Report of Foreign Issuer (6-k)

November 06 2015 - 8:58AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

Date of

Report: November 6, 2015

Commission file number 1-12874

TEEKAY CORPORATION

(Exact name of Registrant as specified in its charter)

4th Floor

Belvedere Building

69 Pitts Bay Road

Hamilton, HM08 Bermuda

(Address of principal executive office)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40- F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ¨ No

x

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7).

Yes ¨ No

x

Item 1 — Information Contained in this Form 6-K Report

Attached as Exhibit 1 is a copy of an announcement of Teekay Corporation dated November 6, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

TEEKAY CORPORATION |

|

|

|

| Date: November 6, 2015 |

|

By: |

|

/s/ Vincent Lok |

|

|

|

|

Vincent Lok |

|

|

|

|

Executive Vice President and Chief Financial Officer

(Principal Financial and Accounting Officer) |

Exhibit 1

TEEKAY CORPORATION ANNOUNCES $200 MILLION ADD-ON OFFERING OF 8.5% SENIOR UNSECURED NOTES DUE 2020

Hamilton, Bermuda, November 6, 2015 - Teekay Corporation (Teekay or the Company) (NYSE: TK) announced today that it intends to

commence a private offering to eligible purchasers, subject to market conditions, of $200 million aggregate principal amount of the Company’s 8.5% Senior Notes due 2020 (the “Notes”). The Notes will be an additional issuance of the

Company’s outstanding 8.5% Senior Notes due 2020, which were issued on January 27, 2010 (the “Original Notes”). The Notes will be issued under the same indenture governing the Original Notes, but will not be fungible with the

Original Notes unless and until such time as the Notes are exchanged for additional Original Notes pursuant to the terms of a registration rights agreement.

Teekay intends to use a portion of the net proceeds to repay a portion of indebtedness outstanding under its $500 million revolving credit facility and the

balance to replenish cash reserves used to repay the outstanding principal balance of Teekay’s NOK Bonds that matured in October 2015.

This press

release shall not constitute an offer to sell, or the solicitation of an offer to buy, any securities, nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any state. Any offers of the notes will be made only by means of a private offering memorandum.

The notes will

be offered and sold only to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and to persons outside the United States pursuant to Regulation S under the Securities

Act.

These securities will not be registered under the Securities Act or any state securities laws, and unless so registered, may not be offered or sold

in the United States or to U.S persons except pursuant to an exemption from the registration requirements of the Securities Act and applicable state and foreign securities laws.

For Investor Relations enquiries contact:

Ryan Hamilton

Tel: +1

(604) 844-6654

- end -

Teekay Corporation Investor Relations Tel: +1 604 844-6654

www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay

Road, Hamilton, HM 08, Bermuda

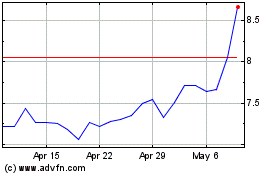

Teekay (NYSE:TK)

Historical Stock Chart

From Mar 2024 to Apr 2024

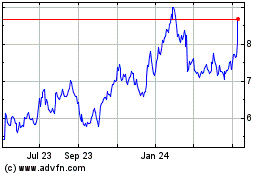

Teekay (NYSE:TK)

Historical Stock Chart

From Apr 2023 to Apr 2024