Report of Foreign Issuer (6-k)

December 16 2016 - 6:05AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2016

Commission File Number 001-14491

TIM PARTICIPAÇÕES S.A.

(Exact name of registrant as specified in its charter)

TIM PARTICIPAÇÕES S.A.

(Translation of Registrant's name into English)

Avenida João Cabral de Melo Neto, nº 850, Torre Norte, 12º andar – Sala 1212,

Barra da Tijuca - Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

TIM PARTICIPAÇÕES S.A.

Publicly-held Company

Corporate Taxpayer's ID (CNPJ/MF): 02.558.115/0001-21

Corporate Registry (NIRE): 33 300 276 963

NOTICE ABOUT RELATED PARTY TRANSACTIONS

TIM PARTICIPAÇÕES S.A. ("Company") (BMF&BOVESPA: TIMP3; NYSE: TSU), in compliance with CVM Instruction nº552/14, hereby informs that on December 15, 2016 it was celebrated the related party transactions as below:

Name of the Related-Party

:

Italtel Brasil Ltda

Transaction Date

:

12/15/2016

Value Involved (Reais):

2016 - R$ 5.092.751,80 / 2017 - R$ 5.807.248,20

Balance Remaining (Reais)

:

Not applicable.

Total (Reais):

Not applicable.

Duration:

11/01/2016 until 12/31/2017

Loan or another type of debt

:

Not applicable.

Interest rate charged

:

Not applicable.

Contract object

:

Provide services, hardware and software upgrade to Policy Based Routing project. The software should provide new network functions (Volume Based Routing, Quality Based Routing: Least Cost Route) associated with projects and new opportunities for wholesale.

Warranty and insurance

:

Insurance company letter: Creditor: TIM Celular S.A. / Guarantor: JMalucelli Seguradora / Bailed: Italtel Brasil LTDA / Expiration - 2016: 11/01/2016 until 12/31/2016/ Guarantee value limitation – 2016: R$ 509.275,18.

In the event of renewal, the surety bond will be renewed according to the validity and negotiated value for the year 2017.

Financial guarantee on contract: irrevocable guarantee letter, without any previous condition to its execution, of 10% of the estimated value on contract, to be signed by a first line insurance company, previously approved by the Contractor and that must remain in force throughout the contract duration.

Insurance: The Agreement provides that the contractor must maintain compulsory insurance that ensure and protect from risks inherent to the services under the contract, against any kind of damage and / or injury caused to the contractor and / or third parties, whether to order material and / or personnel and / or legal and / or financial which shall have effect until the completion and / or issuance of the Final Acceptance Agreement by the contractor, whichever occurs last. Insurance must meet the rules of Brazilian law.

Rescission or extinction

:

The agreement provides many dissolution possibilities, among which, assignment of rights, bankruptcy, acts that affect the reliability and morality of TIM, among others. In any termination event the hired company shall only be entitled to payment for services actually rendered, not being owed any compensation.

Nature and reason for the operation

:

Hiring manufacturer supplier is necessary due to the current solution be property and exclusive of the same technological domain. Furthermore, Italtel submitted an advantageous offer for the Company, as well as great synergy with other services already provided by this supplier.

Relationship with the issuing:

Company has business relationships with other companies from Telecom Italia group.

Name of the Related-Party

:

Italtel Brasil Ltda

Transaction Date

:

12/15/2016

Value Involved (Reais):

R$ 4,647,286.45

Balance Remaining (Reais)

:

Not applicable.

Total (Reais):

Not applicable.

Duration:

01/12/2016 until 30/11/2018

Loan or another type of debt

:

Not applicable.

Interest rate charged

:

Not applicable.

Contract object

:

Unification of the DCN structures between the TIM, Intelig and AES Atimus acquired networks in operation in 2011, as well as the migration of the elements of their current networks to the new architecture and replacement of legacy and unsupported AES Atimus switches .

Warranty and insurance

:

Insurance company letter: Creditor: TIM Celular S.A. / Guarantor: JMalucelli Seguradora / Bailed: Italtel Brasil LTDA / Expiration: 01/12/2016 until 11/30/2018 / Guarantee value limitation of R$ 464,728.69.

Financial guarantee on contract: irrevocable guarantee letter, without any previous condition to its execution, of 10% of the estimated value on contract, to be signed by a first line insurance company, previously approved by the Contractor and that must remain in force throughout the contract duration.

Insurance: The Agreement provides that the contractor must maintain compulsory insurance that ensure and protect from risks inherent to the services under the contract, against any kind of damage and / or injury caused to the contractor and / or third parties, whether to order material and / or personnel and / or legal and / or financial which shall have effect until the completion and / or issuance of the Final Acceptance Agreement by the contractor, whichever occurs last. Insurance must meet the rules of Brazilian law.

Rescission or extinction

:

30 (thirty) days before to finish.

Nature and reason for the operation

:

This contract aims to continue the process of unification among TIM, intelig and AES Atimus networks. Italtel also presented an advantageous offer to the Company, as well as a great synergy with other services already provided.

Relationship with the issuing:

Company has business relationships with other companies from Telecom Italia group.

Name of the Related-Party

:

Telecom Italia Sparkle S.p.A.

Transaction Date

:

12/15/2016

Value Involved (Reais):

R$ 7,346,711.00

Balance Remaining (Reais)

:

Not applicable.

Total (Reais):

Not applicable.

Duration:

10/01/2016 until 03/31/2017

Loan or another type of debt

:

Not applicable.

Interest rate charged

:

Not applicable.

Contract object

:

Bilateral agreement of transport and traffic termination for international voice traffic on Send or Pay (with volume commitment) basis. TIM hires TIS to deliver traffic to various international destinations and TIS hires TIM to deliver traffic in Brazil.

Warranty and insurance

:

Not applicable.

Rescission or extinction

:

Not applicable.

Nature and reason for the operation

:

In bidding process conducted with other providers, Telecom Sparkle S.p.A. was the one with the best financial conditions.

Relationship with the issuing:

Corporate - Contracts between companies belonging to the same group.

Rio de Janeiro, December, 15, 2016.

TIM Participações S.A.

Rogério Tostes

Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

TIM PARTICIPAÇÕES S.A.

|

|

|

|

|

|

|

|

Date: December 15, 2016

|

By:

|

/s/ Rogério Tostes

|

|

|

|

|

|

|

|

|

|

Name: Rogério Tostes

|

|

|

|

|

Title: IRO

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

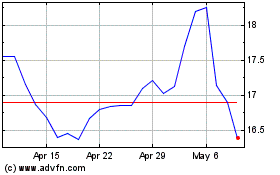

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

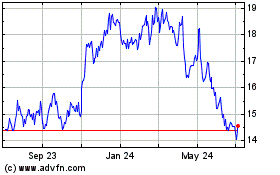

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024