UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| | |

Date of Report (Date of Earliest Event Reported): | | July 23, 2015 |

Trinity Industries, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Delaware | | 1-6903 | | 75-0225040 |

(State or other jurisdiction of incorporation | | (Commission File No.) | | (I.R.S. Employer Identification No.) |

| | | | |

2525 N. Stemmons Freeway, Dallas, Texas | | | | 75207-2401 |

(Address of principal executive offices) | | | | (Zip Code) |

|

| | |

| | |

Registrant's telephone number, including area code: | | 214-631-4420 |

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

The Registrant hereby furnishes the information set forth in its News Release, dated July 23, 2015, announcing operating results for the three and six month periods ended June 30, 2015, a copy of which is furnished as exhibit 99.1 and incorporated herein by reference. On July 24, 2015, the Registrant held a conference call and web cast with respect to its financial results for the three and six month periods ended June 30, 2015. The conference call scripts of Gail M. Peck, Vice President, Finance and Treasurer; S. Theis Rice, Senior Vice President and Chief Legal Officer; Timothy R. Wallace, Chairman, Chief Executive Officer, and President; William A. McWhirter II, Senior Vice President and Group President of the Construction Products, Energy Equipment and Inland Barge Groups; D. Stephen Menzies, Senior Vice President and Group President of the Rail and Railcar Leasing Groups; and James E. Perry, Senior Vice President and Chief Financial Officer are furnished as exhibits 99.2, 99.3, 99.4, 99.5, 99.6, and 99.7, respectively, and incorporated herein by reference.

This information is not "filed" pursuant to the Securities Exchange Act of 1934 and is not incorporated by reference into any Securities Act of 1933 registration statements. Additionally, the submission of the report on Form 8-K is not an admission of the materiality of any information in this report that is required to be disclosed solely by Regulation FD.

Item 7.01 Regulation FD Disclosure.

See "Item 2.02 — Results of Operations and Financial Condition."

This information is not "filed" pursuant to the Securities Exchange Act of 1934 and is not incorporated by reference into any Securities Act of 1933 registration statements. Additionally, the submission of the report on Form 8-K is not an admission of the materiality of any information in this report that is required to be disclosed solely by Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(a) - (c) Not applicable.

(d) Exhibits:

Exhibit No. / Description

99.1 News Release dated July 23, 2015 with respect to the operating results for the three and six month periods ended June 30, 2015.

99.2 Conference call script of July 24, 2015 of Gail M. Peck, Vice President, Finance and Treasurer.

99.3 Conference call script of July 24, 2015 of S. Theis Rice, Senior Vice President and Chief Legal Officer.

99.4 Conference call script of July 24, 2015 of Timothy R. Wallace, Chairman, Chief Executive Officer, and President.

99.5 Conference call script of July 24, 2015 of William A. McWhirter II, Senior Vice President and Group President of the Construction Products, Energy Equipment and Inland Barge Groups.

99.6 Conference call script of July 24, 2015 of D. Stephen Menzies, Senior Vice President and Group President of the Rail and Railcar Leasing Groups.

99.7 Conference call script of July 24, 2015 of James E. Perry, Senior Vice President and Chief Financial Officer.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| Trinity Industries, Inc. |

| | |

July 24, 2015 | By: | /s/ James E. Perry |

| | Name: James E. Perry |

| | Title: Senior Vice President and Chief Financial Officer |

|

| | |

Exhibit Index |

Exhibit No. | | Description |

| | |

99.1 | | News Release dated July 23, 2015 with respect to the operating results for the three and six month periods ended June 30, 2015 |

99.2 | | Conference call script of July 24, 2015 of Gail M. Peck, Vice President, Finance and Treasurer |

99.3 | | Conference call script of July 24, 2015 of S. Theis Rice, Senior Vice President and Chief Legal Officer. |

99.4 | | Conference call script of July 24, 2015 of Timothy R. Wallace, Chairman, Chief Executive Officer, and President. |

99.5 | | Conference call script of July 24, 2015 of William A. McWhirter II, Senior Vice President and Group President of the Construction Products, Energy Equipment and Inland Barge Groups. |

99.6 | | Conference call script of July 24, 2015 of D. Stephen Menzies, Senior Vice President and Group President of the Rail and Railcar Leasing Groups. |

99.7 | | Conference call script of July 24, 2015 of James E. Perry, Senior Vice President and Chief Financial Officer. |

Exhibit 99.1

NEWS RELEASE |

| |

Investor Contact: | Media Contact: |

Jessica Greiner | Jack Todd |

Director of Investor Relations | Vice President, Public Affairs |

Trinity Industries, Inc. | Trinity Industries, Inc. |

214/631-4420 | 214/589-8909 |

FOR IMMEDIATE RELEASE

Trinity Industries, Inc. Announces Strong Second Quarter 2015 Results

and Increases Annual Guidance

DALLAS, Texas - July 23, 2015 - Trinity Industries, Inc. (NYSE:TRN) today announced earnings results for the second quarter ended June 30, 2015, including the following significant highlights:

| |

• | Second quarter earnings per common diluted share of $1.33 compared to $1.01 for the second quarter of 2014, a 32% increase year-over-year |

| |

• | Quarterly revenue and net income of $1.68 billion and $212.0 million, respectively, a year-over-year increase of 13% and 29%, respectively |

| |

• | Rail and Inland Barge Groups reported record operating profit during the second quarter |

| |

• | Rail Group delivered 8,530 railcars and received orders for 11,170 new railcars during the second quarter, increasing its backlog to $6.90 billion |

| |

• | Structural wind towers business received orders totaling $183.9 million, increasing its backlog to $502.6 million |

| |

• | Company raised earnings guidance for full year 2015 to between $4.45 and $4.75 per common diluted share compared to previous guidance of between $4.10 and $4.45 per share |

Consolidated Results

Trinity Industries, Inc. reported net income attributable to Trinity stockholders of $212.0 million, or $1.33 per common diluted share. Net income for the same quarter of 2014 was $164.2 million, or $1.01 per common diluted share. Revenues for the second quarter of 2015 increased 13% to a record $1.68 billion compared to revenues of $1.49 billion for the same quarter of 2014.

“Our performance continues to reflect the strength of our diversified industrial business model and our ability to shift our resources to meet our customers' needs," said Timothy R. Wallace, Trinity’s Chairman, CEO, and President. "I am extremely proud of the exceptional performance delivered by our people. Their consolidated efforts and proven ability to execute were major contributors to the high quality results we achieved during the second quarter," Mr. Wallace added.

Business Group Results

In the second quarter of 2015, the Rail Group reported revenues and record operating profit of approximately $1.11 billion and $227.7 million, respectively, resulting in year-over-year increases compared to the second quarter of 2014 of 24% and 29%, respectively. The increases in revenues and profit were due primarily to higher deliveries, improved pricing, and increased operating efficiencies partially offset by product mix changes. The Rail Group shipped 8,530 railcars and received orders for 11,170 railcars during the second quarter. The Rail Group had a backlog of $6.90 billion as of June 30, 2015, representing 59,830 railcars, compared to a backlog of $6.81 billion as of March 31, 2015, representing 57,190 railcars.

During the second quarter of 2015, the Railcar Leasing and Management Services Group reported record leasing and management revenues of $178.2 million compared to $160.7 million in the second quarter of 2014 due to higher average rental rates and net fleet additions. In addition, the Group recognized revenue of $59.9 million from sales of railcars from the lease fleet owned for less than a year during the second quarter compared to $70.8 million in the second quarter of 2014. Operating profit for this Group was $137.7 million in the second quarter of 2015 compared to operating profit of $102.4 million in the second quarter of 2014 due to a record level of leasing and management operating profit and higher operating profit from sales of railcars from the lease fleet. Supplemental information for the Railcar Leasing and Management Services Group is provided in the following tables.

During the second quarter, the Company sold $222.2 million of leased railcars to Element Financial Corporation ("Element") under a strategic alliance launched in 2013. Since the fourth quarter of 2013 when the alliance was announced, the Company has completed $1.34 billion of leased railcar sales to Element and anticipates fulfilling the $2 billion alliance by the end of 2015. The Company's second quarter results included $0.30 per common diluted share related to sales of leased railcars to Element and other third parties compared to $0.19 per share in the same quarter last year.

The Inland Barge Group reported record revenues of $187.8 million for the second quarter of 2015 compared to revenues of $165.4 million in the second quarter of 2014. Operating profit for this Group was a record $40.7 million in the second quarter of 2015 compared to $30.9 million in the second quarter of 2014. The increase in revenues compared to the same quarter last year was primarily due to higher delivery volumes of hopper barges partially offset by lower delivery volumes of tank barges. The Inland Barge Group received orders of $76.4 million during the quarter, and as of June 30, 2015 had a backlog of $454.0 million compared to a backlog of $565.4 million as of March 31, 2015.

The Energy Equipment Group reported revenues of $281.9 million in the second quarter of 2015 compared to revenues of $227.6 million in the same quarter of 2014. Operating profit for the second quarter of 2015 increased to $36.3 million compared to $28.3 million in the same quarter last year. The increases in revenues and operating profit compared to the same quarter last year were due primarily to an acquisition completed in 2014. During the quarter, the structural wind towers business received orders totaling $183.9 million. The backlog for structural wind towers as of June 30, 2015 was $502.6 million compared to a backlog of $390.7 million as of March 31, 2015.

Revenues in the Construction Products Group were $151.3 million in the second quarter of 2015 compared to revenues of $151.7 million in the second quarter of 2014. The Group recorded an operating profit of $21.3 million in the second quarter of 2015 compared to an operating profit of $22.4 million in the second quarter of 2014. Revenues and operating profit were substantially unchanged year-over-year. Operating profit in the second quarter of 2014 included a gain of $2.6 million related to the early retirement of certain acquisition-related liabilities. In June 2015, the Group completed the sale of the assets of its galvanizing business with facilities located in Texas, Mississippi, and Louisiana and reported a gain on sale of $7.8 million within the segment.

Cash and Liquidity

At June 30, 2015, the Company had cash and cash equivalents of $583.8 million. When combined with capacity under committed credit facilities, the Company had approximately $1.77 billion of available liquidity at the end of the second quarter.

Share Repurchase

The Company repurchased 1,669,764 shares of common stock at a cost of $50.0 million under its share repurchase authorization during the quarter, leaving $143.6 million remaining under its current authorization through December 31, 2015.

Highway Products Litigation

On June 9, 2015, the District Court entered a judgment in the total amount of $682.4 million related to the False Claims Act litigation filed against the Company. The Company's Motion for New Trial is pending. If denied, the Company will vigorously pursue its rights of appeal of the judgment to the Fifth Circuit. Based on information currently available to the Company including the significance of successful completion of eight, post-verdict crash tests of the ET Plus; conclusions reached by the FHWA’s joint task force founded upon such crash tests; and the FHWA's published field observations and research regarding ET Plus systems installed on the nation's roadways; we do not believe that a loss is probable in this matter, therefore no accrual has been included in the accompanying consolidated financial statements.

Earnings Outlook

For the full year of 2015, the Company anticipates earnings per common diluted share of between $4.45 and $4.75 compared to its previous 2015 earnings guidance of $4.10 to $4.45 per share. We expect the level of EPS in the second half of the year to be relatively evenly split between the third and fourth quarters. The 2015 earnings guidance assumes an annual weighted average diluted share count of 153 million shares, which includes 2.1 million shares from the convertible notes. The dilutive impact of the convertible notes reduces full year 2015 earnings per share by approximately $0.07 per share.

Actual results in 2015 may differ from present expectations and could be impacted by a number of factors including, among others, fluctuations in prices of commodities that our customers produce and transport; potential costs or timing of compliance related to final tank car regulations; expenses related to current and potential litigation involving our Highway Products business; the operating leverage and efficiencies that can be achieved by the Company's manufacturing businesses; the level of sales and profitability of railcars; the level of profitability resulting from sales of leased railcars; the dilutive impact of the convertible notes related to changes in the Company's stock price; and the impact of weather conditions on our operations and delivery schedules.

Conference Call

Trinity will hold a conference call at 11:00 a.m. Eastern on July 24, 2015 to discuss its second quarter results. To listen to the call, please visit the Investor Relations section of the Trinity Industries website, www.trin.net and select the Conference Calls menu link. An audio replay may be accessed through the Company’s website or by dialing (402) 220-1346 until 11:59 p.m. Eastern on July 31, 2015.

Trinity Industries, Inc., headquartered in Dallas, Texas, is a diversified industrial company that owns market-leading businesses providing products and services to the energy, transportation, chemical, and construction sectors. Trinity reports its financial results in five principal business segments: the Rail Group, the Railcar Leasing and Management Services Group, the Inland Barge Group, the Construction Products Group, and the Energy Equipment Group. For more information, visit: www.trin.net.

Some statements in this release, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Trinity's estimates, expectations, beliefs, intentions or strategies for the future, and the assumptions underlying these forward-looking statements. Trinity uses the words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance” and similar expressions to identify these forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” and “Forward-Looking Statements” in the Company's Annual Report on Form 10-K for the most recent fiscal year.

- TABLES TO FOLLOW -

Trinity Industries, Inc.

Condensed Consolidated Income Statements

(in millions, except per share amounts)

(unaudited)

|

| | | | | | | |

| Three Months Ended

June 30, |

| 2015 | | 2014 |

Revenues | $ | 1,676.8 |

| | $ | 1,485.3 |

|

Operating costs: | | | |

Cost of revenues | 1,219.6 |

| | 1,098.3 |

|

Selling, engineering, and administrative expenses | 114.4 |

| | 96.4 |

|

Gains on dispositions of property: | | | |

Net gains on lease fleet sales | (30.1 | ) | | (9.7 | ) |

Other | (10.0 | ) | | (1.7 | ) |

| 1,293.9 |

| | 1,183.3 |

|

Operating profit | 382.9 |

| | 302.0 |

|

Interest expense, net | 50.1 |

| | 46.2 |

|

Other, net | (0.7 | ) | | (1.2 | ) |

Income before income taxes | 333.5 |

| | 257.0 |

|

Provision for income taxes | 112.7 |

| | 83.9 |

|

Net income | 220.8 |

| | 173.1 |

|

Net income attributable to noncontrolling interest | 8.8 |

| | 8.9 |

|

Net income attributable to Trinity Industries, Inc. | $ | 212.0 |

| | $ | 164.2 |

|

| | | |

Net income attributable to Trinity Industries, Inc. per common share: | | |

Basic | $ | 1.36 |

| | $ | 1.05 |

|

Diluted | $ | 1.33 |

| | $ | 1.01 |

|

Weighted average number of shares outstanding: | | | |

Basic | 150.7 |

| | 151.0 |

|

Diluted | 154.2 |

| | 157.4 |

|

Trinity is required to utilize the two-class method of accounting when calculating earnings per share as a result of unvested restricted shares that have non-forfeitable rights to dividends and are, therefore, considered to be a participating security. The unvested restricted shares are excluded from the weighted average number of shares outstanding for the purposes of determining earnings per share. The two-class method results in a lower earnings per share than is calculated from the face of the income statement. See Earnings Per Share Calculation table below.

Trinity Industries, Inc.

Condensed Consolidated Income Statements

(in millions, except per share amounts)

(unaudited)

|

| | | | | | | |

| Six Months Ended

June 30, |

| 2015 | | 2014 |

Revenues | $ | 3,303.5 |

| | $ | 2,945.8 |

|

Operating costs: | | | |

Cost of revenues | 2,430.7 |

| | 2,172.3 |

|

Selling, engineering, and administrative expenses | 212.7 |

| | 180.0 |

|

Gains on dispositions of property: | | | |

Net gains on lease fleet sales | (45.0 | ) | | (87.2 | ) |

Other | (10.9 | ) | | (12.6 | ) |

| 2,587.5 |

| | 2,252.5 |

|

Operating profit | 716.0 |

| | 693.3 |

|

Interest expense, net | 101.1 |

| | 92.1 |

|

Other, net | (3.0 | ) | | (1.3 | ) |

Income before income taxes | 617.9 |

| | 602.5 |

|

Provision for income taxes | 208.1 |

| | 196.4 |

|

Net income | 409.8 |

| | 406.1 |

|

Net income attributable to noncontrolling interest | 17.6 |

| | 15.5 |

|

Net income attributable to Trinity Industries, Inc. | $ | 392.2 |

| | $ | 390.6 |

|

| | | |

Net income attributable to Trinity Industries, Inc. per common share: | | |

Basic | $ | 2.52 |

| | $ | 2.51 |

|

Diluted | $ | 2.46 |

| | $ | 2.43 |

|

Weighted average number of shares outstanding: | | | |

Basic | 151.0 |

| | 150.5 |

|

Diluted | 154.3 |

| | 155.6 |

|

Trinity is required to utilize the two-class method of accounting when calculating earnings per share as a result of unvested restricted shares that have non-forfeitable rights to dividends and are, therefore, considered to be a participating security. The unvested restricted shares are excluded from the weighted average number of shares outstanding for the purposes of determining earnings per share. The two-class method results in a lower earnings per share than is calculated from the face of the income statement. See Earnings Per Share Calculation table below.

Trinity Industries, Inc.

Condensed Segment Data

(in millions)

(unaudited)

|

| | | | | | | |

| Three Months Ended

June 30, |

Revenues: | 2015 | | 2014 |

Rail Group | $ | 1,110.3 |

| | $ | 895.6 |

|

Construction Products Group | 151.3 |

| | 151.7 |

|

Inland Barge Group | 187.8 |

| | 165.4 |

|

Energy Equipment Group | 281.9 |

| | 227.6 |

|

Railcar Leasing and Management Services Group | 238.1 |

| | 231.5 |

|

All Other | 26.8 |

| | 28.1 |

|

Segment Totals before Eliminations | 1,996.2 |

| | 1,699.9 |

|

Eliminations - lease subsidiary | (215.5 | ) | | (128.6 | ) |

Eliminations - other | (103.9 | ) | | (86.0 | ) |

Consolidated Total | $ | 1,676.8 |

| | $ | 1,485.3 |

|

| | | |

| Three Months Ended

June 30, |

Operating profit (loss): | 2015 | | 2014 |

Rail Group | $ | 227.7 |

| | $ | 176.0 |

|

Construction Products Group | 21.3 |

| | 22.4 |

|

Inland Barge Group | 40.7 |

| | 30.9 |

|

Energy Equipment Group | 36.3 |

| | 28.3 |

|

Railcar Leasing and Management Services Group | 137.7 |

| | 102.4 |

|

All Other | (0.1 | ) | | (2.6 | ) |

Segment Totals before Eliminations and Corporate Expenses | 463.6 |

| | 357.4 |

|

Corporate | (32.3 | ) | | (29.7 | ) |

Eliminations - lease subsidiary | (49.9 | ) | | (26.9 | ) |

Eliminations - other | 1.5 |

| | 1.2 |

|

Consolidated Total | $ | 382.9 |

| | $ | 302.0 |

|

Trinity Industries, Inc.

Condensed Segment Data

(in millions)

(unaudited)

|

| | | | | | | |

| Six Months Ended

June 30, |

Revenues: | 2015 | | 2014 |

Rail Group | $ | 2,254.8 |

| | $ | 1,753.0 |

|

Construction Products Group | 264.1 |

| | 264.8 |

|

Inland Barge Group | 340.9 |

| | 302.3 |

|

Energy Equipment Group | 582.0 |

| | 438.2 |

|

Railcar Leasing and Management Services Group | 482.9 |

| | 674.6 |

|

All Other | 54.9 |

| | 51.3 |

|

Segment Totals before Eliminations | 3,979.6 |

| | 3,484.2 |

|

Eliminations - lease subsidiary | (474.5 | ) | | (377.7 | ) |

Eliminations - other | (201.6 | ) | | (160.7 | ) |

Consolidated Total | $ | 3,303.5 |

| | $ | 2,945.8 |

|

| | | |

| Six Months Ended

June 30, |

Operating profit (loss): | 2015 | | 2014 |

Rail Group | $ | 440.4 |

| | $ | 343.5 |

|

Construction Products Group | 29.6 |

| | 44.1 |

|

Inland Barge Group | 68.2 |

| | 57.6 |

|

Energy Equipment Group | 73.5 |

| | 51.2 |

|

Railcar Leasing and Management Services Group | 260.5 |

| | 332.7 |

|

All Other | (1.6 | ) | | (8.0 | ) |

Segment Totals before Eliminations and Corporate Expenses | 870.6 |

| | 821.1 |

|

Corporate | (59.0 | ) | | (52.8 | ) |

Eliminations - lease subsidiary | (98.2 | ) | | (76.2 | ) |

Eliminations - other | 2.6 |

| | 1.2 |

|

Consolidated Total | $ | 716.0 |

| | $ | 693.3 |

|

Trinity Industries, Inc.

Leasing Group

Condensed Results of Operations

(unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| ($ in millions) |

Revenues: | | | | | | | |

Leasing and management | $ | 178.2 |

| | $ | 160.7 |

| | $ | 344.3 |

| | $ | 310.9 |

|

Sales of railcars owned one year or less at the time of sale | 59.9 |

| | 70.8 |

| | 138.6 |

| | 363.7 |

|

Total revenues | $ | 238.1 |

| | $ | 231.5 |

| | $ | 482.9 |

| | $ | 674.6 |

|

Operating profit: | | | | | | | |

Leasing and management | $ | 90.6 |

| | $ | 75.5 |

| | $ | 172.9 |

| | $ | 139.4 |

|

Railcar sales: | | | | | | | |

Railcars owned one year or less at the time of sale | 17.0 |

| | 17.2 |

| | 42.6 |

| | 106.1 |

|

Railcars owned more than one year at the time of sale | 30.1 |

| | 9.7 |

| | 45.0 |

| | 87.2 |

|

Total operating profit | $ | 137.7 |

| | $ | 102.4 |

| | $ | 260.5 |

| | $ | 332.7 |

|

Operating profit margin: | | | | | | | |

Leasing and management | 50.8 | % | | 47.0 | % | | 50.2 | % | | 44.8 | % |

Railcar sales | * | | * | | * | | * |

Total operating profit margin | 57.8 | % | | 44.2 | % | | 53.9 | % | | 49.3 | % |

Selected expense information(1): | | | | | | | |

Depreciation | $ | 35.8 |

| | $ | 32.2 |

| | $ | 69.9 |

| | $ | 64.7 |

|

Maintenance | $ | 21.4 |

| | $ | 20.0 |

| | $ | 41.3 |

| | $ | 41.0 |

|

Rent | $ | 9.6 |

| | $ | 13.3 |

| | $ | 21.4 |

| | $ | 26.6 |

|

Interest | $ | 36.4 |

| | $ | 38.1 |

| | $ | 74.3 |

| | $ | 75.4 |

|

|

| | | | | |

| June 30,

2015 | | December 31,

2014 |

Leasing portfolio information: | | | |

Portfolio size (number of railcars) | 76,440 |

| | 75,930 |

Portfolio utilization | 98.9 | % | | 99.5 | % |

|

| | | | | | | |

| Six Months Ended June 30, |

| 2015 | | 2014 |

| (in millions) |

Proceeds from sale of leased railcars to Element Financial Corporation: | | |

Leasing Group: | | | |

Railcars owned one year or less at the time of sale | $ | 110.0 |

| | $ | 331.4 |

|

Railcars owned more than one year at the time of sale | 127.5 |

| | 222.7 |

|

Rail Group | 111.7 |

| | 81.6 |

|

| $ | 349.2 |

| | $ | 635.7 |

|

* Not meaningful

(1) Depreciation, maintenance, and rent expense are components of operating profit. Amortization of deferred profit on railcars sold from the Rail Group to the Leasing Group is included in the operating profits of the Leasing Group resulting in the recognition of depreciation expense based on the Company's original manufacturing cost of the railcars. Interest expense is not a component of operating profit and includes the effect of hedges.

Trinity Industries, Inc.

Condensed Consolidated Balance Sheets

(in millions)

(unaudited) |

| | | | | | | |

| June 30,

2015 | | December 31,

2014 |

Cash and cash equivalents | $ | 583.8 |

| | $ | 887.9 |

|

Short-term marketable securities | — |

| | 75.0 |

|

Receivables, net of allowance | 557.5 |

| | 405.3 |

|

Income tax receivable | 35.3 |

| | 58.6 |

|

Inventories | 989.9 |

| | 1,068.4 |

|

Restricted cash | 197.3 |

| | 234.7 |

|

Net property, plant, and equipment | 5,193.9 |

| | 4,902.9 |

|

Goodwill | 754.2 |

| | 773.2 |

|

Other assets | 320.3 |

| | 327.8 |

|

| $ | 8,632.2 |

| | $ | 8,733.8 |

|

| | | |

Accounts payable | $ | 273.4 |

| | $ | 295.4 |

|

Accrued liabilities | 529.5 |

| | 709.6 |

|

Debt, net of unamortized discount of $52.3 and $60.0 | 3,340.3 |

| | 3,553.0 |

|

Deferred income | 28.3 |

| | 36.4 |

|

Deferred income taxes | 645.3 |

| | 632.6 |

|

Other liabilities | 114.1 |

| | 109.4 |

|

Stockholders' equity | 3,701.3 |

| | 3,397.4 |

|

| $ | 8,632.2 |

| | $ | 8,733.8 |

|

Trinity Industries, Inc.

Additional Balance Sheet Information

(in millions)

(unaudited) |

| | | | | | | |

| June 30,

2015 | | December 31,

2014 |

Property, Plant, and Equipment | | | |

Corporate/Manufacturing: | | | |

Property, plant, and equipment | $ | 1,780.1 |

| | $ | 1,681.7 |

|

Accumulated depreciation | (860.9 | ) | | (820.7 | ) |

| 919.2 |

| | 861.0 |

|

Leasing: | | | |

Wholly-owned subsidiaries: | | | |

Machinery and other | 10.7 |

| | 10.7 |

|

Equipment on lease | 3,516.7 |

| | 3,189.6 |

|

Accumulated depreciation | (607.7 | ) | | (601.1 | ) |

| 2,919.7 |

| | 2,599.2 |

|

Partially-owned subsidiaries: | | | |

Equipment on lease | 2,258.9 |

| | 2,261.2 |

|

Accumulated depreciation | (292.9 | ) | | (261.3 | ) |

| 1,966.0 |

| | 1,999.9 |

|

| | | |

Net deferred profit on railcars sold to the Leasing Group | (611.0 | ) | | (557.2 | ) |

| $ | 5,193.9 |

| | $ | 4,902.9 |

|

Trinity Industries, Inc.

Additional Balance Sheet Information

(in millions)

(unaudited)

|

| | | | | | | |

| June 30,

2015 | | December 31,

2014 |

Debt | | | |

Corporate - Recourse: | | | |

Revolving credit facility | $ | — |

| | $ | — |

|

Senior notes due 2024, net of unamortized discount of $0.4 and $0.4 | 399.6 |

| | 399.6 |

|

Convertible subordinated notes, net of unamortized discount of $51.9 and $59.6 | 397.6 |

| | 389.9 |

|

Other | 0.7 |

| | 0.7 |

|

| 797.9 |

| | 790.2 |

|

Leasing: | | | |

Wholly-owned subsidiaries: | | | |

Recourse: | | | |

Capital lease obligations | 37.5 |

| | 39.1 |

|

| 37.5 |

| | 39.1 |

|

Non-recourse: | | | |

Secured railcar equipment notes | 701.9 |

| | 723.3 |

|

Warehouse facility | 322.1 |

| | 120.6 |

|

Promissory notes | — |

| | 363.9 |

|

| 1,024.0 |

| | 1,207.8 |

|

Partially-owned subsidiaries - Non-recourse: | | | |

Secured railcar equipment notes | 1,480.9 |

| | 1,515.9 |

|

| 1,480.9 |

| | 1,515.9 |

|

| $ | 3,340.3 |

| | $ | 3,553.0 |

|

Trinity Industries, Inc.

Additional Balance Sheet Information

(in millions)

(unaudited)

|

| | | | | | | |

| June 30,

2015 | | December 31,

2014 |

Leasing Debt Summary | | | |

Total Recourse Debt | $ | 37.5 |

| | $ | 39.1 |

|

Total Non-Recourse Debt | 2,504.9 |

| | 2,723.7 |

|

| $ | 2,542.4 |

| | $ | 2,762.8 |

|

Total Leasing Debt | | | |

Wholly-owned subsidiaries | $ | 1,061.5 |

| | $ | 1,246.9 |

|

Partially-owned subsidiaries | 1,480.9 |

| | 1,515.9 |

|

| $ | 2,542.4 |

| | $ | 2,762.8 |

|

Equipment on Lease(1) | | | |

Wholly-owned subsidiaries | $ | 2,919.7 |

| | $ | 2,599.2 |

|

Partially-owned subsidiaries | 1,966.0 |

| | 1,999.9 |

|

| $ | 4,885.7 |

| | $ | 4,599.1 |

|

Total Leasing Debt as a % of Equipment on Lease | | | |

Wholly-owned subsidiaries | 36.4 | % | | 48.0 | % |

Partially-owned subsidiaries | 75.3 | % | | 75.8 | % |

Combined | 52.0 | % | | 60.1 | % |

(1) Excludes net deferred profit on railcars sold to the Leasing Group.

Trinity Industries, Inc.

Condensed Consolidated Cash Flow Statements

(in millions)

(unaudited)

|

| | | | | | | |

| Six Months Ended

June 30, |

| 2015 | | 2014 |

Operating activities: | | | |

Net income | $ | 409.8 |

| | $ | 406.1 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Depreciation and amortization | 130.4 |

| | 111.0 |

|

Net gains on railcar lease fleet sales owned more than one year at the time of sale | (45.0 | ) | | (87.2 | ) |

Other | 19.3 |

| | (19.4 | ) |

Changes in assets and liabilities: | | | |

(Increase) decrease in receivables | (128.8 | ) | | (136.5 | ) |

(Increase) decrease in inventories | 81.7 |

| | (176.4 | ) |

Increase (decrease) in accounts payable and accrued liabilities | (172.7 | ) | | 52.6 |

|

Other | (12.7 | ) | | 7.2 |

|

Net cash provided by operating activities | 282.0 |

| | 157.4 |

|

Investing activities: | | | |

Proceeds from railcar lease fleet sales owned more than one year at the time of sale | 167.4 |

| | 242.1 |

|

Proceeds from disposition of property, plant, and equipment | 4.8 |

| | 21.0 |

|

Capital expenditures - leasing, net of sold lease fleet railcars owned one year or less with a net cost of $96.0 and $257.6 | (419.4 | ) | | (49.5 | ) |

Capital expenditures - manufacturing and other | (100.7 | ) | | (107.5 | ) |

(Increase) decrease in short-term marketable securities | 75.0 |

| | (68.8 | ) |

Acquisitions | (46.2 | ) | | (118.8 | ) |

Divestitures | 51.3 |

| | — |

|

Other | 5.2 |

| | 0.3 |

|

Net cash required by investing activities | (262.6 | ) | | (81.2 | ) |

Financing activities: | | | |

Payments to retire debt | (471.0 | ) | | (90.1 | ) |

Proceeds from issuance of debt | 242.4 |

| | 332.1 |

|

Shares repurchased(1) | (75.0 | ) | | (17.5 | ) |

Dividends paid to common shareholders | (31.1 | ) | | (23.2 | ) |

Purchase of shares to satisfy employee tax on vested stock | (27.2 | ) | | (38.1 | ) |

Contributions from noncontrolling interest | — |

| | 49.6 |

|

Distributions to noncontrolling interest | (19.9 | ) | | (12.3 | ) |

(Increase) decrease in restricted cash | 46.8 |

| | (12.8 | ) |

Other | 11.5 |

| | 22.9 |

|

Net cash (required) provided by financing activities | (323.5 | ) | | 210.6 |

|

Net (decrease) increase in cash and cash equivalents | (304.1 | ) | | 286.8 |

|

Cash and cash equivalents at beginning of period | 887.9 |

| | 428.5 |

|

Cash and cash equivalents at end of period | $ | 583.8 |

| | $ | 715.3 |

|

(1) Reflects shares of stock cash settled during the period.

Trinity Industries, Inc.

Earnings per Share Calculation

(in millions, except per share amounts)

(unaudited)

Basic net income attributable to Trinity Industries, Inc. per common share is computed by dividing net income attributable to Trinity remaining after allocation to unvested restricted shares by the weighted average number of basic common shares outstanding for the period.

|

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, 2015 | | Three Months Ended

June 30, 2014 |

| Income |

| | Average Shares |

| | EPS |

| | Income |

| | Average Shares |

| | EPS |

|

Net income attributable to Trinity Industries, Inc. | $ | 212.0 |

| | | | | | $ | 164.2 |

| | | | |

Unvested restricted share participation | (6.5 | ) | | | | | | (5.5 | ) | | | | |

Net income attributable to Trinity Industries, Inc. - basic | 205.5 |

| | 150.7 |

| | $ | 1.36 |

| | 158.7 |

| | 151.0 |

| | $ | 1.05 |

|

Effect of dilutive securities: | | | | | | | | | | | |

Stock options | — |

| | — |

| | | | — |

| | 0.1 |

| | |

Convertible subordinated notes | 0.1 |

| | 3.5 |

| | | | 0.2 |

| | 6.3 |

| | |

Net income attributable to Trinity Industries, Inc. - diluted | $ | 205.6 |

| | 154.2 |

| | $ | 1.33 |

| | $ | 158.9 |

| | 157.4 |

| | $ | 1.01 |

|

|

| | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended

June 30, 2015 | | Six Months Ended

June 30, 2014 |

| Income |

| | Average Shares |

| | EPS |

| | Income |

| | Average Shares |

| | EPS |

|

Net income attributable to Trinity Industries, Inc. | $ | 392.2 |

| | | | | | $ | 390.6 |

| | | | |

Unvested restricted share participation | (12.2 | ) | | | | | | (13.3 | ) | | | | |

Net income attributable to Trinity Industries, Inc. - basic | 380.0 |

| | 151.0 |

| | $ | 2.52 |

| | 377.3 |

| | 150.5 |

| | $ | 2.51 |

|

Effect of dilutive securities: | | | | | | | | | | | |

Stock options | — |

| | — |

| | | | — |

| | 0.1 |

| | |

Convertible subordinated notes | 0.2 |

| | 3.3 |

| | | | 0.4 |

| | 5.0 |

| | |

Net income attributable to Trinity Industries, Inc. - diluted | $ | 380.2 |

| | 154.3 |

| | $ | 2.46 |

| | $ | 377.7 |

| | 155.6 |

| | $ | 2.43 |

|

Trinity Industries, Inc.

Reconciliation of EBITDA

(in millions)

(unaudited)

“EBITDA” is defined as net income plus interest expense, income taxes, and depreciation and amortization including goodwill impairment charges. EBITDA is not a calculation based on generally accepted accounting principles. The amounts included in the EBITDA calculation are, however, derived from amounts included in the historical consolidated statements of operations data. In addition, EBITDA should not be considered as an alternative to net income or operating income as an indicator of our operating performance, or as an alternative to operating cash flows as a measure of liquidity. We believe EBITDA assists investors in comparing a company’s performance on a consistent basis without regard to depreciation and amortization, which can vary significantly depending upon many factors. However, the EBITDA measure presented in this press release may not always be comparable to similarly titled measures by other companies due to differences in the components of the calculation.

|

| | | | | | | |

| Three Months Ended

June 30, |

| 2015 | | 2014 |

Net income | $ | 220.8 |

| | $ | 173.1 |

|

Add: | | | |

Interest expense | 50.6 |

| | 46.9 |

|

Provision for income taxes | 112.7 |

| | 83.9 |

|

Depreciation and amortization expense | 66.4 |

| | 55.7 |

|

Earnings before interest expense, income taxes, and depreciation and amortization expense | $ | 450.5 |

| | $ | 359.6 |

|

|

| | | | | | | |

| Six Months Ended

June 30, |

| 2015 | | 2014 |

Net income | $ | 409.8 |

| | $ | 406.1 |

|

Add: | | | |

Interest expense | 102.1 |

| | 93.2 |

|

Provision for income taxes | 208.1 |

| | 196.4 |

|

Depreciation and amortization expense | 130.4 |

| | 111.0 |

|

Earnings before interest expense, income taxes, and depreciation and amortization expense | $ | 850.4 |

| | $ | 806.7 |

|

| | | |

| | | |

- END -

Exhibit 99.2

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of Gail M. Peck

Vice President, Finance and Treasurer

July 24, 2015

Thank you, Tanisha. Good morning everyone. Welcome to the Trinity Industries’ second quarter 2015 results conference call. I am Gail Peck, Vice President, Finance and Treasurer of Trinity. Thank you for joining us today.

Similar to the format we used on our last earnings call, we are going to have two parts to our conference call remarks. First, we will begin with an update on the highway litigation matter. We will then follow with our normal quarterly earnings conference call format.

Today’s speakers are:

•Theis Rice, Senior Vice President and Chief Legal Officer;

•Tim Wallace our Chairman, Chief Executive Officer and President;

•Bill McWhirter, Senior Vice President and Group President of the Construction Products, Energy Equipment, and Inland Barge Groups;

•Steve Menzies, Senior Vice President and Group President of the Rail and Railcar Leasing Groups; and

•James Perry, our Senior Vice President and Chief Financial Officer

Following their comments, we will then move to the Q&A session. Mary Henderson, our Vice President and Chief Accounting Officer, is also in the room with us today. I will now turn the call over to Theis Rice.

Theis

Tim

Bill

Steve

James

Q&A Session

That concludes today's conference call. A replay of this call will be available after one o'clock eastern standard time today through midnight on July 31, 2015. The access number is (402) 220-1346. Also the replay will be available on the website located at www.trin.net. We look forward to visiting with you again on our next conference call. Thank you for joining us this morning.

Exhibit 99.3

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of S. Theis Rice

Senior Vice President and Chief Legal Officer

July 24, 2015

Thank you, Gail. Good morning everyone.

As we have previously reported, Trinity Industries and Trinity Highway Products received an adverse jury verdict in October 2014 in a False Claims Act case involving the ET Plus guardrail end terminal system. For purposes of today’s comments I will refer to Trinity Industries and Trinity Highway Products together as the “Company”.

Following the jury verdict, the United States District Court for the Eastern District of Texas, Marshall Division, ordered the parties to engage in good faith negotiations in an effort to reach a settlement of this matter. Recently, on June 9th, the parties reported to the District Court that despite mutual best efforts, the parties were not successful at resolving their disputes.

That afternoon, the District Court issued its Memorandum Opinion and Order in the case, entering judgment on the verdict in the total amount of $682.4 million. On June 23rd, the Company posted a supersedeas bond in the amount of $686.0 million, covering the total judgment and two years of post-judgment interest. The bond was approved by the District Court and has stayed execution on the judgment until all post-judgment motions and appeals are exhausted.

The Company's Motion for New Trial is pending. If denied, the Company will vigorously pursue its rights of appeal of the judgment to the United States Court of Appeals for the Fifth Circuit. The Company’s Motion for New Trial is based on errors committed by the District Court in the course of the trial, the District Court’s failure to apply the applicable law to the allegations in the case, and substantial evidence obtained post-verdict invalidating the claims made.

The Company believes that the evidence presented at trial clearly showed no fraud was committed. At the Fifth Circuit, the Company’s position will be simple - the judgment is erroneous and should be reversed.

Based on information currently available to the Company, including but not limited to, the significance of eight successful, post-verdict crash tests of the ET Plus; conclusions reached by the FHWA’s first joint task force founded upon such crash tests; and the FHWA’s published field observations and research reported by the FHWA’s first joint task force regarding ET Plus systems installed on the nation's roadways; we do not believe that a loss is probable in this matter, therefore no accrual has been included in the consolidated financial statements. For additional information on this matter please see Note 18 in our 10-Q being filed later today.

The Federal Highway Administration formed a second joint task force to further evaluate the in service performance of the ET Plus through the collection and analysis of a broad array of data. The FHWA has stated that the second joint task force will report its findings this summer, at which time we will perform a thorough analysis before resuming any shipment of the product to customers.

We previously reported the Company received a federal subpoena from the U.S. Department of Justice through the U.S. Attorney for the District of Massachusetts. The Company is fully cooperating with the Department of Justice in response to this subpoena.

Our second quarter 10-Q will be filed today. In Note 18 of the 10-Q we provide additional information on this litigation and other related legal matters pertaining to the ET Plus. If you would like more details relating to my comments, please refer to the Company’s website at www.etplusfacts.com.

I will now turn the call over to Tim.

Exhibit 99.4

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of Timothy R. Wallace

Chairman, Chief Executive Officer, and President

July 24, 2015

Thank you, Theis and good morning everyone. I am very pleased with Trinity’s financial performance during the 2nd quarter. Our performance continues to reflect the strength of our diversified industrial business model and our ability to shift resources to meet our customers’ needs. I am extremely proud of the exceptional performance delivered by our people. Their consolidated efforts and proven ability to execute were major contributors to the high quality results we achieved during the 2nd quarter.

Our Rail Group generated strong quarterly financial results, reporting record operating profit during the 2nd quarter. I am very pleased with the level of orders the Group received during the quarter. I am impressed with this Group’s continued ability to increase profitability while making shifts in product mix.

Our Railcar Leasing and Management Services Group delivered record results from operations during the second quarter. The Group’s results were also enhanced by a solid level of sales of leased railcars. I am pleased with the progress our team is making with high-quality institutional investors who are looking to invest long-term capital in portfolios of leased railcars. Over the last several years, we have been successful building a railcar investment platform for institutional equity investors. We expect to continue to grow our railcar investment platform.

I am impressed with our Inland Barge Group’s record financial performance during the 2nd quarter. The Group substantially increased profit levels compared to the lst quarter, as well as year-over-year. The Group’s ability to demonstrate manufacturing flexibility and generate productivity gains over the past couple of years has been remarkable.

The second quarter financial performance of our Energy Equipment Group improved year-over-year. The successful integration of Meyer Steel Structures contributed to the improved results. I am also pleased our Construction Products Group’s profitability improved from the 1st quarter.

From a growth point of view, we continue to search for acquisition and organic growth opportunities in markets that have products, services, technology, and competencies that fit within our portfolio of industrial manufacturing businesses.

Trinity’s financial and operational status continues to be solid. I am pleased with the way we are balancing current business conditions, including litigation matters, while continuing to maintain momentum towards attaining our vision of being a premier diversified industrial company. Our 2015 earnings outlook reflects the positive momentum we are experiencing within our company as well as the benefits of having solid backlogs in our primary businesses. Our accomplishments are due to the capabilities and expertise of our dedicated employees, our ability to respond effectively to shifts in demand, and our ongoing commitment to provide high quality products and services to our customers.

I’ll now turn it over to Bill for his comments.

Exhibit 99.5

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of William A. McWhirter II,

Senior Vice President and Group President

Construction Products, Energy Equipment and Inland Barge Groups

July 24, 2015

Thank you Tim and good morning everyone.

The Energy Equipment Group reported another solid level of profit during the second quarter. Our wind tower business continues to perform well. During the second quarter, the wind tower business received $184 million of orders.

The wind industry continues to make advancements in reducing the installed cost of wind. However, the current order environment is still primarily driven by the extension of the production tax credit late last year.

The current market for utility structures remains competitive, but long-term investment projections for this industry show positive fundamentals. We are well positioned to respond to increased transmission infrastructure spending in North America.

Overall, we are pleased with the performance of the Energy Equipment segment, but do expect some variability within the segment’s performance from quarter to quarter as a result of product mix and volumes.

I am proud of the Construction Products Group’s efforts during the second quarter. The Group faced a challenging operating environment due to significant rainfall during the start of the construction season. In addition, the lack of a longer-term highway bill and ongoing litigation matters in the highway business created headwinds. Despite these pressures, the Group maintained revenues during the quarter in line with last year.

Our aggregates business is benefitting from a robust southern U.S. market, and our recent lightweight acquisitions strengthen our ability to serve our customers.

Moving to the Inland Barge Group.

During the second quarter, our Barge Group reported record levels of revenue and profit. I am impressed with the Group’s ability to achieve such a strong performance in a dynamic market environment where demand conditions are constantly changing. At the end of the quarter, we began converting one of our manufacturing facilities to increase capacity for hopper barges.

Barge demand continues to reflect steady inquiry levels for both dry cargo barges for the agricultural market and smaller tank barges for the chemical market. Demand for large tank barges, that transport oil, is currently soft. During the second quarter, the Barge Group received orders for $76 million.

In closing, our businesses are responding effectively to varying demand conditions. Our long-term outlook for energy and infrastructure investment in North America remains positive. Our businesses have a great deal of potential for future growth. We continue to watch the market for opportunities to add to our portfolio of industrial businesses.

And now, I will turn the presentation over to Steve.

Exhibit 99.6

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of D. Stephen Menzies

Senior Vice President and Group President

Rail and Railcar Leasing Groups

July 24, 2015

Thank you, Bill, good morning!

I continue to be very pleased with the strong operating results generated by our dedicated TrinityRail team and the strength of our integrated business model which includes railcar manufacturing, leasing, parts and services. For the first time, our Rail Group topped a 20% operating profit margin during the quarter, and, once again, achieved record profit levels for its 10th consecutive quarter. Our Leasing Group also reported record profit levels from operations during the quarter. These are all outstanding accomplishments. Our operating and financial flexibility and leading market position allowed us to quickly react to shifting market demand patterns and customer needs as evidenced by our order backlog increase.

During the second quarter, the industry received orders for approximately 20,000 railcars and maintained a steady level of backlog. TrinityRail received orders for 11,170 railcars increasing our backlog to 59,830 railcars with a value of $6.9 billion. We received orders for open top hoppers, covered hoppers of varying capacities, box cars, auto racks, flat cars and tank cars reflecting broad market demand for a wide variety of railcar types. The diversity of these orders reflects demand beyond the energy sector. Activity in the upstream energy markets propelled the railcar industry out of the last downturn and generated a robust level of demand for the last several years. More recently, the demand environment has shifted away from this catalyst and is now supported by increased activity in the downstream petrochemical markets, as well as the agriculture, construction, consumer and automotive markets. The rotation in current railcar market demand drivers toward these broad markets, combined with increased replacement needs for an aging fleet of general purpose freight cars, supports our view of an extended railcar cycle. Order inquiry levels into the third quarter, thus far, have been consistent with the 2nd quarter.

Our industry leading backlog, serving a diverse mix of markets, provides an unprecedented level of visibility with which to plan our operations. An extended railcar cycle provides our operating team an opportunity to achieve exceptional results. During the second quarter, extended production runs positioned our Rail Group to generate higher levels of productivity and increase efficiencies leading to our superior operating performance evidenced by our 20% operating profit margin. During the quarter, we delivered 8,530 railcars. We continue to expect annual deliveries of between 33,000 and 34,500 railcars in 2015.

In early May, the U.S. Department of Transportation and Transport Canada together announced enhanced tank car standards for both newly built and modified tank cars in flammable service. At this time, we are assessing our own lease fleet plans and collaborating with our customers regarding implementation of the new regulations.

As information, as of the second quarter, our wholly-owned and partially-owned lease fleets included approximately 11,800 DOT 111 railcars in flammable service. Roughly 85% of these railcars operated in crude and ethanol service, with a fairly even split between the two commodity services.

TrinityRail is well positioned to help our customers meet the regulatory requirements for their owned tank car fleets, as well as, the needs of our leased and managed fleet, whether by providing newly built tank cars

or modifications to existing tank cars. As we expected, our customers are taking time to evaluate the impacts of the new regulations, and to assess their business needs. Our first priority is to ensure the compliance of our own railcar fleet and those of our key customers. We are engaged with a number of customers discussing modifications to existing tank cars they own and potential new DOT117 tank car purchases. We continue to believe these new regulations will be a demand catalyst for new tank cars, as well as, tank car modification services.

The performance of our Leasing Group continues to reflect strong railcar market fundamentals. Record revenue and profit from operations, which excludes railcar sales, increased year-over-year by 11% and 20%, respectively. New additions to the wholly-owned lease fleet, high fleet utilization levels, and healthy lease renewal increases, all contributed to record quarterly performance during the second quarter. Lease fleet utilization remains high at 98.9%.

Our total lease fleet portfolio now stands at 76,440 railcars after taking delivery of 1,510 new railcars and acquiring 260 railcars in the secondary market, offset by the sale of 1,500 leased railcars during the second quarter. At the end of June, 28% of the railcars in our order backlog were committed to customers of our leasing business, bringing our leased railcar backlog to approximately $2.0 billion.

The size of our lease backlog underscores the expected continued growth in our lease fleet. This growth includes investment in our own lease portfolio and creating new railcar investment vehicles for institutional investors. There is a high degree of interest in owning leased railcars on the part of financial institutions. Our railcar investment platform provides a valuable asset management service to institutional investors interested to invest in portfolios of leased railcars. This service offering is a unique extension of the TrinityRail integrated business model. I am pleased with the progress our teams are making in expanding our interface with key institutional investors which could yield multi-year relationships for creating and managing portfolios of leased railcars for our railcar investment vehicles.

In summary, TrinityRail’s integrated business platform is well-positioned and responding effectively to healthy railcar demand. The Rail Group and Leasing and Management Services Group delivered exceptional results during the second quarter. I expect our performance to be strong throughout the balance of 2015 as well and provide good momentum into the coming year. Our operating and financial flexibility continue to differentiate TrinityRail, enhancing our position as a premier provider of railcar products and services.

I will now turn it over to James for his remarks.

Exhibit 99.7

Trinity Industries, Inc.

Earnings Release Conference Call

Comments of James E. Perry

Senior Vice President and Chief Financial Officer

July 24, 2015

Thank you, Steve and good morning everyone.

Yesterday, we announced our results for the second quarter of 2015. For the quarter, the Company reported earnings per share of $1.33 and record revenues of $1.68 billion, compared to EPS and revenues of $1.01 and $1.49 billion, respectively, for the same period last year. During the second quarter, our EPS reflected strong operating performance by most of our businesses.

During the second quarter, the company repurchased 1.7 million shares of its common stock for $50 million. This year, we have repurchased $75 million of our stock and have $143.6 million of availability under our current authorization.

We pre-paid in full during the second quarter approximately $340 million of secured railcar leasing debt known as TRL VI that we issued in 2008. We used a portion of the railcars from TRL VI to secure a $250 million borrowing under our $1 billion leasing warehouse facility at a current interest rate that is more than 350 basis points lower than the TRL VI interest rate. The railcar assets used to secure the warehouse advance, and those that remain fully unencumbered, are available for use in future financings or sales to institutional investors. This loan prepayment and warehouse borrowing were included in our previous earnings guidance.

During the second quarter, as previously announced, we divested the assets of our galvanizing business for $51 million and recorded a pretax gain of $7.8 million within the Construction Products Group. The impact of this divestiture was not included in our previous earnings guidance.

We invested approximately $179 million in leased railcar additions to our own lease fleet during the second quarter. This investment was partially offset by $149 million of leased railcar sales from our lease fleet. Leased railcars remain a very good investment for us, offering attractive returns with solid cash flow while the railcars are in our fleet, and the opportunity for additional profit recognition when sold to third parties, including institutional investors.

Finally, we invested $47 million in capital expenditures during the quarter across a number of our manufacturing businesses and at the corporate level.

We have significant cash on hand and access to capital through our committed lines of credit at both the corporate and leasing levels. Both our corporate revolver and our leasing warehouse facility were renewed during the second quarter at higher levels of availability with extended termination dates. At the end of the second quarter, our liquidity position remains strong at $1.77 billion.

As provided in our press release yesterday, we increased our annual guidance for 2015 to $4.45 to $4.75 from $4.10 to $4.45. We expect the level of EPS in the second half of the year to be relatively evenly split between the third and fourth quarters.

In 2015, as Steve mentioned, we expect our Rail Group to deliver between 33,000 and 34,500 railcars during the year, which maintains our previous guidance range. This will result in total revenues for the Rail

Group of between $4.35 billion and $4.45 billion and an expected operating margin of 19% to 19.5%. TrinityRail’s strong railcar backlog was enhanced by the solid level of railcar orders taken during the second quarter. It continues to provide a high level of production visibility for our railcar operations in future years.

We expect our Leasing Group to record 2015 operating revenues, excluding leased railcar sales, of $675 million to $700 million, with operating profit from operations of $315 million to $330 million. As a reminder, maintenance expenses tend to be higher in the back half of each year due to timing of the services performed.

Our 2015 guidance includes earnings and cash flow from the sale of leased railcars which are reported in both the Rail and Leasing Groups. Year to date, these earnings totaled $0.47 per share, of which $0.36 per share was reported in the Leasing Group. Sales of leased railcars to Element Financial under the $2 billion strategic railcar alliance totaled approximately $350 million year-to-date, bringing the cumulative total to more than $1.3 billion since program inception in 2013. We expect to fulfill the alliance during the remainder of 2015, and our guidance assumes these sales to Element will be split roughly equally between the Rail and Leasing Groups.

In 2015, we anticipate the Leasing Group will report proceeds from sales of leased railcars from the lease fleet of approximately $775 million to $825 million with profit of $210 million to $240 million, which includes sales to Element as well as other institutional investors and third parties. The increase in this guidance compared to our previous guidance is primarily due to certain Element sales moving from the Rail Group to the Leasing Group. This increase in guidance is offset by a higher level of deferred profit eliminations which I will discuss shortly. The total level of profitability expected from the sale of leased railcars, reflected in the Rail and Leasing Groups, remains substantially unchanged in 2015 compared to our previous guidance.

Earnings and cash flow generation from the sales of leased railcars are expected to be a normal part of our business model going forward and reflect the strength of TrinityRail’s lease origination and servicing capabilities. The level of such transactions will vary from quarter to quarter. Our railcar investment platform provides Trinity with a unique level of financial flexibility for a diversified industrial company.

As we originate a lease, we have the flexibility to retain the asset in our wholly-owned portfolio for the long-term or for a period of time, and then sell the leased railcar; or we can sell the leased railcar into a railcar investment vehicle. The capital generated through our railcar investment platform provides us with the financial flexibility to reinvest in our railcar leasing and management services platform, our portfolio of diversified industrial businesses, or in other investments that will enhance shareholder returns. The level of interest in acquiring leased railcars remains high among institutional investors.

We expect our Energy Equipment Group to generate 2015 revenues of $1.1 billion to $1.2 billion with an operating margin of 11.5% to 12.5%. We were pleased during the quarter to receive orders for $184 million of wind towers, which provides us with production visibility for that business through 2016.

We expect our Construction Products Group to record 2015 revenues of $525 million to $540 million with an operating margin of 9% to 10%. The change in the guidance range from the previous quarter reflects the portfolio restructuring completed in the first half of the year and the gain from the asset divestiture in the second quarter. We continue to experience headwinds associated with uncertainty around highway funding at the federal and state levels in addition to the ongoing highway litigation. We are pleased with the performance and opportunities within our aggregates businesses.

Our Inland Barge Group is expected to report 2015 revenues of $680 million to $700 million with a full year operating margin of 17% to 18%. The increase in guidance is a direct result of the productivity improvements made within our barge facilities.

Corporate expenses are expected to range from $115 million to $125 million during 2015, which includes ongoing litigation-related expenses. This range now includes the pro-rated $2 million of the $3.9 million annual premium associated with the appeal bond we posted during the second quarter to stay the execution of the highway litigation judgment.

In 2015, we now expect to eliminate between $1 billion and $1.1 billion of revenue and defer between $200 million and $225 million of operating profit due to the addition of new railcars to our lease fleet, and the timing of sales to institutional investors of new, leased railcars manufactured by the Rail Group. We eliminated $475 million of revenue and deferred $98 million of profit due to the addition of new railcars to our lease fleet in the first half of the year. We expect to eliminate between $375 million and $400 million of revenues from other intercompany transactions during the year.

Our annual EPS guidance also includes the following assumptions:

•A tax rate of approximately 33.7%, though this rate could vary quarter-to-quarter;

•The deduction of between $30 million and $35 million of non-controlling earnings due to our partial ownership in TRIP and RIV 2013;

•A reduction of 17 cents per share due to the two class method of accounting, compared to calculating Trinity’s EPS directly from the face of the income statement; and

•Dilution of approximately 7 cents per share from the convertible notes

As it pertains to cash flow, we expect the annual net cash investment in new railcars in our lease fleet to be between $160 million and $185 million in 2015, after considering the expected proceeds received from leased railcar sales during the year and the purchase of TRL I that was conducted in the first quarter.

Full-year manufacturing and corporate capital expenditures for 2015 are expected to be between $250 million and $300 million.

We remain very well positioned with a combined $7.8 billion backlog in our railcar, inland barge, and wind towers businesses that will generate incremental earnings and cash flow to enhance our strong balance sheet and liquidity position.

As we prepare for our question and answer session, please note that Theis’ remarks today related to highway litigation were very thorough. We would ask that your questions today focus on our operations and financial performance.

Our operator will now prepare us for the question and answer session.

-- Q&A Session --

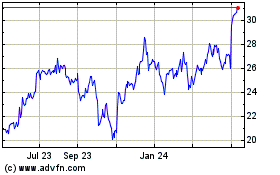

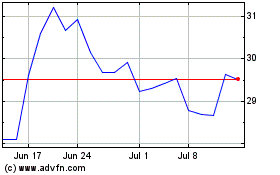

Trinity Industries (NYSE:TRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Industries (NYSE:TRN)

Historical Stock Chart

From Apr 2023 to Apr 2024