By Heather Haddon

Grocers are struggling to lure e-commerce-loving millennials

into their aisles amid what experts say is a permanent shift in

shopping patterns among consumers.

Baby boomers used to bring long grocery lists to supermarkets

and club stores. Now shoppers in their 20s and 30s are visiting

supermarkets less frequently than their parents, government records

and survey data show. They are spreading purchases across new

options, including online grocery services such as AmazonFresh,

beefed-up convenience stores and stronger food offerings from

omnibus retailers like Wal-Mart Stores Inc. and Target Corp.

"I don't think we've seen shopping change so dramatically ever,"

said Marty Siewert, senior vice president for consumer and shopper

analytics at Nielsen. "Those things in the past that have been real

drivers for grocery in terms of freshness and quality aren't the

key drivers for millennials."

Consumers between 25 and 34 years of age last year spent an

average of $3,539 on groceries, about $1,000 less in

inflation-adjusted dollars than people that age spent in 1990,

federal data shows.

On average, consumers overall bought $4,015 in food for their

homes last year.

The shift away from big grocery bills wasn't as obvious before

the financial crisis saddled millennials with student debt and weak

job prospects, and placed a lasting drag on consumer spending.

Sales at food and beverage retailers rose 3.7% between 2002 and

2007, an analysis of U.S. Census figures by A.T. Kearney shows,

while they grew just 2.4% annually from 2008 to 2013.

Alexis Tyler, a 19-year-old college student in Creston, Iowa,

who buys food at Wal-Mart and discount grocer H-E-B, worries about

paying off her student loans after graduation. "I only buy ground

beef and chicken breast and pre-sliced ham for sandwiches," Ms.

Tyler said.

The more than 75 million Americans born in the 1980s and 1990s

are also delaying marriage and childbearing, milestones that

traditionally lead people to start making big trips to the grocery

store.

Aging baby boomers also cut back on grocery-store spending,

federal data shows. That is coming during one of the worst slumps

in years for food retailers, especially those most dependent on

brick-and-mortar stores.

Burt Weiss, a baby boomer from St. Louis, said he's slashed

thousands of dollars of his grocery bills in his later years by

scouting for sales, shopping discount retailers like Aldi and

hitting convenience stores on occasion for food. "The object is to

eat well for as little as possible, " Mr. Weiss said. His grown

sons, in contrast, tend to go out to dine more.

A slump in prices for staples like meat and eggs has also

sparked a margin-erasing price war among supermarkets that, in some

cases, overexpanded during the boom times. Average prices for key

staples have declined year-over-year for 10 straight months, a

slump last topped back in 1960, federal data shows.

There were 1.4 million restaurants and grocery stores in the

U.S. last year, up from half a million in 1985. Wal-Mart, the

nation's largest food seller, added more grocery-selling outlets in

the last decade than any company, more than doubling its total to

4,645, according to industry data from the company and Progressive

Grocer. Discount outlets multiplied as well. Dollar and convenience

stores accounted for 81% of the 6,588 food retailers that opened

between 2013 and 2015, Nielsen TDLinx figures show.

Some supermarkets and food retailers have been forced to merge,

close stores or cancel expansions. Wal-Mart closed 154 U.S. stores

earlier this year, and plans to add only 55 new outlets in its new

fiscal year. Executives at Wal-Mart say the shift, their slowest

expansion in decades, will allow them to prioritize e-commerce

investments.

To win over the key young consumer group, some supermarkets are

testing smartphone apps that customers can use to place their

orders in advance, and introducing new product lines. Grocers are

joining with third-party services such as Instacart Inc., Shipt and

UberRush to reclaim millennials before they drift further to

Amazon.com Inc. or other delivery services such as FreshDirect.

This fall, Walker, Mich.-based Meijer Inc. joined with Shipt to

offer one-hour grocery delivery from 25 stores for a subscription

of $99 annually. Nearly 5,000 users have signed up for the service

so far, outpacing expectations, a Meijer spokesman said.

Still, consolidation is likely to continue in food retailing

before more millennials have children and return to the grocery

store in greater numbers, said Diana Sheehan, director of retail

insights for the consulting firm Kantar.

"What they buy may change, but the value is going to come back,"

said Ms. Sheehan. "It's just going to be a few years later than

expected."

--Julie Jargon contributed to this article.

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

October 27, 2016 10:52 ET (14:52 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

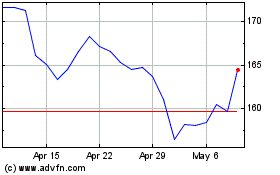

Target (NYSE:TGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

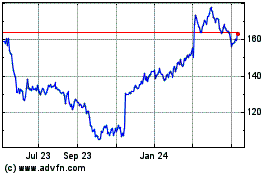

Target (NYSE:TGT)

Historical Stock Chart

From Apr 2023 to Apr 2024