ADRs End Lower; Ctrip.com Climbs

October 26 2015 - 6:45PM

Dow Jones News

International stocks trading in New York closed lower on

Monday.

The BNY Mellon index of American depositary receipts declined

0.50% to 134.95. The European index decreased 0.68% to 135.04, the

Asian index fell 0.20% to 143.18, the Latin American index edged

down 0.13% to 167.14 and the emerging markets index eased 0.04% to

227.78.

Ctrip.com International Ltd. (CTRP, K3RD.SG) was among the

companies with ADRs that traded actively.

Two of China's biggest online travel companies are joining

forces amid intensifying competition for booking train, plane and

hotel reservations in the fast-growing market. A share swap

unveiled on Monday would closely tie U.S.-traded rivals Ctrip.com

International Ltd. (CTRP, K3RD.SG) and Qunar Cayman Islands Ltd.

(QUNR) amid an increasingly expensive race to serve Chinese

travelers. It would also tie the two companies closely to Baidu

Inc. (BIDU, K3SD.SG), the Chinese Internet search company sometimes

called the Google of China. ADRs of Ctrip.com climbed 22% to $90.78

while Qunar increased 7.9% to $42.65 and Baidu advanced 5.5% to

$166.24.

Brazilian phone company Oi SA (OIBR, OIBRC, OIBR4.BR) is getting

a long-awaited second chance at being a key player in the

consolidation process in the country's telecoms industry. Oi said

Monday that LetterOne, an investment firm led by Russian

billionaire Mikhail Fridman, proposed investing $4 billion in the

Brazilian phone company, though the offer is conditioned on the

success of a potential merger with TIM Participacoes SA (TSU,

TIMP3.BR) , the Brazilian unit of Telecom Italia SpA (TI, TIT.MI).

ADRs of Oi rose 3.5% to 88 cents, TIM Participacoes increased 5.8%

to $10.93. Telecom Italia rose 11 cents to $12.75.

Luxottica Group SpA (LUX, LUX.MI) said its third-quarter profit

and sales increased, boosted by favorable currency-exchange

fluctuations and strong growth in the U.S., despite a decline in

consumer traffic in areas such as New York and Miami. ADRs edged

down five cents to $71.37.

Brazil's state oil company Petroleo Brasileiro SA's (PBR,

PETR3.BR, PETR4.BR) board has approved the partial sale of its

natural-gas distribution unit for 1.9 billion reais ($488 million),

kicking off Petrobras's divestment campaign to reduce its debt

burden. ADRs fell 1.2% to $4.92.

Philips NV (PHG, PHIA.AE) said it has run into unexpected

regulatory trouble in the U.S. over the planned sale of its

lighting-components and automotive-lighting unit to a Chinese

investor. The Dutch electronics group said the Committee on Foreign

Investment in the U.S., or CFIUS, has expressed "certain unforeseen

concerns" regarding the planned disposal of an 80% stake in the

Philips business, called Lumileds, without providing further

details. Philips said it would "take all reasonable steps" to

address the committee's concerns. The company also reported that it

swung to a profit in the latest quarter. ADRs eased 12 cents to

$26.07.

WPP PLC (WPPGY, WPP.LN) said a strong quarter from its North

American business helped it post an increase in sales, but the

world's largest advertising holding company also warned that many

of its clients continue to focus on cutting costs rather than

improving revenues. ADRs fell 2.3% to $111.36.

Write to Tess Stynes at tess.stynes@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 26, 2015 18:30 ET (22:30 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

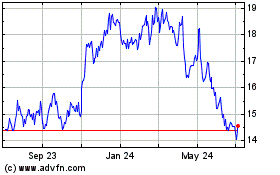

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

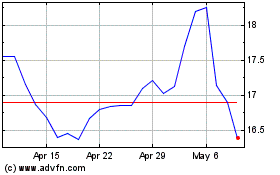

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024