By Laura Stevens And Loretta Chao

For the past two years, Amazon.com Inc., Wal-Mart Stores Inc.,

Target Corp. and other big retailers have been flinging up

warehouses and distribution centers across the country to get their

online orders to customers faster.

In the coming holiday sales season, that building spree could

come back to bite them--and the companies that deliver their

packages.

With the nation's unemployment rate at a seven-year low as

holiday hiring begins to pick up, some retailers and logistics

contractors are already struggling to find enough seasonal workers

to keep their new facilities humming. Soon, United Parcel Service

Inc., FedEx Corp. and smaller regional delivery firms will be

facing the same problem.

Employment agencies for retailers and logistics companies say

they are having trouble finding warehouse workers to stock early

holiday inventory and employees to train for work in fulfillment

centers, where holiday orders will be packed and shipped.

Few could have predicted the nation's unemployment rate would

fall to 5.1%, as it did last month, amid such red-hot growth in

e-commerce. As a result, retailers and delivery companies expect to

have to raise starting pay in some places.

For last-minute cybershoppers, the labor shortage may make the

coming holiday season even riskier than the previous two, when

Amazon and other retailers gummed up the works by trying to ship

too many packages in the final days before Christmas.

"Last year was the first year that companies felt some challenge

[finding workers], and this year they're feeling it even more,"

said Craig Rowley, leader of the retail practice at Hay Group, a

provider of human-resource services. "Between the low unemployment

rate and, hopefully, a good Christmas, it's going to be tough."

The crunch has spurred some retailers to start holiday hiring

earlier than usual. And they are trying to figure out how to be

flexible enough to accommodate employees who can only work certain

hours or shifts.

Starting warehouse wages, which have been stagnant for years,

have been rising by about $1.50 to $3 an hour to attract workers in

some markets, according to logistics staffing firm ProLogistix. The

firm said that in this holiday season, temporary jobs--especially

at e-commerce companies--start in a range of between about $11 and

$13.50 an hour, up from between about $9 and $11, though it varies

significantly by region.

Ozburn-Hessey Logistics LLC, a third-party logistics provider,

is raising its hourly wages by about 10% in some markets to compete

for talent in e-commerce hot spots, such as around Louisville, Ky.,

and Memphis, Tenn., where UPS and FedEx, respectively, operate some

of their biggest package-sorting hubs.

OHL, which typically employs 8,000 in 130 warehouses, plans to

increase its staffing by between 35% and 40% during the

holidays.

"There are a lot of warehouses there, and the market's

saturated. In some areas, the unemployment rate is as low as 3% to

3.5%," said David Hauptman, the company's vice president of product

marketing. "Many of the warehouses we've operated in, we've been in

there for a while. It's not like we're new to the market. [But]

Amazon and others have been coming in and putting wage pressure on

us."

UPS announced its seasonal hiring plans Tuesday, saying it

intends to hire as many as 95,000 employees this year--the same

number as last year.

"Make no mistake, we're obviously feeling some of the crunch

from those economic effects," said Bryan McHugh, corporate director

of the company's human-resources operations. Mr. McHugh said he is

confident UPS can hire all the seasonal workers it needs.

In some markets, that will mean paying more. The company's base

starting salary for package handlers is $10.10 an hour.

UPS said during its most recent earnings call that it would

better control holiday costs this year. Last year, it overran its

holiday cost estimates by $200 million. A labor shortage pushing up

wage rates won't make it any easier for the delivery giant, its

rivals and its customers, all of whom are trying to keep costs

down.

Amazon hasn't disclosed its seasonal hiring plans. Last year,

Amazon said it would hire more than 80,000 people. FedEx increased

its seasonal hiring last year by 25% to 50,000. It is expected to

provide more guidance on its holiday plans during its earnings

conference call Wednesday.

Many in the hiring game say the problem isn't just finding

workers, but finding skilled workers. "It's hard to find people who

can count, that have good math skills, that can communicate very

well and follow direction," says Robert Tompkins, chief executive

of a small logistics provider called Landis Logistics.

His company, which fulfills more than 600,000 orders annually

from five warehouses with 40 employees in Reading, Pa., has been in

need of two to three more full-time warehouse workers and about a

dozen more seasonal warehouse workers to add holiday capacity for

e-commerce clients. But, it hasn't been able to fill the full-time

positions for 30 days, or more than double the time it took last

year, despite rising salary offers.

E-commerce orders up the ante on hiring because it raises the

difficulty for workers. "It's not just, throw something in a

box--there's more to it," Mr. Tompkins said. "You've got to make

sure it's packed accordingly, and make sure it gets to wherever

it's going without having any damage. That does make it difficult

to find people," he said.

He said Landis has raised pay by $1 to $2 an hour from its

previous range of $10 to $15 and hour, and provides health and

dental benefits.

As companies sweeten their offers, it has gotten harder to

retain seasonal workers, especially in markets where multiple

retailers and logistics companies compete for them, says Frank

Layo, a retail strategist with Kurt Salmon. A growing number of his

clients are having workers lured away by competitors offering a

shorter commute or higher wages. That has forced those clients to

raise wages or pay mileage bonuses.

"Early warning signs of people not being able to get enough

labor are really starting to shine through," Mr. Layo said.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

September 15, 2015 20:33 ET (00:33 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

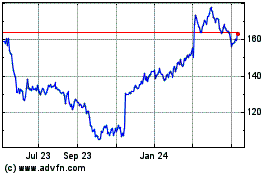

Target (NYSE:TGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

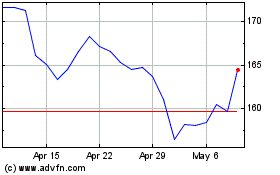

Target (NYSE:TGT)

Historical Stock Chart

From Apr 2023 to Apr 2024