Terex Corporation (NYSE:TEX) today announced a fourth quarter

2016 loss from continuing operations of $313.9 million, or ($2.96)

per share, on net sales of $1.0 billion. In the fourth quarter of

2015, the reported income from continuing operations was $23.8

million, or $0.22 per share, on net sales of $1.2 billion.

Excluding after-tax charges of $321.3 million, income from

continuing operations, as adjusted, for the fourth quarter of 2016

was $7.4 million, or $0.07 per share. This compares to income from

continuing operations, as adjusted, of $32.0 million or $0.29 per

share in the fourth quarter of 2015. The Glossary at the end of

this press release contains further details regarding these

non-GAAP measures.

For the full year 2016, Terex reported a loss from continuing

operations of $193.0 million, or ($1.79) per share, on net sales of

$4.4 billion, compared to income from continuing operations of

$128.4 million, or $1.17 per share, on net sales of $5.0 billion

for the full year 2015. Income from continuing operations, as

adjusted, for the full year 2016 was $95.3 million, or $0.88 per

share, compared to $154.6 million, or $1.41 per share, in 2015.

“Our fourth quarter results were in line with our expectations

and reflect the challenging global market conditions,” said John L.

Garrison, Terex President and CEO.

“We have taken significant steps to better position Terex for

the future,” continued Mr. Garrison. “We completed the sale of our

MHPS business, initiated major restructuring actions within our

Cranes segment, and dramatically improved our balance sheet. We

continue to implement our strategy, to focus and simplify the

company, and build capabilities in key commercial and operational

areas.”

Mr. Garrison continued, “Looking ahead to 2017, we expect our

primary global markets to remain challenging. We anticipate lower

fleet replacement demand from North American AWP rental customers.

The global Crane market remains challenging and we expect a further

decline in 2017. We anticipate modest growth in our Materials

Processing business. Combined with our cost reduction actions and

capital structure improvements, we expect to deliver 2017 earnings

per share of between $0.60 and $0.80, excluding restructuring,

impact from our ownership interest in Konecranes, and other unusual

items, on net sales of approximately $3.9 billion.”

Re-segmentation and Non-GAAP Measures

The current and prior period results reflect the re-segmentation

of our scrap material handling, concrete mixer trucks and concrete

paver business from our former Construction segment into MP, and

part of the North American services business from Cranes to MHPS

and AWP. Our MHPS business is reported as a discontinued operation.

Remaining product lines of our former Construction segment, such as

mini-excavators, loader backhoes and site dumpers are included in

Corporate and Other.

Results of operations reflect continuing operations. All per

share amounts are on a fully diluted basis. A comprehensive review

of the quarterly financial performance is contained in the

presentation that will accompany the Company’s earnings conference

call.

In this press release, Terex refers to various GAAP (U.S.

generally accepted accounting principles) and non-GAAP financial

measures. These non-GAAP measures may not be comparable to

similarly titled measures being disclosed by other companies. Terex

believes that this non-GAAP information is useful to understanding

its operating results and the ongoing performance of its underlying

businesses.

The Company provides guidance on a non-GAAP basis as the Company

cannot predict with a reasonable degree of certainty some elements

that are included in reported GAAP results, such as the timing and

impact of our ownership interest in Konecranes and future

restructuring charges.

The Glossary at the end of this press release contains further

details about this subject.

Conference call

The Company has scheduled a one hour conference call to review

the financial results on Wednesday, February 22, 2017 at 8:30 a.m.

ET. John L. Garrison, President and CEO, will host the call. A

simultaneous webcast of this call will be available on the

Company’s website, www.terex.com. To listen to the call, select

“Investor Relations” from the home page and click on the webcast

microphone link. Participants are encouraged to access the call 10

minutes prior to the starting time. The call will also be archived

on the Company’s website under “Audio Archives” in the “Investor

Relations” section of the website.

Forward-Looking Statements

This press release contains forward-looking information

regarding future events or the Company’s future financial

performance based on the current expectations of Terex Corporation.

In addition, when included in this press release, the words “may,”

“expects,” “intends,” “anticipates,” “plans,” “projects,”

“estimates” and the negatives thereof and analogous or similar

expressions are intended to identify forward-looking statements.

However, the absence of these words does not mean that the

statement is not forward-looking. The Company has based these

forward-looking statements on current expectations and projections

about future events. These statements are not guarantees of future

performance.

Because forward-looking statements involve risks and

uncertainties, actual results could differ materially. Such risks

and uncertainties, many of which are beyond the control of Terex,

include among others: Our business is cyclical and weak general

economic conditions affect the sales of our products and financial

results; the need to comply with restrictive covenants contained in

our debt agreements; our ability to generate sufficient cash flow

to service our debt obligations and operate our business; our

ability to access the capital markets to raise funds and provide

liquidity; our business is sensitive to government spending; our

business is highly competitive and is affected by our cost

structure, pricing, product initiatives and other actions taken by

competitors; our retention of key management personnel; the

financial condition of suppliers and customers, and their continued

access to capital; our providing financing and credit support for

some of our customers; we may experience losses in excess of

recorded reserves; the carrying value of goodwill could become

impaired; our ability to obtain parts and components from suppliers

on a timely basis at competitive prices; our business is global and

subject to changes in exchange rates between currencies, commodity

price changes, regional economic conditions and trade restrictions;

our operations are subject to a number of potential risks that

arise from operating a multinational business, including compliance

with changing regulatory environments, the Foreign Corrupt

Practices Act and other similar laws and political instability; a

material disruption to one of our significant facilities; possible

work stoppages and other labor matters; compliance with changing

laws and regulations, particularly environmental and tax laws and

regulations; litigation, product liability claims, intellectual

property claims, class action lawsuits and other liabilities; our

ability to comply with an injunction and related obligations

imposed by the United States Securities and Exchange Commission

(“SEC”); disruption or breach in our information technology

systems; and other factors, risks and uncertainties that are more

specifically set forth in our public filings with the SEC.

Actual events or the actual future results of Terex may differ

materially from any forward-looking statement due to these and

other risks, uncertainties and significant factors. The

forward-looking statements speak only as of the date of this

release. Terex expressly disclaims any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statement included in this release to reflect any changes in

expectations with regard thereto or any changes in events,

conditions, or circumstances on which any such statement is

based.

About Terex

Terex Corporation is a global manufacturer of lifting and

material processing products and services that deliver lifecycle

solutions to maximize customer return on investment. The company

reports in three business segments: Aerial Work Platforms, Cranes,

and Materials Processing. Terex delivers lifecycle solutions to a

broad range of industries, including the construction,

infrastructure, manufacturing, shipping, transportation, refining,

energy, utility, quarrying and mining industries. Terex offers

financial products and services to assist in the acquisition of

Terex equipment through Terex Financial Services. Terex uses its

website (www.terex.com) and its Facebook page

(www.facebook.com/TerexCorporation) to make information available

to its investors and the market.

TEREX CORPORATION AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS(unaudited)(in millions, except per share data)

Three Months Full Year Ended December 31,

Ended December 31, 2016 2015 2016 2015 Net sales $

974.7 $ 1,167.6 $ 4,443.1 $ 5,021.7 Cost of goods sold

(870.0) (952.3) (3,730.7) (4,050.5) Gross

profit 104.7 215.3 712.4 971.2 Selling, general and administrative

expenses (200.8) (158.1) (684.2) (647.5) Goodwill Impairment

(176.0) — (176.0) — Income (loss) from

operations (272.1) 57.2 (147.8) 323.7 Other income (expense)

Interest income 1.0 1.0 4.3 3.8 Interest expense (26.4) (25.6)

(102.0) (108.1) Other income (expense) – net (11.5)

(5.9) (25.2) (23.7) Income (loss) from continuing

operations before income taxes (309.0) 26.7 (270.7) 195.7

(Provision for) benefit from income taxes (5.1) (3.0)

77.4 (67.5) Income (loss) from continuing operations

(314.1) 23.7 (193.3) 128.2 Income (loss) from discontinued

operations – net of tax 47.7 (9.0) 14.3 17.4 Gain (loss) on

disposition of discontinued operations- net of tax —

1.9 3.5 3.4 Net income (loss) (266.4) 16.6 (175.5)

149.0 Net loss (income) from continuing operations attributable to

non-controlling interest 0.2 0.1 0.3 0.2 Net (income) loss from

discontinued operations attributable to non-controlling interest

(1.0) (0.2) (0.9) (3.3) Net income

(loss) attributable to Terex Corporation $ (267.2) $ 16.5 $ (176.1)

$ 145.9 Amounts attributable to Terex Corporation common

stockholders: Income (loss) from continuing operations $ (313.9) $

23.8 $ (193.0) $ 128.4 Income (loss) from discontinued operations –

net of tax 46.7 (9.2) 13.4 14.1 Gain (loss) on disposition of

discontinued operations – net of tax — 1.9 3.5

3.4 Net income (loss) attributable to Terex Corporation $

(267.2) $ 16.5 $ (176.1) $ 145.9 Basic Earnings (Loss) per Share

Attributable to Terex CorporationCommon Stockholders: Income (loss)

from continuing operations $ (2.96) $ 0.22 $ (1.79) $ 1.20 Income

(loss) from discontinued operations – net of tax 0.44 (0.09) 0.13

0.13 Gain (loss) on disposition of discontinued operations – net of

tax — 0.02 0.03 0.03 Net income (loss)

attributable to Terex Corporation $ (2.52) $ 0.15 $ (1.63) $ 1.36

Diluted Earnings (Loss) per Share Attributable to Terex

CorporationCommon Stockholders: Income (loss) from continuing

operations $ (2.96) $ 0.22 $ (1.79) $ 1.17 Income (loss) from

discontinued operations – net of tax 0.44 (0.09) 0.13 0.13 Gain

(loss) on disposition of discontinued operations – net of tax

— 0.02 0.03 0.03 Net income (loss)

attributable to Terex Corporation $ (2.52) $ 0.15 $ (1.63) $ 1.33

Weighted average number of shares outstanding in per share

calculation Basic 105.9 108.5 107.9

107.4 Diluted 105.9 109.4 107.9 109.6

TEREX CORPORATION AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEET(unaudited)(in millions)

December 31, December 31, 2016 2015

Assets Current assets Cash and cash equivalents $ 428.5 $ 371.2

Other current assets 1,539.1 2,019.4 Current assets held for sale

732.9 749.6 Total current assets 2,700.5 3,140.2

Non-current assets Property, plant and equipment – net 304.6 371.9

Other non-current assets 830.4 943.4 Non-current assets held for

sale 1,171.3 1,160.5 Total non-current assets

2,306.3 2,475.8 Total assets $ 5,006.8 $ 5,616.0

Liabilities and Stockholders’ Equity Current liabilities Notes

payable and current portion of long-term debt $ 13.8 $ 66.4 Other

current liabilities 939.4 946.2 Current liabilities held for sale

453.8 446.0 Total current liabilities 1,407.0

1,458.6 Non-current liabilities Long-term debt, less current

portion 1,562.0 1,729.8 Other non-current liabilities 204.5 217.1

Non-current liabilities held for sale 312.1 298.5

Total non-current liabilities 2,078.6 2,245.4 Total

liabilities 3,485.6 3,704.0 Total stockholders’ equity

1,521.2 1,912.0 Total liabilities and stockholders’

equity $ 5,006.8 $ 5,616.0

TEREX CORPORATION AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENT OF CASH

FLOWS(unaudited)(in millions)

Full Year Ended December 31, 2016 2015

Operating Activities Net income (loss) $ (175.5) $ 149.0

Depreciation and amortization 96.7 132.4 Changes in operating

assets and liabilities and non-cash charges 445.8

(68.5) Net cash provided by (used in) operating activities 367.0

212.9 Investing Activities Capital expenditures (73.0) (103.8)

Other investing activities, net 61.2 (68.9) Net cash

(used in) provided by investing activities (11.8) (172.7) Financing

Activities Net cash provided by (used in) financing activities

(300.1) (14.4) Effect of exchange rate changes on cash and cash

equivalents (19.7) (37.5) Net increase (decrease) in

cash and cash equivalents 35.4 (11.7) Cash and cash equivalents at

beginning of period 466.5 478.2 Cash and cash

equivalents at end of period $ 501.9 $ 466.5

TEREX CORPORATION AND

SUBSIDIARIESSEGMENT RESULTS DISCLOSURE(unaudited)(in

millions)

Q4 Year-to-Date 2016 2015 2016

2015 % of % of % of

% of Net Sales Net Sales Net Sales Net Sales

Consolidated Net sales $ 974.7 $ 1,167.6 $ 4,443.1 $ 5,021.7

Income (loss) from operations $ (272.1) (27.9%) $ 57.2 4.9% $

(147.8) (3.3%) $ 323.7 6.4%

AWP Net sales $ 379.0 $

459.3 $ 1,977.8 $ 2,246.0 Income from operations $ 18.2 4.8% $ 41.6

9.1% $ 177.4 9.0% $ 270.2 12.0%

Cranes Net sales $

327.0 $ 406.2 $ 1,274.5 $ 1,566.5 Income (loss) from operations $

(280.2) (85.7%) $ 20.5 5.0% $ (321.7) (25.2%) $ 56.3 3.6%

MP Net sales $ 236.3 $ 241.5 $ 944.5 $ 940.1 Income from

operations $ 22.4 9.5% $ 13.8 5.7% $ 86.3 9.1% $ 68.6 7.3%

Corp and Other / Eliminations Net sales $ 32.4 $ 60.6 $

246.3 $ 269.1 Loss from operations $ (32.5) n/m $ (18.7) (30.9%) $

(89.8) (36.5%) $ (71.4) (26.5%)

GLOSSARY

In an effort to provide investors with additional information

regarding the Company’s results, Terex refers to various GAAP (U.S.

generally accepted accounting principles) and non-GAAP financial

measures which management believes provides useful information to

investors. These non-GAAP measures may not be comparable to

similarly titled measures being disclosed by other companies. In

addition, the Company believes that non-GAAP financial measures

should be considered in addition to, and not in lieu of, GAAP

financial measures. Terex believes that this non-GAAP information

is useful to understanding its operating results and the ongoing

performance of its underlying businesses. Management of Terex uses

both GAAP and non-GAAP financial measures to establish internal

budgets and targets and to evaluate the Company’s financial

performance against such budgets and targets.

The amounts described below are unaudited, are reported in

millions of U.S. dollars (except share data and percentages), and

are as of or for the period ended December 31, 2016, unless

otherwise indicated.

2017 Outlook: The Company’s 2017 outlook for earnings per

share is a non-GAAP financial measure because it excludes items

such as restructuring and other related charges, impact from our

ownership interest in Konecranes, deal related costs, the impact of

the release of tax valuation allowances, and gains and losses on

divestitures. The Company is not able to reconcile these

forward-looking non-GAAP financial measures to their most directly

comparable forward-looking GAAP financial measures without

unreasonable efforts because the Company is unable to predict with

a reasonable degree of certainty the exact timing and impact of

such items. The unavailable information could have a significant

impact on the Company’s full-year 2017 GAAP financial results.

After-tax gains or losses and per share amounts are

calculated using pre-tax amounts, applying a tax rate based on

jurisdictional rates to arrive at an after-tax amount. This number

is divided by diluted weighted average shares outstanding to

provide the impact on earnings per share. The Company highlights

the impact of these items because when discussing earnings per

share, the Company adjusts for items it believes are not reflective

of ongoing operating activities in the periods. Restructuring and

related charges are a recurring item as Terex’s restructuring

programs usually require more than one year to fully implement and

the Company is continually seeking to take actions that could

enhance its efficiency. Although recurring, these charges are

subject to significant fluctuations from period to period due to

varying levels of restructuring activity and the inherent

imprecision in the estimates used to recognize the costs and taxes

associated with severance and termination benefits in the countries

in which the restructuring actions occur.

Q4 2016

Income (loss) fromContinuing

Operationsbefore Taxes

(Provision for)benefit fromIncome

Taxes*

Income (loss)from

ContinuingOperations**

Earnings (loss)per share***

As Reported (GAAP) $ (309.0 ) (5.1 ) (313.9 ) $ (2.96 ) Deal

Related (9.0 ) 3.0 (6.0 ) (0.06 ) Restructuring & Related 89.2

(5.5 ) 83.7 0.79 Transformation 9.3 (2.6 ) 6.7 0.06 Goodwill/Asset

Impairment 219.6 (16.6 ) 203.0 1.92 Tax Related -

33.9 33.9 0.32

As Adjusted (Non-GAAP) $ 0.1 7.1 7.4 $ 0.07 * Tax

effect on adjustments is calculated using a jurisdictional blended

tax rate ** Excludes $0.2 million net loss attributable to

non-controlling interest *** Based on diluted weighted average

shares outstanding of 105.9 million

Full Year 2016

Income (loss) fromContinuing

Operationsbefore Taxes

(Provision for)benefit fromIncome

Taxes*

Income (loss)from

ContinuingOperations**

Earnings (loss)per share***

As Reported (GAAP) $ (270.7 ) 77.4 (193.0 ) $ (1.79 ) Deal Related

20.5 (3.4 ) 17.1 0.16 Restructuring & Related 137.2 (19.9 )

117.3 1.09 Transformation 9.3 (2.6 ) 6.7 0.06 Goodwill/Asset

Impairment 219.6 (16.6 ) 203.0 1.88 Tax Related -

(55.8 ) (55.8 ) (0.52 ) As

Adjusted (Non-GAAP) $ 115.9 (20.9 ) 95.3 $ 0.88 * Tax effect

on adjustments is calculated using a jurisdictional blended tax

rate ** Excludes $0.3 million net loss attributable to

non-controlling interest *** Based on diluted weighted average

shares outstanding of 107.9 million

Q4 2015

Income (loss) fromContinuing

Operationsbefore Taxes

(Provision for)benefit fromIncome

Taxes*

Income (loss)from

ContinuingOperations**

Earnings (loss)per share***

As Reported (GAAP) $ 26.7 (3.0) 23.8 $ 0.22 Deal Related 5.9 (0.9)

5.0 0.05 Restructuring & Related 4.0 (0.8)

3.2 0.02 As Adjusted (Non-GAAP) $ 36.6 (4.7) 32.0 $ 0.29

* Tax effect on adjustments is calculated using a

jurisdictional blended tax rate ** Excludes $0.1 million net loss

attributable to non-controlling interest *** Based on diluted

weighted average shares outstanding of 109.4 million

Full Year 2015

Income (loss) fromContinuing

Operationsbefore Taxes

(Provision for)benefit fromIncome

Taxes*

Income (loss)from

ContinuingOperations**

Earnings (loss)per share***

As Reported (GAAP) $ 195.7 (67.5 ) 128.4 $ 1.17 Deal Related 14.5

(1.6 ) 12.9 0.12 Restructuring & Related 15.8 (4.1 ) 11.7 0.11

Product Campaign 2.5 (0.9 ) 1.6

0.01 As Adjusted (Non-GAAP) $ 228.5 (74.1 ) 154.6 $ 1.41

* Tax effect on adjustments is calculated using a

jurisdictional blended tax rate ** Excludes $0.2 million net loss

attributable to non-controlling interest *** Based on diluted

weighted average shares outstanding of 109.6 million

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170221006648/en/

Terex CorporationBrian J. Henry, 203-222-5954Senior Vice

PresidentBusiness Development & Investor

Relationsbrian.henry@terex.com

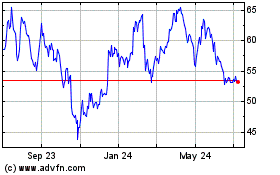

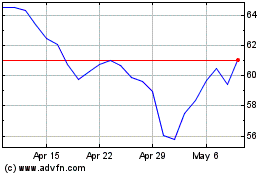

Terex (NYSE:TEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Terex (NYSE:TEX)

Historical Stock Chart

From Apr 2023 to Apr 2024