Report of Foreign Issuer (6-k)

April 14 2016 - 6:16AM

Edgar (US Regulatory)

1934 Act Registration No. 1-14700

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2016

Taiwan

Semiconductor Manufacturing Company Ltd.

(Translation of Registrant’s Name Into English)

No. 8, Li-Hsin Rd. 6,

Hsinchu Science Park,

Taiwan

(Address of

Principal Executive Offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form

20-F

x

Form 40-F

¨

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes

¨

No

x

(If “Yes” is marked, indicated below the file number assigned to the registrant

in connection with Rule 12g3-2(b): 82: .)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Company Ltd.

|

|

|

|

|

|

Date : April 14, 2016

|

|

By

|

|

/s/ Lora Ho

|

|

|

|

|

|

Lora Ho

|

|

|

|

|

|

Senior Vice President & Chief Financial Officer

|

TSMC Reports First Quarter EPS of NT$2.50

Hsinchu, Taiwan, R.O.C., April 14, 2016 —

TSMC today announced consolidated revenue of NT$203.50 billion, net income of NT$64.78 billion, and

diluted earnings per share of NT$2.50 (US$0.38 per ADR unit) for the first quarter ended March 31, 2016.

Year-over-year, first quarter revenue decreased

8.3% while net income and diluted EPS both decreased 18.0%. Compared to fourth quarter 2015, first quarter results represent essentially flat revenue, and an 11.1% decrease in net income. All figures were prepared in accordance with TIFRS on a

consolidated basis.

In US dollars, first quarter revenue was $6.14 billion, which decreased 1.6% from previous quarter and decreased 12.8%

year-over-year.

Gross margin for the quarter was 44.9%, operating margin was 34.6%, and net profit margin was 31.8%. The February 6, 2016 earthquake

negatively impacted TSMC’s gross margin by 2.2 percentage points and operating margin by 2.4 percentage points.

Shipments of 16/20-nanometer

accounted for 23% of wafer revenues, and 28-nanometer process technology accounted for 30% of total wafer revenues. Advanced technologies, defined as 28-nanometer and more advanced technologies, accounted for 53% of total wafer revenues.

“Although the February 6 earthquake caused some delay in wafer shipments in the first quarter, we saw business upside resulting from demand

increases in mid- and low-end smartphone segments and customer inventory restocking,” said Lora Ho, SVP and Chief Financial Officer of TSMC. “We expect our business in the second quarter will benefit from continued inventory restocking and

recovery of the delayed shipments from the earthquake. Based on our current business outlook and exchange rate assumption of 1 US dollar to 32.3 NT dollars, management expects overall performance for second quarter 2016 to be as follows”:

|

|

•

|

|

Revenue is expected to be between NT$215 billion and NT$218 billion;

|

|

|

•

|

|

Gross profit margin is expected to be between 49% and 51%;

|

|

|

•

|

|

Operating profit margin is expected to be between 38.5% and 40.5%.

|

TSMC’s 2016 first quarter consolidated results :

(Unit: NT$ million, except for EPS)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Q16

Amount

a

|

|

|

1Q15

Amount

|

|

|

YoY

Inc. (Dec.)

%

|

|

|

4Q15

Amount

|

|

|

QoQ

Inc. (Dec.)

%

|

|

|

Net sales

|

|

|

203,495

|

|

|

|

222,034

|

|

|

|

(8.3

|

)

|

|

|

203,518

|

|

|

|

(0.0

|

)

|

|

Gross profit

|

|

|

91,338

|

|

|

|

109,429

|

|

|

|

(16.5

|

)

|

|

|

98,925

|

|

|

|

(7.7

|

)

|

|

Income from operations

|

|

|

70,467

|

|

|

|

86,626

|

|

|

|

(18.7

|

)

|

|

|

77,964

|

|

|

|

(9.6

|

)

|

|

Income before tax

|

|

|

72,256

|

|

|

|

88,259

|

|

|

|

(18.1

|

)

|

|

|

80,644

|

|

|

|

(10.4

|

)

|

|

Net income

|

|

|

64,782

|

|

|

|

78,990

|

|

|

|

(18.0

|

)

|

|

|

72,837

|

|

|

|

(11.1

|

)

|

|

EPS (NT$)

|

|

|

2.50

|

b

|

|

|

3.05

|

b

|

|

|

(18.0

|

)

|

|

|

2.81

|

b

|

|

|

(11.1

|

)

|

|

a:

|

1Q2016 figures have not been approved by Board of Directors

|

|

b:

|

Based on 25,930 million weighted average outstanding shares

|

About TSMC

TSMC is the world’s largest dedicated semiconductor foundry, providing the industry’s leading process technology and the foundry’s largest

portfolio of process-proven libraries, IPs, design tools and reference flows. The Company’s owned capacity in 2016 is expected to reach about 10 million (12-inch equivalent) wafers, including capacity from three advanced 12-inch GIGAFAB™

facilities, four eight-inch fabs, one six-inch fab, as well as TSMC’s wholly owned subsidiaries, WaferTech and TSMC China. TSMC is the first foundry to provide both 20nm and 16nm production capabilities. Its corporate headquarters are in

Hsinchu, Taiwan. For more information about TSMC please visit

http://www.tsmc.com

.

# # #

|

|

|

|

|

|

|

|

|

TSMC Spokesperson:

|

|

TSMC Acting Spokesperson:

|

|

For Further Information:

|

|

|

|

|

|

|

|

|

Lora Ho

Senior VP & CFO

Tel: 886-3-505-4602

|

|

Elizabeth Sun

Senior Director

Corporate Communication Division

Tel: 886-3-568-2085

Mobile: 886-988-937-999

E-Mail: elizabeth_sun@tsmc.com

|

|

Michael Kramer

Project Manager

Tel: 886-3-563-6688

Ext. 7125031

Mobile: 886-988-931-352

E-Mail: pdkramer@tsmc.com

|

|

Hui-Chung Su

Administrator

PR Department

Tel: 886-3-563-6688

Ext. 7125033

Mobile: 886-988-930-039

E-Mail: hcsuq@tsmc.com

|

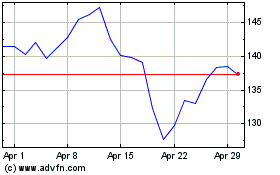

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

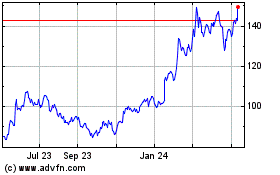

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024