By Ryan Knutson

KOSIVSKA POLIANA, UKRAINE -- A team of network technicians in

February ventured into the snow-covered Carpathian Mountains in

southwestern Ukraine, where a pocket of less than 5,000 people live

in a narrow valley.

They made the trek to install a cellphone antenna, and bring the

village online with third-generation, or 3G, wireless service, the

kind of high-speed Internet technology that allows smartphone users

to surf the web, watch YouTube and hail an Uber taxi. For a place

with so few jobs and no tourist attractions, the installation came

as a surprise.

"I was shocked," said Oleksiy Kopusiak, who was sitting at home

listening to music when he noticed the 3G signal appear on his

phone. The 21-year-old construction worker suddenly could stream

music online with no delay. "Everyone is so happy," he said, before

sitting down to celebrate over beers with his friends.

The interest in the tiny hamlet reflects the maturing state of

the global telecommunications market: operators are hungry for any

growth they can find, even if that means doing business in a

country with an unstable government and an economy hobbled by

corruption and civil war.

"The low hanging fruits have more or less been captured," said

Mats Granryd, head the telecom trade group GSMA. "Now it is more

going after the harder ones."

Ukraine's appeal now is in contrast with the situation two years

earlier, when telecom companies were racing to pull expensive

network gear from cities on the eastern side of this former Soviet

republic. Clashes with Russia-backed separatists were devolving

into war and Ukraine's economy was in shambles.

Many of those problems remain. In April, the country's prime

minister resigned. Yet, three different foreign companies --

Turkcell Iletisim Hizmetleri AS of Turkey, Mobile TeleSystems PJSC

of Russia and VimpelCom Ltd. of the Netherlands -- are investing to

expand wireless services in Ukraine.

Ukraine is a nation left behind in the global technology

build-out. While the economy is more than twice as large as Costa

Rica's, Ukraine's mobile broadband penetration is only one-tenth of

the Central American nation's. Ukraine's population is highly

educated and many people already own low-cost smartphones. The

average annual income in Ukraine is about $3,500, according to the

World Bank, about half that of Botswana.

The opportunity lies in the pent-up demand. Less than an hour

after the 3G antenna covering Kosivska Poliana was switched on in

February, traffic rose to 92% of initial capacity as word spread

that faster connection had arrived.

Operators here began installing 3G for the first time last June

-- more than a decade after such high-speed networks appeared

elsewhere in the world and as the U.S. and other nations are

preparing to install even faster 5G.

"It is like a time machine," said Kaan Terzio lu, chief

executive of Turkcell, the company that installed the antenna in

this small mountain village.

After a political uprising began in late 2013, reformers

eventually set their sights on 3G, as many believed its absence was

a sign of the corruption that hobbled the country's political

system. About a decade ago, the Ukrainian government sold only one

3G license to the monopoly landline provider, Ukrtelecom JSC, which

didn't have a wireless phone service.

Yuriy Kurmaz, Ukrtelekom's general director, says it won't be

easy for wireless carriers to succeed. Much of 3G coverage is only

in cities and not rural areas. "Since the geographical coverage

isn't enough, I don't observe significant growth in 3G usage," Mr.

Kurmaz said.

Turkcell has roughly 13 million subscribers in Ukraine, while

VimpelCom's Kyivstar has 25 million and Mobile TeleSystems has 20

million. Many customers have accounts with more than one operator

In Ukraine to avoid expensive out-of-network calls.

All three foreign operators say they are investing aggressively

in the country. Kyivstar refreshed its brand, dropping a

Soviet-looking star for something that looks younger and local.

Mobile TeleSystems, through a deal with Vodafone Group PLC, is

renaming its stores and service in Ukraine with the British

brand.

Turkcell, which is Turkey's biggest wireless operator and first

moved into Ukraine in 2005, has lost hundreds of millions of

dollars in Ukraine in the past few years as it battles with low

monthly charges and weak local currency. It has invested heavily to

buy airwaves and build its network but charges roughly $1 per

person a month, or one-fortieth of what carriers typically earn in

the U.S. The local currency has depreciated by more than 70% to the

dollar over the past two years.

Turkcell and other foreign carriers also have lost customers and

equipment in the country's disputed eastern region. By late 2014,

Turkcell left Crimea entirely, and pulled network equipment and

employees out of eastern towns like Donetsk and Luhansk. These

days, on the rare occasions Turkcell sends subcontractors to work

on tower sites in the region, the crews go at night to avoid being

caught in crossfire.

The company expects the arrival of 3G network will help it

charge its customers more. More than 45% of Turkcell's user base

has smartphones, and many of them are expected to start consuming

data immediately.

Adding data service doubles average revenue per user, Mr. Terzio

lu says. "As we bring on more digital services, we can double it

again."

Not everyone is eager to pay up, however. Dmytro Danchevsky, a

college student living in Lviv, a large city in western Ukraine,

says prices for wireless service are already too high. He pays a

little more than $1 for about 1 gigabyte of data and burns through

it in about a week, he says. And, he can't afford to buy more.

"That is a tricky issue because people are very poor," says

Peter Chernyshov, the chief executive of Kyivstar, the Ukrainian

wireless operator owned by VimpelCom.

Ilia Kenigshtein, a 44-year-old Ukrainian tech entrepreneur who

organized protests over the lack of high-speed networks in his

country, says it is worth the cost. "You can't live without 3G

right now," he said. "It is part of freedom."

Write to Ryan Knutson at ryan.knutson@wsj.com

(END) Dow Jones Newswires

May 05, 2016 16:25 ET (20:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

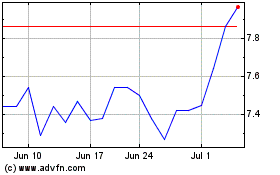

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Mar 2024 to Apr 2024

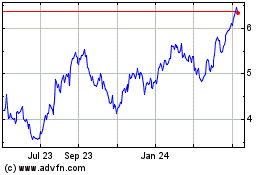

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Apr 2023 to Apr 2024