As filed with the Securities and Exchange Commission on February 24, 2016.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

The Timken Company

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

| Ohio |

|

34-0577130 |

| (State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification No.) |

4500 Mt. Pleasant St. N.W.

North Canton, Ohio 44720-5450

(Address of Principal Executive Offices Including Zip Code)

Company Savings Plan for the Employees of Timken France

(Full Title of the Plan)

Hansal N. Patel

Senior

Corporate Attorney – Securities and Finance

4500 Mt. Pleasant St. N.W.

North Canton, Ohio 44720-5450

(234) 262-3000

(Name,

Address and Telephone Number of Agent For Service)

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer |

|

x |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of Securities

to be Registered |

|

Amount

to be

Registered |

|

Proposed

Maximum Offering

Price Per Share |

|

Proposed

Maximum Aggregate

Offering Price |

|

Amount of

Registration Fee |

| Common Shares, without par value |

|

250,000(1)(2) |

|

$29.99(3) |

|

$7,497,500(3) |

|

$755.00 |

| |

| |

| (1) |

Represents common shares, without par value (“Common Shares”), of The Timken Company (the “Registrant”) issuable pursuant to the Company Savings Plan for the Employees of

Timken France (the “Plan”), being registered hereon. |

| (2) |

Pursuant to Rule 416 of the Securities Act of 1933 (the “Securities Act”), this Registration Statement also covers such additional Common Shares as may become issuable pursuant to the

anti-dilution provisions of the Plan. |

| (3) |

Estimated solely for calculating the amount of the registration fee, pursuant to paragraphs (c) and (h) of Rule 457 of the Securities Act, on the basis of the average of the high and low sale prices of the

Common Shares on the New York Stock Exchange on February 19, 2016, a date that is within five business days prior to filing. |

The Registrant hereby files this Registration Statement on Form S-8 to register an additional

250,000 Common Shares under the Plan for which a previously filed registration statement on Form S-8 relating to the Plan is effective. Pursuant to General Instruction E to Form S-8, this Registration Statement incorporates by reference the contents

of the Registration Statement on Form S-8 (Registration No. 333-62481) filed by the Registrant on August 28, 1998, including all attachments and exhibits thereto, and the contents of the Registration Statement on Form S-8 (Registration

No. 333-157719) filed by the Registrant on March 5, 2009, including all attachments and exhibits thereto, except to the extent supplemented, amended or superseded by the information set forth herein or therein.

PART II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

| Item 5. |

Interests of Named Experts and Counsel. |

The legality of the Common Shares being offered

under this Registration Statement has been passed upon for the Registrant by Mr. Hansal N. Patel. Mr. Patel is the Senior Corporate Attorney – Securities and Finance of the Registrant. As of February 15, 2016, Mr. Patel

beneficially owned 938 Common Shares.

| Item 6. |

Indemnification of Directors and Officers. |

The Registrant’s regulations provide

that it will indemnify, to the fullest extent permitted by law, any person who was or is party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or

investigative, by reason of the fact that he is or was a director or officer of the Registrant, or is or was serving at the Registrant’s request as a director, trustee or officer of another corporation, domestic or foreign, non-profit or

for-profit, partnership, joint venture, trust or other enterprise. The Registrant will not be required to indemnify any person with respect to any action, suit or proceeding that was initiated by that person unless the action, suit or proceeding was

initiated to enforce any rights to indemnification under the Registrant’s regulations and the person is formally adjudged to be entitled to indemnity. The indemnification obligation provided in the Registrant’s regulations is not exclusive

of any other rights to which those seeking indemnification may be entitled under any law, the Registrant’s articles of incorporation or any agreement, vote of shareholders or of disinterested directors or otherwise, both as to action in

official capacities and as to action in another capacity while he or she is the Registrant’s director or officer and shall continue as to a person who has ceased to be a director, trustee or officer and shall inure to the benefit of the heirs,

executors and administrators of that person.

The Registrant’s regulations also permit the Registrant to purchase and maintain

insurance on behalf of any persons that the Registrant is required to indemnify under the regulations against any liability asserted against and incurred by that person, in their status or capacity as a party the Registrant must indemnify, whether

or not the Registrant would have the power to indemnify such person against such liability. The Registrant may also, to the fullest extent permitted by law, enter into an indemnification agreement with any persons that the Registrant is required to

indemnify under the regulations.

The Registrant has entered into contracts with some of its directors and officers to indemnify them

against many of the types of claims that may be made against them. The Registrant also maintains insurance coverage for the benefit of directors and officers with respect to many types of claims that may be made against them, some of which may be in

addition to those described in the regulations.

Section 1701.13 of the Ohio Revised Code, or Section 1701.13, generally permits

indemnification of any director, officer or employee with respect to any proceeding against any such person provided that: (a) such person acted in good faith, (b) such person reasonably believed that the conduct was in or not opposed to

the best interests of the corporation, and (c) in the case of criminal proceedings, such person had no reasonable cause to believe that the conduct was unlawful. Indemnification may be made against expenses (including attorneys’ fees),

judgments, fines and settlements actually and reasonably incurred by such person in connection with the proceeding; provided, however, that if the proceeding is one by or in the right of the corporation, indemnification may be made only against

actual and reasonable expenses (including attorneys’ fees) and may not be made with respect to any proceeding in which the director, officer or employee has been adjudged to be liable to the corporation, except to the extent that the court in

which the proceeding was brought shall determine, upon application, that such person is, in view of all the circumstances, entitled to indemnity for such expenses as the court shall deem proper. To the extent that a director, officer or employee is

successful on the merits or otherwise in defense of the proceeding, indemnification is required. The termination of any proceeding by judgment, order, settlement, conviction or upon a plea of nolo contendere or its equivalent does not, of itself,

create a presumption that the director, officer or employee did not meet the standard of conduct required for indemnification to be permitted.

Section 1701.13 further provides that indemnification thereunder may not be made by the

corporation unless authorized after a determination has been made that such indemnification is proper, with that determination to be made (a) by the Board of Directors by a majority vote of a quorum consisting of directors not parties to the

proceedings; (b) if such a quorum is not obtainable, or, even if obtainable, but a quorum of disinterested directors so directs, by independent legal counsel in a written opinion; (c) by the shareholders; or (d) by the court in which

the proceeding was brought. However, a director (but not an officer, employee or agent) is entitled to mandatory advancement of expenses, including attorneys’ fees, incurred in defending any action, including derivative actions, brought against

the director, provided that the director agrees to cooperate with the corporation concerning the matter and to repay the amount advanced if it is proved by clear and convincing evidence that such director’s act or failure to act was done with

deliberate intent to cause injury to the corporation or with reckless disregard for the corporation’s best interests.

Finally, Section 1701.13

provides that indemnification or advancement of expense provided by that Section is not exclusive of any other rights to which those seeking indemnification may be entitled under the articles of incorporation or regulations or any agreement, vote of

shareholders or disinterested directors or otherwise.

The following Exhibits are being filed as part of this Registration

Statement.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 4.1 |

|

Amended Articles of Incorporation of the Registrant (effective May 31, 2013) (incorporated herein by reference to Exhibit 3.1 to the Registrant’s Quarterly Report on Form 10-Q (Commission No. 001-01169) filed with the

Commission on July 31, 2013) |

|

|

| 4.2 |

|

Amended Regulations of the Registrant (adopted on February 14, 2014) (incorporated herein by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K (Commission No. 001-01169) filed with the Commission on

February 14, 2014) |

|

|

| 4.3 |

|

Company Savings Plan for the Employees of Timken France (incorporated herein by reference to Exhibit 4(c) to the Registrant’s Registration Statement on Form S-8 (Registration No. 333-62481) filed with the Commission on

August 28, 1998) |

|

|

| 5.1 |

|

Opinion of Counsel |

|

|

| 23.1 |

|

Consent of Independent Registered Public Accounting Firm |

|

|

| 23.2 |

|

Consent of Counsel (included in Exhibit 5.1) |

|

|

| 24.1 |

|

Power of Attorney |

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of

the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of North Canton, State of Ohio, on this 24th day of February, 2016.

|

|

|

| THE TIMKEN COMPANY |

|

|

| By: |

|

/s/ William R. Burkhart |

|

|

William R. Burkhart |

|

|

Executive Vice President, General Counsel and Secretary |

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the

following persons in the capacities and on the date indicated.

|

|

|

|

|

| Date: February 24, 2016 |

|

* |

|

|

Richard G. Kyle President, Chief Executive

Officer and Director (Principal Executive Officer) |

|

|

| Date: February 24, 2016 |

|

* |

|

|

Philip D. Fracassa |

|

|

Executive Vice President and Chief Financial Officer

(Principal Financial Officer) |

|

|

| Date: February 24, 2016 |

|

* |

|

|

J. Ted Mihaila |

|

|

Senior Vice President and Controller

(Principal Accounting Officer) |

|

|

| Date: February 24, 2016 |

|

* |

|

|

Maria A. Crowe |

|

|

Director |

|

|

| Date: February 24, 2016 |

|

* |

|

|

John A. Luke, Jr. |

|

|

Director |

|

|

|

| Date: February 24, 2016 |

|

* |

|

|

Christopher L. Mapes |

|

|

Director |

|

|

| Date: February 24, 2016 |

|

* |

|

|

James F. Palmer |

|

|

Director |

|

|

| Date: February 24, 2016 |

|

* |

|

|

Ajita G. Rajendra |

|

|

Director |

|

|

| Date: February 24, 2016 |

|

* |

|

|

Joseph W. Ralston |

|

|

Director |

|

|

| Date: February 24, 2016 |

|

* |

|

|

John P. Reilly |

|

|

Director |

|

|

| Date: February 24, 2016 |

|

* |

|

|

Frank C. Sullivan |

|

|

Director |

|

|

| Date: February 24, 2016 |

|

* |

|

|

John M. Timken, Jr. |

|

|

Director |

|

|

| Date: February 24, 2016 |

|

* |

|

|

Ward J. Timken, Jr. |

|

|

Director |

|

|

| Date: February 24, 2016 |

|

* |

|

|

Jacqueline F. Woods |

|

|

Director |

| * |

This Registration Statement has been signed on behalf of the above officers and directors by William R. Burkhart, as attorney-in-fact pursuant to a power of attorney filed as Exhibit 24.1 to this Registration Statement.

|

|

|

|

|

|

|

|

| DATED: February 24, 2016 |

|

|

|

By: |

|

/s/ William R. Burkhart |

|

|

|

|

|

|

William R. Burkhart, Attorney-in-Fact |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 4.1 |

|

Amended Articles of Incorporation of the Registrant (effective May 31, 2013) (incorporated herein by reference to Exhibit 3.1 to the Registrant’s Quarterly Report on Form 10-Q (Commission No. 001-01169) filed with the

Commission on July 31, 2013) |

|

|

| 4.2 |

|

Amended Regulations of the Registrant (adopted on February 14, 2014) (incorporated herein by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K (Commission No. 001-01169) filed with the Commission on

February 14, 2014) |

|

|

| 4.3 |

|

Company Savings Plan for the Employees of Timken France (incorporated herein by reference to Exhibit 4(c) to the Registrant’s Registration Statement on Form S-8 (Registration No. 333-62481) filed with the Commission on

August 28, 1998) |

|

|

| 5.1 |

|

Opinion of Counsel |

|

|

| 23.1 |

|

Consent of Independent Registered Public Accounting Firm |

|

|

| 23.2 |

|

Consent of Counsel (included in Exhibit 5.1) |

|

|

| 24.1 |

|

Power of Attorney |

EXHIBIT 5.1

February 24, 2016

The Timken Company

4500 Mt. Pleasant St. N.W.

North Canton, Ohio 44720-5450

| |

Re: |

Registration Statement on Form S-8 Filed by The Timken Company |

Ladies and Gentlemen:

I am the Senior Corporate Attorney – Securities and Finance of The Timken Company, an Ohio corporation (the

“Company”), and have acted as counsel for the Company in connection with the Company Savings Plan for the Employees of Timken France (the “Plan”). In connection with the opinion expressed herein, I

have examined such documents, records and matters of law as I have deemed relevant or necessary for purposes of this opinion. Based on the foregoing, and subject to the further limitations, qualifications and assumptions set forth herein, I am of

the opinion that the 250,000 common shares, without par value, of the Company (the “Shares”) that may be issued or delivered and sold pursuant to the Plan will be, when issued or delivered and sold in accordance with the

Plan, validly issued, fully paid and nonassessable.

The opinion expressed herein is limited to the laws of the State of Ohio, as

currently in effect, and I express no opinion as to the effect of the laws of any other jurisdiction. For purposes of this opinion, I have assumed the authenticity of all documents reviewed by me as originals and the conformity to the originals of

all copies of documents reviewed by me. I have also assumed the legal capacity of all natural persons, the genuineness of the signatures of persons signing all documents reviewed by me, and the authority of such persons signing on behalf of the

parties thereto. In addition, I have assumed that the resolutions authorizing the Company to issue or deliver and sell the Shares pursuant to the Plan will be in full force and effect at all times at which the Shares are issued or delivered and sold

by the Company, and that the Company will take no action inconsistent with such resolutions.

I hereby consent to the filing of this

opinion as Exhibit 5.1 to the Registration Statement on Form S-8 filed by the Company to effect the registration of the Shares under the Securities Act of 1933 (the “Act”). In giving such consent, I do not thereby admit that

I am included in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Securities and Exchange Commission promulgated thereunder.

|

| Very truly yours, |

|

| /s/ Hansal N. Patel |

| Hansal N. Patel |

| Senior Corporate Attorney – Securities and Finance |

EXHIBIT 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement on Form S-8 pertaining to the Company Savings Plan for the Employees of Timken

France, for the registration of 250,000 common shares of The Timken Company of our reports dated February 24, 2016, with respect to the consolidated financial statements and schedule of The Timken Company and the effectiveness of internal

control over financial reporting of The Timken Company included in its Annual Report (Form 10-K) for the year ended December 31, 2015, filed with the Securities and Exchange Commission.

Cleveland, Ohio

February 24, 2016

EXHIBIT 24.1

THE TIMKEN COMPANY

REGISTRATION STATEMENT ON FORM S-8

POWER OF ATTORNEY

KNOW ALL MEN BY THESE

PRESENTS, that each of the undersigned directors and officers of The Timken Company, an Ohio corporation (the “Company”), hereby (1) constitutes and appoints Philip D. Fracassa, William R. Burkhart, and J. Ted Mihaila, collectively

and individually, as his or her agent and attorney-in-fact, with full power of substitution and resubstitution, to (a) sign and file on his or her behalf and in his or her name, place and stead in any and all capacities (i) one or more

registration statements on Form S-8, or other appropriate form (the “Registration Statement”) with respect to the registration under the Securities Act of 1933, as amended, of the common shares, without par value, of the Company issuable

pursuant to the Company Savings Plan for the Employees of Timken France (the “Plan”), and, if required, the related participation interests under the Plan, (ii) any and all amendments, including post-effective amendments, and exhibits

to the Registration Statement and (iii) any and all applications or other documents to be filed with the Securities and Exchange Commission or any state securities commission or other regulatory authority with respect to the securities covered

by the Registration Statement, and (b) do and perform any and all other acts and deeds whatsoever that may be necessary or required in the premises; and (2) ratifies and approves any and all actions that may be taken pursuant hereto by any

of the above-named agents and attorneys-in-fact or their substitutes.

This Power of Attorney may be executed in multiple counterparts, each of which

shall be deemed an original with respect to the person executing it.

IN WITNESS WHEREOF, the undersigned directors and officers of the

Company have hereunto set their hands as of the 12th day of February 2016.

|

|

|

|

|

| /s/ Maria A. Crowe |

|

|

|

/s/ Ajita G. Rajendra |

| Maria A. Crowe |

|

|

|

Ajita G. Rajendra |

|

|

|

| /s/ Philip D. Fracassa |

|

|

|

/s/ Joseph W. Ralston |

| Philip D. Fracassa

Executive Vice President and Chief Financial Officer |

|

|

|

Joseph W. Ralston |

|

|

|

| /s/ Richard G. Kyle |

|

|

|

/s/ John P. Reilly |

| Richard G. Kyle President and Chief Executive

Officer |

|

|

|

John P. Reilly |

|

|

|

| /s/ John A. Luke, Jr. |

|

|

|

/s/ Frank C. Sullivan |

| John A. Luke, Jr. |

|

|

|

Frank C. Sullivan |

|

|

|

| /s/ Christopher L. Mapes |

|

|

|

/s/ John M. Timken, Jr. |

| Christopher L. Mapes |

|

|

|

John M. Timken, Jr. |

|

|

|

| /s/ J. Ted Mihaila |

|

|

|

/s/ Ward J. Timken, Jr. |

| J. Ted Mihaila Senior Vice President and

Controller |

|

|

|

Ward J. Timken, Jr. |

|

|

|

| /s/ James F. Palmer |

|

|

|

/s/ Jacqueline F. Woods |

| James F. Palmer |

|

|

|

Jacqueline F. Woods |

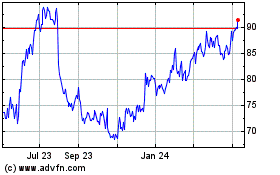

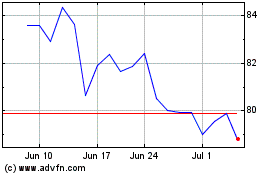

Timken (NYSE:TKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Timken (NYSE:TKR)

Historical Stock Chart

From Apr 2023 to Apr 2024