UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): November 20, 2015

TETRA Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 1-13455 | 74-2148293 |

(State or other jurisdiction | (Commission File Number) | (IRS Employer |

of incorporation) | | Identification No.) |

| | |

24955 Interstate 45 North |

The Woodlands, Texas 77380 |

(Address of Principal Executive Offices and Zip Code) |

| | |

Registrant’s telephone number, including area code: (281) 367-1983 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

As previously disclosed by TETRA Technologies, Inc. (the “Company”) in the Company’s Current Report on Form 8-K filed on November 6, 2015 (the “Prior Form 8-K”), the Company entered into a Note Purchase Agreement (the “Note Purchase Agreement”) dated as of November 5, 2015, by and between the Company and GSO Tetra Holdings LP (“GSO”). The Note Purchase Agreement relates to the Company’s issuance and sale of $125.0 million aggregate principal amount of its 11.00% Senior Notes due November 5, 2022 (the “Senior Notes”). On November 20, 2015 (the “Closing Date”), the Company completed the issuance and sale of the Senior Notes pursuant to the Note Purchase Agreement in a private placement transaction. The Senior Notes are guaranteed by certain of the Company’s domestic subsidiaries (the “Guarantors”) pursuant to a Subsidiary Guaranty dated as of the Closing Date (the “Subsidiary Guaranty”) in favor of the holders from time to time of the Senior Notes issued under the Note Purchase Agreement and any supplement thereto, and their respective successors and assigns.

Immediately after the closing and funding, the Company applied a portion of the proceeds from the sale of the Senior Notes to repay all of the Company’s indebtedness for borrowed money outstanding under its credit agreement. Thereafter, the Company will apply any remaining portion of the proceeds, together with other funds (to the extent necessary), to (i) pay the purchase price for notes accepted for purchase by the Company pursuant to the tender offer described in the Prior Form 8-K, (ii) prepay in full all amounts owed in respect of the Company’s outstanding 5.90% Senior Notes, Series 2006-A, due April 30, 2016 (the Series 2006-A Notes”) and (iii) pay fees and expenses associated with the transactions contemplated under the Note Purchase Agreement.

The Senior Notes have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or the securities laws of any other jurisdiction and may not be offered or sold in the United States absent such registration or an applicable exemption from the registration requirements of the Securities Act.

The foregoing summary of the Note Purchase Agreement, the Senior Notes and the Subsidiary Guaranty does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Note Purchase Agreement filed as Exhibit 4.1 to the Prior Form 8-K and incorporated herein by reference, and to the full text of the Senior Note and Subsidiary Guaranty, copies of which are filed as Exhibits 4.1 and 4.2, respectively, to this Current Report on Form 8-K and incorporated herein by reference. In addition, the information set forth in the Prior Form 8-K, as well as the information set forth below in Item 2.03 of this Current Report on Form 8-K, is incorporated by reference into this Item 1.01.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Senior Notes

Pursuant to the terms of the Note Purchase Agreement, on the Closing Date the Company issued and sold the Senior Notes by issuing a single note in the aggregate principal amount of $125.0 million to GSO in a private placement transaction exempt from the registration requirements of the Securities Act. The Senior Notes will bear interest at the fixed rate of 11.00% and mature on November 5, 2022. Interest on the Senior Notes will be due quarterly on March 15, June 15, September 15 and December 15 of each year, commencing on March 15, 2016. For a further discussion of additional payment terms of the Senior Notes, refer to Item 2.03 of the Prior Form 8-K, which is incorporated herein by reference.

The foregoing description of the Senior Notes does not purport to be complete and is subject to, and qualified in its entirety by, reference to the full text of the Senior Note, a copy of which is filed as Exhibit 4.1 to this Current Report on Form 8-K and incorporated herein by reference.

Subsidiary Guaranty

Payment of principal of, make-whole amount, if any, other premium, if any, and interest on, and each other amount due under the Senior Notes or the Note Purchase Agreement and any supplement thereto, is guaranteed by the Guarantors pursuant to the terms of the Subsidiary Guaranty. Pursuant to the Subsidiary Guaranty, the Guarantors have unconditionally and irrevocably guaranteed to the holders from time to time of the Senior Notes issued under the Note Purchase Agreement and any supplement thereto, and their respective successors and assigns, the due, prompt and complete payment by the Company of any and all amounts owed by the Company in accordance with the terms of the Senior Notes, the Note Purchase Agreement and any supplement thereto.

The foregoing description of the Subsidiary Guaranty does not purport to be complete and is subject to, and qualified in its entirety by, reference to the full text of the Subsidiary Guaranty, a copy of which is filed as Exhibit 4.2 to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.04. Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

On November 20, 2015, the Company provided notice to the holders of the Series 2006-A Notes of the optional prepayment of such Series 2006-A Notes in full pursuant to the Master Note Purchase Agreement dated as of September 27, 2004, as amended and supplemented by the First Supplement thereto, dated as of April 18, 2006, among the Company and the holders of the Series 2006-A Notes. The optional prepayment notice accelerated the payment date of the Series 2006-A Notes from April 30, 2016 to December 21, 2015. The amount due on December 21, 2015 will be approximately $92.4 million, which includes accrued interest and a make-whole payment of approximately $1.6 million, subject to final calculation.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

|

| | |

Exhibit Number | | Description |

4.1 | | 11.00% Senior Note due November 5, 2022. |

4.2 | | Subsidiary Guaranty dated November 20, 2015, executed by Compressco Field Services, L.L.C., Epic Diving & Marine Services, LLC, TETRA Applied Technologies, LLC, TETRA International Incorporated and TETRA Production Testing Services, LLC, in favor of the holders from time to time of the 11.00% Senior Notes due November 5, 2022. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| TETRA Technologies, Inc. |

| |

By: | /s/Stuart M. Brightman |

| Stuart M. Brightman |

| President & Chief Executive Officer |

Date: November 20, 2015 | |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

4.1 | | 11.00% Senior Note due November 5, 2022. |

4.2 | | Subsidiary Guaranty dated November 20, 2015, executed by Compressco Field Services, L.L.C., Epic Diving & Marine Services, LLC, TETRA Applied Technologies, LLC, TETRA International Incorporated and TETRA Production Testing Services, LLC, in favor of the holders from time to time of the 11.00% Senior Notes due November 5, 2022. |

EXHIBIT 4.1

THIS NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND MAY NOT BE SOLD, TRANSFERRED OR OTHERWISE DISPOSED OF IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT OR AN EXEMPTION THEREFROM.

TETRA TECHNOLOGIES, INC.

11.00% SENIOR NOTE DUE NOVEMBER 5, 2022

|

| |

No. R-1 | November 20, 2015 |

$125,000,000.00 | |

FOR VALUE RECEIVED, the undersigned, TETRA TECHNOLOGIES, INC., a Delaware corporation (the “Company”), promises to pay to GSO Tetra Holdings LP, or registered assigns, the principal sum of $125,000,000.00 on November 5, 2022, with interest (computed on the basis of a 360-day year of twelve 30-day months) (a) on the unpaid balance thereof at the rate of 11.00% per annum from the date hereof, payable quarterly, on March 15, June 15, September 15 and December 15, in each year, commencing with March 15, 2016, until the principal hereof shall have become due and payable, and (b) upon the occurrence and during the continuance of an Event of Default (as defined in the Note Purchase Agreement referred to below), to the extent permitted by law, on all principal of, any unpaid interest on and any Make-Whole Amount (as defined in the Note Purchase Agreement referred to below) or any other premium, payable quarterly as aforesaid (or, at the option of the registered holder hereof, on demand), at a rate per annum equal to 13%.

Payments of principal of, interest on, any Make-Whole Amount, if any, and any other premium, if any, with respect to this Note are to be made in lawful money of the United States of America at the principal office of the Company in The Woodlands, Texas or at such other place as the Company shall have designated by written notice to the holder of this Note as provided in the Note Purchase Agreement referred to below.

This Note is issued pursuant to a Note Purchase Agreement dated as of November 5, 2015 (as from time to time amended or supplemented, the “Note Purchase Agreement”), between the Company and the respective Purchasers named therein and is entitled to the benefits thereof. Each holder of this Note will be deemed, by its acceptance hereof, (i) to have agreed to the confidentiality provisions set forth in Section 20 of the Note Purchase Agreement and (ii) to have made the representations set forth in Section 6 of the Note Purchase Agreement.

This Note has been registered with the Company and, as provided in the Note Purchase Agreement, upon surrender of this Note for registration of transfer, duly endorsed, or accompanied by a written instrument of transfer duly executed, by the registered holder hereof or such holder’s attorney duly authorized in writing, a new Note for a like principal amount will be issued to, and registered in the name of, the transferee. Prior to due presentment for registration of transfer, the Company may treat the person in whose name this Note is registered as the owner hereof for the purpose of receiving payment and for all other purposes, and the Company will not be affected by any notice to the contrary.

This Note is subject to optional prepayment, in whole or from time to time in part, at the times and on the terms specified in the Note Purchase Agreement but not otherwise.

If an Event of Default, as defined in the Note Purchase Agreement, occurs and is continuing, the principal of this Note may be declared or otherwise become due and payable in the manner, at the price (including any applicable Make-Whole Amount or other premium) and with the effect provided in the Note Purchase Agreement.

Payment of the principal of, and interest and Make-Whole Amount, if any, or any other premium, if any, on this Note, and all other amounts due under the Note Purchase Agreement, is guaranteed pursuant to the terms of a Subsidiary Guaranty dated as of November 20, 2015 of certain Subsidiaries of the Company, as amended or supplemented from time to time.

This Note shall be construed and enforced in accordance with, and the rights of the parties shall be governed by, the law of the State of New York excluding choice-of-law principles of the law of such State that would require the application of the laws of a jurisdiction other than such State.

[Signature page follows]

IN WITNESS WHEREOF, the Company has caused this instrument to be duly executed.

TETRA TECHNOLOGIES, INC.

By:

Name: Joseph J. Meyer

Title: Vice President - Finance, Treasurer and Assistant Secretary

EXHIBIT 4.2

SUBSIDIARY GUARANTY

THIS GUARANTY (this “Guaranty”) dated November 20, 2015 is made by the undersigned (each, a “Guarantor”), in favor of the holders from time to time of the Notes issued under the Note Purchase Agreement and any Supplement thereto, including each purchaser named in the Note Purchase Agreement and in any Supplement thereto, and their respective successors and assigns (collectively, the “Holders” and each individually, a “Holder”).

W I T N E S S E T H:

WHEREAS, TETRA TECHNOLOGIES, INC., a Delaware corporation (the “Company”), and the initial Holders have entered into a Note Purchase Agreement dated as of November 5, 2015 (the Note Purchase Agreement as amended, supplemented, restated or otherwise modified from time to time in accordance with its terms and in effect, the “Note Purchase Agreement”);

WHEREAS, pursuant to the Note Purchase Agreement, the Company has issued $125,000,000 principal amount of Series 2015 Notes;

WHEREAS, the Company directly or indirectly owns all or a substantial portion of the issued and outstanding Equity Interest of each Guarantor and, by virtue of such ownership and otherwise, such Guarantor will derive substantial benefits from the purchase by the Holders of the Company’s Notes;

WHEREAS, it is a condition precedent to the obligation of the Holders to purchase the Notes that each Guarantor shall have executed and delivered this Guaranty to the Holders and it is and will be a condition to the sale of Additional Notes that this Guaranty run in favor of the holders of such Additional Notes; and

WHEREAS, each Guarantor desires to execute and deliver this Guaranty to satisfy the conditions described in the preceding paragraph;

NOW, THEREFORE, in consideration of the premises and other benefits to each Guarantor and for other good and valuable consideration, the receipt and sufficiency of which are acknowledged, each Guarantor makes this Guaranty as follows:

SECTION 1. Definitions. Any capitalized terms not otherwise herein defined shall have the meanings attributed to them in the Note Purchase Agreement.

SECTION 2. Guaranty. Each Guarantor, jointly and severally with each other Guarantor, unconditionally and irrevocably guarantees to the Holders the due, prompt and complete payment by the Company of the principal of, make-whole amount, if any, other premium, if any, and interest on, and each other amount due under, the Notes or the Note Purchase Agreement and any Supplement thereto, when and as the same shall become due and payable (whether at stated maturity or by required or optional prepayment or by acceleration or otherwise) in accordance with the terms of the Notes, the Note Purchase Agreement and any Supplement thereto (the Notes, the Note Purchase Agreement and any Supplement being sometimes hereinafter collectively referred to as the “Applicable Note Documents” and the amounts payable by the Company under the Applicable Note Documents, and all other monetary obligations of the Company thereunder (including any attorneys’ fees and expenses), being sometimes collectively hereinafter referred to as the “Obligations”). This Guaranty is a guaranty of payment and not just of collectibility and is in no way conditioned or contingent upon any attempt to collect from the Company or upon any other event, contingency or circumstance whatsoever. If for any reason whatsoever the Company shall fail or be unable

duly, punctually and fully to pay such amounts as and when the same shall become due and payable, each Guarantor, without demand, presentment, protest or notice of any kind, will forthwith pay or cause to be paid such amounts to the Holders under the terms of such Applicable Note Documents, in lawful money of the United States, at the place specified in the Note Purchase Agreement, or perform or comply with the same or cause the same to be performed or complied with, together with interest (to the extent provided for under such Applicable Note Documents) on any amount due and owing from the Company. Each Guarantor, promptly after demand, will pay to the Holders the reasonable costs and expenses of collecting such amounts or otherwise enforcing this Guaranty, including, without limitation, the reasonable fees and expenses of counsel. Notwithstanding the foregoing, the right of recovery against each Guarantor under this Guaranty is limited to the extent it is judicially determined with respect to any Guarantor that entering into this Guaranty would violate Section 548 of the United States Bankruptcy Code or any comparable provisions of any state law, in which case such Guarantor shall be liable under this Guaranty only for amounts aggregating up to the largest amount that would not render such Guarantor’s obligations hereunder subject to avoidance under Section 548 of the United States Bankruptcy Code or any comparable provisions of any state law.

SECTION 3. Guarantor’s Obligations Unconditional. The obligations of each Guarantor under this Guaranty shall be primary, absolute and unconditional obligations of each Guarantor, shall not be subject to any counterclaim, set-off, deduction, diminution, abatement, recoupment, suspension, deferment, reduction or defense based upon any claim each Guarantor or any other person may have against the Company or any other person, and to the full extent permitted by applicable law shall remain in full force and effect without regard to, and shall not be released, discharged or in any way affected by, any circumstance or condition whatsoever (whether or not each Guarantor or the Company shall have any knowledge or notice thereof), including:

(a)any termination, amendment or modification of or deletion from or addition or supplement to or other change in any of the Applicable Note Documents or any other instrument or agreement applicable to any of the parties to any of the Applicable Note Documents;

(b)any furnishing or acceptance of any security, or any release of any security, for the Obligations, or the failure of any security or the failure of any person to perfect any interest in any collateral;

(c)any failure, omission or delay on the part of the Company to conform or comply with any term of any of the Applicable Note Documents or any other instrument or agreement referred to in paragraph (a) above, including, without limitation, failure to give notice to any Guarantor of the occurrence of a “Default” or an “Event of Default” under any Applicable Note Document;

(d)any waiver of the payment, performance or observance of any of the obligations, conditions, covenants or agreements contained in any Applicable Note Document, or any other waiver, consent, extension, indulgence, compromise, settlement, release or other action or inaction under or in respect of any of the Applicable Note Documents or any other instrument or agreement referred to in paragraph (a) above or any obligation or liability of the Company, or any exercise or non-exercise of any right, remedy, power or privilege under or in respect of any such instrument or agreement or any such obligation or liability;

(e)any failure, omission or delay on the part of any of the Holders to enforce, assert or exercise any right, power or remedy conferred on such Holder in this Guaranty, or any such failure, omission or delay on the part of such Holder in connection with any Applicable Note Document, or any other action on the part of such Holder;

(f)any voluntary or involuntary bankruptcy, insolvency, reorganization, arrangement, readjustment, assignment for the benefit of creditors, composition, receivership, conservatorship, custodianship, liquidation, marshaling of assets and liabilities or similar proceedings with respect to the Company, any other Guarantor or to any other person or any of their respective properties or creditors, or any action taken by any trustee or receiver or by any court in any such proceeding;

(g)any discharge, termination, cancellation, frustration, irregularity, invalidity or unenforceability, in whole or in part, of any of the Applicable Note Documents or any other agreement or instrument referred to in paragraph (a) above or any term hereof;

(h)any merger or consolidation of the Company or any Guarantor into or with any other Person, or any sale, lease or transfer of any of the assets of the Company or any Guarantor to any other person;

(i)any change in the ownership of any shares of Capital Stock of the Company or any change in the corporate relationship between the Company and any Guarantor, or any termination of such relationship;

(j)any release or discharge, by operation of law, of any other Guarantor from the performance or observance of any obligation, covenant or agreement contained in this Guaranty; or

(k)any other occurrence, circumstance, happening or event whatsoever, whether similar or dissimilar to the foregoing, whether foreseen or unforeseen, and any other circumstance which might otherwise constitute a legal or equitable defense (other than the defense of payment) or discharge of the liabilities of a guarantor or surety or which might otherwise limit recourse against any Guarantor.

SECTION 4. Full Recourse Obligations. The obligations of each Guarantor set forth herein constitute the full recourse obligations of such Guarantor enforceable against it (subject to the last sentence of Section 2) to the full extent of all its assets and properties.

SECTION 5. Waiver. Each Guarantor unconditionally waives, to the extent permitted by applicable law, (a) notice of any of the matters referred to in Section 3, (b) notice to such Guarantor of the incurrence of any of the Obligations, notice to such Guarantor or the Company of any breach or default by such Guarantor or the Company with respect to any of the Obligations or any other notice that may be required, by statute, rule of law or otherwise, to preserve any rights of the Holders against such Guarantor, (c) presentment to or demand of payment from the Company or the Guarantor with respect to any amount due under any Applicable Note Document or protest for nonpayment or dishonor, (d) any right to the enforcement, assertion or exercise by any of the Holders of any right, power, privilege or remedy conferred in the Note Purchase Agreement or any other Applicable Note Document or otherwise, (e) any requirement of diligence on the part of any of the Holders, (f) any requirement to exhaust any remedies or to mitigate the damages resulting from any default under any Applicable Note Document, (g) any notice of any sale, transfer or other disposition by any of the Holders of any right, title to or interest in the Note Purchase Agreement or in any other Applicable Note Document and (h) any other circumstance whatsoever which might otherwise constitute a legal or equitable discharge, release (other than a release of such Guarantor herefrom pursuant to Section 1.2(b) of the Note Purchase Agreement) or defense of a guarantor or surety (other than the defense of payment) or which might otherwise limit recourse against such Guarantor.

SECTION 6. Subrogation, Contribution, Reimbursement or Indemnity. Until all Obligations have been indefeasibly paid in full, each Guarantor agrees not to take any action pursuant to any rights which may have arisen in connection with this Guaranty to be subrogated to any of the rights (whether contractual, under the United States Bankruptcy Code, as amended, including Section 509 thereof, under common law or otherwise) of any of the Holders against the Company or against any collateral security or guaranty or right of offset held by the Holders for the payment of the Obligations. Until all Obligations have been indefeasibly paid in full, each Guarantor agrees not to take any action pursuant to any contractual, common law, statutory or other rights of reimbursement, contribution, exoneration or indemnity (or any similar right) from or against the Company which may have arisen in connection with this Guaranty. So long as any Obligations remain outstanding, if any amount shall be paid by or on behalf of the Company to any Guarantor on account of any of the rights waived in this Section 6, such amount shall be held by such Guarantor in trust, segregated from other funds of such Guarantor, and shall, forthwith upon receipt by such Guarantor, be turned over to the Holders (duly endorsed by such Guarantor to the Holders, if required), to be applied against the Obligations, whether matured or unmatured, in such order as the Holders may determine. The provisions of this Section 6 shall survive the term of this Guaranty and the payment in full of the Obligations.

SECTION 7. Effect of Bankruptcy Proceedings, etc. This Guaranty shall continue to be effective or be automatically reinstated, as the case may be, if at any time payment, in whole or in part, of any of the sums due to any of the Holders pursuant to the terms of the Note Purchase Agreement or any other Applicable Note Document is rescinded or must otherwise be restored or returned by such Holder upon the insolvency, bankruptcy, dissolution, liquidation or reorganization of the Company or any other person, or upon or as a result of the appointment of a custodian, receiver, trustee or other officer with similar powers with respect to the Company or other person or any substantial part of its property, or otherwise, all as though such payment had not been made. If an event permitting the acceleration of the maturity of the principal amount of the Notes shall at any time have occurred and be continuing, and such acceleration shall at such time be prevented by reason of the pendency against the Company or any other person of a case or proceeding under a bankruptcy or insolvency law, each Guarantor agrees that, for purposes of this Guaranty and its obligations hereunder, the maturity of the principal amount of the Notes and all other Obligations shall be deemed to have been accelerated with the same effect as if any Holder had accelerated the same in accordance with the terms of the Note Purchase Agreement or other Applicable Note Document, and such Guarantor shall forthwith pay such principal amount, make-whole amount, if any, other premium, if any, and interest thereon and any other amounts guaranteed hereunder without further notice or demand.

SECTION 8. Term of Agreement. This Guaranty and all guaranties, covenants and agreements of each Guarantor contained herein shall continue in full force and effect and shall not be discharged until such time as all of the Obligations shall be paid and performed in full and all of the agreements of such Guarantor hereunder shall be duly paid and performed in full; provided that each Guarantor shall be automatically and immediately released herefrom without any further act by any Person as provided in Section 1.2(b) of the Note Purchase Agreement.

SECTION 9. Representations and Warranties. Each Guarantor represents and warrants to each Holder that:

(a)such Guarantor is a corporation, limited partnership or limited liability company, as the case may be, duly organized, validly existing and in good standing under the laws of its jurisdiction of organization and has the corporate, limited partnership or limited liability company, as the case may be, power and authority to own and operate its property, to lease the property it operates as lessee and to conduct the business in which it is currently engaged;

(b)such Guarantor has the corporate, limited partnership or limited liability company, as the case may be, power and authority and the legal right to execute and deliver, and to perform its obligations under, this Guaranty, and has taken all necessary corporate, limited partnership or limited liability company, as the case may be, action to authorize its execution, delivery and performance of this Guaranty;

(c)this Guaranty constitutes a legal, valid and binding obligation of such Guarantor enforceable in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency, reorganization, fraudulent conveyance, fraudulent transfer, moratorium or similar laws affecting the enforcement of creditors’ rights generally and by general equitable principles (regardless of whether such enforceability is considered in a proceeding in equity or at law);

(d)the execution, delivery and performance of this Guaranty will not violate any provision of any requirement of law or material contractual obligation of such Guarantor and will not result in or require the creation or imposition of any Lien on any of the properties, revenues or assets of such Guarantor pursuant to the provisions of any material contractual obligation of such Guarantor or any requirement of law;

(e)no consent or authorization of, filing with, or other act by or in respect of, any arbitrator or Governmental Authority is required as to such Guarantor in connection with the execution, delivery or performance of this Guaranty by such Guarantor or the validity or enforceability of this Guaranty;

(f)no litigation, investigation or proceeding of or before any arbitrator or Governmental Authority is pending or, to the knowledge of such Guarantor, threatened by or against such Guarantor or any of its properties or revenues (i) with respect to this Guaranty or any of the transactions contemplated hereby or (ii) which could reasonably be expected to have a Material Adverse Effect;

(g)the execution, delivery and performance of this Guaranty by such Guarantor will not violate any provision of any order, judgment, writ, award or decree of any court, arbitrator or Governmental Authority, domestic or foreign, applicable to such Guarantor or of the certificate or articles of incorporation, by-laws, certificate of formation, articles of organization or operating agreement, as applicable, of such Guarantor or of any securities issued by such Guarantor;

(h)after giving effect to the transactions contemplated herein, (i) the present value of the assets of such Guarantor, at a fair valuation, is in excess of the amount that will be required to pay its probable liability on its existing debts as said debts become absolute and matured, (ii) the property remaining in the hands of such Guarantor is not an unreasonably small capital and (iii) such Guarantor is able to pay its debts as they mature; and

(i)after giving effect to the issuance and sale of the Notes and the application of the proceeds thereof and due consideration to any rights of contribution and reimbursement, such Guarantor has received fair consideration and reasonably equivalent value for the incurrence of its obligations hereunder or as contemplated hereunder.

SECTION 10. Notices. All notices and communications provided for hereunder shall be in writing and sent (a) by facsimile if the sender on the same day sends a confirming copy of such notice by a recognized overnight delivery service (charges prepaid), (b) by registered or certified mail with return receipt requested (postage prepaid), or (c) by a recognized overnight delivery service (with charges prepaid), addressed (a) if to the Company or any Holder at the address or telecopy number set forth in the Note Purchase Agreement

or (b) if to a Guarantor, in care of the Company at the Company’s address or telecopy number set forth in the Note Purchase Agreement, or in each case at such other address or telecopy number as the Company, any Holder or such Guarantor shall from time to time designate in writing to the other parties. Any notice so addressed shall be deemed to be given when actually received.

SECTION 11. Survival. All warranties, representations and covenants made by each Guarantor herein or in any certificate or other instrument delivered by it or on its behalf hereunder shall be considered to have been relied upon by the Holders and shall survive the execution and delivery of this Guaranty, regardless of any investigation made by any of the Holders. All statements in any such certificate or other instrument shall constitute warranties and representations by such Guarantor hereunder.

SECTION 12. Jurisdiction and Process; Waiver of Jury Trial.

(a)Each Guarantor irrevocably submits to the exclusive jurisdiction of any New York or federal court sitting in New York City, over any suit, action or proceeding arising out of or relating solely to this Agreement or the Notes. To the fullest extent permitted by applicable law, each Guarantor irrevocably waives and agrees not to assert, by way of motion, as a defense or otherwise, any claim that it is not subject to the jurisdiction of any such court, any objection that it may now or hereafter have to the laying of the venue of any such suit, action or proceeding brought in any such court and any claim that any such suit, action or proceeding brought in any such court has been brought in an inconvenient forum.

(b)Each Guarantor agrees, to the fullest extent permitted by applicable law, that a final judgment in any suit, action or proceeding of the nature referred to in Section 22.2(a) brought in any such court shall be conclusive and binding upon it subject to rights of appeal, as the case may be, and may be enforced in the courts of the United States of America or the State of New York (or any other courts to the jurisdiction of which it or any of its assets is or may be subject) by a suit upon such judgment.

(c)The Company consents to process being served in any suit, action or proceeding solely of the nature referred to in Section 12(a) by mailing a copy thereof by registered or certified or priority mail, postage prepaid, return receipt requested, or delivering a copy thereof in the manner for delivery of notices specified in Section 10, to it. Each Guarantor agrees that such service upon receipt (i) shall be deemed in every respect effective service of process upon it in any such suit, action or proceeding and (ii) shall, to the fullest extent permitted by applicable law, be taken and held to be valid personal service upon and personal delivery to it. Notices hereunder shall be conclusively presumed received as evidenced by a delivery receipt furnished by the United States Postal Service or any reputable commercial delivery service.

(d)Nothing in this Section 12 shall affect the right of any holder of a Note to serve process in any manner permitted by law, or limit any right that the holders of any of the Notes may have to bring proceedings against the Company in the courts of any appropriate jurisdiction or to enforce in any lawful manner a judgment obtained in one jurisdiction in any other jurisdiction.

(e)EACH GUARANTOR WAIVES TRIAL BY JURY IN ANY ACTION BROUGHT ON OR WITH RESPECT TO THIS AGREEMENT, THE NOTES OR ANY OTHER DOCUMENT EXECUTED IN CONNECTION HEREWITH OR THEREWITH.

SECTION 13. Miscellaneous. Any provision of this Guaranty that is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction. To the extent permitted by applicable law, each Guarantor hereby waives any provision of law that renders any provisions hereof prohibited or unenforceable in any respect. The terms of this Guaranty shall be binding upon, and inure to the benefit of, each Guarantor and the Holders and their respective successors and assigns. No term or provision of this Guaranty may be changed, waived, discharged or terminated orally, but only by an instrument in writing signed by each Guarantor and each Holder, except for a release and discharge of this Guaranty permitted by, and in compliance with, Section 1.2(b) of the Note Purchase Agreement. The section and paragraph headings in this Guaranty are for convenience of reference only and shall not modify, define, expand or limit any of the terms or provisions hereof, and all references herein to numbered sections, unless otherwise indicated, are to sections in this Guaranty. This Guaranty shall be construed and enforced in accordance with, and the rights of the parties shall be governed by, the law of the State of New York excluding choice-of-law principles of the law of such State that would require the application of the laws of a jurisdiction other than such State.

IN WITNESS WHEREOF, each Guarantor has caused this Guaranty to be duly executed as of the day and year first above written.

COMPRESSCO FIELD SERVICES, L.L.C.

EPIC DIVING & MARINE SERVICES, LLC

TETRA APPLIED TECHNOLOGIES, LLC

TETRA INTERNATIONAL INCORPORATED

TETRA PRODUCTION TESTING SERVICES, LLC

By: /s/Joseph J. Meyer

Name: Joseph J. Meyer

Title: Treasurer

FORM OF JOINDER TO SUBSIDIARY GUARANTY

The undersigned (the “Guarantor”), joins in the Subsidiary Guaranty dated as of November 20, 2015 from the Guarantors named therein in favor of the Holders, as defined therein, and agrees to be bound by all of the terms thereof and represents and warrants to the Holders that:

(a)the Guarantor is duly organized, validly existing and in good standing under the laws of its jurisdiction of organization and has the requisite power and authority to own and operate its property, to lease the property it operates as lessee and to conduct the business in which it is currently engaged;

(b)the Guarantor has the requisite power and authority and the legal right to execute and deliver this Joinder to Subsidiary Guaranty (“Joinder”) and to perform its obligations hereunder and under the Subsidiary Guaranty and has taken all necessary action to authorize its execution and delivery of this Joinder and its performance of the Subsidiary Guaranty;

(c)the Subsidiary Guaranty constitutes a legal, valid and binding obligation of the Guarantor enforceable in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency, reorganization, fraudulent conveyance, fraudulent transfer, moratorium or similar laws affecting the enforcement of creditors’ rights generally and by general equitable principles (regardless of whether such enforceability is considered in a proceeding in equity or at law);

(d)the execution, delivery and performance of this Joinder will not violate any provision of any requirement of law or material contractual obligation of the Guarantor and will not result in or require the creation or imposition of any Lien on any of the properties, revenues or assets of the Guarantor pursuant to the provisions of any material contractual obligation of such Guarantor or any requirement of law;

(e)no consent or authorization of, filing with, or other act by or in respect of, any arbitrator or Governmental Authority is required in connection with the execution, delivery, performance, validity or enforceability of this Joinder;

(f)no litigation, investigation or proceeding of or before any arbitrator or Governmental Authority is pending or, to the knowledge of the Guarantor, threatened by or against the Guarantor or any of its properties or revenues (i) with respect to this Joinder, the Subsidiary Guaranty or any of the transactions contemplated hereby or thereby or (ii) that could reasonably be expected to have a Material Adverse Effect;

(g)the execution, delivery and performance of this Joinder will not violate any provision of any order, judgment, writ, award or decree of any court, arbitrator or Governmental Authority, domestic or foreign, applicable to such Guarantor or of the certificate or articles of incorporation, by-laws, certificate of formation, articles of organization or operating agreement, as applicable, of the Guarantor or of any securities issued by the Guarantor;

(h)after giving effect to the transactions contemplated herein, (i) the present value of the assets of the Guarantor, at a fair valuation, is in excess of the amount that will be required to pay its probable liability on its existing debts as said debts become absolute and matured, (ii) the property remaining in the hands of the Guarantor is not an unreasonably small capital, and (iii) the Guarantor is able to pay its debts as they mature; and

(i)after giving effect to the issuance and sale of the Notes and the application of the proceeds thereof and due consideration to any rights of contribution and reimbursement, such Guarantor has received fair consideration and reasonably equivalent value for the incurrence of its obligations hereunder or as contemplated hereunder.

Capitalized terms used but not defined herein have the meanings ascribed in the Subsidiary Guaranty.

IN WITNESS WHEREOF, the undersigned has caused this Joinder to Subsidiary Guaranty to be duly executed as of __________, ____.

[Name of Guarantor]

By:

Name:

Title:

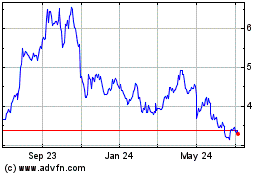

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

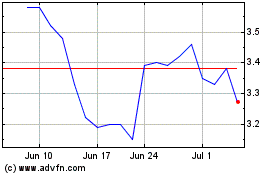

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Apr 2023 to Apr 2024