MESSAGE FROM CEO

Dear Shareholders and Analysts,

The year of 2014 consolidated a significant structural change in the company’s business, following the transformation trends of the entire mobile telecommunications industry. On one hand, it was possible to observe the exceptional growth of our data, value added services and content revenues (SMS excluded), which continue to demonstrate a strong acceleration, closing the year with a growth of 56% year over year in the last quarter when compared to the same period a year before. On the other hand, it was also possible to observe the continuation of the sharp deceleration of the interconnection revenues, due to the regulatory cuts of the MTR (VU-M), as well as to the reduction of SMS revenues, given the growth of the messaging services based on Smartphone applications, what also ended up impacting the voice service usage, which had a slight reduction over the year.

These transformations confirm the correctness of the strategic orientation adopted by the company, which has been focusing intensely on the search for leadership in the Mobile Internet and all of its associated services, based on the development of innovative offers and on the strong investment in a data centric infrastructure.

During 2014, the challenges presented by the country’s macroeconomic environment became more apparent, in particular in the second half of the year, given the reduction of the rhythm of the economy and its direct impact in the reduction of consumption, also punctuated by the competitive intensity of the sector, which, even though presented signs of increased rationality, continues to be high with the presence of four large mobile operators.

It is also worth mentioning that 2014 was marked by a very positive evolution of our fixed businesses, with the return to growth of the former Intelig operation, now rebranded TIM Corporate Solutions, as well as the continuity of growth of our TIM Fiber business unit, through the success of the LiveTIM service, considered today to be the country’s best residential broadband offer, and which presented a growth of over 100% in its client base during the year.

Within this environment, we can without a question state that the results achieved by the company during 2014 were very solid, with a balance between financial, operational and strategic objectives.

User Base Growth

We closed the year with close to 76 million active lines in our user base, and we consider this very large customer base to be our main asset, positioning us as the market share leaders in the prepaid segment in Brazil, as well as the second largest mobile operator by the number of total users. Despite a slower rhythm of growth of the user base both for TIM and the market as a whole, we worked throughout the year with the purpose of improving the value of our customer base, especially through our Liberty Controle postpaid plan, which presented a sound growth of 14% year over year. In a consistent result with our overall strategy, it is also important to mention the strong growth of our data users, which reached the mark of 34 million users at the end of 2014, or a penetration of close to 45% of the total user base.

Infraestructure

In 2014, our infrastructure continued to receive enormous attention as one of our key strategic pillars, with highlights to the number of 125 cities covered by our Mobile Broadband Plan (MBB), the expansion of our coverage through the deployment of a large number of new 3G and 4G sites, the development of our “HetNet” architecture with Small Cells, Femto Cells and WiFi access points, as well as the deployment of our “Bio-Site” project in several cities in the country, demonstrating the innovative approach also in the development of our network infrastructure. These steps mark the continuation of our investment to support the enormous data traffic growth in Brazil, and I believe today that TIM is one of the operators which invests the most in the expansion and improvement of its infrastructure, reaching in 2014 a level above 20% of our total revenues.

Also worth highlighting the success of TIM’s participation in the 700MHz frequency auction conducted by Anatel last year, with the acquisition of its preferential spectrum block by close to its minimum value, correctly positioning the company for the future growth of the 4G services.

Launch of New Services

Given the strong pace of expansion of our infrastructure, our marketing team has also followed the pace with the launch of innovative services throughout the year, with highlights to the Infinity Day offer, bringing per-day charges to prepaid voice, the Controle WhatsApp postpaid plan, an innovative offer in partnership with the world’s most popular messaging service, and the new TIMmusic by Deezer service, just launched at the end of the year. We believe that such agility and innovation in the offers will continue to differentiate TIM, positioning it as one of the forefront players in the industry.

Turnaround of the Corporate segment

After a period of restructuring an repositioning of our fixed corporate operation, rebranded in 2014 as TIM Corporate Solutions, the fourth quarter results brought the confirmation of a significant improvement of both financial as well as operational metrics. The last quarter of the year presented revenue growth when compared to the same period in 2013, and signaled, together with a substantial increase in the rhythm of new sales, a turnaround to a new trajectory of performance from now on. Also important to highlight, starting in the second semester of 2014, the integration of the fixed and mobile services to large clients under the TIM Corporate Solutions umbrella, allowing for convergent offers and a greater competitiveness of our portfolio in the segment.

Financial Results and Profitability

Even though the total net revenues of the company have presented a slight reduction of around 2%, given primarily to the impact of the MTR and SMS reductions as previously mentioned, our main growth indicator, which is the Revenue Generated by our clients (excluding interconnection revenues), presented an excellent result of +6.3% compared with the year before. The transformation of our revenue profile, coupled with a disciplined and prudent cost management, allowed us to present an EBITDA growth of +6.4% in 2014, in addition to a Net Profit growth of +2.7%, indicating a strong resilience towards the challenges faced during the year. This same EBITDA growth, when free of the MTR reduction effects, would have been 13.5%. As an additional highlight, we should also mention the increase of the profitability of the operation, with the elevation of our EBITDA margin in the last quarter of 2014 to 30.1% over total revenues or 38.1% over service revenues, compared to 28.9% and 35.3% respectively in the same quarter in 2013.

Conclusion

In summary, even when still in face of a challenging scenario, I believe that TIM has once more demonstrated its enormous capacity of delivering results, based on its innovation in the development of new offers, on the intense investment in infrastructure and on our solid institutional positioning in search of industry leadership in the Brazilian telecommunications market.

During 2014, we again did not allow baseless rumors and speculation about the consolidation of the Brazilian market to distract us from our execution focus and our strategic plan. I am certain that we initiate 2015 stronger than ever, ready to keep growing and winning market share, and attentive to any strategic opportunity that may present itself, always based on the long-term commitment with the country and on a fantastic team of professionals, of which, without a question, I am very proud of being part of.

Rodrigo Abreu

CEO

MARKETING PROGRESS

TIM Controle WhatsApp

Following the increasing demand for mobile internet, TIM launched in 4Q a new and exclusive plan based on WhatsApp service. In Brazil, WhatsApp has been the most used messaging application. Introducing a unique concept in the market, the new offer allows customers to send unlimited text and voice messages, share photos and videos through the app not consuming users’ data package, which means the app can still be used even if the customer reaches its data plan cap. The price is R$29.90/month and additionally to unlimited WhatsApp usage, users will also have (i) 300MB of internet, (ii) unlimited SMS to all operators and (iii) R$10 of credit for additional services, including calls (on-net and off-net, which are charged in the same mechanics as Infinity Pré plan). Customers also have the option to add unlimited on net calls for an additional R$12/month. This is the first postpaid plan in the market that does not require hiring a voice package.

Internet sharing plans for multiples devices

This quarter, TIM continued to develop innovative products to boost data usage. In October, the Company launched a new offer that allows postpaid customers to connect up to four different devices (e.g.: smartphones, tablets and computers) with only one data package and no charge for additional chip. To ensure that customers have enough volume of data to use in all devices, TIM launched new data packages of 6GB, 10GB, 20GB and 50GB - on top of the current offers of 300MB, 600MB, 1GB and 3GB.

Handset Business

In November, TIM launched the iPhone 6 and iPhone 6 plus in its stores. The launch event happened in 11 stores across the country with free gifts and exclusive payment conditions. New clients were incentivized with progressive discounts (in accordance with the package of minutes hired) to buy the handset together with a Liberty plan and data package. All devices sold by TIM are unlocked and can be paid up to 12 installments using a credit card.

In the fourth quarter, TIM maintained the leadership position as the largest handset seller among the players in Brazil, with share of sales of 48%.

Live TIM: New fixed ultra broadband plan at 90Mbps

Live TIM launched a new fixed ultra broadband plan, offering 90Mbps speed for download and 30Mbps for upload. The plan is priced at R$139.90 per month and as a launch promotion during Black Friday it was sold for R$90,00 (R$1 per Mega). The plan includes a free of charge modem with Wi-Fi router, and has no loyalty clauses, membership fees or installation costs. The new option further expands Live TIM portfolio of speeds, which already includes 35Mbps (R$79.90/month), 50Mbps (R$99,90/month), 70Mbps (R$119,90/month) and 1Gbps (R$1,499/month). Services are available at the cities of São Paulo, Rio de Janeiro, Duque de Caxias and Nova Iguaçu. On quality indicator, Live TIM remained as top notch internet experience, according to Netflix index of speed.

OPERATIONAL PERFORMANCE

BRAZILIAN MARKET OVERVIEW

Brazilian mobile market reached 280.73 million lines by the end of 2014, representing a yearly growth of 3.6%, while penetration rate increased to 138.0%, from 134.3% in 2013. The reduction in pace for subscriber growth is a result of: i) already high penetrated market, customers using multiple SIM-cards and ii) a macroeconomic slowdown. Nonetheless, the mobile market growth is still supported by machine-to-machine business and migration from prepaid to postpaid segment, specially the hybrid plans also known as ‘Control Plan’.

In 4Q14, overall market net additions totaled 2.2 million lines, down by 20.6% when compared to the same period of last year, mainly due to a deceleration in December 2014 as a result of some companies clean-up process. Postpaid and prepaid segment performance follows bellow:

·

Postpaid segment reached 67.8 million lines in December (+13.9% versus Dec/13).

·

Prepaid segment reached 212.9 million lines (+0.6% YoY), accounting for 75.8% of total Brazilian market (vs. 78.0% in 2013).

For the full year of 2014, market net additions totaled 9.6 million, an increase of 3.7% versus 2013.

TIM’s PERFORMANCE

TIM’s subscriber base ended 2014 with 75.7 million lines, 3.1% up compared with the same period of last year. Market share stood fairly flat at 27.0% (versus 27.1% a year ago).

TIM total subscriber base with 3G devices ended 2014 with 37.5 million users, a sound increase of 58.9% against the same period of last year, and above total market growth of 52.7%. Market share in 3G reached 25.9% (vs. 24.9% in Dec/13).

As for the 4G subscriber base, TIM reached an important milestone of 2.0 million users by the end of December/14, an increase of 50.4% over September/14 base with a net add of 686k users in the quarter, an evidence that the Company’s strategy on 4G is paying off. Market share in 4G achieved 30.3% by the end of 4Q14 (vs. 29.3% in 3Q14).

Regarding gross additions figures for 2014, TIM registered 39.1 million new lines, almost flat compared to 39.6 million in 2013. Disconnections amounted 36.8 million lines in the period, also stable versus 36.6 million compared to the same period of last year. As a result, net additions totaled 2.3 million (vs. 3.1 million in 2013).

Gross additions in the quarter reached 10.6 million (+1.7% YoY), while disconnections decreased to 9.8 million (from 9.9 million in 4Q13). Churn rate in 4Q14 dropped to 13.0% from 13.6% in 4Q13.

Postpaid customer base reached 12.5 million users in December 2014, a 1.8% yearly growth. In the 4Q14, TIM added 263k users in the postpaid segment (vs. 346k net adds in the same period of last year). Technology breakdown is described as follow:

·

Voice and data (smartphones) postpaid users reached 11.2 million (+1.2% YoY)

·

Machine-to-machine business reached 1.3 million accesses (+8.1% YoY)

·

Mobile broadband (modems and tablets) reached 493 thousand accesses (-25.7% YoY)

As for the prepaid segment, TIM ended 2014 with 63.2 million users, up 3.4% YoY and above total market growth of 0.6% in the segment. In the quarter, TIM added 580k users (vs. 193k in 4Q13). “Infinity Pré” accounted for 60.4 million users or 95.5% of the prepaid customer base. TIM continues to lead the prepaid market in Brazil, due its innovative pioneering position and simple and transparent concepts.

Live TIM: Net adds speed-up

Live TIM finished 2014 with more than 130 thousand users (+117% YoY), adding approximately 11 thousand new clients in the fourth quarter and more 70 thousand clients in the whole year. Most of our customers are still on the 35Mbps offer, nevertheless, as our portfolio grows, we start seeing customers adhering to other speeds. As an example, the 90Mbps offer, launched in the 4Q14, showed a great success in client addition. Current average speed is at ~39Mbps per connection, way above market average of 2.9Mbps. It is worth mentioning that the good results achieved are based, mainly, on the quality of the service, which reflects customer’s satisfaction level as above market’s average.

At the end of 2014, Live TIM had 25.5 thousand buildings connected (vs. 9.6 thousand in 4Q13), pointing to an addressable market of over 1.5 million households in São Paulo and Rio de Janeiro regions. Prospect clients registered in Live TIM´s website reached more than 858k (vs. 523k in 4Q13).

QUALITY AND NETWORK

QUALITTY DEVELOPMENTS

As for network quality KPI’s, we will be showing this quarter voice and data indicators evolution through 2014. Figures until April/14 are the official data disclosed by Anatel, after that month, numbers are internal estimates. In the course of 2014, all metrics shown below stood within the agency’s target, with significant quality improvements in the Drop Data Connection (3G) and Voice Accessibility indicators.

As for caring quality indicators, TIM’s group (mobile and fixed) kept its position of being the least demanded group at the consumer’s protection agencies (PROCON - SINDEC1), with a volume of demands 55% lower than the market’s average in the year.

Through 2014, TIM continued to move forward with its Quality Plan, showing relevant improvements in complaints at Anatel.

In 2014, total voice network complaints at Anatel (network repair + call completion) posted a significant reduction of 27% when compared to last year. Additionally, total complaints at Anatel associated with data usage2 fell 11% YoY.

NETWORK EVOLUTION

As for network evolution, more than 2.3k TRXs (elements for voice), coupled with close to 131k data channel elements and 2.5k km of optical fiber were implemented in the fourth quarter. In the full year analysis almost 8.6K TRXs, 371K data channel elements and 7.2k km of optical fiber were installed. The elements implementation roll out along with other network prospects – such as sites densification, Wi-Fi and small cell expansion, backhauling infrastructure development, cell-site fine tuning and others – are allowing the Company to keep improving its network quality.

TIM Wi-Fi project kept its good pace. The company added 317 new hotspots in the fourth quarter, totaling the year of 2014 with 655 new hotspots. Comparing with 2013, the number of hotspots increased 92%. Also, TIM Wi-Fi is available in 22 airports of 15 states.

In 2014, Mobile BroadBand (MBB) added 86 new cities, reaching a total of 125 cities in the year and exceeding its goal of deploying 100 cities. In the quarter, 5 new cities were added to the plan.

Cities that have completed the MBB implementation reached a remarkable average throughput gain, which proves the efficient approach used by the project, tackling Access (HSPA+ and dual carrier), Transport (backhaul and backbone using FTTS and high capacity microwave links), and IP-Core (caching, peering and transit).

GSM coverage totaled 94.9% of the urban population in the fourth quarter of 2014, serving 3,433 cities. 3G coverage reached 88 new cities in 4Q14, serving 1,336 cities or 79.4% of the urban population in Brazil. TIM executed an excellent implementation plan during 2014, increasing the number of covered cities and will keep the pace to increase the 3G coverage in 2015. As for the 4G, TIM already covers 35.6% of the Brazilian urban population, stable when compared to the 3Q14.

CORPORATE SOCIAL RESPONSIBILITY

TIM Institute closed 2014 with 80,000 people benefited by its projects throughout Brazil. The Institute, whose mission is to create and enhance resources for the democratization of science, technology, and innovation in Brazil, continues, in 2015, with upwards of ten initiatives underway, all guided by four principles: education, technology applications, inclusion, and work.

The partnership with the “Círculo de Matemática do Brasil” project (“The Math Circle”) to develop a learning program on public schools achieved more than 14,000 classes in 2014. Classes were held in public schools in São Paulo, Rio de Janeiro, Duque de Caxias, Brasília, Porto Alegre, Salvador, Fortaleza, Aracaju, Belém and Porto Velho, benefiting about 8,000 students. The project is expected to reach even more students in 2015.

TIM Makes Science program also attained positive results. Created with the goal of bringing to the classrooms resources and materials to enable teachers to discuss the main intellectual challenges involved in the production of scientific knowledge, the action reached 251 municipalities, benefiting about 70,000 students and empowering more than 2,000 teachers. In 2015, the program's target is to involve 100,000 students.

In addition to the progress made by the existing initiatives, the TIM Institute foresees novelties for the coming months. Among the main ones is the Academic Working Capital project, which will support Exact Science students from partner universities in their final course projects, resulting in the creation of prototype products that are commercially viable. The Institute will also expand its partnership with the Brazilian Public School Mathematical Olympiad (OBMEP) by funding 50 scholarships for medal-winning students who choose college courses in the Exact Sciences.

RELEVANT EVENTS IN 2014

4G AUCTION

On September 30, 2014, TIM Celular participated in the auction of the 700MHz band for expansion of mobile 4th Generation LTE technology, finishing it as the winner of Lot 2, composed of (10 + 10) MHz. The license is valid for a period of 15 years, renewable for another 15 years. Our winning bid price for the band was R$1,947 million (1% premium over the minimum price of R$1,927 million). The auction also includes the reimbursement obligation for the eviction of the frequencies owned by broadcasting, that will be divided by the winning bidders. The amount was adjusted from R$904 million to R$1,199 million due to the fact that two lots had no bidders. Such amount will be paid in four installments: 30% in April 2015, 30% in January 2016, 30% in January 2017 and 10% in January 2018, adjusted by the IGP-DI index as provided in the Notice, to an entity named EAD (Especial Purpose Entity), that will be formed by the winning companies, broadcasters and government until March 2015.

The additional payment of R$295 million for the EAD, however, should have its public price recalculated to present value and discounted from the bid price, according to the Auction notice. In that case, the discount for the national lots would be R$268 million, resulting in R$1,678 million as the final value of the public price to be paid by the Company. As the methodology adopted by the Agency differs from ours, it generated a recalculation of the minimum price, setting the final price at R$1,739 million. Because of this divergence, administrative appeals were presented by each winning bidder before ANATEL. The appeals were dismissed and TIM will file litigation against the payment of R$61 million (currently booked as debt), considered undue.

TIM Celular, after disbursement of R$1,678 million to the Agency, signed the Authorization Form on December 5, 2014, published in the Brazilian Official Gazette on December 8, 2014.

FINANCIAL PERFORMANCE

OPERATING REVENUES

Gross revenues totaled R$29,005 million in 2014 (-2.2% YoY), impacted by a strong MTR cut and SMS usage drop (Interconnection Revenues fell 30.0% YoY) and voice traffic reduction. The latter was driven by macroeconomic slowdown and migration of usage to data. In this context, it is important to highlight VAS performance, growing 23.6% in the year and contributing to a “Business generated” (outgoing voice + data usage + other) evolution of +3.8% YoY, a clear evidence of company’s resilience.

In the quarter, total gross revenues reached R$7,571 million (-1.5% YoY), impacted by the MTR cut and reduction in SMS usage (interconnection revenues fell -33.9% YoY). ‘Business generated’ performance came at +1.8% YoY.

Gross revenues breakdown and other highlights are presented as follows:

FY2014 Mobile usage and monthly fee gross revenues reached R$11,007 million, -2.7% YoY impacted by a reduction in usage as a consequence of macroeconomic slowdown and migration from voice to data services. In the quarter, mobile usage and monthly fees came at R$ 2,716 million (-8.1% YoY).

Value Added Services (VAS) gross revenues totaled R$6,616 million in 2014, another year with a solid double digit growth of 23.6% when compared to 2013. In the quarter, VAS gross revenues totaled R$1,862 million, accelerating to 28.1% YoY. Strong adoption of new data plans such as Controle WhatsApp and successful launch of new VAS offers were the drivers for such performance. Data users have reached 45% of our total base (vs. 36% in 4Q13), totaling 33.8 million lines.

As percentage of mobile gross service revenues, VAS reached 31% in 4Q14 up from 23% in 4Q13. In the 2014 full year perspective, 28% of mobile gross revenue was represented by VAS vs. 22% in 2013.

Long distance gross revenues came at R$3,094 million in 2014, a drop of 7.2% YoY, mainly due to the LD traffic reduction, especially in the end of the year. This result confirms the commoditization process of this service and depicts a customer trend of switching long distance calls for new technologies based on data (e.g. WhatsApp). As for the 4Q14, Long distance gross revenues reached R$747 million.

Interconnection gross revenues in 2014 dropped 30.0% YoY to R$2,631 million, due to the impact of MTR cut during the year and the reduction of incoming SMS revenue. As for the 4Q14 interconnection gross revenues dropped 33.9% YoY.

Fixed business gross revenues closed the year at R$901 million. In 4Q14, this revenue stream totaled R$226 million (-4.2 YoY), showing a strong recovery in the decline pace compared to previous quarters. This performance is a result of the corporate business restructuring process, as well as Live TIM increasing importance in the fixed revenue segment.

Product gross revenues closed the year at R$4,471 million (-2.7% YoY), impacted by a reduced volume of handsets sold (11.9 mln units in 2014 vs 12.5 mln units in 2013), amid a better device mix that pushed average prices up. In 4Q14, gross revenues from products’ sales grew 10% YoY, reaching R$1,314 million. This performance is mainly explained by a change in the volume trend boosted by a strong performance during Christmas campaign and maintenance of an improving mix. Volume in 4Q14 reached 3.4 million units, up by 6.3% when compared to 4Q13 (3.2 million units).

As a result, Total Net Revenues reached R$19,498 (-2.1% YoY) in 2014 and R$5,168 million in 4Q14 (-0.3% YoY). 2014 total net services revenues reached R$16,325 million (-2.3% YoY), and 4Q14 total net services revenues came at R$4,196 million (-3.4% YoY).

For a better understanding of business operational performance, excluding MTR cuts effects, total net services revenues in this quarter would have increased +0.5%, totaling R$4,363 million and in a full year perspective would have increased 1.7% totaling R$16,985 million.

Despite the MTR impact on total net services revenues, as shown above, the magnitude of this regulatory measure have been decreasing significantly, as our exposure is achieving its lowest level, at approximately 12%.

ARPU (average revenue per user) reached R$18 in 4Q14, down -6.3% YoY, largely impacted by MTR cut aforesaid. However, “business generated” performance partially offset the MTR cut. ARPU ex-MTR impact would have fallen 2.5% YoY.

MOU (minutes of use) reached 136 minutes in 2014, down 8.1% when compared to 2013, mainly due to the reduction on the outgoing traffic that shows the tendency of customers to change voice for new technologies related to data. As for the 4Q14, MOU achieved 130 minutes, down 12.5% YoY when compared to 4Q13.

OPERATING COSTS AND EXPENSES

In 2014, Operating Costs and Expenses totaled R$13,960 million, a decrease of 5.1% YoY, mostly explained by a strong saving of network & interconnection costs (-18.7% YoY). In the quarter, operating expenses reached R$3,610 million, a decrease of 2.0% YoY also due to network & interconnection costs, which more than compensated higher handset costs (+15.6% YoY), following an increase in the volume of devices sold (3.4k in 4Q14 vs. 3.2k in 4Q13). Excluding handset costs in Q4, total operating expenses were down by 6.5% YoY.

Operating expenses breakdown in 2014 is presented as follows:

In 2014, Personnel Expenses reached R$963 million, up 15.7% YoY. In 4Q14, personnel expenses reached R$256 million (+17.1% YoY). Both variations are mainly driven by an increase in the total number of employees, reaching 12,860 people in the 2014, up by 5.7% or 693 people when compared to 2013. Network expansion and insource program, together with owned stores growth (to 173 in 4Q14 from 163 in 4Q13) were the main drivers for hiring in the period. Also, the Company adjusted salaries near to inflation on top of others benefits adjustments.

For FY2014, Selling & Marketing expenses amounted to R$3,991 million, an increase of 1.3% versus last year, due to higher expenditures on commissioning and rental expenses as a result of owned stores growth. In the quarter, selling & marketing expenses reached R$962 million, down by 2.1% YoY chiefly due to a decrease in advertising and billing costs in 4Q14, which more than compensated higher FISTEL taxes.

In 2014, Network & Interconnection costs reached R$4,318 million, a sound reduction of 18.7% over 2013. In the quarter, network & interconnection costs came at R$1,047 million (-19.1% YoY). The performance of this line is still heavly driven by MTR cut, voice and SMS off-net traffic reduction, on top of leased lines’ cost savings.

In 2014, General & Administrative expenses (G&A) amounted to R$670 million, an increase of 7.3% YoY, mainly due to expenses on legal advisory services related to the tower sale process. In the quarter, G&A totaled R$175 million, an increase of 10.6% YoY mainly driven by higher maintenance costs.

For FY2014, Cost of Goods Sold reached R$3,340 million, almost flat compared to 2013 due to a better device mix, concentrated in smartphones and tablets, which offsetted a lower volume of handsets sold (-4.5% YoY). In the quarter, handset costs amounted R$1,013 million (+15.6% YoY) as a result of higher volume of handsets sold during Christmas campaign and maintenance of an improving mix. It’s worth highlighting that handset margin posted a slight improvement in the quarter when compared to 4Q13, with revenue growth of 10.0% YoY coupled with an increase in the average handset price.

In 2014, Bad Debt expenses amounted R$249 million, a 3.6% increase when compared to 2013, a good performance considering a tougher macroeconomic scenario this year, as the number of indebted families remains high and consumers default levels have accelerated when compared to 2013, on top an increase in the postpaid base. In the quarter, bad debt fell by 15.7% YoY due to the seasonal effect and our austere control policy, reaching R$37 million. As a percentage of gross revenues, bad debt reached 0.49% in 4Q14 (vs. 0.57% in 4Q13), the lowest level ever reached.

For FY2014, Other operational expenses totaled R$429 million in 2014, an increase of 3.0% YoY mainly due to higher costs on FUST/FUNTTEL taxes. In Q4, other operational expenses reached R$120 million, up by 8.2% YoY.

Subscriber Acquisition Costs (where SAC = subsidy + commissioning + total advertising expenses) came at R$27.4 per gross adds in 2014, a decrease of 0.9% YoY, while in the quarter, SAC reached R$20.6 per gross adds, down by 15.0% YoY, as a result of lower commissioning expenses due to a weaker performance of the pure postpaid gross additions. SAC/ARPU ratio (indicating the payback per customer) remained flat at 1.5x in 2014 when compared to 2013.

EBITDA

In 2014, EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) totaled R$5,538 million, a solid increase of 6.4% when compared to R$5,207 million last year. In 4Q14, EBITDA reached R$1,558 million, 4.0% higher compared to 4Q13. Improving EBITDA performance has been supported, throughout the year, by a better contribution margin3 (+5.1% YoY) as value added services continue to play a key role, along with a lower off-net traffic cost for voice and SMS and savings on network cost.

In 2014, EBITDA margin also showed once again a significant improvement of 227bps, reaching 28.4% vs. 26.1% in 2013. As for the quarter analysis, EBITDA margin came at 30.1%, higher than 28.9% in 4Q13.

EBITDA margin on services (excluding handset revenues and costs) came at 34.9% in 2014, up by 299bps when compared to 32.0% in 2013. In 4Q14, EBITDA margin on services reached historical 38.1%, up by 403bps when compared to the same period of last year, 35.3%.

Excluding MTR cut impact, EBITDA would have been R$5,910 million in 2014, up 13.5% when compared to 2013. In Q4, EBITDA excluding MTR cut impact would have reached R$1,655 million, representing a 10.4% yearly growth. It is also important to highlight that EBITDA exposure to the MTR effects have been constantly dropping, renewing its lowest level of 18% of EBITDA this quarter.

EBIT

In 2014, EBIT (earnings before interest and taxes) totaled R$2,486 million, representing an increase of 1.9% when compared to 2013 and EBIT margin at 12.7% (vs. 12.2% in 2013). In the 4Q14 analysis, EBIT reached R$756 million, -2.6% YoY, with EBIT margin at 15% almost stable vs. 4Q13.

In 2014, Depreciation and Amortization totaled R$3,053 million, up 10.3% YoY versus 2013. As for the 4Q14, depreciation and amortization amounted R$803 million, 11.0% higher when compared to the same period of last year. The quarterly and annually upward trend is explained by an increase in depreciation and amortization of network equipment as investments towards infrastructure are growing continuously.

NET FINANCIAL RESULT

In 2014, Net financial result came at -R$293 million, a reduction of 3.3% vs. -R$303 million in 2013, due to higher Financial Revenues (R$702 million, +55.6% YoY), largely impacted by higher interest on cash position. This performance more than offsetted higher Financial Expenses (R$997 million, +33% YoY), as a consequence of an increase in monetary adjustments and interest on loans. In 4Q14, net financial result came at -R$110 million or +9.3% YoY.

INCOME AND SOCIAL CONTRIBUTION TAXES

In 2014, Income and Social Contribution taxes came at R$646 million, fairly stable when compared to R$631 million in 2013. Annual effective tax rate stood flat at 29.5% when compared to 2013. Considering only 4Q14, Income Tax came at R$185 million and 5.2% higher than 4Q13.

NET INCOME

In 2014, Net Income totaled R$1,546 million, an increase of 2.7% YoY. In 4Q14, net income totaled R$460 million (-7.7% YoY). Annual EPS (Earnings per Share) reached R$0.64 (vs. R$0.62 in 2013).

CAPEX

In 2014, Organic Capex (excluding the 700MHz frequency acquisition and LT Amazonas leasing effect) reached R$3,928 million, a yearly increase of 10.3%. In the quarter, Organic Capex amounted to R$1,315 million, up 26.1% when compared to 4Q13, due to higher investments in network aiming to improve availability and quality of services.

This year, Capex was impacted by the 4G auction for the 700MHz band which totaled R$2,923 million in 4Q14. This amount is composed by R$1,740 million related to the license acquisition and R$1,183 million related to the spectrum cleanup adjusted cost4. Considering the 700MHz band acquisition and LT Amazonas Leasing, Capex in 2014 amounted to R$6,854 million (versus R$3,871 million in 2013), while in the quarter Capex totaled R$4,237 million (compared to R$1,102 in 4Q13).

It’s worth highlighting that more than 93% of the total Organic Capex in 2014 has been dedicated to infrastructure, largely related to 3G and 4G technologies.

DEBT, CASH AND FREE CASH FLOW

Gross Debt reached R$6,507 million in the end of 2014, including the first disbursement in 2Q14 of R$1,749 million by BNDES to help financing CAPEX 2014-15.

Company's debt is concentrated in long-term contracts (80% of the total) composed mainly by financing from BNDES (Brazilian Economic and Social Development Bank) and EIB (European Investment Bank), as well as borrowings from other top local and international financial institutions.

Approximately 35% of total debt is denominated in foreign currency (USD), and it is 100% hedged in local currency. In 2014, average cost of debt was 9.48% compared to 7.90% in 2013. As for the quarter, average cost of debt was 9.78% compared to 8.58% in 4Q13. Nevertheless, the increase in cost of debt was more than offsetted by a higher cash yield in both periods.

Cash and Cash equivalents totaled R$5,233 million by the end of 2014, almost stable vs. R$5,288 in 2013. While the first disbursement from BNDES aforesaid helped increase cash, the R$1,678 million payment of the 700MHz frequency acquisition made in Dec/14 off set it. Average cash yield reached 10.88% in 2014 (compared to 8.08% in 2013). Considering 4Q14, the average cash yield was 11.25% compared to 9.50% in 4Q13.

Considering the last 12 months EBITDA, Net Debt/EBITDA ratio stood at 0.23x in 2014 compared to -0.08x in 2013. Due to the 700MHz frequency payment aforesaid, net debt increased from -R$421 million in 2013 to R$1,274 million by the end of 2014.

Reported Operating Free Cash Flow came at -R$45 million in 2014 and -R$320 million in 4Q14, impacted by R$2,923 million from 700MHz auction, partially compensated by R$1,2425 million not yet paid (booked in accounts payable).

Consequently, Reported Net Cash Flow in 2014 totaled -R$1,695 million and -R$483 million in the fourth quarter of 2014.

If we were to adjust the Operating Free Cash Flow by the one off events related to 700MHz auction and LT Amazonas leasing, Organic Operating Free Cash Flow would have been R$1,514 million in 2014, versus R$2,545 million in 2013, due to higher organic capex and a reduction in the growth pace of the accounts payable. In the quarter, Organic Operating Free Cash Flow would have been R$1,422 million compared to R$2,130 million in 4Q13.

STOCK PERFORMANCE

TIM Participações's common stocks are traded on BM&FBOVESPA under the ticker TIMP3 and ADRs are traded on NYSE under the ticker TSU.

TIMP3 ended 2014 at R$11.78, down by 4.5% when compared to the end of 2013. Bovespa Index (Ibovespa) fell 2.9% over 2013. The Company's ADRs closed 2014 at US$22.21, a decrease of 15.4% over US$26.24 in the end of 2013 (Brazilian reais depreciated by 13.4% in 2014 vs. 2013).

DIVIDENDS

Management proposed to the Board of Directors the distribution of R$367 million of dividends, an increase of 2.7% versus R$358 million in 2013, excluding complementary dividends of R$486 million in 2013. The amount to be distributed is equivalent to R$0.15 per common share and R$0.76 per ADR (1 ON = 5 ADR). After analysis by the Board of Directors, the proposal will be submitted to the Company’s annual shareholders’ meeting to be held on April of 2015.

OWNERSHIP BREAKDOWN

ABOUT TIM PARTICIPAÇÕES S.A.

TIM Participações S.A. is a holding Company that provides telecommunication services all across Brazil through its subsidiaries, TIM Celular S.A. and Intelig Telecomunicações LTDA. TIM Participações is a subsidiary of TIM Brasil Serviços e Participações S.A., a Telecom Italia group Company. TIM launched its operations in Brazil in 1998 and consolidated its nationwide footprint in 2002, thus becoming the first wireless operator to be present in all of Brazilians states.

TIM provides mobile, fixed and long distance telephony as well as data transmission services, with the focus on quality of the services offered to clients. As of Dec’14, TIM has a nationwide reach of approximately 95% of the urban population, with presence in 3,433 cities. TIM also provides extensive data coverage services in the country, based on a Third Generation (3G) network serving 79% of the country’s urban population, in addition to a fast growing, state of the art Fourth Generation (4G) network. The Company has 450 network agreements available for international roaming of TIM clients in more than 200 countries across six continents.

The TIM brand is strongly associated with innovation and quality. During its presence in the country, it has become the pioneer in a diversity of products and services, such as MMS and Blackberry in Brazil. Continuing this trend, it renewed the portfolio in 2009 to position itself as the operator that devises “Plans and Promotions that Revolutionize”. It launched two families of plans – ‘Infinity’ and ‘Liberty’. The new portfolio is based on an innovative concept, with a great deal of incentive to use (billing by call, billing by day, unlimited use) and constantly explores the concept of TIM community, with 75.7 million lines in Brazil. This innovation continued with the introduction of pre-paid data plans, Liberty Controle plans and several Value Added Service offers in content and applications, such as TIMmusic, TIMprotect and TIM Controle Whatsapp.

- Consolidated company with a nationwide footprint since 2002

- Network: excellent coverage and quality in 2G, 3G and 4G

- Innovative offers: new concepts leveraging TIM community

- Brand: associated to innovation

- Sustainability: Maintained in ISE index for 2015/2016

- Is listed in Novo Mercado since August 2011

In December 2009, the Company concluded the merger of 100% of Intelig, which provides fixed, long distance and data transmission services in Brazil. This merger supports the expansion of TIM´s infrastructure, a combination that allows to speed up the development of the 3G and 4G networks, to optimize the cost of renting facilities, and also to improve our competitive positioning in the telecom market.

In accordance with our commercial strategy of expansion of activities and strengthening of the Company’s infrastructure, its wholly-owned subsidiary TIM Celular acquired TIM Fiber RJ and SP, both merged into TIM Celular in 2012. Both Companies are providers of infrastructure and solutions to high performance communications, which serve the main municipalities of the metropolitan areas of the States of Rio de Janeiro and São Paulo, encompassing a potential market of approximately 8.5 million homes and more than 550 thousand companies in 21 cities, through an optical fiber network of 5.5 thousand kilometers, which today supports the fast expansion of our Mobile Broadband infrastructure in those two cities, in addition to the vast construction of our own fiber network in all of the key cities in Brazil as we expand our Mobile Broadband offers. In September 2014, TIM has also become one of the winners of the most recent 4G spectrum auction carried out by Anatel for the 700MHz frequency band, securing its future as a key player in mobile data in the country.

TIM Participações is a publicly-held Company, whose share are listed on the São Paulo Stock Exchange (BM&FBOVESPA) and ADRs (American Depositary Receipts) are listed on the New York Stock Exchange (NYSE). TIM is also included in a selective group of companies of the Corporate Sustainability Index (ISE) and the only telecom Company in Novo Mercado segment of BM&FBOVESPA.

DISCLAIMER

This document may contain forward-looking statements. Such statements are not statements of historical fact and reflect the beliefs and expectations of the Company's management. The words "anticipates”, "believes”, "estimates”, "expects”, "forecasts”, "plans”, "predicts”, "projects”, "targets" and similar words are intended to identify these statements, which necessarily involve known and unknown risks and uncertainties foreseen, or not, by the Company. Therefore, the Company’s future operating results may differ from current expectations and readers of this release should not base their assumptions exclusively on the information given herein. Forward-looking statements only reflect opinions on the date on which they are made and the Company is not obliged to update them in light of new information or future developments.

ATTACHMENTS

Attachment 1:

Balance Sheet

Attachment 2: Income Statements

Attachment 3:

Cash Flow Statements

Attachment 4:

Operational Indicators

The Complete Financial Statements, including Explanatory Notes, are available at the Company’s Investor Relations Website: www.tim.com.br/ir.

Attachment 1

TIM PARTICIPAÇÕES S.A.

Balance Sheet

(R$ Thousands)

Attachment 2

TIM PARTICIPAÇÕES S.A.

Income Statements

(R$ Thousands)

Attachment 3

TIM PARTICIPAÇÕES S.A.

Cash Flow Statements

(R$ Thousands)

Attachment 4

TIM PARTICIPAÇÕES S.A.

Operational Indicators

Footnotes

1 SINDEC is the National Information System of Consumer Protection, which integrates 360 agencies (PROCONs). It is estimated that these PROCONs represent 43% of total demands in Brazil. Figures consider both mobile and fixed business.

2 The concept of data complaints at Anatel is estimated by TIM and is composed by a subset of Additional Services complaint group.

3 Contribution Margin = Net service revenues - Interconnection

4 Cleanup adjusted costs consider NPV of principal value plus monetary adjustments and insurance.

5 700MHz auction effect in the accounts payable is composed by NPV of clean up cost + warranty insurance + monetary adjustments.

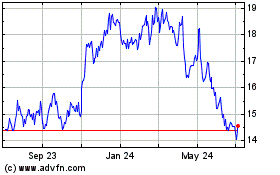

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

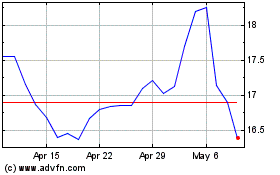

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024