SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2016

Commission File Number 001-14491

TIM PARTICIPAÇÕES S.A.

(Exact name of registrant as specified in its charter)

TIM PARTICIPAÇÕES S.A.

(Translation of Registrant's name into English)

Av. das Américas, 3434, Bloco 1, 7º andar – Parte

22640-102 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

01 – Management’s Report and

Consolidated Financial

Statements of the Company,

dated as of December 31st, 2015

and Item 10 from the Reference Form

TIM PARTICIPAÇÕES S.A.

MANAGEMENT REPORT, FINANCIAL STATEMENTS AND THE OPINION OF INDEPENDENT AUDITOR AND STATUTORY AUDIT COMMITTEE, FOR THE YEAR OF 2015

Shareholders,

In compliance with the Circular Letter CVM/SEP/Nº02/2016, and as set forth in the CVM Instruction N. 481/09, TIM Participações S.A. inform that the Management Report, the Financial Statements, the Opinions of the Independent Auditor and Statutory Audit Committee and the DFP Form, for the year of 2015, are available on the site of Comissão de Valores Mobiliários (Brazilian Securities and Exchange Commission), and on the site of Investors Relations of the Company, on the links above:

http://www.cvm.gov.br/

http://www.tim.com.br/ir

Rio de Janeiro, March 11, 2016.

Franco Bertone

President of the Board of Directors

10. Management’ comments

10.1. The management shall comment on:

a. general financial and equity conditions

In 2015, the company maintained an excellent financial and equity position, with level of indebtedness (Net Debt/EBITDA) of only 0.26 times, with net debt of R$1,733 million. The company's cash increased by 28%, ending the year with R$6,700 million, while its gross debt reached the amount of R$8,432 million, including the acknowledgment of the lease in the total amount of R$1,245 million, after the leaseback of the towers sold (3 installments). In addition to the solid cash position, the company also had growth of 19.3% in its EBITDA, reaching R$6,606 million.

Financial Condition (R$ mln) |

12/2015 |

12/2014 |

12/2013 |

Cash |

6,700 |

5,233 |

5,288 |

EBTIDA |

6,606 |

5,538 |

5,207 |

Gross Debt |

8,432 |

6,507 |

4,867 |

Net Debt |

1,733 |

1,274 |

-421 |

|

|

|

|

Net Debt / EBTIDA |

0.26 |

0.23 |

-0.08 |

It should be emphasized that the Company's debt is concentrated in long-term contracts (78% of total), mainly distributed in contracts with BNDES and the European Investment Bank. Moreover, approximately 35% of the total debt is denominated in foreign currency (USD), 100% protected by hedge in local currency. In 2015, the average cost of the debt was 11.73%, compared to 9.70% in 2014. The average return on cash reached 13.5% in 2015, compared to 10.88% in 2014.

Combined with its solid cash position, the company also has stable liquidity ratios, showing full capacity to meet its short-term and long-term obligations. Regarding the liquidity ratios (General Liquidity and Current Liquidity), the company had: General liquidity ((Current Assets+Long-Term Assets)/(Current Liabilities+Non-Current Liabilities)), Long-Term Assets being understood as the Non-Current Assets of the Company, for the years 2013, 2014 and 2015 of 2.08, 1.90 and 1.92, respectively; and Current Liquidity (Current Assets/Current Liabilities), of 1.33, 1.22 and 1.39, respectively.

Concerning the indebtedness profile, the company has been keeping the concentration of its short-term obligations stable, having in the years 2013, 2014 and 2015 current liabilities over total liability less shareholders’ equity of 59%, 54% and 47%, respectively. These percentages are fully acceptable, considering the comfortable liquidity situation of the company.

In view of the foregoing, the management understand that the Company has sufficient financial and equity conditions to face its growth strategy and to comply with its short-term and long-term obligations.

b. capital structure

The management understand that the current capital structure of the Company has conservative leverage levels. At the end of 2015, the Company's shareholders’ equity was R$16.933 million and its gross indebtedness was R$8.432 million, generating a leverage ratio (Gross Debt/Shareholders’ Equity) of 50%.

The general Indebtedness ratio shows a lower presence of capital from third parties in the structure (in 2015, 52.2% of the asset came from third parties and 47.8% from equity). The loans fall within the financing plan approved by the Brazilian development bank, BNDES. Additionally, the trend of extension of the indebtedness profile, indicated by the indebtedness composition ratio, ensures the Company's concern to maintain a capital structure that supports the needs of the business.

Capital structure ratios |

12/2015 |

12/2014 |

12/2013 |

General Indebtedness (Current Liabilities + Non-Current Liabilities)/ Total Liabilities |

52.2% |

52.6% |

48.1% |

Composition of Indebtedness (Current liabilities /(Current liabilities + Non-Current liabilities)) |

46.9% |

53.6% |

59.4% |

In parallel, the Company is capable of generating enough cash to comply with its obligations, having in 2015 a net debt*/EBITDA ratio of 0.26X, significantly below the average for the telecommunications industry.

*Net debt is composed of the total of loans, leases and Anatel debt, less the total cash and cash equivalents.

There is no possibility of stock redemption, except for those provided for in the Stock Corporations Act.

ii. calculation method for redemption value

Not applicable.

c. capacity to pay concerning financial commitments undertaken

The Executive Board believes that it has enough capital resources and liquidity to cover the investments, operating expenses and debts taken. The Company's current working capital is sufficient for the current demands. Its resources from cash and also from third parties loans are sufficient to finance its activities. The Company also believes that it is able to take new loans to finance investments that follow opportunities in the industry.

The liquidity ratios, indicating the company's financial capacity to fulfill commitments with third parties, have healthy levels compatible with the strategic moves that the company has been doing, as can be noted in the table below.

Liquidity ratios |

12/2015 |

12/2014 |

12/2013 |

Immediate liquidity (Available/Current liabilities) |

77.4% |

57.4% |

65,7% |

Current Liquidity (Current Asset/Current liabilities) |

139.0% |

122.5% |

133,5% |

Quick Ratio (Current Asset-Stock)/Current liabilities |

137.3% |

119.6% |

129,8% |

Additionally, other two indicators also relevant, and used to measure the ability of coverage of the financial expenses and gross debt indicate a healthy situation of the Company as the description below:

- EBITDA in 2013 totaled R$5.207 million, while the financial expense of the same period amounted R$750 million and the total gross debt at the end of the period was R$4.867 million, This way, the financial expense coverage level, that measures the ability to pay financial expense related to EBITDA, was 0.144 times and the coverage level of the debt, that measures the gross indebtedness level related to EBITDA was 0.93 times.

- EBITDA in 2014 totaled R$5.538 million, while the financial expense of the same period amounted R$997 million and the total gross debt at the end of the period was R$6.507 million, This way, the financial expense coverage level, that measures the ability to pay financial expense related to EBITDA, was 0.18 times and the coverage level of the debt, that measures the gross indebtedness level related to EBITDA was 1.17 times.

- EBITDA in 2015 totaled R$6.606 million, while the financial expense of the same period amounted R$1.115 million and the total gross debt at the end of the period was R$8.432 million, This way, the financial expense coverage level, that measures the ability to pay financial expense related to EBITDA, was 0.17 times and the coverage level of the debt, that measures the gross indebtedness level related to EBITDA was 1.28 times.

Management believes that, the increase of the indebtedness does not represent a tendency that argues against the Company's financial health, in view of its low leverage level. As presented in the previous item, the debt's profile is long-term and the financing sources provide us with very competitive conditions. Sale operations with commercial leasing (sale-leaseback) of assets can change the indebtedness dynamic with entry of resources in cash and new long-term commitments. The Board expects that the balance of these transactions can reduce the net debt*.

*Net debt is composed of the total of loans, commercial leasing and debt along with Anatel, less the cash total and cash equivalents.

d. financing sources for working capital and for investment in non-current assets used

The main financing source is the generation of operational cash, completed by short-term lines of credit with local and international banks and long-term financing from national and international development agencies such as BNDES, BNB and BEI.

e. financing sources for working capital and for investment in non-current assets with intention of use for coverage of liquidity deficiency

For coverage of eventual future liquidity deficiencies, we intend to use generation of operational cash, renegotiation of maturing debts in short-term and new financings.

f. indebtedness levels and the features of such debts, further describing:

By the end of 2015, we presented an indebtedness level of 0.498 times (Financial Debt/Shareholders’ equity). Next, we present the features of our loans and financings considered relevant by us:

|

|

|

|

|

|

Consolidated |

Description: |

Currency |

Charges (p.y.) |

Expiration |

Guarantees |

|

12/2015 |

12/2014 |

12/2013 |

|

|

|

|

|

|

|

|

|

BNDES |

URTJLP |

TJLP to TJLP + 3,62% |

Jul/17 to Jul/22 |

Guarantee from TIM Part. and receivables from TIM Celular |

|

2,528,158 |

2,522,781 |

1,934,955 |

BNDES |

UMIPCA |

UMIPCA + 2,62% |

Jul/17 |

Guarantee from TIM Part. and receivables from TIM Celular |

|

68,628 |

92,939 |

116,298 |

BNDES |

UM143 |

SELIC+2,52% |

Jul/22 |

Guarantee from TIM Part. and receivables from TIM Celular |

|

1,475,426 |

913.208 |

- |

BNDES (PSI) |

R$ |

2,50% to 4,50% |

Jul/18 to Jan/21 |

Guarantee from TIM Part. and receivables from TIM Celular |

|

563,465 |

386,420 |

334,890 |

BNB |

R$ |

10.00% |

Jan/16 |

Bank Guarantee and Guarantee from TIM Part. |

|

931 |

11,966 |

23,012 |

Banco do Brasil (CCB) |

R$ |

106,50% of CDI |

Feb/15 to Dec/15 |

- |

|

- |

413,458 |

481,447 |

Banco BNP Paribas |

USD |

Libor 6M + 2,53% |

Dec/17 |

Guarantee from TIM Part. |

|

187,038 |

190,841 |

224,395 |

European Investment Bank (BEI) |

USD |

Libor 6M + 0,57% to 1,324% |

Sept/16 to Feb/20 |

Bank Guarantee and Guarantee from TIM Part. |

|

1,859,821 |

1,264,463 |

1,115,324 |

Bank of America (Res. 4131) |

USD |

Libor 3M + 1,35% |

Sept/16 |

- |

|

468,114 |

318,387 |

280,822 |

KFW |

USD |

Libor 6M + 1,35% |

Apr/19 |

Guarantee from TIM Part. |

|

304,924 |

266,509 |

- |

JP Morgan (Res. 4131) |

USD |

1.73% |

Sept/15 |

- |

|

- |

133,448 |

117,704 |

Cisco Capital |

USD |

1,80% to 2,50% |

Sept/18 to Dec/20 |

- |

|

469,931 |

239,998 |

117,768 |

Total: |

|

|

|

|

|

7,926,436 |

6,754,419 |

4,746,656 |

|

|

|

|

|

|

|

|

|

Current |

|

|

|

|

|

2,326,186 |

1,281,554 |

966.658 |

Non-Current |

|

|

|

|

|

5,600,250 |

5,472,865 |

3,779,998 |

The holding company TIM Participações does not have loans and financings on December 31, 2015.

Lines of Credit |

|

|

|

|

|

|

|

Amount used until |

Type |

Currency: |

Opening date |

Deadline |

Total amount |

Remaining Amount |

31 of December of 2015 |

BNDES (1) |

URTJLP |

Dec/13 |

Dec/16 |

2,635,600 |

|

437,927 |

1,411,173 |

BNDES (1) |

UM143 |

Dec/13 |

Dec/16 |

2,636,400 |

|

435,530 |

1,355,370 |

BNDES (PSI) (1) |

R$ |

Dec/13 |

Dec/16 |

428,000 |

|

299,000 |

|

- |

BNDES (2) |

R$ |

Dec/15 |

Dec/17 |

60,995 |

60,995 |

- |

BNDES (2) |

TJLP |

Dec/15 |

Dec/18 |

2,940 |

2,940 |

- |

KFW Finnvera (3) |

USD |

Dec/15 |

jun/18 |

150,000 |

|

- |

150,000 |

Total: |

|

|

|

|

|

1,172,457 |

Objective:

- To finance the investments in network and in IT for the years of 2014, 2015 and 2016.

- To finance TIM's Innovation Projects for the years of 2016, 2017 and 2018.

The loan in foreign currency, hired with Banco BNP Paribas, and TIM Celular's financings, hired with BNDES, were obtained for the expansion of the mobile network and have restrictive contract covenants that foresee the compliance with certain financial ratios calculated every six months. The subsidiary, TIM Celular, has been accomplishing the agreed ratios.

The PSI (Investment Support Program) financing lines, hired with BNDES, are referring to specific programs of the institution and present interest rates lower than those foreseen in BNDES' ordinary operations. The balance on December 31, 2015 corresponding to the adjustment referring to award granted by BNDES for the totality of lines of the PSI is, approximately, R$146 million, with this amount being recorded in the "Deferred Incomes" group in the "Government Awards" heading and the deferment is performed according with the lifespan of the asset being financed and suitable in the result in "Other Award Incomes".

In July of 2015, TIM Celular settled in advance the CCBs existing along Banco do Brasil in the total amount of R$300 million. This settlement happened on July 1st, 2015 and aimed at the efficient management of the Company's indebtedness through settlement of its most expensive debts.

The subsidiary TIM Celular has swap operations, aiming to protect itself from the risks of devaluation of the Real against the American Dollar in its loan and financing operations. However, "hedge accounting" is not applied.

The loans and financings on December 31, 2015 falling due on long term comply with the following scaling:

|

|

Consolidated |

|

|

|

2017 |

|

1,212,352 |

2018 |

|

1,137,206 |

2019 |

|

1,478,750 |

2020 |

|

914,706 |

2021 on |

|

857,236 |

|

|

5,600,250 |

On December 31, 2015, the Company had the obligation to comply semiannually with the following financial ratings, which act as restrictive covenants of the loans indicated in item F.

a) Capitalization Ratio (PL/AT): equal or higher than 0.35;

b) EBITDA / Net Financial Expenses: equal or higher than 3.50;

c) Total Financial Debt / EBITDA: equal or inferior to 3.00;

d) Short-Term Net Financial Debt / EBITDA: equal or inferior to 0.35;

e) Net Debt / EBITDA: equal or inferior to 2.50;

f) EBITDA / Net Financial Expenses¹: equal or higher than 2.25;

g) EBITDA / Debt Service: equal or higher than 1.30;

¹ Fin. Exp. Net considering only financial expenses and incomes directly related to loans, such as interests without loan, JSCP, Bank remuneration, Interests without Appl. Fin., Cur. Exchange variance and Monetary wo/ loan, Hedge.

The Company has been comfortably attending the financial ratios defined.

Additionally to the financial ratios, there are also restrictive covenants that include:

Sale, acquisition, incorporation, merger, demerger or any other act importing or that could import in modifications in the current corporate configuration of the Company, except those within the same economic group; and

Disposals and permutations of assets by the Company and its subsidiaries.

g. limits of the hired financings and percentages already used

TIM has a balance not yet used and/or releases of approximately R$2.767 million, referring to BNDES' financing contract hired on December/2013.

Besides that, on December/2015 there was the hiring of two new credit lines; one with BNDES to fund the Innovation projects in the amount of R$ 64 million and, another along KFW Finnvera, in the amount of USD 150 million. Until December/31, no amount of these lines was paid out.

h. significant alterations in each item of the financial statements

Our Consolidated Financial Statements

We prepared our consolidated financial statements according with the accounting practices adopted in Brazil and with the IFRS, issued by IASB, and our individual financial statements according with BR GAAP. The accounting practices adopted in Brazil comprehend those included in the Brazilian corporate legislation, the norms and regulations of Brazilian Securities Commission - CVM and the statements, the guidelines and interpretations issued by CPC, approved by the Brazilian Securities Commission and by CFC. We reviewed our financial statements to ensure that they are representing the information related to the economic conditions of our business environment.

Description of the Main Lines of the Income Statement

Gross Service Revenues

Represents the revenues derived from the rendering of telecommunications services, among which the signature and usage services (voice revenues) and VAS (data revenues) are present.

Gross Products Revenues

Represents the revenues derived from the sale of mobile devices, accessories, among others.

Taxes and discounts over total Revenues

Represent the spending incurred with the taxes, rates, contributions and discounts over the services of telecommunications and sale of merchandise.

Net Services Revenues

Represents the revenues derived from the rendering of telecommunications services minus taxes and discounts.

Net Products Revenues

Represents the revenues derived from the sale of mobile devices, accessories, among others, minus taxes and discounts.

Costs of the Operation

Represent the costs incurred in the maintenance, operation activities and other activities related directly with the production of income of services and sale of products, besides the consumption of goods and/or services to produce and sell products and/or services, manage the company, fund its operations and perform other similar activities.

Net Financial Result

Represents the balance between the capital remuneration obtained in financial operations and the spending incurred with the remuneration of the loans and financings obtained along third parties.

Earnings before Taxes

Represent the Company's net profit before the provision as income tax and social contribution over the profit of the period investigated according to the accrual basis, as well as over the additions of temporary differences between the accounting profit and the real profit.

Net Income

Represents the operational profit minus financial incomes and expenses, and income tax and social contribution. Represents the calculation of incomes after the costs and expenses of the operation, depreciation and amortization, interests, taxes and other expenses.

Net Margin

Represents the margin of the income's net profit over the Company's total net income.

Statement of the incomes consolidated for the fiscal year endedfiscal year ended on December 31, 2015 compared to the statement of the incomes consolidated for the fiscal year endedfiscal year ended on December 31, 2014

The table below presents the amounts related to the statement of the incomes consolidated for the social exercises concluded on December 31, 2015 and 2014.

Gross Revenues

In the year of 2015, the total gross revenues reached R$25.768 million, a 11.2% decrease when compared to 2014. The gross income with services dropped 5% when compared to the previous year, reaching R$23.121 million in 2015. The gross income of products totalized R$2.647 million, a 40.8% drop.

Gross Telecommunications Revenues

Our gross revenues of services decreased R$1.412 million or 5.8%, going from R$24.533 million in the fiscal year endedfiscal year ended on December 31, 2014, to R$23.121 million in the fiscal year endedfiscal year ended on December 31, 2015.

Mobile Services and Other Incomes Our mobile services account and other incomes decreased R$1.514 million or 6.4%, going from R$23.632 million in the fiscal year ended on December 31, 2014, to R$22.118 million in the fiscal year ended on December 31, 2015 due to: an adverse macroeconomic environment, acceleration of voice to data transition and a significant impact from MTR cut.

Usage and monthly fee. Our usage and monthly fee account had a drop of 11.3% registering R$9.764 million in the fiscal year ended on December 31, 2015, compared to the R$11.007 million registered in the fiscal year ended on December 31, 2014. This drop is, basically, explained by the reduction of outgoing traffic and by a higher replacement, through the clients, from services related to voice to services related to data.

VAS – Value-added Services Our VAS account recorded a growth of 17.0% or R$1.126 million, going from R$6.616 million in the fiscal year ended on December 31, 2014, to R$7.742 million in the fiscal year ended on December 31, 2015. Such growth derives, mainly, from the strong increase of the innovative income, 35% in the result.

Long Distance. Our long distance account dropped -12.4%, going from R$3.094 million in the fiscal year ended on December 31, 2014, to R$2.711 million in the fiscal year ended on December 31, 2015. Such result is explained by the exposition to the change of use, from voice to data, in 2015. Such process is accelerating the commoditization of the long distance services and impacted its performance during the year. The new offers launched in November, including off-net calls with the same price of on-net calls on all national territory, can reduce the rhythm of this process.

Interconnection. Our interconnection account recorded a drop of -39.9%, going from R$2.631 million in the fiscal year ended on December 31, 2014, to R$1.582 million in the fiscal year ended on December 31, 2015. Such drop can be explained by the combination of the strong reduction in the VU-M price and the change in the dynamics of voice traffic. The reduction of use of SMS also presented impact on this line.

Fixed Services and Other Revenues. Our fixed services and other revenues account has grown 11.3%, going from R$901 million in the fiscal year ended on December 31, 2014, to R$1.003 million in the fiscal year ended on December 31, 2015. The solid recovery of the fixed business is based on the attractiveness of the ultra broad band and the rewards of the successful reconstruction process of TIM's corporate portfolio.

Products Gross Revenues

Products gross revenues totaled R$2.647 million, a -40.8% drop when compared to 2014. Such reduction is due to the challenging macroeconomic environment affecting the retail segment in Brazil as a whole and the depreciation of Real.

Taxes and Discounts over Total Income

Our taxes and discounts over total revenues dropped -9.2%, going from R$9.506 million in the fiscal year ended on December 31, 2014, to R$8.629 million in the fiscal year ended on December 31, 2015. Such drop is basically due to the drop in the total income.

Costs and Expenses of the Operation

Our total operational costs and expenses decreased -15.9% in the year reaching R$11.744 million in 2015.

Personnel cost: The expenses with personnel reached R$1.044 million in 2015, a 8.4% growth when compared with the same period of last year, as result of the stabilization of our number of employees, which has been increasing throughout the last years due to the expansion of the network and the internalization program, along with the increase of own stores.

Commercialization: The expenses with sales and marketing retreated 6.1%, totaling R$3.747 million in 2015, due to (i) significant reduction of the costs with advertising, despite the launching of new portfolio in November; (ii) strong drop in the expenses with commissioning and; (iii) important economy with FISTEL (-17% P/Y) due to strong disconnection in prepaid users of low ARPU.

Network and Interconnection The costs of Network & Interconnection dropped 11.4% P/Y in 2015, strongly impacted by the reductions (i) of VU-M duties, (ii) of off-net voice traffic/SMS and (iii) the costs of rented lines, but which have been partially compensated by more elevated costs of electricity (+44% P/Y) and the expenses with rent of lands due to the acceleration of the expansion of the network's coverage.

General and Administrative. The annual reduction of 8.8% in General & Administrative expenses (G&A) was mainly driven by the Efficiency Plan started in 2T15.

Cost of the Sold Products. The Cost of the Sold Products (CPV) was R$1.857 million, presenting a strong drop, -44.4%, when compared to the same period of 2014, due to the reduction of 61% in the number of sold devices. The harder macroeconomic environment that affected the retail segment as a whole, and the strong devaluation of the Real were the main factors for this performance.

Allowance for Doubtful Accounts. The Allowances for Doubtful Accounts (PDD) dropped 7.3% P/Y in 2015 due to the improvement of the performance of the landline segment, result of the restructuring of this business. As percentage of the gross income, the Default reached 0.89% in 2015, practically stable when compared to 2014 (0.86%) despite an even more challenging macroeconomic environment.

Other Operational Incomes (Expenses) reached R$432 million in 2015, keeping itself stable when compared to 2014, when it presented R$429 million.

Main alterations in the equity accounts Balance sheet consolidated on December 31, 2015 when compared to balance sheet consolidated on December 31, 2014

Current Assets

The current asset closed on R$12.033 million on December 31, 2015, when compared to R$11.174 million on December 31, 2014 and R$10.741 million on December 31, 2013. This presents an increase of 7.7% or R$858 million in 2015 and 4.0% or R$434 million in 2014. As percentage of total assets, the current asset presents 34.0% on December 31, 2015, represented 34.5% on December 31, 2014 and 38.2% on December 31, 2013.

The main variations of the current asset refer to operations with derivatives.

Non-Current Asset

The non-current asset closed with R$23.570 million on December 31, 2015, R$21.169 million on December 31, 2014 and R$17.397 million on December 31, 2013, representing an increase of 10.4% or R$2.202 million in 2015 and an increase of 21.7% or R$3.771. As percentage of total assets, the non-current asset went to 66.0% on December 31, 2015, when compared to a percentage of 65.5% on December 31, 2014 and 61.8% on December 31, 2013.

This increase was due to the increase in the fixed and intangible assets accounts, showing the fulfillment of the company's investment guidance in order to improve the network's quality.

Current Liabilities

The non-current liabilities closed on R$8.658 million on December 31, 2015, when compared to R$9.123 million on December 31, 2014 and R$8.048 million on December 31, 2013. This presents a decrease of 5.1% or R$465 million in 2015 against an increase of 13.4% or R$1.075 million in 2014. As percentage of the liability's total and shareholders’ equity, the current liabilities went to 24.5% on December 31, 2015, when compared to a percentage of 28.2% on December 31, 2014 and 28.6% on December 31, 2013.

The variations of the current liabilities in the period refer to the reduction in the debt along with suppliers, indirect taxes payable and other liabilities.

Non-Current Liabilities

The non-current liabilities closed on R$9.812 million on December 31, 2015, when compared to a balance of R$7.898 million on December 31, 2014 and R$5.495 million on December 31, 2013. This presents an increase of 24.2% or R$1.914 million in 2015 and 24.4% or R$2.402 million in 2014. As percentage of the liability's total and shareholders’ equity, the non-current liabilities represented 27.7% on December 31, 2015, when compared to a percentage of 24.4% on December 31, 2014 and 19.5% on December 31, 2013. The main impact in the group of accounts can be verified in the leasing account, derived from the leaseback of the towers sold.

Shareholders’ equity

The shareholders’ equity closed with R$16.933 million on December 31, 2015 when compared to a balance of R$15.322 million on December 31, 2014 and R$14.595 on December 31, 2013, representing an increase of R$1.611 million in the exercise of 2015 and an increase of 727 million in the exercise of 2014. Such increase refers mainly to the increase of the balance of the revenue reserve's account deriving from the Company's positive incomes.

Social exercises concluded on December 31, 2015 and December 31, 2014

Operating Activities

The net cash generated by the operating activities was R$4.278 million in the exercise concluded on December 31, 2015 when compared to R$6.441 million in the fiscal year concluded on December 31, 2014. This presents a decrease of the cash flow of 33.6% or R$2.163 million.

The cash generated by our invoicing is applied mainly to our main business line. The cash flow funds part of the Capex acquisitions, according with the item "Investment Activities" below. Additionally, the cash is used for acquisition of stocks, payment to employees, payment of rates and taxes, amortization of financings and distribution of profits.

Investment Activities

The net cash used in the investment activities was R$2.824 million in the exercise concluded on December 31, 2015, when compared to R$6.863 in the exercise concluded on December 31, 2014, a decrease of 58.9% due to the higher investments during the year.

Financing Activities

The net cash generated by the financing activities was negative, closing in the order of R$587 million in the exercise concluded on December 31, 2015.

10.2. The management must comment on:

a. results of the issuer's operations, specially:

i. description of any components important to the income

The company generates its revenues in local currency, from the use of telecommunications services with mobile, fixed, long distance calls and ultra broadband, besides added-value services (which also includes data transmission). Another important component of the income is the network usage or interconnection revenues, deriving from the value charged to all other companies for the termination of the traffic in the Company's network. The income of devices is also integrated to the group of incomes, referring to the sale of mobiles and mini-modens for connection to internet.

Over 2015, the short-term pressures derived from the drop of voice, SMS and interconnection revenues caused the total services revenues to present a 5.8% drop in the year. However, excluding the interconnection revenues (which face a path of regulatory decrease and suffered a new reduction of the VU-M duties), we were able to reach the stability of the so-called generated revenues by our users, from the significant growth of the data incomes, which had a total growth in the year of approximately 40%, with positive results both in ARPU and in user data base. It's important to note that the greater decrease in the total revenues derived from the direct impact of the strategy of decrease of the sales and devices volumes (which do not present significant contribution for operating margin), and focus on the most valuable clients.

We present below the table with breakage of the main income lines for the periods referring to the years of 2015, 2014 and 2013.

ii. factors that have materially affected the operating incomes

Economic environment

In 2013, United States were able to show more elevated recovery levels. GDP grew 2.2% and the unemployment rate returned to the levels only seen before the 2008 crisis, around 7%. In turn, in Brazil, the year of 2013 was marked by several data, more negative than positive. From the positive point, it's important to highlight the extremely low unemployment rate, of 5.4%, lower annual average since 2003. And from the negative point, the highlights are for GDP below average, in 2.5%, and the return of the growth of inflation of 5.91%. With the fighting policy against the acceleration of inflation, Banco Central had to review its reduction policy of SELIC, taking it to 10.0% by the end of 2013.

In 2014, the economy of the United Stated showed an expansion in the growth, with GDP growing 2.4% in the year; what culminated in the shutdown of the title purchase program, launched after-crisis, by FED. In Brazil, the year of 2014 was marked by the World Cup and the presidential elections, which were the most heated in the last years. In the economic scope, the year was a challenging one with GDP growing less than 0.3% and inflation reaching 6.41%, pressured, mainly, by the electricity costs, strongly impacted by the water crisis that hit the country. The Federal Government kept several measures to stop the rise in the dollar, which has gone 13.0% up in the year, motivated, mainly, by the end of FED's incentive program and the fear of increase in the basic rate in the United States. The trade balance concluded 2014 with a accumulated deficit of US$ 3.93 billion, what can be explained by three main factors: i) widespread decrease in the price of the commodities, mainly iron ore; ii) widespread economic crisis in Argentina, one of the main importers of Brazilian products; iii) high fuel imports, that despite having reduced against the previous year, presented a good slice of the imports.

In 2015, the United States' economy presented a stable growth rhythm when compared to the previous year, expanding 2.4%. The growth was driven by the expansion in the consumer's spending, fixed residential spending and spending in state and local governments. In the opposite direction, the slow-down of the exports, increase of imports and decrease in the federal spending stopped the economic expansion.

For Brazil, in 2015, the macroeconomic scenario was really difficult, when the political instability, contraction of the GDP, acceleration of inflation, fall of the credit notes and slow-down of the world economy made Brazil's situation worse. The policy of increase of interests in the United States, the slow-down of the Chinese and European economies and the reduction of the price of oil and other commodities led the country to a contraction of the Gross Domestic Product (GDP) in -3.8%, according with the Report of IBGE of 2015, and an increase of the unemployment rate to 9.0% per year, according with the last Continuous PNAD, published by IBGE on October.

The official inflation ended the year in 10.67%, above the target ceiling, of 6.5%, despite Banco Central (BACEN) has implemented successive increases in the basic interest rate (SELIC), which, in 2015, went from 11.75% to 14.25% by the end of the year.

Concerning the exchange rate, Brazil keeps trying to hold the dollar's appreciation, which went up 47% against the Real in 2015, even with BACEN upkeeping the sale of the currency in the market with swap contracts. On the other hand, despite the 14% reduction in the exports, the slow-down of the Brazilian economy contributed to reduce even further the imports, resulting in a commercial balance with a cumulative surplus of US$19.7 billion.

Telecommunications Sector

In 2013, the telecommunications sector in Brazil had a more modest growth, when compared to the previous years of strong growth. The mobile market reached a total of 271.1 million accesses, an annual growth of 3.6 %, totalizing 9.3 million new lines in 2013, according to ANATEL. The penetration rate reached 134.4%.

In 2014, the Brazilian telecommunications sector showed its resilience. Even against a harder economic scenario, the sector had a growth of 3.6%, reaching 280.7 million accesses. Totalizing 9.6 million new lines. The penetration rate reached 138.0%, according to ANATEL.

In 2015, the Brazilian telecommunications sector was affected by the adverse macroeconomic scenario and presented a reduction of 8.2% in the mobile market, closing the year with 257.8 million accesses. The prepaid modality presented reduction of 13.3%, reaching the order of 184 million accesses, in contrast, contract segment grew 8.0%, reaching 73 million accesses. The penetration rate reached 125.7%, according to ANATEL

The reduction in the base reflects the acceleration of the replacement of voice by use of data and message apps, this way, leading to the start of the decay of the use of multiple chips and the reduction of the community effect in the prepaid users.

Special features of the sector

The mobile telephony in Brazil is characterized by being a private sector where the prices and duties are regulated by the market. ANATEL acts as the agency governing all telecommunications sectors in Brazil with the mission to "promote the development of the telecommunications in the country to provide it with a modern and efficient telecommunications infrastructure, capable of offering to the society appropriate, diversified and fair-priced services, on all national territory"

In the competitive environment, the Brazilian mobile sector is presented as one of the most competitive in the world, being one of the few to have four large competitors with national presence and market share of 18% to 29%. The strong competitive movement in the market implicates a higher pressure over margins due to the commercial expenses related to advertisement, commissions and benefits.

The necessity of intensive capital is also one of the main features of the telecommunications sector. To support the increase in the traffic of the network throughout the years and arrival of new technologies, high investment levels are needed to ensure range and quality of the services rendered.

Operating Incomes

Client Base

In 2015, the Brazilian mobile market reached 257.8 million lines, representing an annual decrease of 8.2% and a penetration rate of 125.7%, when compared to 137.9% by the end of 2014. The growth of the mobile market continued to be supported by: i) the machine-to-machine segment (M2M), ii) the rising demand for data services, specially in smart/webphones and iii) migration from prepaid to contract plans.

In 2015, the Brazilian mobile market recorded negative net additions in the order of 22.9 million, a 338% slow-down versus the record of 2014 (9.6 million).

The Company's total base of subscribers concluded the year of 2015 with 66.2 million lines, 12.5% smaller than in 4T14; representing a market-share of 25.7%.

The contract client base reached 13.5 million users, a 8.6% growth P/Y against 1.8% in 4T14.

In the prepaid segment, the total of users reached 52.6 million, drop of 16.7% P/Y - strongly impacted by: (i) difficult macroeconomic scenario, (ii) process of consolidation of multiple chips, (iii) high penetration of the mobile service and (iv) quick replacement of voice for use of data, resulting in an important reduction in the community effect.

Network & Quality

The Company's investments prioritize projects for (i) expansion of the optical fiber network, (ii) optimization of the network's use, with adjustments to improve the quality of the signal in the current coverage areas, (iii) mapping of the main causes of interruption and faults of the network, as well as the measures necessary to prevent these events, ensuring the quality of the connection of calls and data, for a higher access capacity of the user.

As renderer of an essential service for the socioeconomic development of the country, we really believe that the promotion of the universal access to telecommunications services is contributing for the development of the country's infrastructure. The Company reaffirms its commitment with investments for 2016 and with the never-ending pursuit of more and better services, pushing harder to attend all needs from all of its clients.

TIM had, today, a broad national reach, covering approximately 95% of the Brazilian urban population, with presence in over 3.400 cities. TIM also has an extensive data coverage all over the country, using the latest 3G and 4G technologies available to 82% and 54% of the urban population, respectively.

From the total of investments in 2015, R$2.7 million were invested only in network and IT, in a way to expand the coverage and capacity, with the growth of the voice and data traffic.

TIM will continue to invest to provide a high-performance mobile broad band, specially through the Mobile Broad Band (MBB) program. This program enables the network for high-quality data transmission services using 3G with HSPA+, enabling access up to 21Mbps by carrier, besides enabling the dual carrier (DC) resource, totalizing up to 42Mbps per antenna. MBB also included activation sites with LTE (4G) network, high-capacity backhaul antennas through expansion of the FTTS network (Fiber to the Site), microwave links, and use of a new content managing model (Cache infrastructure), reducing latency services and improving the client's experience.

The year of 2015 ends with the delivery of the main infrastructure projects for benefit of the users. Improvements in the data transmission enable a differentiated browsing performance for users of mobile broad band through websites connected to optical fiber and high-capacity microwaves, modernization of the access by radio and implementation of new resources in the network's core.

In 2015, TIM increased 108% the volume of installations of eNodeB equipment, also increasing in 32% the number of locations connected by optical fiber and microwaves, enabling an increase in the data transmission capacity.

It's important to highlight that in the beginning of 2016, TIM reached the leadership in 4G coverage with 411 cities and over 100 million environments that can now rely on the technology of 4th generation of mobile internet. In 2016, TIM will accelerate this expansion rhythm.

The Company kept the internal program started in 2009 to monitor qthe network's quality, based on sampling of measurements in the streets of the country's main metropolitan areas. The program monitors the development of TIM's network and also from other mobile carriers and is used to make fine adjustments, improving the quality of the network

.

MOU (monthly minutes average per users)

In 2015, MOU reached 119 minutes, which represents a 12% drop when compared to the previous year. Such performance is due to the reduction of the outgoing traffic, which shows the clients' increasing tendency to change voice servicer for new technologies related to data.

b. variations of the revenues attributable to alterations of prices, exchange rates, inflation, alterations of volumes and introduction of new products and services

The Company's income is basically composed by local currency, this way, not being affected by possible exchange variations. It's directly impacted by alterations in its client base, variations in the volume of use and modifications in the duties charges due to new tariff plan, launching of products or introduction of promotions. The Company can adjust the prices practiced to the public since the new value is within a range previously approved by ANATEL, the maximum value is subjected to an annual readjustment according with the behavior of the inflation. In many cases, despite ANATEL allowing readjustments, the strong competition in the sector has been resulting in the duties practiced.

The total net revenues of 2015 was R$17.139 million (a 12.1% decrease when compared to 2014), while the net services revenue totalized R$15.384 million (5.8% less than in 2014), mainly impacts by the accelerated transition from use of voice to data and by adverse macroeconomic scenario. The net income of devices totalized R$1.755 million in the period, a 44.7% drop when compared to the same period last year, reflex of the depreciation of the Real and the challenging macroeconomic environment.

The gross income of Added-Value Services (SVA) grew 17% P/Y in 2015, totalizing R$7.742 million, as the innovative income increased its relevance on the income. Although the instant message business (SMS) has shrunken more than once, continuing to negatively impact the income of Added-Value Services, the Innovative Income grew 35% P/Y. In general, the SVA income reached 38% of the net mobile services revenue and presented a positive contribution for the Company's margin. Before this "perfect storm" scenario, TIM kept its focus in the execution of the strategic planning and short/long term goals, particularly with the intense investment in infrastructure. Additionally, the company quickly acted in the portfolio's repositioning before the structural changes of the sector, intensifying the efficiency actions, which helped to protect the Company's financial incomes and to expand an operating margin even in a income retraction year and, in lower intensity, of EBITDA. In November of 2015, TIM launched its new portfolio of offers, innovating once more and bringing a disruptive element to the market with a proposal of fixed duty, allowing the off-net use for all segments, focusing on mobile packages (voice + data) and recurring prepaid offers.

c. impact of the inflation, price variance of the main inputs and products, of exchange and interest rate in the operating income and financial income of the issuer, when relevant

Inflation: Potential increases in the inflation rate can lead to higher costs for the Company and consequent reduction of margins. In case of strong inflationary scenario, the government will be able to adopt a more austere monetary policy, with increase of the interest rate, reducing and endearing the credit offer and, consequently, affecting our consumers of telecommunications services.

Interest rates: The Company's financial expenses are affected by fluctuations in the interest rates, as the TJLP (Long-Term Interest Rate) used by BNDES and CDI (Interbank Deposit Certification). The Company keeps its financial resources mainly applied on Interbank Deposit Certificates (CDI), what substantially reduces this risk. In 2013, the Company presented availabilities in the total amount of R$ 5.288 million and a gross debt of R$4.867 million with a current installment of R$1.009 and a indebtedness level concerning EBITDA of -0.08x.

In 2014, the Company presented availabilities in the total amount of R$ 5.233 million and a gross debt of R$6.507 million with a current installment of R$1.352 and a indebtedness level concerning EBITDA of 0.23x.

In 2015, the Company presented availabilities in the total amount of R$ 6.700 million and a gross debt of R$8.432 million with a current installment of R$2.474 and a indebtedness level concerning EBITDA of 0.26x.

Exchange: By the end of 2013, the exchange exposure of the debt was 37%. The Company, to protect itself from eventual currency fluctuations, kept its hedge policy to 100% of its exposure through foreign exchange swap contracts.

In 2014, the exchange exposure of the debt decreased to 35%. The Company, to protect itself from eventual currency fluctuations, kept its hedge policy to 100% of its exposure through foreign exchange swap contracts.

In 2015, the exchange exposure of the debt kept itself on 35%. The Company, to protect itself from eventual currency fluctuations, kept its hedge policy to 100% of its exposure through foreign exchange swap contracts. In 2015, the average cost of the debt was 11.73% when compared to 9.70% in 2014; Even so, the increase in the debt's cost was more than that compensated by the increase in the profitability of the cash.

Besides that, the Company acquires part of equipment of network and cell phones from global providers, whose prices are defined in American dollar. The depreciation of the Real when compared to the American dollar can result in relative increase of the acquisition price of products.

10.3. The management shall comment the relevant effects that the events below have caused or are expected to cost in the financial statements of the issuer and its incomes:

a. introduction or alienation of operational segment

There was no introduction or alienation of operational segment in 2015.

b. constitution, acquisition or alienation of shareholding

There was no constitution, acquisition or alienation of shareholding in 2015.

c. unusual events or operations

In 2015, TIM concluded the closing of three lots under the Towers Sale Contract signed on November, 2014 with American Tower do Brasil (ATC) that comprised overall sale of 6,481 towers for approximately R$3 billion in cash.

- First closing: On April 29th, 2015, TIM transferred 4,176 towers to ATC and received approximately R$1.9 billion.

- Second closing: On September 30th, 2015, TIM transferred 1,125 towers to ATC and received approximately R$517 billion.

- Third closing: On December 16th, 2015, TIM transferred 182 towers to ATC and received approximately R$517 billion.

The master lease agreement (MLA) defines the leaseback of the transferred towers for a 20 years period. According with IAS17, this transaction should be accounted for as (1) sale and (2) leaseback and after its demands, the leaseback is registered as financial leasing.

See below the conciliation of the effects in the Financial Statement and the corresponding notes with more information about the three closings:

10.4. The management must comment on:

a. significant changes in the accounting practices

In 2015, the Company started presenting the deferred income tax and social contribution balances per contributing entity. To keep the consistency in the comparability of the financial information, consolidated comparative balances from December 31, 2014 and 2013, are also presented by net, what represents a reduction of R$351.967 and R$206.444, respectively, in the comparative digits of "Deferred social contribution and income tax" in the non-current asset and non-current liabilities. Even if the adjustment could be considered as a correction of an error, the Administration believes that the same is immaterial for purposes of previous years.

b. significant effects of the alterations in accounting practices

The administration believes that there is no significant effects of the alterations in accounting practices.

c. reservations and emphasis present in the auditor's report

Reservations

The Company's management affirm that there are no reservations in the reports of the independent auditors concerning the financial statements for the exercises concluded on December 31, 2015, 2014 and 2013.

Emphasis

For the exercise concluded on December 31, 2015, there is no emphasis in the reports of the independent auditors.

Due to the rotation of independent auditors, individual and consolidated accounting statements of TIM Participações S.A., referring to the exercise concluded on December 31, 2014, were audited by other independent auditors, over which they issued audit report dated on February 12nd, 2015, without reservations.

For the exercise concluded on December 31, 2014, there are no emphasis in the reports from the independent auditors, due to the accounting practices adopted in Brazil applied in the individual financial statements, from 2014, do not differ from IFRS applicable to separate financial statements, once that IFRS started to allow application of the equity equivalence method in subsidiaries in the separate statements, they are also in compliance with the International Financial Reporting Standards (IFRS), issued by International Accounting Standards Board (IASB).

On December 31, 2013, the auditors' report presented emphasis due to the individual financial statements have been prepared according with the accounting practices adopted in Brazil. In the case of TIM Participações S.A., these practices differ from the IFRS applicable to separate financial statements, only in relation to the evaluation of the investments in subsidiaries by the equity equivalence method, once that, for IFRS purpose, it would be fair cost or amount. The Company's management explain that the opinion from independent auditors is not reserved due to this subject.

10.5. The management must indicate and comment critical accounting policies adopted by the issuer, exploring, specially, accounting estimates performed by the administration concerning uncertain issues and relevant for the description of the financial condition and the results, demanding subjective or complex judgments, such as: provisions, contingencies, acknowledgement of the income, tax credits, long-term assets, lifespan of non-current assets, pension plans, adjustments of conversion in foreign currency, costs of environmental recovery, criteria for recovery test of financial instruments and assets

Critical Accounting Policies

The fundamental accounting policies are those significant for the presentation of our financial condition and incomes of the operations and demand more subjective and complex judgments by the management, frequently demanding the them to estimate the effect of factors of uncertain nature. As the number of variables and assumptions that affect the possible resolution of uncertainties increases, these decisions become more complex. We base our estimated and assumptions in historical experience, tendencies of the sector and other factors that we consider reasonable in the circumstances. The real results could differ the foreseen, and different assumptions or estimates of the future could also alter the financial results shown. To facilitate the understanding of how the Company's administration estimated the potential impact of certain uncertainties, including the variables and assumptions which base the estimates, we identified the fundamental accounting policies discussed bellow.

We described our main accounting policies, including the ones discussed bellow, in the notes of our consolidated financial statements.

A loss by reduction to recoverable amount exists when the accounting amount of an asset or unit generating cash exceeds its recoverable amount, which is the highest between the fair value less sale costs and the amount in use. The calculation of the fair value less sales costs is based on available information of transactions of similar assets sale or market prices less additional costs to dispose the asset. The calculation of the amount in use is based on the model of discounted cash flow. The cash flows derive from the Company's business plan. For being a continuous business, from the fifth year of projection, a nominal growth perpetuity was estimated from the cash flows.

Eventual reorganization activities with which the Company is not committed in the database of presentation of the financial statements or future significant investments that will improve the assets base of the unit generating cash object of this test are excluded for purposes of impairment test.

The recoverable amount is sensible to the discount rate used in the discounted cash flow method, as well as the future cash receipts expected and the rate of growth of incomes and expenses used for purposes of extrapolation. Adverse economic conditions may cause this assumptions to suffer significant alterations.

On December 31, 2015 and 2014, the main non-financial assets for which this evaluation was made are premiums registered in the Company.

(a) Income tax and social contribution (current and deferred)

The income tax and social contribution (current and deferred) are calculated according with the interpretations of the legislation in effect. This process usually involves complex estimates to determine taxable income and the differences. Particularly, the tax credit deferred over tax losses, negative base of social contribution and temporary differences is acknowledged in the proportion of the probability that the future taxable income is available and could be used. The mensuration of the recoverability of the deferred tax income over tax losses, negative base of social contribution and temporary differences take into consideration the estimate of taxable income.

(b) Provision for law and administrative suits

The law and administrative suits are analyzed by the Administration along with its legal advisors (internal and external). The Company considers in its analysis factors such as hierarchy of the laws, available precedents, more recent decisions in the courts and its relevance in the legal system. These evaluations involve judgment by the Administration.

(c) Fair value of derivatives and other financial instruments

The financial instruments presented in the balance sheet by the fair value are measured through evaluation techniques that consider observable data or derived from observable data in the market.

(d) Unbilled revenues

As some court dates for billing occur on intermediary dates within the months of the year, by the end of each month there are incomes already earned by the Company, but not effectively billed to its clients. These unbilled incomes are registered based on estimate, that takes into consideration historic consumption data, number of days elapsed since the last billing date, among others.

10.6. The management shall describe the relevant items not shown in the financial statements of the issuer, indicating:

a. the assets and liabilities detained by the issuer, directly or indirectly, that do not appear in its balance sheet (off-balance sheet items), such as:

i. operating commercial leasings, assets and liabilities

ii. receivables portfolio over which the entity keeps risks and responsibilities, indicating respective liabilities

iii. contracts of future sale and purchase of products or services

iv. unfinished building contracts

v. Future financing receipt contracts

There are no commitments of material value that have not been indicated in the financial statements.

b. other items not shown in the financial statements

Not applicable, as the Company don't have other material items, from other natures, that are not registered in our balance sheet.

10.7. Concerning each one of the items not shown in the financial statements indicated on item 10.6, the management shall comment:

a. how such items change or could change the incomes, the expenses, the operating income, the financial expenses or other items of the issuer's financial statements

Not applicable to the year of 2015.

b. nature and the purpose of the operation

Not applicable to the year of 2015.

c. nature and amount of the obligations assumed and the rights generated in favor of the issuer due to the operation

Not applicable.

10.8. The management must indicate and comment the main elements of the issuer's business plan, specifically exploring the following topics:

a. investments, including:

i. quantitative and qualitative description of the investments in progress and the investments foreseen

In the year of 2015, more than 92% of the total Capex was dedicated to infrastructure, focusing on 3G and 4G networks, with the purpose of providing more service quality and efficiency in the network costs. In this sense, were invested more than R$4.7 billion, that enabled to overcome the goals for infrastructure growth for the year, reaching the mark of 411 cities covered with 4G, or 59% of the country's urban population, what represents the leadership in 4G coverage in Brazil.

The evolution of the network is still going through investments that stratify into access network, last mile, optical fiber and radio backhauling and backbone besides the residential landline service of ultra broad band in São Paulo and Rio de Janeiro. These projects aim to expand the capacity and coverage of TIM's infrastructure, ensuring high quality levels and supporting the marketing strategies.

Concerning the development of the business, among other projects, the IT projects that aim to update and develop TIM's technological systems and platforms stand out. The projects at issue aim at operating, management improvements and specially development of new and innovative products that are the brand of the Company.

ii. financing sources of the investments

On December 2013, TIM signed a line of credit to fund its investments with BNDES. The new contract, in the amount of R$5.700 million has a really attractive cost and supports the Company's CAPEX investments in the triennium 2014-2016. Among the clauses of the contract, one of them foresees that can only be acquired, through this financing, equipment from national suppliers; what reinforces the Company's commitment with the growth of the industry in the country.

In 2014, the Company disbursed R$ 1.761 million from this line and, in the forth trimester of 2015, R$ 1.172 million. With this, it's still available for draft in 2016 the total of R$ 2.767 million.

iii. relevant disinvestments in progress and disinvestments foreseen

There were no relevant disinvestments in the year of 2015.

b. as long as already disclosed, indicate the acquisition of plants, equipment, patents or other assets that should materially influence the issuer's productive capacity

On December 17th, 2015, TIM was classified as Applicant with the best proposal for acquisition of 02 Lots Type B (E-30 – AR41, Curitiba and Metropolitan Region; and E-68 – AR81, Recife and Metropolitan Region) and is waiting for the conclusion of the Opening, Analysis and Trial of the Proposals of Bidding Price Session n.. 002/2015-SOR/SPR/ANATEL to confirm its expectation of acquisition of 10+ 10 MHz in 2.500 MHz in the referred Bidding. It's expected the conclusion of the Trial Session during the 1st semester of 2016 and signature of corresponding Authorization Terms in the 2nd trimester of 2016.

c. new products and services, indicating:

i. description of the researched in progress already disclosed

ii. total amounts spent by the issuer on researches for development of new products and services

iii. Projects in development already disclosed

iv. total amounts spent by the issuer on development of new products and services

Not applicable, once that the Company do not have researches in progress already disclosed.

10.9. Comment about other factors that influenced in a relevant way the operating performance and that had not been identified or commented in all other items of this section

In compliance with the guidelines of Ofício-Circular/CVM/SEP/Nº02/2016 the Company presents below its comments on marketing costs and expenses, reported in Note 29 to the Financial Statements 2015:

|

|

Consolidated |

|

|

2015 |

2014 |

2013 |

|

|

|

|

|

Personnel |

|

- 687,629 |

- 624,730 |

- 563.486 |

Third party services (*) |

|

- 2,191,028 |

- 2,180,640 |

- 2,201,727 |

Advertising and publicity |

|

- 560,558 |

- 622,781 |

- 592.421 |

Allowance for doubtful accounts |

|

- 230,357 |

- 248,576 |

- 240.051 |

ANATEL fees (**) |

|

- 871,184 |

- 1,043,713 |

- 1,030,576 |

Depreciation and amortization |

|

- 162,267 |

- 158,888 |

- 170.084 |

Rentals and insurance |

|

- 93,265 |

- 95,057 |

- 76.509 |

Training |

|

- 509 |

- 1,644 |

- 1.186 |

Others |

|

- 30,098 |

- 46,943 |

- 35.482 |

|

|

- 4,826,895 |

- 5,022,972 |

- 4,911,522 |

Marketing expenses fell 6.1% yoy in 2015 due to (i) a significant reduction in advertising costs, despite the launch of new portfolio in November 2015; (ii) sharp drop in commissioning expenses; (iii) significant savings of FISTEL (-17% yoy) as a result of strong prepaid with low ARPU disconnection.

Bad debt expenses fell 7.3% yoy in 2015, due to improved performance of the fixed segment, a result of the restructuring of that business. As a percentage of gross revenue, delinquency reached 0.89% in 2015, virtually unchanged compared to 2014 (0.86%) despite a macroeconomic environment more challenging.

Subscriber Acquisition Costs (where SAC = subsidy + commissioning + total advertising expenses) reached R$30.5 per gross add in 2015, an increase of 11.3% yoy due to a greater focus on customer acquisition high value. The SAC/ARPU ratio (indicating the payback per customer) reached 1.9x in 2015, stable compared to 2014, despite an increase of 8.6% yoy post-paid customers.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

TIM PARTICIPAÇÕES S.A. |

|

| |

|

|

|

| Date: March 11, 2016 |

By: |

/s/ Rogério Tostes |

|

|

|

|

|

| |

|

Name: Rogério Tostes |

|

| |

|

Title: IRO |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

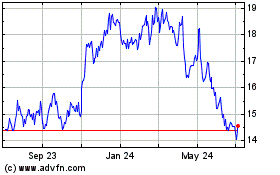

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

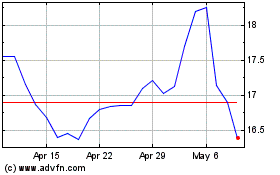

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024