iii) imposed a requirement that the Partnership use designated consolidated cash and cash equivalent balances in excess of $35.0 million (the amount of such excess, the “Excess Cash Amount”) to prepay the loans in an amount equal to the lesser of the Excess Cash Amount and the aggregate amount of the loans outstanding; (iv) imposed a requirement to deliver on an annual basis, and at such other times as may be required, an appraisal of the Partnership’s compressor equipment; (v) increased the amount of equipment and real property that may be disposed of by the Partnership in any four consecutive fiscal quarters from $5.0 million to $20.0 million; (vi) allow the prepayment or purchase of indebtedness by the Partnership with proceeds from the issuances of equity securities or in exchange for the issuances of equity securities; and (vii) reduced the amount of the Partnership’s permitted capital expenditures in the ordinary course of business during each fiscal year from $150.0 million to $25.0 million in 2016, $50.0 million in each of 2017 and 2018, and $75.0 million in 2019, provided that 50% of the amounts for 2017 and 2018 may, to the extent not used, be carried over to the succeeding year.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference in this Item 2.03.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

10.1

|

|

Third Amendment to Credit Agreement dated May 25, 2016, by and among CSI Compressco LP, CSI Compressco Sub Inc., Bank of America, N.A., in its capacity as administrative agent, collateral agent, lender, letter of credit issuer and swing line issuer, and the other lenders and loan parties a party thereto.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TETRA Technologies, Inc.

|

|

|

|

|

By:

|

/s/Stuart M. Brightman

|

|

|

Stuart M. Brightman

|

|

|

President & Chief Executive Officer

|

|

Date: May 25, 2016

|

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

10.1

|

|

Third Amendment to Credit Agreement dated May 25, 2016, by and among CSI Compressco LP, CSI Compressco Sub Inc., Bank of America, N.A., in its capacity as administrative agent, collateral agent, lender, letter of credit issuer and swing line issuer, and the other lenders and loan parties a party thereto.

|

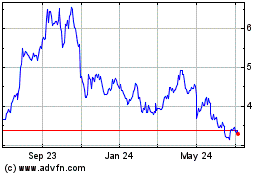

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

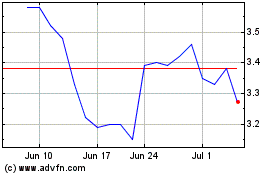

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Apr 2023 to Apr 2024