UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| | |

Date of Report (Date of Earliest Event Reported): | | February 18, 2016 |

__________________________________________

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Delaware | | 1-6903 | | 75-0225040 |

(State or other jurisdiction of incorporation | | (Commission File No.) | | (I.R.S. Employer Identification No.) |

| | | | |

2525 N. Stemmons Freeway, Dallas, Texas | | | | 75207-2401 |

(Address of principal executive offices) | | | | (Zip Code) |

|

| | |

| | |

Registrant's telephone number, including area code: | | 214-631-4420 |

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

The Registrant hereby furnishes the information set forth in its News Release, dated February 18, 2016, announcing operating results for the three and twelve month periods ended December 31, 2015, a copy of which is furnished as exhibit 99.1 and incorporated herein by reference. On February 19, 2016, the Registrant held a conference call and web cast with respect to its financial results for the three and twelve month periods ended December 31, 2015. The conference call scripts of Gail M. Peck, Vice President, Finance and Treasurer; S. Theis Rice, Senior Vice President and Chief Legal Officer; Timothy R. Wallace, Chairman, Chief Executive Officer, and President; William A. McWhirter II, Senior Vice President and Group President of the Construction Products, Energy Equipment and Inland Barge Groups; D. Stephen Menzies, Senior Vice President and Group President of the Rail and Railcar Leasing Groups; and James E. Perry, Senior Vice President and Chief Financial Officer are furnished as exhibits 99.2, 99.3, 99.4, 99.5, 99.6, and 99.7, respectively, and incorporated herein by reference.

This information is not "filed" pursuant to the Securities Exchange Act of 1934 and is not incorporated by reference into any Securities Act of 1933 registration statements. Additionally, the submission of the report on Form 8-K is not an admission of the materiality of any information in this report that is required to be disclosed solely by Regulation FD.

Item 7.01 Regulation FD Disclosure.

See "Item 2.02 — Results of Operations and Financial Condition."

This information is not "filed" pursuant to the Securities Exchange Act of 1934 and is not incorporated by reference into any Securities Act of 1933 registration statements. Additionally, the submission of the report on Form 8-K is not an admission of the materiality of any information in this report that is required to be disclosed solely by Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(a) - (c) Not applicable.

(d) Exhibits:

Exhibit No. / Description

99.1 News Release dated February 18, 2016 with respect to the operating results for the three and twelve month periods ended December 31, 2015.

99.2 Conference call script of February 19, 2016 of Gail M. Peck, Vice President, Finance and Treasurer.

99.3 Conference call script of February 19, 2016 of S. Theis Rice, Senior Vice President and Chief Legal Officer.

99.4 Conference call script of February 19, 2016 of Timothy R. Wallace, Chairman, Chief Executive Officer, and President.

99.5 Conference call script of February 19, 2016 of William A. McWhirter II, Senior Vice President and Group President of the Construction Products, Energy Equipment and Inland Barge Groups.

99.6 Conference call script of February 19, 2016 of D. Stephen Menzies, Senior Vice President and Group President of the Rail and Railcar Leasing Groups.

99.7 Conference call script of February 19, 2016 of James E. Perry, Senior Vice President and Chief Financial Officer.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| Trinity Industries, Inc. |

| | |

February 19, 2016 | By: | /s/ James E. Perry |

| | Name: James E. Perry |

| | Title: Senior Vice President and Chief Financial Officer |

|

| | |

Exhibit Index |

Exhibit No. | | Description |

| | |

99.1 | | News Release dated February 18, 2016 with respect to the operating results for the three and twelve month periods ended December 31, 2015 |

99.2 | | Conference call script of February 19, 2016 of Gail M. Peck, Vice President, Finance and Treasurer |

99.3 | | Conference call script of February 19, 2016 of S. Theis Rice, Senior Vice President and Chief Legal Officer. |

99.4 | | Conference call script of February 19, 2016 of Timothy R. Wallace, Chairman, Chief Executive Officer, and President. |

99.5 | | Conference call script of February 19, 2016 of William A. McWhirter II, Senior Vice President and Group President of the Construction Products, Energy Equipment and Inland Barge Groups. |

99.6 | | Conference call script of February 19, 2016 of D. Stephen Menzies, Senior Vice President and Group President of the Rail and Railcar Leasing Groups. |

99.7 | | Conference call script of February 19, 2016 of James E. Perry, Senior Vice President and Chief Financial Officer. |

Exhibit 99.1

NEWS RELEASE |

| |

Investor Contact: | Media Contact: |

Jessica Greiner | Jack Todd |

Director of Investor Relations | Vice President, Public Affairs |

Trinity Industries, Inc. | Trinity Industries, Inc. |

214/631-4420 | 214/589-8909 |

FOR IMMEDIATE RELEASE

Trinity Industries, Inc. Announces Strong Fourth Quarter

and Record Full Year 2015 Results

DALLAS, Texas - February 18, 2016 - Trinity Industries, Inc. (NYSE:TRN) today announced earnings results for the fourth quarter ended December 31, 2015, including the following significant highlights:

Fourth Quarter 2015

| |

• | Earnings per common diluted share of $1.30, up 51% year-over-year |

| |

• | Record operating margin for the Rail Group of 23.6% with record deliveries of 8,835 railcars |

| |

• | Company completes sales of $479.5 million of leased railcars |

| |

• | New institutional investor fund was formed, expanding the railcar investment vehicle ("RIV") platform |

| |

• | Inland Barge Group receives orders with a value of $190.1 million |

Full Year 2015

| |

• | Record consolidated revenues of $6.4 billion |

| |

• | Record railcar deliveries of 34,295 |

| |

• | Record earnings per common diluted share of $5.08, up 21% year-over-year |

| |

• | Backlog commitments in Rail, Inland Barge, and Energy Equipment Groups valued at $6.2 billion |

| |

• | Company completes sales of $1.2 billion of leased railcars |

| |

• | Liquidity position of $2.1 billion, including cash, marketable securities and available credit facilities |

Consolidated Results

Trinity Industries, Inc. reported net income attributable to Trinity stockholders of $200.0 million, or $1.30 per common diluted share, for the fourth quarter ended December 31, 2015. Net income for the same quarter of 2014 was $138.2 million, or $0.86 per common diluted share. Revenues for the fourth quarter of 2015 totaled $1.55 billion compared to revenues of $1.66 billion for the same quarter of 2014.

For the year ended December 31, 2015, the Company reported record net income attributable to Trinity stockholders of $796.5 million, or $5.08 per common diluted share. In 2014, the Company reported net income of $678.2 million, or $4.19 per common diluted share. Revenues for the year ended December 31, 2015 were $6.39 billion, a 4% increase compared to revenues of $6.17 billion in 2014.

“During 2015, Trinity reported its third consecutive year of record revenues, operating profit, and earnings per common diluted share. We utilized the strengths of our integrated business model and the capabilities and expertise of our dedicated employees to achieve these impressive results," said Timothy R. Wallace, Trinity’s Chairman, CEO and President.

Mr. Wallace added, “I am pleased that during the fourth quarter we expanded the RIV platform, selling approximately $335 million of leased railcars to a new institutional investor fund. We believe the RIV platform provides Trinity with a high degree of financial flexibility and contributes additional income through the profits recognized at sale and, in addition, management fees earned over the longer term.”

Mr. Wallace concluded, “Our outlook for 2016 reflects the weakening in the industrial economy that began broadly impacting our businesses late last summer. In this environment, we are placing a high priority on cost containment and various initiatives to enhance our performance. We will continue to reposition and streamline our manufacturing operations as business conditions fluctuate.”

Business Group Results

In the fourth quarter of 2015, the Rail Group reported revenues and record operating profit of approximately $1.13 billion and $267.9 million, respectively, resulting in year-over-year increases compared to the fourth quarter of 2014 of 6% and 38%, respectively. The increases in revenues and profit were due primarily to higher deliveries, improved pricing, and increased operating efficiencies partially offset by product mix changes. The Rail Group shipped a record 8,835 railcars and received orders for 2,455 railcars during the fourth quarter. The Rail Group had a backlog of $5.40 billion as of December 31, 2015, representing 48,885 railcars, compared to a backlog of $6.25 billion as of September 30, 2015, representing 55,265 railcars. At the end of the fourth quarter, the backlog of railcar orders extends into 2020.

The Railcar Leasing and Management Services Group ("Leasing Group") reported leasing and management revenues of $179.0 million in the fourth quarter of 2015 compared to $162.8 million in the fourth quarter of 2014 due to higher average rental rates and net fleet additions. In addition, the Group recognized revenue of $193.7 million during the fourth quarter from sales of railcars from the lease fleet owned for one year or less compared to $75.2 million in the fourth quarter of 2014. Operating profit for this Group was $187.5 million in the fourth quarter of 2015 compared to operating profit of $96.6 million in the fourth quarter of 2014 due to higher leasing and management operating profit and higher operating profit from sales of railcars from the lease fleet.

In total, Trinity sold $479.5 million of leased railcars to third parties during the fourth quarter, of which $84.7 million were reported in the Rail Group. Trinity's fourth quarter results included $0.58 per common diluted share related to sales of leased railcars compared to $0.14 per share of leased railcar sales in the same quarter last year. Supplemental information for the Leasing Group is provided in the accompanying tables.

The Inland Barge Group reported revenues of $147.2 million for the fourth quarter of 2015 compared to revenues of $167.8 million in the fourth quarter of 2014. Operating profit for this Group was $20.7 million in the fourth quarter of 2015 compared to $25.8 million in the fourth quarter of 2014. The decrease in revenues compared to the same quarter last year was primarily due to lower tank barge deliveries partially offset by higher delivery volumes of hopper barges. The Inland Barge Group received orders of $190.1 million during the quarter, and as of December 31, 2015 had a backlog of $416.0 million compared to a backlog of $373.1 million as of September 30, 2015.

The Energy Equipment Group reported revenues of $242.2 million in the fourth quarter of 2015 compared to revenues of $284.4 million in the same quarter of 2014. Operating profit for the fourth quarter of 2015 increased to $32.6 million compared to $26.9 million in the same quarter last year. The decrease in revenues compared to the same quarter last year was due to lower delivery volumes while the increase in operating profit was due primarily to improved manufacturing efficiencies. The backlog for structural wind towers as of December 31, 2015 was $371.3 million compared to a backlog of $424.4 million as of September 30, 2015.

Revenues in the Construction Products Group were $113.7 million in the fourth quarter of 2015 compared to revenues of $116.5 million in the fourth quarter of 2014. The Group recorded an operating profit of $5.0 million in the fourth quarter of 2015 compared to an operating loss of $0.3 million in the fourth quarter of

2014. Revenues decreased compared to the same quarter last year primarily as a result of lower delivery volumes in our Highway Products business and the divestiture of our galvanizing business partially offset by higher delivery volumes in our Aggregates business. Operating profit increased compared to the same quarter of 2014 due to improved manufacturing efficiencies.

Cash and Liquidity

At December 31, 2015, the Company had cash, cash equivalents, and short-term marketable securities of $870.9 million. When combined with capacity under committed credit facilities, the Company had approximately $2.12 billion of available liquidity at the end of the fourth quarter.

Share Repurchase

In December 2015, the Company’s Board of Directors renewed its $250 million share repurchase program effective January 1, 2016 through December 31, 2017. The new program replaced the previous program which expired on December 31, 2015. The Company repurchased 3.9 million shares at a cost of $115.0 million during the full year 2015. No shares were repurchased during the fourth quarter of 2015.

Earnings Guidance for 2016

For the full year of 2016, the Company anticipates earnings per common diluted share of between $2.00 and $2.40. The Company’s 2016 earnings guidance assumes the current weak market conditions will continue throughout the year.

For the Rail Group, annual deliveries in 2016 are now expected to be approximately 27,000 railcars, reflecting the delivery of firm backlog and a lower anticipated level of new orders. The Group expects revenues of approximately $3.1 billion with an operating margin of approximately 15% in 2016. This guidance reflects a change in product mix and pricing compared to 2015 for the Group’s 2016 railcar deliveries; a decrease in operating leverage related to an approximate 20% reduction in expected volumes; and costs associated with aligning the Group’s production footprint with demand.

In 2016, the Company expects to record revenue eliminations associated with railcars sold to the Leasing Group of approximately $1.1 billion with profit deferrals of approximately $215 million.

The Leasing Group expects revenues and profit from leasing and management operations in 2016 of approximately $700 million and $300 million, respectively.

The Company expects to continue expanding the RIV platform in 2016. Proceeds from the sale of leased railcars are expected to be approximately $500 million with a profit of approximately $100 million.

In 2016, the Inland Barge Group expects revenues of approximately $445 million with an operating margin of approximately 10%. The expected decrease in revenues and operating margin from 2015 reflects a lower level of demand; a change in product mix; and the competitive pricing environment.

The Company will provide additional details pertaining to its 2016 guidance during its conference call tomorrow.

Actual results in 2016 may differ from present expectations and could be impacted by a number of factors including, among others, fluctuations in prices of commodities that our customers produce and transport; expenses related to current and potential litigation; the operating leverage and efficiencies that can be achieved by the Company's manufacturing businesses; the costs associated with aligning manufacturing production capacity with demand; the level of sales and profitability of railcars; the level of profitability resulting from sales of leased railcars; the dilutive impact of the convertible notes related to changes in the Company's stock price; and the impact of weather conditions on our operations and delivery schedules.

Conference Call

Trinity will hold a conference call at 11:00 a.m. Eastern on February 19, 2016 to discuss its fourth quarter and full year results. To listen to the call, please visit the Investor Relations section of the Trinity Industries

website, www.trin.net and select the Conference Calls menu link. An audio replay may be accessed through the Company’s website or by dialing (402) 220-2686 until 11:59 p.m. Eastern on February 26, 2016.

Trinity Industries, Inc., headquartered in Dallas, Texas, is a diversified industrial company that owns market-leading businesses providing products and services to the energy, transportation, chemical, and construction sectors. Trinity reports its financial results in five principal business segments: the Rail Group, the Railcar Leasing and Management Services Group, the Inland Barge Group, the Construction Products Group, and the Energy Equipment Group. For more information, visit: www.trin.net.

Some statements in this release, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Trinity's estimates, expectations, beliefs, intentions or strategies for the future, and the assumptions underlying these forward-looking statements. Trinity uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “outlook,” and similar expressions to identify these forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” and “Forward-Looking Statements” in the Company's Annual Report on Form 10-K for the most recent fiscal year.

- TABLES TO FOLLOW -

Trinity Industries, Inc.

Condensed Consolidated Income Statements

(in millions, except per share amounts)

(unaudited)

|

| | | | | | | |

| Three Months Ended

December 31, |

| 2015 | | 2014 |

Revenues | $ | 1,547.0 |

| | $ | 1,661.4 |

|

Operating costs: | | | |

Cost of revenues | 1,116.1 |

| | 1,275.3 |

|

Selling, engineering, and administrative expenses | 137.1 |

| | 110.6 |

|

Gains on dispositions of property: | | | |

Net gains on lease fleet sales | (63.3 | ) | | (2.1 | ) |

Other | (0.9 | ) | | 1.1 |

|

| 1,189.0 |

| | 1,384.9 |

|

Operating profit | 358.0 |

| | 276.5 |

|

Interest expense, net | 45.3 |

| | 51.6 |

|

Other, net | (1.6 | ) | | (1.7 | ) |

Income before income taxes | 314.3 |

| | 226.6 |

|

Provision for income taxes | 110.3 |

| | 80.3 |

|

Net income | 204.0 |

| | 146.3 |

|

Net income attributable to noncontrolling interest | 4.0 |

| | 8.1 |

|

Net income attributable to Trinity Industries, Inc. | $ | 200.0 |

| | $ | 138.2 |

|

| | | |

Net income attributable to Trinity Industries, Inc. per common share: | | |

Basic | $ | 1.30 |

| | $ | 0.89 |

|

Diluted | $ | 1.30 |

| | $ | 0.86 |

|

Weighted average number of shares outstanding: | | | |

Basic | 149.0 |

| | 151.2 |

|

Diluted | 149.6 |

| | 155.7 |

|

Trinity is required to utilize the two-class method of accounting when calculating earnings per share as a result of unvested restricted shares that have non-forfeitable rights to dividends and are, therefore, considered to be a participating security. The unvested restricted shares are excluded from the weighted average number of shares outstanding for the purposes of determining earnings per share. The two-class method results in a lower earnings per share than is calculated from the face of the income statement. See Earnings Per Share Calculation table below.

Trinity Industries, Inc.

Condensed Consolidated Income Statements

(in millions, except per share amounts)

(unaudited)

|

| | | | | | | |

| Year Ended

December 31, |

| 2015 | | 2014 |

Revenues | $ | 6,392.7 |

| | $ | 6,170.0 |

|

Operating costs: | | | |

Cost of revenues | 4,656.2 |

| | 4,619.8 |

|

Selling, engineering, and administrative expenses | 476.4 |

| | 403.6 |

|

Gains on dispositions of property: | | | |

Net gains on lease fleet sales | (166.1 | ) | | (92.3 | ) |

Other | (12.7 | ) | | (12.1 | ) |

| 4,953.8 |

| | 4,919.0 |

|

Operating profit | 1,438.9 |

| | 1,251.0 |

|

Interest expense, net | 192.5 |

| | 191.5 |

|

Other, net | (5.6 | ) | | (4.6 | ) |

Income before income taxes | 1,252.0 |

| | 1,064.1 |

|

Provision for income taxes | 426.0 |

| | 354.8 |

|

Net income | 826.0 |

| | 709.3 |

|

Net income attributable to noncontrolling interest | 29.5 |

| | 31.1 |

|

Net income attributable to Trinity Industries, Inc. | $ | 796.5 |

| | $ | 678.2 |

|

| | | |

Net income attributable to Trinity Industries, Inc. per common share: | | |

Basic | $ | 5.14 |

| | $ | 4.35 |

|

Diluted | $ | 5.08 |

| | $ | 4.19 |

|

Weighted average number of shares outstanding: | | | |

Basic | 150.2 |

| | 151.0 |

|

Diluted | 152.2 |

| | 156.7 |

|

Trinity is required to utilize the two-class method of accounting when calculating earnings per share as a result of unvested restricted shares that have non-forfeitable rights to dividends and are, therefore, considered to be a participating security. The unvested restricted shares are excluded from the weighted average number of shares outstanding for the purposes of determining earnings per share. The two-class method results in a lower earnings per share than is calculated from the face of the income statement. See Earnings Per Share Calculation table below.

Trinity Industries, Inc.

Condensed Segment Data

(in millions)

(unaudited)

|

| | | | | | | |

| Three Months Ended

December 31, |

Revenues: | 2015 | | 2014 |

Rail Group | $ | 1,133.6 |

| | $ | 1,067.4 |

|

Construction Products Group | 113.7 |

| | 116.5 |

|

Inland Barge Group | 147.2 |

| | 167.8 |

|

Energy Equipment Group | 242.2 |

| | 284.4 |

|

Railcar Leasing and Management Services Group | 372.7 |

| | 238.0 |

|

All Other | 28.3 |

| | 30.2 |

|

Segment Totals before Eliminations | 2,037.7 |

| | 1,904.3 |

|

Eliminations - lease subsidiary | (381.5 | ) | | (145.9 | ) |

Eliminations - other | (109.2 | ) | | (97.0 | ) |

Consolidated Total | $ | 1,547.0 |

| | $ | 1,661.4 |

|

| | | |

| Three Months Ended

December 31, |

Operating profit (loss): | 2015 | | 2014 |

Rail Group | $ | 267.9 |

| | $ | 194.2 |

|

Construction Products Group | 5.0 |

| | (0.3 | ) |

Inland Barge Group | 20.7 |

| | 25.8 |

|

Energy Equipment Group | 32.6 |

| | 26.9 |

|

Railcar Leasing and Management Services Group | 187.5 |

| | 96.6 |

|

All Other | (3.6 | ) | | (14.3 | ) |

Segment Totals before Eliminations and Corporate Expenses | 510.1 |

| | 328.9 |

|

Corporate | (53.9 | ) | | (29.5 | ) |

Eliminations - lease subsidiary | (95.8 | ) | | (22.6 | ) |

Eliminations - other | (2.4 | ) | | (0.3 | ) |

Consolidated Total | $ | 358.0 |

| | $ | 276.5 |

|

Trinity Industries, Inc.

Condensed Segment Data

(in millions)

(unaudited)

|

| | | | | | | |

| Year Ended

December 31, |

Revenues: | 2015 | | 2014 |

Rail Group | $ | 4,461.8 |

| | $ | 3,816.8 |

|

Construction Products Group | 532.6 |

| | 551.7 |

|

Inland Barge Group | 652.9 |

| | 638.5 |

|

Energy Equipment Group | 1,113.7 |

| | 992.3 |

|

Railcar Leasing and Management Services Group | 1,104.8 |

| | 1,118.3 |

|

All Other | 112.3 |

| | 110.4 |

|

Segment Totals before Eliminations | 7,978.1 |

| | 7,228.0 |

|

Eliminations - lease subsidiary | (1,164.4 | ) | | (710.1 | ) |

Eliminations - other | (421.0 | ) | | (347.9 | ) |

Consolidated Total | $ | 6,392.7 |

| | $ | 6,170.0 |

|

| | | |

| Year Ended

December 31, |

Operating profit (loss): | 2015 | | 2014 |

Rail Group | $ | 931.6 |

| | $ | 724.1 |

|

Construction Products Group | 54.5 |

| | 65.4 |

|

Inland Barge Group | 117.0 |

| | 114.4 |

|

Energy Equipment Group | 150.9 |

| | 108.1 |

|

Railcar Leasing and Management Services Group | 606.2 |

| | 516.3 |

|

All Other | (8.2 | ) | | (25.6 | ) |

Segment Totals before Eliminations and Corporate Expenses | 1,852.0 |

| | 1,502.7 |

|

Corporate | (152.6 | ) | | (119.0 | ) |

Eliminations - lease subsidiary | (259.6 | ) | | (133.1 | ) |

Eliminations - other | (0.9 | ) | | 0.4 |

|

Consolidated Total | $ | 1,438.9 |

| | $ | 1,251.0 |

|

Trinity Industries, Inc.

Leasing Group

Condensed Results of Operations

(unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

| ($ in millions) |

Revenues: | | | | | | | |

Leasing and management | $ | 179.0 |

| | $ | 162.8 |

| | $ | 699.9 |

| | $ | 632.0 |

|

Sales of railcars owned one year or less at the time of sale | 193.7 |

| | 75.2 |

| | 404.9 |

| | 486.3 |

|

Total revenues | $ | 372.7 |

| | $ | 238.0 |

| | $ | 1,104.8 |

| | $ | 1,118.3 |

|

Operating profit: | | | | | | | |

Leasing and management | $ | 76.4 |

| | $ | 74.1 |

| | $ | 331.1 |

| | $ | 287.9 |

|

Railcar sales: | | | | | | | |

Railcars owned one year or less at the time of sale | 47.8 |

| | 20.4 |

| | 109.0 |

| | 136.1 |

|

Railcars owned more than one year at the time of sale | 63.3 |

| | 2.1 |

| | 166.1 |

| | 92.3 |

|

Total operating profit | $ | 187.5 |

| | $ | 96.6 |

| | $ | 606.2 |

| | $ | 516.3 |

|

Operating profit margin: | | | | | | | |

Leasing and management | 42.7 | % | | 45.5 | % | | 47.3 | % | | 45.6 | % |

Railcar sales | * | | * | | * | | * |

Total operating profit margin | 50.3 | % | | 40.6 | % | | 54.9 | % | | 46.2 | % |

Selected expense information(1): | | | | | | | |

Depreciation | $ | 36.5 |

| | $ | 32.9 |

| | $ | 142.3 |

| | $ | 130.0 |

|

Maintenance | $ | 31.4 |

| | $ | 20.1 |

| | $ | 97.3 |

| | $ | 78.9 |

|

Rent | $ | 10.3 |

| | $ | 13.2 |

| | $ | 41.6 |

| | $ | 52.9 |

|

Interest | $ | 32.0 |

| | $ | 38.8 |

| | $ | 138.8 |

| | $ | 153.3 |

|

|

| | | | | |

| December 31,

2015 | | December 31,

2014 |

Leasing portfolio information: | | | |

Portfolio size (number of railcars) | 76,765 |

| | 75,930 |

Portfolio utilization | 97.7 | % | | 99.5 | % |

|

| | | | | | | |

| Year Ended December 31, |

| 2015 | | 2014 |

| (in millions) |

Proceeds from sale of leased railcars to Element Financial Corporation: | | |

Leasing Group: | | | |

Railcars owned one year or less at the time of sale | $ | 228.6 |

| | $ | 446.6 |

|

Railcars owned more than one year at the time of sale | 294.7 |

| | 235.7 |

|

Rail Group | 227.5 |

| | 200.4 |

|

| $ | 750.8 |

| | $ | 882.7 |

|

* Not meaningful

(1) Depreciation, maintenance, and rent expense are components of operating profit. Amortization of deferred profit on railcars sold from the Rail Group to the Leasing Group is included in the operating profit of the Leasing Group resulting in the recognition of depreciation expense based on the Company's original manufacturing cost of the railcars. Interest expense is not a component of operating profit and includes the effect of hedges.

Trinity Industries, Inc.

Condensed Consolidated Balance Sheets

(in millions)

(unaudited) |

| | | | | | | |

| December 31,

2015 | | December 31,

2014 |

Cash and cash equivalents | $ | 786.0 |

| | $ | 887.9 |

|

Short-term marketable securities | 84.9 |

| | 75.0 |

|

Receivables, net of allowance | 369.9 |

| | 405.3 |

|

Income tax receivable | 94.9 |

| | 58.6 |

|

Inventories | 943.1 |

| | 1,068.4 |

|

Restricted cash | 195.8 |

| | 234.7 |

|

Net property, plant, and equipment | 5,348.0 |

| | 4,902.9 |

|

Goodwill | 753.8 |

| | 773.2 |

|

Other assets | 309.5 |

| | 289.3 |

|

| $ | 8,885.9 |

| | $ | 8,695.3 |

|

| | | |

Accounts payable | $ | 216.8 |

| | $ | 295.4 |

|

Accrued liabilities | 529.6 |

| | 709.6 |

|

Debt, net of unamortized discount of $44.2 and $60.0 | 3,195.4 |

| | 3,514.5 |

|

Deferred income | 27.1 |

| | 36.4 |

|

Deferred income taxes | 752.2 |

| | 632.6 |

|

Other liabilities | 116.1 |

| | 109.4 |

|

Stockholders' equity | 4,048.7 |

| | 3,397.4 |

|

| $ | 8,885.9 |

| | $ | 8,695.3 |

|

Trinity Industries, Inc.

Additional Balance Sheet Information

(in millions)

(unaudited) |

| | | | | | | |

| December 31,

2015 | | December 31,

2014 |

Property, Plant, and Equipment | | | |

Corporate/Manufacturing: | | | |

Property, plant, and equipment | $ | 1,861.5 |

| | $ | 1,681.7 |

|

Accumulated depreciation | (905.4 | ) | | (820.7 | ) |

| 956.1 |

| | 861.0 |

|

Leasing: | | | |

Wholly-owned subsidiaries: | | | |

Machinery and other | 10.7 |

| | 10.7 |

|

Equipment on lease | 3,664.7 |

| | 3,049.0 |

|

Accumulated depreciation | (549.1 | ) | | (460.5 | ) |

| 3,126.3 |

| | 2,599.2 |

|

Partially-owned subsidiaries: | | | |

Equipment on lease | 2,406.5 |

| | 2,401.8 |

|

Accumulated depreciation | (467.9 | ) | | (401.9 | ) |

| 1,938.6 |

| | 1,999.9 |

|

| | | |

Net deferred profit on railcars sold to the Leasing Group | (673.0 | ) | | (557.2 | ) |

| $ | 5,348.0 |

| | $ | 4,902.9 |

|

Trinity Industries, Inc.

Additional Balance Sheet Information

(in millions)

(unaudited)

|

| | | | | | | |

| December 31,

2015 | | December 31,

2014 |

Debt | | | |

Corporate - Recourse: | | | |

Revolving credit facility | $ | — |

| | $ | — |

|

Senior notes due 2024, net of unamortized discount of $0.4 and $0.4 | 399.6 |

| | 399.6 |

|

Convertible subordinated notes, net of unamortized discount of $43.8 and $59.6 | 405.6 |

| | 389.9 |

|

Other | 0.5 |

| | 0.7 |

|

| 805.7 |

| | 790.2 |

|

Less: unamortized debt issuance costs | (4.7 | ) | | (5.5 | ) |

| 801.0 |

| | 784.7 |

|

Leasing: | | | |

Wholly-owned subsidiaries: | | | |

Recourse: | | | |

Capital lease obligations, net of unamortized debt issuance costs of $0.1 and $0.2 | 35.7 |

| | 38.9 |

|

| 35.7 |

| | 38.9 |

|

Non-recourse: | | | |

Secured railcar equipment notes | 679.5 |

| | 723.3 |

|

Warehouse facility | 264.3 |

| | 120.6 |

|

Promissory notes | — |

| | 363.9 |

|

| 943.8 |

| | 1,207.8 |

|

Less: unamortized debt issuance costs | (15.1 | ) | | (13.8 | ) |

| 928.7 |

| | 1,194.0 |

|

Partially-owned subsidiaries - Non-recourse: | | | |

Secured railcar equipment notes | 1,446.9 |

| | 1,515.9 |

|

Less: unamortized debt issuance costs | (16.9 | ) | | (19.0 | ) |

| 1,430.0 |

| | 1,496.9 |

|

| $ | 3,195.4 |

| | $ | 3,514.5 |

|

Trinity Industries, Inc.

Additional Balance Sheet Information

(in millions)

(unaudited)

|

| | | | | | | |

| December 31,

2015 | | December 31,

2014 |

Leasing Debt Summary | | | |

Total Recourse Debt | $ | 35.7 |

| | $ | 38.9 |

|

Total Non-Recourse Debt | 2,358.7 |

| | 2,690.9 |

|

| $ | 2,394.4 |

| | $ | 2,729.8 |

|

Total Leasing Debt | | | |

Wholly-owned subsidiaries | $ | 964.4 |

| | $ | 1,232.9 |

|

Partially-owned subsidiaries | 1,430.0 |

| | 1,496.9 |

|

| $ | 2,394.4 |

| | $ | 2,729.8 |

|

Equipment on Lease(1) | | | |

Wholly-owned subsidiaries | $ | 3,126.3 |

| | $ | 2,599.2 |

|

Partially-owned subsidiaries | 1,938.6 |

| | 1,999.9 |

|

| $ | 5,064.9 |

| | $ | 4,599.1 |

|

Total Leasing Debt as a % of Equipment on Lease | | | |

Wholly-owned subsidiaries | 30.8 | % | | 47.4 | % |

Partially-owned subsidiaries | 73.8 | % | | 74.8 | % |

Combined | 47.3 | % | | 59.4 | % |

(1) Excludes net deferred profit on railcars sold to the Leasing Group.

Trinity Industries, Inc.

Condensed Consolidated Cash Flow Statements

(in millions)

(unaudited)

|

| | | | | | | |

| Year Ended

December 31, |

| 2015 | | 2014 |

Operating activities: | | | |

Net income | $ | 826.0 |

| | $ | 709.3 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Depreciation and amortization | 266.4 |

| | 244.6 |

|

Net gains on railcar lease fleet sales owned more than one year at the time of sale | (166.1 | ) | | (92.3 | ) |

Other | 179.3 |

| | 38.2 |

|

Changes in assets and liabilities: | | | |

(Increase) decrease in receivables | (0.8 | ) | | (56.4 | ) |

(Increase) decrease in inventories | 128.5 |

| | (186.3 | ) |

Increase (decrease) in accounts payable and accrued liabilities | (248.2 | ) | | 142.8 |

|

Other | (45.4 | ) | | 19.3 |

|

Net cash provided by operating activities | 939.7 |

| | 819.2 |

|

Investing activities: | | | |

Proceeds from railcar lease fleet sales owned more than one year at the time of sale | 514.6 |

| | 265.8 |

|

Proceeds from dispositions of property | 8.2 |

| | 23.0 |

|

Capital expenditures - leasing, net of sold lease fleet railcars owned one year or less with a net cost of $295.9 and $350.2 | (833.8 | ) | | (245.3 | ) |

Capital expenditures - manufacturing and other | (196.0 | ) | | (219.3 | ) |

(Increase) decrease in short-term marketable securities | (9.9 | ) | | 74.7 |

|

Acquisitions | (46.2 | ) | | (714.4 | ) |

Divestitures | 51.3 |

| | — |

|

Other | 0.5 |

| | 0.8 |

|

Net cash required by investing activities | (511.3 | ) | | (814.7 | ) |

Financing activities: | | | |

Payments to retire debt | (587.2 | ) | | (186.6 | ) |

Proceeds from issuance of debt | 242.4 |

| | 727.3 |

|

Shares repurchased | (115.0 | ) | | (36.5 | ) |

Dividends paid to common shareholders | (64.9 | ) | | (54.4 | ) |

Purchase of shares to satisfy employee tax on vested stock | (27.5 | ) | | (38.3 | ) |

Contributions from noncontrolling interest | — |

| | 49.6 |

|

Distributions to noncontrolling interest | (39.2 | ) | | (28.2 | ) |

Decrease in restricted cash | 48.3 |

| | 1.0 |

|

Other | 12.8 |

| | 21.0 |

|

Net cash (required) provided by financing activities | (530.3 | ) | | 454.9 |

|

Net (decrease) increase in cash and cash equivalents | (101.9 | ) | | 459.4 |

|

Cash and cash equivalents at beginning of period | 887.9 |

| | 428.5 |

|

Cash and cash equivalents at end of period | $ | 786.0 |

| | $ | 887.9 |

|

Trinity Industries, Inc.

Earnings per Share Calculation

(in millions, except per share amounts)

(unaudited)

Basic net income attributable to Trinity Industries, Inc. per common share is computed by dividing net income attributable to Trinity remaining after allocation to unvested restricted shares by the weighted average number of basic common shares outstanding for the period.

|

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, 2015 | | Three Months Ended

December 31, 2014 |

| Income |

| | Average Shares |

| | EPS |

| | Income |

| | Average Shares |

| | EPS |

|

Net income attributable to Trinity Industries, Inc. | $ | 200.0 |

| | | | | | $ | 138.2 |

| | | | |

Unvested restricted share participation | (5.9 | ) | | | | | | (4.3 | ) | | | | |

Net income attributable to Trinity Industries, Inc. - basic | 194.1 |

| | 149.0 |

| | $ | 1.30 |

| | 133.9 |

| | 151.2 |

| | $ | 0.89 |

|

Effect of dilutive securities: | | | | | | | | | | | |

Stock options | — |

| | — |

| | | | — |

| | 0.1 |

| | |

Convertible subordinated notes | — |

| | 0.6 |

| | | | 0.1 |

| | 4.4 |

| | |

Net income attributable to Trinity Industries, Inc. - diluted | $ | 194.1 |

| | 149.6 |

| | $ | 1.30 |

| | $ | 134.0 |

| | 155.7 |

| | $ | 0.86 |

|

|

| | | | | | | | | | | | | | | | | | | | | |

| Year Ended

December 31, 2015 | | Year Ended

December 31, 2014 |

| Income |

| | Average Shares |

| | EPS |

| | Income |

| | Average Shares |

| | EPS |

|

Net income attributable to Trinity Industries, Inc. | $ | 796.5 |

| | | | | | $ | 678.2 |

| | | | |

Unvested restricted share participation | (24.1 | ) | | | | | | (22.1 | ) | | | | |

Net income attributable to Trinity Industries, Inc. - basic | 772.4 |

| | 150.2 |

| | $ | 5.14 |

| | 656.1 |

| | 151.0 |

| | $ | 4.35 |

|

Effect of dilutive securities: | | | | | | | | | | | |

Stock options | — |

| | — |

| | | | — |

| | 0.1 |

| | |

Convertible subordinated notes | 0.3 |

| | 2.0 |

| | | | 0.7 |

| | 5.6 |

| | |

Net income attributable to Trinity Industries, Inc. - diluted | $ | 772.7 |

| | 152.2 |

| | $ | 5.08 |

| | $ | 656.8 |

| | 156.7 |

| | $ | 4.19 |

|

Trinity Industries, Inc.

Reconciliation of EBITDA

(in millions)

(unaudited)

“EBITDA” is defined as net income plus interest expense, income taxes, and depreciation and amortization including goodwill impairment charges. EBITDA is not a calculation based on generally accepted accounting principles. The amounts included in the EBITDA calculation are, however, derived from amounts included in the historical consolidated statements of operations data. In addition, EBITDA should not be considered as an alternative to net income or operating income as an indicator of our operating performance, or as an alternative to operating cash flows as a measure of liquidity. We believe EBITDA assists investors in comparing a company’s performance on a consistent basis without regard to depreciation and amortization, which can vary significantly depending upon many factors. However, the EBITDA measure presented in this press release may not always be comparable to similarly titled measures by other companies due to differences in the components of the calculation.

|

| | | | | | | |

| Three Months Ended

December 31, |

| 2015 | | 2014 |

Net income | $ | 204.0 |

| | $ | 146.3 |

|

Add: | | | |

Interest expense | 45.9 |

| | 52.0 |

|

Provision for income taxes | 110.3 |

| | 80.3 |

|

Depreciation and amortization expense | 68.5 |

| | 73.1 |

|

Earnings before interest expense, income taxes, and depreciation and amortization expense | $ | 428.7 |

| | $ | 351.7 |

|

|

| | | | | | | |

| Year Ended

December 31, |

| 2015 | | 2014 |

Net income | $ | 826.0 |

| | $ | 709.3 |

|

Add: | | | |

Interest expense | 194.7 |

| | 193.4 |

|

Provision for income taxes | 426.0 |

| | 354.8 |

|

Depreciation and amortization expense | 266.4 |

| | 244.6 |

|

Earnings before interest expense, income taxes, and depreciation and amortization expense | $ | 1,713.1 |

| | $ | 1,502.1 |

|

- END -

Exhibit 99.2

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of Gail M. Peck

Vice President, Finance and Treasurer

February 19, 2016

Thank you, Aaron. Good morning everyone. Welcome to the Trinity Industries’ fourth quarter 2015 results conference call. I am Gail Peck, Vice President, Finance and Treasurer of Trinity. Thank you for joining us today.

Similar to the format we have used on our recent earnings call, we will begin with an update on the Highway Products litigation matter. We will then follow with our normal quarterly earnings conference call format.

Today’s speakers are:

•Theis Rice, Senior Vice President and Chief Legal Officer;

•Tim Wallace our Chairman, Chief Executive Officer and President;

•Bill McWhirter, Senior Vice President and Group President of the Construction Products, Energy Equipment, and Inland Barge Groups;

•Steve Menzies, Senior Vice President and Group President of the Rail and Railcar Leasing Groups; and

•James Perry, our Senior Vice President and Chief Financial Officer

Following their comments, we will then move to the Q&A session. Mary Henderson, our Vice President and Chief Accounting Officer, is also in the room with us today. I will now turn the call over to Theis Rice.

Theis

Tim

Bill

Steve

James

Q&A Session

That concludes today's conference call. A replay of this call will be available after one o'clock eastern standard time today through midnight on February 26, 2016. The access number is (402) 220-2686. Also the replay will be available on the website located at www.trin.net. We look forward to visiting with you again on our next conference call. Thank you for joining us this morning.

Exhibit 99.3

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of S. Theis Rice

Senior Vice President and Chief Legal Officer

February 19, 2016

Thank you Gail and good morning everyone.

In my comments today I will refer to Trinity Industries and Trinity Highway Products together as Trinity. As previously reported, Trinity has appealed to the Fifth Circuit the June 2015 False Claims Act judgment involving the ET Plus® guardrail end terminal system. We will file our opening brief next month with full briefing by the parties to follow. We expect the Fifth Circuit will not issue a ruling in this case earlier than late 2016.

I would like to reiterate a few points related to this appeal: First, Trinity believes strongly in its appellate arguments; we are confident that no fraud was committed; and we believe there are strong legal grounds for the Fifth Circuit to overturn the judgment. Second, we stand 100 percent behind our product - the ET Plus® System - and we are selling it today. In the fall of 2015, after completing what the Federal Highway Administration termed the most thorough evaluation of a roadside device ever conducted, the FHWA reconfirmed yet again that the ET Plus® Systems in use today on the nation’s roadways meet all federal testing criteria and performance evaluation standards and that the system has been, and remains, fully eligible for federal-aid reimbursement.

We have also previously reported that the Commonwealth of Virginia has intervened in a state court action under the Virginia Fraud Against Taxpayers Act filed by the same party who filed the federal False Claims Act case. In an order entered by the Virginia court on January 27, 2016, the Commonwealth’s case was stayed pending resolution of the federal False Claims Act case currently on appeal.

The same party who filed the federal False Claims Act case and the Virginia case has also filed six other, state false claims act cases under each state’s law. Each of these six states has declined to intervene in or join the case filed in their state and all six cases are currently stayed.

Please refer to www.etplusfacts.com/virginia for more information on the Virginia litigation.

Our 2015 10-K will be filed today. In Note 18 of the 10-K we provide additional information on the foregoing and other Company legal matters. For additional information and details on the Company’s positions on these and related issues, please refer to www.etplusfacts.com

I would like to conclude my comments today by sharing a few very important facts and making a brief statement. For over 80 years, Trinity has operated with the highest level of integrity. Our reputation for honesty and ethical business practices is beyond question and underscores the rock solid foundation on which we have built the market-leading positions we earn and maintain year after year. Trinity’s Highway Products business unit has played an integral role in bringing innovative, life-saving products to market. We have aligned ourselves with world-class researchers and engineers who share our vision for highway safety. We employ dedicated workers who manufacture products, like the ET Plus® System, to the highest levels of craftsmanship. And we deliver market-leading products that meet rigorous standards. I believe accusations of fraud against Trinity are unwarranted and erroneous, and we will pursue every legal avenue to reverse the False Claims Act judgment.

Thank you. I will now turn the call over to Tim.

Exhibit 99.4

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of Timothy R. Wallace

Chairman, Chief Executive Officer, and President

February 19, 2016

Thank you Theis, and good morning everyone.

I am very pleased with Trinity’s financial performance during 2015. For the third straight year, we established records for revenues, net income and earnings per share. Our businesses created value by leveraging their combined expertise, competencies, and manufacturing capacity to produce high quality products for a broad range of industrial markets.

The most recent quarter completes an impressive five-year period in which our Company has demonstrated a solid track record of growth. During that 5 year time period, revenues more than tripled, going from $1.9 billion to $6.4 billion. In 2015, earnings per share and net income were 11 times greater than in 2010. From 2010 to 2015, net income increased from $67 million to $797 million and earnings per share grew from $0.43 cents per share to $5.08 per share. Our financial performance during the last 5 years is a great example of the potential we have as a company.

Our Company is on a transformational journey and has made significant progress during the past five years toward our vision of being a premier diversified industrial company. We have added new businesses to our portfolio with long-term growth potential and we have invested in our manufacturing footprint to increase efficiency and flexibility. Pre-tax profit from our railcar leasing and management services operations has more than tripled since 2010. We have also enhanced our company’s earnings and cash flow through the development of the RIV platform.

Our guidance for 2016 reflects the weakening in the industrial economy that began broadly impacting our businesses late last summer. As I stated in our 3rd quarter conference call, most of the industrial companies we serve are continuing to take a ‘wait and see’ approach to capital investment. At this time, it continues to be difficult to predict when demand will improve. Our 2016 earnings guidance assumes the economic conditions will continue throughout the year.

In this environment, we are placing a high priority on cost containment and various initiatives to enhance our performance. We will continue to reposition and streamline our manufacturing operations as business conditions fluctuate. Over my forty-year career at Trinity, I have participated in a number of business cycles. Our business leaders have a proven track record for balancing staffing levels in all types of markets. I am confident our businesses will respond to the shift in demand for our products. Historically, we have made strategic investments during downturns. Our liquidity position and balance sheet strength have never been better.

In summary, I am extremely proud of our team’s accomplishments during 2015, and throughout this upcycle. Trinity’s corporate business model is built on the premise that we enrich companies we own by leveraging the strengths contained within our enterprise as a whole. Trinity’s employees do a fabulous job of collaborating as they manufacture high quality products for our customers while creating value for our shareholders. Our operating and financial flexibility enable us to pursue a variety of opportunities as well as successfully confront market challenges. I am confident that Trinity will emerge from the current period of uncertainty

as a stronger company. Our goal is to continually improve upon the superior products and services we provide to our customers, and the returns we generate for our shareholders.

I’ll now turn it over to Bill for his comments.

Exhibit 99.5

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of William A. McWhirter II,

Senior Vice President and Group President

Construction Products, Energy Equipment and Inland Barge Groups

February 19, 2016

Thank you Tim and good morning everyone.

The Barge Group’s fourth quarter performance reflects several factors: the competitive dynamics occurring within the industry, a less favorable product mix and the closure of one of our facilities. Our barge team is doing an outstanding job of maintaining production efficiencies and reducing costs as we align our production footprint with current demand.

The Barge Group received orders for $190 million during the quarter resulting in a backlog of $416 million at the end of December. Replacement needs for dry cargo barges drove 4th quarter orders. Current inquiry levels indicate lower barge demand and subsequently, lower manufacturing levels in the near term when compared to the past few years. The investments in our barge business in recent years have increased this Group’s production efficiencies and positioned our Barge team to respond effectively to changes in market demand. We are prepared to make additional adjustments to our manufacturing footprint as needed.

The Construction Products Group improved quarterly profitability year-over-year despite the slowdown that typically takes place during the winter months.

At the end of the year, the federal government passed a five-year, $305 billion dollar funding bill for highways and other related transit programs. The FAST ACT authorizes funding through 2021 and will provide much needed stability for public agencies charged with planning transportation projects. Our highway products business anticipates an improvement in market demand over the next few years.

Demand for aggregates remains robust in the markets we serve in the southwestern United States. Repositioning our Construction Products business during the last few years and continuing to expand our aggregates business has benefitted this Group’s overall performance. We are committed to finding opportunities to expand our product portfolio and grow our market positions.

The Energy Equipment Group reported another strong quarter and ended the year with record revenues and operating profit.

The wind tower business continued to deliver solid results. At the end of the fourth quarter, the wind tower backlog totaled $371 million, most of which will be delivered in 2016. This level of production essentially fills the manufacturing space currently dedicated to this business.

At the end of 2015, the federal government passed a five-year spending bill that includes a tax incentive for the wind industry through 2019. In recent years, legislation for wind power tax incentives was unpredictable and short in duration, causing volatility in the wind industry. The multi-year federal incentive provides developers and their supply chain partners the necessary time needed to plan and develop wind projects. We are prepared to adjust our capacity should demand increase significantly.

The current market for utility structures remains highly competitive and continues to experience some capacity rationalization. We expect revenues for this business to decline further during 2016. Over the long term, investment forecast are positive. The recently passed federal tax incentive for wind power is expected to drive the development of additional transmission infrastructure to bring new wind power to market.

In closing, our businesses are responding effectively to changing demand conditions. We believe these businesses have significant growth potential as our long-term outlook for energy and infrastructure investment in North America remains positive.

And now, I will turn the presentation over to Steve.

Exhibit 99.6

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of D. Stephen Menzies

Senior Vice President and Group President

Rail and Railcar Leasing Groups

February 19, 2016

Thank you, Bill, good morning!

The TrinityRail team completed another record quarter in terms of railcar deliveries, profit and operating margin, as well as, its second consecutive year of record revenues, profit, and railcar deliveries. In 2015, our Rail Group achieved a 20.9% operating profit margin on deliveries of 34,295 railcars. Our Leasing Group grew year-over-year revenue and profit from operations by 11% and 15%, respectively, while generating significant income and cash flow from the sales of leased railcars through our railcar investment vehicle platform. TrintyRail’s outstanding performance reflects the strength of our integrated railcar manufacturing, leasing and services business model. Our operating and financial flexibility and leading market position give us confidence we can effectively adapt to rapidly changing market conditions.

The weakness in the industrial sector of the economy, along with declining railcar loadings, improved rail cycle times, and increasing numbers of railcars in storage, is creating a challenging set of market dynamics. We are aligning our production footprint to a lower rate of production while meeting our scheduled railcar backlog delivery requirements.

Our Rail Group received 2,455 orders during the fourth quarter. The orders we received represent a mix of tank cars, covered hoppers, flat cars and autoracks. Industry orders for the 4th quarter affirmed a weaker demand trend that began in the 3rd quarter. In total, more than 53,000 orders were placed in 2015 - a healthy level by historical standards. However, industry orders in the second half of 2015 declined approximately 50% compared to the level of orders in the first half of 2015 indicating a significant shift toward a weakening demand trend. First quarter 2016 inquiry levels continue at a weakened level. We are seeing pockets of demand, however. The level of automotive related activity remains favorable. The outlook of new petrochemical capacity coming online during the next few years is positive. We remain optimistic regarding long-term railcar demand fundamentals, as third party independent forecasts project industry deliveries in 2016 and 2017 above historical averages, albeit below the strong 2015 levels.

During the fourth quarter TrinityRail delivered 8,835 railcars. A favorable product mix, extended production runs, high levels of productivity and declining material costs contributed to a record 23.6% operating margin during the quarter for our Rail Group. I am very proud of our team’s ability to maximize operational performance on a record level of railcar deliveries.

Our backlog of approximately 49,000 railcars, valued at $5.4 billion at the end of 2015, provides good visibility for 2016 production planning. Our current expectations for deliveries in 2016 is approximately 27,000 railcars, of which, approximately 90% are already in our backlog. We project operating margins of approximately 15% for 2016 reflecting a significant shift in our planned 2016 product mix, weak pricing for orders taken in Q4-2015 scheduled for production in 2016 and projected pricing for our unsold backlog production, as well as, costs and efficiencies associated with reducing our production footprint to align with current demand. I am confident our operations team will execute in this environment with the same level of skill that produced record results. Our projections assume no significant improvement in market conditions in 2016.

We are closely monitoring the industry’s implementation of HM-251 tank car regulations. Several factors, including the continued low price of crude oil, the reduced utilization of railcars transporting crude oil and the extended timeline for the mandated schedule for modifications have caused customers to postpone decisions pertaining to modifying railcars used in flammable commodity service. As we have indicated previously, our first priority is to ensure regulatory compliance within our leased railcar fleet. Modifications to our lease fleet are currently in process. I am pleased with the flexibility of our expanded maintenance service facilities which are making HM-251 modifications while also providing regulatory compliance services for our owned and managed lease fleets. We continue to engage in dialogues with our customers, a number of whom appear to be finalizing their fleet modification plans.

The Leasing Group’s performance during 2015 was also impressive, reflecting solid railcar market fundamentals during the year. High lease fleet utilization, favorable lease rate pricing, and new lease fleet additions contributed to annual revenue and profit from operations growth. The leasing company ended the year with 97.7% utilization and a total of 76,765 railcars in our wholly-owned and partially owned lease fleets. Our total managed fleet including our wholly-owned, partially owned and investor owned fleets now exceeds 94,800 railcars.

We expect our committed leased railcar backlog of $1.5 billion to generate further growth of our lease portfolio. Lease expirations in 2016 reflect the broad diversification of our lease fleet as roughly 15% of our total portfolio remains up for renewal in 2016. The weaker market environment is placing pressure on lease rates and may adversely impact lease fleet utilization.

During the last several years, we sold a significant number of leased railcars through the Railcar Investment Vehicle platform. These sales demonstrate the value we have created in our leasing business and have contributed significantly to Trinity’s financial flexibility and earnings performance.

Railcar Investment Vehicle’s, or “RIV’s”, are discreet investments in leased railcars, developed and managed by TrinityRail, for institutional investors who desire to invest capital in leased railcars. Leased railcars are viewed by institutional investors as stable, hard asset investments with an inflationary hedge component. We continue to engage with institutional investors interested to invest in leased railcars. The scale of our leasing platform and our lease origination capabilities, combined with our “cradle to grave” asset expertise, attracts institutional investors to the RIV platform. To meet the specific investment objectives of varied investors, Trinity develops diversified leased railcar portfolios by selecting leased railcars from our wholly owned lease portfolio or from railcars in our lease order backlog. Further, Trinity manages the assets on behalf of the investors providing administrative and maintenance services. We have successfully developed the RIV platform over the last 10 years, comprised of over $5 billion in leased railcars (at original sale prices). The RIV platform provides TrinityRail financial capacity to enhance our lease origination capabilities and lease portfolio funding diversification and provides Trinity with additional financial flexibility. We expect to grow this platform by facilitating additional RIV’s for institutional investors.

During 2016, we currently plan to expand the RIV platform by selling approximately $500 million of leased railcars to institutional investors. We have inquiries from institutional investors to acquire railcars through the RIV platform that exceeds $500 million, as such, we will evaluate the possibility of additional leased railcar sales through the RIV platform during 2016, as we balance investment demand from institutional investors with the size of our wholly owned lease fleet.

In summary, the Rail Group and Leasing and Management Services Group delivered exceptional results during the fourth quarter and throughout 2015. As we move into 2016, we are focused on controlling costs,

maximizing our production efficiency on reduced production levels and maintaining high fleet utilization. We will continue to build out the RIV platform. Our operating and financial flexibility continue to differentiate TrinityRail, enhancing our position as a premier provider of railcar products and services.

I will now turn it over to James for his remarks.

Exhibit 99.7

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of James E. Perry

Senior Vice President and Chief Financial Officer

February 19, 2016

Thank you, Steve and good morning everyone.

Yesterday, we announced our results for the fourth quarter and full year 2015. For the quarter, the Company reported earnings per share of $1.30 and revenues of $1.55 billion, compared to EPS and revenues of $0.86 and $1.66 billion, respectively, for the same period last year. During the fourth quarter, our EPS reflected strong operating performance by our businesses and the continued expansion of the railcar investment vehicle platform, which we refer to as the RIV platform.

For the full year, we recorded revenues of $6.39 billion and EPS of $5.08, both records for Trinity. We ended the year with $871 million of cash on hand and have access to additional capital through our committed lines of credit at both the corporate and leasing levels. At the end of the year, our liquidity position was more than $2.1 billion.

During the fourth quarter, we invested $51 million in capital expenditures across a number of our manufacturing businesses and at the corporate level. For the full year, this figure totaled $196 million.

During the fourth quarter, we invested approximately $338 million in leased railcar additions to our wholly-owned lease fleet. This number included new originations as well as some secondary market purchases. This investment was offset by $395 million of leased railcar sales from our lease fleet.

I would like to add to the background on our RIV platform that Steve provided. The RIV platform provides Trinity with a level of financial flexibility that is unique among diversified industrial companies. The cash flow generated from this platform provides flexibility to reinvest in our railcar leasing and management services platform, our portfolio of diversified industrial businesses, and in other opportunities that enhance shareholder returns. Expanding this platform is a core element of our strategy, with the associated earnings and cash flows enhancing our financial flexibility.

In addition to financial flexibility, we garner other benefits when we sell a leased railcar to the RIV platform. When we do so, we maintain the management of the railcar. This generates recurring management fees for Trinity that are expected to grow as we continue to expand the platform. This management role allows us to maintain close relationships with the end users of the railcars, giving us real-time information on the markets we serve and our customers’ ongoing needs. As managers, we also coordinate the maintenance of the railcars, through our maintenance facilities and facilities owned by third parties.

The accounting treatment for sales of leased railcars can be complex and difficult for our investors to understand. When railcars are manufactured by Trinity and sold to our leasing company, they are transferred at market pricing levels - the revenue and profit are recorded in the Rail Group. When we consolidate Trinity’s financial statements, the revenue from the railcar sale is eliminated and the profit is deferred.

If a railcar is later sold from our lease fleet to an RIV or another third party, the remaining deferred profit on our balance sheet for a particular railcar is recognized as income at that time. In addition, we recognize the gain on the sale as compared to the book value of the railcar.

There is another accounting treatment that applies to the revenue recognition for railcars sold with leases. This is determined by how long the railcar was in the lease fleet. For railcars that have been in our lease fleet for one year or less, revenue is recognized in the Leasing Group; for railcars in the lease fleet for more than one year, no revenue is recognized. The profit on the sale of the leased railcar is fully recognized no matter the length of time the railcar was in our fleet.

During the fourth quarter, we sold $470 million of leased railcars to the RIV platform, including $85 million sold directly from the Rail Group. For the full year, we sold approximately $1.1 billion of leased railcars to the RIV platform. Over the last decade, we have placed approximately $5.0 billion of leased railcars at the time of the sale to various RIVs.

In 2015, we sold almost $1.2 billion of leased railcars to RIVs and other third parties. Of this total, $260 million was sold directly from our manufacturing business - this figure was included in the Rail Group’s revenues. Another $405 million worth of railcars were sold from the lease fleet, and had only been in the fleet for one year or less, so were included in the Leasing Group’s revenues. The final $515 million of leased railcar sales were railcars that had been in the fleet for more than one year, so no revenue was booked - these proceeds are shown on our cash flow statement.

Now, I will move to our guidance for 2016.

This year is expected to be more challenging in terms of the demand in the markets we serve. Historically, we achieve high levels of operating leverage as our volumes rise in a strong economic cycle. The last few years are a prime example of our ability to achieve record earnings during a solid industrial demand environment. On the other hand, we historically lose some of the operating leverage and efficiencies we gained during the up cycle as we begin to cycle down. When this occurs, we are focused on preserving as much of the momentum and benefits that we gained from the previously strong demand environment. We have costs associated with the shifts in our product mix and rationalization of our footprint. As a result, our margins are impacted and it is difficult to precisely predict how much. Our businesses have been highly focused on responding to the current economic conditions and have been taking the appropriate steps.

In our October conference call, we mentioned that were seeing a slowdown in the industrial markets we serve and thus hesitancy from our customers to place orders - this trend has continued into early 2016. When we experience several months of persistent economic conditions, we incorporate that trend into our guidance and provide our insight accordingly. It is difficult for us to provide guidance in such a challenging environment. At this time, our guidance does not assume that economic conditions improve in 2016.

In our press release yesterday, we provided EPS guidance of $2.00 to $2.40 in 2016. This represents several factors: our current firm backlogs; expectations for our operations against the weak industrial outlook; and a lower level of leased railcar sales to the RIV platform.

We expect our Rail Group to deliver approximately 27,000 railcars in 2016. This is a decrease of over 7,000 railcars from 2015. We expect revenues in the Rail Group of approximately $3.1 billion; this is a decrease of almost $1.4 billion year-over-year. Our operating leverage will decline due to the lower level of production and certain costs associated with aligning our manufacturing footprint with demand, resulting in an operating margin of approximately 15%.

In 2016, we expect to eliminate approximately $1.1 billion of revenues related to railcar sales to our leasing company and defer approximately $215 million of operating profit. These revenue eliminations and profit

deferrals result from the accounting treatment I just reviewed for sales from our manufacturing company to our leasing company.

In 2016, we expect our Leasing Group to record operating revenues, excluding leased railcar sales, of approximately $700 million, with profit from operations of approximately $300 million.

In 2016, our forecast includes approximately $500 million of sales of leased railcars to RIVs with a profit of approximately $100 million. As these sales are dynamic, we have yet to identify which cars will be sold to RIVs so we cannot provide the Group in which the transaction will be recorded or the accounting treatment related to the revenues and profits. Our guidance at this time assumes the sales occur from the lease fleet. The demand for leased railcars among institutional investors remains high, so we may have the opportunity for a higher level of leased railcar sales this year as we balance this strong level of demand with our own ownership of leased assets and market demand for new leased railcars.

We expect our Energy Equipment Group to have 2016 revenues of approximately $1 billion with an operating margin of approximately 12%. We are pleased with the $371 million backlog we have in our wind towers business, which essentially fills our production facilities dedicated to that product line during 2016.

We expect our Construction Products Group to record 2016 revenues of approximately $560 million with an operating margin of approximately 11%. As Bill mentioned, the country now has a federal highway bill, which provides some longer-term benefits to this Group as projects begin. We continue to be pleased with the performance and opportunities within our aggregates businesses.

Our Inland Barge Group is expected to generate revenues of approximately $445 million in 2016 with an operating margin of approximately 10%. Low commodity prices and the strong US dollar have reduced demand for products transported in barges. Combining these factors with lower steel prices, we expect revenues and profit in this Group to be lower than in the last few years. We continue to monitor demand and align our production footprint accordingly in this Group, as we do in all of our businesses.

Our annual EPS guidance also includes the following assumptions:

•A tax rate of approximately 36%;

•Corporate expenses of $130 million to $150 million, which include ongoing litigation-related expenses;

•The deduction of approximately $20 million of non-controlling earnings due to our partial ownership in TRIP and RIV 2013;

•A reduction of approximately 7 cents per share due to the two-class method of accounting, compared to calculating Trinity’s EPS directly from the face of the income statement; and

•No dilution from the convertible notes, based on the current stock price.

As it pertains to cash flow, we expect the annual net cash investment in railcars added to our lease fleet to be approximately $385 million in 2016. Our guidance incorporates the guidance we discussed for 2016 from the sales of leased railcars from the Leasing Group.

Full-year manufacturing and corporate capital expenditures for 2016 are expected to be between $150 million and $200 million.

Our share repurchases in 2015 totaled $115 million, with no repurchases occurring during the fourth quarter. In December, the Board authorized a $250 million share repurchase program through 2017 and we expect to be in the market repurchasing shares this year.

At this time, we expect for our total cash flow to be positive in 2016.

In conclusion, we enter this economic down cycle with a strong balance sheet and $2.1 billion of liquidity. We continue to seek organic and acquisition investment opportunities that enhance shareholder value. We are confident that Trinity will respond appropriately to the weak industrial markets this year as we continue to pursue our vision to be a premier diversified industrial company.

Our operator will now prepare us for the question and answer session.

-- Q&A Session --

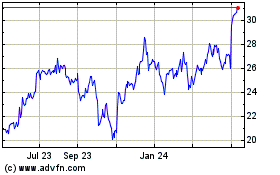

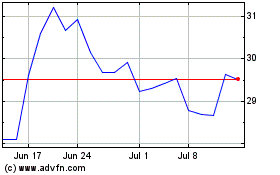

Trinity Industries (NYSE:TRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Industries (NYSE:TRN)

Historical Stock Chart

From Apr 2023 to Apr 2024