Trinity Industries, Inc. Announces the Repayment and Partial Refinancing of $340 million of Secured Lease Financing

June 05 2015 - 8:30AM

Business Wire

Trinity Industries, Inc. (NYSE:TRN) today announced that its

indirect wholly-owned subsidiary, Trinity Rail Leasing VI LLC (“TRL

VI”), repaid in full approximately $340 million of non-recourse

promissory notes (“the Notes”) in May. TRL VI is a wholly-owned

subsidiary of Trinity Industries Leasing Company (“TILC”). The

Notes were issued by TRL VI in 2008 and secured by a diversified

portfolio of leased railcars and certain cash reserves. The Notes

had an effective interest rate of 5.63%, after consideration of

interest rate hedges. Per the original terms of the Notes, the

borrowing margin was scheduled to increase by 0.50% in May.

As previously indicated on its first quarter 2015 earnings

conference call, the Company anticipated repaying the Notes ahead

of scheduled maturity to reduce financing costs and create

flexibility to use the portfolio of leased railcars in future

financings or sales to institutional investors.

The Company has partially refinanced the Notes repayment with a

$250 million borrowing under TILC’s warehouse facility, which was

recently renewed and increased in April from $475 million to $1

billion. The initial effective interest rate on the warehouse

borrowing is expected to be 1.95%. This refinancing was included in

the Company’s most recent earnings guidance.

Trinity Industries, Inc., headquartered in Dallas, Texas, is a

diversified industrial company that owns market-leading businesses

which provide products and services to the energy, transportation,

chemical and construction sectors. Trinity reports its financial

results in five principal business segments: the Rail Group, the

Railcar Leasing and Management Services Group, the Inland Barge

Group, the Construction Products Group, and the Energy Equipment

Group. For more information, visit: www.trin.net.

Some statements in this release, which are not historical facts,

are “forward-looking statements” as defined by the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include statements about Trinity's estimates,

expectations, beliefs, intentions or strategies for the future, and

the assumptions underlying these forward-looking statements.

Trinity uses the words “anticipates,” “believes,” “estimates,”

“expects,” “intends,” “forecasts,” “may,” “will,” “should,” and

similar expressions to identify these forward-looking statements.

Forward-looking statements involve risks and uncertainties that

could cause actual results to differ materially from historical

experience or our present expectations. For a discussion of such

risks and uncertainties, which could cause actual results to differ

from those contained in the forward-looking statements, see

“Forward-Looking Statements” in the Company's Annual Report on Form

10-K for the most recent fiscal year.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150605005378/en/

Trinity Industries, Inc.Investor Contact:Jessica L.

Greiner, 214-631-4420Director of Investor RelationsorMedia

Contact:Jack Todd, 214-589-8909Vice President, Public

AffairsTrinity Industries, Inc.

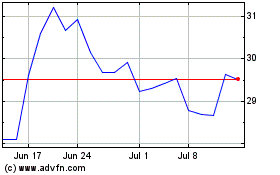

Trinity Industries (NYSE:TRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

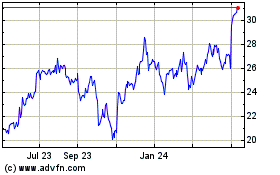

Trinity Industries (NYSE:TRN)

Historical Stock Chart

From Apr 2023 to Apr 2024