SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of May, 2016

Commission File Number 001-14491

TIM PARTICIPAÇÕES S.A.

(Exact name of registrant as specified in its charter)

TIM PARTICIPAÇÕES S.A.

(Translation of Registrant's name into English)

Av. das Américas, 3434, Bloco 1, 7º andar – Parte

22640-102 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

TIM PARTICIPAÇÕES S.A.

Publicly Held Company

CNPJ/MF 02.558.115/0001-21

NIRE 33.300.276.963

MINUTES OF THE BOARD OF DIRECTORS’ MEETING

HELD ON MAY 11TH, 2016

DATE, TIME AND PLACE

: May 11th, 2016, at 10h00, at the headquarters of TIM Participações S.A. (“Company”), in the city and state of Rio de Janeiro.

PRESENCE

:

The Board of Directors’ Meeting was held at the date, time and place above mentioned, with the presence of Messrs. Adhemar Gabriel Bahadian, Alberto Emmanuel Carvalho Whitaker, Francesca Petralia, Franco Bertone, Herculano Aníbal Alves, Manoel Horacio Francisco da Silva, Mario Di Mauro, Oscar Cicchetti, and Rodrigo Modesto de Abreu, either in person or by means of videoconference, as provided in paragraph 2, Article 25 of the Company’s By-laws. The meeting was also attended by Mr. Jaques Horn, Legal Officer and Secretary. Justified absences of Messrs. Piergiorgio Peluso

BOARD

: Mr. Franco Bertone – Chairman; and Mr. Jaques Horn – Secretary.

AGENDA

:

(1)

To acknowledge on the activities carried out by the Control and Risks Committee;

(2)

To acknowledge on the activities carried out by the Statutory Audit Committee;

(3)

To acknowledge on the Quarterly Information Report (“ITRs”) of the 1st quarter of 2016, dated as of March 31st, 2016;

(4)

To resolve on the composition of the Board of Executive Officers of the Company and to indicate the Executive Officers of TIM Celular S.A. and Intelig Telecomunicações Ltda.;

(5)

Organizational Structure’s Agenda;

(6)

Presentation on political and economic scenarios;

(7)

Marketing Agenda;

(8)

Investor Relations Agenda; and

(9)

To resolve on the supply of services agreement to be entered between the subsidiaries of the Company, TIM Celular S.A. and Intelig Telecomunicações S.A., and Italtel Brasil Ltda.

RESOLUTIONS

:

Upon review and discussion of the subject included on the Agenda, the Board Members, unanimously by those present at the meeting and with the expressed abstention of the legally restricted, decided to register the discussions as follows:

(1)

Acknowledged

on the activities carried out by the Control and Risks Committee (“CCR”) at its meetings held on April, 13th and May 2nd, 2016, in accordance with the report presented by Mr. Franco Bertone, Chairman of the Control and Risks Committee.

(2)

Acknowledged

on the activities carried out by the Statutory Audit Committee (“CAE”) at its meetings held on April 13th and 14th and on May 2nd and 10th, 2016, in accordance with the report presented by Mr. Alberto Emmanuel Carvalho Whitaker, Coordinator of CAE.

(3)

Acknowledged

on the Quarterly Information Report (“ITRs”) of the first quarter of 2016, dated as of March 31st, 2016 based on the information provided by the Company administration, by the independent auditors BDO RCS Auditores Independentes S.S. (“BDO”), and in accordance with the favorable reviews issued by the CAE and Fiscal Council of the Company. Such reports were subject to a limited revision by the independent auditors of the Company, BDO;

Before proceeding with the

(4)

item of the agenda, Mr. Rodrigo Modesto de Abreu presented the resignation of his position as member of the Board of Directors to the Chairman of the Board of Directors, effective as of May 11th, 2016. The Board Members expressed their appreciation for Mr. Abreu for his commitment, dedication and contribution for the Company’s development throughout his term, and wished success in his future professional endeavors. Due to the resignation presented and the consequent vacancy of the Board of Directors’ position, the Members resolved, unanimously, to elect Mr.

Stefano de Angelis

, Italian, married, Bachelor in Economics, bearer of the Passport Nr. YA 6409957, valid through June, 16th, 2024, enrolled with the CPF/MF under Nr. 059.567.317-10 domiciled at Viale Dei Colli Portuensi 545, Rome, Italy, for the position of Board of Directors’ Member, by co-optation, to be ratified on the next Shareholders Annual Meeting pursuant to the Article 150 of the Brazilian Law Nr. 6,404/1976. In view of the above, the Company’s Board of Directors shall be composed by Messrs: Adhemar Gabriel Bahadian, Alberto Emmanuel Carvalho Whitaker, Francesca Petralia, Franco Bertone, Herculano Aníbal Alves, Manoel Horacio Francisco da Silva, Mario Di Mauro, Oscar Cicchetti, Piergiorgio Peluso and Stefano de Angelis. The elected hereby declares, under penalty of law, that he is not involved in any of the crimes provided for by law that prevents him from performing business activities, in accordance with Article 147 of Law 6,404/ 1976, and also informs, that will present the instrument of investiture, the statement provided by the CVM Instruction Nr. 367/2002, the statements provided in Sections 18 and 19 of the Company’s By-laws and other statements, within the legal term.

(4)

(4.1)

Due to the the term of office of the Statutory Board of Officers, the board members

elected

the Company’s Board of Statutory Officers, that consists of eight (8) Officers, denominated as follows:

(i)

Chief Executive Officer, Mr. Stefano de Angelis, Italian, married, Bachelor in Economics, bearer of the Passport Nr. YA6409957, valid through June, 16th, 2024, enrolled with the CPF/MF under Nr. 059.567.317-10, domiciled at Viale Dei Colli Portuensi 545, Rome, Italy;

(ii)

Chief Financial Officer, Mr. Guglielmo Noya, Italian, married, engineer, bearer of the RNE nº V561719-Y, enrolled with the CPF/MF under Nr. 060.808.117-58, domiciled at Avenida das Américas, nº 3434, Bloco 1, 6th floor, Barra da Tijuca, City and State of Rio de Janeiro;

(iii)

Chief Operating Officer, Mr. Pietro Labriola, Italian, married, administrator, bearer of the RNE nº G188964-B, enrolled with the CPF/MF under Nr. 074.053.501-35, domiciled at Avenida das Américas, nº 3434, Bloco 1, 6th floor, Barra da Tijuca, City and State of Rio de Janeiro;

(iv)

Purchasing & Supply Chain Officer, Mr. Daniel Junqueira Pinto Hermeto, Brazilian, married, electric engineer, bearer of the Identity Card Nr. 23.804.412-9, issued by SSP/SP, on October 31st, 1996, enrolled with the CPF/MF under Nr. 004.078.756-70, domiciled at Avenida das Américas, nº 3434, Bloco 1, 6th floor, Barra da Tijuca, City and State of Rio de Janeiro;

(v)

Regulatory and Institutional Affairs Officer, Mr. Mario Girasole, Italian, married, Bachelor in Economics, bearer of the RNE nº V396929-V, enrolled with the CPF/MF under Nr. 059.292.237-50, domiciled at Avenida das Américas, nº 3434, Bloco 1, 6th floor, Barra da Tijuca, City and State of Rio de Janeiro;

(vi)

Investor Relations Officer, Mr. Rogério Tostes Lima, Brazilian, married, Bachelor in Administration, bearer of the Identity Card Nr. MG-4380990, issued by SSP/MG, , enrolled with the CPF/MF under Nr. 698.713.966-00, domiciled at Avenida das Américas, nº 3434, Bloco 1, 6th floor, Barra da Tijuca, City and State of Rio de Janeiro;

(vii)

Legal Officer, Mr. Jaques Horn, Brazilian, married, Lawyer, bearer of the Identity Card Nr. 70.654, issued by OAB/RJ, enrolled with the CPF/MF under Nr. 846.062.237-15, domiciled at Avenida das Américas, nº 3434, Bloco 1, 6th floor, Barra da Tijuca, City and State of Rio de Janeiro; and

(viii)

Chief Technology Officer, Mr. Leonardo de Carvalho Capdeville, Brazilian, married, electric engineer, bearer of the Identity Card Nr. 83.403-6, issued by SSP/ES, enrolled with the CPF/MF under Nr. 015.358.317-74, , domiciled at Avenida das Américas, nº 3434, Bloco 1, 6th floor, Barra da Tijuca, City and State of Rio de Janeiro.All Board of Officers’ members will remain in the office until the first Board of Directors` meeting to be held after the Annual Shareholders` Meeting of the year 2018. The elected hereby declares, under penalty of law, that he is not involved in any of the crimes provided for by law that prevents him from performing business activities, in accordance with Article 147 of Law 6,404/ 1976, and also informs, that will present the instrument of investiture, the statement provided by the CVM Instruction Nr. 367/2002, the statements provided in Sections 18 and 19 of the Company’s By-laws and other statements, within the legal term. Mr. Stefano de Angelis will take office in the position of Chief Executive Officer after he has fulfilled all the legal formalities required for the appropriate visa, to be authorized by the Coordenação Geral de Imigração do Ministério do Trabalho e Emprego, according to the legislation in force, at this time it will be invested with all powers necessary for the administration and management of the Company Once granted the referred visa, Mr. Stefano de Angelis shall present the term of investiture and other documents, duly executed, within the legal term;

(4.2)

In accordance with Article 22, single paragraph, of the Company’s By-laws and considering that the position of Chief Executive Officer will remain vacant until the regularization of Mr. Stefano de Angelis’ documentation, the Board of Directors, rectifies the limits of the authority approved on the meeting held on February 13th, 2014 as follows: (i)

Chief Executive Officer:

full power and the authority to, acting individually, carry out any and all act and sign any and all document on behalf of the Company up to the maximum amount of R$30.000.000,00 (thirty million Reais) per operation; (ii)

Chief Financial Officer

: (a) full power and the authority to, acting individually, carry out any and all act and sign any and all document on behalf of the Company, up to the maximum amount of R$30.000.000,00 (thirty million Reais) per operation, until the Chief Executive Officer takes office; and (b) after the investiture of the Chief Executive Officer, full power and the authority to, acting individually, carry out any and all act and sign any and all document, related to the activities of the financial sector, including without limitation, contract financial and treasury operations, including loan granting, authorization and payments, transfers, investments and resource withdrawals, assignment and discount bonds, up to the maximum amount of R$ 30,000,000.00 (thirty million Reais) per operation; and (iii) Chief Operating Officer; Purchasing & Supply Chain Officer; Regulatory and Institutional Affairs Officer; Chief Technology Officer; Investor Relations Officer and Legal Officer: full power and the authority to, acting individually, carry out any and all act and sign any and all document on behalf of the Company, up to the maximum amount of R$5.000.000,00 (five million Reais) per operation. The Officers have the power to grant powers of attorney, on behalf of the Company, up to the respective limits of authority set above and pursuant to the Company's Bylaws.

(4.3)

In accordance with Article 22, item XXIV of the Company’s By-laws,

indicated

to compose the Statutory Board of Officers of TIM Celular S.A. (“TCEL”), a wholly-owned subsidiary of the Company, Messrs:

(i)

Chief Executive Officer, Mr. Stefano de Angelis;

(ii)

Chief Financial Officer, Mr. Guglielmo Noya;

(iii)

Chief Operating Officer, Mr. Pietro Labriola;

(iv)

Purchasing & Supply Chain Officer, Mr. Daniel Junqueira Pinto Hermeto;

(v)

Regulatory and Institutional Affairs Officer, Mr. Mario Girasole;

(vi)

Legal Officer, Mr. Jaques Horn; and

(vii)

Chief Technology Officer, Mr. Leonardo de Carvalho Capdeville;

(4.4)

Also in accordance with Article 22, item XXIV of the Company’s By-laws,

indicated

to compose the Statutory Board of Officers of Intelig Telecomunicações Ltda. (“INTELIG”), a subsidiary of the Company, Messrs:

(i)

Chief Executive Officer, Mr. Alex Martins Salgado;

(ii)

Legal Officer, Mr. Jaques Horn;

(iii)

Chief Financial Officer, Mr. Guglielmo Noya and

(iv)

Chief Operating Officer, Mr. Pietro Labriola.

(5)

Mr. Flavio Morelli, responsible for the People Value Area, made a presentation on the scenarios faced by the Company during the last year, the studies and assessments that were made, and the results achieved through the efficiency plan developed and implemented.

(6)

Mr. Mario Girasole, Regulatory and Institutional Affairs Officer, and Christopher Garman representative of Eurasia Group, made a presentation on the main aspects of the political and economic scenarios, highlighting the risks and challenges regarding the current situation and issues of the international market that may impact the Company.

(7)

Mr. Pietro Labriola, Chief Operating Officer of the Company and Mr. Rogério Takayanagi, responsible for the Marketing area, made a presentation on the main activities developed by the area, regarding the telecom market and the Company´s positioning in view of the new challenges for the sector.

(8)

The Investor Relations Officer, Mr. Rogerio Tostes, presented the main activities developed by the Investor Relations Area, with emphasis on the telecommunications market, the capital market and the main market topics related to the Company.

(9)

Approved

the execution of the contracts to be entered into between TIM Celular S.A. and Intelig Telecomunicações Ltda., on one side, and Italtel Brasil Ltda. or any company of the same group indicated by this, on the other side, for:

(i)

the platform implementation services responsible for control of business rules, policies of use, services information, status and user data package, effective from June, 2016 until July, 2019, in the amount of R$10,863,729.00 (ten million, eight hundred sixty-three thousand, seven hundred and twenty-nine Reais), for the first year of the the contract, considering CAE’ favorable opinion, on its meeting held on May 10th, 2016, the

SAS N° 16138

and the material presented, which is filed at the Company's headquarters; and

(ii)

the

provision of technical support services and hardware repair, effective from July, 2016 until June, 2017 in the amount of R$ 20,040,871.15 (twenty million, forty thousand, eight-hundred and seventy-one Reais), for the first year of the contract, based on the favorable opinion of the CAE, in a meeting held on May 10th, 2016, the

SAS N° 16139

and the material presented, which is filed at the Company's headquarters.

CLARIFICATIONS AND CLOSING

: With no further issues to discuss, the meeting was adjourned and these minutes drafted as summary, read, approved and signed by all attendees Board Members: Messrs. Adhemar Gabriel Bahadian, Alberto Emmanuel Carvalho Whitaker, Francesca Petralia, Franco Bertone, Herculano Aníbal Alves, Manoel Horacio Francisco da Silva, Mario Di Mauro, Oscar Cicchetti, Piergiorgio Peluso and Rodrigo Modesto de Abreu.

I herein certify that these minutes are the faithful copy of the original version duly recorded in the respective corporate book.

Rio de Janeiro (RJ), May 11th, 2016.

JAQUES HORN

Secretary

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

TIM PARTICIPAÇÕES S.A.

|

|

|

|

|

|

|

|

Date: May 11, 2016

|

By:

|

/s/ Rogério Tostes

|

|

|

|

|

|

|

|

|

|

Name: Rogério Tostes

|

|

|

|

|

Title: IRO

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

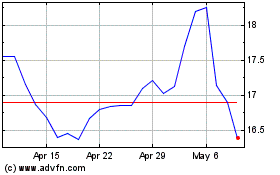

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

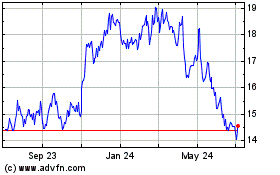

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024