Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC) (BIST:TCELL):

- Please note that all financial data is

consolidated and comprises that of Turkcell Iletisim Hizmetleri

A.S., (the “Company”, or “Turkcell”) and its subsidiaries and

associates (together referred to as the “Group”). All non-financial

data is unconsolidated and comprises Turkcel Turkey only figures.

The terms "we", "us", and "our" in this press release refer only to

Turkcell Turkey, except in discussions of financial data, where

such terms refer to the Group, and where context otherwise

requires.

- In this press release, a year-on-year

comparison of our key indicators is provided and figures in

parentheses following the operational and financial results for

March 31, 2015 refer to the same item as at March 31, 2014. For

further details, please refer to our consolidated financial

statements and notes as at and for March 31, 2015, which can be

accessed via our website in the investor relations section

(www.turkcell.com.tr).

- Please note that selected financial

information presented in this press release for the first and

fourth quarters of 2014, and first quarter of 2015, both in TRY and

US$, is based on IFRS figures.

- In the tables used in this press

release totals may not foot due to rounding differences. The same

applies for the calculations in the text.

IMPORTANT NOTICE

Our target is to be an integrated communication and technology

services player in the region, operating a converged mobile and

fixed network platform and offering a wide range of innovative

products and services. We believe that it will be important to

offer to our consumer and corporate customers the full range of our

mobile, fixed and broadband services to meet their expectations.

Consequently, we intend to refocus our marketing and sales around

customer groups, presenting to each group the full scope of our

relevant services in an integrated and coordinated manner. In

pursuit of this goal, financial reporting of our telecommunication

businesses will now be presented under two major groups: “Turkcell

Turkey” and “Turkcell International”. The remaining businesses,

mainly the betting businesses in Turkey and Azerbaijan, continue to

be reported under “Other Subsidiaries”.

Turkcell Turkey comprises the business segments that have

historically reported as “Turkcell İletişim Hizmetleri A.Ş.” and

“Superonline İletişim Hizmetleri A.Ş.”, together with other Turkish

telecom related businesses including “Global Bilgi Pazarlama

Danışma ve Çağrı Servisi Hizmetleri A.Ş.” (call center services),

“Turktell Bilişim Servisleri A.Ş.” (Information technology, value

added GSM services investments), “Turkcell Teknoloji Araştırma ve

Geliştirme A.Ş.” (research and development), “Kule Hizmet ve

İşletmecilik A.Ş.” (telecommunications infrastructure business),

“Turkcell Satış ve Dağıtım Hizmetleri A.Ş.” (retail store in

telecommunications), “Turkcell Interaktif Dijital Platform ve

İçerik Hizmetleri A.Ş.” (radio and television broadcasting),

“Global Ödeme Hizmetleri A.Ş.” (value-added GSM services),

“Turkcell Gayrimenkul Hizmetleri A.Ş.” (real estate business for

Turkcell Group only), and “Rehberlik Hizmetleri A.Ş.” (information

services). Prior to this change, these businesses other than

Turkcell İletişim Hizmetleri A.Ş. and Superonline İletişim

Hizmetleri A.Ş. were reported under “Other Subsidiaries”. This new

reporting thus brings together all of our Turkish

telecommunications activities, including mobile services, fixed

line and fixed broadband, in accordance with our strategy of

offering a converged network to all of our customers.

Turkcell International comprises the business segments that have

historically reported as “Euroasia Telecommunications Holdings

B.V.”, “LLC Astelit” (Astelit in Ukraine) and “Belarusian

Telecommunications Network”, together with our other international

telecommunication operations, including “Beltur Coopertief U.A.”,

“Beltel Telekomünikasyon Hizmetleri A.Ş.”, “Lifetech LLC.”, “Kıbrıs

Mobile Telekomünikasyon Limited Şirketi”, “East Asian Consortium

B.V.” “LLC Ukrtower”, “LLC Global Bilgi ” “Turkcell Europe GmbH”

and “Fintur Holdings B.V.”(equity accounted investee).

We will begin applying this change in reporting to our first

quarter presentation and press release, reflecting the new approach

in both our financial and operational reporting. Accordingly, we

may be introducing new key performance indicators as necessary and

may phase out those that we believe are no longer relevant to an

understanding of our business.

Within Turkcell Turkey, we will monitor and present our revenue

performance across three separate customer segments – Consumer,

Corporate and Wholesale – and will provide performance indicators

measuring the use of different services (voice, data, services and

other, as appropriate). This represents a change from our prior

method of reporting, in which we reported the key revenue lines of

mobile services in Turkey along with total fixed services revenue.

Our IFRS financial statements reflect this new reporting structure

and our presentation of business segments changed accordingly.

As discussed above, we are implementing significant changes to

the manner in which we oversee our business and in the related

financial reporting. While we are confident that this will help to

improve our competitive position and results, no assurances can be

given that this will be the case. Organizational changes carry

inherent risks, including notably customer, distributor and

employee acceptance and operational disruption. They also present

challenges with respect to ensuring adequate financial reporting

and internal controls over financial reporting. Furthermore,

implementing such changes may require significant management time

and energy, diverting resources away from other issues. While we

will of course endeavor to limit and manage any such issues as and

when they arise, no assurance can be given that the changes

described will be effectively applied and will achieve the desired

results, will not lead to further changes, and will not have

adverse effects on our competitive position and financial

results.

HIGHLIGHTS OF THE FIRST QUARTER OF 2015

- Turkcell Group registered its

historically highest first quarter revenue of TRY2,978 million

(TRY2,855 million) on 4.3% year-on-year growth

- Turkcell Group EBITDA1 rose by 4.5% to

its record high first quarter level of TRY927 million (TRY887

million) as well, while the EBITDA margin was flat at 31.1%

(31.1%)

- Turkcell Group EBIT2 grew by 9.2% to

TRY533 million (TRY488 million)

- Turkcell Group recorded net income of

TRY141 million (TRY359 million). Yet while Turkcell Turkey recorded

a net income of TRY779 million (TRY557 million) on 40% year-on-year

growth, Group net income was negatively impacted by the TRY656

million (TRY219 million) net loss of Turkcell International due to

currency devaluation

- Excluding the impact of foreign

exchange movements, monetary gain in relation to inflationary

accounting in Belarus and one-off items, Group net income would

have increased by 8.6% year-on-year to TRY655 million (TRY603

million)

- Turkcell Turkey revenues, comprising

consumer, corporate and wholesale revenues, in total increased by

10% to TRY2,711 million (TRY2,475 million) with an EBITDA margin of

30.7% (31.1 %)

- Consumer segment revenues grew by 10%

to TRY2,122 million (TRY1,930 million) fueled predominantly by the

increase in mobile broadband revenues, but also in fixed broadband

revenues

- Corporate segment revenues rose by 9%

to TRY532 million (TRY487 million), mainly due to the rise in

mobile broadband revenues, as well as in fixed broadband

revenues

- Wholesale segment increased by 2% to

TRY71 million (TRY70 million)

- Turkcell International revenues

declined by 38% to TRY193 million (TRY311 million), mainly due to

devaluation of local currencies in Ukraine and Belarus against

US$

- On March 25, 2015, Mr. Kaan Terzioğlu

was appointed as Turkcell Chief Executive Officer, effective from

April 1, 2015

- The general assembly, outstanding for

the past five years, was held on March 26, 2015, and accordingly a

dividend of TRY1.78 per share was distributed in April, amounting

to TRY3,925 million in total

(1) EBITDA is a non-GAAP financial measure. See page 15 for the

reconciliation of EBITDA to net cash from operating activities.

(2) EBIT is a non-GAAP financial measure and is equal to EBITDA

minus depreciation and amortization expenses.

(*)For further details, please refer to our consolidated

financial statements and notes as at and for March 31, 2015 which

can be accessed via our web site in the investor relations section

(www.turkcell.com.tr).

COMMENTS FROM CEO, KAAN TERZIOGLU

“Turkcell Group generated record high first quarter revenue and

EBITDA in the first quarter of 2015. Consolidated revenue rose 4.3%

to TRY3.0 billion and EBITDA grew by 4.5% to TRY927 million.

Consolidated EBIT grew by 9.2% to TRY533 million. Net income of

TRY141 million was impacted by currency devaluation in the

countries of our international subsidiaries.

“Overall, first quarter performance was in line with our

expectations, enabling us to reiterate our revenue growth guidance*

at 6% - 9% for 2015. Further, we target an EBITDA margin within the

31% - 32% range.

“In the first quarter of 2015 Turkcell Group witnessed a number

of notable developments. The general assembly, outstanding for the

past five years, was held, and accordingly a dividend of TRY1.78

per share was distributed, amounting to TRY3,925 million in total.

Meanwhile, Astelit, our Ukrainian subsidiary, won that country’s

most efficient 3G frequency licence, confirming our long-term

commitment to the country. Moreover, Astelit posted 18% top-line

growth for this quarter in local currency and we believe it will

strengthen its growth momentum on the back of upcoming 3G

services.

“In its twenty year history, Turkcell’s pioneering and

successful track record has earned it the appreciation of Turkey.

And now, a new business model in step with changing sector dynamics

has become a necessity in order to advance this success to the next

level. In this regard, and starting from the first quarter of the

year, we have grouped our telecommunication businesses as “Turkcell

Turkey” and “Turkcell International”.

“Within this context, at “Turkcell Turkey”, we have set a new

structure for managing our mobile, fixed and TV business more

effectively. We will monitor our businesses under three segments,

including consumer, corporate and wholesale. And so we hereby

announce our new approach, which is reflected in our reporting

starting from this quarter. Our aim is to extend our innovative

approach and converged services already applied in the corporate

segment to the consumer segment. We believe that our converged

offerings should advance customer loyalty, our competitive strength

and operational efficiency, which together will underpin

sustainable growth. We believe that we can strengthen our position

serving integrated communication and technology services both in

Turkey and in the region, on the back of our converged network

platform, wide portfolio of innovative products and services,

robust financial standing and successful teamwork.

“We sincerely believe that we will bolster and extend Turkcell’s

success story to the region as we build the future together. We

thank all of our stakeholders for sharing our success story with

us.”

(*) Please note that this paragraph contains forward looking

statements based on our current estimates and expectations

regarding market conditions for each of our different businesses.

No assurance can be given that actual results will be consistent

with such estimates and expectations. For a discussion of factors

that may affect our results, see our Annual Report on Form 20-F for

2014 filed with U.S. Securities and Exchange Commission, and in

particular, the risk factor section therein.

OVERVIEW OF TURKCELL TURKEY

In the first quarter, consumer business in the

telecommunications market saw slightly increased competition

compared to the previous quarter. On the mobile front, competition

revolved around increased incentives, particularly on data as part

of bundle offers at price levels similar to the previous quarter.

Meanwhile, on the fixed side, multiplay services remained

aggressively priced by major players. So far in April, we have

observed a similar competition trend on both the mobile and fixed

fronts. In this environment, we have continued to seek to

facilitate our customers’ lives through specialized and targeted

offers matching their needs with our segmented approach.

Furthermore, we have designed and communicated our strategy around

clear pricing, triple play and customer care on the fixed

front.

On the corporate front, for which we foresee great potential, a

number of factors including geopolitical tension and its

macroeconomic consequences, as well as Turkey’s approaching

elections, have collectively contributed to curbing the market’s

growth momentum for the quarter. Yet in this environment, we

believe that we remained a valued partner for our corporate

customers, enabling them to transform their business processes with

new generation mobile and fixed technologies. In this respect, our

“real-time enterprise” initiative aims to transform traditional

enterprise models into innovative, mobile-centric, and real-time

business processes on the following three pillars. By becoming a

“mobile enterprise” with our converged offers and solutions,

corporates communicate efficient “real-time marketing” to their

customers. Meanwhile, our “zero-infrastructure enterprise” pillar,

which leverages our strong converged network platform, provides

enterprises a flexible, fast and secure IT & communication

infrastructure without the burden of capital expenditure. Moreover,

our machine-to-machine solutions, data center and cloud services,

supported by the largest commercial sales team, sustain our

leadership in mobile services, while strengthening our fixed

services growth momentum.

With our differentiating value propositions served on a superior

quality network, we are on track with our operational targets for

the first quarter. On the mobile side, our postpaid subscribers

continued to expand, by 313 thousand quarterly additions to 15.5

million, constituting 45.3% (40.5%) of total mobile subscribers.

The total mobile subscriber base declined by 370 thousand, mainly

on losses from price sensitive prepaid customers. In our fixed

business, including ADSL and fiber, we are reaping the fruits of

our investments into coverage, a unique and efficient sales force

and diligent customer service. Together, we have reached 1.3

million subscribers with net quarterly ADSL additions of 39

thousand and fiber additions of 41 thousand. With 776 thousand

subscribers, we maintained our leading position in the fiber

segment. Moreover, our TV platform, Turkcell TV+, a catalyst of

potential growth, has seen outstanding penetration, which had

reached around 100 thousand subscribers in the six months since its

launch alone.

On the terminal front, the number of smartphones on our network

grew by 589 thousand quarterly additions to 13.2 million,

corresponding to 42% penetration. This was achieved through our

attractive contract offers and promotional campaigns. Meanwhile,

our own-branded T-series smartphones now include the “Turbo T50”,

which supports triple carrier technology providing users the

fastest 3G broadband speed of 63.3 Mbps on our network.

Furthermore, we continue to differentiate ourselves through

innovative additions to our services. We have upgraded our BİP

service, Turkey’s first all access instant messaging platform,

providing an enriched instant messaging experience with advanced

qualifications, which has reached half a million subscribers in

less than a month. Meanwhile, Turkcell Muzik, with its enhanced

features, remained Turkey’s biggest digital music service with the

largest local content catalogue, exceeding 1 million subscribers.

In short, we continue to improve our customers’ lives with our

differentiating value propositions.

FINANCIAL AND OPERATIONAL REVIEW OF THE FIRST QUARTER

2015

The following discussion focuses principally on the developments

and trends in our business in the first quarter of 2015 in TRY

terms. Selected financial information presented in this press

release for the first and fourth quarters of 2014, and the first

quarter of 2015, both in TRY and US$ is based on IFRS figures.

Selected financial information for the first and fourth quarters

of 2014, and the first quarter of 2015, both in TRY and in US$

prepared in accordance with IFRS, and in TRY prepared in accordance

with the Turkish Accounting standards, is also included at the end

of this press release.

Financial Review of Turkcell Group

Profit & Loss Statement (million TRY)

Q114 Q414 Q115 y/y

% q/q % Total Revenue

2,855.2 3,103.2 2,978.2

4.3% (4.0%) Direct cost of revenues1 (1,742.3)

(1,972.2) (1,828.6) 5.0% (7.3%)

Direct cost of

revenues1/revenues (61.0%) (63.6%)

(61.4%) (0.4pp) 2.2pp Depreciation and

amortization (399.6) (450.7) (394.3) (1.3%) (12.5%)

Gross

Margin 39.0% 36.4% 38.6% (0.4pp)

2.2pp Administrative expenses (142.1) (146.8) (140.8) (0.9%)

(4.1%)

Administrative expenses/revenues (5.0%)

(4.7%) (4.7%) 0.3pp - Selling and

marketing expenses (483.1) (517.8) (476.3) (1.4%) (8.0%)

Selling

and marketing expenses/revenues (16.9%) (16.7%)

(16.0%) 0.9pp 0.7pp EBITDA2

887.3 917.1 926.8 4.5% 1.1%

EBITDA Margin 31.1% 29.6% 31.1%

- 1.5pp EBIT3 487.7 466.4

532.5 9.2% 14.2% Net finance income /

(expense) (303.3) (176.9) (483.4) 59.4% 173.3% Finance expense

(551.9) (400.1) (735.7) 33.3% 83.9% Finance income 248.6 223.2

252.3 1.5% 13.0% Share of profit of associates 73.6 (6.9) 94.8

28.8% n.m. Other income / (expense) (3.5) 1.4 (53.0) n.m. n.m.

Monetary gains / (losses) 64.5 32.3 - n.m. n.m. Non-controlling

interests 200.7 128.9 284.4 41.7% 120.6% Income tax expense (160.2)

(187.3) (234.2) 46.2% 25.0%

Net Income 359.5

257.9 141.1 (60.8%)

(45.3%)

(1) Including depreciation and amortization expenses.

(2) EBITDA is a non-GAAP financial measure. See page 15 for the

reconciliation of EBITDA to net cash from operating activities.

(3) EBIT is a non-GAAP financial measure and is equal to EBITDA

minus depreciation and amortization expenses.

Revenue grew by 4.3% year-on-year to TRY2,978 million

(TRY2,855 million).

Turkcell Turkey revenues reached TRY2,711 million (TRY2,475

million) on 9.5% growth.

- Consumer and Corporate revenues in

total grew by 9.8% to TRY2,654 million (TRY2,417 million)

- Voice revenues declined by 3.5% to

TRY1,432 million (TRY1,484 million)

- Data revenues grew by 46.2% to TRY826

million (TRY565 million) driven by the increased smartphone

penetration, higher user number and rise in data consumption

- Services and solutions revenues

declined by 1.2% to TRY278 million (TRY281 million) mainly due to

the decrease in messaging revenues

- Other revenues mainly comprising our

retail and call center revenues grew by 36.3% to TRY118 million

(TRY87 million)

- Wholesale revenues climbed 1.7% to

TRY71 million (TRY70 million)

Turkcell International revenues declined by 38.0% to TRY193

million (TRY311 million), due mainly to devaluation of UAH against

US$ in Ukraine and BYR against US$ in Belarus.

Other subsidiaries1 revenues, mainly comprising our betting

business revenues, increased by 7.4% to TRY75 million (TRY70

million).

Direct cost of revenues grew by 5.0% to TRY1,829 million

(TRY1,742 million), while as a percentage of revenues rising to

61.4% (61.0%). This was driven by increase in operational expenses

of certain subsidiaries and other various cost items more than

offsetting the decrease in interconnect costs and depreciation

amortization expenses as a percentage of revenues.

The table below presents the mobile interconnect revenues and

costs of Turkcell Turkey:

Million TRY Q114 Q414

Q115 y/y % q/q %

Interconnect revenues 253.7 281.3 278.4

9.7% (1.0%)

as a % of revenues 10.3%

10.2% 10.3% - 0.1pp Interconnect costs

(241.4) (267.1) (261.8) 8.5% (2.0%)

as a % of revenues

(9.8%) (9.6%) (9.7%)

0.1pp (0.1pp)

Administrative expenses as a percentage of revenues fell

0.3pp to 4.7% (5.0%) year-on-year due to the decline in various

cost items.

Selling and marketing expenses as a percentage of

revenues declined by 0.9pp to 16.0% (16.9%) year-on-year due to

decrease in selling expenses (1.0pp), as opposed to the increase in

other cost items (0.1pp).

EBITDA* rose by 4.5% to TRY927 million (TRY887

million) year-on-year, while the EBITDA margin was at 31.1%

(31.1%). The decrease in selling and marketing expenses by 0.9pp,

as well as administrative expenses by 0.3pp was offset by increase

in direct cost of revenues (excluding depreciation and

amortization) by 1.2pp as a percentage of revenues.

The EBITDA of Turkcell International declined by 34.2% to TRY53

million (TRY81 million) with the negative impact of local currency

devaluation in Ukraine and Belarus. Meanwhile, the EBITDA of Other

subsidiaries1 improved by 15.0% to TRY43 million (TRY37

million).

Net finance expense of TRY483 million (TRY303 million)

was recorded in Q115, due mainly to the increase in translation

losses to TRY698 million (TRY509 million).

The table below presents translation gain and loss details:

Million TRY Q114 Q414

Q115 Turkcell Turkey 9.2 64.3

308.2 Turkcell International (517.7) (447.6) (1,008.2) Other

Subsidiaries (0.1) 0.3 1.7

Turkcell Group

(508.6) (383.0) (698.3)

Share of profit of equity accounted investees comprising

our share in the net income of unconsolidated investee Fintur rose

by 28.8% year-on-year to TRY94.8 million (TRY73.6 million2).

(*)EBITDA is a non-GAAP financial measure. See page 15 for the

reconciliation of EBITDA to net cash from operating activities.

(1)Other subsidiaries mainly comprise our betting business and

interbusiness eliminations.

(2)In Q114, share of profit of equity accounted investees also

included A-Tel.

Income tax expense details in Q115 are presented in the

table below:

Million TRY Q114 Q414

Q115 y/y % q/q % Current

Tax expense (174.0) (170.3) (251.9)

44.8% 47.9% Deferred Tax Income/expense 13.8 (17.0) 17.7

28.3% (204.1%)

Income Tax expense (160.2)

(187.3) (234.2) 46.2%

25.0%

Net income fell by 60.8% to TRY141 million (TRY359

million) in Q115, mainly driven by higher translation losses and

income tax expense recorded along with one-off provisions booked

for commercial agreements, despite the increase in EBITDA. Higher

translation losses mainly originated from 49% devaluation of UAH

against US$ in Ukraine and 24% devaluation of BYR against US$ in

Belarus, which was partially compensated for by the translation

gain originated from 13% devaluation of TRY against US$ due to our

foreign currency cash position. Moreover, as the decision to end

inflationary accounting in Belarus has been taken on the back of a

relatively lower inflationary environment, no monetary gain was

booked in Q115, which has also impacted net income.

Excluding the foreign exchange movement impacts, monetary gain

impact in relation to inflationary accounting in Belarus and

one-off items, Group net income would have increased by 8.6%

year-on-year to TRY655 million (TRY603 million). One-off items in

Q114 were mainly related to penalties and legal provisions.

Net income impacts (million TRY) Q114

Net income impacts (million TRY)

Q115 Net income excluding one-offs* 603 Net income

excluding one-offs* 655 Translation loss (509) Translation

loss (698) Minority share 209 Minority share 293 Income tax impact

(1) Income tax impact (62) Monetary gain 64 Monetary gain - One off

impacts (7) One off impacts (47)

Net income reported

359 Net income reported 141

(*) Net income excluding one-off impacts is a presentation of

our net income, adjusted to exclude certain items that we consider

to be exceptional. However, it should not be relied upon as

comparable to reported net income prepared in accordance with the

IFRS that we apply. Although we expect that the specific items

represented in this adjustment are non-recurring, no assurance can

be given that this will be the case and that we will not be

affected by similar items in the future.

Total debt as of March 31, 2015 increased to TRY4,127.3

million (US$1,581.2 million) from TRY3,697.7 million (US$1,594.6

million) as of December 31, 2014 in consolidated terms. Turkcell

Turkey’s debt balance was TRY1,055.2 million (US$404.3 million), of

which TRY574.6 million (US$220.2 million) was denominated in US$.

The debt balance of Ukraine (including intra-group debt) was

TRY2,228.8 million (US$853.9 million). Belarus had a debt balance

of TRY1,814.6 million (US$695.2 million).

TRY3,283.4 million (US$1,257.9 million) of our consolidated debt

is at a floating rate, while TRY3,577.6 million (US$1,370.7

million) will mature within less than a year. (Please note that the

figures in parentheses refer to US$ equivalents).

Cash flow analysis: Capital expenditures, including

non-operational items, amounted to TRY755.5 million in Q115, of

which TRY344 million was related to Turkcell Turkey, and TRY408

million to Turkcell International. The cash flow item noted as

“other” included cash outflows in relation to change in corporate

tax payment of Turkcell İletişim (TRY132 million), frequency usage

fee payment (TRY495 million) and other items (TRY663 million),

which is mainly related to net working capital.

Consolidated Cash Flow (million TRY)

Q114 Q414 Q115

EBITDA1 887.3 917.1

926.8 LESS: Capex and License (340.4) (935.3) (755.5)

Turkcell Turkey (315.7) (867.5) (343.9) Turkcell International2

(23.0) (67.2) (408.4) Other Subsidiaries3 (1.7) (0.6) (3.2) Net

interest Income/ (expense) 205.4 206.1 214.9 Other (995.9) 57.8

(1,290.6) Net Change in Debt 103.8 94.2 46.3

Cash generated

(139.8) 339.9 (858.0) Cash balance

7,989.1 9,031.9 8,173.8

(1) EBITDA is a non-GAAP financial measurement. See page 15 for

the reconciliation of EBITDA to net cash from operating

activities.

(2) The impact from the movement of reporting currency (TRY)

against US$ is included in this line.

(3) Other subsidiaries comprise our betting business and

interbusiness eliminations.

Operational Review in Turkey

Summary of Operational data Q114

Q414 Q115 y/y % q/q

% Number of mobile subscribers (million)

34.8 34.6 34.3

(1.4%) (0.9%) Postpaid 14.1 15.2 15.5 9.9%

2.0% Prepaid 20.7 19.4 18.7 (9.7%) (3.6%)

Mobile ARPU (Average

Monthly Revenue per User), blended (TRY) 21.0

23.0 22.7 8.1% (1.3%) Postpaid 36.3

38.0 36.9 1.7% (2.9%) Prepaid 10.8 11.6 11.3 4.6% (2.6%)

Mobile

ARPU (Average Monthly Revenue per User), blended (US$)

9.5 10.3 9.2 (3.2%) (10.7%)

Postpaid 16.3 17.0 15.0 (8.0%) (11.8%) Prepaid 4.8 5.2 4.6 (4.2%)

(11.5%)

Mobile Churn (%) 7.8% 7.7% 7.7%

(0.1pp) - Mobile MOU (Average Monthly Minutes of

usage per subs)blended 254.6 279.3 275.7

8.3% (1.3%) Number of Fixed subscriber

(thousand) 942.1 1,191.3 1,271.6

35.0% 6.7% Fiber 614.0 735.1 776.1 26.4% 5.6% ADSL

328.1 456.2 495.5 51.0% 8.6%

Fixed Residential ARPU, blended

(TRY) 47.2 48.1 47.1

(0.2%) (2.1%)

Mobile Subscribers of Turkcell Turkey fell by 370

thousand to 34.3 million during the first quarter due to losses in

the more price-sensitive prepaid segment with the increased

competition. Meanwhile, we expanded our postpaid subscriber base by

313 thousand quarterly net additions mainly through pre to post

switches. We believe that our network quality was a factor driving

this growth. Consequently, the postpaid subscriber share in our

total subscriber base has improved to 45.3% (40.5%).

Mobile Churn Rate refers to voluntarily and involuntarily

disconnected subscribers. Our churn rate declined by 0.1pp

year-on-year to 7.7% (7.8%) while remained flat compared to

previous quarter.

Mobile ARPU grew by 8.1% to TRY22.7 (TRY21.0) in Q115 on

the back of increased mobile broadband usage and higher postpaid

customer base.

Mobile MoU rose by 8.3% to 275.7 minutes in Q115 driven

by higher incentives and higher package utilization.

Fixed Subscribers of Turkcell Turkey reached 1.3 million

with the growth of our fiber and ADSL customer base on the back of

our investments into coverage, efficient sales force and diligent

customer service. Fiber customers rose to 776 thousand with 41

thousand quarterly net additions while ADSL customers reached 496

thousand with 39 thousand quarterly increase. Meanwhile, our fiber

network rose to 33.4 thousand km with home passes reaching 2.2

million.

Fixed Residential ARPU was nearly flat at TRY47.1

(TRY47.2) in Q115.

TURKCELL INTERNATIONAL

Astelit’s financial performance continued to be

negatively impacted by the challenging macroeconomic environment in

Ukraine. In Q115, the local currency has significantly depreciated

by 49% against US$ during the quarter, which has negatively

impacted Astelit’s contribution to Turkcell Group revenues, leading

to substantial translation losses at the consolidated level.

Astelit sustained its top-line growth momentum, registering 18%

revenue growth in local currency terms. Yet in Turkish Lira terms,

revenues fell by 42.8% to TRY126 million (TRY220 million) and

EBITDA declined by 44.4% to TRY39 million (TRY70 million) with an

EBITDA margin of 31.0% (31.8%).

Astelit increased its three-month active subscribers to 10.3

million, registering 1.0 million net additions year-on-year.

Blended ARPU (3-month active) rose by 5.9% to UAH34.3 (UAH32.4)

driven by increased data consumption. The MoU (12-month active)

declined 6.7% to 155.9 minutes (167.1 minutes) in Q115 resulting

from changing consumer behavior due to tough macroeconomic

conditions.

Political tension prevailing in Ukraine since early 2014, has

started to settle down following the ceasefire and “global

political settlement” announced at the Minsk summit in February.

While the conflict areas in eastern Ukraine continue to be

challenging, our operations in these regions are running without

major incidents.

In the 3G licence tender Astelit won the most efficient

frequency band, in terms of investment and provision of high

quality services, for UAH3.4 billion (approximately US$143 million

as of March 31, 2015). This investment is proof of our long-term

commitment to the country where 3G can be considered an important

milestone in its telecommunication sector. Having initiated

pre-subscription for its 3G services, Astelit intends to launch

them this summer.

Astelit* Q114 Q414

Q115 y/y % q/q % Number of

subscribers (million)1 12.5

13.9 13.7 9.6%

(1.4%) Active (3 months)2 9.3 10.3 10.3 10.8% -

MoU

(minutes) (12 months) 167.1 162.8 155.9

(6.7%) (4.2%) ARPU (Average Monthly Revenue per

User), blended (US$) 2.6 1.8 1.2

(53.8%) (33.3%) Active (3 months) (US$) 3.6 2.4 1.7

(52.8%) (29.2%) Active (3 months) (UAH) 32.4 33.3 34.3 5.9% 3.0%

Revenue (million UAH) 899.5 1,046.7

1,059.0 17.7% 1.2% Revenue (million TRY) 220.3

167.1 126.1 (42.8%) (24.5%)

Revenue (million US$)

99.0 74.5 51.4 (48.1%) (31.0%)

EBITDA (million UAH) 287.7 310.4 327.5 13.8% 5.5%

EBITDA

(million TRY) 70.1 49.7 39.0

(44.4%) (21.5%) EBITDA (million US$)3 31.5 22.2 15.9

(49.5%) (28.4%)

EBITDA margin (UAH) 32.0%

29.7% 30.9% (1.1pp) 1.2pp EBITA margin

(TRY) 31.8% 29.7% 31.0% (0.8pp) 1.3pp

EBITDA margin (US$)

31.9% 29.7% 31.0% (0.9pp) 1.3pp

Net loss (million UAH) (2,004.9) (2,078.7) (5,630.0)

180.8%

170.8% Net loss (million TRY) (478.1)

(323.2) (675.2) 41.2% 108.9% Net loss

(million US$) (213.1) (145.0) (279.0) 30.9% 92.4%

Capex (million

UAH) 75.2 327.2 3,621.6 n.m.

n.m. Capex (million TRY) 15.0 37.7 403.2 n.m. 969.5%

Capex (million US$) 6.9 15.8

154.5 n.m. 877.8%

(1) We may occasionally offer campaigns and tariff schemes that

have an active subscriber life differing from the one that we

normally use to deactivate subscribers and calculate churn.

(2) Active subscribers are those who in the past three months

made a revenue generating activity.

(*) Astelit, in which we hold a 55% stake through Euroasia, has

operated in Ukraine since February 2005.

BeST’s financial performance was negatively impacted by

the macroeconomic environment in Belarus. The local currency

depreciating 24% against US$ during the quarter, led BeST’s

contribution to Turkcell Group revenues to decline and caused

significant translation losses at the Group level.

In TRY terms, BeST’s revenues fell 25.6% to TRY30 million (TRY40

million) while its EBITDA declined to TRY0.1 million (TRY0.9

million) with an EBITDA margin of 0.3% (2.3%). In local currency

terms revenue rose by 1%.

BeST* Q114 Q414

Q115 y/y % q/q % Revenue

(billion BYR) 175.6 198.3 176.6

0.6% (10.9%) Revenue (million TRY) 40.3 40.7 30.0 (25.6%)

(26.3%)

Revenue (million US$) 18.1 18.2 12.2 (32.6%) (33.0%)

EBITDA (billion BYR) 4.1 (6.3) 0.4 (90.2%) (106.3%)

EBITDA

(million TRY) 0.9 (1.2) 0.1 (88.9%) (108.3%) EBITDA (million

US$)3 0.4 (0.5) 0.0 (100.0%) (100.0%)

EBITDA margin (BYR)

2.3% (3.2%) 0.2% (2.1pp) 3.4pp EBITDA margin (TRY) 2.3% (3.0%) 0.3%

(2.0pp) 3.3pp

EBITDA margin (US$) 2.4% (3.0%)

0.0% (2.4pp) 3.0pp Net loss (billion BYR)

(348.3) (941.3) (2,163.5) 521.2% 129.8%

Net loss (million

TRY) (78.2) (172.2) (378.5) 384.0% 119.8% Net loss (million

US$) (35.5) (73.5) (160.5) 352.1% 118.4%

Capex (billion BYR)

29.2 85.9 20.2 (30.8%) (76.5%) Capex (million TRY) 6.5 15.1 3.6

(44.6%) (76.2%)

Capex (million US$) 3.0 6.4

1.4 (53.3%) (78.1%)

(*)BeST, in which we hold a 80% stake, has operated in Belarus

since July 2008. As Inflation accounting is ended starting from

Q1’15, Q1’14 and Q4’14 figures presented in the table are not

inflation adjusted for comparative purposes.

Fintur’s subscriber base declined by 322 thousand during

the quarter, due mainly to KCell’s subscriber decline of 363

thousand. Fintur’s consolidated revenues fell by 10.4% mostly due

to the decline in KCell and Azercell revenues. Kcell’s revenue

decline resulted from increased competition and lower interconnect

costs, while Azercell revenues decreased mainly due to devaluation

of the Azerbaijani Manat (AZN) against the US$. However, Fintur’s

contribution to net income rose by 15% to US$38 million (US$33

million) year-on-year due to positive foreign exchange rate effect

mainly related to US$ cash balances in Azerbaijan.

Fintur* Q114 Q414

Q115 y/y % q/q % Subscribers

(million) 1 17.9 18.2

17.8 (0.6%) (2.2%) Kazakhstan

11.2 11.2 10.8 (3.6%) (3.6%) Azerbaijan 4.0 4.2 4.2 5.0% - Moldova

0.9 0.9 0.9 - - Georgia 1.9 1.9 1.9 - -

Revenue (million

US$) 432 423 387 (10.4%) (8.5%) Kazakhstan

259 248 233 (10.0%) (6.0%) Azerbaijan 124 127 113 (8.9%) (11.0%)

Moldova 17 17 15 (11.8%) (11.8%) Georgia 31 31 25 (19.4%) (19.4%)

Fintur’s contribution to Group’s net income 33

(3) 38 15.2%

n.m.

(1) Telia Sonera disclosed a change to the definition of prepaid

mobile subscription for all countries of operations in its Q115

results announcement on April 21, 2015. Prepaid subscriptions are

counted if the subscriber has been active during the last three

months. In line with Telia Sonera’s reporting, we disclose Fintur

operations’ subscriber numbers as three-month active. Prior periods

are restated accordingly.

(*) We hold a 41.45% stake In Fintur, which has interests in

Kazakhstan, Azerbaijan, Moldova and Georgia.

Turkcell Group Subscribers amounted to approximately 67.9

million as of March 31, 2015. This figure is calculated by taking

the number of subscribers of Turkcell and each of our subsidiaries

and unconsolidated investees. It includes the total number of

mobile subscribers of Turkcell Turkey, Astelit and BeST, as well as

of our operations in the Turkish Republic of Northern Cyprus

(“Northern Cyprus”), Fintur.

Turkcell Group Mobile Subscribers* (million)

Q114 Q414 Q115 y/y

% q/q % Turkcell 34.8 34.6

34.3 (1.4%) (0.9%) Ukraine 12.5 13.9 13.7 9.6% (1.4%)

Fintur1 17.9 18.2 17.8 (0.6%) (2.2%) Northern Cyprus 0.4 0.4 0.4 -

- Belarus 1.3 1.4 1.4 7.7% - Turkcell Europe2 0.4 0.4 0.3 (25.0%)

(25.0%)

TURKCELL GROUP 67.3 68.9

67.9 0.9% (1.5%)

(*) Turkcell Group subscribers figure include the subscriber

figures of our non-consolidated subsidiaries.

(1) Telia Sonera disclosed a change to the definition of prepaid

mobile subscription for all countries of operations in its Q115

results announcement on April 21, 2015. Prepaid subscriptions are

counted if the subscriber has been active during the last three

months. In line with Telia Sonera’s reporting, we disclose Fintur

operations’ subscriber numbers as three-month active. Prior periods

are restated accordingly.

(2) The “wholesale traffic purchase” agreement, signed between

Turkcell Europe GmbH operating in Germany and Deutsche Telekom for

five years in 2010, had been modified to reflect the shift in

business model to a “marketing partnership”. The new agreement

between Turkcell and a subsidiary of Deutsche Telekom was signed on

August 27, 2014. The transfer of Turkcell Europe operations to

Deutsche Telekom’s subsidiary was completed on January 15, 2015.

Subscribers are still included in Turkcell Group Subscriber

figure.

OVERVIEW OF THE MACROECONOMIC ENVIRONMENT

The foreign exchange rates used in our financial reporting,

along with certain macroeconomic indicators, are set out below.

Q114 Q414

Q115 y/y % q/q % US$ / TRY

rate Closing Rate 2.1898

2.3189 2.6102 19.2% 12.6% Average Rate 2.2253 2.2421 2.4633 10.7%

9.9%

Consumer Price Index (Turkey) 3.6% 1.6%

3.0% (0.6pp) 1.4pp GDP Growth (Turkey)

4.8% 2.4% n.a. n.a. n.a. US$

/ UAH rate Closing Rate 10.95 15.77 23.44 114.1% 48.6% Average

Rate 9.15 14.09 21.18 131.5% 50.3%

US$ / BYR rate Closing

Rate 9,870 11,850 14,740 49.3% 24.4% Average Rate 9,697

10,912 14,528 49.8% 33.1%

RECONCILIATION OF NON-GAAP FINANCIAL MEASUREMENTS:

We believe that EBITDA is a measurement commonly used by

companies, analysts and investors in the telecommunications

industry that enhances the understanding of our cash generation

ability and liquidity position, and assists in the evaluation of

our capacity to meet our financial obligations. We also use EBITDA

as an internal measurement tool, and accordingly, we believe that

its presentation provides useful and relevant information to

analysts and investors. Our EBITDA definition includes Revenue,

Direct Cost of Revenue excluding depreciation and amortization,

Selling and Marketing expenses and Administrative expenses, but

excludes translation gain/(loss), finance income, share of profit

of equity accounted investees, gain on sale of investments,

income/(loss) from related parties, minority interest and other

income/(expense). EBITDA is not a measure of financial performance

under IFRS, and should not be construed as a substitute for net

earnings (loss) as a measure of performance, or cash flow from

operations as a measure of liquidity. The following table provides

a reconciliation of EBITDA, which is a non-GAAP financial

measurement, to net cash from operating activities, which we

believe is the most directly comparable financial measurement

calculated and presented in accordance with IFRS.

Turkcell Group (million US$) Q114

Q414 Q115 y/y %

q/q % EBITDA 399.2 409.1

376.6 (5.7%) (7.9%)

Income tax expense (72.1) (83.5) (95.2) 32.0% 14.0% Other operating

income / (expense) (2.1) (1.3) (3.4) 61.9% 161.5% Financial income

/ (expense) (16.2) 3.9 3.7 (122.8%) (5.1%) Net increase /

(decrease) in assets and liabilities (386.7) 14.9 (571.5) 47.8%

n.m.

Net cash from operating activities (77.9)

343.1 (289.8) 272.0%

(184.5%)

FORWARD-LOOKING STATEMENTS: This release includes

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, Section 21E of the Securities Exchange Act

of 1934 and the Safe Harbor provisions of the US Private Securities

Litigation Reform Act of 1995. This includes, in particular, our

targets for revenue, EBITDA and capex in 2015 and our 4G and 3G

development in Turkey and Ukraine, respectively. More generally,

all statements other than statements of historical facts included

in this press release, including, without limitation, certain

statements regarding our operations, financial position and

business strategy may constitute forward-looking statements. In

addition, forward-looking statements generally can be identified by

the use of forward-looking terminology such as, among others,

"will," "expect," "intend," "estimate," "believe", "continue" and

“guidance”.

Although Turkcell believes that the expectations reflected in

such forward-looking statements are reasonable at this time, it can

give no assurance that such expectations will prove to be correct.

All subsequent written and oral forward-looking statements

attributable to us are expressly qualified in their entirety by

reference to these cautionary statements. For a discussion of

certain factors that may affect the outcome of such forward looking

statements, see our Annual Report on Form 20-F for 2014 filed with

the U.S. Securities and Exchange Commission, and in particular the

risk factor section therein. We undertake no duty to update or

revise any forward looking statements, whether as a result of new

information, future events or otherwise.

ABOUT TURKCELL: Turkcell is an integrated communication

and technology services player in Turkey. Turkcell Group has

approximately 67.9 million mobile subscribers in nine countries as

of March 31, 2015. Turkcell was one of the first among the global

operators to have implemented HSPA+. It has announced two new HSPA+

Technologies on its 3G network to meet rising data usage. Having

successfully integrated 3C-HSDPA and DC-HSUPA Technologies, it

became the first mobile operator in the world to enable peak speed

of 63.3 Mbps downlink while also enabled an 11.5 Mbps uplink on a

3G network. Turkcell is the first telecom operator to offer

households fiber broadband connection at speeds of up to 1,000 Mbps

in Turkey. As of March 2015, Turkcell’s population coverage is at

99.81% in 2G and 92.01% in 3G. Turkcell Group reported a TRY3.0

billion (US$1.2 billion) revenue with total assets of TRY24.0

billion (US$9.2 billion) as of March 31, 2015. It has been listed

on the NYSE and the BIST since July 2000, and is the only

NYSE-listed company in Turkey. Read more at

www.turkcell.com.tr.

Appendix A – Mapping of New Revenue Breakdown of Turkcell

Turkey

TRY Million

REVENUE BREAKDOWN - OLD REPORTING

REVENUE BREAKDOWN

- NEW REPORTING

SUPERONLINE TURKCELL TURKEY

OTHERSUBS

REPORTED Q115

FixedBroadband

Voice

MobileBroadband

Messaging

MobileServices

CONSUMER & CORPORATE 2,654 Voice 0 1,432 - - - -

1,432 Data 220 - 606 - - -

826 Services &

Solutions 13 - - 136 124 5

278 Other 11 26 - - - 82

118 WHOLESALE 38 26 - - - 7

71 OTHER

68 1 - - - (83)

-14 349 1,485

606 136 124 12

2,711

Explanatory note on definitions for Turkcell Turkey:

- The revenue breakdown of “consumer

and corporate” mainly comprise of the following:

- Voice: Outgoing, incoming and

roaming revenues of our mobile subscribers.

- Data: mobile broadband, fixed

broadband and fixed voice over IP services revenues, datacenter,

cloud, hosting and satellite revenues.

- Services: mobile services, fixed

services, and SMS revenues

- Other: call center revenues,

sales through flagship retail stores and equipment, support and

installations, simcard revenues and monthly fees.

- Wholesale revenues include

mainly our carrier business, visitor roaming, mobile international

incoming revenues.

- Other include consolidation

eliminations.

Appendix B – Historical Group Revenues

TRY MILLION

Q1

2013 Q1 2014 Q1 2015 TURKCELL

GROUP 2,688 2,855

2,978 TURKCELL TURKEY1 2,394

2,475 2,711 CONSUMER

1,915 1,930 2,122

CORPORATE 439 487

532 WHOLESALE 50 70

71

TURKCELL INTERNATIONAL

245 311 193 OTHER

SUBSIDIARIES2 50 70

75

1 Turkcell Turkey revenues include eliminations

2 Other subsidiaries include betting business in Turkey and

Azerbaijan and Group eliminations

TURKCELL ILETISIM HIZMETLERI

A.S.TURKISH ACCOUNTING STANDARDS SELECTED FINANCIALS (TRY

Million)

Quarter

EndedMarch 31,2014 Quarter

EndedDecember 31,2014 Year

EndedDecember 31,2014

Quarter EndedMarch 31,2015

Consolidated Statement of Operations Data Revenues

Turkcell Turkey 2,474.6 2,770.5 10,636.9 2,710.5 Consumer 1,930.3

2,170.2 8,298.5 2,122.1 Corporate 486.6 551.9 2,073.3 531.7 Other

57.7 48.4 265.1 56.7 Turkcell International 311.0 254.3 1,137.9

192.9 Other 69.6 78.4 268.8 74.8 Total revenues 2,855.2 3,103.2

12,043.6 2,978.2 Direct cost of revenues (1,740.9) (1,972.2)

(7,380.8) (1,828.0) Gross profit 1,114.3 1,131.0 4,662.8 1,150.2

Administrative expenses (142.1) (146.8) (562.7) (140.8) Selling

& marketing expenses (483.1) (517.8) (1,974.6) (476.3) Other

Operating Income / (Expense) 255.9 269.4 1,053.6 569.9 Operating

profit before financing and investing costs 745.0 735.8 3,179.1

1,103.0 Income from investing activities 4.9 5.4 20.0 3.6 Expense

from investing activities (10.8) 9.3 (16.8) (22.4) Share of profit

of equity accounted investees 73.6 (6.9) 207.3 94.8 Income before

financing costs 812.7 743.6 3,389.6 1,179.0 Finance income - - - -

Finance expense (556.7) (459.8) (1,424.9) (1,087.5) Monetary

gain/(loss) 64.5 32.3 205.1 - Income before tax and non-controlling

interest 320.5 316.1 2,169.8 91.5 Income tax expense (160.6)

(187.1) (731.1) (234.3) Income before non-controlling interest

159.9 129.0 1,438.7 (142.8) Non-controlling interest 200.7 128.9

428.2 284.4 Net income 360.6 257.9 1,866.9 141.6 Net income

per share 0.16 0.12 0.85 0.06

Other Financial Data

Gross margin 39.0% 36.4% 38.7% 38.6% EBITDA(*) 887.3 917.1

3,761.8 926.8 Capital expenditures 340.4 935.3 2,144.8 755.5

Consolidated Balance Sheet Data (at period end) Cash and

cash equivalents 7,989.1 9,031.9 9,031.9 8,173.8 Total assets

21,480.5 23,668.3 23,668.3 23,952.5 Long term debt 1,363.5 1,247.9

1,247.9 549.7 Total debt 3,515.5 3,697.7 3,697.7 4,127.3 Total

liabilities 6,478.1 6,979.5 6,979.5 11,046.5 Total shareholders’

equity / Net Assets 15,002.4 16,688.8 16,688.8 12,906.0

** For further details, please refer to our consolidated

financial statements and notes as at 31 March 2015 on our web site.

TURKCELL ILETISIM HIZMETLERI

A.S.IFRS SELECTED FINANCIALS (TRY Million)

Quarter

EndedMarch 31,2014 Quarter

EndedDecember 31,2014 Year

EndedDecember 31,2014

Quarter EndedMarch 31,2015

Consolidated Statement of Operations Data Revenues

Turkcell Turkey 2,474.6 2,770.5 10,636.9 2,710.5 Consumer 1,930.3

2,170.2 8,298.5 2,122.1 Corporate 486.6 551.9 2,073.3 531.7 Other

57.7 48.4 265.1 56.7 Turkcell International 311.0 254.3 1,137.9

192.9 Other 69.6 78.4 268.8 74.8 Total revenues 2,855.2 3,103.2

12,043.6 2,978.2 Direct cost of revenues (1,742.3) (1,972.2)

(7,383.9) (1,828.6) Gross profit 1,112.9 1,131.0 4,659.7 1,149.6

Administrative expenses (142.1) (146.8) (562.7) (140.8) Selling

& marketing expenses (483.1) (517.8) (1,974.6) (476.3) Other

Operating Income / (Expense) (3.5) 1.4 (76.3) (53.0)

Operating profit before financing costs 484.2 467.8 2,046.1 479.5

Finance costs (551.9) (400.1) (1,247.0) (735.7) Finance income

248.6 223.2 955.4 252.3 Monetary gain/(loss) 64.5 32.3 205.1 -

Share of profit of equity accounted investees 73.6 (6.9) 207.3 94.8

Income before taxes and minority interest 319.0 316.3 2,166.9 90.9

Income tax expense (160.2) (187.3) (730.4) (234.2) Income before

minority interest 158.8 129.0 1,436.5 (143.3) Non-controlling

interests 200.7 128.9 428.2 284.4 Net income 359.5 257.9 1,864.7

141.1 Net income per share 0.16 0.12 0.85 0.06

Other Financial Data Gross margin 39.0% 36.4% 38.7%

38.6% EBITDA(*) 887.3 917.1 3,761.8 926.8 Capital expenditures

340.4 935.3 2,144.8 755.5

Consolidated Balance Sheet Data

(at period end) Cash and cash equivalents 7,989.1 9,031.9

9,031.9 8,173.8 Total assets 21,508.1 23,694.2 23,694.2 23,977.7

Long term debt 1,363.5 1,247.9 1,247.9 549.7 Total debt 3,515.5

3,697.7 3,697.7 4,127.3 Total liabilities 6,482.4 6,983.6 6,983.6

11,050.4 Total shareholders’ equity / Net Assets 15,025.6 16,710.6

16,710.6 12,927.3 ** For further details, please

refer to our consolidated financial statements and notes as at 31

March 2015 on our web site.

TURKCELL ILETISIM HIZMETLERI

A.S.IFRS SELECTED FINANCIALS (US$ MILLION)

Quarter

EndedMarch 31,2014 Quarter

EndedDecember 31,2014 Year

EndedDecember 31,2014

Quarter EndedMarch 31,2015

Consolidated Statement of Operations Data Revenues

Turkcell Turkey 1,112.6 1,235.6 4,872.9 1,101.2 Consumer 867.9

967.8 3,801.5 862.1 Corporate 218.8 246.2 949.5 216.0 Other 25.9

21.6 121.9 23.1 Turkcell International 140.1 113.0 519.9 78.4 Other

31.3 34.0 120.1 30.3 Total revenues 1,284.0 1,382.6 5,512.9 1,209.9

Direct cost of revenues (783.6) (877.6) (3,375.5) (743.0) Gross

profit 500.4 505.0 2,137.4 466.9 Administrative expenses (63.9)

(65.2) (256.8) (57.2) Selling & marketing expenses (217.1)

(230.7) (903.1) (193.3) Other Operating Income / (Expense) (1.5)

0.6 (35.5) (21.1) Operating profit before financing costs

217.9 209.7 942.0 195.3 Finance expense (246.6) (175.4) (559.3)

(310.4) Finance income 111.7 98.9 437.5 102.6 Monetary gain/(loss)

29.5 12.6 88.4 - Share of profit of equity accounted investees 33.1

(2.7) 96.6 38.2 Income before taxes and minority interest 145.6

143.1 1,005.2 25.7 Income tax expense (72.1) (83.5) (334.6) (95.2)

Income before minority interest 73.5 59.6 670.6 (69.5) Minority

interest 89.4 57.9 194.3 117.6 Net income 162.9 117.5 864.9 48.1

Net income per share 0.07 0.05 0.39 0.02

Other

Financial Data Gross margin 39.0% 36.5% 38.8% 38.6%

EBITDA(*) 399.2 409.1 1,725.2 376.6 Capital expenditures 155.4

394.2 924.9 289.4

Consolidated Balance Sheet Data (at

period end) Cash and cash equivalents 3,648.3 3,894.9 3,894.9

3,131.5 Total assets 9,821.9 10,217.9 10,217.9 9,186.2 Long term

debt 622.7 538.1 538.1 210.6 Total debt 1,605.4 1,594.6 1,594.6

1,581.2 Total liabilities 2,960.3 3,011.6 3,011.6 4,233.5 Total

equity 6,861.6 7,206.3 7,206.3 4,952.6 * Please refer

to the notes on reconciliation of Non-GAAP Financial measures on

page 15 ** For further details, please refer to our consolidated

financial statements and notes as at 31 March 2015 on our web site.

TurkcellInvestor Relations:Nihat Narin, Tel: + 90 212 313

1888investor.relations@turkcell.com.trorCorporate

Communications:Tel: + 90 212 313

2321Turkcell-Kurumsal-Iletisim@turkcell.com.tr

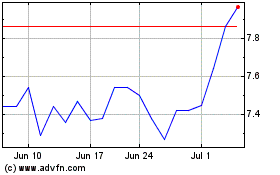

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Mar 2024 to Apr 2024

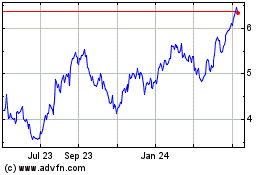

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Apr 2023 to Apr 2024