UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): December 7, 2015

TETRA Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 1-13455 | 74-2148293 |

(State or other jurisdiction | (Commission File Number) | (IRS Employer |

of incorporation) | | Identification No.) |

| | |

24955 Interstate 45 North |

The Woodlands, Texas 77380 |

(Address of Principal Executive Offices and Zip Code) |

| | |

Registrant’s telephone number, including area code: (281) 367-1983 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

On December 8, 2015, TETRA Technologies, Inc. (the “Company”) issued a press release announcing the completion of its previously announced tender offer (the “Tender Offer”) to purchase for cash up to $25,000,000 aggregate principal amount of the Company’s outstanding 5.09% Senior Notes, Series 2010-A, due December 15, 2017 and 5.67% Senior Notes, Series 2010-B, due December 15, 2020 (collectively, the “Notes”). A copy of this press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

Item 8.01. Other Events.

On December 8, 2015, the Company announced the completion of the Tender Offer. The offered consideration for Notes purchased in the Tender Offer was an amount, payable in cash, equal to $100,000 per $100,000 principal amount of Notes validly tendered by registered holders of the Notes prior to the expiration of the Tender Offer immediately after 11:59 p.m., Eastern Time, on December 7, 2015, and accepted for purchase by the Company, plus accrued and unpaid interest on such Notes from the last interest payment date to, but not including, the date of payment for such Notes.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

| | |

Exhibit Number | | Description |

99.1 | | Press Release, dated December 8, 2015, announcing the expiration and results of the Tender Offer. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| TETRA Technologies, Inc. |

| |

By: | /s/Stuart M. Brightman |

| Stuart M. Brightman |

| President & Chief Executive Officer |

Date: December 8, 2015 | |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

99.1 | | Press Release, dated December 8, 2015, announcing the expiration and results of the Tender Offer. |

EXHIBIT 99.1

FOR IMMEDIATE RELEASE

TETRA TECHNOLOGIES, INC.

COMPLETES ITS TENDER OFFER FOR UP TO $25,000,000

OF ITS 5.09% SENIOR NOTES, SERIES 2010-A, DUE DECEMBER 15, 2017

AND 5.67% SENIOR NOTES, SERIES 2010-B, DUE DECEMBER 15, 2020

The Woodlands, Texas (December 8, 2015) - TETRA Technologies, Inc. (NYSE:TTI) (the “Company” or “TETRA”) today announced the completion of its previously announced tender offer (the “Tender Offer”) to purchase up to $25,000,000 aggregate principal amount of its 5.09% Senior Notes, Series 2010-A, due December 15, 2017 (PPN 88162F B#1) (the “2010-A Notes”) and its 5.67% Senior Notes, Series 2010-B, due December 15, 2020 (PPN 88162F C*4) (the “2010-B Notes” and collectively with the 2010-A Notes, the “Notes”). The Tender Offer expired immediately after 11:59 p.m., Eastern Time, on Monday, December 7, 2015 (the “Expiration Time”).

By the Expiration Time, TETRA received Notes validly tendered (and not validly withdrawn) in an aggregate principal amount in excess of the $25,000,000 maximum purchase amount set forth in the Offer to Purchase dated November 5, 2015 (the “Offer to Purchase”). As a result, the Company has purchased $25,000,000 aggregate principal of Notes on a pro rata basis in accordance with the terms set forth in the Offer to Purchase. Set forth in the table below is the aggregate principal amount of each series of Notes that TETRA has accepted for purchase pursuant to the Tender Offer and the aggregate principal amount of each series of Notes that remains outstanding following settlement of the Tender Offer.

|

| | |

Title of Security | Aggregate Principal Amount Accepted for Purchase | Aggregate Principal Amount that Remains Outstanding |

2010-A Notes | $18,055,555.56 | $46,944,444.44 |

2010-B Notes | $6,944,444.44 | $18,055,555.56 |

The Company has paid total consideration of $100,000 per $100,000 principal amount of the tendered Notes, plus accrued and unpaid interest from the last interest payment date to, but not including, the payment date.

About TETRA

TETRA is a geographically diversified oil and gas services company, focused on completion fluids and associated products and services, water management, frac flowback, production well testing, offshore rig cooling, compression services and equipment, and selected offshore services including well plugging and abandonment, decommissioning, and diving. TETRA owns an equity interest, including all of the general partner interest, in CSI Compressco LP (NASDAQ:CCLP), a master limited partnership.

Contact:

TETRA Technologies, Inc., The Woodlands, Texas

Stuart M. Brightman, 281/367-1983

Fax: 281/364-4346

www.tetratec.com

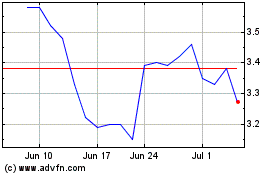

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

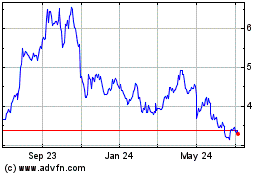

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Apr 2023 to Apr 2024