Amended Securities Registration (foreign Private Issuer) (f-4/a)

May 18 2016 - 4:46PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on May 18, 2016

Registration Statement No. 333-211069

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

to

FORM F-4

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

TEEKAY CORPORATION

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Republic of The Marshall Islands

|

|

4412

|

|

98-0224774

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

4th Floor, Belvedere Building

69 Pitts Bay Road

Hamilton HM 08, Bermuda

Telephone: (441) 298-2530

Fax: (441) 292-3931

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive office)

Watson Farley & Williams LLP

Attention: Daniel C. Rodgers

250 West 55th Street

New

York, New York 10036

(212) 922-2200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

David

S. Matheson

Perkins Coie LLP

1120 N.W. Couch Street, Tenth Floor

Portland, OR 97209-4128

(503) 727-2008

Approximate date of

commencement of proposed sale of the securities to the public:

As soon as practicable after the effective date of this registration statement and the satisfaction or waiver of all other conditions to the exchange offer described herein.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering.

¨

If

applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i)

(Cross-Border Issuer Tender Offer)

¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

¨

CALCULATION

OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Security to be Registered

|

|

Amount

to be Registered

|

|

Proposed

Maximum

Offering

Price

Per Unit(1)(2)

|

|

Proposed

Maximum

Aggregate

Offering Price(1)(2)

|

|

Amount of

Registration Fee(3)

|

|

8.5% Senior Notes due 2020

|

|

$200,000,000

|

|

100%

|

|

$200,000,000

|

|

$20,140(4)

|

|

|

|

|

|

(1)

|

The securities being registered hereby are offered in exchange for the 8.5% Senior Notes due 2020 previously issued and sold by Teekay Corporation in transactions exempt from registration under the Securities Act of

1933, as amended (the “Securities Act”).

|

|

(2)

|

Exclusive of accrued interest, if any, and estimated solely for the purpose of calculating the registration fee.

|

|

(3)

|

Calculated pursuant to Rule 457(f)(2) under the Securities Act.

|

The registrant hereby amends

this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

The sole purpose of this Amendment No. 1 to the Registration Statement on Form F-4 (File No. 333-211069) (the “Registration

Statement”) is to amend the signatures to include the signature of Teekay Corporation’s authorized representative in the United States. Accordingly, this Amendment No. 1 consists only of the facing page, this explanatory note and Part

II, including the signatures and the exhibit index. This Amendment No. 1 does not contain a copy of the prospectus that was previously included in the Registration Statement and is not intended to amend or delete any part of the prospectus.

Part II

Information Not Required in Prospectus

|

Item 20.

|

Indemnification of Directors and Officers

|

Teekay Corporation (or

Teekay

) is

a Marshall Islands corporation. The Marshall Islands Business Corporations Act (or

MIBCA

) provides that a Marshall Islands corporation shall have the power to indemnify any person who was or is a party or is threatened to be made a party to

any threatened, pending or completed action, suit or proceeding whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that he is or was a director or officer of

the corporation, or is or was serving at the request of the corporation as a director or officer of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees, judgments, fines and

amounts paid in settlement) actually and reasonably incurred by him in connection with such action, suit or proceeding if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation,

and, with respect to any criminal action or proceeding, had no reasonable cause to believe that his conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction, or upon a plea of no contest, or

its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal

action or proceeding, had reasonable cause to believe that his conduct was unlawful.

A Marshall Islands corporation also has the power to indemnify any

person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure judgment in its favor by reason of the fact that he is or was a director or

officer of the corporation, or is or was serving at the request of the corporation as a director or officer of another corporation, partnership, joint venture, trust or other enterprise against expenses (including attorneys’ fees) actually and

reasonably incurred by him or in connection with the defense or settlement of such action or suit if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation and except that no

indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable for negligence or misconduct in the performance of his duty to the corporation unless and only to the extent that

the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such

expenses which the court shall deem proper.

To the extent that a director or officer of a Marshall Islands corporation has been successful on the merits

or otherwise in defense of any action, suit or proceeding referred to in the preceding paragraphs, or in the defense of a claim, issue or matter therein, he shall be indemnified against expenses (including attorneys’ fees) actually and

reasonably incurred by him in connection therewith. Expenses incurred in defending a civil or criminal action, suit or proceeding may be paid in advance of the final disposition of such action, suit or proceeding as authorized by the board of

directors in the specific case upon receipt of an undertaking by or on behalf of the director or officer to repay such amount if it shall ultimately be determined that he is not entitled to be indemnified by the corporation as authorized in the

MIBCA.

In addition, a Marshall Islands corporation has the power to purchase and maintain insurance on behalf of any person who is or was a director or

officer of the corporation or is or was serving at the request of the corporation as a director or officer against any liability asserted against him and incurred by him in such capacity whether or not the corporation would have the power to

indemnify him against such liability under the provisions of the MIBCA.

Section F of Teekay’s Articles of Incorporation, as amended, provides

that to the fullest extent permitted under the MIBCA, a director of Teekay shall not be liable to Teekay or its stockholders for monetary damages for breach of fiduciary duty as a director. Section 10.00 of Teekay’s Bylaws provides that

any person who is made party to a proceeding by virtue of being an officer or director of Teekay or, being or having been such a director or officer or an employee of Teekay, serving at the request of Teekay as a director, officer, employee or agent

of another corporation or other enterprise, shall be indemnified and held harmless to the fullest extent permitted by the MIBCA against any and all expense, liability, loss (including attorneys’ fees), judgments, fines or penalties and amounts

paid in settlement actually incurred or suffered by such person in connection with the proceeding.

Teekay maintains a directors’ and officers’

liability insurance policy that, subject to the limitations and exclusions stated therein, covers its officers and directors for certain actions or inactions that they may take or omit in their capacities as officers and directors. In addition,

Teekay has entered into separate indemnification agreements with some of its executive officers and directors. These indemnification agreements provide for indemnification of the director or officer against all expenses, judgments, fines and amounts

paid in settlement actually and reasonably incurred by him in connection with any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except to the extent that such person is

otherwise indemnified, such action, suit or proceeding arose out of such person’s intentional misconduct, knowing violation of law or out of a transaction in which such director or officer is finally judicially determined to have derived an

improper personal benefit, or if it shall be determined by a final judgment or other final adjudication that such indemnification was not lawful.

|

Item 21.

|

Exhibits and Financial Statement Schedules

|

(a) Exhibits.

The

Exhibits listed in the accompanying Exhibit Index are filed or incorporated by reference as part of this Registration Statement.

(b) Financial Statement

Schedules.

All schedules have been omitted because they are not applicable or because the required information is shown in the financial statements or

notes thereto.

(A) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: (i) to include any

prospectus required by Section 10(a)(3) of the Securities Act of 1933; (ii) to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment

thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar

value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b)

if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new

registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial, bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the

offering.

(4) To file a post-effective amendment to the registration statement to include any financial information required by Item 8.A. of

Form 20-F at the start of any delayed offering or throughout a continuous offering.

(5) That, for the purpose of determining liability under the

Securities Act of 1933 to any purchaser: if the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule

430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a

purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior

to such date of first use.

(6) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the

initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the

securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such

securities to such purchaser: (i) any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424; (ii) any free writing prospectus relating to the offering prepared

by or on behalf of the undersigned registrant or used or referred to by the undersigned

registrant; (iii) the portion of any other free writing prospectus relating to the offering containing

material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and (iv) any other communication that is an offer in the offering made by the undersigned registrant to the

purchaser.

(B) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing

of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the

Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof.

(C) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be

permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed

in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant

in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has

been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

(D) The undersigned registrant hereby undertakes (i) to respond to requests for information that is incorporated by reference in the prospectus pursuant

to Item 4, 10(b), 11, or 13 of this form, within one business day of receipt of such request, and to send the incorporated documents by first class mail or other equally prompt means, and (ii) to arrange or provide for a facility in the

United States for the purpose of responding to such requests. This includes information contained in documents filed subsequent to the effective date of the registration statement through the date of responding to the request.

(E) The undersigned registrant hereby undertakes to supply by means of a post-effective amendment all information concerning a transaction, and the company

being acquired involved therein, that was not the subject of and included in the registration statement when it became effective.

Signatures

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant has duly caused this Amendment No. 1 to the Registration Statement

on Form F-4 to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Vancouver, British Columbia, on May 18, 2016.

|

|

|

|

|

TEEKAY CORPORATION

|

|

|

|

|

By:

|

|

/s/ Peter Evensen

|

|

|

|

Peter Evensen, President and Chief

Executive

Officer

|

Pursuant to the requirements of the Securities Act of 1933, as amended, this Amendment No. 1 to the

Registration Statement on Form F-4 has been signed by the following persons in the capacities indicated on May 18, 2016.

|

|

|

|

|

Signature

|

|

Title

|

|

|

|

|

/s/ Peter Evensen

|

|

Director, President, Chief Executive Officer and Authorized Representative in the United States

(Principal Executive Officer)

|

|

Peter Evensen

|

|

|

|

|

|

|

/s/ Vincent Lok

|

|

Executive Vice President and Chief Financial Officer (Principal Financial and Accounting

Officer)

|

|

Vincent Lok

|

|

|

|

|

|

|

/s/ C. Sean Day*

|

|

Chairman of the Board

|

|

C. Sean Day

|

|

|

|

|

|

|

/s/ Axel Karlshoej*

|

|

Director

|

|

Axel Karlshoej

|

|

|

|

|

|

|

|

|

|

|

Alan Semple

|

|

Director

|

|

|

|

|

William Utt

|

|

Director

|

|

|

|

|

/s/ Peter S. Janson*

|

|

Director

|

|

Peter S. Janson

|

|

|

|

|

|

|

/s/ Thomas Kuo-Yuen Hsu*

|

|

Director

|

|

Thomas Kuo-Yuen Hsu

|

|

|

|

|

|

|

|

|

|

|

Eileen A. Mercier

|

|

Director

|

|

|

|

|

/s/ Bjorn Moller*

|

|

Director

|

|

Bjorn Moller

|

|

|

|

|

|

|

/s/ Tore I. Sandvold*

|

|

Director

|

|

Tore I. Sandvold

|

|

|

|

|

|

|

|

*By:

|

|

/s/ Peter Evensen

|

|

|

|

Peter Evensen

Attorney-in-fact

|

Exhibit Index

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

1.1

|

|

Amended and Restated Articles of Incorporation of Teekay Corporation. (13)

|

|

|

|

|

1.2

|

|

Articles of Amendment of Articles of Incorporation of Teekay Corporation. (13)

|

|

|

|

|

1.3

|

|

Amended and Restated Bylaws of Teekay Corporation. (1)

|

|

|

|

|

2.1

|

|

Registration Rights Agreement among Teekay Corporation, Tradewinds Trust Co. Ltd., as Trustee for the Cirrus Trust, and Worldwide Trust Services Ltd., as Trustee for the JTK Trust. (2)

|

|

|

|

|

2.2

|

|

Specimen of Teekay Corporation Common Stock Certificate. (2)

|

|

|

|

|

2.8

|

|

Indenture dated as of January 27, 2010 among Teekay Corporation and The Bank of New York Mellon Trust Company, N.A. for US $450,000,000 8.5% Senior Notes due 2020. (14)

|

|

|

|

|

2.9

|

|

Agreement, dated October 5, 2012, for NOK 700,000,000 Senior Unsecured Bonds due October 2015, among us and Norsk Tillitsmann ASA. (18)

|

|

|

|

|

2.10

|

|

First Supplemental Indenture dated November 16, 2015 among Teekay Corporation and The Bank of New York Mellon Trust Company, N.A. for U.S. $200,000,000 8.5% Senior Unsecured Notes due 2021. (22)

|

|

|

|

|

4.1

|

|

1995 Stock Option Plan. (2)

|

|

|

|

|

4.2

|

|

Amendment to 1995 Stock Option Plan. (3)

|

|

|

|

|

4.3

|

|

Amended 1995 Stock Option Plan. (4)

|

|

|

|

|

4.4

|

|

Amended 2003 Equity Incentive Plan. (16)

|

|

|

|

|

4.5

|

|

Annual Executive Bonus Plan. (5)

|

|

|

|

|

4.7

|

|

Form of Indemnification Agreement between Teekay and each of its officers and directors. (2)

|

|

|

|

|

4.8

|

|

Amended Rights Agreement, dated as of July 2, 2010 between Teekay Corporation and The Bank of New York, as Rights Agent. (7)

|

|

|

|

|

4.9

|

|

Agreement dated June 26, 2003 for a U.S. $550,000,000 Secured Reducing Revolving Loan Facility among Norsk Teekay Holdings Ltd., Den Norske Bank ASA and various other banks. (8)

|

|

|

|

|

4.10

|

|

Agreement dated September 1, 2004 for a U.S. $500,000,000 Credit Facility Agreement to be made available to Teekay Nordic Holdings Incorporated by Nordea Bank Finland PLC. (5)

|

|

|

|

|

4.11

|

|

Supplemental Agreement dated September 30, 2004 to Agreement dated June 26, 2003, for a U.S. $550,000,000 Secured Reducing Revolving Loan Facility among Norsk Teekay Holdings Ltd., Den Norske Bank ASA and various other banks.

(5)

|

|

|

|

|

|

|

|

|

4.12

|

|

Agreement dated May 26, 2005 for a U.S. $550,000,000 Credit Facility Agreement to be made available to Avalon Spirit LLC et al by Nordea Bank Finland PLC and others. (6)

|

|

|

|

|

4.13

|

|

Agreement dated October 2, 2006, for a U.S. $940,000,000 Secured Reducing Revolving Loan Facility among Teekay Offshore Operating L.P., Den Norske Bank ASA and various other banks. (9)

|

|

|

|

|

4.14

|

|

Agreement dated August 23, 2006, for a U.S. $330,000,000 Secured Reducing Revolving Loan Facility among Teekay LNG Partners L.P., ING Bank N.V. and various other banks. (9)

|

|

|

|

|

4.15

|

|

Agreement, dated November 28, 2007 for a U.S. $845,000,000 Secured Reducing Revolving Loan Facility among Teekay Corporation, Teekay Tankers Ltd., Nordea Bank Finland PLC and various other banks. (10)

|

|

|

|

|

4.16

|

|

Agreement dated May 16, 2007 for a U.S. $700,000,000 Credit Facility Agreement to be made available to Teekay Acquisition Holdings L.L.C. et al by HSH NordBank AG and others. (11)

|

|

|

|

|

4.17

|

|

Amended and Restated Omnibus Agreement dated as of December 19, 2006, among Teekay Corporation, Teekay GP L.L.C., Teekay LNG Partners L.P., Teekay LNG Operating L.L.C., Teekay Offshore GP L.L.C., Teekay Offshore Partners L.P.,

Teekay Offshore Operating GP. L.L.C. and Teekay Offshore Operating L.P. (12)

|

|

|

|

|

4.18

|

|

2013 Equity Incentive Plan. (15)

|

|

|

|

|

4.19

|

|

Agreement, dated December 21, 2012 for a U.S. $200,000,000 Margin Loan Agreement among Teekay Finance Limited, Citibank, N.A. and others. (17)

|

|

|

|

|

4.20

|

|

Amendment Agreement, dated December 18, 2013 for a U.S. $300,000,000 Margin Loan Agreement among Teekay Finance Limited, Citibank, N.A. and others. (19)

|

|

|

|

|

4.21

|

|

Agreement, dated February 24, 2014 for a U.S. $815,000,000 Secure Term Loan Facility Agreement among Knarr L.L.C., Citibank, N.A. and others. (20)

|

|

|

|

|

4.22

|

|

Agreement dated July 7, 2014; Teekay LNG Operating L.L.C. entered into a shareholder agreement with China LNG Shipping (Holdings) Limited to form TC LNG Shipping L.L.C in connection with the Yamal LNG Project. (21)

|

|

|

|

|

4.23

|

|

Agreement dated December 17, 2014, for a U.S. $450,000,000 secured loan facility between Nakilat Holdco L.L.C. and Qatar National Bank SAQ. (21)

|

|

|

|

|

4.24

|

|

Amendment Agreement No. 2, dated December 19, 2014 for a U.S. $200,000,000 Margin Loan Agreement among Teekay Finance Limited, Citibank, N.A. and others. (21)

|

|

|

|

|

4.25

|

|

Amendment Agreement No. 3, dated October 5, 2015 for a U.S. $500,000,000 Margin Loan Agreement among Teekay Finance Limited, Citibank, N.A. and others. (22)

|

|

|

|

|

4.26

|

|

Amendment Agreement No. 4, dated December 17, 2015 for a U.S. $500,000,000 Margin Loan Agreement among Teekay Finance Limited, Citibank, N.A. and others. (22)

|

|

|

|

|

4.27

|

|

Agreement, dated July 31, 2015, among OOGTK Libra GmbH & Co KG, ABN AMRO Bank N.V. and various other banks for a U.S. $803,711,786.92 term loan due 2027. (22)

|

|

|

|

|

|

|

|

|

4.28

|

|

Purchase Agreement, dated as of November 10, 2015, between Teekay Corporation and J.P. Morgan Securities LLC, for itself and on behalf of the several initial purchasers listed in Schedule 1 thereto. (22)

|

|

|

|

|

4.29

|

|

Registration Rights Agreement, dated November 16, 2015 by and among Teekay Corporation and J.P. Morgan Securities LLC, for itself and as representative of the several initial purchasers listed in Schedule 1 thereto. (22)

|

|

|

|

|

4.30

|

|

Secured Term Loan and Revolving Credit Facility Agreement dated January 8, 2016 between Teekay Tankers Ltd., Nordea Bank Finland PLC and various other banks, for a $894.4 million long-term debt facility. (22)

|

|

|

|

|

4.31

|

|

Form of 8.5% Senior Notes due January 15, 2020 (CUSIP 87900YAA10) offered hereby (23)

|

|

|

|

|

4.32

|

|

Form of outstanding, unregistered 8.5% Senior Notes due January 15, 2020 (CUSIP Nos.

87900YAB9 and Y8564WAC7) issued November 16, 2015 (included in Exhibit 2.10)

|

|

|

|

|

5.1

|

|

Opinion of Perkins Coie LLP relating to the legality of the securities being registered (23)

|

|

|

|

|

5.2

|

|

Opinion of Watson Farley & Williams LLP relating to the legality of the securities being registered (23)

|

|

|

|

|

12.1

|

|

Computation of Ratio of Earnings to Fixed Charges (23)

|

|

|

|

|

21.1

|

|

List of Significant Subsidiaries (23)

|

|

|

|

|

23.1

|

|

Consent of KPMG LLP (23)

|

|

|

|

|

23.2

|

|

Consent of Perkins Coie LLP (contained in Exhibit 5.1)

|

|

|

|

|

23.3

|

|

Consent of Watson Farley & Williams LLP (contained in Exhibit 5.2)

|

|

|

|

|

24.1

|

|

Power of Attorney (23)

|

|

|

|

|

99.1

|

|

Form of Letter of Transmittal for the Exchange Offer (23)

|

|

|

|

|

99.2

|

|

Form of Notice of Guaranteed Delivery for tender of Exchange Offer (23)

|

|

(1)

|

Previously filed as an exhibit to the Company’s Report on Form 6-K (File No.1-12874), filed with the SEC on August 31, 2011, and hereby incorporated by reference to such Report.

|

|

(2)

|

Previously filed as an exhibit to the Company’s Registration Statement on Form F-1 (Registration No. 33-7573-4), filed with the SEC on July 14, 1995, and hereby incorporated by reference to such

Registration Statement.

|

|

(3)

|

Previously filed as an exhibit to the Company’s Form 6-K (File No.1-12874), filed with the SEC on May 2, 2000, and hereby incorporated by reference to such Report.

|

|

(4)

|

Previously filed as an exhibit to the Company’s Annual Report on Form 20-F (File No.1-12874), filed with the SEC on April 2, 2001, and hereby incorporated by reference to such Report.

|

|

(5)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 8, 2005, and hereby incorporated by reference to such Report.

|

|

(6)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 10, 2006, and hereby incorporated by reference to such Report.

|

|

(7)

|

Previously filed as an exhibit to the Company’s Form 8-A/A (File No.1-12874), filed with the SEC on July 2, 2010, and hereby incorporated by reference to such Report.

|

|

(8)

|

Previously filed as an exhibit to the Company’s Report on Form 6-K (File No. 1-12874), filed with the SEC on August 14, 2003, and hereby incorporated by reference to such Report.

|

|

(9)

|

Previously filed as an exhibit to the Company’s Report on Form 6-K (File No. 1-12874), filed with the SEC on December 21, 2006, and hereby incorporated by reference to such Report.

|

|

(10)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 11, 2008, and hereby incorporated by reference to such Report.

|

|

(11)

|

Previously filed as an exhibit to the Company’s Schedule TO – T/A, filed with the SEC on May 18, 2007, and hereby incorporated by reference to such schedule.

|

|

(12)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 19, 2007, and hereby incorporated by reference to such Report.

|

|

(13)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 7, 2009, and hereby incorporated by reference to such Report.

|

|

(14)

|

Previously filed as an exhibit to the Company’s Report on Form 6-K (File No. 1-12874), filed with the SEC on January 27, 2010, and hereby incorporated by reference to such Report.

|

|

(15)

|

Previously filed as an exhibit to the Company’s Registration Statement on Form S-8 (Registration No. 333-187142), filed with the SEC on March 8, 2013, and hereby incorporated by reference to such

Registration Statement.

|

|

(16)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 25, 2012, and hereby incorporated by reference to such Report.

|

|

(17)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 29, 2013, and hereby incorporated by reference to such Report.

|

|

(18)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 28, 2014, and hereby incorporated by reference to such Report.

|

|

(19)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 28, 2014, and hereby incorporated by reference to such Report.

|

|

(20)

|

Previously filed as an exhibit to the Company’s Report on Form 6-K (File No. 1-12874), filed with the SEC on September 2, 2014, and hereby incorporated by reference to such Report.

|

|

(21)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 29, 2015, and hereby incorporated by reference to such Report.

|

|

(22)

|

Previously filed as an exhibit to the Company’s Report on Form 20-F (File No. 1-12874), filed with the SEC on April 26, 2016, and hereby incorporated by reference to such Report.

|

|

(23)

|

Previously filed as an exhibit to the Company’s Registration Statement on Form F-4 (File No. 333-211069), filed with the SEC on May 2, 2016.

|

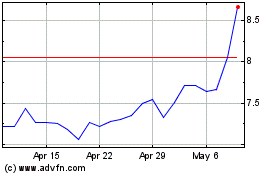

Teekay (NYSE:TK)

Historical Stock Chart

From Mar 2024 to Apr 2024

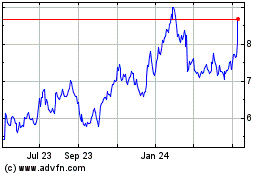

Teekay (NYSE:TK)

Historical Stock Chart

From Apr 2023 to Apr 2024