Report of Foreign Issuer (6-k)

February 25 2015 - 11:30AM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Report on Form 6-K dated February 25, 2015

Commission File Number: 001-15092

TURKCELL ILETISIM HIZMETLERI A.S.

(Translation of registrant’s name in English)

Turkcell Plaza

Mesrutiyet Caddesi No. 71

34430 Tepebasi

Istanbul, Turkey

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F Q Form 40-F £

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes £ No Q

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes £ No Q

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes £ No Q

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- __________

Enclosure: A press release dated February 24, 2015 announcing the amendment of Turkcell’s Articles of Association.

Istanbul, February 24, 2015

Announcement Regarding the Amendment of Articles of Association

Subject: Statement made pursuant to Communique II-15.1 of the Capital Markets Board

Turkcell Board of Directors has decided to amend the Articles of Association as attached, subject to the approval of the Capital Markets Board and the Ministry of Customs and Trade in accordance with the principles of Capital Markets Law, Turkish Commercial Code, and related legislation. This amendment is subject to approval of General Assembly.

For more information:

Turkcell Investor Relations

investor.relations@turkcell.com.tr

Tel: + 90 212 313 1888

TURKCELL İLETİŞİM HİZMETLERİ A.Ş.

ARTICLES OF ASSOCIATION AMENDMENT PROPOSAL

|

CURRENT VERSION

|

AMENDED VERSION

|

|

ARTICLE 3 - PURPOSE AND SUBJECT-MATTER

|

ARTICLE 3 - SCOPE OF BUSINESS

|

|

The Company is incorporated primarily for the provision of any telephone, telecommunication and similar services in compliance with the Telegraph and Telephone Law number 406 and services stated in the GSM Pan Europe Mobile Telephone System bid that was signed with the Ministry of Transportation and to operate within the authorization regarding the IMT-2000/UMTS services and the infrastructure.

In order to achieve the above-mentioned subject matter, the Company may:

|

The Company is incorporated to primarily provide the services authorized within the context of concession agreements signed with the Information and Communications Technologies with regard to Grant a License of Establishing and Operating GSM Pan Europe Mobile Telephone System and Establishing, Operating and Providing IMT-2000/UMTS Infrastructures and Services and any other services authorized pursuant to relevant legislation and regulatory decrees.

In order to achieve the above-mentioned scope of business, the Company may:

|

|

1)

|

enter into service, proxy, agency, commission agreements, undertakings and any other agreements within the purpose and the subject-matter of the Company and within this scope obtain short, middle and long term credits and loans or issue, accept and endorse bonds, extend credits to the companies in Turkey and abroad, in which it has direct or indirect shareholding interest, to its main company and group companies, in Turkish Lira or other foreign currencies, on condition that such extensions do not contradict with laws and regulations.

|

1)

|

enter into service, proxy, agency, commission agreements, undertakings and any other agreements within the purpose and the subject-matter of the Company and within this scope obtain short, middle and long term credits and loans or issue, accept and endorse bonds, extend credits to the companies in Turkey and abroad, in which it has direct or indirect shareholding interest, to its main company and group companies, in Turkish Lira or other foreign currencies, on condition that such extensions do not contradict with laws and regulations;

|

|

2)

|

cooperate, establish new partnerships or companies or enterprises with existing or future local or foreign individuals or legal entities; completely or partially acquire local or foreign companies or enterprises, participate in share capitals of such companies or enterprises, establish representative offices in Turkey and abroad, participate in foundations constituted for various purposes, reserve part of the profit for or be authorized to pay dividends and make donations to this kind of real or legal person and in the event a donation is made or part of the profits is reserved for foundations or this kind of real or legal entity, the rules provided by the Capital Markets Board will be complied with and the notifications required by the Capital Markets Board will be made,

|

2)

|

cooperate, establish new partnerships or companies or enterprises with existing or future local or foreign individuals or legal entities; completely or partially acquire local or foreign companies or enterprises, participate in share capitals of such companies or enterprises, establish representative offices in Turkey and abroad, participate in foundations constituted for various purposes, establish foundations, reserve assets to these foundations, reserve part of the profit for or be authorized to pay dividends and make all kind of donations and aids to this kind of real or legal person without vitiating its purpose and subject matter and provided that, those are not contrary to income shifting regulations of Capital Market Acts and other related legislation, necessary material disclosures are made and donations made within a year are submitted to the shareholder’s information at general assembly.

|

|

3)

|

issue, acquire, sell, create security over or to perform any other legal actions of all kind of securities, commercial papers, profit sharing instruments, bond and convertible bonds via board resolutions under the conditions authorized by the relevant legislation provided that such actions are not qualified as brokerage activities and portfolio management;

|

3)

|

issue, acquire, sell, create security over or to perform any other legal actions of all kind of securities, commercial papers, profit sharing instruments, bond and convertible bonds via board resolutions under the conditions authorized by the relevant legislation provided that such actions are not qualified as investment services and activities.

|

|

4)

|

enter into licence, concession, trademark, know-how, technical information and assistance and any other intellectual property right agreements and acquire and give a license to such rights and register them;

|

4)

|

enter into licence, concession, trademark, know-how, technical information and assistance and any other intellectual property right agreements and acquire and give a license to such rights and register them;

|

|

5)

|

acquire, lease, rent and sell of all types of movable and immovable property; construct plant or any other buildings; enter into financial leasing agreements; acquire any of the personal or property rights regarding movable and immovable property, including but not limited to, promise to sell, pledges, mortgages and commercial business pledges; register them in title deeds; accept mortgage from third parties; discharge pledges and mortgages created in favour of the Company; create security over movable and immovable properties owned by the Company, including creation of mortgage, pledge and commercial enterprises pledge, on its own or in favour of the companies which are fully consolidated in financial statements of the Company or in favour of the third parties’ on condition that the context of the ordinary business operations of the Company directly requires, as necessitated by the purpose and subject matter of the Company, provided that the Company shall comply with the principles regulated in accordance with the capital markets legislation regarding the transactions of providing guarantees or pledges including mortgages to third parties and disclosures necessary in accordance with the Capital Market Board within the scope of special circumstances, be made in order to inform investors in transactions to be performed in favour of third parties.

|

5)

|

acquire, lease, rent and sell of all types of movable and immovable property; construct plant or any other buildings; enter into financial leasing agreements; acquire any of the personal or property rights regarding movable and immovable property, including but not limited to, promise to sell, pledges, mortgages and commercial business pledges; register them in title deeds; accept mortgage from third parties; discharge pledges and mortgages created in favour of the Company; create security over movable and immovable properties owned by the Company, including creation of mortgage, pledge and commercial enterprises pledge, on its own or in favour of the companies which are fully consolidated in financial statements of the Company or in favour of the third parties’ on condition that the context of the ordinary business operations of the Company directly requires, as necessitated by the scope of business of the Company, provided that the Company shall comply with the principles regulated in accordance with the capital markets legislation regarding the transactions of providing guarantees or pledges including mortgages to third parties and disclosures necessary in accordance with the Capital Market Board within the scope of special circumstances, be made in order to inform investors in transactions to be performed in favour of third parties;

|

|

6)

|

enter into other enterprises, relevant transactions and agreements necessitated by the purpose and the subject matter of the Company;

|

6)

|

enter into other enterprises, relevant transactions and agreements necessitated by the scope of business of the Company;

|

|

7)

|

register SIM card trademark and symbol; sell, lease, re-purchase, re-sell the same; agree with dealers abroad or in the country for the sale of such cards; export same; import other SIM cards and perform all related actions;

|

7)

|

register SIM card trademark and symbol; sell, lease, re-purchase, re-sell the same; agree with dealers abroad or in the country for the sale of such cards; export same; import other SIM cards and perform all related actions.

|

|

In addition, if it is deemed appropriate and beneficial for the Company to perform any transactions other than those stated above, upon the proposal of the Board of Directors, the matter shall be submitted to the approval of the General Assembly and may be performed pursuant to the resolution of the General Assembly. In order for such changes to be effective, the permissions of the Foreign Investment Directorate, the Ministry of Industry and Commerce and the Capital Market Board shall be obtained, registered with the Trade Registry and announced in the Trade Registry Gazette as amendments to the Articles of Association.

|

The Company, by resolution of general assembly may perform activities other than listed herein, by fulfilling related legal requirements and in condition that these activities are not in contradiction with legislation, which are related to or to be deemed expedient for its subject matter.

|

| |

|

|

ARTICLE 4 – HEADQUARTER AND BRANCHES

|

ARTICLE 4 – HEADQUARTER AND BRANCHES

|

|

The Company shall be headquartered in Istanbul, at the address of Turkcell Plaza, Meşrutiyet Caddesi, No:153, Tepebaşı, Beyoğlu/İstanbul.

The new address, whenever changed, shall be registered with the Trade Registry and published in the Trade Registry Gazette and notified to the Capital Market Board and the Ministry of Industry and Commerce.

|

The Company shall be headquartered in Istanbul, at the address of Turkcell Plaza, Meşrutiyet Caddesi, 34430, No: 71, Tepebaşı, Beyoğlu/İstanbul.

The new address, whenever changed, shall be registered with the Trade Registry and published in the Trade Registry Gazette and notified to the Capital Market Board and the Ministry of Customs and Commerce.

|

| |

|

| |

Any notification sent to the address registered and published shall be deemed as received by the Company. If the Company changes its address and does not register the new one in due time, the situation will be deemed as one of the termination causes of the Company.

|

Any notification sent to the address registered and published shall be deemed as received by the Company. If the Company changes its address and does not register the new one in due time, the situation will be deemed as one of the termination causes of the Company.

|

|

| |

The Company may open branches and representative offices in or outside Turkey provided that the Ministry of Industry and Commerce, Foreign Investment Directorate and the Capital Market Board are informed thereof

|

The Company may open branches and representative offices in or outside Turkey provided that the Ministry of Customs and Commerce, Foreign Investment Directorate and the Capital Market Board are informed thereof.

|

|

| |

|

|

|

| |

ARTICLE 6 – SHARE CAPITAL

|

ARTICLE 6 – SHARE CAPITAL

|

|

| |

The registered capital of the Company is 2.200.000.000 (Two billion two hundred million) New Turkish Liras, divided into registered shares of 2.200.000.000 (Two billion two hundred million), having a value of 1.- (One) New Turkish Liras each.

|

The company accepted the registered capital system according to the former Capital Market Code No.2499 and carried the said system into practice by Capital Market Board’s permit dated 13.04.2000 and numbered 40/572.

|

|

| |

The Company’s issued share capital, is 1,474,639,361 (One billion four hundred and seventy-four million six hundred and thirty-nine thousand three hundred and sixty-one) New Turkish Liras and fully paid in compliance with the Incentive and Investment Allowance Certificate of Foreign Capital General Directorate of the Undersecretariat of Treasury of the Prime Ministry of the Republic of Turkey dated 23 August 1993 and numbered 1746 and its special conditions dated 19.12.1994 and Incentive and Investment Allowance Certificate dated 6 November 1997 and 2741 numbered and its special conditions dated 16.07.1999, 16.12.1999 and 30.11.2000 and Incentive and Investment Allowance Certificate dated 26 February 2001 and 3704 numbered and is divided into 1,474,639,361 (One billion four hundred and seventy-four million six hundred and thirty-nine thousand three hundred and sixty-one) shares

|

The ceiling of registered capital of the Company is 2.200.000.000 (Two billion two hundred million) TL and divided into registered share of 2.200.000.000 (Two billion two hundred million) having a value of 1,00 (One) Turkish Lira each. The Company’s issued share capital is 2.200.000.000 (Two billion two hundred million) TL and fully paid and is divided into registered share of 2.200.000.000 (Two billion two hundred million Turkish Lira) shares having a value of 1,00 (One) TL each.

The authorization of the ceiling of registered capital given by the Capital Market Board, shall be effective for the years between 2015-2019 (5 years). Even though the ceiling of the registered capital is not reached, after the year 2019, it is mandatory for the Board of Directors, to obtain permit of the General Assembly in order to pass a resolution to increase the capital by way of also having authorization of Capital Market Boards for the ceiling previously authorized or for a new ceiling amount which is not more than five years. In case the abovementioned authorization is not taken, capital increase shall not be made with a Board of Members Resolution.

|

|

| |

|

|

|

| |

|

The Board of Directors, between the years 2015-2019, in accordance with the provisions of Capital Market Act, when necessary, is authorized to increase the issued share capital by issuing registered shares up to the authorized share capital; and authorized to resolve on the matters which are relating to limiting the right of obtaining new shares of the shareholders’ and issuing of premium shares.

Shares representing the issued share capital are tracked in connection with the dematerialization principles.

|

|

| |

|

|

|

| |

ARTICLE 7 - SHARE TRANSFER

|

ARTICLE 7 - SHARE TRANSFER

|

|

| |

Transfer of Shares is subject to the provisions of the Turkish Commercial Code, Capital Market Legislation and the Regulations on Value Added Telecommunications Services.

|

Transfer of Shares is subject to the provisions of the Turkish Commercial Code, Capital Market Legislation and By law on the Authorization on the Electronic Communication Sector and concession agreements with regard to Grant a License of Establishing and Operating GSM Pan Europe Mobile Telephone System and concession agreement of Establishing Operating and Providing IMT-2000/UMTS Infrastructures and Services.

|

|

| |

The Board of Directors may restrict the share transfers to the foreigners in order to comply with the restrictions concerning the shareholders determined under the Regulations on Value Added Telecommunications Services and/or other legislation, of which the Company is subject to.

|

The Board of Directors may restrict the share transfers to the foreigners in order to comply with the restrictions concerning By law on the authorization on the Electronic Communication Sector and concession agreement with regard to Grant a License of Establishing and Operating GSM Pan Europe Mobile Telephone System and concession agreement of the Establishing Operating an Providing IMT-2000/UMTS Infrastructure and Services and the restrictions concerning the shareholders determined under and/or other legislation, of which the Company is subject to. Article 137.3 of the Capital Markets Law is reserved.

|

|

| |

|

|

|

| |

ARTICLE 8 – CAPITAL INCREASE AND SHARE CERTIFICATES

|

ARTICLE 8 – CAPITAL INCREASE AND SHARE CERTIFICATES

|

|

| |

The Board of Directors of the Company is authorised to increase the issued share capital by issuing new shares up to the authorised share capital, to resolve to restrict the pre-emption rights of the shareholders and to take resolutions regarding the issuance of premium shares whenever it is deemed necessary, in compliance with the Capital Market Law.

|

This Article was removed from the text.

|

|

| |

During capital increases shares remaining pursuant to the exercise of pre-emptive rights and in the event pre-emptive rights are restricted, all of the newly issued shares shall be offered to the public at their market value but not less than their nominal value.

|

|

|

| |

New shares may not be issued until all the issued shares are fully sold and paid. The issued share capital has to be indicated on all documents bearing the trade name of the Company.

|

|

|

| |

The Board of the Directors of the Company may issue share certificates in different denominations representing more than one share in compliance with the relevant regulations of the Capital Market Board.

|

|

|

| |

|

|

|

| |

ARTICLE 9 - BOARD OF DIRECTORS

|

ARTICLE 9 - BOARD OF DIRECTORS

|

|

| |

The Company is managed and represented by the Board. The Board is fully authorised to carry out the affairs of the Company and management of Company assets and the activities relating to the Company purpose and subject matter other than those that have to be solely carried out by the General Assembly.

|

The Company is managed and represented by the Board. The Board is fully authorized for all matters relating to the Company’s business and to carry out the affairs of the Company and management of Company assets and the activities relating to the Company’s scope of business other than those fallen within the competence of the General Assembly.

|

|

| |

The Board is comprised of 7 (seven) members elected by the General Assembly.

|

The Board shall be comprised of 7 (seven) members to be elected by the General Assembly.

The relevant legislation shall be applicable to relations of the committees with the board of directors and to the formation, rules of procedures of the committees which The Board is responsible to establish within the context of Capital Markets Law, Turkish Commercial Code and relevant legislation.

|

|

| |

|

|

|

| |

In case the Board of Directors is informed that a member of the Board of Directors no longer has any relation with and is no longer a representative of the legal entity it represents or that a legal entity having a representative on the Board of Directors has transferred its shares to a third party, such member of the Board of Directors and representative of the such legal entity shall be considered as having resigned from its membership on the Board of Directors and the Board shall temporarily appoint another member until the next General Assembly.

|

|

|

| |

|

|

|

| |

ARTICLE 10 – DUTY PERIOD

|

ARTICLE 10 – DUTY PERIOD

|

|

| |

The members of the Board of Directors may be elected for a period of maximum three years.

|

The members of the Board of Directors may be elected for a period of maximum three years.

|

|

| |

The members of the Board of Directors whose duty period ends may be re-elected.

|

The members of the Board of Directors whose duty period ends may be re-elected.

|

|

| |

If one of the memberships is left during the duty period, new members may be elected to replace these in accordance with the related provisions of the Turkish Commercial Code and Article 11 of this Article Of Association

|

If one of the memberships becomes vacant or an independent board member ceases to be independent, an appointment shall be made in accordance with provisions of Turkish Commercial Code and Capital Markets Board regulations and submitted to approval of the first general assembly.

|

|

| |

|

|

|

| |

ARTICLE 11 – MEETINGS OF THE BOARD OF DIRECTORS

|

ARTICLE 11 – MEETINGS OF THE BOARD OF DIRECTORS

|

|

| |

1) Meetings of the Board of Directors:

|

1) Meetings of the Board of Directors:

|

|

| |

The Board of Directors shall meet whenever necessitated by the affairs of the Company. Meetings of the Board of Directors shall be held at the headquarters of the Company or at any place agreed upon.

|

The Board of Directors shall meet whenever necessitated by the affairs of the Company. Meetings of the Board of Directors shall be held at the headquarters of the Company or at any place agreed upon.

|

|

| |

|

Pursuant to article 1527 of the Turkish Commercial Code, members who have a right to attend the Board meetings, may attend such meeting by electronical means. Pursuant to the Comminiqué on Electronic Meetings Held in Companies Other Than General Meetings of the Joint Stock Companies, the Company may either set up the Electronical Meeting System, which enables right holders to attend such meetings and equally vote on the agenda items; or purchase related services from the systems providers, that are specifically found for such purposes. During these meetings, right holders shall be provided to enjoy their rights electronically, as stipulated under the aforementioned Communiqué, either be over a set up system or a purchased system which are both established subject to this provision of the articles of association of the Company.

|

|

| |

2) Meeting and Decision Making Quorum:

|

2) Meeting and Decision Making Quorum:

|

|

| |

Quorum for Board meetings shall consist of a minimum 5 directors. Ordinary actions of the Board shall be taken by affirmative votes of 4 of the directors upon the presence of 5 directors and affirmative votes of 5 directors upon the presence of more than 5 directors.

|

Quorum for Board meetings shall consist of a minimum 5 directors. Ordinary actions of the Board shall be taken by affirmative votes of 4 of the directors upon the presence of 5 directors and affirmative votes of 5 directors upon the presence of more than 5 directors.

|

|

| |

|

|

|

| |

ARTICLE 12 – BINDING AND REPRESENTATION OF THE COMPANY

|

ARTICLE 12 – BINDING AND REPRESENTATION OF THE COMPANY

|

|

| |

All documents, bonds, powers of attorney, written undertakings, contracts, offers, demands, acceptances, announcements and all other documents related with the Company, will be valid and binding the Company, if signed by person or persons so authorized by the Board of Directors on condition that they sign under the Company name, in circumstances registered and published as allowing such signature. The Board of Directors will determine the conditions on which the person(s) authorized to bind the company will sign.

|

The authority to represent and bind the Company is vested with the Board of Directors. All documents, bonds, powers of attorney, written undertakings, contracts, offers, demands, acceptances, announcements and all other documents related with the Company, will be valid and binding the Company, if signed by person or persons so authorized by the Board of Directors on condition that they sign under the Company name, in circumstances registered and published as allowing such signature. The Board of Directors will determine the conditions on which the person(s) authorized to bind the company will sign.

|

|

| |

|

|

|

| |

ARTICLE 13 – SHARING DUTIES AND ASSIGNING DIRECTORS

|

ARTICLE 13 – SHARING DUTIES AND ASSIGNING DIRECTORS

|

|

| |

The Board of Directors may assign all of its authorities related to management and representation or the parts pertaining to the execution phase of the company business or the parts it finds necessary to delegate members of the Board of Directors or to General Directors or Directors or other officers for whom it is not necessary to have a share and the Board of Directors may give them authority to sign. Minimum one member of the Board of Directors shall have the authority to represent the Company even if the authority to manage and represent the Company is left to the General Directors or Directors or other officers who do not hold any shares in the Company. The Board of Management may give Third Persons special authority to represent and bind the Company. The duty period of other officers who have the authority to put the signatures of the General Directors and Directors is not limited with the election periods of the Board of Directors members. The provisions of 11-2 article of these Articles of Association are preserved.

The Board of Directors shall always be free to cancel such delegated authority of such members and directors.

|

The Board of Directors, in accordance with Article 367 of Turkish Commercial Code, is authorized, in whole or in part to cede the management to one or more Board members or a third person pursuant to Internal Guidelines prepared by itself excluding unassignable duties and authorities which are defined under Article 375 of the Turkish Commercial Code. In addition, the Board of Directors may cede its authority to represent the Company to one or more executive directors or to a third person as a director.

The General Manager is the head of the executive branch. He performs his duties in such capacity in accordance with the instructions given by the Board of Directors or General Assembly, and within the scope and authority granted by the Board of Directors or General Assembly. He reports to the Board in respect of his executive act.

|

|

| |

|

|

|

| |

ARTICLE 14 - AUDITORS AND THEIR DUTIES

|

ARTICLE 14 - AUDITORS AND THEIR DUTIES

|

|

| |

The General Assembly shall elect 2 auditors from among either the shareholders or third parties.

The auditors shall be elected for a period of maximum three years. The auditors may be re-elected.

The auditors are responsible for fulfilling the tasks stated in Articles 353 to 357 of the Turkish Commercial Code.

|

This article was removed from the text.

|

|

| |

|

|

|

| |

ARTICLE 15 – DIRECTORS AND AUDITORS FEE

|

ARTICLE 15 – BOARD OF DIRECTORS’ FEES

|

|

| |

The General Assembly determines the fee to be paid to the members of the Board of Management and to the Auditors.

|

The General Assembly determines the fee to be paid to the members of the Board of Directors’.

|

|

| |

|

|

|

| |

ARTICLE 16 – INDEPENDENT AUDITOR

|

ARTICLE 16 – AUDIT

|

|

| |

In addition to the auditors, the Board of Directors shall elect one of the international auditing firms incorporated in Turkey and acceptable to the Capital Market Board as an Independent Auditor for the yearly auditing of the Company’s commercial book and records. The provisions of Capital Market Board regarding the approval of independent auditor and principals of independent auditing shall be applied.

|

Relevant provisions of Turkish Commercial Code and Capital Market Legislation shall be applicable with regard to audit of the Company.

|

|

| |

|

|

|

| |

ARTICLE 17 – GENERAL ASSEMBLY

|

ARTICLE 17 – GENERAL ASSEMBLY

|

|

| |

The below issues shall be applied for the General Assembly:

|

The below issues shall be applied for the General Assembly:

|

|

| |

1. Convening: The meeting of the General Assembly shall convene either for ordinary or extraordinary meetings. The convening for the meetings shall be made in accordance with the provisions of the Turkish Commercial Code and Capital Market Law. The General Assembly may convene without invitation in accordance with Article 370 of the Turkish Commercial Code.

|

1. Convening: The meeting of the General Assembly shall convene either for ordinary or extraordinary meetings. In these meetings the agenda items, prepared by the Board, shall be discussed and resolved within the scope of relevant provisions of the Turkish Commercial Code. The extraordinary meetings of the General Assembly shall convene and resolve as deemed necessary by the Company’s business.

The convening for the meetings shall be made in accordance with the provisions of the Turkish Commercial Code and Capital Market Law.

The general assembly meeting procedures are regulated under the Internal Guidelines. Accordingly, general assembly meetings procedures shall execute with the related provisions of the Turkish Commercial Code and the Internal Guidelines.

|

|

| |

|

|

|

| |

2. Date: Ordinary meetings of General Assembly shall convene once a year and within the three months following the end of Company’s fiscal year, the Extraordinary meetings of the General Assembly shall convene whenever necessitated by the affairs of the Company. |

2. Attending the General Assembly meeting by Electronical Means:

Right holders, who have a right to attend the general assembly meetings, can attend such meetings by electronic means pursuant to article 1527 of the Turkish Commercial Code.

Pursuant to the Comminiqué on Electronic Meetings Held in Companies Other Than General Meetings of the Joint Stock Companies, the Company shall procure the right holders to attend, to deliver an opinion and to vote by electronical means, either setting up the electronic general assembly system; or purchase related services from the system providers that are specifically found for such purposes. Pursuant to this provision of the articles of association of the Company, right holders and their representatives shall be procured to enjoy their rights, as stipulated under the aforementioned Communiqué.

|

|

| |

3. Voting Rights and Appointing Proxy: In Ordinary or Extraordinary meetings of the General Assembly, shareholders or their proxies shall have one vote per share. In General Assembly meetings, shareholders may have themselves represented through a proxy who may be a shareholder or a non-shareholder. Proxies who are also shareholders of the Company are authorised to vote both for themselves and on behalf of the shareholders being represented by such proxies.

|

3. Date: Ordinary meetings of General Assembly shall convene once a year and within the three months following the end of Company’s fiscal year, the Extraordinary meetings of the General Assembly shall convene whenever necessitated by the affairs of the Company.

|

|

| |

Regulations of the Capital Market Board relating to proxy votes on behalf of the shareholders shall apply.

|

|

|

| |

4. Voting Method: Votes are cast in General Assembly meetings by the raising of hands. However, votes shall be cast by secret ballot upon the request of the shareholders representing one tenth of the shares represented in a meeting. The related provisions of the Capital Market Board shall apply.

|

4. Voting Rights and Appointing Proxy: Right holders or their representatives attending the General Assembly meeting shall enjoy their voting rights pro rata to the sum of their nominal shares. Each shareholder has one voting right.In General Assembly meetings, shareholders may have themselves represented through a proxy who may be a shareholder or a non-shareholder. Proxies who are also shareholders of the Company are authorised to vote both for themselves and on behalf of the shareholders being represented by such proxies.

|

|

| |

|

Regulations of the Capital Market Board relating to proxy votes on behalf of the shareholders shall apply.

|

|

| |

5. Presidency of the General Assembly: President of the General Assembly meetings shall be the chairman of the Board of Directors, in his absence, the deputy chairman or in the absence of both, one of the members of the Board of Directors. The secretary of the General Assembly may be elected from among the shareholders or non-shareholders.

|

5. Voting Method: Votes are cast in General Assembly meetings by the raising of hands. However, votes shall be cast by secret ballot upon the request of the shareholders representing one tenth of the shares represented in a meeting. The related provisions of the Capital Market Board shall apply.

|

|

| |

|

|

|

| |

6. Meetings and Decision Making Quorum: At meetings of the General Assembly, the items specified in Article 369 of the Turkish Commercial Code shall be discussed and resolved. Save as higher quorums are provided for in the Turkish Commercial Code, meeting quorum at the General Assembly requires the presence of at least 51% of shareholders represented by themselves or proxies and save as higher quorums are provided for in the Turkish Commercial Code decision making quorum requires the majority of the affirmative of shareholders present at the meeting.

|

6. Presiding Committee of the General Assembly: President of the General Assembly meetings shall be the Chairman of the Board of Directors, in his absence, the Vice-Chairman, or in the absence of both, President of the General Assembly shall be elected from among the shareholders or non-shareholders.

|

|

| |

However, the decisions regarding the amendments to the Articles of Association of the Company excluding the increase in the ceiling of the authorized share capital requires the presence of shareholders holding the 2/3 of the share capital and affirmative votes of 2/3 of the shareholders represented in the meeting.

|

|

|

| |

7. Place of Meeting: General Assembly meetings shall convene at the Company’s headquarters or upon the decision Board of Directors at another suitable place of the city where the headquarters of the Company is located.

|

7. Meetings and Decision Making Quorum:

Save as higher quorums are provided for in the Turkish Commercial Code and the Capital Markets Law, meeting quorum at the General Assembly requires the presence of at least 51% of shareholders represented by themselves or proxies and save as higher quorums are provided for in the Turkish Commercial Code and the Capital Markets Law, decision-making quorum requires the majority of the affirmative votes of shareholders present at the meeting.

As an exception to the above-mentioned rule, and save as higher quorums are provided for in the Turkish Commercial Code and the Capital Markets Law, the decisions regarding the amendments to the Articles of Association of the Company excluding the increase in the ceiling of the authorized share capital requires the presence of shareholders holding the 2/3 of the share capital and affirmative votes of 2/3 of the shareholders represented in the meeting.

|

|

| |

|

8. Place of Meeting: General Assembly meetings shall convene at the Company’s headquarters or upon the decision Board of Directors at another suitable place of the city where the headquarters of the Company is located.

|

|

| |

|

|

|

| |

ARTICLE 18 – PRESENCE OF A COMMISSIONER AT THE MEETINGS

|

ARTICLE 18 – PRESENCE OF A MINISTRY REPRESENTATIVE AT THE MEETINGS

|

|

| |

The presence of T.R. Ministry of Industry and Commerce Commissioner is necessary at both ordinary and extraordinary General Assembly meetings. The commissioner has to sign the meeting reports. General Assembly meeting decisions taken in the absence of the commissioner and reports which do not bear the commissioner’s signature shall not be valid.

|

The presence of T.R. Ministry of Customs and Commerce Representative is necessary at both ordinary and extraordinary General Assembly meetings. The ministry representative has to sign the meeting reports. General Assembly meeting decisions taken in the absence of the ministry representative and reports which do not bear the ministry representative’s signature shall not be valid.

|

|

| |

ARTICLE 19 - ANNOUNCEMENTS AND ANNUAL REPORTS OF THE COMPANY

|

ARTICLE 19 - ANNOUNCEMENTS AND ANNUAL REPORTS

|

|

| |

Announcements concerning the Company shall be made in the newspaper published at the city where the Headquarters of the Company are located at least 15 days in advance provided that the provisions of Article 37/4 of the Turkish Commercial Code are reserved. If there is no newspaper published at the place where the Headquarters are located, then the announcement shall be made in the newspaper published at the closest place to the Headquarters.

However, announcements regarding the invitation of the General Assembly, in accordance with Article 368 of the Turkish Commercial Code, excluding the dates of announcement and invitation shall be made two weeks in advance and the date of the meeting shall be notified to the shareholders via registered mail.

Provisions of Articles 397 and 438 of the Turkish Commercial Code shall be applicable to the announcements regarding the share capital decrease and liquidation of the Company.

Any other announcement and information responsibilities pursuant to the Capital Market legislation and the Turkish Commercial Code are reserved.

Financial tables and reports and also independent audit reports required by the Capital Market Board shall be disclosed to the public and delivered to the Capital Market Board in accordance with the provisions and principles of the Board of Directors.

|

Announcements with regard to the Company shall be made in accordance with provisions of Turkish Commercial Code, Capital Markets Board regulations and relevant legislation.

The announcement period requirements, with regard to announcements of the General Assemblies, provided by the applicable Turkish Commercial Code, Capital Market legislations and the Capital Markets Board’s Corporate Governance Rules shall be complied with. The announcement of the General Assembly meeting shall be notified to the shareholders minimum three weeks before the date of General Assembly meeting, in addition to the means provided in the legislation, via any means of communication including electronic communication that ensure attendance of maximum number of shareholders.

The Board of Directors’ activity report and independent audit report with annual balance sheets and profit-loss statements, and copies of each minutes of the general assembly meetings and list of attendees; shall be provided at least within one month, prior to the date of the general assembly meeting, with the Ministry of Customs and Commerce or the attending ministry representative, in the event that whose attendance is a must.

Financial tables and reports required by the Capital Market Board and independent audit report, shall be disclosed to the public according to rules and procedures set forth by Turkish Commercial Code and Capital Markets Board.

|

|

| |

ARTICLE 21 - DETERMINATION AND DISTRIBUTION OF THE PROFIT

|

ARTICLE 21 - DETERMINATION AND DISTRIBUTION OF THE PROFIT

|

|

| |

If any, the net profit drawn up in the annual budget after the deduction of all expenses and depreciation sums, reserves and taxes needed to be paid by or charged to the Company, from the revenues of the Company as determined by the end of the accounting term and after the deduction of the previous year’s loss, shall be distributed in accordance with the Capital Market Law and communiqués of the Capital Market Board as follows:

|

If any, the net profit drawn up in the annual budget after the deduction of all expenses and depreciation sums, reserves and taxes needed to be paid by or charged to the Company, from the revenues of the Company as determined by the end of the accounting term and after the deduction of the previous year’s loss, shall be distributed respectively as follows:

General Statutory Reserve Fund:

|

|

| |

a)

|

5% statutory reserve fund shall be set aside as the first statutory reserve fund.

|

a)

|

5% shall be set aside as the statutory reserve fund.

|

|

| |

|

|

First Dividend:

|

|

| |

b)

|

The first dividend shall be set aside from the remaining amount in the ratio determined by the Capital Market Board.

|

b)

|

Profit share shall be set aside from the remaining amount calculated by adding the amount of donation if made within a year, over the ratio set by General assembly in line with the dividend distribution policy of the Company according to Turkish Commercial Code and Capital Markets legislation.

|

|

| |

c)

|

Amount of the net profit remaining after the deduction of the amounts stated in (a) and (b) may be distributed partially or fully as second dividend or set aside as extraordinary statutory reserve fund as per the General Assembly resolutions. The General Assembly may set aside an amount as profit share for the members of the Board of Directors, officers, employees and workers and foundations constituted for various purposes and this kind of real or legal persons.

|

c)

|

Following deduction of the above amounts the General Assembly has the right to distribute dividend to the Board of Director members, workers of the company, foundations and real and legal persons apart from the shareholders.

|

|

| |

|

|

Second Dividend:

|

|

| |

d)

|

It may not be resolved that any other reserve funds be set aside or left for the following year unless reserve funds and first dividend stated in the Articles of Association for the shareholders are set aside in compliance with the legislation and it may not be resolved that the profit be distributed to the members of the Board of Directors, officers and employees and foundations constituted for various purposes and this kind of real or legal persons unless first dividend is distributed.

|

d)

|

The General Assembly is entitled to distribute, partially or fully, the amount of the net profit remaining after the deduction of the amounts stated in (a), (b) and (c) or to set aside this amount as a reserve fund voluntarily set aside according to Article 521 of Turkish Commercial Code.

|

|

| |

e)

|

The dividend can be distributed to all the shares that exist as of the accounting period, irregardless of their issue or enforcement dates.

|

e)

|

10/100 of the amount, which were calculated by the deduction of profit share in the amount of %5 of the capital from the portion which were decided to be distributed to shareholders and other persons who participate the profit, shall be added to general statutory reserve fund according to 2nd paragraph of Article 519 of Turkish Commercial Code.

|

|

| |

Article 466/2(3) of the Turkish Commercial Code is reserved.

|

Unless statutory legal reserves and dividend portion which is determined to be distributed to the shareholders by the articles of association or dividend distribution policy of the company are set aside the Company shall not decide to reserve any other funds, to carry out profit to the next year, to distribute dividend for the members of the Board of Directors, workers of the company, foundations and real or legal persons apart from shareholders and unless the dividend determined to be distributed to the shareholders is paid in cash, any portion of the dividend cannot be distributed to these persons.

|

|

| |

|

Dividend shall be distributed equally to the all current shares as of the date of distribution regardless their issuance and acquisition dates.

|

|

| |

|

Procedure and date of dividend distribution shall be decided by General Assembly upon Board of Directors’ proposal.

|

|

| |

|

Resolution of General Assembly regarding profit share distribution resolved pursuant to this Article of Association may not be revoked.

|

|

| |

|

Company can decide to distribute advance dividend in accordance with the conditions established by the Capital Market legislation and other related legislation.

|

|

| |

ARTICLE 24 - LEGAL PROVISIONS

|

ARTICLE 24 - LEGAL PROVISIONS

|

|

| |

The provisions of the Turkish Commercial Code, the Capital Market Law and related legislations shall be applicable to matters not covered by the Articles of Association.

|

This Article was removed from the text.

|

|

| |

|

|

|

| |

ARTICLE 25 - BONDS AND OTHER SECURITIES

|

ARTICLE 25 - BONDS AND OTHER SECURITIES

|

|

| |

The Company may issue bonds and any other debt securities bearing the features of capital market securities which the Board of Directors may be authorized to issue, in order to sell them to individuals or legal entities, in Turkey or abroad in accordance with the Turkish Commercial Code, the Capital Market Law and any other related legislation via resolutions of Board of Directors.

|

The Company may issue other capital market instruments by way of a Board of Directors’ resolution, in accordance with the provisions of the Turkish Commercial Code, Capital Markets legislations.

|

|

| |

The Company may also issue convertible bonds as per resolutions of Board of Directors in compliance with the regulations of the Capital Market Board.

|

|

|

| |

|

|

|

| |

|

ARTICLE 26 - COMPLIANCE WITH CORPORATE GOVERNANCE RULES

Compliance with the Capital Markets Board’s mandatory Corporate Governance Rules shall be ensured. Transactions and Board decisions in violation of the mandatory Corporate Governance Rules shall be deemed to be in violation of the articles of association, and invalid.

With regard to the transactions deemed material within the context of implementation of Corporate Governance Rules, and related party transactions of the company as well as for the transactions with respect to giving guarantee, pledge and mortgage in favor of the third parties, Corporate Governance regulations of Capital Markets Board shall be complied.

The number and qualifications of independent board members who will be appointed to The Board shall be determined in accordance with the regulations in the Corporate Governance Rules of Capital Markets Board.

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Turkcell Iletisim Hizmetleri A.S. has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

|

| |

TURKCELL ILETISIM HIZMETLERI A.S.

|

|

| |

|

|

| |

|

|

|

Date: February 25, 2015

|

By:

|

/s/Murat Dogan Erden

|

|

| |

Name: |

Murat Dogan Erden |

|

| |

Title: |

Chief Financial Officer |

|

| |

|

|

|

| |

TURKCELL ILETISIM HIZMETLERI A.S.

|

|

| |

|

|

| |

|

|

|

Date: February 25, 2015

|

By:

|

/s/Nihat Narin

|

|

| |

Name: |

Nihat Narin |

|

| |

Title: |

Investor Relations Director |

|

| |

|

|

|

Turkcell lletism Hizmetl... (NYSE:TKC)

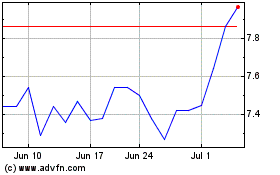

Historical Stock Chart

From Mar 2024 to Apr 2024

Turkcell lletism Hizmetl... (NYSE:TKC)

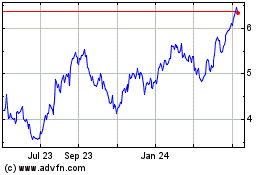

Historical Stock Chart

From Apr 2023 to Apr 2024