As filed with the Securities and Exchange Commission on March 10, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company

report

Commission File Number: 1-15092

TURKCELL

ILETISIM HIZMETLERI A.S.

(Exact Name of Registrant as Specified in Its Charter)

TURKCELL

(Translation of Registrant’s Name into English)

Republic of Turkey

(Jurisdiction of Incorporation or Organization)

Turkcell Plaza

Mesrutiyet Caddesi No: 71

34430 Tepebasi

Istanbul, Turkey

(Address of Principal Executive Offices)

Mr. Nihat Narin

Telephone: +90 212 313 1244

Facsimile: +90 212 292 9322

Turkcell Plaza

Mesrutiyet Caddesi No: 71

34430 Tepebasi

Istanbul, Turkey

(Name, Telephone,

E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities

registered pursuant to Section 12(b) of the Act:

|

|

|

| Title of each class |

|

Name of each exchange on which registered |

| American Depositary Shares Ordinary Shares, Nominal Value TRY 1.000* |

|

New York Stock Exchange New York Stock Exchange |

| * |

Not for trading on the NYSE, but only in connection with the registration of ADSs representing such ordinary shares pursuant to the requirements of the Securities and

Exchange Commission. |

Securities registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the

number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Ordinary Shares, Nominal Value TRY

1.000 2,200,000,000

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90

days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a

non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated

Filer x Accelerated Filer ¨ Non-Accelerated Filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ International

Financial Reporting Standards as issued by the International Accounting Standards Board x Other ¨

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement

item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ¨ No x

TABLE OF CONTENTS

INTRODUCTION

This is the 2014 annual report for Turkcell Iletisim Hizmetleri A.S. (“Turkcell”), a joint stock company organized and existing under the laws of the Republic of Turkey. The terms

“Company,” “we”, “us”, “our”, and similar ones refer to Turkcell, its predecessors, and its consolidated subsidiaries, except as the context otherwise requires.

Our audited Consolidated Financial Statements as of December 31, 2014 and 2013 and for each of the years in the three-year period ended December 31, 2014 included in this annual report have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the

International Accounting Standards Board (“IASB”).

Certain figures included in this annual report have been subject

to rounding adjustments. Accordingly, figures shown for the same category presented in different tables may vary slightly, and figures shown as totals in certain tables may not total exactly. In this annual report, references to “TL”,

“TRY” and “Turkish Lira” are to the Turkish Lira, and references to “$”, “U.S. Dollars”, “USD”, “U.S. $” and “cents” are to U.S. Dollars and, except as otherwise

noted, all interest rates are on a per annum basis. In this annual report, references to “Turkey” or the “Republic” are to the Republic of Turkey.

Statements regarding our market share and total market size in Turkey are based on the Information and Communication Technologies Authority’s (“ICTA”) or operators’ announcements, and

statements regarding penetration are based on the Turkish Statistical Institute’s (“TUIK”) announcements pertaining to the Turkish population. Furthermore, statements regarding our 2G coverage are based on the ICTA’s

specifications as well as the TUIK’s announcements, and statements regarding our 3G coverage are based on the ICTA’s 3G coverage calculation specifications issued on April 25, 2012.

References to the Information and Communication Technologies Authority or the ICTA include its predecessor entity, the Telecommunications

Authority.

FORWARD-LOOKING STATEMENTS

This annual report includes forward-looking statements within the meaning of Section 27A of

the U.S. Securities Act of 1933, as amended, Section 21E of the U.S. Securities Exchange Act of 1934, as amended, and the Safe Harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements

other than statements of historical facts included in this annual report, including, without limitation, certain statements regarding our operations, financial position, and business strategy, may constitute

forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking

terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, or similar statements.

Although we believe that the expectations reflected in such forward-looking statements are

reasonable at this time, we can give no assurance that such expectations will prove to be correct. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking

statements. Important factors that could cause actual results to differ materially from our expectations are contained in cautionary statements in this annual report, including, without limitation, in conjunction with the forward-looking statements listed below, and include, among others, the following:

| |

• |

|

competition in our main market; |

| |

• |

|

increased competition and/or the entrance of new direct and indirect competitors in the market due to new applications and regulatory changes in Turkey

with respect to certain technologies; |

| |

• |

|

failure to successfully integrate and manage the opportunities we pursue, particularly related to our current mobile communications business and 3G

business, new business models, new technologies and international activities; |

1

| |

• |

|

regulatory decisions and changes in the regulatory environment, in particular the ICTA’s decisions in 2013, 2014 and 2015;

|

| |

• |

|

failure to abide by the requirements of our licenses or applicable regulations; |

| |

• |

|

economic and political developments in Turkey and internationally; |

| |

• |

|

exposure to certain risks through our interests in associated companies, especially due to political instability in Ukraine;

|

| |

• |

|

foreign exchange rate risks; |

| |

• |

|

reduction in cash generated from operations and increased capital needs, which may increase our borrowing requirements, and consequently, our finance

costs and exposure to the risks associated with borrowing; |

| |

• |

|

our ability to deal with spectrum limitations; |

| |

• |

|

zoning limitations related to our Base Transceiver Stations (“BTS”) and potential increase in coverage requirements;

|

| |

• |

|

potential liability and possible reduced usage of mobile phones as a result of alleged health risks related to BTSs and the use of handsets;

|

| |

• |

|

our dependence on certain suppliers for network equipment and the provision of data services; |

| |

• |

|

Turkcell’s complex ownership structure and ongoing disagreements among our main shareholders; |

| |

• |

|

our dependence on certain systems and suppliers for IT services and our exposure to potential natural disasters, regular or severe IT and network

failures, human error, security breaches and other cybersecurity incidents and IT migration risk; |

| |

• |

|

technological changes in the telecommunications market; |

| |

• |

|

our dependence on third party providers to help us navigate the regulatory, security and business risks of industries where we traditionally do not

compete; |

| |

• |

|

our ability to retain key personnel and distributors; |

| |

• |

|

legal actions and claims to which we are a party; and |

| |

• |

|

effective internal control over financial reporting. |

All subsequent written and oral forward-looking statements attributable to us are expressly qualified in their entirety by reference to these cautionary

statements.

| ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not Applicable.

| ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

Not Applicable.

3.A Selected Financial Data

Our audited Consolidated Financial Statements as of

December 31, 2014 and 2013 and for each of the years in the three-year period ended December 31, 2014 included in this annual report have been prepared in accordance

with IFRS as issued by the IASB.

2

The following information should be read in conjunction with “Item 5. Operating

and Financial Review and Prospects”, our audited Consolidated Financial Statements as of December 31, 2014 and 2013 and the related consolidated statements of profit or loss, comprehensive income, changes in equity, and cash

flows for the years ended December 31, 2014, 2013 and 2012, and the related notes appearing elsewhere in this annual report.

The following table presents our selected consolidated statements of operations, statement of financial position and cash flows data as of and for each of the years in the five-year period ended December 31, 2014, presented in accordance with IFRS as issued by the IASB which have been derived from our audited Consolidated Financial Statements as of and for the years

ended December 31, 2014, 2013, 2012, 2011 and 2010.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

| |

|

(Million $, except share data and certain other data) |

|

| Selected Financial Data Prepared in Accordance with IFRS as Issued by the IASB |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Statement of Operations Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Communication fees |

|

|

4,779.3 |

|

|

|

5,369.0 |

|

|

|

5,374.0 |

|

|

|

5,225.4 |

|

|

|

5,670.2 |

|

| Commission fees on betting business |

|

|

54.0 |

|

|

|

52.2 |

|

|

|

47.1 |

|

|

|

39.1 |

|

|

|

31.2 |

|

| Monthly fixed fees |

|

|

23.6 |

|

|

|

40.0 |

|

|

|

50.6 |

|

|

|

63.0 |

|

|

|

75.4 |

|

| Revenue from betting business |

|

|

82.1 |

|

|

|

68.2 |

|

|

|

41.9 |

|

|

|

12.3 |

|

|

|

— |

|

| Simcard sales |

|

|

14.6 |

|

|

|

15.6 |

|

|

|

18.3 |

|

|

|

21.2 |

|

|

|

22.9 |

|

| Call center revenues |

|

|

75.8 |

|

|

|

57.8 |

|

|

|

44.9 |

|

|

|

38.1 |

|

|

|

25.2 |

|

| Other revenues |

|

|

483.5 |

|

|

|

372.6 |

|

|

|

289.0 |

|

|

|

210.6 |

|

|

|

157.2 |

|

| Total revenues |

|

|

5,512.9 |

|

|

|

5,975.4 |

|

|

|

5,865.8 |

|

|

|

5,609.7 |

|

|

|

5,982.1 |

|

| Direct cost of revenues(1) |

|

|

(3,375.5 |

) |

|

|

(3,693.3 |

) |

|

|

(3,622.3 |

) |

|

|

(3,528.9 |

) |

|

|

(3,349.0 |

) |

| Gross profit |

|

|

2,137.4 |

|

|

|

2,282.1 |

|

|

|

2,243.5 |

|

|

|

2,080.8 |

|

|

|

2,633.1 |

|

| Other income |

|

|

27.1 |

|

|

|

18.3 |

|

|

|

18.1 |

|

|

|

32.6 |

|

|

|

14.7 |

|

| Administrative expenses |

|

|

(256.8 |

) |

|

|

(286.8 |

) |

|

|

(270.5 |

) |

|

|

(246.5 |

) |

|

|

(347.3 |

) |

| Selling and marketing expenses |

|

|

(903.1 |

) |

|

|

(964.1 |

) |

|

|

(953.2 |

) |

|

|

(1,010.6 |

) |

|

|

(1,085.8 |

) |

| Other expenses |

|

|

(62.6 |

) |

|

|

(47.5 |

) |

|

|

(76.9 |

) |

|

|

(161.3 |

) |

|

|

(64.2 |

) |

| Results from operating activities |

|

|

942.0 |

|

|

|

1,002.0 |

|

|

|

961.0 |

|

|

|

695.0 |

|

|

|

1,150.5 |

|

| Finance income |

|

|

437.5 |

|

|

|

395.4 |

|

|

|

386.1 |

|

|

|

330.3 |

|

|

|

277.1 |

|

| Finance costs |

|

|

(559.3 |

) |

|

|

(95.5 |

) |

|

|

(125.5 |

) |

|

|

(289.7 |

) |

|

|

(102.6 |

) |

| Net finance income/(costs) |

|

|

(121.8 |

) |

|

|

299.9 |

|

|

|

260.6 |

|

|

|

40.6 |

|

|

|

174.5 |

|

| Monetary gain(2) |

|

|

88.4 |

|

|

|

82.9 |

|

|

|

95.3 |

|

|

|

144.8 |

|

|

|

— |

|

| Share of profit of equity accounted

investees(3) |

|

|

96.6 |

|

|

|

155.4 |

|

|

|

121.7 |

|

|

|

136.9 |

|

|

|

122.8 |

|

| Profit before income taxes |

|

|

1,005.2 |

|

|

|

1,540.2 |

|

|

|

1,438.6 |

|

|

|

1,017.3 |

|

|

|

1,447.8 |

|

| Income tax expense |

|

|

(334.6 |

) |

|

|

(310.7 |

) |

|

|

(291.5 |

) |

|

|

(292.2 |

) |

|

|

(320.8 |

) |

| Profit for the period |

|

|

670.6 |

|

|

|

1,229.5 |

|

|

|

1,147.1 |

|

|

|

725.1 |

|

|

|

1,127.0 |

|

|

|

|

|

| Attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

| Equity holders of the Company |

|

|

864.9 |

|

|

|

1,228.2 |

|

|

|

1,158.8 |

|

|

|

751.7 |

|

|

|

1,170.2 |

|

| Non-controlling interest |

|

|

(194.3 |

) |

|

|

1.3 |

|

|

|

(11.7 |

) |

|

|

(26.6 |

) |

|

|

(43.2 |

) |

| Profit for the period |

|

|

670.6 |

|

|

|

1,229.5 |

|

|

|

1,147.1 |

|

|

|

725.1 |

|

|

|

1,127.0 |

|

| Basic and diluted earnings per share |

|

|

0.39 |

|

|

|

0.56 |

|

|

|

0.53 |

|

|

|

0.34 |

|

|

|

0.53 |

|

| Consolidated Statement of Financial Position Data (at period end) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

3,894.9 |

|

|

|

3,808.7 |

|

|

|

3,926.2 |

|

|

|

2,508.5 |

|

|

|

3,302.2 |

|

| Total assets |

|

|

10,217.9 |

|

|

|

9,972.6 |

|

|

|

10,483.2 |

|

|

|

9,098.8 |

|

|

|

9,794.6 |

|

| Long-term

debt(4) |

|

|

538.1 |

|

|

|

716.2 |

|

|

|

619.2 |

|

|

|

1,057.4 |

|

|

|

1,407.3 |

|

| Total debt(5) |

|

|

1,594.6 |

|

|

|

1,561.4 |

|

|

|

1,705.2 |

|

|

|

1,868.1 |

|

|

|

1,837.5 |

|

| Total liabilities |

|

|

3,011.6 |

|

|

|

3,068.7 |

|

|

|

3,323.1 |

|

|

|

3,367.2 |

|

|

|

3,561.0 |

|

| Share capital |

|

|

1,636.2 |

|

|

|

1,636.2 |

|

|

|

1,636.2 |

|

|

|

1,636.2 |

|

|

|

1,636.2 |

|

| Total equity/net assets |

|

|

7,206.3 |

|

|

|

6,903.9 |

|

|

|

7,160.1 |

|

|

|

5,731.6 |

|

|

|

6,233.6 |

|

| Weighted average number of shares |

|

|

2,200,000,000 |

|

|

|

2,200,000,000 |

|

|

|

2,200,000,000 |

|

|

|

2,200,000,000 |

|

|

|

2,200,000,000 |

|

| Consolidated Cash Flows Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash generated by operating activities |

|

|

801.8 |

|

|

|

994.0 |

|

|

|

1,188.3 |

|

|

|

925.8 |

|

|

|

1,262.6 |

|

| Net cash (used in)/ generated by investing activities |

|

|

(573.1 |

) |

|

|

(469.7 |

) |

|

|

304.6 |

|

|

|

(1,410.5 |

) |

|

|

(704.9 |

) |

| Net cash generated by/(used in) financing activities |

|

|

39.5 |

|

|

|

(121.6 |

) |

|

|

(171.2 |

) |

|

|

31.6 |

|

|

|

(303.7 |

) |

| Other Financial Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends declared or proposed(6)(7) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

573.0 |

|

| Dividends per share (declared or

proposed)(7) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.26 |

|

| Gross margin(8) |

|

|

39 |

% |

|

|

38 |

% |

|

|

38 |

% |

|

|

37 |

% |

|

|

44 |

% |

| Adjusted EBITDA(9) |

|

|

1,725.2 |

|

|

|

1,858.0 |

|

|

|

1,808.4 |

|

|

|

1,748.1 |

|

|

|

1,957.4 |

|

| Capital expenditures |

|

|

924.9 |

|

|

|

853.8 |

|

|

|

975.5 |

|

|

|

866.0 |

|

|

|

1,078.6 |

|

3

| (1) |

Direct cost of revenues includes payments for our treasury share (the amount paid to the government under our license) and universal service fund, transmission fees,

base station rent and energy expenses, billing costs, depreciation and amortization charges, technical, repair and maintenance expenses, roaming charges, interconnection fees, costs of simcards sold, handset costs where we are the principal in the

sale of handsets and personnel expenses related to our technicians. |

| (2) |

See Note 2 (Basis of preparation) to our Consolidated Financial Statements in this Form 20-F for information regarding

monetary gain. |

| (3) |

Share of profit of equity accounted investees primarily includes the income related to our 41.45% and 50.00% stake in Fintur Holdings B.V. (“Fintur”) and A-Tel Pazarlama ve Servis Hizmetleri A.S. (“A-Tel”), respectively. Fintur currently holds all of our international mobile communications investments other than those

related to our operations in Northern Cyprus, Ukraine, Belarus and Germany. The service provider and distribution agreement with A-Tel was annulled via notification dated January 31, 2012, which was

effective from August 1, 2012. Turkcell’s ownership in A-Tel was sold to Bereket Holding A.S. for a consideration of TL 31.0 million (equivalent to $14.3 million as at transaction date) pursuant

to the Share Sale Agreement signed on August 27, 2014. See Note 16 and 34 to our audited Consolidated Financial Statements included in “Item 18. Financial Statements” of this annual report on Form 20-F. |

| (4) |

Long-term debt consists of long-term loans and borrowings as well as long-term lease obligations. |

| (5) |

Total debt consists of long-term and short-term loans and borrowings as well as lease

obligations excluding option contracts. |

| (6) |

On March 23, 2011, our Board of Directors proposed a dividend distribution for the year ended December 31, 2010 amounting to TRY

1,328.7 million ($573.0 million computed using the Central Bank of the Republic of Turkey’s (CBRT) TRY/U.S. Dollar exchange rate on December 31, 2014), which corresponds to 75% of our distributable net income for

the year. This dividend proposal was discussed but not approved at the General Assembly Meetings held in 2011. There were no Board of Directors’ resolutions for the dividend distribution for the years 2011, 2012, 2013 and 2014. The

General Assembly Meetings, on June 29, 2012, May 22, 2013, June 24, 2013 and May 29, 2014 could not be held since the quorum required had not been reached and the dividend payment could not be discussed. Our Board

of Directors has decided to convene the General Assembly meeting of our Company pertaining to the years 2010, 2011, 2012, 2013 and 2014 on March 26, 2015. |

| (7) |

The U.S. Dollar equivalent of the dividend for the year ended December 31, 2010 was computed by using the CBRT’s TRY/USD exchange rate on

December 31, 2014. Dividends per share for the year ended December 31, 2010 was computed over 2,200,000,000 shares. For the year ended December 31, 2010, the dividend per share was TRY 0.60 (equivalent to $0.24 as of March 3,

2015). |

| (8) |

Gross margin is calculated as gross profit divided by total revenues. |

| (9) |

Adjusted EBITDA is a non-GAAP financial measure that we have defined as net cash from operating activities adjusted to exclude the effects of the net change in

assets and liabilities, finance income, finance costs, income tax expense, other operating income and expense. |

Non-IFRS measures

Adjusted EBITDA is a non-GAAP

financial measure that we have defined as net cash from operating activities adjusted to exclude the effects of the net change in assets and liabilities, finance income, finance costs, income tax expense, other operating income and expense. Our

management views adjusted EBITDA as a key indicator each month to monitor our cash generation ability and liquidity position. Net income is generally considered by our management as the main indicator for our operating performance. Adjusted EBITDA

is not a measurement of liquidity under IFRS as issued by the IASB and should not be construed as a substitute for profit for the period as a measure of performance or cash flow from operations as a measure of liquidity.

We believe adjusted EBITDA, among other measures, facilitates liquidity comparisons from period to period and management decision making.

It also facilitates liquidity comparisons from company to company. Adjusted EBITDA as a liquidity measure eliminates potential differences caused by variations in capital structures (affecting interest expense), tax positions (such as the impact of

changes in effective tax rates on periods or companies) and the age and book depreciation of tangible and intangible assets (affecting relative depreciation expense). We also present adjusted EBITDA because we believe it is frequently used by

securities analysts, investors and other interested parties in evaluating the liquidity of other mobile operators in the telecommunications industry in Europe, many of whom present adjusted EBITDA when reporting their results.

Nevertheless, adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation from, or as a substitute

for analysis of, our results of operations, as reported under IFRS as issued by the IASB.

Some of these limitations are:

| |

• |

|

it does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; |

| |

• |

|

it does not reflect changes in, or cash requirements for, our working capital needs; |

4

| |

• |

|

it does not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on our debt;

|

| |

• |

|

although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will

often have to be replaced in the future, and adjusted EBITDA does not reflect any cash requirements for such replacements; |

| |

• |

|

it is not adjusted for all non-cash income or expense items that are reflected in our consolidated statement of

cash flows; and |

| |

• |

|

other companies in our industry may calculate this measure differently than we do, which may limit its usefulness as a comparative measure.

|

We compensate for these limitations by relying primarily on our results under IFRS as issued by the IASB

and using adjusted EBITDA measures only supplementally. See “Item 5. Operating and Financial Review and Prospects” and the Consolidated Financial Statements contained elsewhere in this annual report.

The following table provides a reconciliation of adjusted EBITDA, as calculated using financial data prepared in accordance with IFRS as

issued by the IASB, to net cash from operating activities, which we believe is the most directly comparable financial measure calculated and presented in accordance with IFRS as issued by the IASB.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year ended December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

| |

|

(Million $) |

|

| Adjusted EBITDA |

|

|

1,725.2 |

|

|

|

1,858.0 |

|

|

|

1,808.4 |

|

|

|

1,748.1 |

|

|

|

1,957.4 |

|

| Income tax expense |

|

|

(334.6 |

) |

|

|

(310.7 |

) |

|

|

(291.5 |

) |

|

|

(292.2 |

) |

|

|

(320.8 |

) |

| Other operating income/(expense) |

|

|

(40.3 |

) |

|

|

(29.2 |

) |

|

|

17.5 |

|

|

|

(57.9 |

) |

|

|

(49.4 |

) |

| Finance income/(costs) |

|

|

17.8 |

|

|

|

299.9 |

|

|

|

(120.3 |

) |

|

|

(52.5 |

) |

|

|

(99.9 |

) |

| Net (decrease) in assets and liabilities |

|

|

(566.3 |

) |

|

|

(824.0 |

) |

|

|

(225.8 |

) |

|

|

(419.7 |

) |

|

|

(224.7 |

) |

| Net cash from operating activities |

|

|

801.8 |

|

|

|

994.0 |

|

|

|

1,188.3 |

|

|

|

925.8 |

|

|

|

1,262.6 |

|

The following table presents selected operational data:

I. Operating Results

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year ended December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| Industry Data |

|

|

|

|

|

|

|

|

|

|

|

|

| Population of Turkey (in millions)(1) |

|

|

77.7 |

|

|

|

76.7 |

|

|

|

75.6 |

|

| Turkcell Data(2) |

|

|

|

|

|

|

|

|

|

|

|

|

| Number of postpaid subscribers at end of period (in millions)(3) |

|

|

15.2 |

|

|

|

14.0 |

|

|

|

13.2 |

|

| Number of prepaid subscribers at end of period (in millions)(3) |

|

|

19.4 |

|

|

|

21.2 |

|

|

|

21.9 |

|

| Total subscribers at end of period (in millions)(3) |

|

|

34.6 |

|

|

|

35.2 |

|

|

|

35.1 |

|

| Average monthly revenue per user (in $)(4) |

|

|

11.2 |

|

|

|

11.4 |

|

|

|

11.6 |

|

| Postpaid |

|

|

18.8 |

|

|

|

19.6 |

|

|

|

21.0 |

|

| Prepaid |

|

|

5.8 |

|

|

|

6.2 |

|

|

|

6.4 |

|

| Average monthly minutes of use per subscriber(5) |

|

|

275.3 |

|

|

|

259.3 |

|

|

|

243.3 |

|

|

Churn(6)

|

|

|

28.3 |

% |

|

|

27.4 |

% |

|

|

27.1 |

% |

| Number of Turkcell employees at end of period |

|

|

3,319 |

|

|

|

3,316 |

|

|

|

3,585 |

|

| Number of employees of consolidated subsidiaries at end of period(7) |

|

|

12,311 |

|

|

|

10,999 |

|

|

|

9,829 |

|

| (1) |

The population of Turkey for 2014, 2013 and 2012 is based on TUIK’s announcements. |

| (2) |

For a discussion of how these metrics affect our revenues, please see “Item 5A. Operating Results,—VI. Year Ended

December 31, 2014 Compared to the Year Ended December 31, 2013—a. Revenues”. |

5

| (3) |

Subscriber numbers do not include subscribers in Ukraine, Belarus, Northern Cyprus and Germany or those of Fintur subsidiaries. |

| (4) |

We calculate average revenue per user (“ARPU”) using the weighted average number of our mobile subscribers in Turkey during the period.

|

| (5) |

Average monthly minutes of use per subscriber is calculated by dividing the total number of incoming and outgoing airtime minutes of use by the

average monthly sum of postpaid and prepaid GSM subscribers in Turkey for the year divided by twelve. |

| (6) |

Churn rate is the percentage calculated by dividing the total number of subscriber disconnections during a certain period by the average number of subscribers for

the same period. For these purposes, we define “average number of subscribers” as the number of subscribers at the beginning of the period plus one half of the total number of gross subscribers acquired during the period. Churn refers

to our mobile subscribers in Turkey that are both voluntarily and involuntarily disconnected from our network. |

| (7) |

See “Item 6.D. Employees” for information concerning our consolidated subsidiaries. |

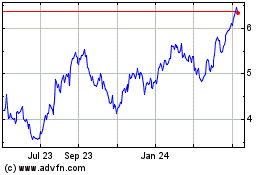

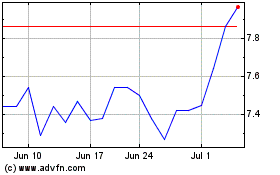

II. Exchange Rate Data

The Federal Reserve Bank of New York does not report, and historically has not reported, a noon buying rate for the Turkish Lira. For the

convenience of the reader, this annual report presents translations of certain Turkish Lira amounts into U.S. Dollars at the relevant Turkish Lira exchange rate for purchases of U.S. Dollars at the $/TRY exchange rate announced by the

CBRT. As of January 1, 2006, any statement of financial position data (monetary or non-monetary), except for equity items in U.S. Dollars derived from our Consolidated Financial Statements, are

translated from Turkish Lira into U.S. Dollars at exchange rates at the reporting date. Income and expenses for each statement of profit or loss except foreign operations in hyperinflationary economies (including comparatives) are translated to

U.S. Dollars at monthly average exchange rates.

The income and expenses of foreign operations in hyperinflationary

economies are translated into USD at the exchange rate as of the reporting date. Prior to translating the financial statements of foreign operations in hyperinflationary economies (Republic of Belarus), their financial statements for the current

period are restated to account for changes in the general purchasing power of the local currency. The restatement is based on relevant price indices at the reporting date. Unless otherwise indicated, the $/TRY exchange rate used in this annual

report is the $/TRY exchange rate in respect of the date of the financial information being referred to. As stated in the annual monetary and exchange rate policy announcements of the CBRT, which have been published since 2002, the foreign exchange

rate is not a policy tool or target; it is determined by the supply and demand conditions in the market. Along with inflation targeting, the CBRT announced that it will continue the implementation of the floating exchange rate regime in 2015.

The following table sets forth, for the periods and the dates indicated, the CBRT’s buying rates for U.S. Dollars.

These rates may differ from the actual rates used in preparation of our Consolidated Financial Statements and other information appearing herein. The $/TRY exchange rate on March 3, 2015 was TRY 2.512= $1.00.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2015(2)(3) |

|

|

2014(2) |

|

|

2013(2) |

|

|

2012(2) |

|

|

2011(2) |

|

|

2010(2) |

|

| High |

|

|

2.512 |

|

|

|

2.367 |

|

|

|

2.160 |

|

|

|

1.889 |

|

|

|

1.907 |

|

|

|

1.598 |

|

| Low |

|

|

2.278 |

|

|

|

2.071 |

|

|

|

1.746 |

|

|

|

1.734 |

|

|

|

1.496 |

|

|

|

1.388 |

|

| Average(1) |

|

|

2.396 |

|

|

|

2.188 |

|

|

|

1.901 |

|

|

|

1.793 |

|

|

|

1.670 |

|

|

|

1.500 |

|

| Period End |

|

|

2.512 |

|

|

|

2.319 |

|

|

|

2.134 |

|

|

|

1.783 |

|

|

|

1.889 |

|

|

|

1.546 |

|

Source:

CBRT

| (1) |

Calculated based on the average of the daily exchange rates of each month during the relevant period. |

| (2) |

These columns set forth the CBRT’s buying rates for U.S. Dollars expressed in Turkish Lira. |

| (3) |

Through March 3, 2015. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

March

2015(1) |

|

|

February

2015 |

|

|

January

2015 |

|

|

December

2014 |

|

|

November

2014 |

|

|

October

2014 |

|

| High |

|

|

2.512 |

|

|

|

2.490 |

|

|

|

2.401 |

|

|

|

2.367 |

|

|

|

2.271 |

|

|

|

2.288 |

|

| Low |

|

|

2.508 |

|

|

|

2.410 |

|

|

|

2.278 |

|

|

|

2.210 |

|

|

|

2.203 |

|

|

|

2.217 |

|

Source:

CBRT

6

| (1) |

Through March 3, 2015. |

No

representation is made that Turkish Lira or the U.S. Dollar amounts as presented in this annual report could have been or could be converted into U.S. Dollars or Turkish Lira, as the case may be, at any particular rate. Changes in the

exchange rate between Turkish Lira and U.S. Dollars could affect our financial results. For a discussion of the effects of fluctuating exchange rates on our business, see “Item 5A. Operating Results”.

3.B Capitalization and Indebtedness

Not applicable.

3.C Reasons for the Offer and Use of Proceeds

Not applicable.

3.D Risk Factors

The following is a discussion of those risks that we believe are the principal material risks faced by our Company and its subsidiaries. No assurance can be given that risks that we do not believe to

be material today will not prove to be material in the future. Consequently, the risks described below should not be considered to be exhaustive.

The majority of our revenue comes from our operations in Turkey. Competition in this market and certain regulatory actions that limit our ability to respond effectively to competitive pressures may

adversely affect the growth of our business and our financial condition.

The majority of our revenue comes from our

operations in Turkey and, thus, the growth and development of our business is mainly dependent on the development of the Turkish mobile telecommunications and broadband markets. In this market, we currently face intensifying competition from two

other mobile operators, Vodafone Telekomunikasyon A.S. (“Vodafone”) and Avea Iletisim Hizmetleri A.S. (“Avea”), and from the incumbent fixed line telecommunications operator, Turk Telekomunikasyon A.S. (“Turk Telekom”).

Continued price and higher incentive-driven competition has, and will continue to, put pressure on our prices, market shares and profitability, as well as our liquidity. If the competition further intensifies, or the market slows or develops in

unexpected ways, this could harm our business and financial condition.

Turkey’s principal telecommunications regulator,

the ICTA, has interfered, and may continue to interfere, with our ability to price our services and respond to competitive pressures. Regulatory actions such as the introduction of mobile number portability in 2008, the ICTA’s regulations on

our retail pricing and the ICTA’s ongoing pressure on interconnection rates and maximum retail prices have also been, and will likely continue to be, a significant factor in shaping the development of the Turkish market and in our ability to

respond to changes in the market. In addition, regulatory interventions, which have often favored our competitors, have increased competition. Furthermore, sub-brand initiatives of the existing competitor mobile operators, and new licenses and

authorizations issued by the regulator such as Fixed Telephony Service (“FTS”) and Mobile Virtual Network Operator (“MVNO”) licenses have made it easier and/or more attractive for new direct and indirect competitors to enter the

market. Competition in the mobile market may also be affected by regulatory actions in other areas, such as banking and tax. For example, new regulations banning credit card installment plans for handsets or the inability of providing contracted

bundled campaigns may have a negative impact on our ability to drive forward our revenues from existing and new customers. Any precautionary measures taken by the government as a response to the current account deficit, such as additional taxes on

imported handsets, may have a negative impact on smartphone penetration in the market and have an adverse impact on our revenues and profitability. The increase in smartphone penetration in our bundled offers is an important part of our strategy,

and thus such regulations may adversely affect the execution of this strategy and our financial condition.

7

In addition, competition may be affected by the increasing use of applications and services

that make use of the internet as a substitute (namely “over the top” or “OTT” services) for some of our more traditional services, such as messaging and voice, competition from new technologies such as wifi, and converged offers.

Our competitive position may be adversely impacted if we fail to provide converged services on a timely basis relative to our competitors. These have had an impact on our revenues which may in the future be material. Reduced demand for our core

services of voice, messaging and data could significantly impact our growth and profitability.

With respect to terminals,

there is an increasing emphasis in the Turkish market on terminal bundled campaigns. Increased demand for terminal bundled campaigns has led and may continue to lead to higher working capital requirements and bad debt expense. In addition, our

competitive position is dependent on certain distributors for products, such as terminals, and the failure of any of our distributors to supply products to our distribution channel, and at the level of quality we require, may adversely affect our

business and financial condition. Our distributors’ financial performance is vital to our business and financial model as they are a critical component within the ecosystem while providing terminals that are offered in contracted bundled

campaigns. At the same time, any regulations that could decelerate these bundled campaigns may also impact distributors’ revenues and profitability, which could in turn affect our business and financial condition.

We are expecting a major step forward in the development of telecommunications in Turkey with the deployment of 4G networks. The auction

for the 4G license is planned to be held in 2015. There can be no assurance that we will obtain a license, that we will be able to develop a 4G network on technologically and commercially reasonable terms, and/or that we will not experience delays

in developing our networks and that competing licensees will not get to market before us, in each case harming our competitive position. If we are not successful in the pursuit of such a license, or if one were to be owned or operated by a

competitor, we could find ourselves at a competitive disadvantage in this key market.

These factors together with

macroeconomic factors are likely to continue to result in changes in consumer behavior that have and may continue to adversely affect our revenues and expenses.

Our growth strategy is partly dependent on new investment opportunities, which could affect our business and financial condition, and the return on our investments cannot be guaranteed.

In addition to growing our existing business as a leading communications and technology company, our strategy for growth involves

selectively seeking and evaluating new investment opportunities and participating in those meeting our criteria. We may consider launching greenfield operations, as well as forming alliances, which may include management service agreements and

marketing partnerships, and conducting mergers and/or acquisitions, both inside and outside of Turkey or in countries in which we already have a presence. These opportunities may be in the area of mobile or fixed telecommunications and services,

including as an MVNO or in a marketing partnership with a local operator. In addition, we may provide services in related areas and also consider investing or increasing our investments in business areas outside of the scope of our core business.

New investments may not achieve expected returns or returns that are in line with those of our core business, which may cause

high value erosion. In many of the markets and businesses in which we have invested or may invest, it may take several years and significant investments to achieve desired profitability, if at all. In addition, if an asset in which we have invested

does not provide the expected returns, we may need to make further investment or we may consider disposal at a sale price that may be below carrying value or liquidation.

In the context of our evaluation of potential investments in the regions we target for international expansion, Turkcell has, from time to time, considered opportunities in countries in Eastern Europe,

the Balkans, and the Middle East and Africa (“MEA”), and may consider such opportunities in the future. As further described below, operations in many of these countries are subject to economic, political and other risks. Furthermore, for

acquisitions outside of Turkey, current and future E.U., U.S. and international laws and regulations, as well as

8

legal and regulatory actions, targeting certain countries, local companies and individuals may curtail our ability to do business in affected countries and may impede our exercise of control.

Turkcell itself, as well as certain of its key employees (notably those who are E.U. or U.S. citizens), could be subject to sanctions under such laws and regulations. Some of the countries and companies in which we have contemplated making

investments and in which we may from time to time consider opportunities, such as Iran, Libya and Syria, and certain individuals involved in such companies, have been the specific targets of such laws and regulations. In the same vein, jurisdictions

in which we have invested may from time to time come under sanctions, as has been the case in Crimea. Investors may be reticent to invest in a company doing business in such countries or other countries that may be at risk due to the political

instability. These factors could have an adverse effect on the demand for our shares.

Regulatory decisions and changes in

the regulatory environment could adversely affect our business and financial condition.

We operate in an industry that is

subject to extensive regulation, in Turkey and the other countries in which we operate. Compliance with new and existing laws and regulations has had and is likely to continue to have a significant impact on the ways in which we do business. This

may include but is not limited to the impact on our ability to set our pricing and offer new and existing services, on customer use of our services, the way we handle, process and store customer data, the terms of our subscriber contracts, the way

we can communicate with customers and our ability to obtain and maintain licenses. Furthermore, the laws, regulations, regulatory orders and licenses under which we operate are subject to interpretation and enforcement by regulators with which we

are not always in agreement. Complying with regulations may be costly, and failure to comply may lead to significant penalties, adverse publicity and the loss of licenses and could adversely affect our business and financial condition. For more

information on regulation and how it may impact our business, see “Item 4.B. Business Overview—Regulation of the Turkish Telecommunications Industry”.

Pricing is one of the key areas in which we are subject to regulation. The actions of the ICTA and the Ministry of Transport, Maritime Affairs and Communications in our voice, SMS, data, value added

services, roaming and interconnection pricing have, and will continue to, negatively affect our pricing and our ability to design and launch campaigns and offers. Consequently, these actions have and will continue to adversely affect our business

and financial condition. For instance, by linking the mobile termination rates to our retail tariff, the ICTA has indirectly increased the minimum retail tariff to be applied by Turkcell and set the minimum retail price for SMS, applicable to both

tariffs and campaigns, as well as reduced voice and SMS mobile termination rates, which adversely affected and is likely to continue to adversely affect our competitive position and our financial condition. For more information, see “Item 4.B.

Business Overview—Regulation of the Turkish Telecommunications Industry”. In addition, the ICTA may in certain markets determine that we are an operator with significant market power and as a result impose certain constraints on us, while

imposing less stringent ones on other mobile and fixed telecom players in the market, both of which may adversely affect our business and financial condition. Furthermore, such determinations may be made on the basis of the ICTA’s own market

analysis, with which we may not agree, and on the basis of definitions and terms that may change. Additionally, in Northern Cyprus there have been regulatory changes regarding mobile termination rates and price caps which could affect our business

performance. Another recent example of ICTA pricing-related action that adversely affects us is that as of April 1, 2015, the ICTA is imposing new rules regarding the proration of service fees that will lead to loss of revenue for us in several

scenarios such as a change of tariff/plan, new subscription, suspension or cancellation of subscription, etc., for subscribers billed in arrears.

In addition, regulations regarding the quality of service, the sharing of our infrastructure, the protection of personal data and electronic commerce are among those regulations which may have

an adverse effect on various aspects of our business. For example, as a result of the amendment of the Law for Metropolitan Municipalities, the number of metropolitan municipalities increased and the borders of some metropolitan municipalities were

extended. After this amendment, the ICTA increased our coverage obligations, defined in our concession agreement, by its decision, based on this amendment. This decision imposed a heavy financial burden on us by requiring material capital

expenditures. Therefore, we filed a lawsuit for the cancellation of this decision. There

9

has been no progress in this case yet. If another increase in the number of metropolitan municipalities or borders occurs, we may face additional coverage obligations. We may also be required to

share infrastructure or operate through a common infrastructure with our competitors, and to offer national roaming to their subscribers, which could adversely affect our ability to use our network to maintain a competitive edge. With respect to

personal data, the law on Electronic Commerce passed in October 2014 that comes into force on May 1, 2015, requires service providers to obtain permission from customers to use their data, for example to send them commercial electronic

messages, or to demand double opt-in from customers before purchasing mobile services, which will likely result in a decline in revenues for some corporate messaging and other mobile services we provide, as

well as a decline in the sales of online stores. Furthermore, current and proposed regulations may affect our business by limiting our ability to obtain and maintain the necessary licenses for our operations, which could affect our business plan and

expectations.

In the area of consumer protection, new regulations have been enacted that could limit our marketing and

advertising activities, allow certain forms of advertising by competitors that could weaken our brand image, or limit our flexibility to respond to customer needs immediately. This could encourage further price-driven competition, causing us to lose

subscribers and/or revenue, and potentially increase operating expenses.

Any downturn in the economy and instability in

the political environment in Turkey and internationally may have an adverse effect on our business and our financial condition.

With a substantial portion of our revenues, assets and business derived from and located in Turkey, and denominated in Turkish Lira, adverse developments in the Turkish market are likely to have a

material adverse effect on our business and financial condition. In our view, the biggest threats to the global economy, including Turkey, in 2015, are sustainability of economic growth, sustainability of current low energy prices, which have

generally benefitted the Turkish economy and current account balance, uncertainty regarding U.S. accommodative monetary policy, continuing Eurozone recession and deflation risks, and geopolitical risks in Ukraine and the Middle East region.

The Turkish economy grew uninterruptedly for twenty quarters in a row and grew by 2.8% in the first nine months of 2014. If

the Turkish economy slows or develops in unexpected ways, this may have an adverse impact on our operations and financial condition. The performance of the Turkish economy may be affected by domestic and regional political developments. Turkey will

enter into an electoral period, with parliamentary elections in 2015. On a regional level, potential or further instability in the Commonwealth of Independent States (CIS), Balkans, Middle East, North Africa and Caucasian regions may impact the

development of the Turkish economy.

We hold interests in several companies that may expose us to various economic,

business, political, social, financial, liquidity, regulatory and legal risks and may not provide the benefits that we expect, and our pursuit of acquisition opportunities may increase these risks.

Our investments in subsidiaries and associated companies within Turkey and internationally could expose us to economic, political, social,

financial, regulatory and legal risks. Any such risks in our subsidiaries or associated companies could lead us to exit an investment and/or may result in write-down of the carrying value of our assets. These

risks have affected and could adversely affect our result of operations and the value of certain companies in which we have invested in our financial statements. Turkcell Group has investments in Azerbaijan, Belarus, Georgia, Kazakhstan, Moldova,

the Turkish Republic of Northern Cyprus and Ukraine and has operations or business activities that involve other emerging markets. We are also exploring new investment opportunities, primarily in emerging markets. Our current and potential future

activities in these countries include operating mobile communications networks and routing cables. We may also transfer data through such countries. Legal systems, including telecommunications regulations, institutions, commercial practices and

economies in emerging markets tend to be relatively underdeveloped and some of these countries may also suffer from relatively high rates of fraud and corruption. Furthermore, through our subsidiaries in Turkey and internationally, we engage in

businesses outside of the scope of our core mobile business. These other businesses are subject to risks that are in some respects different from those of our mobile business.

10

In some countries, we hold our investments with another shareholder or local government and

in some cases we are a non-controlling shareholder. Should there be a disagreement between us and other shareholders in the future, the ability of the invested company’s management to move forward with

its business plan may be affected and no assurance can be given that it will be able to take the course of action we believe is appropriate. In these cases, we may consider exiting, or alternatively increasing our investment and our stake in order

to take control. Furthermore, some of the countries in which we have businesses or would consider investing, and the companies and individuals that we come into contact with, may be the target of E.U., U.S. and international sanctions, as has

occurred in Crimea. There can be no assurance that political, legal, economic, social or other actions or developments in these countries or involving such companies and individuals will not have an adverse impact on our investments and businesses

in these countries.

In this regard, we have and are likely to continue to experience issues in some of our international

businesses that adversely affect our Company. Recent issues include the following:

| |

• |

|

Our operations in Ukraine may be adversely affected by military actions, political instability, civil unrest and economic problems in that country in

2015. Due to increased political instability in the Crimea region, providing services remained a significant challenge throughout 2014 and we were eventually obliged to discontinue these services during the fourth quarter. After evaluating our

alternatives, we impaired our assets in the Crimea region down to their scrap value, while retaining our license and frequency rights. Astelit is currently evaluating its options with respect to the disposal of its assets in Crimea. The operating

environment in Crimea and the actions that we may take in response may raise challenges with respect to compliance with Astelit’s license requirements. Furthermore, the current military and political crisis in the Eastern part (mainly in

Donetsk and Luhansk) and with Russia remains unresolved, similar to the situation in Crimea and could lead us to evaluate our options in the Eastern region. The ongoing crisis may further adversely affect the Ukrainian economy and our results of

operations in Ukraine and/or the value and security of our operations there. We are unable to predict the likely course or duration of these events, or the extent of the adverse impact that they have had and are likely to have on the

telecommunications market dynamics and composition, our investment in Ukraine and our operations there. |

| |

• |

|

In Ukraine, the local currency, Ukrainian Hryvnia (“UAH”), has depreciated against the U.S. Dollar by 97% in 2014. In November 2014, the

National Bank of Ukraine announced a fixed rate foreign exchange regime based on interbank foreign exchange. However, in order to comply with IMF aid negotiations, the UAH was once again allowed to float freely in February 2015. Following this

decision, the UAH has depreciated by 57% to 24.8 per USD as of March 3, 2015, from the 2014 year-end official rate of UAH 15.77 per USD. Furthermore, the National Bank of Ukraine, among other

measures, continues to impose certain restrictions on the processing of client payments by banks and on the purchase of foreign currency on the inter-bank market. In December 2014, Ukraine’s sovereign rating was further downgraded to CCC- by S&P with a negative outlook. The National Bank of Ukraine increased its discount rate from 19.5% to 30% in its latest monetary policy meeting on March 3, 2015. The move was aimed at tightening

liquidity conditions to curb devaluation in the UAH. As a result, the UAH appreciated to UAH 23 per USD from UAH 28 per USD. There is a further currency devaluation risk as the country is suffering from continuing instability as noted

above, and has a large current account deficit and high external funding needs. The debt balance related to our Ukranian operations is approximately $681.5 million as of December 31, 2014. Astelit’s foreign currency revenues were estimated

at 19% of revenues and its foreign currency operational expenses were estimated at 20% of the total in 2014. Any further depreciation of the UAH will lead to a foreign exchange loss. We have been unable to hedge this exposure to the UAH.

|

| |

• |

|

Our development strategy in Ukraine may lead us to increase our investment there, which will further increase our country and currency risk exposure.

In Ukraine, a 3G licensing tender was announced by the Ukrainian National Commission for Communications and IT Regulation in December 2014 and was held in February 2015. After bidding the highest offer among three bidders retained for the three

licenses, Astelit was awarded the license for the first lot. The associated costs will increase our |

11

| |

Ukrainian financing needs, which could in turn require us to consider new sources of funding or the extension of existing sources and could require Turkcell to provide guarantees in respect of

any Astelit debt, in addition to the guarantees already provided. There can be no assurance that we will be able to develop a 3G network on commercially reasonable terms, that we will not experience delays in developing our network and that

competing licensees will not get to market before us (one bidder has already begun tests), in each case harming our competitive position. This could have an adverse effect on the value of our investment there. |

| |

• |

|

The economic situation is fragile in Belarus. The country remains vulnerable to global shocks which may trigger renewed weakness in the country’s

ability to service its external debt and further depreciation of the local currency, Belarusian Rubles (“BYR”), which could in turn lead to a further reduction in the value of our investment in this country. The BYR depreciated against the

U.S. Dollar by 25% in 2014 and further devaluated in 2015 by 26% as of March 3, 2015 following decreases in both foreign exchange purchase taxes and minimum reserve requirements. Devaluation risks still remain, as limited currency

reserves, high debt repayments and the current account deficit coupled with the close ties to the currently troubled Russian Economy puts the recent BYR stabilization at risk and creates inflationary and devaluation pressure. Our subsidiary in

Belarus, Best, had foreign currency debt of $660 million as of December 31, 2014, guaranteed by Turkcell. |

| |

• |

|

Corruption is an area of concern in emerging markets and can lead to reputational risk, losses, significant fines and sanctions against affected

companies and their personnel and may extend to controlling persons. In this regard, allegations have been made regarding improper payments relating to the operations of Kcell, a mobile operator in Kazakhstan and 51% subsidiary of Fintur Holdings

B.V., in which we hold a 41.45% stake and TeliaSonera holds the remainder. With respect to Kcell, through our representation on the Fintur board, we remain vigilant about such allegations, however there can be no assurance that such issues will not

be substantiated or that new allegations will not arise. More generally, there can be no assurance that other acts of corruption will not occur or be alleged in respect of any of our activities, including but not limited to those of the Fintur

companies. Turkcell has received and responded to a request from the U.S. Securities and Exchange Commission (“SEC”) to submit documents and information related to Uzbekistan and the Uzbek subsidiary of TeliaSonera (which, as noted above,

is the majority owner of Fintur). |

We are subject to laws such as the U.S. Foreign Corrupt Practices Act,

which prohibit corrupt payments to governmental officials or certain payments or remunerations to customers. Violations of these laws and regulations could result in fines, criminal sanctions against us, our officers or our employees and could

adversely affect our business in affected countries. Such violations or allegations of violations may also adversely affect our reputation, our revenue or our overall financial performance.

In addition to the foregoing, the new Turkish Commercial Code and related legislation may require us to provide new capital or other

financial support to certain of our controlled subsidiaries, which may divert resources from other needs. Our international and Turkish subsidiaries may not benefit us in the way we expect for the reasons cited above, as well as other reasons,

including general macroeconomic conditions, poor management and legal, regulatory or political obstacles. For many of these subsidiaries, we do not expect to achieve desired levels of profitability in the near or

mid-term, and we may be required to record impairments. We may also in response to such conditions consider increasing, restructuring or exiting certain of our investments.

Furthermore, in addition to investing in our international operations, we also engage in business through roaming agreements in a number

of countries. In international markets in which duopoly markets exist, such as the United Arab Emirates, Tunisia or the Maldives, operators tend to increase their roaming prices despite the overall trend of declining roaming prices in the world,

which could increase our roaming costs.

12

We are exposed to foreign exchange rate risks and risks relating to our cash balance

management that could significantly affect our results of operation and financial position.

We are exposed to foreign

exchange rate risks because our income, expenses, assets and liabilities are denominated in a number of different currencies, primarily Turkish Lira, U.S. Dollars, Euros, Ukrainian Hryvnia, Belarusian Rubles and Azerbaijani Manat. In particular, a

substantial majority of our debt obligations and equipment expenditures are currently, and are expected to continue to be, denominated in U.S. Dollars, while the revenues generated by our activities are denominated in other currencies, in particular

the Turkish Lira, Ukrainian Hryvnia, Belarusian Ruble, Azerbaijani Manat and Euro. In addition, we are exposed to such currency mismatches with respect to certain capital expenditures and off-balance sheet obligations, in particular our obligations

in respect of universal service for the installation of infrastructure in uncovered areas of Turkey, a service that we have contracted to provide for an amount in TRY, but which requires expenditures in foreign currencies. See “Item 8.

Financial Information” and Note 31 to our audited Consolidated Financial Statements included in “Item 18. Financial Statements” of this annual report on Form 20-F.

The TRY depreciated by 8.6% against the U.S. Dollar in 2014, driven mainly by expectations regarding the Federal Reserve’s

increasing interest rates, and there is a possibility of further devaluation. The Belarusian Ruble depreciated against the U.S. Dollar by 25% while the Ukrainian Hryvnia lost 97% of its value in 2014. Furthermore, as of March 3, 2015, the

Belarussian Ruble had depreciated against the U.S. Dollar by an additional 26% while the Ukrainian Hryvnia had lost an additional 57%. There was no major change in the Azerbaijani Manat against the U.S. Dollar in 2014. However, the

Azerbaijani Manat depreciated against the U.S. Dollar by 34% as of March 3, 2015.

Sudden increases in inflation or

the devaluation of these currencies or other currencies in which we generate revenue, have had, and may continue to have, an adverse effect on our consolidated financial condition or liquidity. In the current economic environment and considering the

fragile economic conditions in Belarus and the current situation in Ukraine, there is a possibility of further devaluation. There are no tools to hedge foreign exchange rate risks effectively due to restricted and undeveloped financial markets in

these countries.

Fluctuations between Turkish Lira, Ukrainian Hryvnia, Belarusian Rubles and Azerbaijani Manat, on the one

hand, and U.S. Dollars and Euros, on the other, have had and may have an unfavorable impact on us. We may enter into derivative transactions to manage the risk with respect to the Turkish Lira; however, these transactions have a cost and do not

fully cover all of our risks. As of December 31, 2014, our consolidated debt was $1,594.6 million and around $1,385.8 million of this amount was in foreign currency of which $252.6 million was related to operations in Turkey.

When we translate our results of operations and financial position into U.S. Dollars for the purpose of preparing our financial

statements that are expressed in U.S. Dollars, the dollar amounts will vary in accordance with applicable exchange rates. We do not hedge this so-called “translation risk”.

Reduction in cash generated from operations and increased capital needs may increase our borrowing requirements, which may increase

our financing costs and our exposure to the risks associated with borrowing.

We continue to experience challenging

macroeconomic, regulatory and competitive conditions in our markets that may reduce cash generated from operations, and we may continue to face increased capital needs to finance our technological and geographic expansion. In 2015, this may include

significant additional capital expenditure requirements with respect to the 3G license in Ukraine and with respect to 4G in Turkey, if we are successful in our pursuit of a 4G license. Furthermore, depending on the result of our general assembly

meetings in 2015, we may pay a dividend for the first time in several years. In addition, an increase in the volume of assigned contracted receivables has resulted in and may continue to result in higher working capital requirements. These pressures

have in the past reduced, and may continue to reduce, our liquidity. Reduced liquidity may lead to an increase in our borrowing requirements. Borrowing by Turkcell group companies

13

exposes us to interest rate risk and possibly increases interest expense, obligates us to meet certain covenants and exposes us to financial risks if covenants are not satisfied or if additional

financing is required, each of which could have a material adverse effect on our consolidated financial condition and results of operations. Furthermore, no assurance can be given that we will continue to have access to financing on terms that are

satisfactory to us.

As of December 31, 2014, our consolidated debt was $1,594.6 million. $347.9 million of our debt

portfolio consisted of financing obligations paying interest at fixed rates. The remainder of our debt portfolio pays interest at floating rates, which has been favorable in the current interest rate environment, but would expose us to increased

costs if rates increase further.

In June 2011, we engaged in a forward start collar agreement for some portion of our debt

which is due in 2015 and exposed to interest rate risk. The collar hedges variable interest rate risk for the period between 2013 and 2015.

Some of the borrowing agreements entered into or guaranteed by Turkcell have financial covenants that the borrower is required to observe. Although we are not presently concerned with Turkcell’s

ability to meet its financial covenants, no assurance can be given that the covenants in borrowings entered into or guaranteed by Turkcell will at all times be met. Furthermore some of our borrowing agreements contain cross default clauses under

which a default by a group company could constitute an event of default under certain of our borrowings.

A company in our

Group has defaulted, and others may in the future default on their financial covenants and payment obligations. For example, we cannot ensure that our subsidiary in Belarus will be able to meet its payment obligations. It may default on its debt