Trinity Industries, Inc. Announces $1 Billion Extension of Strategic Railcar Alliance with Element Financial Corporation

October 14 2015 - 8:11AM

Business Wire

Today, Trinity Industries, Inc. (NYSE: TRN), through its

wholly-owned subsidiary, TrinityRail Asset Management Company, LLC

(“TRAMCo”) announced the extension of its strategic railcar

alliance with Element Financial Corporation (TSX:EFN) (“Element”),

one of North America's leading equipment finance companies. Under

the extended alliance, Element is expected to acquire up to an

additional $1 billion of leased railcars during the period of 2016

through 2019.

Similar to past purchases by Element under the existing

alliance, the portfolio is expected to consist of new railcars from

Trinity’s leased railcar backlog and existing leased railcars from

the Trinity Industries Leasing Company (“TILC”) fleet; the

portfolio may also include secondary market purchases of leased

railcars identified by Trinity and Element. TILC will continue to

act as exclusive servicer for the leased railcars purchased by

Element under the alliance, maintaining its relationship with the

individual lessees, and receive management fees accordingly.

At this time, the amount of expected sales to Element in each

year of the extended alliance has not been determined. Consistent

with the existing alliance, sales are expected to be reported in

both the Rail and Leasing and Management Services Groups. Macquarie

Capital advised Trinity on this alliance.

“We believe the long-term extension of our successful alliance

with Element further strengthens our unique railcar investment

vehicle platform,” said D. Stephen Menzies, Trinity Industries,

Inc. Senior Vice President and the Group President responsible for

Trinity’s railcar manufacturing and leasing businesses. “In recent

years, the addition of institutional investors and strategic

partners, like Element, enhance our financial flexibility to

further grow our managed lease fleet,” added Mr. Menzies.

Trinity Industries, Inc., headquartered in Dallas, Texas, is a

diversified industrial company that owns market-leading businesses,

which provide products and services to the energy, transportation,

chemical, and construction sectors. Trinity reports its financial

results in five principal business segments: the Rail Group, the

Railcar Leasing and Management Services Group, the Inland Barge

Group, the Construction Products Group, and the Energy Equipment

Group. For more information, visit: www.trin.net.

Some statements in this release, which are not historical facts,

are “forward-looking statements” as defined by the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include statements about Trinity's estimates,

expectations, beliefs, intentions or strategies for the future, and

the assumptions underlying these forward-looking statements.

Trinity uses the words “anticipates,” “believes,” “estimates,”

“expects,” “intends,” “forecasts,” “may,” “will,” “should,”

“guidance” and similar expressions to identify these

forward-looking statements. Forward-looking statements involve

risks and uncertainties that could cause actual results to differ

materially from historical experience or our present expectations.

For a discussion of such risks and uncertainties, which could cause

actual results to differ from those contained in the

forward-looking statements, see “Risk Factors” and “Forward-Looking

Statements” in the Company's Annual Report on Form 10-K for the

most recent fiscal year.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151014005809/en/

Trinity Industries, Inc.Investor Contact:Jessica L.

Greiner, 214-631-4420Director of Investor RelationsorMedia

Contact:Jack Todd, 214-589-8909 or 214-589-2567Vice President,

Public Affairs

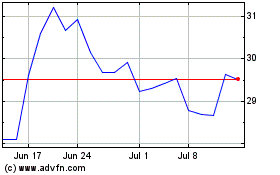

Trinity Industries (NYSE:TRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

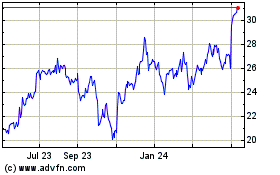

Trinity Industries (NYSE:TRN)

Historical Stock Chart

From Apr 2023 to Apr 2024