Apple's Slowing iPhone Sales Take Bite Out of Suppliers' Revenue

January 14 2016 - 7:47AM

Dow Jones News

By Eva Dou

TAIPEI--Companies that make parts for Apple Inc. are warning of

lower first-half revenues, in a sign of slowing sales of the latest

iPhones.

Taiwan Semiconductor Manufacturing Co., which manufactures the

chips that run iPhones and other popular electronic devices,

forecast Thursday its first-quarter revenue would decline by as

much as 10.8% from the previous year, citing demand weakness for

high-end smartphones.

Apple components contribute 20% of sales for TSMC, the world's

largest contract chip maker, according to a Credit Suisse

report.

Largan Precision Co., which supplies iPhone camera modules, said

it expected "quite a weak" first quarter, while Catcher Technology

Co., a maker of iPhone metal casings, said its revenue for the

first half would be flat from a year earlier.

Samsung Electronics Co., which also supplies the computing

brains in smartphones, known as processors, earlier this month said

it expects competition will intensify this year for all of

Samsung's main products including memory chips. In addition to

supplying components to Apple, Samsung competes with the Cupertino,

Calif.-based company in selling smartphones.

The first half of the year is traditionally a slow season for

Apple's supply chain and the broader gadget industry. But this

year's slowdown is likely to be more pronounced, with sluggish

sales of the iPhone 6S and iPhone 6 Plus launched last fall,

compared with the booming popularity of the iPhone 6 in 2014, said

people familiar with iPhone production.

Apple has cut its order forecasts to iPhone suppliers in the

past few months, The Wall Street Journal reported last week.

Such concerns have pushed Apple's stock price below $100 for the

first time in 15 months and hit stocks of iPhone suppliers.

"We see a reduction in high-end smartphone demand," said Mark

Liu, one of TSMC's co-chief executives, at an investor conference

Thursday, without mentioning specific customers. He said China and

other emerging markets, however, were showing "signs of recovery"

and that TSMC expected to return to growth after the first

quarter.

TSMC forecast revenue of between 198 billion New Taiwan dollars

(US$5.93 billion) and NT$201 billion in the first quarter, down

9.5% to 10.8% from a year earlier and 1.2% to 2.7% lower from the

fourth quarter. Still, the company said it expected to boost

capital expenditure this year by 10% to 20% to between $9 billion

and $10 billion.

Mr. Liu said TSMC expected the global smartphone market to hold

up better than other electronics segments in 2016. TSMC forecast 8%

growth in global smartphone-unit shipments this year, versus 3% and

7% declines for personal computers and tablets, respectively.

Suppliers are giving brighter outlooks for the full year,

however, with Apple expected to launch its next-generation iPhone

that should have more new features than the iPhone 6S, based on its

pattern of a major iPhone upgrade every two years.

A spokesman for Pegatron Corp., which makes some iPhones, said

his company expected its smartphone sales to grow for the full

year. He declined to comment on the outlook for the first half.

C.C. Wei, another TSMC co-chief executive, said the company

planned to begin production of chips in the second quarter, using

its new "InFO" technology that allows for thinner chipsets--and

therefore slimmer gadgets.

This technology won't be widely adopted by TSMC's customers in

2016, but there will be "a few, very large-volume customers," he

said. Bernstein Research analyst Mark Li wrote in a report in

October that Apple will be TSMC's only meaningful customer for InFO

this year, with the technology allowing better performance and a

thinner chipset for the next-generation iPhone.

A spokeswoman for Apple referred to comments made by Apple Chief

Executive Tim Cook on an earnings call in 2013 during which he said

it was difficult to accurately extrapolate business outlooks from

individual data points in the supply chain.

"There's just an inordinately long list of things that would

make any single data point not a great proxy for what's going on,"

he said at the time.

TSMC said Thursday its fourth-quarter net profit fell 8.9% to

NT$72.84 billion from NT$79.99 billion a year earlier. The result

marked a slowdown from the previous year's rapid growth when TSMC

began supplying processors for Apple's iPhones and tablets. In the

2014 fourth quarter, its net profit rose 79%, hitting a new

quarterly record.

TSMC's revenue fell 8.5% to NT$203.52 billion in the three

months ended Dec. 31 from NT$222.52 billion a year earlier.

Write to Eva Dou at eva.dou@wsj.com

(END) Dow Jones Newswires

January 14, 2016 07:32 ET (12:32 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

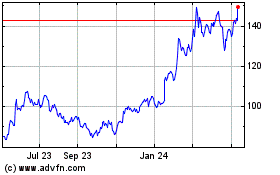

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

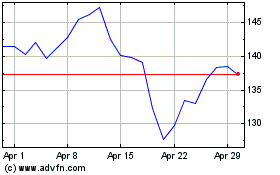

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024