ADRs End Lower; Oil Majors Decline

December 07 2015 - 6:02PM

Dow Jones News

International stocks trading in New York closed lower on

Monday.

Major oil producers were among the companies with ADRs that

traded actively.

The BNY Mellon index of American depositary receipts fell 1% to

129.73. The European index decreased 0.94% to 129.13, the Asian

index dropped 0.90% to 140.38, the Latin American index fell 1.6%

to 155.75 and the emerging markets index declined 1.2% to

222.58.

Oil prices plunged to near seven-year lows Monday on

expectations that producers around the world will continue pumping

crude at near-record levels in an already oversupplied market.

Among major oil companies with ADRs whose shares declined, BP PLC

(BP, BP.LN) fell 4.3% to $31.26, Cnooc Ltd. (CEO, 0883.HK) dropped

7.3% to $106.64, China Petroleum & Chemical Corp. (SNP,

0386.HK) retreated 4.9% to $58.75, PetroChina Co. Ltd. (PTR,

0857.HK, 601857.SH, K3OD.SG) fell 4.3% to $67.90, Petroleo

Brasileiro SA (PBR, PETR3.BR, PETR4.BR) declined 4.6% to $4.57, and

Royal Dutch Shell PLC (RDSA, RDSA.LN) dropped 4.4% to $46.30.

Total SA (TOT, FP.FR) said Monday it intends to back French oil

services company CGG SA (CGG) as the exploration equipment and

services firm seeks to raise 350 million euros ($380 million) in

fresh capital to counter low crude prices. ADRs of CGG fell 7.5% to

$3.09, while Total declined 2.5% to $46.65.

Jiayuan.com International Ltd. (DATE) said Monday it agreed to

be bought by Baihe subsidiary LoveWorld Inc. for $7.56 per American

depositary share in a deal that values China's largest online

dating platform at about $250 million. Jiayuan.com's ADRs rose 4.9%

to $7.34.

Taiwan Semiconductor Manufacturing Co. (TSM, 2330.TW) plans to

build a $3 billion advanced chip plant in China, as the world's

largest chip maker by revenue bets that cost advantages outweigh

any potential competitive threat. ADRs fell seven cents to

$23.24.

WPP PLC (WPPGY, WPP.LN) Chief Executive Martin Sorrell said he

remains an "unabashed raging bull on China" despite the slowdown in

the country's economic growth. Speaking at a UBS conference in New

York, Mr. Sorrell reiterated that the advertising company aims to

derive 40% to 45% of its revenue from "fast growth markets" and new

media over the next five years. The biggest threat to growth in

these fast growth markets are currency fluctuations, he added. ADRs

rose 1.6% to $116.03.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

December 07, 2015 17:47 ET (22:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

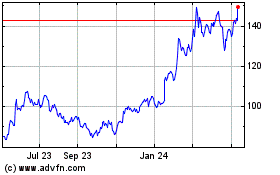

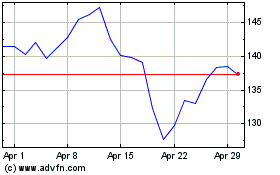

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024