LetterOne Seeks to Invest $4 Billion in Brazil's Telecom Oi -- Update

October 26 2015 - 11:44AM

Dow Jones News

By Rogerio Jelmayer

SÃO PAULO--Brazilian phone company Oi SA is getting a

long-awaited second chance at being a key player in the

consolidation process in the country's telecoms industry.

Oi said Monday that LetterOne, an investment firm led by Russian

billionaire Mikhail Fridman, proposed investing $4 billion in the

Brazilian phone company, though the offer is conditioned on the

success of a potential merger with TIM Participações SA, the

Brazilian unit of Telecom Italia SpA.

If the merger goes ahead, LetterOne will be an important

shareholder in the new company, though the exact size of the stake

has yet to be defined, according to a person involved in the talks

who declined to be identified.

The LetterOne investment will be presented to Oi's board later

this week and if it's approved, "a formal proposal to Telecom

Italia will be made by the end of November," said the person,

without providing any more details.

TIM Participações said Monday in a statement that there are

currently no talks with LetterOne or Oi about a possible merger or

acquisition. LetterOne didn't respond to a request for comment.

It's not the first time Oi has tried to spark a consolidation in

Brazil's telecom industry as the company struggles to reduce its

huge debt.

In August of 2014, Oi said it had hired Brazilian investment

bank BTG Pactual to look into acquisition and merger possibilities

in Brazil, including a potential deal with TIM Participações.

BTG--which still has a mandate from the company to work on a

potential deal--received a proposal from LetterOne that could

include a capital contribution of as much as $4 billion in Oi, the

phone company said Monday.

In 2014, Oi and BTG agreed to work with the Brazilian unit of

Telefónica SA and Claro, owned by Mexico's America Movil SAB de CV,

to make a combined offer to buy TIM Participacoes and split up its

assets, a person involved in the deal told The Wall Street Journal

at the time.

The offer never materialized, though, after Telefónica and Claro

chose instead to invest directly in their own operations.

Oi has 35% of Brazil's fixed-line telephone market, but fell

behind rivals in the mobile race and has been trying to make up

ground while cutting its heavy debt load. In the second quarter,

the most recent figure available, its net debt totaled 34.64

billion reais ($8.99 billion), while its net revenue in the period

totaled 6.78 billion reais.

"Oi can't stay paralyzed, the company needs to do something to

reduce its debt because its main competitors continue to invest and

gain even more of a competitive advantage," said Alexandre Montes,

a telecom industry analyst at consultant firm Lopes Filho

Consultores, in Rio de Janeiro.

Oi could use LetterOne's $4 billion to cut debt, paving the way

for a merger with TIM Participações, Mr. Montes said.

"From TIM's side, a merger with Oi could be positive, because

TIM doesn't have a relevant position in the fixed-phone and

broad-brand markets," he added.

Oi shares rose as much as 15% in early trading Monday, and was

up 6.4% at 3.57 reais to 12:39 p.m. local time. TIM Participações

shares were up 4.7% to 8.47 reais. By comparison, the main local

stock market index, the Ibovespa, was down 0.6% at 12:39 p.m.

Write to Rogerio Jelmayer at rogerio.jelmayer@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 26, 2015 11:29 ET (15:29 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

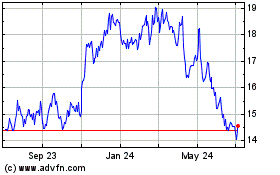

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

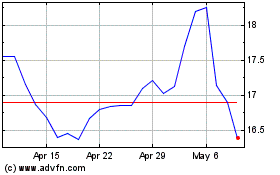

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024