Current Report Filing (8-k)

March 16 2015 - 5:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event

reported): March 16,

2015

THE TIMKEN COMPANY

(Exact Name of Registrant as Specified in its Charter)

Ohio

(State or Other Jurisdiction of Incorporation)

|

|

|

| 1-1169 |

|

34-0577130 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

|

| 4500 Mount Pleasant St. N.W., North Canton, Ohio 44720-5450 |

| (Address of Principal Executive Offices) (Zip Code) |

(234) 262-3000

(Registrant’s telephone number,

including area code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions.

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Item 7.01 |

Regulation FD Disclosure |

On March 17, 2015,

The Timken Company (the “Company”) will present at the Bank of America Merrill Lynch Global Industrials & EU Autos Investor Conference. A live webcast of the presentation and a copy of the investor presentation slides will be

available on the Company’s website, www.timken.com/investors, until March 31, 2015. The investor presentation slides are attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by this reference.

This information shall not be deemed to be “filed” for the purposes of Section 18 of the

Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, or the Exchange Act, except as shall be

expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Investor Presentation Slides dated March 17, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| THE TIMKEN COMPANY |

|

|

| By: |

|

/s/ William R. Burkhart |

|

|

William R. Burkhart

Executive Vice President, General Counsel and Secretary |

Date: March 16, 2015

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Investor Presentation Slides dated March 17, 2015. |

|

|

| Bank of America

Merrill Lynch Investor Conference March 17, 2015 •

London

Exhibit 99.1 |

|

|

| 2

Certain

statements

in

this

presentation

(including

statements

regarding

the

company's

forecasts,

beliefs,

estimates

and

expectations)

that

are

not

historical

in

nature

are

"forward-looking"

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

In

particular,

the

statements

related

to

Timken’s

plans,

outlook,

future

financial

performance,

targets,

projected

sales,

cash

flows,

liquidity

and

expectations

regarding

the

future

financial

performance

of

the

company,

including

the

information

under

the

headings

“The

Timken

Business

Model”,

“The

Growth

Plan:

What

You

Can

Expect”,

“2014

Actions

Drive

Strong

Performance

&

Opportunity”,

“Balance

Sheet

and

Leverage”,

“Impact

of

Currency

on

2015

Outlook”,

and

“Investment

Summary -

Why

Own

Timken”

are

forward-looking.

The

company

cautions

that

actual

results

may

differ

materially

from

those

projected

or

implied

in

forward-looking

statements

due

to

a

variety

of

important

factors,

including:

the

company’s

ability

to

respond

to

the

changes

in

its

end

markets

that

could

affect

demand

for

the

company’s

products;

unanticipated

changes

in

business

relationships

with

customers

or

their

purchases

from

the

company;

changes

in

the

financial

health

of

the

company’s

customers,

which

may

have

an

impact

on

the

company’s

revenues,

earnings

and

impairment

charges;

fluctuations

in

raw-material

and

energy

costs;

the

impact

of

the

company’s

last-in,

first-out

accounting;

weakness

in

global

or

regional

economic

conditions

and

financial

markets;

changes

in

the

expected

costs

associated

with

product

warranty

claims;

the

ability

to

integrate

acquired

companies

to

achieve

satisfactory

operating

results;

the

impact

on

operations

of

general

economic

conditions;

fluctuations

in

customer

demand;

the

impact

on

the

company’s

pension

obligations

due

to

changes

in

interest

rates,

mortality

assumptions

or

investment

performance,

the

company’s

ability

to

complete

and

achieve

the

benefits

of

its

announced

plans,

programs,

initiatives

and

capital

investments;

the

taxable

nature

of

the

spinoff;

and

the

company’s

ability

to

realize

the

potential

benefits

of

the

spinoff

of

the

steel

business

and

avoid

possible

indemnification

liabilities

under

certain

agreements

it

entered

into

with

TimkenSteel

Corporation

in

connection

with

the

spinoff.

Additional

factors

are

discussed

in

the

company’s

filings

with

the

Securities

and

Exchange

Commission,

including

the

company’s

annual

report

on

Form

10-K

for

the

year

ended

Dec.

31,

2014,

quarterly

reports

on

Form

10-Q

and

current

reports

on

Form

8-K.

Except

as

required

by

the

federal

securities

laws,

the

company

undertakes

no

obligation

to

publicly

update

or

revise

any

forward-looking

statement,

whether

as

a

result

of

new

information, future

events

or

otherwise.

This

presentation

includes

certain

non-GAAP

financial

measures

as

defined

by

the

rules

and

regulations

of

the

Securities

and

Exchange

Commission.

Reconciliation

of

those

measures

to

the

most

directly

comparable

GAAP

equivalents

are

provided

in

the

Appendix

to

this

presentation.

FORWARD-LOOKING STATEMENTS |

|

|

| Company Overview

and Direction *

*

*

* |

|

|

| 4

A Proud History and A Compelling Future

A Leader in Bearings, Power Transmission and Related Services

Ticker

Legacy

2014 Sales

Employees

Global Footprint

Dividend

NYSE: TKR

c. 1899; 115 years of operations

$3.1B

16,000 worldwide

Headquarters in North Canton, OH

28 countries

62 manufacturing facilities

Payout every quarter since IPO in

1922

TIMKEN

AT

A

GLANCE |

|

|

| 5

The Timken Transformation 2007 -

2014

•

Exited automotive business that did not

meet value proposition criteria

–

$1B exited and business restructured

–

Completed in December 2013

•

Built capabilities to win in the marketplace

–

Global ERP system

–

Global footprint expansion

–

Product expansion

–

Service capabilities

•

Company-wide operational excellence

initiative

•

TimkenSteel spinoff

•

Aerospace restructure

•

Pension plans fully funded; derisking

underway

2007

2014

See Appendix for reconciliation of adjusted EBIT margin to its most directly comparable GAAP

equivalent. (1) Total Shareholder Return for the Company takes into account the value

of TimkenSteel common shares distributed in the Spinoff on June 30, 2014 and assumes

quarterly reinvestment of dividends. 2004 –

2008

2010 –

2014

Sales:

EBIT Margin (Adj.):

$3.7B

5.0%

$3.1B

12.6%

5-Year Average

(5-Year Annualized, ending 12/31/14)

Timken Improved Financial Performance

Total

Shareholder

Return

(1)

TIMKEN

TRANSFORMATION |

|

|

| 6

Driving a More Balanced and Profitable Portfolio of Businesses

End-Market Sectors

Product Offering

Channel Overview

OEM

(Aftermarket Parts)

OEM

(New

Equipment

Builds)

Aftermarket

•

Highly diverse end-

market sectors, customer

base and applications

•

Attractive business mix

•

Expanding beyond

tapered roller bearings

•

Power transmission and

services diversification

•

Reflects new products,

acquisitions and global

expansion

•

Large installed base

drives aftermarket

–

Lifetime of revenue

–

Higher margin mix

•

1/3 of OEM business is

OEM service

Note: Based on 2014 sales of $3.1B.

Bearings

Services

Power Transmission

Products

19%

15%

ATTRACTIVE BUSINESS PROFILE |

|

|

| Technology

& Know How

Business

Capabilities

Operational

Excellence

Talent

Growth Markets Driven

by Strong Macros

Expand Global Reach with

Adjacent Products &

Services

Value

Creation

Challenging

Applications

Aftermarket

& Rebuild

Fragmentation

High Service

Requirements

7

THE TIMKEN BUSINESS MODEL |

|

|

| 8

Capture Share

and

Market Growth

Apply Timken Business Model

Win Globally

Grow International Sales and

Focus on Emerging Markets

Leverage

Technology and

Know-How to

Grow Organically

Accelerate Product Development Rate

Pursue Strategic,

Bolt-on

Acquisitions

Focus on:

Bearings | International | Services

Power Transmission Adjacencies

1.

2.

3.

4.

THE GROWTH PLAN: WHAT YOU CAN EXPECT |

|

|

| February

2010

July

2010

February

2013

Type E

Ball bearing

housed units

Split roller housed

units

July

2014

November

2014

9

Spherical roller

bearing steel

housed unit

Feb

2003

SNT Plummer

UC Series

Ball Bearing

•

Housed bearing units provide enhanced bearing protection in a

multitude of harsh conditions. Timken housed units feature robust

sealing options –

enhancing bearing protection in debris-filled,

contaminated or high-moisture environments.

BEARING HOUSED UNIT PORTFOLIO TRANSFORMATION

BUILDING FOR GROWTH

TIMKEN NOW MARKETS AMONG THE BROADEST RANGE OF BEARING HOUSED UNITS IN THE INDUSTRY

|

|

|

| 10

•

Successful organization in place and TimkenSteel spin completed

•

2014 earnings growth (adj. EPS) of 23% on modest top line growth

•

Launched multiple growth opportunities & margin enhancement

initiatives

–

DeltaX

–

Disciplined and strategic M&A --Schulz and Revolvo

–

Aerospace restructuring

–

Operational

excellence

•

Pension de-risking

•

Returned capital to shareholders through dividends and increased

level

of share repurchases in 2014

See appendix for reconciliation of adjusted EPS to its most directly comparable GAAP

equivalent. 2014 ACTIONS DRIVE

STRONG PERFORMANCE & OPPORTUNITY |

|

|

| 12

Execution of Timken Business Model Drives Success

Revenue

Adj. EBIT Margin

Adj. EPS

Up 6% excluding planned

program exits in Mobile

Industries and currency

$3.0

$3.1

10.8%

12.2%

$2.07

$2.55

Improvement driven by operational excellence

initiatives and cost reduction;

EPS increase includes share repurchases

($ in Billions)

Up 1%

Up 140 bps

Up 23%

See appendix for reconciliations of adjusted sales, adjusted EBIT Margin, adjusted EPS and

adjusted ROIC to their most directly comparable GAAP equivalents.

Other Highlights:

•

Process Industries

sales up 10.4% vs.

2013

•

SG&A expense

improved 40 bps

(% of sales) vs.

2013

•

Adjusted ROIC of

11.5%, up from

9.7% in 2013 (cost

of capital ~9%)

2014 FINANCIAL ACCOMPLISHMENTS

|

|

|

| 13

See Appendix for reconciliations of Net Debt/Capital and adjusted EPS to their most directly

comparable GAAP equivalents. Balance Sheet Presents Value-Creation Opportunity

Capital Structure

Cash

$294

Debt

530

Net Debt

236

Equity

1,589

Net Capital

$1,825

Leverage

Total Debt/Capital

25%

Net Debt/Capital

13%

($ Millions)

Balance Sheet (12/31/14)

Target:

30 –

40%

Net Debt

Net Debt/ Capital

($ Millions)

Net Debt / Capital

2014 Actual

9%

2%

13%

Capital

Expenditures

Dividend

Share Repurchases

Acquisitions

Executing Plan:

2015 Outlook

–

Target CapEx at ~4% of sales

–

Expect

to

remain

at

or

above

top-end

of

25

–

35%

targeted

payout

ratio

–

Continued focus on pipeline of attractive M&A

targets aligned with criteria

–

Remaining share repurchase authorization of

8.9M shares; expires 12/31/15

–

Invested $127M in CapEx (4.1% of sales), including

growth initiatives

–

Paid dividends totaling $1.00 per share; 39% payout

ratio (on Adj. EPS of $2.55)

–

Completed acquisitions of Schulz Group and Revolvo

Ltd. ($22 million spend)

–

Repurchased 5.2M shares for $271 million (6% of

outstanding as of 12/31/13)

BALANCE SHEET AND LEVERAGE |

|

|

| 14

US dollar index (DXY)

90.3

100.2

USD/EUR

1.21

1.05

Est. full year revenue impact down

3%* down 6%

January 1

March 13

Currency Impact on 2015 (vs. 2014):

* Included in original outlook provided on January 29

Appreciation in US dollar since year-end driving larger

adverse impact on 2015 revenue versus prior year

Over 45% of Timken 2014 revenue was generated

outside the United States:

IMPACT OF

CURRENCY ON 2015

OUTLOOK |

|

|

| 15

•

Differentiated Business Model delivers strong financial results

–

Fragmented, diverse end-markets and customers

–

Attractive mix

–

Global growth opportunity

•

Strong, results oriented Management Team

•

Shifted focus from transformation to:

–

Growth

–

Margin performance

–

Capital allocation; improved FCF generation leads to increased return of

capital and funding of growth

…Prepared to Deliver Strong Shareholder Value

Timken is a Compelling Investment…

INVESTMENT SUMMARY – WHY OWN TIMKEN |

|

|

| Bank of America

Merrill Lynch Investor Conference March 17, 2015 •

London

*

*

*

* |

|

|

| 18

Reconciliation of Sales, EBIT to Net Income, EBIT After Adjustments to Net Income , EBIT as a

Percentage of Sales and EBIT After Adjustments as a Percentage of Sales; all excluding

the Steel Business: The following reconciliation is provided as additional relevant

information about the Company's performance. Management believes that EBIT and

EBIT margin, after adjustments, are representative of the Company's core operations and therefore

useful to investors.

(Dollars in millions)

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

Net sales (as reported)

4,513.7

$

5,168.4

$

4,973.4

$

5,236.0

$

5,663.7

$

3,548.4

$

4,055.5

$

5,170.2

$

Net sales attributable to TimkenSteel

1,221.7

1,582.2

1,327.8

1,415.1

1,694.0

672.9

1,256.9

1,836.6

Net sales - The Timken Company (pro forma)

3,292.0

$

3,586.3

$

3,645.5

$

3,820.9

$

3,969.7

$

2,875.4

$

2,798.6

$

3,333.6

$

3,359.5

$

3,035.4

$

3,076.2

$

5 Year Average Net sales: Year Ending (2004-2008)

3,662.9

$

5 Year Average Net sales: Year Ending (2010-2014)

3,120.7

$

Net Income (as reported)

135.7

$

260.3

$

176.4

$

219.4

$

267.7

$

(138.6)

$

269.5

$

456.6

$

495.9

$

263.0

$

173.3

$

Income from Discontinued Operations, net of income taxes

(164.4)

(87.5)

(24.0)

Provision for income taxes

64.1

130.3

77.8

62.9

157.9

1.5

136.0

240.2

186.3

114.6

54.7

Gain (loss) on divesiture

(19.9)

Interest expense

49.4

48.1

44.8

35.6

39.0

40.2

38.2

36.8

31.1

24.4

28.7

Interest income

-

-

-

-

-

-

(3.7)

(5.6)

(2.9)

(1.9)

(4.4)

Consolidated earnings before interest and taxes (EBIT)

249.2

$

438.7

$

299.0

$

317.9

$

464.6

$

(116.9)

$

440.0

$

728.0

$

546.0

$

312.6

$

228.3

$

EBIT attributable to TimkenSteel

54.8

219.8

206.7

213.1

264.0

(57.9)

146.1

265.3

-

EBIT - The Timken Company

194.5

$

218.9

$

92.3

$

104.8

$

200.6

$

(59.0)

$

293.9

$

462.7

$

546.0

$

312.6

$

228.3

$

EBIT - The Timken Company (pro forma) % to Net Sales

5.9%

6.1%

2.5%

2.7%

5.1%

-2.1%

10.5%

13.9%

16.3%

10.3%

7.4%

Adjustments:

Gain on sale of real estate in Brazil

(5.4)

(22.6)

Cost-reduction initiatives and plant rationalization costs

27.0

17.3

24.4

34.5

5.8

11.1

28.0

22.0

37.1

14.8

14.6

Loss on divestitures

64.3

0.5

(0.0)

19.9

Impairment and restructuring

13.4

26.1

44.9

40.4

64.4

216.7

121.6

Pension settlement charges

7.2

33.7

Other Special Items, including CDSOA expense (receipts)

(43.0)

(85.4)

(94.7)

(13.2)

(29.3)

2.0

(2.3)

(2.4)

(108.0)

Total Adjustments

(2.5)

$

(42.1)

$

38.9

$

62.2

$

40.8

$

249.7

$

25.7

$

19.6

$

(70.9)

$

16.6

$

147.3

$

Adjusted EBIT - The Timken Company (pro forma)

192.0

$

176.9

$

131.2

$

167.0

$

241.4

$

190.8

$

319.6

$

482.3

$

475.1

$

329.2

$

375.6

$

Adjusted EBIT - The Timken Company (pro forma) % to Net Sales

5.8%

4.9%

3.6%

4.4%

6.1%

6.6%

11.4%

14.5%

14.1%

10.8%

12.2%

5 Year Average Adjusted EBIT Margin: Year Ending (2004-2008)

5.0%

5 Year Average Adjusted EBIT Margin: Year Ending (2010-2014)

12.6%

Twelve Months Ended December 31,

:

2004 – 2014

GAAP RECONCILIATION

|

|

|

| 19

The Timken Company

(Dollars in millions) (Unaudited)

2014

2013

Net Sales

3,076.2

$

3,035.4

$

Less: Planned Program Exits

110.0

Add back: Currency impact

(30.4)

Total

3,216.6

$

3,035.4

$

Year-over-Year change

181.2

$

6.0%

Reconciliation of Net Sales After Planned Program Exits and Currency Effects to Net Sales

The following reconciliation is provided as additional relevant information about the Company's

performance. Management believes that net sales, after planned program exits and currency

effects, are representative of the Company's continuing operations and therefore useful to

investors. Twelve Months Ended

December 31,

GAAP RECONCILIATION

EXITS & CURRENCY EFFECTS

: SALES EXCLUDING

PLANNED PROGRAM |

|

|

| 20

(Dollars in millions, except share data) (Unaudited)

2014

Percentage

to

Net Sales

2013

Percentage

to

Net Sales

Net Income

173.3

$

5.6

%

263.0

$

8.7

%

Income From Discontinued Operations, net of income taxes

(24.0)

(0.8)%

(87.5)

(2.9)%

Provision for income taxes

54.7

1.8

%

114.6

3.8

%

Interest expense

28.7

0.9

%

24.4

0.8

%

Interest income

(4.4)

(0.1)%

(1.9)

(0.1)%

Consolidated earnings before interest and taxes (EBIT)

228.3

$

7.4

%

312.6

$

10.3

%

Adjustments:

Gain on sale of real estate in Brazil

(1)

(22.6)

(0.7)%

(5.4)

(0.2)%

Charges for cost-reduction initiatives and plant rationalization costs

(2)

14.6

0.5

%

14.8

0.5

%

Aerospace impairment and restructuring charges

(3)

121.6

4.0

%

—

—%

Pension settlement charges

(4)

33.7

1.1

%

7.2

0.2

%

Total Adjustments

147.3

4.8

%

16.6

0.5

%

Consolidated earnings before interest and taxes (EBIT), after

adjustments

375.6

$

12.2

%

329.2

$

10.8

%

(4)

Pension settlement charges related to the settlement of certain U.S. pension

obligations. December 31,

(1)

Gain on the sale of real estate relates to the sale of the former

(2)

Cost-reduction

initiatives

and

plant

rationalization

costs

related

to

plant

closures,

the

rationalization

of

certain

plants,

and

(3)

Aerospace impairment and restructuring charges related to goodwill impairment

charges, inventory valuation adjustments, Reconciliation of EBIT Margin, After

Adjustments, to Net Income as a Percentage of Sales and EBIT, After Adjustments, to

Net Income:

The following reconciliation is provided as additional relevant information about

the Company's performance. Management believes that EBIT and EBIT

margin, after adjustments, are representative of the Company's core operations and therefore

useful to investors.

Twelve Months Ended

GAAP RECONCILIATION

: CONSOLIDATED EBIT & EBIT MARGIN

|

|

|

| 21

Reconciliation of Adjusted Return on Invested Capital (ROIC):

The following reconciliation is provided as additional relevant information about the

Company's performance. Management believes that ROIC, after adjustments, is

representative of financial return of the Company's core operations and therefore

useful to investors. The Company uses NOPAT/Average Invested Capital as a type of ratio

that indicates return on invested capital.

Reconciliation of Adjusted EBIT

2014

2013

Income from continuing operations, net of income taxes

149.3

$

175.5

$

Provision for income taxes

54.7

114.6

Interest expense

28.7

24.4

Interest income

(4.4)

(1.9)

Earnings Before Interest and Taxes (EBIT) (As Reported)

228.3

312.6

Gain on sale of real estate in Brazil

(22.6)

(5.4)

Charges for cost-reduction initiatives and plant rationalization costs

14.6

14.8

Aerospace impairment and restructuring charges

121.6

-

Pension settlement costs

33.7

7.2

Adjusted EBIT

375.6

$

329.2

$

Reconciliation of Net Operating Profit after Taxes

2014

2013

Adjusted EBIT

375.6

$

329.2

$

Tax Rate

33.0%

35.1%

Calculated Income Taxes

123.9

115.7

Net operating profit after taxes

251.7

213.5

Reconciliation of Adjusted Invested Capital

2014

2013

2012

Total debt

530.1

445.7

448.8

Total equity

1,589.1

2,648.6

2,246.6

Equity related to discontinued operations

-

826.7

549.2

Adjusted total equity

1,589.1

1,821.9

1,697.4

Adjusted invested capital (Total debt + Adjusted total equity)

2,119.2

2,267.6

2,146.2

Adjusted invested capital (two-point average)

2,193.4

2,206.9

Calculation of Adjusted Return on Invested Capital

2014

2013

Net operating profit after taxes (NOPAT)

251.7

$

213.5

$

Adjusted invested capital (two-point average)

2,193.4

2,206.9

Return on invested capital

11.5%

9.7%

GAAP RECONCILIATION: ADJUSTED

ROIC |

|

|

| 22

Reconciliation of Net Debt to Total Debt and the Ratio of Net Debt to Capital:

This reconciliation is provided as additional relevant information about the Company's

financial position. Capital, used

for

the

ratio

of

total

debt

to

capital,

is

defined

as

total

debt

plus

total

shareholders'

equity.

Capital,

used

for

the ratio of net debt to capital, is defined as total debt less cash and cash equivalents plus

total shareholders' equity.

Management

believes

Net

Debt

is

an

important

measure

of

the

Company's

financial

position,

due

to

the

amount of cash and cash equivalents.

(Dollars in millions)

June 30,

2014

December 31,

2014

December 31,

2013

Short-term debt

314.6

$

8.0

$

269.3

$

Long-term debt

176.2

522.1

176.4

Total Debt

(1)

490.8

$

530.1

$

445.7

$

Less: Cash, cash equivalents and restricted cash

(310.1)

(294.1)

(399.7)

Net Debt

(1)

180.7

$

236.0

$

46.0

$

Total equity

1,804.1

$

1,589.1

$

2,648.6

$

Ratio of Total Debt to Capital

21.4

%

25.0

%

14.4

%

Ratio of Net Debt to Capital

9.1

%

12.9

%

1.7

%

(1) Total Debt and Net Debt at December 31, 2013 excludes $30.2 million of debt transferred to

TimkenSteel and is considered discontinued operations. GAAP RECONCILIATION: NET DEBT / CAPITAL |

|

|

| 23

Reconciliation of Earnings Per Share and Earnings Per Share After Adjustments to Net Income;

excluding the Steel Business:

The following reconciliation is provided as additional relevant information about the

Company's performance. Management believes that earnings per share (EPS), after

adjustments, are representative of the Company's core operations and therefore useful

to investors. 2013

2014

Reported EPS

1.82

$

1.61

$

Adjustments:

EPS Attributable to TimkenSteel

-

Gain on sale of real estate in Brazil

(0.06)

(0.25)

Cost-reduction initiatives and plant rationalization costs

0.15

0.16

Impairment and restructuring

1.33

Special items - other (income) expense

Tax impact of discrete items

CDSOA expense (receipts)

-

Pension settlement charges

0.08

0.37

Provision for income taxes

0.07

(0.68)

Total Adjustments

0.24

$

0.94

$

EPS - The Timken Company, after adjustments (pro forma)

2.07

$

2.55

$

Twelve Months Ended

GAAP RECONCILIATION: PRO FORMA EPS |

|

|

| 24

Reconciliation of EBIT After Adjustments and EBIT as a Percentage of Sales:

The following reconciliation is provided as additional relevant information about the

Company's performance. Management believes that EBIT and EBIT margin, after

adjustments, are representative of the Company's core operations and therefore useful

to investors. Mobile Industries

(Dollars in millions) (Unaudited)

Twelve

Months

Ended

December 31,

2014

Percentage

to Net Sales

Earnings before interest and taxes (EBIT)

65.6

$

3.9%

Gain on sale of real estate in Brazil

(1)

(22.6)

(1.3)%

Charges for cost-reduction initiatives and plant rationalization costs

(2)

11.8

0.7

%

Aerospace impairment and restructuring charges

(3)

121.6

7.2

%

Pension settlement charges

(4)

0.7

—%

Earnings before interest and taxes (EBIT), after adjustments

177.1

$

10.5%

Process Industries

(Dollars in millions) (Unaudited)

Twelve

Months

Ended

December 31,

2014

Percentage

to Net Sales

Earnings before interest and taxes (EBIT)

267.1

$

19.2%

Charges for cost-reduction initiatives and plant rationalization costs

(2)

2.2

0.2%

Earnings before interest and taxes (EBIT), after adjustments

269.3

$

19.4%

(2)

Cost-reduction

initiatives

and

plant

rationalization

costs

related

to

plant

closures,

the

rationalization

of

certain

plants,

and

severance

related

to

cost

reduction

initiatives.

(1)

Gain on the sale of real estate relates to the sale of the former manufacturing

facility in Sao Paulo, Brazil. (3)

Aerospace impairment and restructuring charges related to goodwill impairment

charges, inventory valuation adjustments, and severance.

(4)

Pension settlement charges related to the settlement of certain U.S. pension

obligations. GAAP RECONCILIATION: SEGMENT ADJUSTED EBIT |

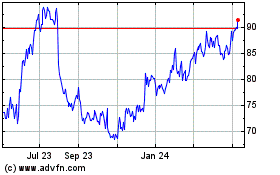

Timken (NYSE:TKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

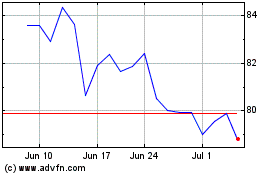

Timken (NYSE:TKR)

Historical Stock Chart

From Apr 2023 to Apr 2024