SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

|

| |

Date of Report (Date of earliest event reported): | February 3, 2016 |

|

|

THE TIMKEN COMPANY |

(Exact Name of Registrant as Specified in its Charter) |

|

|

Ohio |

(State or Other Jurisdiction of Incorporation) |

|

| | |

1-1169 | | 34-0577130 |

(Commission File Number) | | (I.R.S. Employer Identification No.) |

|

|

4500 Mt. Pleasant St. NW, North Canton, Ohio 44720-5450

|

(Address of Principal Executive Offices) (Zip Code) |

|

|

(234) 262-3000 |

(Registrant's Telephone Number, Including Area Code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions.

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

The Timken Company (the "Company") issued a press release on February 3, 2016 announcing results for the fourth quarter and full-year of 2015. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by this reference.

Also on February 3, 2016, the Timken Company will host a conference call and post conference call materials on its website, www.timken.com. A copy of the conference call materials is attached as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by this reference.

This information shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act") or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

| | |

Exhibit No. | | Description |

99.1 | | Press Release of The Timken Company dated February 3, 2016 |

99.2 | | Investor Presentation dated February 3, 2016 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | THE TIMKEN COMPANY |

| | | |

| | By: | /s/ William R. Burkhart |

| | | William R. Burkhart |

| | | Executive Vice President, General Counsel and Secretary |

Date: | | February 3, 2016 | |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

99.1 | | Press Release of The Timken Company dated February 3, 2016 |

99.2 | | Investor Presentation dated February 3, 2016 |

Timken Reports Fourth-Quarter Results,

Provides 2016 Outlook

| |

• | Reported adjusted earnings of $0.59 per diluted share (EPS) in the quarter on sales of $714 million |

| |

• | Generated strong free cash flow in the quarter of $88 million |

| |

• | Repurchased 2.7 million shares in the quarter, totaling 8.6 million for the year |

| |

• | Announced new share repurchase authorization of 5 million shares for 2016 |

| |

• | Expects 2016 adjusted EPS of $1.90 to $2.00 |

NORTH CANTON, Ohio: Feb. 3, 2016 - The Timken Company (NYSE: TKR; www.timken.com), a global leader in bearings, today reported sales of $714.4 million for the fourth quarter of 2015, approximately 6 percent lower than the same period a year ago. Excluding the impact of currency, sales were down just under 2 percent, primarily due to market-related declines in Process Industries, which were partially offset by sales from the recently acquired Carlisle belts product line.

In the fourth quarter, Timken posted a net loss from continuing operations of $35.7 million or $0.44 per basic share, versus net income of $41.2 million or $0.46 per diluted share a year ago. The loss included certain unusual items including non-cash pension settlement charges of $242 million (pre-tax), offset partially by a divestiture gain and the reversal of certain tax reserves (reference Table I).

Excluding unusual items, adjusted net income from continuing operations was $49.0 million or $0.59 per diluted share. This compares with $57.9 million or $0.65 per diluted share for the same period in 2014. The year-over-year change in adjusted net income reflects lower volume and unfavorable currency, partially offset by the impact of favorable material and operating costs and lower SG&A expenses. Earnings per share also benefited from the company’s share buyback program, with 2.7 million shares repurchased in the fourth quarter.

Free cash flow (net cash from operations minus capital expenditures) for the quarter was $88 million, compared with $69 million in the prior-year period. The strong performance was driven primarily by lower working capital.

“Given the soft industrial environment globally, we were pleased with our fourth quarter results,” said Richard G. Kyle, Timken president and chief executive officer. “Demand declined slightly less than anticipated and our cost-reduction initiatives continued to gain momentum, resulting in a solid finish to a challenging year.

“In 2015, we gained share in sectors like automotive, wind and rail, maintained double-digit operating margins, generated strong cash flow, acquired the Carlisle belts product line and made structural improvements to our cost-competitiveness and operating margins,” said Kyle. “We also continued to return capital to shareholders by increasing our dividend and buying back nearly 10 percent of our outstanding shares.”

Kyle concluded, “We enter 2016 with a lower backlog and a significant degree of market uncertainty. As such, we are planning for 2016 revenue to be lower than 2015, reflecting softer end-user demand across most of the industrial landscape and a continued strong U.S. dollar. Our strategic priorities remain the same: We will continue to focus on outgrowing our end markets through our DeltaX initiative, driving operational excellence with an emphasis on cost reductions and cash generation, as well as effective capital deployment to increase shareholder value.”

Table I: Adjusted Net Income & Earnings Per Share (EPS) from Continuing Operations

|

| | | | |

| 2015 - 4Q | 2015 - Full Year |

| ($M) | EPS | ($M) | EPS |

Net (Loss) Income Attributable to The Timken Company | $ (35.7) | $ (0.44) | $ (70.8) | $ (0.84) |

Adjustments: | | | | |

Pension settlement charges | $ 241.8 | $ 2.92 | $ 465.0 | $ 5.45 |

Impairment and restructuring charges | 3.1 | 0.04 | 15.9 | 0.19 |

Gain on divestitures | (29.0) | (0.35) | (28.7) | (0.33) |

Acquisition-related charges | 3.8 | 0.05 | 5.7 | 0.07 |

Fixed asset write-off | 9.7 | 0.12 | 9.7 | 0.11 |

Tax benefit from above adjustments (net) | (109.6) | (1.32) | (173.1) | (2.03) |

Other income tax adjustments | (35.1) | (0.43) | (34.6) | (0.41) |

Total adjustments | 84.7 | 1.03 | 259.9 | 3.05 |

Net Income, after adjustments | $ 49.0 | $ 0.59 | $ 189.1 | $ 2.21 |

2015 Full-Year Results

For 2015, sales were $2.9 billion, 7 percent lower than 2014. Excluding the impact of currency, sales declined almost 2 percent, primarily driven by weaker end‑market demand across both Mobile and Process Industries, offset partially by the benefit of acquisitions. Net loss from continuing operations was $70.8 million or $0.84 per basic share for the year, versus net income of $146.8 million or $1.61 per diluted share a year ago.

Adjusted net income was $189.1 million or $2.21 per diluted share. This compares with $232.9 million or $2.55 per diluted share in 2014. The decline in earnings reflects negative currency, volume and net price/mix and higher interest expense, partially offset by favorable material and operating costs, lower SG&A expenses and a lower tax rate. Earnings per share also benefited from the company’s share buyback program, with 8.6 million shares repurchased in 2015.

Among recent developments, the company:

| |

• | Broke ground on a new tapered roller bearing manufacturing facility in Ploiesti, Romania. The company expects to begin production in 2017; |

| |

• | Returned $103.1 million in capital to shareholders in the fourth quarter, through the repurchase of 2.7 million shares and payment of dividends, bringing total capital returned to shareholders to nearly $400 million for the year; |

| |

• | Received board authorization to repurchase up to 5 million shares in 2016; |

| |

• | Entered into a group annuity contract to transfer approximately $475 million of retiree pension obligations to Prudential Insurance Company of America. Coupled with a similar transaction in the first quarter, the total liability transferred was over $1 billion in 2015, funded entirely with plan assets; and |

| |

• | Completed its global rollout of the Timken® 6000 series metric deep groove ball bearings and introduced a new line of Drives® Leaf Chain, both as part of its DeltaX growth initiative. |

Fourth-Quarter Segment Results

Mobile Industries reported fourth-quarter sales of $380.3 million, approximately 2 percent lower than the same period a year ago. Excluding the impact of currency, sales increased over 2 percent driven by the net benefit of acquisitions. Organically, revenue was roughly flat, with automotive growth partially offset by lower off-highway and rail demand.

Earnings before interest and taxes (EBIT) for the fourth quarter were $58.9 million or 15.5 percent of sales, compared with EBIT of $22.4 million or 5.8 percent of sales for the same period a year ago. Adjusted EBIT was $36.2 million or 9.5 percent of sales, compared with $28.6 million or 7.3 percent of sales in the fourth quarter last year. The increase in year-over-year adjusted EBIT was driven by the impact of favorable material and operating costs and lower SG&A expenses, partially offset by the impact of lower production volume.

Process Industries sales of $334.1 million for the fourth quarter declined approximately 10 percent from the same period a year ago. Excluding the impact of currency, sales were down about 6 percent, driven by weaker demand in the industrial aftermarket and heavy industries, partially offset by growth in wind energy and military marine, and the benefit of acquisitions.

EBIT for the quarter was $45.2 million or 13.5 percent of sales, compared with EBIT of $79.7 million or 21.4 percent of sales for the same period a year ago. Adjusted EBIT was $55.7 million or 16.7 percent of sales, compared with $79.4 million or 21.3 percent of sales in the fourth quarter last year. The decrease in year-over-year adjusted EBIT was driven by the impact of lower volume and currency, partially offset by favorable material costs, lower SG&A expenses and the benefit of acquisitions.

2016 Outlook

The company is planning for 2016 revenue to be down approximately 4 to 5 percent versus 2015, including 2 percent from currency declines.

Within its segments, the company estimates full-year 2016:

| |

• | Mobile Industries' sales to be down approximately 5 percent. Excluding the impact of currency, sales are expected to be down around 3 percent, reflecting lower demand in rail, off-highway and aerospace, offset partially by growth in automotive and the net benefit of acquisitions. |

| |

• | Process Industries' sales to be down approximately 4 percent. Excluding the impact of currency, sales are expected to be down around 2 percent, driven by declines across the industrial aftermarket and heavy industries, offset partially by the benefit of acquisitions. |

Timken anticipates 2016 earnings per diluted share to range from $1.35 to $1.45 for the full year on a GAAP basis. Excluding unusual items, the company expects 2016 adjusted earnings per diluted share to be $1.90 to $2.00. Earnings per share estimates reflect the benefit of share repurchases completed by the end of 2015 and currency rates as of Dec. 31, 2015.

Conference Call Information

Timken will host a conference call today at 9:00 a.m. Eastern Time to review its financial results. Presentation materials will be available online in advance of the call for interested investors and securities analysts.

Conference Call: Wednesday, February 3, 2016

9:00 a.m. Eastern Time

Live Dial-In: 888-240-1251 or 913-981-5544

(Call in 10 minutes prior to be included.)

Conference ID: Timken Earnings Call

Live Webcast: www.timken.com/investors

Conference Call Replay: Replay Dial-In available through February 17, 2016:

888-203-1112 or 719-457-0820

Replay Passcode: 8118267

About The Timken Company

The Timken Company (NYSE: TKR; www.timken.com) engineers, manufactures and markets bearings, transmissions, gearboxes, belts, chain and related products, and offers a spectrum of powertrain rebuild and repair services. The leading authority on tapered roller bearings, Timken today applies its deep knowledge of metallurgy, tribology and mechanical power transmission across a variety of bearings and related systems to improve reliability and efficiency of machinery and equipment all around the world. The company’s growing product and services portfolio features many strong industrial brands including Timken®, Fafnir®, Philadelphia Gear®, Carlisle®, Drives® and InterlubeTM. Known for its quality products and collaborative technical sales model, Timken posted $2.9 billion in sales in 2015. With more than 14,000 employees operating from 29 countries, Timken makes the world more productive and keeps industry in motion.

Certain statements in this release (including statements regarding the company's forecasts, estimates plans and expectations) that are not historical in nature are "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995. In particular, the statements related to expectations regarding the company's future financial performance, including information under the heading "Outlook," are forward-looking.

The company cautions that actual results may differ materially from those projected or implied in forward-looking statements due to a variety of important factors, including: the finalization of the company's financial statements for the fourth quarter and full-year of 2015; the company's ability to respond to the changes in its end markets that could affect demand for the company's products; unanticipated changes in business relationships with customers or their purchases from the company; changes in the financial health of the company's customers, which may have an impact on the company's revenues, earnings and impairment charges; fluctuations in raw material and energy costs; the impact of the company's last-in, first-out accounting; weakness in global or regional economic conditions and capital markets; fluctuations in currency valuations; changes in the expected costs associated with product warranty claims; the ability to achieve satisfactory operating results in the integration of acquired companies; the impact on operations of general economic conditions; fluctuations in customer demand; the impact on the company’s pension obligations due to changes in interest rates, investment performance and other tactics designed to reduce risk; the company’s ability to complete and achieve the benefits of announced plans, programs, initiatives, and capital investments; the company’s ability to avoid any indemnification liabilities under certain agreements it entered into with TimkenSteel Corporation in connection with the spinoff and the ability of TimkenSteel Corporation to satisfy any indemnification liabilities it entered into in connection with the spinoff; and the taxable nature of the spinoff. Additional factors are discussed in the company's filings with the Securities and Exchange Commission, including the company's Annual Report on Form 10-K for the year ended Dec. 31, 2014, quarterly reports on Form 10-Q and current reports on Form 8-K. Except as required by the federal securities laws, the company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

###

|

| | |

Media Contact: Clark Harvey | | Investor Contact: Shelly Chadwick |

Manager - Communications | | Vice President - Treasury & Investor Relations |

Telephone: (234) 262-3514 | | Telephone: (234) 262-3223 |

mediarelations@timken.com | | shelly.chadwick@timken.com |

|

| | | | | | | | | | | | | |

The Timken Company | | | | | |

CONDENSED CONSOLIDATED STATEMENTS OF INCOME | | | | | |

(Unaudited) | | | | | |

(Dollars in millions, except per share data) | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2015 | 2014 | | 2015 | 2014 |

Net sales | $ | 714.4 |

| $ | 762.2 |

| | $ | 2,872.3 |

| $ | 3,076.2 |

|

Cost of products sold | 523.5 |

| 541.4 |

| | 2,078.4 |

| 2,178.2 |

|

Gross Profit | 190.9 |

| 220.8 |

| | 793.9 |

| 898.0 |

|

Selling, general & administrative expenses (SG&A) | 119.0 |

| 131.7 |

| | 494.3 |

| 542.5 |

|

Impairment and restructuring charges | 2.7 |

| 5.4 |

| | 14.7 |

| 113.4 |

|

Pension settlement charges | 241.8 |

| 33.0 |

| | 465.0 |

| 33.7 |

|

Gain on divestitures | (29.0 | ) | — |

| | (28.7 | ) | — |

|

Operating (Loss) Income | (143.6 | ) | 50.7 |

| | (151.4 | ) | 208.4 |

|

Other (expense) income, net | (6.7 | ) | (0.8 | ) | | (7.5 | ) | 19.9 |

|

(Loss) Earnings Before Interest and Taxes (EBIT)(1) | (150.3 | ) | 49.9 |

| | (158.9 | ) | 228.3 |

|

Interest expense, net | (7.7 | ) | (7.0 | ) | | (30.7 | ) | (24.3 | ) |

(Loss) Income From Continuing Operations Before Income Taxes | (158.0 | ) | 42.9 |

| | (189.6 | ) | 204.0 |

|

(Benefit) provision for income taxes | (122.6 | ) | 1.3 |

| | (121.6 | ) | 54.7 |

|

(Loss) Income From Continuing Operations | (35.4 | ) | 41.6 |

| | (68.0 | ) | 149.3 |

|

Income from discontinued operations, net of income taxes(2) | — |

| 5.3 |

| | — |

| 24.0 |

|

Net (Loss) Income | (35.4 | ) | 46.9 |

| | (68.0 | ) | 173.3 |

|

Less: Net Income Attributable to Noncontrolling Interest | 0.3 |

| 0.4 |

| | 2.8 |

| 2.5 |

|

Net (Loss) Income Attributable to The Timken Company | $ | (35.7 | ) | $ | 46.5 |

| | $ | (70.8 | ) | $ | 170.8 |

|

| | | | | |

Net (Loss) Income per Common Share Attributable to The Timken Company Common Shareholders | | | | | |

Basic (Loss) Earnings per share - Continuing Operations | $ | (0.44 | ) | $ | 0.46 |

| | $ | (0.84 | ) | $ | 1.62 |

|

Basic Earnings per share - Discontinued Operations | — |

| 0.06 |

| | — |

| 0.27 |

|

Basic (Loss) Earnings per share | $ | (0.44 | ) | $ | 0.52 |

| | $ | (0.84 | ) | $ | 1.89 |

|

| | | | | |

Diluted (Loss) Earnings per share - Continuing Operations | $ | (0.44 | ) | $ | 0.46 |

| | $ | (0.84 | ) | $ | 1.61 |

|

Diluted Earnings per share - Discontinued Operations | — |

| 0.06 |

| | — |

| 0.26 |

|

Diluted (Loss) Earnings per share | $ | (0.44 | ) | $ | 0.52 |

| | $ | (0.84 | ) | $ | 1.87 |

|

| | | | | |

Average Shares Outstanding | 81,845,054 |

| 88,633,323 |

| | 84,631,778 |

| 90,367,345 |

|

Average Shares Outstanding - assuming dilution | 81,845,054 |

| 89,600,784 |

| | 84,631,778 |

| 91,224,328 |

|

| | | | | |

(1) EBIT is defined as operating income plus other income (expense). EBIT is an important financial measure used in the management of the business, including decisions concerning the allocation of resources and assessment of performance. Management believes that reporting EBIT is useful to investors as this measure is representative of the Company's performance. |

|

(2) Discontinued Operations related to the spinoff of the steel business on June 30, 2014 and includes both operating results and separation costs. |

|

| | | | | | | | | | | | | |

BUSINESS SEGMENTS | | | | | |

(Unaudited) | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

(Dollars in millions) | 2015 | 2014 | | 2015 | 2014 |

| | | | | |

Mobile Industries | | | | | |

Net sales to external customers | $ | 380.3 |

| $ | 389.5 |

| | $ | 1,558.3 |

| $ | 1,685.4 |

|

Earnings before interest and taxes (EBIT) (1) | $ | 58.9 |

| $ | 22.4 |

| | $ | 173.3 |

| $ | 65.6 |

|

EBIT Margin (1) | 15.5 | % | 5.8 | % | | 11.1 | % | 3.9 | % |

| | | | | |

Process Industries | | | | | |

Net sales to external customers | $ | 334.1 |

| $ | 372.7 |

| | $ | 1,314.0 |

| $ | 1,390.8 |

|

Earnings before interest and taxes (EBIT) (1) | $ | 45.2 |

| $ | 79.7 |

| | $ | 190.2 |

| $ | 267.1 |

|

EBIT Margin (1) | 13.5 | % | 21.4 | % | | 14.5 | % | 19.2 | % |

| | | | | |

Unallocated corporate expense | $ | (12.6 | ) | $ | (19.2 | ) | | $ | (57.4 | ) | $ | (71.4 | ) |

Unallocated pension settlement charges (2) | (241.8 | ) | (33.0 | ) | | (465.0 | ) | (33.0 | ) |

| | | | | |

Consolidated | | | | | |

Net sales to external customers | $ | 714.4 |

| $ | 762.2 |

| | $ | 2,872.3 |

| $ | 3,076.2 |

|

(Loss) earnings before interest and taxes (EBIT) (1) | $ | (150.3 | ) | $ | 49.9 |

| | $ | (158.9 | ) | $ | 228.3 |

|

EBIT Margin (1) | (21.0 | )% | 6.5 | % | | (5.5 | )% | 7.4 | % |

| | | | | |

(1) EBIT is defined as operating income plus other income (expense). EBIT Margin is EBIT as a percentage of net sales. EBIT and EBIT Margin are important financial measures used in the management of the business, including decisions concerning the allocation of resources and assessment of performance. Management believes that reporting EBIT and EBIT Margin is useful to investors as these measures are representative of the Company's performance. |

| | | | | |

(2) Unallocated pension settlement charges primarily related to two agreements pursuant to which two of the Company's U.S. defined benefit pension plans purchased group annuity contracts from Prudential Insurance Company of America (Prudential), which require Prudential to pay and administer future benefits for a total of approximately 8,400 U.S. Timken retirees, as well as lump sum distributions to new retirees during 2015. |

| | | | | |

|

| | | | | | | |

CONDENSED CONSOLIDATED BALANCE SHEETS | | |

| | | |

(Dollars in millions) | (Unaudited) December 31, 2015 | | December 31,

2014 |

ASSETS | | | |

Cash and cash equivalents | $ | 129.6 |

| | $ | 278.8 |

|

Restricted cash | 0.2 |

| | 15.3 |

|

Accounts receivable | 447.0 |

| | 475.7 |

|

Inventories, net | 543.2 |

| | 585.5 |

|

Other current assets | 78.8 |

| | 126.6 |

|

Total Current Assets | 1,198.8 |

| | 1,481.9 |

|

Property, Plant and Equipment, net | 777.8 |

| | 780.5 |

|

Goodwill and other intangible assets | 598.6 |

| | 499.3 |

|

Non-current pension assets | 86.3 |

| | 176.2 |

|

Other assets | 128.9 |

| | 63.5 |

|

Total Assets | $ | 2,790.4 |

| | $ | 3,001.4 |

|

| | | |

LIABILITIES | | | |

Accounts payable | $ | 159.7 |

| | $ | 143.9 |

|

Short-term debt, including current portion of long-term debt | 77.1 |

| | 8.0 |

|

Income taxes | 13.1 |

| | 80.2 |

|

Accrued expenses | 247.8 |

| | 301.7 |

|

Total Current Liabilities | 497.7 |

| | 533.8 |

|

| | | |

Long-term debt | 580.6 |

| | 522.1 |

|

Accrued pension cost | 146.9 |

| | 165.9 |

|

Accrued postretirement benefits cost | 136.1 |

| | 141.8 |

|

Other non-current liabilities | 71.8 |

| | 48.7 |

|

Total Liabilities | 1,433.1 |

| | 1,412.3 |

|

| | | |

EQUITY | | | |

The Timken Company shareholders' equity | 1,337.2 |

| | 1,576.2 |

|

Noncontrolling Interest | 20.1 |

| | 12.9 |

|

Total Equity | 1,357.3 |

| | 1,589.1 |

|

Total Liabilities and Equity | $ | 2,790.4 |

| | $ | 3,001.4 |

|

|

| | | | | | | | | | | | |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | | | | |

(Unaudited) | | | | |

| Three Months Ended December 31, | Twelve Months Ended December 31, |

(Dollars in millions) | 2015 | 2014 | 2015 | 2014 |

Cash Provided (Used) | | | | |

OPERATING ACTIVITIES | | | | |

Net (loss) income attributable to The Timken Company | $ | (35.7 | ) | $ | 46.5 |

| $ | (70.8 | ) | $ | 170.8 |

|

Net income from discontinued operations | — |

| (5.3 | ) | — |

| (24.0 | ) |

Net income attributable to noncontrolling interest | 0.3 |

| 0.4 |

| 2.8 |

| 2.5 |

|

Adjustments to reconcile net (loss) income to net cash provided (used) by operating activities: | | | | |

Depreciation and amortization | 33.0 |

| 33.6 |

| 130.8 |

| 137.0 |

|

Impairment charges | — |

| 0.1 |

| 3.3 |

| 98.9 |

|

Loss (gain) on sale of assets | 10.0 |

| 0.7 |

| 11.8 |

| (20.2 | ) |

Gain on divestitures | (29.0 | ) | — |

| (28.7 | ) | — |

|

Pension and other postretirement expense | 251.4 |

| 39.5 |

| 502.9 |

| 62.0 |

|

Pension and other postretirement benefit contributions and payments | (6.3 | ) | (2.3 | ) | (29.8 | ) | (49.9 | ) |

Changes in operating assets and liabilities: | | | | |

Accounts receivable | 18.0 |

| 4.3 |

| 16.1 |

| (48.3 | ) |

Inventories | 45.8 |

| 25.3 |

| 52.9 |

| (26.8 | ) |

Accounts payable | (15.4 | ) | (39.3 | ) | 11.6 |

| 8.0 |

|

Accrued expenses | 0.2 |

| 9.6 |

| (55.8 | ) | 2.2 |

|

Income taxes | (152.9 | ) | (21.0 | ) | (210.5 | ) | (68.6 | ) |

Other, net | 9.1 |

| 16.6 |

| 38.2 |

| 37.9 |

|

Net Cash Provided by Operating Activities - Continuing Operations | $ | 128.5 |

| $ | 108.7 |

| $ | 374.8 |

| $ | 281.5 |

|

Net Cash Provided by Operating Activities - Discontinued Operations | — |

| 2.9 |

| — |

| 25.5 |

|

Net Cash Provided by Operating Activities | $ | 128.5 |

| $ | 111.6 |

| $ | 374.8 |

| $ | 307.0 |

|

INVESTING ACTIVITIES | | | | |

Capital expenditures | $ | (40.5 | ) | $ | (39.7 | ) | $ | (105.6 | ) | $ | (126.8 | ) |

Acquisitions | 0.3 |

| (9.7 | ) | (213.3 | ) | (21.7 | ) |

Divestitures | 43.4 |

| 7.4 |

| 46.2 |

| 7.4 |

|

Other | 0.4 |

| 4.4 |

| 7.5 |

| 23.4 |

|

Net Cash (Used) Provided by Investing Activities - Continuing Operations | $ | 3.6 |

| $ | (37.6 | ) | $ | (265.2 | ) | $ | (117.7 | ) |

Net Cash Used by Investing Activities - Discontinued Operations | — |

| — |

| — |

| (77.0 | ) |

Net Cash (Used) Provided by Investing Activities | $ | 3.6 |

| $ | (37.6 | ) | $ | (265.2 | ) | $ | (194.7 | ) |

FINANCING ACTIVITIES | | | | |

Cash dividends paid to shareholders | $ | (21.3 | ) | $ | (22.1 | ) | $ | (87.0 | ) | $ | (90.3 | ) |

Purchase of treasury shares | (81.8 | ) | (4.4 | ) | (309.7 | ) | (270.9 | ) |

Net proceeds (payments) from credit facilities | (21.4 | ) | (0.3 | ) | 55.0 |

| (9.8 | ) |

Net proceeds (payments) from long-term debt | (44.5 | ) | (0.1 | ) | 75.1 |

| 95.5 |

|

Distribution of TimkenSteel | — |

| — |

| — |

| (46.5 | ) |

Other | 17.6 |

| (0.2 | ) | 25.0 |

| 19.8 |

|

Net Cash Used by Financing Activities - Continuing Operations | $ | (151.4 | ) | $ | (27.1 | ) | $ | (241.6 | ) | $ | (302.2 | ) |

Net Cash Provided by Financing Activities - Discontinued Operations | — |

| — |

| — |

| 100.0 |

|

Net Cash Used by Financing Activities | $ | (151.4 | ) | $ | (27.1 | ) | $ | (241.6 | ) | $ | (202.2 | ) |

Effect of exchange rate changes on cash | (6.1 | ) | (6.3 | ) | (17.2 | ) | (15.9 | ) |

(Decrease) Increase in Cash and Cash Equivalents | $ | (25.4 | ) | $ | 40.6 |

| $ | (149.2 | ) | $ | (105.8 | ) |

Cash and cash equivalents at Beginning of Period | 155.0 |

| 238.2 |

| 278.8 |

| 384.6 |

|

Cash and Cash Equivalents at End of Period | $ | 129.6 |

| $ | 278.8 |

| $ | 129.6 |

| $ | 278.8 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reconciliations of Adjusted Net Income from Continuing Operations to GAAP (Loss) Income from Continuing Operations and Adjusted Diluted Earnings Per Share to GAAP (Loss) Earnings Per Share: |

(Unaudited) |

These reconciliations are provided as additional relevant information about the Company's performance. Management believes that adjusted net income from continuing operations and adjusted diluted earnings per share, adjusted to remove: (a) pension settlement charges; (b) impairment and restructuring charges; (c) gain on divestitures and the sale of real estate; (d) acquisition related charges; (e) fixed asset write-offs; and (f) the benefit from income taxes are representative of the Company's performance and therefore useful to investors. |

| | | | | | | | | | | | | | |

(Dollars in millions, except share data) | | Three Months Ended

December 31, | | Twelve Months Ended December 31, |

| | 2015 | | EPS | 2014 | | EPS | | 2015 | | EPS | 2014 | | EPS |

(Loss) Income from Continuing Operations | | $ | (35.4 | ) | | | $ | 41.6 |

| | | | $ | (68.0 | ) | | | $ | 149.3 |

| | |

Less: Net Income Attributable to Noncontrolling Interest | | 0.3 |

| | | 0.4 |

| | | | 2.8 |

| | | 2.5 |

| | |

Net (Loss) Income from Continuing Operations Attributable to The Timken Company | | $ | (35.7 | ) | | $ | (0.44 | ) | $ | 41.2 |

| | $ | 0.46 |

| | $ | (70.8 | ) | | $ | (0.84 | ) | $ | 146.8 |

| | $ | 1.61 |

|

| | | | | | | | | | | | | | |

Adjustments: | | | | | | | | | | | | | | |

Pension settlement charges (1) | | $ | 241.8 |

| | $ | 2.92 |

| $ | 33.0 |

| | $ | 0.36 |

| | $ | 465.0 |

| | $ | 5.45 |

| $ | 33.7 |

| | $ | 0.37 |

|

Impairment and restructuring charges (2) | | 3.1 |

| | 0.04 |

| 5.9 |

| | 0.07 |

| | 15.9 |

| | 0.19 |

| 136.2 |

| | 1.49 |

|

Gain on divestitures and sale of real estate (3) | | (29.0 | ) | | (0.35 | ) | — |

| | — |

| | (28.7 | ) | | (0.33 | ) | (22.6 | ) | | (0.25 | ) |

Acquisition related charges (4) | | 3.8 |

| | 0.05 |

| — |

| | — |

| | 5.7 |

| | 0.07 |

| — |

| | — |

|

Fixed asset write-off (5) | | 9.7 |

| | 0.12 |

| — |

| | — |

| | 9.7 |

| | 0.11 |

| — |

| | — |

|

Tax benefit from above adjustments (net) (6) | | (109.6 | ) | | (1.32 | ) | (13.7 | ) | | (0.15 | ) | | (173.1 | ) | | (2.03 | ) | (52.5 | ) | | (0.58 | ) |

Other income tax adjustments (7) | | (35.1 | ) | | (0.43 | ) | (8.5 | ) | | (0.09 | ) | | (34.6 | ) | | (0.41 | ) | (8.7 | ) | | (0.09 | ) |

Total Adjustments: | | 84.7 |

| | 1.03 |

| 16.7 |

| | 0.19 |

| | 259.9 |

| | 3.05 |

| 86.1 |

| | 0.94 |

|

Adjusted Net Income from Continuing Operations | | $ | 49.0 |

| | $ | 0.59 |

| $ | 57.9 |

| | $ | 0.65 |

| | $ | 189.1 |

| | $ | 2.21 |

| $ | 232.9 |

| | $ | 2.55 |

|

| | | | | | | | | | | | | | |

(1) Pension settlement charges primarily related to two agreements pursuant to which two of the Company's U.S. defined benefit pension plans purchased group annuity contracts from Prudential, which require Prudential to pay and administer future benefits for a total of approximately 8,400 U.S. Timken retirees, as well as lump sum distributions to new retirees during 2015. |

| | | | | | | | | | | | | | |

(2) Impairment and restructuring charges, including rationalization costs recorded in cost of products sold, related to plant closures, the rationalization of certain plants and severance related to cost reduction initiatives. |

| | | | | | | | | | | | | | |

(3) Gain on divestitures related to the gain on the sale of Timken Alcor Aerospace Technologies, Inc. (Alcor) located in Mesa, Arizona, of $29.0 million in the fourth quarter of 2015. Gain on the sale of real estate related to the sale of the former manufacturing facility in Sao Paulo, Brazil of $22.6 million in the first quarter of 2014. |

| | | | | | | | | | | | | | |

(4) Acquisition charges related to the acquisition of the Carlisle belts product line, including an inventory step up and one time transaction costs. |

| | | | | | | | | | | | | | |

(5) The fixed asset write-off related to costs that remained in construction in process (CIP) after the related assets were placed into service. The majority of these assets were placed into service between 2008 and 2012. This error was identified during an examination of aged balances in the CIP account. Management of the Company concluded that the correction of this error in the fourth quarter of 2015 and the presence of this error in prior periods is immaterial to all periods presented. |

| | | | | | | | | | | | | | |

(6) Tax benefit from above adjustments (net) included the tax impact on pre-tax special items as well as adjustments to reflect the use of one overall effective tax rate on adjusted pre-tax income in interim periods. |

| | | | | | | | | | | | | | |

(7) Other income tax adjustments included the impact of discrete tax items recorded during the respective periods, including the reversal of certain valuation allowances on deferred tax assets and reversals of uncertain tax positions in the fourth quarter of 2015. |

|

| | | | | | | | | | | | | | | | | | | | | |

Reconciliation of EBIT to GAAP Net (Loss) Income, and EBIT Margin, After Adjustments, to Net (Loss) Income as a Percentage of Sales and EBIT, After Adjustments, to Net (Loss) Income: |

(Unaudited) |

The following reconciliation is provided as additional relevant information about the Company's performance. Management believes consolidated (loss) earnings before interest and taxes (EBIT) is representative of the Company's performance and that it is appropriate to compare GAAP net (loss) income to consolidated EBIT. Management also believes that EBIT and EBIT margin, after adjustments, are representative of the Company's core operations and therefore useful to investors. |

| | | | | | | | | |

(Dollars in millions, except share data) | Three Months Ended

December 31, | | Twelve Months Ended December 31, |

| 2015 | Percentage to Net Sales | 2014 | Percentage to Net Sales | | 2015 | Percentage to Net Sales | 2014 | Percentage to Net Sales |

Net (Loss) Income | $ | (35.4 | ) | (5.0 | )% | $ | 46.9 |

| 6.2 | % | | $ | (68.0 | ) | (2.4 | )% | $ | 173.3 |

| 5.6 | % |

| | | | | | | | | |

Income from discontinued operations, net of income taxes | — |

| — | % | (5.3 | ) | (0.7 | )% | | — |

| — | % | (24.0 | ) | (0.8 | )% |

(Benefit) provision for income taxes | (122.6 | ) | (17.1 | )% | 1.3 |

| 0.2 | % | | (121.6 | ) | (4.2 | )% | 54.7 |

| 1.8 | % |

Interest expense | 8.4 |

| 1.2 | % | 8.3 |

| 1.1 | % | | 33.4 |

| 1.2 | % | 28.7 |

| 0.9 | % |

Interest income | (0.7 | ) | (0.1 | )% | (1.3 | ) | (0.2 | )% | | (2.7 | ) | (0.1 | )% | (4.4 | ) | (0.1 | )% |

Consolidated (loss) earnings before interest and taxes (EBIT) | $ | (150.3 | ) | (21.0 | )% | $ | 49.9 |

| 6.5 | % | | $ | (158.9 | ) | (5.5 | )% | $ | 228.3 |

| 7.4 | % |

| | | | | | | | | |

Adjustments: | | | | | | | | | |

Pension settlement charges (1) | $ | 241.8 |

| 33.9 | % | $ | 33.0 |

| 4.4 | % | | $ | 465.0 |

| 16.2 | % | $ | 33.7 |

| 1.1 | % |

Impairment and restructuring charges(2) | 3.1 |

| 0.4 | % | 5.9 |

| 0.8 | % | | 15.9 |

| 0.5 | % | 136.2 |

| 4.4 | % |

Gain on divestitures and sale of real estate (3) | (29.0 | ) | (4.1 | )% | — |

| — | % | | (28.7 | ) | (1.0 | )% | (22.6 | ) | (0.7 | )% |

Acquisition related charges(4) | 3.8 |

| 0.5 | % | — |

| — | % | | 5.7 |

| 0.2 | % | — |

| — | % |

Fixed asset write-off (5) | 9.7 |

| 1.4 | % | — |

| — | % | | 9.7 |

| 0.3 | % | — |

| — | % |

Total Adjustments | 229.4 |

| 32.1 | % | 38.9 |

| 5.2 | % | | 467.6 |

| 16.2 | % | 147.3 |

| 4.8 | % |

Consolidated earnings before interest and taxes (EBIT), after adjustments | $ | 79.1 |

| 11.1 | % | $ | 88.8 |

| 11.7 | % | | $ | 308.7 |

| 10.7 | % | $ | 375.6 |

| 12.2 | % |

| | | | | | | | | |

(1) Pension settlement charges primarily related to two agreements pursuant to which two of the Company's U.S. defined benefit pension plans purchased group annuity contracts from Prudential, which require Prudential to pay and administer future benefits for a total of approximately 8,400 U.S. Timken retirees, as well as lump sum distributions to new retirees during 2015. |

| | | | | | | | | |

(2) Impairment and restructuring charges, including rationalization costs recorded in cost of products sold, related to plant closures, the rationalization of certain plants, and severance related to cost reduction initiatives. |

| | | | | | | | | |

(3) Gain on divestitures related to the gain on the sale of Alcor located in Mesa, Arizona, of $29.0 million in the fourth quarter of 2015. Gain on the sale of real estate related to the sale of the former manufacturing facility in Sao Paulo, Brazil of $22.6 million in the first quarter of 2014. |

| | | | | | | | | |

(4) Acquisition charges related to the acquisition of the Carlisle belts product line, including an inventory step up and one time transaction costs. |

|

(5) The fixed asset write-off related to costs that remained in CIP after the related assets were placed into service. The majority of these assets were placed into service between 2008 and 2012. This error was identified during an examination of aged balances in the CIP account. Management of the Company concluded that the correction of this error in the fourth quarter of 2015 and the presence of this error in prior periods is immaterial to all periods presented. |

|

| | | | | | | | | | | | | | | | | | | | | |

Reconciliation of segment EBIT Margin, After Adjustments, to segment EBIT as a Percentage of Sales and segment EBIT, After Adjustments, to segment EBIT: |

(Unaudited) |

The following reconciliation is provided as additional relevant information about the Company's Mobile Industries and Process Industries segment performance. Management believes that segment EBIT and EBIT margin, after adjustments, are representative of the segment's core operations and therefore useful to investors. |

| | | | | | | | | |

Mobile Industries | | | | | | | | | |

(Dollars in millions) | Three Months Ended December 31, 2015 | Percentage to Net Sales | Three Months Ended December 31, 2014 | Percentage to Net Sales | | Twelve Months Ended December 31, 2015 | Percentage to Net Sales | Twelve Months Ended December, 2014 | Percentage to Net Sales |

Earnings before interest and taxes (EBIT) | $ | 58.9 |

| 15.5 | % | $ | 22.4 |

| 5.8 | % | | $ | 173.3 |

| 11.1 | % | $ | 65.6 |

| 3.9 | % |

| | | | | | | | | |

Pension settlement charges (1) | — |

| — | % | — |

| — | % | | — |

| — | % | 0.7 |

| — | % |

Impairment and restructuring charges (2) | 2.5 |

| 0.6 | % | 6.2 |

| 1.5 | % | | 6.9 |

| 0.4 | % | 133.4 |

| 7.9 | % |

Gain on divestitures and sale of real estate (3) | (29.0 | ) | (7.6 | )% | — |

| — | % | | (29.0 | ) | (1.8 | )% | (22.6 | ) | (1.3 | )% |

Acquisition related charges (4) | 2.3 |

| 0.6 | % | — |

| — | % | | 3.0 |

| 0.2 | % | — |

| — | % |

Fixed asset write-off (5) | 1.5 |

| 0.4 | % | — |

| — | % | | 1.5 |

| 0.1 | % | — |

| — | % |

Earnings before interest and taxes (EBIT), after adjustments | $ | 36.2 |

| 9.5 | % | $ | 28.6 |

| 7.3 | % | | $ | 155.7 |

| 10.0 | % | $ | 177.1 |

| 10.5 | % |

| | | | | | | | | |

Process Industries | | | | | | | | | |

(Dollars in millions) | Three Months Ended December 31, 2015 | Percentage to Net Sales | Three Months Ended December 31, 2014 | Percentage to Net Sales | | Twelve Months Ended December 31, 2015 | Percentage to Net Sales | Twelve Months Ended December, 2014 | Percentage to Net Sales |

Earnings before interest and taxes (EBIT) | $ | 45.2 |

| 13.5 | % | $ | 79.7 |

| 21.4 | % | | $ | 190.2 |

| 14.5 | % | $ | 267.1 |

| 19.2 | % |

| | | | | | | | | |

Impairment and restructuring charges(2) | 1.0 |

| 0.3 | % | (0.3 | ) | (0.1 | )% | | 8.9 |

| 0.7 | % | 2.2 |

| 0.2 | % |

Loss on divestitures (3) | — |

| — | % | — |

| — | % | | 0.3 |

| — | % | — |

| — | % |

Acquisition related charges (4) | 1.3 |

| 0.4 | % | — |

| — | % | | 1.8 |

| 0.1 | % | — |

| — | % |

Fixed asset write-off (5) | 8.2 |

| 2.5 | % | — |

| — | % | | 8.2 |

| 0.6 | % | — |

| — | % |

Earnings before interest and taxes (EBIT), after adjustments | $ | 55.7 |

| 16.7 | % | $ | 79.4 |

| 21.3 | % | | $ | 209.4 |

| 15.9 | % | $ | 269.3 |

| 19.4 | % |

| | | | | | | | | |

(1) Pension settlement charges related to the settlement of certain pension obligations in Canada.

|

| | | | | | | | | |

(2) Impairment and restructuring charges, including rationalization costs recorded in cost of products sold, related to plant closures, the rationalization of certain plants, and severance related to cost reduction initiatives. |

| | | | | | | | | |

(3) (Gain) loss on divestitures related to the gain on the sale of Alcor located in Mesa, Arizona, of $29.0 million in the fourth quarter of 2015, and the loss on the sale of the Company's repair business in Niles, Ohio, of $0.3 million in the second quarter of 2015. Gain on the sale of real estate related to the sale of the former manufacturing facility in Sao Paulo, Brazil of $22.6 million in the first quarter of 2014. |

| | | | | | | | | |

(4) Acquisition charges related to the acquisition of the Carlisle belts product line, including an inventory step up and one time transaction costs. |

| | | | | | | | | |

(5) The fixed asset write-off related to costs that remained in CIP after the related assets were placed into service. The majority of these assets were placed into service between 2008 and 2012. This error was identified during an examination of aged balances in the CIP account. Management of the Company concluded that the correction of this error in the fourth quarter of 2015 and the presence of this error in prior periods is immaterial to all periods presented. |

|

| | | | | | | | | | | | |

Reconciliation of Total Debt to Net Debt and the Ratio of Net Debt to Capital to the Ratio of Total Debt to Capital: |

(Unaudited) |

These reconciliations are provided as additional relevant information about the Company's financial position. Capital, used for the ratio of total debt to capital, is defined as total debt plus total shareholders' equity. Capital, used for the ratio of net debt to capital, is defined as total debt less cash, cash equivalents and restricted cash plus total shareholders' equity. Management believes Net Debt and the Ratio of Net Debt to Capital are important measures of the Company's financial position, due to the amount of cash and cash equivalents. |

| | |

(Dollars in millions) | | |

| | | December 31,

2015 | December 31,

2014 |

Short-term debt, including current portion of long-term debt | | | $ | 77.1 |

| $ | 8.0 |

|

Long-term debt | | | 580.6 |

| 522.1 |

|

Total Debt | | | $ | 657.7 |

| $ | 530.1 |

|

Less: Cash, cash equivalents and restricted cash | | | (129.8 | ) | (294.1 | ) |

Net Debt | | | $ | 527.9 |

| $ | 236.0 |

|

| | | | |

Total equity | | | $ | 1,357.3 |

| $ | 1,589.1 |

|

| | | | |

Ratio of Total Debt to Capital | | | 32.6 | % | 25.0 | % |

Ratio of Net Debt to Capital | | | 28.0 | % | 12.9 | % |

Reconciliation of Free Cash Flow to GAAP Net Cash Provided by Operating Activities: |

(Unaudited) |

Management believes that free cash flow is useful to investors because it is a meaningful indicator of cash generated from operating activities available for the execution of its business strategy. |

| | |

(Dollars in millions) | | |

| Three Months Ended

December 31, | Twelve Months Ended

December 31, |

| 2015 | 2014 | 2015 | 2014 |

Net cash provided by operating activities from continuing operations | $ | 128.5 |

| $ | 108.7 |

| $ | 374.8 |

| $ | 281.5 |

|

Less: capital expenditures | (40.5 | ) | (39.7 | ) | (105.6 | ) | (126.8 | ) |

Free cash flow | $ | 88.0 |

| $ | 69.0 |

| $ | 269.2 |

| $ | 154.7 |

|

|

| | | | | | | |

Reconciliation of Adjusted Earnings per Share to GAAP Earnings per Share for Full Year 2016 Outlook: |

(Unaudited) |

This reconciliation is provided as additional relevant information about the Company's performance. Management believes that adjusted diluted earnings per share, adjusted to remove: (a) pension settlement charges; and (b) restructuring charges are representative of the Company's performance and therefore useful to investors. |

| | | |

| Low End Earnings Per Share | | High End Earnings Per Share |

Forecasted full year GAAP diluted earnings per share | $ | 1.35 |

| | $ | 1.45 |

|

|

| | |

Adjustments: | | | |

Pension settlement charges (1) | 0.25 |

| | 0.25 |

|

Restructuring charges (2) | 0.30 |

| | 0.30 |

|

Total Adjustments: | $ | 0.55 |

| | $ | 0.55 |

|

Forecasted full year adjusted diluted earnings per share | $ | 1.90 |

| | $ | 2.00 |

|

| | | |

(1) Pension settlement charges primarily relate to anticipated lump sum settlement activity. |

| | | |

(2) Restructuring charges relate to severance and other cost reduction initiatives. |

| | | |

4Q 2015 Earnings Investor Presentation February 3, 2016

2 4Q 2015 EARNINGS CONFERENCE CALL DETAIL Conference Call: Wednesday, Feb. 3, 2016 9:00 a.m. Eastern Time Live Dial-In: 888-240-1251 or 913-981-5544 (Call in 10 minutes prior to be included) Conference ID: Timken Earnings Call Conference Call Replay: Replay Dial-In available through Feb. 17, 2016 888-203-1112 or 719-457-0820 Replay Passcode: 8118267 Live Webcast: www.timken.com/investors

3 FORWARD-LOOKING STATEMENTS SAFE HARBOR AND NON-GAAP FINANCIAL INFORMATION Certain statements in this presentation (including statements regarding the company's forecasts, beliefs, estimates and expectations) that are not historical in nature are "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995. In particular, the statements related to Timken’s plans, outlook, future financial performance, targets, projected sales, cash flows, liquidity and expectations regarding the future financial performance of the company, including the information under the headings, “Improving Cost Structure – SG&A”, “ Accelerating Organic Growth”, “2016 Market Outlook and Drivers”, “2016 Outlook Highlights”, “4Q 2015 Net Income and Diluted EPS”, “2016 Full-Year Outlook”, “Capital Allocation”, “Pension Strategy & De-Risking Update”, “2016 Adjusted Outlook – Walk from 2015” and “What to Expect in 2016” are forward-looking. The company cautions that actual results may differ materially from those projected or implied in forward-looking statements due to a variety of important factors, including: the finalization of the company's financial statements for the fourth quarter and full-year of 2015; the company's ability to respond to the changes in its end markets that could affect demand for the company's products; unanticipated changes in business relationships with customers or their purchases from the company; changes in the financial health of the company's customers, which may have an impact on the company's revenues, earnings and impairment charges; fluctuations in raw material and energy costs; the impact of the company's last-in, first-out accounting; weakness in global or regional economic conditions and capital markets; fluctuations in currency valuations; changes in the expected costs associated with product warranty claims; the ability to achieve satisfactory operating results in the integration of acquired companies; the impact on operations of general economic conditions; fluctuations in customer demand; the impact on the company’s pension obligations due to changes in interest rates, investment performance and other tactics designed to reduce risk; the company’s ability to complete and achieve the benefits of announced plans, programs, initiatives, and capital investments; the company’s ability to avoid any indemnification liabilities under certain agreements it entered into with TimkenSteel Corporation in connection with the spinoff and the ability of TimkenSteel Corporation to satisfy any indemnification liabilities it entered into in connection with the spinoff; and the taxable nature of the spinoff. Additional factors are discussed in the company's filings with the Securities and Exchange Commission, including the company's Annual Report on Form 10-K for the year ended Dec. 31, 2014, quarterly reports on Form 10-Q and current reports on Form 8-K. Except as required by the federal securities laws, the company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. This presentation includes certain non-GAAP financial measures as defined by the rules and regulations of the Securities and Exchange Commission. Reconciliation of those measures to the most directly comparable GAAP equivalents are provided in the Appendix to this presentation.

4 4Q 2015 SUMMARY • Sales of $714 million decreased 6% from prior year, or down just under 2% excluding currency Process Industries sales down 10%; down 6% excluding currency Mobile Industries sales down 2%; up over 2% excluding currency • GAAP net loss per share from continuing operations of $0.44 versus net income of $0.46 in same quarter last year Adjusted EPS of $0.59, compared with $0.65 last year Adjusted EBIT margin of 11.1% • Capital Allocation Purchased 2.7 million shares in the quarter; 8.6 million for the full year Belts integration continues; delivered ~$0.01 adjusted EPS in 4Q-15 Ended the year at ~28% net debt-to-capital • Strong Free Cash Flow Generated $88 million of free cash flow, $269M for the year or 142% of adjusted net income See Appendix for reconciliation of adjusted EPS, adjusted EBIT margin, net debt–to-capital, free cash flow and adjusted net income to their most directly comparable GAAP equivalents.

5 QUARTERLY SALES TREND YEAR-OVER-YEAR -2% 0% 8% 4% 3% -3% -5% -2% -6% -4% -2% 0% 2% 4% 6% 8% 10% 1Q-2014 2Q-2014 3Q-2014 4Q-2014 1Q-2015 2Q-2015 3Q-2015 4Q-2015 All periods exclude currency impact, but include acquisitions See Appendix for reconciliation of net sales excluding the impact of currency to net sales. Belts acquisition added ~1% in 3Q-2015 and ~4% in 4Q-2015

6 Timken performing well despite tough markets Despite challenging markets and a strong U.S. dollar, we advanced our major initiatives: • Outgrowth Advanced initiatives with new applications, new products and additional sales and engineering resources • Operational Excellence Drove $60M in cost savings Improved manufacturing footprint Reduced SG&A expenses as a percentage of sales Generated $269M free cash flow with working capital improvements • Capital Allocation Reduced our gross pension obligations by ~50% Paid 374th consecutive dividend Repurchased 10% of outstanding shares Acquired Carlisle belts product line 2015: A YEAR OF STRONG EXECUTION See Appendix for reconciliation of free cash flow to its most directly comparable GAAP equivalent.

7 IMPROVING COST STRUCTURE - SG&A $542.5 $494.3 $475.0 $400 $430 $460 $490 $520 $550 2014A 2015A 2016E* ($M) Percent of Sales 17.6% 17.2% 17.3% *Based on current forecast as of February 3, 2016. •2015 decline reflects: cost-reduction initiatives lower compensation expense benefit of currency offset by partial-year belts SG&A •2016 target includes: additional cost-reduction initiatives full-year belts SG&A normal inflation

8 ACCELERATING ORGANIC GROWTH Our multi-year global initiative to accelerate organic growth in bearings and win in the marketplace: • Increase and accelerate product and application development • Enhance and expand our best-in-class collaborative technical sales model • Increase global penetration

9 2016 MARKET OUTLOOK AND DRIVERS Markets Market Drivers/Timken Dynamics Timken Automotive Gaining share in NA light truck Wind Market flat to down, share gains Construction Defense Military marine strong, aero down General Industrial Heavy Truck US OE down, aftermarket/ROW stable Agriculture Belts mitigates revenue impact Rail US market down, share gains mitigate Civil Aerospace Timken PMA divestiture impacts Metals Mining Oil & Gas Red: decline Yellow: roughly flat Green: growth

10 2016 OUTLOOK HIGHLIGHTS Net Sales $2.7B to $2.8B Organic -5 to -6% • Weaker end-market demand, partially offset by 1-2% outgrowth Inorganic +3% • Belts acquisition, partially offset by impact of Aero PMA sale in 2015 Currency -2% • Based on 12/31/15 rates Total -4 to -5% GAAP EPS $1.35 to $1.45 • Includes $0.55 of restructuring and pension settlement charges Adjusted EPS $1.90 to $2.00 • Down ~12% at the mid-point YOY 2016 Outlook Guidance Reflects

Financial Review

12 4Q-2015 Excluding vs. impact Region 4Q-2014 of currency NA -4% -3% EMEA -6% 6% APAC -9% -4% LatAm -19% -4% Geographic Sales Comparison4Q 2015 FINANCIAL HIGHLIGHTS - SALES • Sales of $714 million, down 6.3% from a year ago Excluding currency impact of ~4.6%, sales declined ~1.7% Decline driven by weakness across most industrial sectors partially offset by growth in automotive, military marine, wind energy and the benefit of acquisitions 4Q-15 4Q-14 $714.4 $762.2 $ B/(W) Sales % B/(W) $(47.8) (6.3)% ($M) 4Q 2014 Organic Currency Inorganic 4Q 2015 $(35) $25 $762 $714 $(38)

13 4Q 2015 FINANCIAL HIGHLIGHTS - ADJUSTED EBIT 4Q-15 4Q-14 $714.4 $762.2 $ B/(W) Sales % B/(W) $(47.8) (6.3)% 190.9 220.8 Gross Profit 119.0 131.7 SG&A 33.0 Pension settlement charges $49.9 EBIT ($M) % of sales 16.7% 17.3% % of sales 26.7% 29.0% (230) bps 60 bps See Appendix for reconciliation of EBIT, adjusted EBIT, and EBIT and adjusted EBIT margins to their most directly comparable GAAP equivalents. (1) Includes rationalization costs recorded in cost of products sold. (0.8) 12.7 241.8 $(150.3) (6.7) $(200.2) (29.9) 5.4 Impairment & restructuring 2.7 - Impairment & restructuring(1) - Pension settlement charges Adjustments: $79.1 $88.8 EBIT after adjustments $(9.7) 11.1% 11.7% EBIT Margins (60) bps 33.0 5.9 3.1 241.8 - Gain on divestitures (29.0) -- -- Gain on divestitures (29.0) - Acquisition-related charges 3.8 -- - Fixed asset write-off 9.7 -- Other (expense) income net

14 4Q 2015 EARNINGS COMPARISON • Adjusted EBIT of $79.1 million or 11.1% of sales compares with $88.8 million or 11.7% of sales in the same period a year ago Driven by the impact of lower volume and currency, partially offset by favorable material and operating costs and lower SG&A expenses Certain data contained in the graph above has been rounded for presentation purposes. See Appendix for reconciliations of adjusted EBIT and adjusted EBIT margin to their most directly comparable GAAP equivalents. 4Q 2014 Volume Price / Mix Costs of Production SG&A Expenses Currency Inorganic/ Other 4Q 2015 Adjusted EBIT - ($M) $89 $79 $(6) $(20) $5 $11 $(0) Lower material and operating costs partially offset by the impact of lower production volume

15 4Q 2015 NET INCOME AND DILUTED EPS 4Q-15 $(35.7) $(0.44) Net (Loss) Income from Continuing Operations - Fixed asset write-off Net Income, after adjustments $49.0 $0.59 $M EPS 4Q-14 $41.2 $0.46 $57.9 $0.65 EPS Adjusted tax rate: Quarter 31% 29% - Impairment & restructuring charges 3.1 5.9 0.04 • EPS benefited from share buybacks • GAAP tax rate of 77.6% in 4Q-15 (tax benefit on pre-tax loss) 4Q-15 GAAP tax expense includes $35M of discrete tax benefits, including reversal of valuation allowances on certain foreign deferred tax assets and reversal of tax reserves from prior years • Adjusted tax rate of 31% in 4Q-15 driven primarily by geographic mix of earnings Adjusted tax rate of ~31% expected for 2016 0.07 - Pension settlement charges 241.8 33.0 2.92 - Gain on divestitures (29.0) (0.35) -- 0.36 -- $M - Acquisition-related charges 3.8 0.05 -- -- YTD 31% 33% Average diluted shares outstanding: Quarter 82.5 million 89.6 million - Other income tax adjustments (35.1) (8.5) (0.43) (0.09) - Tax benefit from above adjustments (net) 9.7 0.12 -- -- (109.6) (13.7) (1.32) (0.15)

16 MOBILE INDUSTRIES Heavy Truck Automotive Aerospace Rail ($M) 2015 2014 Change Sales $380.3 $389.5 $(9.2) EBIT $58.9* $22.4 $36.5 Margin 15.5%* 5.8% 970 bps Adjusted(1): EBIT $36.2 $28.6 $7.6 Margin 9.5% 7.3% 220 bps 4Q YOY Commentary 4Q Performance • Sales down 2.4%; excluding currency, sales up 2.5% Driven by net benefit of acquisitions Organic sales roughly flat with automotive growth offsetting lower off-highway and rail demand • Increase in adjusted EBIT driven by the impact of favorable material and operating costs and lower SG&A expenses, partially offset by the impact of lower production volume Off-Highway Inorganic (net) +2% (1) See Appendix for reconciliations of adjusted EBIT and adjusted EBIT margins to their most directly comparable GAAP equivalents. 4Q YOY Sales Walk 2016 Full-Year Outlook 4Q 2014 Organic Currency Inorganic 4Q 2015 $(19) $10 $389 $380 $(0) *Includes gain from divestiture of Aerospace PMA business. Currency Organic down ~5% Sales: Down ~5% (down ~3% excluding currency) -2%

17 PROCESS INDUSTRIES Original Equipment Aftermarket ($M) 2015 2014 Change Sales $334.1 $372.7 $(38.6) EBIT $45.2 $79.7 $(34.5) Margin 13.5% 21.4% (790) bps Adjusted(1): EBIT $55.7 $79.4 $(23.7) Margin 16.7% 21.3% (460) bps 4Q YOY Commentary 4Q Performance • Sales down 10.4%; excluding currency, sales down 6.1% Driven by weaker demand in the industrial aftermarket and heavy industries, partially offset by growth in wind energy and military marine, and the benefit of acquisitions • Decrease in adjusted EBIT driven by the impact of lower volume and currency, partially offset by favorable material costs, lower SG&A expenses and the benefit of acquisitions (1) See Appendix for reconciliations of adjusted EBIT and adjusted EBIT margins to their most directly comparable GAAP equivalents. 4Q YOY Sales Walk 2016 Full-Year Outlook Inorganic +4% 4Q 2014 Organic Currency Inorganic 4Q 2015 $(16) $15 $373 $334 $(38) Currency -2% Organic down ~6% Sales: Down ~4% (down ~2% excluding currency)

18 4Q 2015 CASH FLOW OVERVIEW 4Q-15 4Q-14 $(35.4) $41.6 Income from Continuing Operations $128.5 $108.7 Cash from operations (9.7) 48.4 Change in working capital (trade) (152.9) (21.0) Income taxes 33.0 37.2 Depreciation & amortization $88.0 $69.0 Free cash flow 245.1 Pension/OPEB expense, net of contributions / payments 33.6 (39.7) (40.5) Capital expenditures 19.3 Other ($M) 27.0 (29.0) Gain on divestiture -- Strong Free Cash Flow in the Quarter Driven by Favorable Working Capital

19 $46 $236 $528 0% 10% 20% 30% 40% $0 $185 $370 $555 $740 2013 2014 2015 2016 Capital Expenditures Dividend Share Repurchases Acquisitions Framework: Capital Structure Cash $130 Debt 658 Net Debt 528 Equity 1,357 Net Capital $1,885 Leverage Total Debt/Capital 33% Net Debt/Capital 28% ($M) Balance Sheet (12/31/15) Net Debt and Net Debt/Capital See Appendix for reconciliations of Net Debt and Net Debt/Capital to their most directly comparable GAAP equivalents. (1) Based on common share closing price on February 1, 2016 (2) Subject to Board approval on a quarterly basis CAPITAL ALLOCATION Net Debt Net Debt/Capital 13% 2% 28% Target: 30 – 40% 2015 Update: • CapEx of $106M or 3.7% of sales • Raised quarterly dividend to $0.26 per share in May. Current yield ~4.0%.(1) • Purchased Carlisle Belts for $220M • Repurchased 8.6M shares in 2015 for $310M 2016 Outlook: • CapEx of ~4.5% of sales; adding capacity in low-cost countries • Maintain dividend(2) • Continue to pursue attractive acquisition candidates • New 5M share buyback authorization for 2016; expect to be in market buying shares in 1Q-16

20 PENSION STRATEGY & DE-RISKING UPDATE In 2015, we continued to de-risk our fully funded pension plans and took strategic actions to reduce our gross liability Gross Pension Liability Reduced by ~50% in 2015 • Moved to liability-driven investment strategy to protect fully funded status in our US and UK plans • Purchased 2 group annuity contracts from Prudential for US retirees, funded entirely with plan assets, reducing our gross liability by over $1B or more than 50% Affected plans remain fully funded • Continued to offer lump sum payments to retirees and other deferred vested participants • Incurred $465M of non-cash pension settlement charges in 2015 ($242M in 4Q-15) • No significant pension contributions required in 2016

21 2016 FULL-YEAR OUTLOOK (1) Adjusted net income divided by free cash flow. Adjusted net income excludes pension settlement charges and restructuring charges. Free cash flow is defined as net cash provided by operating activities (includes pension contributions) minus capital expenditures. Net Sales (vs. 2015) Organic Inorganic Currency Mobile Industries -5% +2% -2% Down ~5% Process Industries -6% +4% -2% Down ~4% Timken -5 to -6% +3% -2% Down 4 to 5% Earnings Per Share (EPS) - GAAP $1.35 - $1.45 Includes (expense) / income: - Pension settlement charges (non-cash) $(0.25) - Restructuring charges $(0.30) Adjusted EPS - excluding unusual items $1.90 - $2.00 Free Cash Flow (FCF) ~$175M FCF Conversion(1) ~110% • Sales down 4 to 5% Negative impact from currency of ~2% Decline driven primarily by weakness across most industrial sectors offset partially by growth in automotive and the benefit of acquisitions • GAAP EPS estimate of $1.35 to $1.45 per diluted share • Adjusted EPS estimate of $1.90 to $2.00 per diluted share excluding unusual items • Free Cash Flow of ~$175 million Assumes CapEx of ~4.5% of sales

22 2016 ADJUSTED OUTLOOK – WALK FROM 2015 See Appendix for reconciliation of adjusted 2015 EPS to its most directly comparable GAAP equivalent. 2016 Adjusted EPS Guidance Range: $1.90 - $2.00 Positives: ● Market outgrowth of 1 to 2% ● Cost reductions of ~$60M vs. 2015 Material, mfg. and SG&A SG&A expenses expected to be ~$475M ● Share repurchases completed in 2015 contribute ~$0.10 to EPS in 2016 ● Year-over-year benefit of $0.07 from the belts acquisition Negatives: ● Weaker demand across most industrial sectors ● Negative currency impact of approximately $0.13 ● Price/mix Based on mid-point of guidance (amounts in millions except per share data) Revenue EPS 2015 Adjusted EPS 2,872$ 2.21$ Volume/mix/price (net of (155) (0.26) cost reduction initiatives) Share count 0.10 Belts acquisition 95 0.07 Aero PMA divestiture (15) (0.02) Currency (55) (0.13) Interest/other (0.02) 2016 Guidance Mid-Point 2,742$ 1.95$

23 • Emphasis on outgrowing our markets • Drive further margin enhancement/competitiveness initiatives Operational excellence SG&A efficiency Investments in the business • Continued focus on capital allocation WHAT TO EXPECT IN 2016

Appendix

25 2015 GEOGRAPHIC SALES VS. 2014 Argentina U.S. Mexico Brazil Australia China Spain France India South Africa Poland Italy U.K. Romania Russia Czech Republic Germany Indonesia Taiwan Thailand Singapore Japan South Korea Vietnam Turkey U.A.E. Canada LatAm -13% (+1% excluding impact of currency) NA -4% (-3% excluding impact of currency) EMEA -11% (+4% excluding impact of currency) APAC -9% (-5% excluding impact of currency) Sales of $2.9 billion, down 7% year-over-year Currency had a negative impact of 5% NA; 59% EMEA; 17% APAC; 16% LatAm; 8% Percentage of sales by region, based on 2015 sales of $2.9B Malaysia Serbia

26 GAAP RECONCILIATION: NET INCOME & EPS (Unaudited) (Dollars in millions, except share data) 2015 EPS 2014 EPS 2015 EPS (Loss) Income from Continuing Operations (35.4)$ 41.6$ (68.0)$ Less: Net Income Attributable to Noncontrolling Interest 0.3 0.4 2.8 Net (Loss) Income from Continuing Operations attributable to The Timken Company (35.7)$ (0.44)$ 41.2$ 0.46$ (70.8)$ (0.84)$ Adjustments: Pension settlement charges (1) 241.8$ 2.92$ 33.0$ 0.36$ 465.0$ 5.45$ Impairment and restructuring charges (2) 3.1 0.04 5.9 0.07 15.9 0.19 Gain on divestitures (3) (29.0) (0.35) - - (28.7) (0.33) Acquisition related charges (4) 3.8 0.05 - - 5.7 0.07 Fixed asset write-off (5) 9.7 0.12 - - 9.7 0.11 Tax benefit from above adjustments (net) (6) (109.6) (1.32) (13.7) (0.15) (173.1) (2.03) Other income tax adjustments (7) (35.1) (0.43) (8.5) (0.09) (34.6) (0.41) Total Adjustments: 84.7 1.03 16.7 0.19 259.9 3.05 Adjusted Net Income from Continuing Operations 49.0$ 0.59$ 57.9$ 0.65$ 189.1$ 2.21$ (6) Tax benefit from above adjustments (net) included the tax impact on pre-tax special items as well as adjustments to reflect the use of one overall effective tax rate on adjusted pre-tax income in interim periods. (7) Other income tax adjustments included the impact of discrete tax items recorded during the respective periods, including the reversal of certain valuation allowances on deferred tax assets and reversals of uncertain tax positions in the fourth quarter of 2015. Reconciliations of Adjusted Net Income from Continuing Operations to GAAP (Loss) Income from Continuing Operations and Adjusted Diluted Earnings Per Share to GAAP (Loss) Earnings Per Share: These reconciliations are provided as additional relevant information about the Company's performance. Management believes that adjusted net income from continuing operations and adjusted diluted earnings per share, adjusted to remove: (a) pension settlement charges; (b) impairment and restructuring charges; (c) gain on divestitures; (d) acquisition related charges; (e) fixed asset write-offs; and (f) the benefit from income taxes are representative of the Company's performance and therefore useful to investors. (1) Pension settlement charges primarily related to two agreements pursuant to which two of the Company's U.S. defined benefit pension plans purchased group annuity contracts from Prudential, which require Prudential to pay and administer future benefits for a total of approximately 8,400 U.S. Timken retirees, as well as lump sum distributions to new retirees during 2015. (5) The fixed asset write-off related to costs that remained in construction in process (CIP) after the related assets were placed into service. The majority of these assets were placed into service between 2008 and 2012. This error was identified during an examination of aged balances in the CIP account. Management of the Company concluded that the correction of this error in the fourth quarter of 2015 and the presence of this error in prior periods is immaterial to all periods presented. (2) Impairment and restructuring charges, including rationalization costs recorded in cost of products sold, related to plant closures, the rationalization of certain plants and severance related to cost reduction initiatives. (3) Gain on the divestiture related to the gain on the sale of Timken Alcor Aerospace Technologies, Inc. (Alcor) located in Mesa, Arizona, of $29.0 million in the fourth quarter of 2015. Three Months Ended December 31, Twelve Months Ended December 31, (4) Acquisition charges related to the acquisition of the Carlisle belts product line, including an inventory step up and one time transaction costs.

27 GAAP RECONCILIATION: CONSOLIDATED EBIT & EBIT MARGIN (Unaudited) (Dollars in millions, except share data) 2015 Percentage to Net Sales 2014 Percentage to Net Sales Net (Loss) Income (35.4)$ (5.0)% 46.9$ 6.2 % Income from discontinued operations, net of income taxes — —% (5.3) (0.7)% (Benefit) provision for income taxes (122.6) (17.1)% 1.3 0.2 % Interest expense 8.4 1.2 % 8.3 1.1 % Interest income (0.7) (0.1)% (1.3) (0.2)% Consolidated (loss) earnings before interest and taxes (EBIT) (150.3)$ (21.0)% 49.9$ 6.5 % Adjustments: Pension settlement charges (1) 241.8$ 33.9 % 33.0$ 4.4 % Impairment and restructuring charges (2) 3.1 0.4 % 5.9 0.8 % Gain on divestitures (3) (29.0) (4.1)% — —% Acquisition related charges (4) 3.8 0.5 % — —% Fixed asset write-off (5) 9.7 1.4 % — —% Total Adjustments 229.4 32.1 % 38.9 5.2 % Consolidated earnings before interest and taxes (EBIT), after adjustments 79.1$ 11.1 % 88.8$ 11.7 % (5) The fixed asset write-off related to costs that remained in CIP after the related assets were placed into service. The majority of these assets were placed into service between 2008 and 2012. This error was identified during an examination of aged balances in the CIP account. Management of the Company concluded that the correction of this error in the fourth quarter of 2015 and the presence of this error in prior periods is immaterial to all periods presented. (4) Acquisition charges related to the acquisition of the Carlisle belts product line, including an inventory step up and one time transaction costs. (3) Gain on the divestiture related to the gain on the sale of Alcor located in Mesa, Arizona, of $29.0 million in the fourth quarter of 2015. (2) Impairment and restructuring charges, including rationalization costs recorded in cost of products sold, related to plant closures, the rationalization of certain plants, and severance related to cost reduction initiatives. Reconciliation of EBIT to GAAP Net (Loss) Income, and EBIT Margin, After Adjustments, to Net (Loss) Income as a Percentage of Sales and EBIT, After Adjustments, to Net (Loss) Income: December 31, Three Months Ended The following reconciliation is provided as additional relevant information about the Company's performance. Management believes consolidated (loss) earnings before interest and taxes (EBIT) is representative of the Company's performance and that it is appropriate to compare GAAP net (loss) income to consolidated EBIT. Management also believes that EBIT and EBIT margin, after adjustments, are representative of the Company's core operations and therefore useful to investors. (1) Pension settlement charges primarily related to two agreements pursuant to which two of the Company's U.S. defined pension plans purchased group annuity contracts from Prudential, which require Prudential to pay and administer future benefits for a total of approximately 8,400 U.S. Timken retirees, as well as lump sum distributions to new retirees during 2015.

28 GAAP RECONCILIATION: NET DEBT (Unaudited) (Dollars in millions) December 31, 2015 December 31, 2014 December 31, 2013 Short-term debt, including current portion of long-term debt 77.1$ 8.0$ 269.3$ Long-term debt 580.6 522.1 176.4 Total Debt 657.7$ 530.1$ 445.7$ Less: Cash, cash equivalents and restricted cash (129.8) (294.1) (399.7) Net Debt 527.9$ 236.0$ 46.0$ Total equity 1,357.3$ 1,589.1$ 2,648.6$ Ratio of Total Debt to Capital 32.6 % 25.0 % 14.4 % Ratio of Net Debt to Capital 28.0 % 12.9 % 1.7 % Reconciliation of Total Debt to Net Debt and the Ratio of Net Debt to Capital to the Ratio of Total Debt to Capital: These reconciliations are provided as additional relevant information about the Company's financial position. Capital, used for the ratio of total debt to capital, is defined as total debt plus total shareholders' equity. Capital, used for the ratio of net debt to capital, is defined as total debt less cash, cash equivalents and restricted cash plus total shareholders' equity. Management believes Net Debt and the Ratio of Net Debt to Capital are important measures of the Company's financial position, due to the amount of cash and cash equivalents.

29 GAAP RECONCILIATION: FREE CASH FLOW (Unaudited) (Dollars in millions) 2015 2014 2015 2014 Net cash provided by operating activities from continuing operations 128.5$ 108.7$ 374.8$ 281.5$ Less: capital expenditures (40.5) (39.7) (105.6) (126.8) Free cash flow 88.0$ 69.0$ 269.2$ 154.7$ Three Months Ended Twelve Months Ended December 31, December 31, Reconciliation of Free Cash Flow to GAAP Net Cash Provided by Operating Activities: Management believes that free cash flow is useful to investors because it is a meaningful indicator of cash generated from operating activities available for the execution of its business strategy.

30 GAAP RECONCILIATION: NET SALES (Unaudited) (Dollars in millions) March 31, 2013 June 30, 2013 September 30, 2013 December 31, 2013 Net Sales 763.2$ 791.2$ 731.5$ 749.5$ Add back: Currency Impact 7.2 (2.6) 2.2 3.5 Net Sales Excluding the Impact from Currency 770.4$ 788.6$ 733.7$ 753.0$ March 31, 2014 June 30, 2014 September 30, 2014 December 31, 2014 Net Sales 736.8$ 789.2$ 788.0$ 762.2$ Add back: Currency Impact 8.2 2.3 2.5 18.4 Net Sales Excluding the Impact from Currency 745.0$ 791.5$ 790.5$ 780.6$ Year-over-Year change excluding impact from currency $ (18.2) 0.3 59.0 31.1 Year-over-Year change excluding impact from currency % -2% 0% 8% 4% March 31, 2015 June 30, 2015 September 30, 2015 December 31, 2015 Net Sales 722.5$ 728.0$ 707.4$ 714.4$ Add back: Currency Impact 33.6 39.3 43.8 34.9 Net Sales Excluding the Impact from Currency 756.1$ 767.3$ 751.2$ 749.3$ Year-over-Year change excluding impact from currency $ 19.3 (21.9) (36.8) (12.9) Year-over-Year change excluding impact from currency % 3% -3% -5% -2% This reconciliation is provided as additional relevant information about the Company's financial position. Management believes net sales excluding the impact from currency is an important measure of the Company's financial position, and therefore useful to investors. Reconciliation of Net Sales to Net Sales Excluding the Impact from Currency:

31 GAAP RECONCILIATION: SEGMENT EBIT & EBIT MARGIN (Unaudited) Mobile Industries (Dollars in millions) Three Months Ended December 31, 2015 Percentage to Net Sales Three Months Ended December 31, 2014 Percentage to Net Sales Earnings before interest and taxes (EBIT) 58.9$ 15.5% 22.4$ 5.8 % Impairment and restructuring charges (1) 2.5 0.6 % 6.2 1.5 % Gain on divestitures (2) (29.0) (7.6)% - —% Acquisition related charges (3) 2.3 0.6 % - —% Fixed asset write-off (4) 1.5 0.4 % - —% Earnings before interest and taxes (EBIT), after adjustments 36.2$ 9.5% 28.6$ 7.3% Process Industries (Dollars in millions) Three Months Ended December 31, 2015 Percentage to Net Sales Three Months Ended December 31, 2014 Percentage to Net Sales Earnings before interest and taxes (EBIT) 45.2$ 13.5% 79.7$ 21.4% Impairment and restructuring charges (1) 1.0 0.3 % (0.3) (0.1)% Acquisition related charges (3) 1.3 0.4 % - —% Fixed asset write-off (4) 8.2 2.5 % - —% Earnings before interest and taxes (EBIT), after adjustments 55.7$ 16.7% 79.4$ 21.3% (4) The fixed asset write-off related to costs that remained in CIP after the related assets were placed into service. The majority of these assets were placed into service between 2008 and 2012. This error was identified during an examination of aged balances in the CIP account. Management of the Company concluded that the correction of this error in the fourth quarter of 2015 and the presence of this error in prior periods is immaterial to all periods presented. (3) Acquisition charges related to the acquisition of the Carlisle belts product line, including an inventory step up and one time transaction costs. (2) Gain on the divestiture related to the gain on the sale of Alcor located in Mesa, Arizona, of $29.0 million in the fourth quarter of 2015. Reconciliation of segment EBIT Margin, After Adjustments, to segment EBIT as a Percentage of Sales and segment EBIT, After Adjustments, to segment EBIT: The following reconciliation is provided as additional relevant information about the Company's Mobile Industries and Process Industries segment performance. Management believes that segment EBIT and EBIT margin, after adjustments, are representative of the segment's core operations and therefore useful to investors. (1) Impairment and restructuring charges, including rationalization costs recorded in cost of products sold, related to plant closures, the rationalization of certain plants, and severance related to cost reduction initiatives.

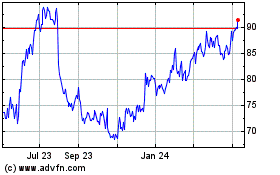

Timken (NYSE:TKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

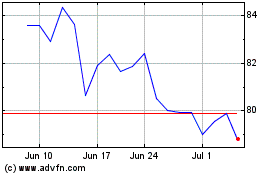

Timken (NYSE:TKR)