Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

November 13 2015 - 4:08PM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Registration Statement 333- 187080

Thermo Fisher Scientific Inc.

Term Sheet

November 13, 2015

1.500% Senior Notes due 2020

|

|

|

| Issuer: |

|

Thermo Fisher Scientific Inc. |

|

|

| Legal Format: |

|

SEC Registered |

|

|

| Security: |

|

1.500% Notes due 2020 |

|

|

| Principal Amount: |

|

€425,000,000 |

|

|

| Maturity Date: |

|

December 1, 2020 |

|

|

| Coupon (Interest Rate): |

|

1.500% per annum |

|

|

| Mid-Swaps Yield: |

|

0.236% |

|

|

| Spread to Mid-Swap: |

|

+127 basis points |

|

|

| Yield to Maturity: |

|

1.506% |

|

|

| Benchmark Bund: |

|

OBL 0.250% DBR due October 2020 |

|

|

| Benchmark Bund Yield/Price: |

|

-0.101% / 101.73% |

|

|

| Spread to Benchmark Bund: |

|

+160.7 basis points |

|

|

| Interest Payment Dates: |

|

December 1 of each year, commencing on December 1, 2016 |

|

|

| Day Count Convention: |

|

Actual/Actual (ICMA) |

|

|

| Business Days: |

|

New York, London, TARGET2 |

|

|

|

| Redemption Provision: |

|

Prior to September 1, 2020 (three months prior to their maturity), the issuer will have the option to redeem the notes, in whole at any time or in part from time to time, at a redemption price equal to the greater of (1)

100% of the principal amount of the notes to be redeemed and (2) the sum of the present values of the remaining scheduled payments of the notes being redeemed (not including any portion of the payments of interest accrued but unpaid as of the date

of redemption) discounted to the date of redemption on an annual basis (ACTUAL/ACTUAL (ICMA)), using a discount rate equal to the Comparable Bond Rate plus 25 basis points, plus accrued and unpaid interest thereon, if any, to, but excluding, the

redemption date. In addition, on and after September 1, 2020 (three months prior to their maturity), the issuer will have the option to redeem the notes, in whole at any time or in part from time to time, at a redemption price equal to 100% of

the principal amount of the notes to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the date of redemption. |

|

|

| Issue Price: |

|

99.971% |

|

|

| Underwriting Discount: |

|

0.325% |

|

|

| Net Proceeds, Before Expenses, to Issuer: |

|

€423,495,500 |

|

|

| Settlement Date: |

|

November 24, 2015 (T+7) |

|

|

| Trade Date: |

|

November 13, 2015 |

|

|

| Current Ratings*: |

|

Moody’s: Baa3 (Positive) S&P: BBB

(Stable) Fitch: BBB (Stable) |

|

|

|

| Currency of Payment: |

|

All payments of principal of, and premium, if any, and interest on, the notes, including any payments made upon any redemption of the notes, will be made in euros. If the euro is unavailable to the issuer due to the imposition of

exchange controls or other circumstances beyond the issuer’s control or if the euro is no longer being used by the then member states of the European Monetary Union that have adopted the euro as their currency or for the settlement of

transactions by public institutions of or within the international banking community, then all payments in respect of the notes will be made in U.S. dollars until the euro is again available to the issuer or so used. |

|

|

| Payment of Additional Amounts: |

|

The issuer will, subject to certain exceptions and limitations, pay to the beneficial owners of the notes who are Non-U.S. Persons, additional amounts as may be necessary so that every net payment of the principal of, and

premium, if any, and interest on, such holder’s note after deduction or withholding for or on account of any present or future tax, assessment or other governmental charge imposed upon that holder by the United States (or any political

subdivision or taxing authority thereof or therein), will not be less than the amount provided in such holder’s note to be then due and payable. |

|

|

| Redemption for Tax Reasons: |

|

The issuer may redeem all, but not less than all, of the notes in the event of certain changes in the tax laws of the United States or any political subdivision or taxing authority thereof or therein) which would create a

material probability that the issuer would be obligated to pay additional amounts as described above. This redemption would be made on at least 15 days’ but not more than 60 days’ notice and at a redemption price equal to 100% of the

principal amount of the notes, plus any accrued and unpaid interest on the notes to, but not including, the date fixed for redemption. |

|

|

| Purchase of Notes Upon a Change of Control Triggering Event: |

|

Upon the occurrence of a Change of Control Triggering Event, the issuer will, in certain circumstances, be required to make an offer to purchase the notes at a price equal to 101% of their principal amount plus any accrued and

unpaid interest, if any, to, but excluding, the date of repurchase. |

|

|

|

| Denominations: |

|

€100,000 x €1,000 |

|

|

| ISIN/Common Code: |

|

XS1322986537/132298653 |

|

|

| Listing: |

|

The issuer intends to apply to list the notes on the New York Stock Exchange. Upon such listing, the issuer will use commercially reasonable best efforts to maintain such listing and satisfy the requirements for such continued

listing as long as the notes are outstanding. |

|

|

| Joint Book-Running Managers: |

|

Deutsche Bank AG, London Branch HSBC Bank

plc |

|

|

| Co-Managers: |

|

Barclays Bank plc BNP Paribas

Credit Suisse Securities (Europe) Limited |

| * |

A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. Credit ratings are subject to change depending on financial and other factors.

|

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication

relates. Before you invest, you should read the prospectus and prospectus supplement thereto in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and

this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the active joint book-running managers can arrange to send you the prospectus and

prospectus supplement thereto if you request it by calling Deutsche Bank AG, London Branch toll-free at 1-800-503-4611 or HSBC Bank plc toll free at 1-866-811-8049.

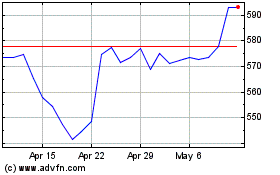

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

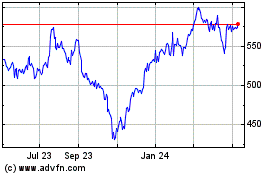

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Apr 2023 to Apr 2024