Turkcell Iletisim Hizmetleri (NYSE:TKC) (BIST:TCELL):

- Please note that all financial data is

consolidated and comprises that of Turkcell Iletisim Hizmetleri

A.S., (the “Company”, or “Turkcell”) and its subsidiaries and

associates (together referred to as the “Group”). All non-financial

data is unconsolidated and comprises Turkcell Turkey only figures.

As previously announced, starting from Q115, "Turkcell Turkey"

comprises all of our telecom related businesses in Turkey (as used

in our previous releases, this term covered only mobile

businesses). The terms "we", "us", and "our" in this press release

refer only to Turkcell Turkey, except in discussions of financial

data, where such terms refer to the Group, and except where context

otherwise requires.

- In this press release, a year-on-year

comparison of our key indicators is provided and figures in

parentheses following the operational and financial results for

June 30, 2015 refer to the same item as at June 30, 2014. For

further details, please refer to our consolidated financial

statements and notes as at and for June 30, 2015, which can be

accessed via our website in the investor relations section

(www.turkcell.com.tr).

- Please note that selected financial

information presented in this press release for the second quarter

of 2014, and first and second quarters of 2015, both in TRY and

US$, is based on IFRS figures.

- In the tables used in this press

release totals may not foot due to rounding differences. The same

applies for the calculations in the text.

- Year-on-year and quarter-on-quarter

changes appearing in this press release reflect mathematical

calculation.

HIGHLIGHTS OF THE SECOND QUARTER OF 2015

- In the second quarter, Turkcell Turkey

and Turkcell Group recorded their historically highest second

quarter revenue, EBITDA and net income.

- Turkcell Turkey, accounting for 92% of

Group revenues, grew by 9.2% to TRY2,835 million (TRY2,595 million)

with an increased EBITDA margin of 32.3% (31.5%) driven by strong

mobile and fixed broadband revenues as well as mobile

services.

- Turkcell International revenues,

generating 7% of Group revenues fell 23.6% to TRY205 million

(TRY268 million), heavily impacted by year-on-year currency

devaluation in Ukraine and Belarus. While the EBITDA margin

improved to 27.2% (23.9%), the quarterly appreciation of the

Hryvnia led to TRY109 million net income.

- Overall, in line with our plan, Group

revenues grew by 5.8% year-on-year, to TRY3,093 million (TRY2,923

million).

- Group EBITDA1 rose by 9.7% to TRY995

million (TRY907 million), while the EBITDA margin rose to 32.2%

(31.0%) on the back of better operational expense management

supported by our new customer acquisition strategy, focused on

higher value generation.

- Group net income grew by 44.6% to

TRY712 million (TRY492 million) with the increasing operational

strength of Turkcell Turkey, coupled with the positive impact of

currency movements in Ukraine and Turkey operations.

- On June 26, 2015, we announced the

acquisition of the remaining 44.96% stake in Astelit for USD100

million, which was completed on July 10, 2015. Having full control

of the business should enable us to manage it more effectively with

a view to solidifying its market position, ultimately enhancing its

contribution to the Group.- Further, Astelit’s debt has been

restructured, and the loan portfolio from financial instiutions has

fallen to a more healthy level of UAH3.6 billion2 (US$163 million).

Astelit’s debt denominated fully in local currency, lifts the

potential impact of foreign exchange movements.

(1) EBITDA is a non-GAAP financial measure. See page 15 for the

reconciliation of EBITDA to net cash from operating activities.(2)

UAH/US$ rate is assumed 22.00(*)For further details, please refer

to our consolidated financial statements and notes as at and for

June 30, 2015 which can be accessed via our web site in the

investor relations section (www.turkcell.com.tr).

COMMENTS FROM CEO, KAAN TERZIOGLU

“In the second quarter of 2015, Turkcell Turkey’s revenues,

accounting for 92% of total Group revenues, increased 9.2% on the

back of mobile and fiber broadband as well as mobile services.

Meanwhile, Turkcell International revenues, accounting for 7% of

total Group revenues, declined by 23.6% in TRY terms due to yearly

currency devaluation in Ukraine and Belarus, while grew by 2.8%

excluding movements in foreign exchange rates.

On a consolidated basis, revenues reached TRY3,093 million on

5.8% growth, while EBITDA rose 9.7% to TRY995 million. The EBITDA

margin increased by 1.2 percentage points to 32.2%. Group net

income amounted to TRY712 million on 44.6% growth as a result of

strong operational performance and translation gains recorded.

Thus, like Turkcell Turkey, Turkcell Group recorded its

historically highest second quarter revenue, EBITDA and net

income.

Overall, the first half of 2015 was in line with our

expectations. Based on current market conditions, we maintain our

full year guidance, including targeted revenue growth of 6% - 9%

and an EBITDA margin targeted to be within the 31% - 32% range.

In the first half of the year, we have taken significant steps

with regards to our priorities communicated earlier in order to

increase shareholder value.

Firstly, we shifted to a new organizational structure with the

aim of increasing efficiency and simplification in our business

processes, as well as strengthening our position as a provider of

integrated communication and telecommunication services. In this

regard, the sixteen chief executive roles that reflected our

previous segmented mobile operator identity, are now reorganized

into eight functions that embody our integrated player vision.

Through our merged sales channels and integrated technical

platform, we have generated efficiencies. Meanwhile, customer

services have become a separate focus area.

Secondly, Turkcell Turkey has positioned itself as an integrated

player in the total telecommunication market in line with our new

strategic priorities. Accordingly, our addressable market is now

larger by 56% in terms of revenues. Going forward, we will monitor

our market share in terms of total telecom revenues instead of

mobile only revenues, or subscribers. In this regard, positioned as

the second player, our priority will be to increase our 35.6%

revenue share within this market through differentiating our

services and solutions, while remaining attuned to

profitability.

In this regard, we have increased our focus on valuable

customers. We have enlarged our share of the fiber market to 53%

through superior customer services, and maintained our market

leader role. Our TV customers increased by 40 thousand for the

period in line with our full year targets. Moreover, as part of our

T-series which has reached unit sales of 2 million to date, we

launched our affordable 4G enabled smartphone, T60. We have geared

up in the personal cloud market by increasing tenfold the capacity

of our “Smart Storage”, the most widely used personal cloud service

in Turkey. Additionally, while BİP downloads have exceeded 1.5

million, over 60 million songs were listened to through Turkcell

Müzik in the quarter.

Thirdly, we acquired the remaining 44.96% stake in Astelit for

USD100 million in order to strengthen our regional position, to

reach a larger customer base that will create economies of scale

and to increase its contribution to the Group. With this

acquisition, we have increased our flexibility in building more

effective strategies to increase the return on investment in

Ukraine. Moreover, we have restructured Astelit’s debt, which has

long been an issue. Accordingly, Astelit now has a healthy balance

sheet by drawing down the debt in local currency and at the level

of around two times its EBITDA. As a result of this restructuring,

we have eliminated the potential foreign exchange risk in relation

to Astelit’s debt and its impact on Group net income. On the

operational front, we started providing 3G services to 2.7 million

subscribers within a very short period of time following the launch

on June 4.

Going forward, our key priorities will be to strengthen our

position in the Turkish telecommunication market as an integrated

player, to evaluate M&A opportunities and our options with

regards to our subsidiaries and to solidify our Group balance sheet

structure. Further, the expected spectrum tender will be among our

top agenda items.

We would like to congratulate all our stakeholders for their

contribution to our success and extend our thanks to our Board of

Directors for their support.”

(*) Please note that this paragraph contains forward looking

statements based on our current estimates and expectations

regarding market conditions for each of our different businesses.

No assurance can be given that actual results will be consistent

with such estimates and expectations. For a discussion of factors

that may affect our results, see our Annual Report on Form 20-F for

2014 filed with U.S. Securities and Exchange Commission, and in

particular, the risk factor section therein.

OVERVIEW OF TURKCELL TURKEY

In the second quarter, the telecom market in Turkey grew by

9.3%* in terms of revenues, and Turkcell Turkey performed in line.

Mobile and fixed broadband and services have been the key growth

drivers, reflecting ever rising demand coupled with seasonally

higher consumption.

In this environment, Turkcell Turkey has continued to improve

its financial and operational performance as an integrated player.

Generating 92% of Group revenues, Turkcell Turkey grew 9.2% on the

back of 9.9% higher consumer revenues and 8.6% increased corporate

revenues. Both mobile and fixed broadband, as well as our services

and solutions, contributed to the growth of these segments. On the

mobile side, our postpaid subscriber base displayed healthy growth

with 334 thousand quarterly net additions, reaching 15.9 million

and constituting 46.7% (41.9%) of the total base. Helped by this

improved subscriber mix as well as higher data consumption, mobile

blended ARPU grew by 8.6% to TRY24.0 (TRY22.1). Data consumption

per user, which has reached 1.4GB on 14% quarterly growth, was

supported by the rise in number of smartphone users on our network

to 13.8 million. With 547 thousand quarterly net additions,

smartphone penetration increased to 45%. Our new T-series phone,

T60, which stands out for its user friendly features at an

affordable price relative to its benchmarks, has also contributed

to this penetration figure. Meanwhile, we sustained our focus on

leveraging our wide range of services and solutions. Our instant

messaging service, BİP, has been downloaded more than 1.5 million

times to date, increasing its popularity. While Turkcell Müzik

users doubled the number of songs they played to 60 million during

the quarter, our renewed “Smart Storage” service with over 840

thousand active users has become the most widely used personal

cloud service in Turkey.

Meanwhile, Turkcell Turkey’s broadband business continued its

strong customer acquisition on a solid ARPU performance. Our fiber

and ADSL customers in total have exceeded 1.3 million, supported by

our expanding fiber network, outperforming sales force and customer

care efforts. In fiber, we, yet again, gained the highest quarterly

net additions of 42 thousand in the market, strengthening our

market leader position and increasing our share to 53%. In

addition, the continued growth momentum in ADSL resulted in 32

thousand quarterly net additions. Moreover, the Turkcell TV

platform, which successfully continued its user penetration growth,

reaching nearly 140 thousand customers (~210 thousand

including mobile TV and web users) on 40 thousand

quarterly additions, has increased our triple play ratio to 16% in

our total fiber subscriber base. In total overall, fixed

residential ARPU reached TRY47.9.

Turkcell Group

Guidance**:

The overall performance of Turkcell Group in the first half has

been in line with our plans. Accordingly, on the basis of current

market conditions, we maintain our full year revenue growth

guidance target of 6% - 9% and EBITDA margin targeted within the

31% - 32% range for 2015.

(*) Includes the growth of Turk Telekom, Vodafone Turkey and

Turkcell Turkey revenues(**) Please note that this paragraph

contains forward looking statements based on our current estimates

and expectations regarding market conditions for each of our

different businesses. No assurance can be given that actual results

will be consistent with such estimates and expectations. For a

discussion of factors that may affect our results, see our Annual

Report on Form 20-F for 2014 filed with U.S. Securities and

Exchange Commission, and in particular, the risk factor section

therein.

FINANCIAL AND OPERATIONAL REVIEW OF THE SECOND QUARTER

2015

The following discussion focuses principally on the developments

and trends in our business in the second quarter of 2015 in TRY

terms. Selected financial information presented in this press

release for the second quarter of 2014, and the first and second

quarters of 2015, both in TRY and US$ is based on IFRS figures.

Selected financial information presented in this press release

for the second quarter of 2014, and the first and second quarters

of 2015, both in TRY and in US$ prepared in accordance with IFRS,

and in TRY prepared in accordance with the Turkish Accounting

standards, is also included at the end of this press release.

Financial Review of Turkcell Group

Profit & Loss Statement (million TRY) Q214

Q115 Q215 y/y %

q/q % Total Revenue 2,923.0

2,978.2 3,092.9 5.8%

3.9% Direct cost of revenues1 (1,789.2) (1,828.6) (1,898.3)

6.1% 3.8%

Direct cost of revenues1/revenues

(61.2%) (61.4%) (61.4%) (0.2pp)

- Depreciation and amortization (386.2) (394.3) (409.5) 6.0%

3.9%

Gross Margin 38.8% 38.6% 38.6%

(0.2pp) - Administrative expenses (135.8) (140.8)

(150.4) 10.8% 6.8%

Administrative expenses/revenues

(4.6%) (4.7%) (4.9%) (0.3pp)

(0.2pp) Selling and marketing expenses (477.2) (476.3)

(458.9) (3.8%) (3.7%)

Selling and marketing

expenses/revenues (16.3%) (16.0%) (14.8%)

1.5pp 1.2pp EBITDA2 907.0

926.8 994.8 9.7% 7.3% EBITDA

Margin 31.0% 31.1% 32.2% 1.2pp

1.1pp EBIT3 520.8 532.5

585.3 12.4% 9.9% Net finance income /

(expense) 46.6 (483.4) 397.1 752.1% (182.1%) Finance expense

(211.3) (735.7) 221.9 (205.0%) (130.2%) Finance income 257.9 252.3

175.2 (32.1%) (30.6%) Share of profit of associates 73.8 94.8 94.0

27.4% (0.8%) Other income / (expense) (92.0) (53.0) (123.4) 34.1%

132.8% Monetary gains / (losses) 60.0 - - - - Non-controlling

interests 49.6 284.4 (100.5) (302.6%) (135.3%) Income tax expense

(166.5) (234.2) (140.5) (15.6%) (40.0%)

Net Income

492.3 141.1 712.0

44.6% 404.6%

(1) Including depreciation and amortization expenses.(2) EBITDA

is a non-GAAP financial measure. See page 15 for the reconciliation

of EBITDA to net cash from operating activities.(3) EBIT is a

non-GAAP financial measure and is equal to EBITDA minus

depreciation and amortization expenses.

Revenue grew by 5.8% year-on-year to TRY3,093 million

(TRY2,923 million).

Turkcell Turkey revenues increased to TRY2,835 million (TRY2,595

million) on 9.2% growth, mainly driven by 9.9% growth in consumer

segment revenues to TRY2,206 million (TRY2,008 million) and an 8.6%

rise in corporate segment revenues to TRY550 million (TRY507

million). The performance of key revenue drivers were as

follows:

- Consumer and Corporate revenues in

total rose by 9.6% to TRY2,756 million (TRY2,514 million).

- Voice revenues fell by 4.2% to TRY1,467

million (TRY1,532 million), reflecting the market trend.

- Data revenues rose by 42.2% to TRY871

million (TRY613 million) on the back of 47.2% mobile broadband and

30.1% fixed broadband revenue growth which have been positively

impacted by increased smartphone penetration, higher user number

and the rise in data consumption.

- SMS, Services and Solutions revenues

grew by 9.6% to TRY295 million (TRY269 million) driven by 48.9%

increase in services revenues despite the continued down-fall in

SMS revenues by 15.3%, reflecting global trends.

- Other revenues mainly comprising our

retail and call center revenues grew by 22.0% to TRY122 million

(TRY100 million).

- Wholesale revenues remained almost

stable at TRY92 million (TRY93 million).

Turkcell International revenues contracted by 23.6% to TRY205

million (TRY268 million), mainly due to year-on-year currency

devaluation in Ukraine and Belarus, while grew by 2.8% excluding

movements in foreign exchange rates.

Other subsidiaries1 revenues, mainly comprised of our

information and entertainment services revenues, fell by 11% to

TRY54 million (TRY60 million).

Operational expenses:

This quarter, despite the increase in direct cost of revenues,

with the improvement in sales and marketing expenses, there was an

overall improvement in operational expenses as a percentage of

revenues.

Direct cost of revenues as a percentage of revenues rose to

61.4% (61.2%), driven by the rise in various cost items which more

than offset the decrease in interconnect costs (0.8pp) as a

percentage of revenues.

Meanwhile, better operational expense management led to

decreased selling and marketing expenses by 1.5pp to 14.8% (16.3%)

with the decline in selling expenses (0.7pp), marketing expenses

(0.4pp) and other cost items (0.4pp).

EBITDA* grew by 9.7% to TRY995 million (TRY907

million) year-on-year leading to an EBITDA margin improvement of

1.2pp to 32.2% (31.0%) driven by better operational expense

management. Accordingly, selling and marketing expenses declined by

1.5pp more than offsetting the increase in administrative expenses

by 0.3pp and direct cost of revenues (excluding depreciation and

amortization) by 0.1pp as a percentage of revenues.

The EBITDA of Turkcell International fell by 12.9% to TRY56

million (TRY64 million) due to the negative impact of currency

devaluation in Ukraine and Belarus on a year-on-year basis. The

EBITDA of Other subsidiaries1 declined by 5.4% to TRY25 million

(TRY26 million).

Net finance income of TRY397 million (TRY47 million) was

recorded in Q215. This was mainly driven by the translation gains

of TRY261 million registered in Q215 as opposed to translation

losses of TRY165 million in Q214 despite the decline in interest

earned on time deposits to TRY62 million (TRY173 million).

Higher translation gains mainly driven by positive quarterly

currency movement impact from Ukraine operations as UAH appreciated

quarterly 10% against US$ and Turkey operations due to our foreign

currency cash position as TRY depreciated 3% against US$.

(*)EBITDA is a non-GAAP financial measure. See page 15 for the

reconciliation of EBITDA to net cash from operating

activities.(1)Other subsidiaries mainly comprise our information

and entertainment services business and interbusiness

eliminations.

Table: Translation gain and loss details

Million TRY Q214 Q115

Q215 Turkcell Turkey (20.1) 308.2 96.6

Turkcell International (144.5) (1,008.2) 164.3 Other Subsidiaries

(0.1) 1.7 0.2

Turkcell Group (164.7)

(698.3) 261.1

Income tax expense details in Q215 are presented in the

table below:

Million TRY Q214 Q115

Q215 y/y % q/q % Current Tax

expense (165.6) (251.9) (145.2) (12.3%)

(42.4%) Deferred Tax income/expense (0.9) 17.7 4.7 (622.2%)

(73.4%)

Income Tax expense (166.5)

(234.2) (140.5) (15.6%) (40.0%)

Net income rose by 44.6% to TRY712 million (TRY492

million) year-on-year mainly driven by increased EBITDA and

positive impact of quarterly currency movements in Ukraine and

Turkey operations. Meanwhile, we recorded a lower interest income

on time deposits with the decrease in cash balance post dividend

payment and booked no monetary gain in Q215 as we ended

inflationary accounting in Belarus starting from Q115.

Translation gain of TRY261 million in Q215 had a positive impact

of TRY132 million on net income, while translation losses of TRY165

in Q214 had negative net income impact of TRY113 after accounting

for minority share and income tax.

Net income was impacted by one-off items both in Q215 and Q214.

One-off items having a total impact of TRY80 million in Q215 were

mainly related to payments regarding commercial agreement

terminations. In Q214, one-off items which amounted to TRY119

million, included administrative fines imposed by the Ministry of

Industry and Trade in relation to service subscriptions and content

sales, and by the Competition Board regarding vehicle tracking

systems, as well as reimbursement in relation to the ICTA

regulation on limited usage services.

Total debt as of June 30, 2015 decreased to TRY4,014.2

million (US$1,494.3 million) from TRY4,127.3 million (US$1,581.2

million) as of March 31, 2015 in consolidated terms. Turkcell

Turkey’s debt balance was TRY861.5 million (US$320.7 million), of

which TRY254.7 million (US$94.8 million) was denominated in US$.

The debt balance of Ukraine (including intra-group debt) was

TRY2,349.7 million (US$874.7 million). Belarus had a debt balance

of TRY1,847.3 million (US$687.7 million).

TRY3,056.2 million (US$1,137.7 million) of our consolidated debt

is at a floating rate, while TRY3,402.4 million (US$1,266.6

million) will mature within less than a year. (Please note that the

figures in parentheses refer to US$ equivalents).

Cash flow analysis: Capital expenditures, including

non-operational items, amounted to TRY957.4 million in Q215, of

which TRY683.3 million was related to Turkcell Turkey, and TRY263.8

million to Turkcell International. The cash flow item noted as

“other” included cash inflows of TRY333 million mainly relating to

net working capital and cash outflow of TRY218 million comprised of

corporate tax payment of Turkcell Iletisim.

Consolidated Cash Flow (million TRY) Q214

Q115 Q215 EBITDA1

907.0 926.8 994.8 LESS: Capex

and License (314.0) (755.5) (957.4) Turkcell Turkey (296.5) (343.9)

(683.3) Turkcell International2 (16.4) (408.4) (263.8) Other

Subsidiaries3 (1.1) (3.2) (10.3) Net interest Income/ (expense)

211.2 214.9 136.0 Other4 (915.3) (1,290.6) 114.6 Net Change in Debt

38.9 46.3 (239.0)

Cash generated (72.2)

(858.0) 49.0 Cash balance before dividend

payment 7,916.9 8,173.8 8,222.8

Dividend paid - - (3,925.0) Cash

balance after dividend payment - -

4,297.8

(1) EBITDA is a non-GAAP financial measurement. See page 15 for

the reconciliation of EBITDA to net cash from operating

activities.(2) The impact from the movement of reporting currency

(TRY) against US$ is included in this line.(3) Other subsidiaries

comprise our information and entertainment services business and

interbusiness eliminations.(4) Other item in Q214 mainly included

cash outflows of advance payments for fixed asset purchases (TRY341

million), corporate tax payment of Turkcell Iletisim (TRY129

million), payments for fines imposed (TRY98 million) and other

items (TRY347 million)" mainly relating to net working capitalOther

item in Q115 included cash outflows in relation to change in

corporate tax payment of Turkcell Iletisim (TRY132 million),

frequency usage fee payment (TRY495 million) and other items

(TRY663 million) which is mainly related to net working

capital.

Operational Review in Turkey

Summary of Operational data Q214

Q115 Q215 y/y % q/q

% Number of mobile subscribers (million)

34.6 34.3 34.0

(1.7%) (0.9%) Postpaid 14.5 15.5 15.9 9.7%

2.6% Prepaid 20.1 18.7 18.1 (10.0%) (3.2%)

Mobile ARPU (Average

Monthly Revenue per User), blended (TRY) 22.1

22.7 24.0 8.6% 5.7% Postpaid 36.8 36.9

38.0 3.3% 3.0% Prepaid 11.8 11.3 12.2 3.4% 8.0%

Mobile ARPU

(Average Monthly Revenue per User), blended (US$) 10.4

9.2 9.1 (12.5%) (1.1%) Postpaid 17.3

15.0 14.3 (17.3%) (4.7%) Prepaid 5.6 4.6 4.6 (17.9%) -

Mobile

Churn (%) 8.1% 7.7% 8.0% (0.1pp)

0.3pp Mobile MOU (Average Monthly Minutes of usage per

subs)blended 279.5 275.7 302.0 8.1%

9.5% Number of fixed subscribers (thousand)

1,031.7 1,271.6 1,345.5 30.4%

5.8% Fiber 652.5 776.1 817.6 25.3% 5.3% ADSL 379.2 495.5

528.0 39.2% 6.6%

Fixed Residential ARPU, blended (TRY)

47.0 47.1 47.9

1.9% 1.7%

Mobile business KPIs:

Mobile subscribers of Turkcell Turkey declined by 290 thousand

to 34.0 million during the quarter due to losses in the more

price-sensitive prepaid segment. Meanwhile, we registered 334

thousand postpaid net additions due mainly to our value

propositions and pre to post switch focus. Accordingly, the share

of postpaid subscribers in our total subscriber base has reached

46.7% (41.9%).

Churn rate refers to voluntarily and involuntarily disconnected

subscribers. Our churn rate was 8.0% (8.1%) in Q215.

ARPU rose by 8.6% to TRY24.0 (TRY22.1) in Q215 on increased

mobile broadband usage, increased demand for mobile services and

higher postpaid customer base.

MoU rose by 8.1% year-on-year to 302.0 minutes driven mainly by

higher package utilization. 9.5% quarter-on-quarter increase of MOU

was driven by seasonality.

Fixed business KPIs:

Fixed subscribers of Turkcell Turkey exceeded 1.3 million driven

by the expansion of our fiber and ADSL customer base. We continued

to reap the benefits of our network investments as well as sales

and customer service efforts as we registered 42 thousand fiber and

32 thousand ADSL customer net additions quarterly. Meanwhile, our

fiber network increased to 34.2 thousand km with home passes

exceeding 2.2 million.

Fixed Residential ARPU improved by 1.9% to TRY47.9 (TRY47.0) in

Q215.

TURKCELL INTERNATIONAL

Astelit continued to pursue its operations in a tough

macroeconomic environment. While 10% appreciation of the local

currency against US$ during the quarter allowed Astelit to register

translation gains, devaluation on a year-on-year basis led to a

decline in its contribution to Group revenues.

Astelit maintained its growth momentum in local currency terms

posting 11.9% revenue growth and increasing its EBITDA margin to

30.2% year-on-year on the back of increased customer base and

retail prices. In Turkish Lira terms, revenues declined by 24.5% to

TRY133 million (TRY177 million) and EBITDA declined by 21.1% to

TRY40 million (TRY51 million). Meanwhile, Astelit recorded net

income of TRY210 million (net loss of TRY127 million) with the

contribution of translation gains registered in Q215.

Astelit’s three-month active subscriber base reached 10.6

million with 293 thousand quarterly net additions. Blended ARPU

(3-month active) rose by 1.2% to UAH34.5 (UAH34.1) driven mainly by

increased data consumption. The MoU (12-month active) fell by 9.5%

to 152.8 minutes (168.8 minutes) due to changing consumer behavior

in tough macroeconomic conditions.

Astelit launched its 3G services on June 4, merely three and a

half months following the tender and became the first operator to

offer a 3G+ network in Ukraine. Astelit offers 3G with

three-carrier technology, allowing the fastest download speed of up

to 63.3 Mbps achievable with this technology. At current, 3G+ is

available to nearly 2.7 million subscribers. The rapid roll out of

Astelit’s 3G service is proof of our commitment to the country.

As of July 10, 2015 we completed the acquisition of the

remaining 44.96% stake in Astelit for a total consideration of

US$100 million in order to manage our operations more effectively

and consequently increase Astelit’s contribution to the Group.

Following this transaction, we took the further step of converting

a material portion of debt to equity and restructuring remaining

debt in order to eliminate the foreign exchange risk associated

with its US$ denominated debt and its potential impact on our

consolidated financials. Accordingly, Astelit’s loan portfolio from

financial institutions has become fully denominated in local

currency and the remaining balance is UAH3.6 billion* (US$163

million). We believe that this level, which is at around two times

Astelit’s EBITDA, is optimal and will allow Astelit to manage its

cash flow more efficiently.

Brief notes on restructuring:

Prior to restructuring, Astelit had outstanding debt of US$875

million. Within the framework of debt restructuring and 2015

working capital needs, Astelit’s capital has been increased by $686

million, Astelit utilized UAH2.7 billion (~US$125 million) loans

under the guarantee of Turkcell and obtained a US$66 million

subordinated loan directly from Turkcell. Of the total funds

received by Astelit, around US$387 million has been used to pay

intra-group liabilities. Once the debt restructuring is fully

completed and associated payments to third party financial

institutions are made, the total cash outflow at the Group level

will be around US$300 million.

* UAH/USD rate is assumed as 22.00

Astelit* Q214 Q115

Q215 y/y % q/q % Number of

subscribers (million)1 12.7

13.7 14.0 10.2%

2.2% Active (3 months)2 9.5 10.3 10.6 11.6% 2.9%

MoU

(minutes) (12 months) 168.8 155.9 152.8

(9.5%) (2.0%) ARPU (Average Monthly Revenue per

User), blended (US$) 2.2 1.2 1.2

(45.5%) - Active (3 months) (US$) 3.0 1.7 1.6 (46.7%)

(5.9%) Active (3 months) (UAH) 34.1 34.3 34.5 1.2% 0.6%

Revenue

(million UAH) 961.0 1,059.0 1,075.6

11.9% 1.6% Revenue (million TRY) 176.9 126.1 133.5

(24.5%) 5.9%

Revenue (million US$) 83.4 51.4

50.2 (39.8%) (2.3%) EBITDA (million UAH) 277.5

327.5 324.3 16.9% (1.0%)

EBITDA (million TRY) 51.1

39.0 40.3 (21.1%) 3.3% EBITDA (million

US$) 24.1 15.9 15.2 (36.9%) (4.4%)

EBITDA margin (UAH)

28.9% 30.9% 30.2% 1.3pp (0.7pp)

EBITA margin (TRY) 28.9% 31.0% 30.2% 1.3pp (0.8pp)

EBITDA margin

(US$) 28.9% 31.0% 30.2% 1.3pp

(0.8pp) Net income / loss (million UAH) (677.8) (5,630.0)

1,776.7 (362.1%) (131.6%)

Net income / loss

(million

TRY) (126.6) (675.2) 209.6 (265.6%)

(131.0%) Net income / loss (million US$) (59.4) (279.0) 79.5

(233.8%) (128.5%)

Capex (million UAH) 75.4

3,621.6 1,530.1 n.m. (57.8%) Capex

(million TRY) 12.0 403.2 255.3 n.m. (36.7%)

Capex (million

US$) 5.9 154.5 90.7

n.m. (41.3%)

(1) We may occasionally offer campaigns and tariff schemes that

have an active subscriber life differing from the one that we

normally use to deactivate subscribers and calculate churn.(2)

Active subscribers are those who in the past three months made a

revenue generating activity.(*) Astelit, in which we held a 55%

stake through Euroasia as of June 30, 2015, has operated in Ukraine

since February 2005. Since July 10, 2015, we hold 100% stake in

Astelit.

BeST’s financial performance continued to be impacted by

the macroeconomic environment in Belarus. The local currency has

further depreciated by 4% against US$ during the quarter leading to

further translation losses.

In TRY terms, BeST’s revenues remained nearly flat at TRY34

million (TRY34 million) while its EBITDA improved to TRY0.8 million

(TRY0.1 million) with an EBITDA margin of 2.2% (0.4%). In local

currency terms revenue rose by 16.7% with the expanding three-month

active subscriber base reaching 1.1 million.

BeST* Q214 Q115

Q215 y/y % q/q % Number of

subscribers (million) 1.3 1.4 1.4

7.7% - Active (3 months) 1.0 1.0 1.1 10.0% 10.0%

Revenue

(billion BYR) 163.1 176.6 190.3

16.7% 7.8% Revenue (million TRY) 34.5 30.0 34.1

(1.2%) 13.7%

Revenue (million US$) 16.3 12.2

12.9 (20.9%) 5.7% EBITDA (billion BYR) 0.7 0.4

4.2 500.0% 950.0%

EBITDA (million TRY) 0.1 0.1

0.8 700.0% 700.0% EBITDA (million US$) 0.1 0.0

0.3 200.0% -

EBITDA margin (BYR) 0.4% 0.2%

2.2% 1.8pp 2.0pp EBITDA margin (TRY) 0.4% 0.3%

2.2% 1.8pp 1.9pp

EBITDA margin (US$) 0.4% 0.0%

2.2% 1.8pp 2.2pp Net loss (billion BYR)

(335.1) (2,163.5) (643.4) 92.0% (70.3%)

Net loss (million

TRY) (67.2) (378.5) (115.0) 71.1%

(69.6%) Net loss (million US$) (32.3) (160.5) (43.0) 33.1%

(73.2%)

Capex (billion BYR) 16.2 20.2

22.3 37.7% 10.4% Capex (million TRY) 3.0 3.6

3.9 30.0% 8.3%

Capex (million US$) 1.5

1.4 1.4 (6.7%) -

(*) BeST, in which we hold an 80% stake, has operated in Belarus

since July 2008. As inflation accounting is ended starting from

Q1’15, Q2’14 figures presented in the table are not inflation

adjusted for comparative purposes.

Fintur’s subscribers remained nearly flat during the

quarter. Consolidated revenues of Fintur fell by 20.3% year-on-year

basis, mostly driven by the decline in Kcell and Azercell revenues.

Kcell revenues decreased due to increased competition, while

Azercell revenue decline resulted from devaluation of the

Azerbaijani Manat (AZN) against the US$. The contribution of Fintur

to Group net income remained stable at US$35 million (US$35

million) year-on-year.

Fintur* Q214 Q115

Q215 y/y % q/q % Subscribers

(million) 1 18.1 17.8

17.8 (1.7%) - Kazakhstan 11.4

10.8 10.8 (5.3%) - Azerbaijan 3.9 4.2 4.2 7.7% - Moldova 0.8 0.9

0.9 12.5% - Georgia 1.9 1.9 2.0 5.3% 5.3%

Revenue (million

US$) 468 387 373 (20.3%)

(3.6%) Kazakhstan 274 233 231 (15.7%) (0.9%) Azerbaijan 144

113 101 (29.9%) (10.6%) Moldova 18 15 18 - 20.0% Georgia 32 25 23

(28.1%) (8.0%)

Fintur’s contribution to Group’s net income

35 38 35 -

(7.9%)

(1) TeliaSonera disclosed a change to the definition of prepaid

mobile subscription for all countries of operations in its Q115

results announcement on April 21, 2015. Prepaid subscriptions are

counted if the subscriber has been active during the last three

months. In line with Telia Sonera’s reporting, we disclose Fintur

operations’ subscriber numbers as three-month active. Prior periods

are restated accordingly.(*) We hold a 41.45% stake In Fintur,

which has interests in Kazakhstan, Azerbaijan, Moldova and

Georgia.

Turkcell Group Subscribers

Turkcell Group mobile subscribers amounted to approximately 67.9

million as of June 30, 2015. This figure is calculated by taking

the number of subscribers of Turkcell and each of our subsidiaries

and unconsolidated investees. It includes the total number of

mobile subscribers of Turkcell Turkey, Astelit and BeST, as well as

of our operations in the Turkish Republic of Northern Cyprus

(“Northern Cyprus”), Fintur.

Turkcell Group Subscribers Q214

Q115 Q215 y/y % q/q

% Turkcell 34.6 34.3 34.0 (1.7%)

(0.9%) Ukraine 12.7 13.7 14.0 10.2% 2.2% Fintur1 18.1 17.8

17.8 (1.7%) - Northern Cyprus 0.4 0.4 0.4 - - Belarus 1.3 1.4 1.4

7.7% - Turkcell Europe2 0.4 0.3 0.3 (25.0%) -

Turkcell Group

Mobile Subscribers* (million) 67.5 67.9

67.9 0.6% -

Turkcell Group Fixed Subscribers

(thousand) 1,031.7 1,271.6

1,345.5 30.4% 5.8%

(*) Turkcell Group mobile subscribers figure includes the

subscriber figures of our non-consolidated subsidiaries.(1)

TeliaSonera disclosed a change to the definition of prepaid mobile

subscription for all countries of operations in its Q115 results

announcement on April 21, 2015. Prepaid subscriptions are counted

if the subscriber has been active during the last three months. In

line with TeliaSonera’s reporting, we disclose Fintur operations’

subscriber numbers as three-month active. Prior periods are

restated accordingly.(2) The “wholesale traffic purchase”

agreement, signed between Turkcell Europe GmbH operating in Germany

and Deutsche Telekom for five years in 2010, had been modified to

reflect the shift in business model to a “marketing partnership”.

The new agreement between Turkcell and a subsidiary of Deutsche

Telekom was signed on August 27, 2014. The transfer of Turkcell

Europe operations to Deutsche Telekom’s subsidiary was completed on

January 15, 2015. Subscribers are still included in the Turkcell

Group Subscriber figure.

OVERVIEW OF THE MACROECONOMIC ENVIRONMENT

The foreign exchange rates used in our financial reporting,

along with certain macroeconomic indicators, are set out below.

Q214 Q115 Q215

y/y % q/q % US$ / TRY rate

Closing Rate 2.1234 2.6102

2.6863 26.5% 2.9% Average Rate 2.1221 2.4633 2.6571 25.2% 7.9%

Consumer Price Index (Turkey) 2.1% 3.0%

1.7% (0.4pp) (1.3pp) GDP Growth

(Turkey) 2.3% 2.3% n.a n.a

n.a US$ / UAH rate Closing Rate 11.82 23.44 21.02

77.8% (10.3%) Average Rate 11.52 21.18 21.44 86.1% 1.2%

US$ /

BYR rate Closing Rate 10,200 14,740 15,346 50.5% 4.1% Average

Rate 10,035 14,528 14,801 47.5%

1.9%

RECONCILIATION OF NON-GAAP FINANCIAL MEASUREMENTS:

We believe that EBITDA is a measurement commonly used by

companies, analysts and investors in the telecommunications

industry that enhances the understanding of our cash generation

ability and liquidity position, and assists in the evaluation of

our capacity to meet our financial obligations. We also use EBITDA

as an internal measurement tool, and accordingly, we believe that

its presentation provides useful and relevant information to

analysts and investors. Our EBITDA definition includes Revenue,

Direct Cost of Revenue excluding depreciation and amortization,

Selling and Marketing expenses and Administrative expenses, but

excludes translation gain/(loss), finance income, share of profit

of equity accounted investees, gain on sale of investments,

income/(loss) from related parties, minority interest and other

income/(expense). EBITDA is not a measure of financial performance

under IFRS, and should not be construed as a substitute for net

earnings (loss) as a measure of performance, or cash flow from

operations as a measure of liquidity. The following table provides

a reconciliation of EBITDA, which is a non-GAAP financial

measurement, to net cash from operating activities, which we

believe is the most directly comparable financial measurement

calculated and presented in accordance with IFRS.

Turkcell Group (million US$) Q214

Q115 Q215 y/y % q/q

% EBITDA 427.8 376.6

374.3 (12.5%) (0.6%) Income tax expense (78.5)

(95.2) (52.9) (32.6%) (44.4%) Other operating income / (expense)

(45.1) (3.4) (66.5) 47.5% n.m Financial income / (expense) 28.4 3.7

4.2 (85.2%) 13.5% Net increase / (decrease) in assets and

liabilities (169.2) (571.5) 98.9 (158.5%) (117.3%)

Net cash from

operating activities 163.4 (289.8)

358.0 119.1% (223.5%)

FORWARD-LOOKING STATEMENTS: This release includes

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, Section 21E of the Securities Exchange Act

of 1934 and the Safe Harbor provisions of the US Private Securities

Litigation Reform Act of 1995. This includes, in particular, our

targets for revenue, EBITDA and capex in 2015 and our 4G and 3G

development in Turkey and Ukraine, respectively. More generally,

all statements other than statements of historical facts included

in this press release, including, without limitation, certain

statements regarding our operations, financial position and

business strategy may constitute forward-looking statements. In

addition, forward-looking statements generally can be identified by

the use of forward-looking terminology such as, among others,

"will," "expect," "intend," "estimate," "believe", "continue" and

“guidance”.Although Turkcell believes that the expectations

reflected in such forward-looking statements are reasonable at this

time, it can give no assurance that such expectations will prove to

be correct. All subsequent written and oral forward-looking

statements attributable to us are expressly qualified in their

entirety by reference to these cautionary statements. For a

discussion of certain factors that may affect the outcome of such

forward looking statements, see our Annual Report on Form 20-F for

2014 filed with the U.S. Securities and Exchange Commission, and in

particular the risk factor section therein. We undertake no duty to

update or revise any forward looking statements, whether as a

result of new information, future events or otherwise.

ABOUT TURKCELL: Turkcell is an integrated communication

and technology services player in Turkey. Turkcell Group has

approximately 67.9 million mobile subscribers in nine countries and

over 1.3 million fixed subscribers in Turkey as of June 30, 2015.

Turkcell was one of the first among the global operators to have

implemented HSPA+. It has announced two new HSPA+ Technologies on

its 3G network to meet rising data usage. Having successfully

integrated 3C-HSDPA and DC-HSUPA Technologies, it became the first

mobile operator in the world to enable peak speed of 63.3 Mbps

downlink while also enabled an 11.5 Mbps uplink on a 3G network.

Turkcell is the first telecom operator to offer households fiber

broadband connection at speeds of up to 1,000 Mbps in Turkey. As of

June 2015, Turkcell’s population coverage is at 99.85% in 2G and

92.06% in 3G. Turkcell Group reported a TRY3.1 billion (US$1.2

billion) revenue with total assets of TRY20.7 billion

(US$7.7billion) as of June 30, 2015. It has been listed on the NYSE

and the BIST since July 2000, and is the only NYSE-listed company

in Turkey. Read more at www.turkcell.com.tr

This press release can also be viewed using the Turkcell

Investor Relation app, which can be downloaded

here for iOS,

and here for Android mobile

devices.

Appendix A – Mobile Interconnect Revenues and Costs

Table: Mobile interconnect revenues and costs of

Turkcell Turkey

Million TRY Q214 Q115

Q215 y/y % q/q % Interconnect

revenues 281.2 278.4 312.2 11.0%

12.1%

as a % of revenues 10.8% 10.3%

11.0% 0.2pp 0.7pp Interconnect costs (262.7)

(261.8) (291.0) 10.8% 11.2%

as a % of revenues

(10.1%) (9.7%) (10.3%)

(0.2pp) (0.6pp) TURKCELL ILETISIM

HIZMETLERI A.S.

TURKISH ACCOUNTING STANDARDS SELECTED

FINANCIALS (TRY Million)

Quarter Ended Quarter Ended Quarter

Ended Half Ended Half Ended June

30, March 31, June 30, June 30, June

30,

2014

2015

2015

2014

2015

Consolidated Statement of Operations Data Turkcell

Turkey 2 595,1 2 710,5 2 834,6 5 069,7 5 545,1 Consumer 2 007,6 2

122,1 2 205,8 3 937,9 4 327,9 Corporate 506,6 531,7 550,0 993,2 1

081,7 Other 80,9 56,7 78,8 138,6 135,5 Turkcell International 268,0

192,9 204,7 579,0 397,6 Other 59,9 74,8 53,6 129,5 128,4 Total

revenues 2 923,0 2 978,2 3 092,9 5 778,2 6 071,1 Direct cost of

revenues (1 788,7) (1 828,0) (1 897,2) (3

529,6) (3 725,2) Gross profit 1 134,3 1 150,2 1 195,7 2

248,6 2 345,9 Administrative expenses (135,8) (140,8) (150,4)

(277,9) (291,2) Selling & marketing expenses (477,2) (476,3)

(458,9) (960,3) (935,2) Other Operating Income / (Expense) 104,3

569,9 153,0 360,2 722,9 Operating

profit before financing and investing costs 625,6 1 103,0 739,4 1

370,6 1 842,4 Income from investing activities 8,0 3,6 2,1 12,9 5,7

Expense from investing activities (5,1) (22,4) (4,5) (15,9) (26,9)

Share of profit of equity accounted investees 73,8 94,8

94,0 147,4 188,8 Income before financing costs

702,3 1 179,0 831,0 1 515,0 2 010,0 Finance expense (152,8) (1

087,5) 122,7 (709,5) (964,8) Monetary gain/(loss) 60,0 -

- 124,5 - Income before tax and

non-controlling interest 609,5 91,5 953,7 930,0 1 045,2 Income tax

expense (166,4) (234,3) (140,8) (327,0)

(375,1) Income before non-controlling interest 443,1 (142,8) 812,9

603,0 670,1 Non-controlling interest 49,6 284,4

(100,4) 250,3 184,0 Net income 492,7 141,6 712,5

853,3 854,1 Net income per share 0,22 0,06 0,33 0,39 0,39

Other Financial Data Gross margin 38,8% 38,6%

38,7% 38,9% 38,6% EBITDA(*) 907,0 926,8 994,8 1 794,3 1 921,7

Capital expenditures 314,0 755,5 957,4 654,4 1 712,9

Consolidated Balance Sheet Data (at period end) Cash and

cash equivalents 7 916,9 8 173,8 4 297,8 7 916,9 4 297,8 Total

assets 21 740,1 23 952,5 20 636,8 21 740,1 20 636,8 Long term debt

1 111,6 549,7 611,7 1 111,6 611,7 Total debt 3 459,9 4 127,3 4

014,2 3 459,9 4 014,2 Total liabilities 6 217,6 11 046,5 7 159,4 6

217,6 7 159,4 Total shareholders’ equity / Net Assets 15 522,5 12

906,0 13 477,5 15 522,5 13 477,5 ** For further details,

please refer to our consolidated financial statements and notes as

at 30 June 2015 on our web site.

TURKCELL ILETISIM

HIZMETLERI A.S.

IFRS SELECTED FINANCIALS (TRY

Million)

Quarter Ended Quarter Ended Quarter

Ended Half Ended Half Ended June

30, March 31, June 30, June 30, June

30,

2014

2015

2015

2014

2015

Consolidated Statement of Operations Data Turkcell

Turkey 2 595,1 2 710,5 2 834,6 5 069,7 5 545,1 Consumer 2 007,6 2

122,1 2 205,8 3 937,9 4 327,9 Corporate 506,6 531,7 550,0 993,2 1

081,7 Other 80,9 56,7 78,8 138,6 135,5 Turkcell International 268,0

192,9 204,7 579,0 397,6 Other 59,9 74,8 53,6 129,5 128,4 Total

revenues 2 923,0 2 978,2 3 092,9 5 778,2 6 071,1 Direct cost of

revenues (1 789,2) (1 828,6) (1 898,3) (3

531,5) (3 726,9) Gross profit 1 133,8 1 149,6 1 194,6 2

246,7 2 344,2 Administrative expenses (135,8) (140,8) (150,4)

(277,9) (291,2) Selling & marketing expenses (477,2) (476,3)

(458,9) (960,3) (935,2) Other Operating Income / (Expense) (92,0)

(53,0) (123,4) (95,5) (176,4)

Operating profit before financing costs 428,8 479,5 461,9 913,0

941,4 Finance costs (211,3) (735,7) 221,9 (763,2) (513,8) Finance

income 257,9 252,3 175,2 506,5 427,5 Monetary gain/(loss) 60,0 - -

124,5 - Share of profit of equity accounted investees 73,8

94,8 94,0 147,4 188,8 Income before taxes and

minority interest 609,2 90,9 953,0 928,2 1 043,9 Income tax expense

(166,5) (234,2) (140,5) (326,7) (374,7)

Income before minority interest 442,7 (143,3) 812,5 601,5 669,2

Non-controlling interests 49,6 284,4 (100,5)

250,3 183,9 Net income 492,3 141,1 712,0

851,8 853,1 Net income per share 0,22 0,06

0,33 0,39 0,39

Other Financial Data Gross

margin 38,8% 38,6% 38,6% 38,9% 38,6% EBITDA(*) 907,0 926,8 994,8 1

794,3 1 921,7 Capital expenditures 314,0 755,5 957,4 654,4 1 712,9

Consolidated Balance Sheet Data (at period end) Cash

and cash equivalents 7 916,9 8 173,8 4 297,8 7 916,9 4 297,8 Total

assets 21 767,2 23 977,7 20 661,4 21 767,2 20 661,4 Long term debt

1 111,6 549,7 611,7 1 111,6 611,7 Total debt 3 459,9 4 127,3 4

014,2 3 459,9 4 014,2 Total liabilities 6 221,8 11 050,4 7 162,8 6

221,8 7 162,8 Total shareholders’ equity / Net Assets 15 545,4 12

927,3 13 498,6 15 545,4 13 498,6 ** For further details,

please refer to our consolidated financial statements and notes as

at 30 June 2015 on our web site.

TURKCELL ILETISIM

HIZMETLERI A.S.

IFRS SELECTED FINANCIALS (US$

MILLION)

Quarter Ended Quarter Ended Quarter

Ended Half Ended Half Ended June

30, March 31, June 30, June 30, June

30,

2014

2015

2015

2014

2015

Consolidated Statement of Operations Data

Turkcell Turkey 1 223,5 1 101,2 1 066,7 2 336,1 2 167,9 Consumer

946,5 862,1 830,1 1 814,4 1 692,2 Corporate 238,8 216,0 207,0 457,6

423,0 Other 38,2 23,1 29,6 64,1 52,7 Turkcell International 126,9

78,4 77,0 267,0 155,4 Other 28,3 30,3 20,2 59,6 50,5 Total revenues

1 378,7 1 209,9 1 163,9 2 662,7 2 373,8 Direct cost of revenues

(843,9) (743,0) (714,4) (1 627,5) (1

457,4) Gross profit 534,8 466,9 449,5 1 035,2 916,4 Administrative

expenses (64,1) (57,2) (56,6) (128,0) (113,8) Selling &

marketing expenses (225,0) (193,3) (172,8) (442,1) (366,1) Other

Operating Income / (Expense) (43,3) (21,1) (46,3)

(44,8) (67,4) Operating profit before

financing costs 202,4 195,3 173,8 420,3 369,1 Finance expense

(99,7) (310,4) 84,4 (346,3) (226,0) Finance income 121,1 102,6 65,9

232,8 168,5 Monetary gain/(loss) 29,2 - - 58,7 - Share of profit of

equity accounted investees 34,8 38,2 35,4 67,9

73,6 Income before taxes and minority interest 287,8 25,7

359,5 433,4 385,2 Income tax expense (78,5) (95,2)

(52,9) (150,6) (148,1) Income before minority

interest 209,3 (69,5) 306,6 282,8 237,1 Minority interest 23,2

117,6 (38,1) 112,6 79,5 Net income

232,5 48,1 268,5 395,4 316,6 Net

income per share 0,11 0,02 0,12 0,18 0,14

Other Financial

Data Gross margin 38,8% 38,6% 38,6% 38,9% 38,6%

EBITDA(*) 427,8 376,6 374,3 827,0 750,9 Capital expenditures 152,8

289,4 348,2 308,2 637,6

Consolidated Balance Sheet Data

(at period end) Cash and cash equivalents 3 728,4 3 131,5 1

599,9 3 728,4 1 599,9 Total assets 10 251,1 9 186,2 7 691,4 10

251,1 7 691,4 Long term debt 523,5 210,6 227,7 523,5 227,7 Total

debt 1 629,4 1 581,2 1 494,3 1 629,4 1 494,3 Total liabilities 2

930,1 4 233,5 2 666,4 2 930,1 2 666,4 Total equity 7 321,0 4 952,6

5 025,0 7 321,0 5 025,0 * Please refer to the notes on

reconciliation of Non-GAAP Financial measures on page 15 ** For

further details, please refer to our consolidated financial

statements and notes as at 30 June 2015 on our web site.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150730006065/en/

TurkcellInvestor RelationsNihat Narin, Tel: + 90

212 313 1888investor.relations@turkcell.com.trorCorporate

Communications:Tel: + 90 212 313

2321Turkcell-Kurumsal-Iletisim@turkcell.com.tr

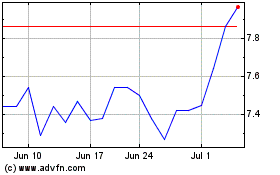

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Mar 2024 to Apr 2024

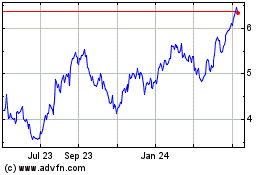

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Apr 2023 to Apr 2024