ASML Paying $3.09 Billion to Buy Taiwan Chip-Tech Firm Hermes Microvision

June 16 2016 - 10:40AM

Dow Jones News

ASML Holding NV has agreed to buy Taiwan-based Hermes

Microvision Inc. for about US$3.09 billion, the latest in a string

of deals in the global semiconductor industry.

ASML will pay 1,410 New Taiwan Dollars per share for Hermes

Microvision, representing a 31% premium on the company's average

share price over the past 30 days. The acquisition will be financed

by debt, stock and cash and is expected to close before the end of

the year.

ASML, based in Veldhoven, the Netherlands, is the world's

largest manufacturer by sales of lithography systems, which are

used to print circuit patterns on silicon wafers. Hermes

Microvision specializes in making pattern verification systems for

semiconductor devices.

ASML had sales of €6.3 billion ($7.1 billion) in 2015, while

Hermes Microvision recorded €182 million in revenue.

The semiconductor industry has experienced a wave of

consolidation in the past two years as chip-makers and their

suppliers look to build scale in response to slowing growth and

rising costs. Last year alone, chip companies announced more than

$100 billion in mergers and acquisitions, according to

Dealogic.

ASML said the industry is seeking to develop ever-smaller and

more complex chips and that its acquisition of Hermes Microvision

could make it easier to address these challenges. The tie-up will

enable the companies to accelerate their product integration,

helping the industry to boost production of the most advanced

microchips, it said.

"Our two companies have worked together for almost two years to

see how we could best combine our capabilities, and found that we

could significantly improve this constructive cooperation and

better serve our customer by teaming up as one company," said ASML

Chief Executive Peter Wennink.

ASML plays an important role in the global semiconductor market

as the leading supplier of the equipment needed to produce chips

for everything from smartphones to computers. Its biggest clients

are Intel Corp., Taiwan Semiconductor Manufacturing Co. and Samsung

Electronics Co., who together invested billions of dollars in the

company in 2012 to speed up development of so-called extreme

ultraviolet lithography machines, or EUV.

The EUV technology, which had a breakthrough last year, can

produce smaller and more powerful chips but its development has

been costly and complex. ASML said the acquisition of Hermes

Microvision could also support its EUV systems, which are scheduled

to begin with volume production in 2018.

Bryan Garnier analysts welcomed the deal but said the

acquisition "doesn't change our view that the timing of adoption of

EUV is under pressure given the current tough environment in the

semiconductor market."

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com and

Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

June 16, 2016 10:25 ET (14:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

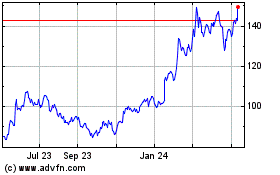

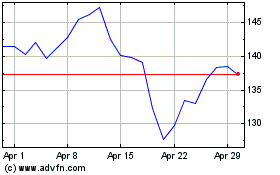

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024