Current Report Filing (8-k)

May 25 2016 - 4:48PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported):

May 25, 2016

TETRA Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

1-13455

|

74-2148293

|

|

(State or other jurisdiction

|

(Commission File Number)

|

(IRS Employer

|

|

of incorporation)

|

|

Identification No.)

|

|

|

|

|

|

24955 Interstate 45 North

|

|

The Woodlands, Texas 77380

|

|

(Address of Principal Executive Offices and Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

(281) 367-1983

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On May 25, 2016, TETRA Technologies, Inc. (the “Company”) drew down a total of $35.0 million on its revolving credit facility under the Credit Agreement dated as of June 27, 2006, as amended (the “Credit Agreement”), by and among the Company and certain of its subsidiaries, as borrowers, JPMorgan Chase Bank, N.A., as administrative agent, Bank of America, National Association, as syndication agent, Comerica Bank, as documentation agent, and the lenders party thereto. The Company intends to use these proceeds to purchase for cash the notes validly tendered (and not validly withdrawn) in its previously announced tender offer (the “2013 Notes Tender Offer”) for any and all of the Company’s outstanding 4.00% Senior Notes due April 29, 2020 (PPN 88162F C@2) (the “2013 Notes”) in the aggregate principal amount of $35,000,000.

A more detailed description of the Credit Agreement can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015, filed with the Securities and Exchange Commission (the “SEC”) on March 4, 2016. The foregoing description of the Credit Agreement is qualified in its entirety by reference to the full text of (i) the original Credit Agreement, a copy of which was attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on June 30, 2006, (ii) the Agreement and First Amendment to Credit Agreement dated as of December 15, 2006, a copy of which was attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on January 10, 2007, (iii) the Agreement and Second Amendment to Credit Agreement dated as of October 29, 2010, a copy of which was attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on November 3, 2010, and (iv) the Agreement and Third Amendment to Credit Agreement dated as of September 30, 2014, a copy of which was attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on October 6, 2014.

Item 7.01. Regulation FD Disclosure.

On May 25, 2016, the Company issued a press release announcing the completion of its previously announced 2013 Notes Tender Offer to purchase for cash any and all of the 2013 Notes. A copy of this press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

Item 8.01. Other Events.

On May 25, 2016, the Company announced the completion of the 2013 Notes Tender Offer. The offered consideration for the 2013 Notes purchased in the 2013 Notes Tender Offer was an amount, payable in cash, equal to $100,000 per $100,000 principal amount of 2013 Notes validly tendered (and not validly withdrawn) by registered holders of the 2013 Notes prior to the expiration of the 2013 Notes Tender Offer immediately after 11:59 p.m., Eastern Time, on May 24, 2016 (the “Expiration Time”), and accepted for purchase by the Company, plus accrued and unpaid interest on such 2013 Notes from the last interest payment date to, but not including, the date of payment for such 2013 Notes. By the Expiration Time, the Company received 2013 Notes validly tendered (and not validly withdrawn) in an aggregate principal amount of $35,000,000 representing the total outstanding amount of the 2013 Notes, and as a result, the Company has purchased all of the outstanding 2013 Notes.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

99.1

|

|

Press Release dated May 25, 2016, announcing the expiration and results of the 2013 Notes Tender Offer.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TETRA Technologies, Inc.

|

|

|

|

|

By:

|

/s/Stuart M. Brightman

|

|

|

Stuart M. Brightman

|

|

|

President & Chief Executive Officer

|

|

Date: May 25, 2016

|

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

99.1

|

|

Press Release dated May 25, 2016, announcing the expiration and results of the 2013 Notes Tender Offer.

|

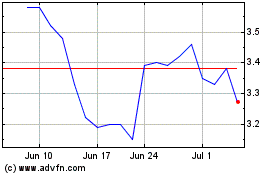

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

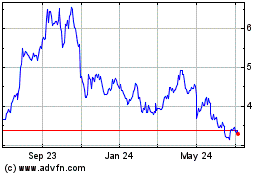

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Apr 2023 to Apr 2024