Terex Corporation Announces Commencement of Consent Solicitation

September 21 2016 - 9:29PM

Business Wire

Terex Corporation (NYSE:TEX) (“Terex”), announced today that it

is soliciting consents from holders of its 6.00% Senior Notes due

2021 (the “2021 Notes”) and 6.50% Senior Notes due 2020 (the “2020

Notes” and together with the 2021 Notes, the “Notes”) to obtain

certain waivers from the asset sale covenants in the indentures

governing the Notes. In order to maximize Terex’s flexibility with

its implementation of the previously announced disposition of its

Material Handling and Port Solutions business to Konecranes Plc

(the “MHPS Sale”) and the timing and use of the net cash payments

received from the MHPS Sale or from the sale of shares of

Konecranes Plc (the “Konecranes Shares”) received as partial

consideration for the MHPS Sale, Terex is seeking to obtain a

waiver from (a) the requirements that Terex and its restricted

subsidiaries receive 75% of the consideration in the form of cash

and cash equivalents for the MHPS Sale (the “75% Cash Requirement)

and (b) the obligations to apply the net cash payments received

from the MHPS Sale or from the sale of Konecranes Shares in

accordance with the asset sale covenants, including the requirement

to make an offer to purchase the Notes at par (the “Par Offer

Requirement”) (collectively, the “Proposed Waivers”). The MHPS Sale

is currently expected to close in January 2017. Terex is offering

cash fees of $2.50 for each $1,000 principal amount of 2021 Notes

and $2.50 for each $1,000 principal amount of 2020 Notes (each, a

“Consent Fee”) to holders of such Notes who consent to the Proposed

Waivers.

The consent solicitation is subject to the terms and conditions

set forth in the Notice of Consent Solicitation dated September 21,

2016 (the “Notice”), which is being distributed to holders of the

Notes.

In order to receive a Consent Fee, holders of record at 5:00

p.m., New York City time, on September 21, 2016 of Notes need to

validly deliver their consents, and not validly revoke such

consents, prior to 5:00 p.m., New York City time, on September 30,

2016 (the “Expiration Time”). Payment of a Consent Fee for each

series of Notes is subject to a variety of conditions described in

the Notice, including the receipt by Terex of the required majority

consents in respect of each series of Notes. Terex will pay the

Consent Fee for each series of Notes, to the extent then

outstanding, at such time as all the conditions with respect to

each series of Notes, including the consummation of the MHPS Sale,

have been satisfied or waived. Holders of Notes of any series who

do not submit consents prior to the Expiration Time will not

receive a Consent Fee, even if the Proposed Waivers become

effective for each series of Notes.

The consent solicitation for the 2021 Notes is conditioned on

receipt of majority consent for the 2020 Notes, and the consent

solicitation for the 2020 Notes is conditioned on receipt of

majority consent for the 2021 Notes. Terex may, in its sole

discretion, waive this condition. Adoption of the Proposed Waivers

is not a condition to the consummation of the MHPS Sale. However,

obtaining the Proposed Waivers will simplify the closing process.

While Terex expects to execute a waiver agreement for each series

of Notes promptly after the receipt of the applicable consents, the

terms of the waiver agreements will not become operative unless and

until, with respect to the 75% Cash Requirement (1) all conditions,

including the MHPS Sale Condition, have been satisfied or waived

and (2) the Consent Fee shall have been paid to consenting Holders,

and with respect to the Par Offer Requirement, in addition to the

foregoing (1) and (2) being satisfied, Terex uses at least $300.0

million of the net cash payments received from the MHPS Sale,

within 60 days of receipt thereof, to reduce its outstanding senior

indebtedness by, at its option, (i) prepaying a portion of its

senior secured term loans and/or (ii) repurchasing, redeeming or

otherwise retiring other senior indebtedness (provided that the

repayment of revolving indebtedness shall be considered the

repayment of other senior indebtedness only to the extent

accompanied by a permanent reduction of the related

commitment).

Terex may, in its sole discretion, terminate, extend or amend

the consent solicitation at any time as described in the Notice. If

the consent solicitation is terminated, the Proposed Waivers will

have no effect on the Notes or the holders of the Notes.

Terex has engaged Credit Suisse Securities (USA) LLC to act as

Solicitation Agent and Global Bondholder Services Corporation to

act as Information and Tabulation Agent for the consent

solicitation. Questions regarding the consent solicitation may be

directed to Credit Suisse Securities (USA) LLC at (800) 820-1653

(toll-free) or (212) 538-1862 (collect). Requests for documents

relating to the consent solicitation may be directed to Global

Bondholder Services Corporation at (866) 470-3800 (toll-free),

(212) 430-3774 (banks and brokers), (212) 430-3775/3779 (facsimile)

and (212) 430-3774 (confirmation).

This press release is for informational purposes only and the

consent solicitation is only being made pursuant to the terms of

the Notice and the related Consent Form. The consent solicitation

is not being made to, and consents are not being solicited from,

holders of Notes in any jurisdiction in which it is unlawful to

make such consent solicitation or grant such consent. None of

Terex, the Trustee, the Solicitation Agent or the Information and

Tabulation Agent makes any recommendation as to whether or not

holders should deliver consents. Each holder must make its own

decision as to whether or not to deliver consents.

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities.

Forward Looking Statements

This press release may contain forward-looking information and

statements regarding Terex and the consent solicitation. Any

statements included in this press release that address activities,

events or developments that will or may occur in the future are

forward looking, and include among others, statements regarding:

(i) the Proposed Waivers, (ii) the expected payment of a Consent

Fee, and (iii) the consummation of the MHPS Sale. Actual results

may differ materially due to a variety of factors including:

changed market conditions, the conditions for completing the MHPS

Sale, the participation of and level of participation by the

holders of Notes in the consent solicitation and other factors

listed in the Notice under “Statement Regarding Forward-Looking

Statements.” Except as required by law, Terex undertakes no

obligation to update forward-looking information if circumstances

or management’s estimates or opinions should change. Do not place

undue reliance on forward-looking information.

About Terex

Terex Corporation is a global manufacturer of lifting and

material processing products and services that deliver lifecycle

solutions to maximize customer return on investment. The Company

reports in three business segments: Aerial Work Platforms, Cranes

and Materials Processing. Terex delivers lifecycle solutions to a

broad range of industries, including the construction,

infrastructure, manufacturing, shipping, transportation, refining,

energy, utility, quarrying and mining industries. Terex offers

financial products and services to assist in the acquisition of

Terex equipment through Terex Financial Services. Terex uses its

website (www.terex.com) and its Facebook page

www.facebook.com/TerexCorporation to make information available to

investors and the market.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160921006626/en/

For Terex CorporationBrian Henry, 203-222-5954Senior Vice

President, BusinessDevelopment and Investor

Relationsbrian.henry@terex.com

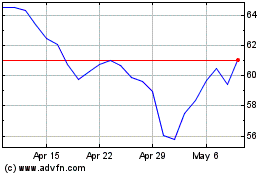

Terex (NYSE:TEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

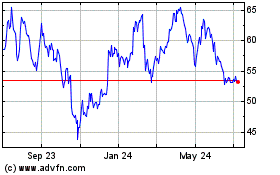

Terex (NYSE:TEX)

Historical Stock Chart

From Apr 2023 to Apr 2024