TRINITY INVESTORS: Lieff Cabraser Announces Class Action Litigation Against Trinity Industries, Inc. - TRN

May 26 2015 - 5:12PM

Business Wire

The law firm of Lieff Cabraser Heimann & Bernstein, LLP

announces that class action litigation has been brought on behalf

of investors who purchased or otherwise acquired the securities of

Trinity Industries, Inc. (“Trinity” or the “Company”) (NYSE:TRN)

between February 16, 2012 and April 29, 2015, inclusive (the “Class

Period”).

If you purchased or otherwise acquired Trinity securities during

the Class Period, you may move the Court for appointment as lead

plaintiff by no later than June 29, 2015. A lead plaintiff is a

representative party who acts on behalf of other class members in

directing the litigation. Your share of any recovery in the action

will not be affected by your decision of whether to seek

appointment as lead plaintiff. You may retain Lieff Cabraser, or

other attorneys, as your counsel in the action.

Trinity investors who wish to learn more about the action and

how to seek appointment as lead plaintiff should click here or

contact Sharon M. Lee of Lieff Cabraser toll-free at

1-800-541-7358.

Background on the Trinity Securities Class

Litigation

The actions charge Trinity and certain of its officers with

violations of sections 10(b) and 20(a) of the Securities Exchange

Act of 1934. Trinity is a Dallas, Texas-based manufacturer of

industrial, construction, and transportation products.

The actions allege that defendants made false and/or misleading

statements and/or failed to disclose that Trinity made design

changes to its ET-Plus guardrails in 2005 installed on highways

throughout the United States without notifying the Federal Highway

Administration (the “FHWA”), the government agency that certified

the safety of the guardrails and determined their eligibility for

federal-aid reimbursement.

On October 12, 2014, The New York Times reported that at least

three states had banned further installation of Trinity’s ET Plus

guardrails due to safety concerns following cost-saving changes

Trinity secretly made in 2005 that allegedly caused some guardrail

heads to malfunction and, in essence, turned the rails into spears

when hit by a vehicle instead of cushioning the blow as they were

expected to do. Following this news, on October 13, 2014, Trinity

stock fell $2.07 per share, or 5.9%. On October 14, 2014, the Times

reported that the State of Virginia threatened to ban Trinity

guardrails unless the company performed additional safety tests.

Trinity’s stock price fell another $0.53 per share, or 1.5%, on

this news.

On October 20, 2014, a jury in a whistleblower law suit against

Trinity found that the company deliberately withheld information

from the federal government about the changes made to the ET Plus

guardrail system and that Trinity defrauded the government out of

$175 million. On this news, the price of Trinity stock fell $4.45

per share, or 12.3%.

On October 24, 2014, Trinity announced that it would stop

shipments of its ET Plus guardrails until additional crash testing

is complete. Following this announcement, Trinity stock fell $0.46

per share, or 1.2%.

On April 22, 2015, Bloomberg News reported that the U.S.

Department of Justice (the “DOJ”) had launched a criminal

investigation into the use of ET Plus guardrails linked to at least

eight deaths. On this news, Trinity stock fell $3.43 per share, or

approximately 9.4%. On April 24, 2015, Trinity confirmed that it

was the target of a DOJ investigation. Trinity’s stock fell another

$4.66, or 14%, on this news.

On April 29, 2015, Bloomberg News reported that Trinity had

received a subpoena from the DOJ regarding “its allegedly defective

guardrail safety system” and that the DOJ sought “documents from

1999 and later regarding Trinity’s guardrail end terminals[.]” On

this news, Trinity’s stock fell $0.98, or 3.49%, on heavy trading

volume.

About Lieff Cabraser

Lieff Cabraser Heimann & Bernstein, LLP, with offices in San

Francisco, New York, and Nashville, is a nationally recognized law

firm committed to advancing the rights of investors and promoting

corporate responsibility.

The National Law Journal has recognized Lieff Cabraser as one of

the nation’s top plaintiffs’ law firms for eleven years. In

compiling the list, the National Law Journal examines recent

verdicts and settlements and looked for firms “representing the

best qualities of the plaintiffs' bar and that demonstrated unusual

dedication and creativity.” Best Lawyers and U.S. News have also

named Lieff Cabraser as a “Law Firm of the Year” each year the

publications have given this award to law firms.

For more information about Lieff Cabraser and the firm’s

representation of investors, please visit lieffcabraser.com.

This press release may be considered Attorney Advertising in

some jurisdictions under the applicable law and ethical rules.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150526006256/en/

Source/Contact for Media Inquiries

Only:Lieff Cabraser Heimann & Bernstein, LLPSharon M.

Lee, 1-800-541-7358

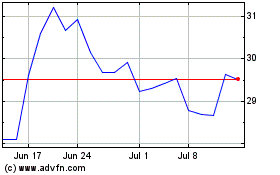

Trinity Industries (NYSE:TRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

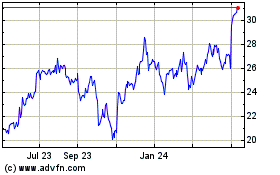

Trinity Industries (NYSE:TRN)

Historical Stock Chart

From Apr 2023 to Apr 2024