Robbins Arroyo LLP: Teekay Corporation (TK) Misled Shareholders According to a Recently Filed Class Action

December 19 2016 - 1:44PM

Business Wire

Shareholder rights law firm Robbins Arroyo LLP announces that a

class action complaint was filed against Teekay Corporation (NYSE:

TK) in the U.S. District Court for the District of Connecticut. The

complaint is brought on behalf of all purchasers of Teekay

securities between June 30, 2015 and December 17, 2015, for alleged

violations of the Securities Exchange Act of 1934 by Teekay's

officers and directors. Teekay primarily provides crude oil and gas

marine transportation services in Bermuda and internationally.

Teekay gets the vast majority of its cash flow from the

distributions paid by its master limited partnerships ("MLPs"),

Teekay LNG Partners L.P. ("TGP") and Teekay Offshore Partners L.P.

("TOO").

View this information on the law firm's Shareholder Rights

Blog:www.robbinsarroyo.com/shareholders-rights-blog/teekay-corporation-dec-2016

Teekay Accused of Misleading Investors About Its Dividend

Payments

According to the complaint, on June 30, 2015, Teekay officials

increased the company's quarterly dividend by 75% to $0.55 per

share, assuring investors that the company would at least maintain

this higher dividend, and that the company intended to increase it

by 15-20% in the coming years. In several subsequent earnings calls

with analysts, Teekay officials predicted an optimistic outlook for

the company's dividends, emphasizing the robust pipeline of $6.2

billion of growth projects at its daughter entities stretching to

2020. However, the complaint alleges that Teekay failed to disclose

that: (1) the company's repeated assurances that it would maintain

a quarterly dividend of at least $0.55 per share were baseless; (2)

the company knew that it could not support future dividend payments

in excess of $0.55 per share; and (3) the cash flows from the

company's MLPs (TGP and TOO) could not possibly sustain such high

dividends.

On December 16, 2015, Teekay revealed in a press release that

the company's quarterly dividend was being reduced by 90% to only

$0.055 per share, commencing with the fourth quarter of 2015

dividend payable in February 2016. Deutsche Bank commented that the

reduced dividend was a "surprising announcement" that "represents a

significant about-face for the company" and cut its price target

from $60 to $10 per share. On this news, Teekay's stock declined

over 58% to close at $7.27 per share on December 17, 2015.

Teekay Shareholders Have Legal Options

Concerned shareholders who would like more information about

their rights and potential remedies can contact attorney Darnell R.

Donahue at (800) 350-6003, DDonahue@robbinsarroyo.com, or via the

shareholder information form on the firm's website.

Robbins Arroyo LLP is a nationally recognized leader in

shareholder rights law. The firm represents individual and

institutional investors in shareholder derivative and securities

class action lawsuits, and has helped its clients realize more than

$1 billion of value for themselves and the companies in which they

have invested.

Attorney Advertising. Past results do not guarantee a similar

outcome.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161219006071/en/

Robbins Arroyo LLPDarnell R. Donahue(619) 525-3990 or Toll Free

(800) 350-6003DDonahue@robbinsarroyo.comwww.robbinsarroyo.com

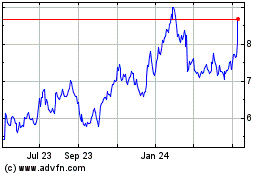

Teekay (NYSE:TK)

Historical Stock Chart

From Mar 2024 to Apr 2024

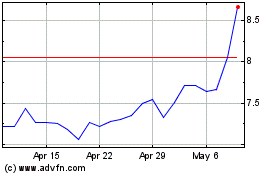

Teekay (NYSE:TK)

Historical Stock Chart

From Apr 2023 to Apr 2024