Iliad Founder Neil Has 15% Stake in Telecom Italia

October 30 2015 - 9:10AM

Dow Jones News

MILAN—Italy's market regulator said Friday that Xavier Niel, the

founder of French telecom firm Iliad SA, holds warrants that amount

to a 15.1% stake in Telecom Italia SpA, further extending the

French businessman's interest in the struggling Italian

company.

In addition to holding options to buy a 11.2% share of Telecom

Italia, disclosed on Thursday, the regulator said on Friday that

Mr. Niel has increased his potential stake with more warrants,

bringing his potential interest in the Italian telecommunications

company to 15.1%. All of the options—most of which can be exercised

beginning next summer—are for shares with voting rights.

Mr. Niel's interest in Telecom Italia has raised speculation

concerning a possible joint bid or a takeover battle with the

largest shareholder in Telecom Italia: Vincent Bolloré . Mr.

Bolloré , another prominent French businessman, has amassed a 20%

stake in Telecom Italia through Vivendi SA, the media company where

he is chairman and the largest shareholder.

People familiar with the thinking of Mr. Bolloré and Vivendi say

the two billionaires haven't been coordinating or working together

on Telecom Italia. But a spokesman for Vivendi said on Friday that:

"We'd be delighted to work with anyone who has the company's

long-term interests at heart." He reiterated Vivendi's position

that it is a "long-term shareholder" in the Italian firm.

Mr. Niel didn't respond Friday to a request for comment.

The interest in Telecom Italia comes as Europe's telecom

companies push for more consolidation amid intense competition from

low-cost entrants, changing consumer habits and regulation that has

kept pricing low. After months of intense M&A activity in the

sector, the European Union has signaled a tougher stance on

telecoms mergers, saying it does not necessarily result in a better

deal for consumers.

Telecom Italia, which right now doesn't have any other large

individual shareholders apart from Vivendi and Mr. Niel, is hoping

for a turnaround after years of poor performance, which has

depressed the stock—now one of the cheapest in the European telecom

sector.

After years of harsh tensions among shareholders and a lack of a

clear strategic direction, it has resolved conflicts among

investors and internal struggles for control, making its

shareholding structure more stable. It has also recently started to

invest more in its domestic business, seen as key to a significant

improvement of its business in the near future.

The operator, a former monopoly which still owns the largest

market share in Italy, said earlier this year that it plans to

invest €14.5 billion ($15.9 billion) as part of its three-year

plan, with about three-fourths of that in Italy. But as of the

first-half of this year, revenues were still falling, keeping the

company's shares depressed.

Investor interest in Telecom Italia could also stem from its

second market, Brazil, analysts say. Revenue there is also

shrinking, but several bidders are circling the Brazilian unit,

dubbed TIM Participacoes.

In 2014, its Brazilian competitor Oi SA and local investment

bank BTG Pactual agreed to work with the Brazilian unit of Telefó

nica SA and Claro, owned by Mexico's America Movil SAB de CV, to

make a combined offer to buy TIM Participacoes, and split up its

assets. So far nothing further has happened with regard to this

deal.

Earlier this week, Russian investment firm LetterOne proposed

investing $4 billion in Oi, but added that the offer is conditional

on the success of a potential merger with TIM Participacoes.

According to a person familiar with the matter, any action or

consolidation in Brazil won't happen before next summer, which is

when most of Mr. Niel's options can be exercised.

The news of Mr. Niel's interest in Telecom Italia prompted the

Italian firm's stock price to jump on Thursday—it closed 8.7%

higher—because of speculation the purchase could lead to a takeover

battle. Shares added as much as 4% Friday on news that Mr. Niel's

had increased his stake.

Write to Manuela Mesco at manuela.mesco@wsj.com and Nick Kostov

at Nick.Kostov@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 30, 2015 08:55 ET (12:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

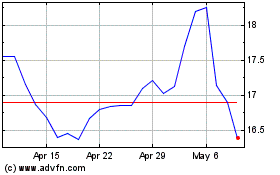

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

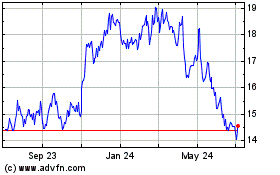

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024