UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 25, 2015

Toll Brothers, Inc.

(Exact Name of Registrant as Specified in Charter)

|

| | | | |

Delaware | | 001-09186 | | 23-2416878 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

250 Gibraltar Road, Horsham, PA | | 19044 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (215) 938-8000

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On August 25, 2015, Toll Brothers, Inc. issued a press release which contained Toll Brothers, Inc.’s results of operations for its nine-month and three-month periods ended July 31, 2015, a copy of which release is attached hereto as Exhibit 99.1 to this report.

The information hereunder shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d). Exhibits

The following Exhibits are furnished as part of this Current Report on Form 8-K:

Exhibit

No. Item

| |

99.1* | Press release of Toll Brothers, Inc. dated August 25, 2015 announcing its financial results for the nine-month and three-month periods ended July 31, 2015. |

* Filed electronically herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | | TOLL BROTHERS, INC. |

| | | |

Dated: | August 25, 2015 | | | By: | | /s/ Joseph R. Sicree |

| | | | | | Joseph R. Sicree Senior Vice President, Chief Accounting Officer |

EXHIBIT 99.1

|

| |

FOR IMMEDIATE RELEASE | CONTACT: Frederick N. Cooper (215) 938-8312 |

August 25, 2015 | fcooper@tollbrothersinc.com |

TOLL BROTHERS REPORTS FY 2015 3RD QTR AND 9 MONTH RESULTS

Horsham, PA, August 25, 2015 -- Toll Brothers, Inc. (NYSE:TOL) (www.tollbrothers.com), the nation’s leading builder of luxury homes, today announced results for its third quarter and nine months ended July 31, 2015.

FY 2015 Third Quarter Financial Highlights:

| |

• | FY 2015’s third-quarter net income was $66.7 million, or $0.36 per share diluted, compared to net income of $97.7 million, or $0.53 per share diluted, in FY 2014’s third quarter. |

| |

• | Pre-tax income was $107.5 million, compared to pre-tax income of $151.3 million in FY 2014’s third quarter. Included in FY 2015’s third-quarter cost of sales were impairments of $18.0 million and a $4.9 million net increase in reserves, compared to impairments of $6.0 million and a reserve reversal of $7.0 million in FY 2014’s third quarter. |

| |

• | Revenues of $1.03 billion and home building deliveries of 1,419 units declined 3% in dollars and 2% in units, compared to FY 2014’s third quarter. The average price of homes delivered was $724,000, compared to $732,000 in FY 2014’s third quarter. |

| |

• | Net signed contracts of $1.23 billion and 1,479 units rose 30% in dollars and 12% in units, compared to FY 2014’s third quarter. The average price of net signed contracts was $834,000, the highest quarterly average in the Company’s history, compared to $717,000 in FY 2014’s third quarter, driven by an increase in the number and average price of California contracts. |

| |

• | For the first four weeks of August, the start of the Company’s FY 2015 fourth quarter, net contracts were up 16% in units compared to the same period in FY 2014. |

| |

• | Backlog of $3.69 billion and 4,447 units rose 19% in dollars and 6% in units, compared to FY 2014’s third-quarter-end backlog. This was the highest backlog for any quarter-end in eight years, dating back to FY 2007’s second-quarter end. At FY 2015's third-quarter end, the average price of homes in backlog was $829,000, compared to $737,000 at FY 2014’s third-quarter end. This was the first time that the Company’s average price in backlog at quarter end exceeded $800,000. |

| |

• | Gross margin was 19.8% in FY 2015’s third quarter, compared to 22.7% in FY 2014’s third quarter. Excluding interest, impairments and changes in reserves, FY 2015’s third-quarter gross margin was 25.6%, compared to 26.1% in FY 2014’s third quarter. |

| |

• | SG&A as a percentage of revenue was 11.3%, compared to 10.4% in FY 2014’s third quarter. |

| |

• | Income from operations was 8.5% of revenue, compared to 12.3% of revenue in FY 2014’s third quarter. |

| |

• | Other income and Income from unconsolidated entities totaled $20.0 million, compared to $21.7 million in FY 2014’s third quarter. |

| |

• | At FY 2015’s third-quarter end, the Company had approximately 45,400 lots owned and optioned, compared to approximately 45,000 one quarter earlier and 49,000 one year ago. |

| |

• | The Company ended its third quarter with 267 selling communities, compared to 269 at FY 2015’s second-quarter end, and 256 at FY 2014’s third-quarter end. The Company expects to end FY 2015 with between 270 and 285 selling communities. |

| |

• | The Company expects FY 2015 fourth quarter deliveries of between 1,645 and 1,945 units with an average price of between $780,000 and $800,000. This range results in projected full FY 2015 deliveries of between 5,350 and 5,650 units with an average delivered price of between $745,000 and $760,000. |

| |

• | The Company expects its FY 2015 fourth quarter gross margin, excluding interest, impairments, and changes in reserves, to be approximately 26.7%, resulting in a full FY 2015 gross margin projection, excluding interest, impairments and changes in reserves, of approximately 26.2%. This is 20 basis points higher than the previous FY 2015 full year guidance. The Company expects continued margin expansion in FY 2016. |

Douglas C. Yearley, Jr., Toll Brothers’ chief executive officer, stated: “We have produced four consecutive quarters of year-over-year growth in contract dollars and units. In our third quarter, which ended July 31st, contracts rose 30% in dollars and 12% in units. In the previous three quarters, starting with FY 2014’s fourth quarter, signed contracts were up 16%, 24% and 25% in dollars and 10%, 16% and 10% in units on a year-over-year basis. Through the first four weeks of August, the start of our fourth quarter, contracts in units were up 16% compared to the same period one year ago.

“Most of our markets around the country continue to perform well. We remain especially pleased with the performance of our Northern and Southern California communities. Our operations in New York City (which include joint ventures), Seattle, Dallas and Nevada are also showing particularly strong backlogs.

“Our rental apartment business continues to outperform our expectations. We are currently leasing up three new communities totaling about 1,100 units - one in downtown Washington, DC, one in suburban Philadelphia and our newest offering - a 417 unit, 38-story tower in Jersey City. They are all leasing at faster paces and higher rents than we had originally projected.

“We are currently in construction on four other rental communities totaling over 1,400 units stretching from Massachusetts to Maryland and have nearly 3,000 additional units in our pipeline. We will expand this business nationally.

“This housing recovery appears to be built on a very solid foundation. We believe that the slow but steady acceleration we and the industry are experiencing bodes well for the long-term health of the housing market based on increasing household formations, pent-up demand and current industry-wide production that is still well below historic norms. With our great land positions, well-established brand, broad product and geographic diversification and solid financial footing, we are very optimistic about the future. We believe we have significant room for growth and increased profitability in FY 2016 and beyond.”

Martin P. Connor, Toll Brothers’ chief financial officer, stated: “This quarter’s flat deliveries, which reflected the lull in sales demand that occurred last year, generally met our expectations. Excluding impairments and changes in reserves, our gross margin came in slightly above our expectations. Our third-quarter gross margin was negatively impacted by approximately 220 basis points due to $18.0 million of impairments and a $4.9 million net increase in reserves. Approximately two-thirds of the $18.0 million of impairments were related to two non-strategic parcels that we are considering selling. We believe that the sale of these two parcels would generate an estimated $75 million in sales proceeds and tax savings. The net additional reserves we accrued in cost of sales were primarily associated with repairs in a sold-out community.

“Subject to the caveats in our Statement on Forward-Looking Information included in this release, we offer the following limited guidance. In FY 2015’s fourth quarter, we expect between 1,645 and 1,945 deliveries at an average price of between $780,000 and $800,000. This narrows our previous guidance on deliveries for full FY 2015 to between 5,350 and 5,650 homes at an average price of between $745,000 and $760,000 per home. We expect to end FY 2015 with between 270 and 285 selling communities.

“SG&A continues to grow in line with expectations set for the year as we reiterated on our second-quarter earnings call. The growth in our backlog, contracts, and joint ventures is adding costs prior to recognition of revenue. We expect FY 2015’s fourth quarter SG&A as a percentage of revenues to be approximately 8.8%, which translates into a full FY 2015 SG&A as a percentage of revenues of approximately 11.0%.

“With the improvement we saw in gross margin this quarter (excluding interest, impairments and changes in reserves) and with better visibility into our fourth quarter deliveries we project a fourth-quarter gross margin (excluding interest, impairments and changes in reserves) of approximately 26.7%. This increases our full FY 2015 gross margin expectation (excluding interest, impairments, and changes in reserves) by 20 basis points to 26.2%. We continue to expect higher margins and higher net income in FY 2016.”

Robert I. Toll, executive chairman, stated: “We are encouraged by the report last week of improvement in single-family housing starts to the best pace since 2007. Although seasonally adjusted total starts rose to an annualized 1.2 million pace, that leaves lots of room before we are at historical norms, dating back over forty years, of 1.5 to 1.6 million starts. Population continues to grow, yet the supply of homes on the market remains well below historic norms as does new home production.

“An improving employment landscape, three consecutive quarters of accelerating household formations, pent-up demand, increasing rents and still attractive affordability are supporting the for-sale housing market’s steady recovery. We believe that, as the job picture continues to improve, greater demand should lead to rising home prices, which should encourage more people to sell their existing homes and move up or add a second home. Based on these and other factors, we believe the housing market remains on an upward trend and has considerable room to grow.”

The financial highlights for the third quarter and nine months ended July 31, 2015 (unaudited):

| |

• | FY 2015’s third-quarter net income was $66.7 million, or $0.36 per share diluted, compared to FY 2014’s third-quarter net income of $97.7 million, or $0.53 per share diluted. |

| |

• | FY 2015’s third-quarter pre-tax income was $107.5 million, compared to FY 2014’s third-quarter pre-tax income of $151.3 million. FY 2015’s third-quarter results included pre-tax inventory impairments totaling $18.0 million ($6.0 million attributable to an operating community and $12.0 million attributable to future communities) and a $4.9 million net increase in reserves. FY 2014’s third-quarter results included pre-tax inventory impairments of $6.0 million ($4.8 million attributable to an operating community and $1.2 million attributable to future communities) and a $7.0 million reserve reversal. |

| |

• | FY 2015’s nine-month net income was $216.0 million, or $1.17 per share diluted, compared to FY 2014’s nine-month net income of $208.5 million, or $1.13 per share diluted. |

| |

• | FY 2015’s nine-month pre-tax income was $318.0 million, compared to FY 2014’s nine-month pre-tax income of $316.0 million. |

| |

• | FY 2015’s third-quarter total revenues of $1.03 billion and 1,419 units decreased 3% in dollars and 2% in units, compared to FY 2014’s third-quarter total revenues of $1.06 billion and 1,444 units. |

| |

• | FY 2015’s nine-month total revenues of $2.73 billion and 3,705 units rose 7% in dollars and 3% in units, compared to FY 2014’s same period totals of $2.56 billion and 3,590 units. |

| |

• | The Company’s FY 2015 third-quarter net contracts of $1.23 billion and 1,479 units rose by 30% in dollars and 12% in units, compared to FY 2014’s third-quarter net contracts of $949.1 million and 1,324 units. The average price of net signed contracts was $834,000, the highest quarterly average in the Company’s history, compared to $717,000 in FY 2014’s third quarter, driven by an increase in California contracts. |

| |

• | On a per-community basis, FY 2015’s third-quarter net signed contracts were up 5% to 5.50 units, compared to third-quarter totals of 5.25 units in FY 2014, 6.24 in FY 2013 and 4.87 in FY 2012. |

| |

• | The Company’s FY 2015 nine-month net contracts of $3.70 billion and 4,473 units increased 27% in dollars and 12% in units, compared to net contracts of $2.93 billion and 3,989 units in FY 2014’s nine-month period. |

| |

• | FY 2015’s third-quarter cancellation rate (current-quarter cancellations divided by current-quarter signed contracts) was 5.9%, compared to 6.6% in FY 2014’s third quarter. As a percentage of beginning-quarter backlog, FY 2015’s third-quarter cancellation rate was 2.1%, compared to 2.2% in FY 2014’s third quarter. |

| |

• | FY 2015, third-quarter-end backlog of $3.69 billion and 4,447 units increased 19% in dollars and 6% in units, compared to FY 2014’s third-quarter-end backlog of $3.10 billion and 4,204 units. At third-quarter end, the average price of homes in backlog was $829,000, compared to $737,000 at FY 2014’s third-quarter end. This was the first time that the Company’s average price in backlog at quarter end exceeded $800,000. |

| |

• | The Company reported a third quarter FY 2015 gross margin of 19.8% compared to 22.7% in FY 2014’s third quarter. FY 2015’s third-quarter gross margin, excluding interest, impairments and changes in reserves, was 25.6%, compared to 26.1% in FY 2014’s third quarter. |

| |

• | Interest included in cost of sales was 3.6% of revenues in FY 2015’s third quarter, compared to 3.5% in FY 2014’s third quarter. |

| |

• | Reflecting the continued growth in backlog, contracts and joint ventures, SG&A as a percentage of revenue was 11.3% in FY 2015’s third quarter, compared to 10.4% in FY 2014’s third quarter. |

| |

• | Income from operations of $87.4 million represented 8.5% of revenues in FY 2015’s third quarter, compared to $129.6 million and 12.3% of revenues in FY 2014’s third quarter. |

| |

• | Income from operations of $250.9 million represented 9.2% of revenues in FY 2015’s nine-month period, compared to $229.5 million and 9.0% of revenues in FY 2014’s nine-month period. |

| |

• | Other income and Income from unconsolidated entities in FY 2015’s third quarter totaled $20.0 compared to $21.7 million in FY 2014’s same quarter. |

| |

• | Other income and Income from unconsolidated entities in FY 2015’s nine-month period totaled $67.1 million, including an $8.1 million gain from the sale of home security accounts to a third party by the Company’s wholly-owned Westminster Security Company, compared to $86.6 million in FY 2014’s same period, which included a $12.0 million gain associated with the refinancing of a stabilized, mature apartment community and $23.5 million related to the sale of two shopping centers in which Toll Brothers was a 50% partner. |

| |

• | In FY 2015’s third quarter, unconsolidated entities in which the Company had an interest delivered $24.6 million of homes, compared to $16.4 million in the third quarter of FY 2014. In FY 2015’s first nine months, unconsolidated entities in which the Company had an interest delivered $60.9 million of homes, compared to $39.6 million in the same nine-month period of FY 2014. The Company recorded its share of the results from these entities’ operations in “Income from Unconsolidated Entities” on the Company’s Statement of Operations. |

| |

• | In FY 2015’s third quarter, unconsolidated entities in which the Company had an interest signed contracts for $72.4 million of homes, compared to $75.5 million in the third quarter of FY 2014. In FY 2015’s first nine months, unconsolidated entities in which the Company had an interest signed contracts for $185.6 million of homes, compared to $243.2 million in the same nine-month period of FY 2014. |

| |

• | At July 31, 2015, unconsolidated entities in which the Company had an interest had a backlog of $409.2 million, compared to $249.9 million at July 31, 2014. |

| |

• | In FY 2015’s third quarter and first nine months, the Company’s Gibraltar Capital and Asset Management subsidiary reported pre-tax income of $0.8 million and $6.3 million respectively, compared to FY 2014’s third quarter and first nine-month results of $5.1 million and $11.0 million. |

| |

• | The Company ended its FY 2015 third quarter with $404.8 million of cash and marketable securities, compared to $542.2 million at 2015’s second-quarter end and $386.7 million at FY 2014’s third-quarter end. At FY 2015’s third-quarter end, it had $711.2 million available under its $1.035 billion 15-bank credit facility, which matures in August 2018. |

| |

• | On May 15, 2015, the Company retired, at maturity, its $300 million, 5.15% 10-year bonds using $50 million of cash and $250 million drawn from its $1.035 billion, 15-bank credit facility. Since the Company currently capitalizes all of its interest incurred, the benefit of this retirement of debt will be realized in Income Statements in FY 2016 and beyond. |

| |

• | The Company’s Stockholders’ Equity at FY 2015’s third-quarter end was $4.12 billion, compared to $3.80 billion at FY 2014’s third-quarter end. |

| |

• | The Company ended FY 2015’s third quarter with a net debt-to-capital ratio(1) of 40.6%, compared to 40.8% at FY 2015’s second-quarter end, and 43.3% at FY 2014’s third-quarter end. |

| |

• | The Company ended FY 2015’s third quarter with approximately 45,400 lots owned and optioned, compared to 45,000 one quarter earlier, 49,000 one year earlier and 91,200 at its peak at FY 2006’s second-quarter end. At 2015’s third-quarter end, approximately 35,700 of these lots were owned, of which approximately 16,000 lots, including those in backlog, were substantially improved. |

| |

• | In the third quarter of FY 2015, the Company spent approximately $86.3 million on land to purchase 887 lots. |

| |

• | The Company ended FY 2015’s third quarter with 267 selling communities, compared to 269 at FY 2015’s second-quarter end and 256 at FY 2014’s third-quarter end. The Company now expects to end FY 2015 with between 270 and 285 selling communities compared to previous guidance of 270 to 310 communities. |

| |

• | Based on FY 2015’s third-quarter-end backlog and the pace of activity at its communities, the Company expects FY 2015 fourth quarter deliveries of between 1,645 and 1,945 units with an average price of between $780,000 and $800,000. This range results in narrowed delivery guidance of between 5,350 and 5,650 homes in full FY 2015 (from 5,300 to 5,900 homes previously), with an average price of between $745,000 and $760,000 per home. |

| |

• | The Company expects its FY 2015 fourth-quarter gross margin, excluding interest, impairments, and changes in reserves, to be approximately 26.7%. This increases its full FY 2015 gross margin guidance (excluding interest, impairments, and changes in reserves) to 26.2%, which is 20 basis points higher than the previous FY 2015 full year guidance. |

| |

• | The Company expects SG&A as a percentage of revenues to be approximately 8.8%, which results in full FY 2015 SG&A as a percentage of revenue of approximately 11.0%, which is consistent with FY 2014. |

| |

(1) | Net debt-to-capital is calculated as total debt minus mortgage warehouse loans minus cash and marketable securities, divided by total debt minus mortgage warehouse loans minus cash and marketable securities plus stockholders' equity. |

Toll Brothers will be broadcasting live via the Investor Relations section of its website, www.tollbrothers.com, a conference call hosted by CEO Douglas C. Yearley, Jr. at 11:00 a.m. (EDT) today, August 25, 2015, to discuss these results and its outlook for FY 2015. To access the call, enter the Toll Brothers website, click on the Investor Relations page, and select "Conference Calls”. Participants are encouraged to log on at least fifteen minutes prior to the start of the presentation to register and download any necessary software.

The call can be heard live with an online replay which will follow. MP3 format replays will be available after the conference call via the "Conference Calls" section of the Investor Relations portion of the Toll Brothers website.

Toll Brothers, Inc., A FORTUNE 1000 Company, is the nation's leading builder of luxury homes. The Company began business in 1967 and became a public company in 1986. Its common stock is listed on the New York Stock Exchange under the symbol "TOL." The Company serves move-up, empty-nester, active-adult, and second-home buyers and operates in 19 states: Arizona, California, Colorado, Connecticut, Delaware, Florida, Illinois, Maryland, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New York, North Carolina, Pennsylvania, Texas, Virginia, and Washington, as well as in the District of Columbia.

Toll Brothers builds an array of luxury residential single-family detached, attached home, master planned resort-style golf, and urban low-, mid-, and high-rise communities, principally on land it develops and improves. The Company operates its own architectural, engineering, mortgage, title, land development and land sale, golf course development and management, home security, and landscape subsidiaries. The Company also operates its own lumber distribution, house component assembly, and manufacturing operations. The Company purchases distressed loan and real estate asset portfolios through its wholly owned subsidiary, Gibraltar Capital and Asset Management. The Company acquires and develops commercial and apartment properties through Toll Commercial and Toll Apartment Living, and the affiliated Toll Brothers Realty Trust, and develops urban low-, mid-, and high-rise for-sale condominiums through Toll Brothers City Living.

Toll Brothers was recently named as The Most Admired Home Building Company in Fortune magazine’s survey of the World’s Most Admired Companies for 2015. Toll Brothers was also named 2015 America’s Most Trusted Home Builder™ by Lifestory Research, an award which was based on a study of 43,200 new home shoppers in the nation’s top 27 housing markets. Toll Brothers was named 2014 Builder of the Year by Builder magazine, and is honored to have been awarded Builder of the Year in 2012 by Professional Builder magazine, making it the first two-time recipient. Toll Brothers proudly supports the communities in which it builds; among other philanthropic pursuits, the Company sponsors the Toll Brothers Metropolitan Opera International Radio Network, bringing opera to neighborhoods throughout the world. For more information, visit www.tollbrothers.com.

Forward Looking Statement

Information presented herein for the second quarter ended July 31, 2015 is subject to finalization of the Company's regulatory filings, related financial and accounting reporting procedures and external auditor procedures.

Certain information included in this release is forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, information related to: anticipated operating results; anticipated financial performance, resources and condition; selling communities; home deliveries; average home prices; consumer demand and confidence; contract pricing; business and investment opportunities; and market and industry trends.

Such forward-looking information involves important risks and uncertainties that could significantly affect actual results and cause them to differ materially from expectations expressed herein and in other Company reports, SEC filings, statements and presentations. These risks and uncertainties include, among others: local, regional, national and international economic conditions; fluctuating consumer demand and confidence; interest and unemployment rates; changes in sales conditions, including home prices, in the markets where we build homes; conditions in our newly entered markets and newly acquired operations; the competitive environment in which we operate; the availability and cost of land for future growth; conditions that could result in inventory write-downs or write-downs associated with investments in unconsolidated entities; the ability to recover our deferred tax assets; the availability of capital; uncertainties in the capital and securities markets; liquidity in the credit markets; changes in tax laws and their interpretation; effects of governmental legislation and regulation; the outcome of various legal proceedings; the availability of adequate insurance at reasonable cost; the impact of construction defect, product liability and home warranty claims, including the adequacy of self-insurance accruals, and the applicability and sufficiency of our insurance coverage; the ability of customers to obtain financing for the purchase of homes; the ability of home buyers to sell their existing homes; the ability of the participants in various joint ventures to honor their commitments; the availability and cost of labor and building and construction materials; the cost of raw materials; construction delays; domestic and international political events; and weather conditions. For a more detailed discussion of these factors, see the information under the captions "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our most recent annual report on Form 10-K and our subsequent quarterly reports on Form 10-Q filed with the Securities and Exchange Commission.

Any or all of the forward-looking statements included in this release are not guarantees of future performance and may turn out to be inaccurate. Forward-looking statements speak only as of the date they are made. The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

TOLL BROTHERS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

|

| | | | | | | |

| July 31,

2015 | | October 31,

2014 |

| (Unaudited) | | |

ASSETS | | | |

Cash and cash equivalents | $ | 394,808 |

| | $ | 586,315 |

|

Marketable securities | 10,008 |

| | 12,026 |

|

Restricted cash | 17,920 |

| | 18,342 |

|

Inventory | 6,990,878 |

| | 6,490,321 |

|

Property, construction and office equipment, net | 138,597 |

| | 143,010 |

|

Receivables, prepaid expenses and other assets | 275,759 |

| | 251,572 |

|

Mortgage loans held for sale | 127,405 |

| | 101,944 |

|

Customer deposits held in escrow | 48,296 |

| | 42,073 |

|

Investments in unconsolidated entities | 334,925 |

| | 447,078 |

|

Investments in foreclosed real estate and distressed loans | 59,459 |

| | 73,800 |

|

Deferred tax assets, net of valuation allowances | 232,840 |

| | 250,421 |

|

| $ | 8,630,895 |

| | $ | 8,416,902 |

|

| | | |

LIABILITIES AND EQUITY | | | |

Liabilities: | | | |

Loans payable | $ | 866,876 |

| | $ | 654,261 |

|

Senior notes | 2,356,068 |

| | 2,655,044 |

|

Mortgage company loan facility | 100,000 |

| | 90,281 |

|

Customer deposits | 299,611 |

| | 223,799 |

|

Accounts payable | 242,770 |

| | 225,347 |

|

Accrued expenses | 579,268 |

| | 581,477 |

|

Income taxes payable | 60,316 |

| | 125,996 |

|

Total liabilities | 4,504,909 |

| | 4,556,205 |

|

| | | |

Equity: | | | |

Stockholders’ Equity | | | |

Common stock | 1,779 |

| | 1,779 |

|

Additional paid-in capital | 728,501 |

| | 712,162 |

|

Retained earnings | 3,448,039 |

| | 3,232,035 |

|

Treasury stock, at cost | (54,438 | ) | | (88,762 | ) |

Accumulated other comprehensive loss | (2,900 | ) | | (2,838 | ) |

Total stockholders' equity | 4,120,981 |

| | 3,854,376 |

|

Noncontrolling interest | 5,005 |

| | 6,321 |

|

Total equity | 4,125,986 |

| | 3,860,697 |

|

| $ | 8,630,895 |

| | $ | 8,416,902 |

|

TOLL BROTHERS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Nine Months Ended

July 31, | | Three Months Ended

July 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Revenues | $ | 2,734,046 |

| | $ | 2,560,912 |

| | $ | 1,028,011 |

| | $ | 1,056,857 |

|

| | | | | | | |

Cost of revenues | 2,152,938 |

| | 2,019,262 |

| | 824,394 |

| | 817,232 |

|

Selling, general and administrative expenses | 330,174 |

| | 312,171 |

| | 116,175 |

| | 109,981 |

|

| 2,483,112 |

| | 2,331,433 |

| | 940,569 |

| | 927,213 |

|

| | | | | | | |

Income from operations | 250,934 |

| | 229,479 |

| | 87,442 |

| | 129,644 |

|

Other: | | | | | | | |

Income from unconsolidated entities | 17,080 |

| | 38,192 |

| | 5,952 |

| | 950 |

|

Other income - net | 50,005 |

| | 48,373 |

| | 14,070 |

| | 20,731 |

|

Income before income taxes | 318,019 |

| | 316,044 |

| | 107,464 |

| | 151,325 |

|

Income tax provision | 102,015 |

| | 107,536 |

| | 40,715 |

| | 53,618 |

|

Net income | $ | 216,004 |

| | $ | 208,508 |

| | $ | 66,749 |

| | $ | 97,707 |

|

Income per share: | | | | | | | |

Basic | $ | 1.22 |

| | $ | 1.17 |

| | $ | 0.38 |

| | $ | 0.55 |

|

Diluted | $ | 1.17 |

| | $ | 1.13 |

| | $ | 0.36 |

| | $ | 0.53 |

|

Weighted-average number of shares: | | | | | | | |

Basic | 176,443 |

| | 177,591 |

| | 176,797 |

| | 178,217 |

|

Diluted | 184,692 |

| | 185,944 |

| | 185,133 |

| | 186,501 |

|

TOLL BROTHERS, INC. AND SUBSIDIARIES

SUPPLEMENTAL DATA

(Amounts in thousands)

(unaudited)

|

| | | | | | | | | | | | | | | |

| Nine Months Ended

July 31, | | Three Months Ended

July 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Impairment charges recognized: | | | | | | | |

Cost of sales - land owned/controlled for future communities | $ | 13,279 |

| | $ | 2,198 |

| | $ | 11,969 |

| | $ | 1,192 |

|

Cost of sales - operating communities | 18,000 |

| | 7,700 |

| | 6,000 |

| | 4,800 |

|

| $ | 31,279 |

| | $ | 9,898 |

| | $ | 17,969 |

| | $ | 5,992 |

|

| | | | | | | |

Depreciation and amortization | $ | 17,667 |

| | $ | 16,690 |

| | $ | 5,895 |

| | $ | 5,594 |

|

Interest incurred | $ | 117,896 |

| | $ | 123,267 |

| | $ | 37,438 |

| | $ | 40,638 |

|

Interest expense: | | | | | | | |

Charged to cost of sales | $ | 94,942 |

| | $ | 91,766 |

| | $ | 36,989 |

| | $ | 37,181 |

|

Charged to other income - net | 2,795 |

| | 1,876 |

| | 1,057 |

| | 836 |

|

| $ | 97,737 |

| | $ | 93,642 |

| | $ | 38,046 |

| | $ | 38,017 |

|

| | | | | | | |

Home sites controlled: | | | | | | | |

Owned | 35,713 |

| | 38,320 |

| | | | |

Optioned | 9,662 |

| | 10,717 |

| | | | |

| 45,375 |

| | 49,037 |

| | | | |

Inventory at July 31, 2015 and October 31, 2014 consisted of the following (amounts in thousands):

|

| | | | | | | |

| July 31,

2015 | | October 31,

2014 |

Land and land development costs | $ | 2,495,229 |

| | $ | 2,716,950 |

|

Construction in progress | 3,960,669 |

| | 3,292,056 |

|

Sample homes | 343,598 |

| | 264,219 |

|

Land deposits and costs of future development | 171,532 |

| | 200,495 |

|

Other | 19,850 |

| | 16,601 |

|

| $ | 6,990,878 |

| | $ | 6,490,321 |

|

Toll Brothers operates in two segments: Traditional Home Building and Urban Infill ("City Living"). Within Traditional Home Building, Toll operates in four geographic segments:

| |

North: | Connecticut, Illinois, Massachusetts, Michigan, Minnesota, New Jersey and New York |

| |

Mid-Atlantic: | Delaware, Maryland, Pennsylvania and Virginia |

| |

South: | Florida, North Carolina and Texas |

| |

West: | Arizona, California, Colorado, Nevada, and Washington |

|

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

July 31, |

| Units | | $ (Millions) | | Average Price Per Unit $ |

| 2015 |

| 2014 |

| 2015 |

| 2014 | | 2015 | | 2014 |

HOME BUILDING REVENUES | | | | | | | | | | | |

North | 287 |

| | 270 |

| | $ | 180.7 |

| | $ | 163.5 |

| | $ | 629,600 |

| | $ | 605,700 |

|

Mid-Atlantic | 364 |

| | 319 |

| | 228.3 |

| | 202.8 |

| | 627,200 |

| | 635,700 |

|

South | 299 |

| | 331 |

| | 233.5 |

| | 239.9 |

| | 780,900 |

| | 724,800 |

|

West | 389 |

| | 444 |

| | 325.0 |

| | 381.7 |

| | 835,400 |

| | 859,500 |

|

Traditional Home Building | 1,339 |

| | 1,364 |

| | 967.5 |

| | 987.9 |

| | 722,600 |

| | 724,200 |

|

City Living | 80 |

| | 80 |

| | 60.5 |

| | 69.0 |

| | 756,400 |

| | 862,400 |

|

Total consolidated | 1,419 |

| | 1,444 |

| | $ | 1,028.0 |

| | $ | 1,056.9 |

| | $ | 724,500 |

| | $ | 731,900 |

|

| | | | | | | | | | | |

CONTRACTS | | | | | | | | | | | |

North | 271 |

| | 270 |

| | $ | 190.1 |

| | $ | 173.0 |

| | $ | 701,400 |

| | $ | 640,700 |

|

Mid-Atlantic | 353 |

| | 303 |

| | 221.8 |

| | 187.6 |

| | 628,300 |

| | 619,200 |

|

South | 247 |

| | 322 |

| | 200.5 |

| | 238.1 |

| | 812,000 |

| | 739,400 |

|

West | 578 |

| | 386 |

| | 561.6 |

| | 298.6 |

| | 971,600 |

| | 773,700 |

|

Traditional Home Building | 1,449 |

| | 1,281 |

| | 1,174.0 |

| | 897.3 |

| | 810,200 |

| | 700,500 |

|

City Living | 30 |

| | 43 |

| | 59.9 |

| | 51.8 |

| | 1,995,500 |

| | 1,203,800 |

|

Total consolidated | 1,479 |

| | 1,324 |

| | $ | 1,233.9 |

| | $ | 949.1 |

| | $ | 834,300 |

| | $ | 716,800 |

|

| | | | | | | | | | | |

BACKLOG | | | | | | | | | | | |

North | 970 |

| | 984 |

| | $ | 638.6 |

| | $ | 624.9 |

| | $ | 658,300 |

| | $ | 635,100 |

|

Mid-Atlantic | 893 |

| | 970 |

| | 568.8 |

| | 598.7 |

| | 637,000 |

| | 617,200 |

|

South | 941 |

| | 1,033 |

| | 770.2 |

| | 759.6 |

| | 818,500 |

| | 735,300 |

|

West | 1,527 |

| | 998 |

| | 1,488.8 |

| | 814.9 |

| | 975,000 |

| | 816,600 |

|

Traditional Home Building | 4,331 |

| | 3,985 |

| | 3,466.4 |

| | 2,798.1 |

| | 800,400 |

| | 702,200 |

|

City Living | 116 |

| | 219 |

| | 221.9 |

| | 301.5 |

| | 1,913,300 |

| | 1,376,600 |

|

Total consolidated | 4,447 |

| | 4,204 |

| | $ | 3,688.3 |

| | $ | 3,099.6 |

| | $ | 829,400 |

| | $ | 737,300 |

|

|

| | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended

July 31, |

| Units | | $ (Millions) | | Average Price Per Unit $ |

| 2015 | | 2014 | | 2015 | | 2014 | | 2015 | | 2014 |

HOME BUILDING REVENUES | | | | | | | | | | | |

North | 735 |

| | 718 |

| | $ | 463.1 |

| | $ | 428.4 |

| | $ | 630,100 |

| | $ | 596,700 |

|

Mid-Atlantic | 929 |

| | 865 |

| | 579.2 |

| | 552.3 |

| | 623,500 |

| | 638,500 |

|

South | 824 |

| | 841 |

| | 611.3 |

| | 576.6 |

| | 741,900 |

| | 685,600 |

|

West | 1,075 |

| | 1,025 |

| | 895.4 |

| | 889.5 |

| | 832,900 |

| | 867,800 |

|

Traditional Home Building | 3,563 |

| | 3,449 |

| | 2,549.0 |

| | 2,446.8 |

| | 715,400 |

| | 709,400 |

|

City Living | 142 |

| | 141 |

| | 185.0 |

| | 114.1 |

| | 1,302,800 |

| | 809,200 |

|

Total consolidated | 3,705 |

| | 3,590 |

| | $ | 2,734.0 |

| | $ | 2,560.9 |

| | $ | 737,900 |

| | $ | 713,300 |

|

| | | | | | | | | | | |

CONTRACTS | | | | | | | | | | | |

North | 827 |

| | 754 |

| | $ | 537.1 |

| | $ | 490.8 |

| | $ | 649,500 |

| | $ | 650,900 |

|

Mid-Atlantic | 992 |

| | 933 |

| | 628.5 |

| | 578.1 |

| | 633,600 |

| | 619,600 |

|

South | 802 |

| | 918 |

| | 658.3 |

| | 662.7 |

| | 820,800 |

| | 721,900 |

|

West | 1,738 |

| | 1,222 |

| | 1,687.0 |

| | 1,005.9 |

| | 970,700 |

| | 823,200 |

|

Traditional Home Building | 4,359 |

| | 3,827 |

| | 3,510.9 |

| | 2,737.5 |

| | 805,400 |

| | 715,300 |

|

City Living | 114 |

| | 162 |

| | 191.8 |

| | 188.2 |

| | 1,682,500 |

| | 1,161,700 |

|

Total consolidated | 4,473 |

| | 3,989 |

| | $ | 3,702.7 |

| | $ | 2,925.7 |

| | $ | 827,800 |

| | $ | 733,400 |

|

Unconsolidated entities:

Information related to revenues and contracts of entities in which we have an interest for the three-month and nine-month periods ended July 31, 2015 and 2014, and for backlog at July 31, 2015 and 2014 is as follows:

|

| | | | | | | | | | | | | | | | | | | | | |

| Units | | $ (Millions) | | Average Price Per Unit $ |

| 2015 | | 2014 | | 2015 | | 2014 | | 2015 | | 2014 |

Three months ended July 31, | | | | | | | | | | | |

Revenues | 26 |

| | 21 |

| | $ | 24.6 |

| | $ | 16.4 |

| | $ | 946,000 |

| | $ | 778,900 |

|

Contracts | 42 |

| | 34 |

| | $ | 72.4 |

| | $ | 75.5 |

| | $ | 1,723,900 |

| | $ | 2,221,300 |

|

| | | | | | | | | | | |

Nine months ended July 31, | | | | | | | | | | | |

Revenues | 75 |

| | 49 |

| | $ | 60.9 |

| | $ | 39.6 |

| | $ | 811,400 |

| | $ | 807,800 |

|

Contracts | 107 |

| | 121 |

| | $ | 185.6 |

| | $ | 243.2 |

| | $ | 1,734,400 |

| | $ | 2,010,300 |

|

| | | | | | | | | | | |

Backlog at July 31, | 167 |

| | 134 |

| | $ | 409.2 |

| | $ | 249.9 |

| | $ | 2,450,200 |

| | $ | 1,864,700 |

|

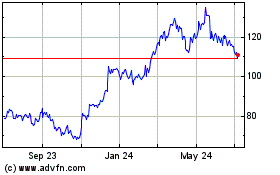

Toll Brothers (NYSE:TOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

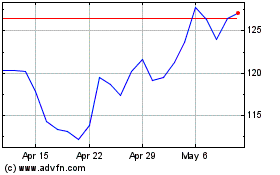

Toll Brothers (NYSE:TOL)

Historical Stock Chart

From Apr 2023 to Apr 2024