Report of Foreign Issuer (6-k)

December 17 2015 - 6:03AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2015

Commission File Number 001-14491

TIM PARTICIPAÇÕES S.A.

(Exact name of registrant as specified in its charter)

TIM PARTICIPAÇÕES S.A.

(Translation of Registrant's name into English)

Av. das Américas, 3434, Bloco 1, 7º andar – Parte

22640-102 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

TIM PARTICIPAÇÕES S.A.

Publicly-held Company

Corporate Taxpayer's ID (CNPJ/MF): 02.558.115/0001-21

Corporate Registry (NIRE): 33 300 276 963

MATERIAL FACT

Closing of Towers Sale Third Tranche

TIM Participações S.A. ("Company") (BOVESPA: TIMP3 and NYSE: TSU), pursuant to the provisions of Rule CVM 358 and to Article 157, § 4th, of Law No. 6,404/76, following the material fact disclosed on November 21, 2014, which informed the market of the execution of the Infrastructure Items Purchase and Sale Agreements ("Purchase and Sale Agreements") for up to 6,481 (six thousand, four hundred and eighty-one) telecommunication towers, and the following material facts disclosed on April 29 and September 30, 2015, which informed the market, respectively, of the first and second closing of the transaction as contemplated by the Purchase and Sale Agreements with the transfer, until now, of 5,301 (five thousand, three hundred and one) telecommunication towers to American Tower for a purchase price of approximately R$ 2,417 billion, hereby informs its shareholders and the market in general what follows:

On the date hereof, the third closing of the transaction as contemplated by the Purchase and Sale Agreements occurred with the transfer to American Tower of 182 (one hundred and eighty two) telecommunication towers for a purchase price of approximately R$ 84 million to TIM Celular.

The proceeds from the transaction, which aim to optimize the Company’s capital allocation, will contribute to support the investment strategy disclosed by the Company to the market.

The Company expects to conclude the sale of the telecommunication towers in the coming months.

Rio de Janeiro, December 16, 2015

TIM Participações S.A.

Rogério Tostes

Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

TIM PARTICIPAÇÕES S.A. |

|

| |

|

|

|

| Date: December 16, 2015 |

By: |

/s/ Rogério Tostes |

|

|

|

|

|

| |

|

Name: Rogério Tostes |

|

| |

|

Title: IRO |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

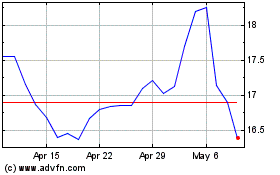

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

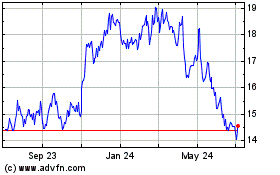

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024