Intel Completes Acquisition of Altera

December 28 2015 - 5:10PM

Dow Jones News

Intel Corp. on Monday completed its biggest-ever acquisition, a

deal that underscores Chief Executive Brian Krzanich's plan to use

new tactics to expand the chip maker's business.

The $16.7 billion purchase of Altera Corp. makes Intel, known

for microprocessors used in computers, the second-largest maker of

chips that can be programmed after they leave the factory. Altera's

chips are used in an assortment of devices that include networking

equipment, a field that Intel has targeted recently.

But Intel's more pressing priority is continuing to serve the

computing needs of giant Web services like Facebook Inc., Google

Inc. and Microsoft Corp. that rely on the company's Xeon

processors. That is becoming more difficult to accomplish through

Intel's traditional practice of squeezing more transistors on each

piece of silicon.

Microsoft and others, seeking faster performance in tasks like

Web searches, have experimented with augmenting Intel's processors

with the kind of chips sold by Altera known as FPGAs, or field

programmable gate arrays. Intel's first product priority after

closing the Altera deal is to extend that concept.

The Santa Clara, Calif., chip giant, which announced the Altera

deal at the end of May, has said it plans in 2016 to begin selling

products with a Xeon chip and an Altera FPGA in a single package.

But Mr. Krzanich has promised to pack traditional processor and

FPGA circuitry onto one chip, bringing still greater performance

benefits.

Wendell Brooks, Intel's vice president in charge of mergers and

acquisitions, estimated that the first approach can bring a 30% to

50% speed improvement over using processors and FPGAs separately.

Integrating the two functions, which won't occur until after 2016,

can double or triple the performance, he said. That combination, he

said, should bring dramatic benefits for jobs like facial

recognition, where computers may have to search through hundreds of

millions of images to find matches.

In a different vein, Mr. Brooks said, integrating Intel's tiny

Atom chips with FPGAs could also help the company in new areas such

as automobile electronic systems, where the ability to reprogram

chips could bring new features to vehicles even after they have

been sold to consumers.

Intel is betting that its production technology can help bring

such integrated products to market quickly. At the same time, it

intends to improve Altera's products with the goal of taking sales

from longtime rival Xilinx Inc.

"The biggest impact of the deal is the way Intel can bring its

manufacturing process to the FPGA business," said Mark Hung, an

analyst with Gartner Inc.

Intel plans to let Altera operate as a new business unit that

will keep the Altera brand and some operations that are foreign to

Intel. Though future Altera chips will be made in Intel factories,

for example, existing products will continue to be manufactured by

Taiwan Semiconductor Manufacturing Co.

The unit, called the programmable solutions group, also will

continue to deliver some products that use processor designs

licensed from ARM Holdings PLC. Intel has long fought—largely

unsuccessfully—to displace ARM chips from smartphones in favor of

its mainstay x86 processor technology.

"We are going to support and develop ARM-based products, just as

Altera did historically," Mr. Brooks said.

Linley Gwennap, a Silicon Valley chip analyst who heads a firm

called the Linley Group, said the Altera deal illustrates Mr.

Krzanich's willingness to try new approaches in search of growth

beyond the slowing market for PC chips.

Another sign is a series of recent senior executive hires from

outside Intel, which has tended to promote from within the

company.

In November, Intel recruited longtime Qualcomm Inc. executive

Venkata "Murthy" Renduchintala to run the company's largest

businesses. Mr. Krzanich recently estimated that about 40% of his

direct staff is new to the company.

"It's a big change for them," Mr. Gwennap said. "I really get

the feeling that Brian wants to shake things up."

Most of Altera's roughly 3,300 employees will remain in their

current jobs or be encouraged to find other positions at Intel, Mr.

Brooks said. One who won't stay is John Daane, Altera's chief

executive. The new unit will be run by Dan McNamara, a longtime

Altera executive.

Write to Don Clark at don.clark@wsj.com

(END) Dow Jones Newswires

December 28, 2015 16:55 ET (21:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

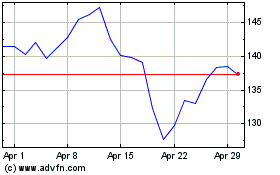

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

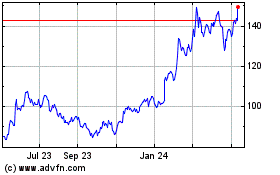

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024