Blackstone Nears Deal to Sell Hotel Portfolio to Anbang

March 13 2016 - 9:10PM

Dow Jones News

HONG KONG—Blackstone Group LP is selling a portfolio of U.S.

luxury hotels to the Chinese owner of New York's Waldorf Astoria,

just months after buying it for $4 billion.

China's Anbang Insurance Group Co. is near a deal to buy

Strategic Hotels & Resorts Inc. from a Blackstone-managed

real-estate fund, according to people familiar with the situation.

The price Anbang is paying couldn't be determined, but Blackstone

is expected to turn a profit after taking the company private in

December.

Blackstone has built itself into the world's largest real-estate

private-equity fund manager by assets, and typically holds such

assets for years.

Anbang is among China's most ambitious overseas acquirers,

snatching up insurance companies and property assets across the

U.S. and Europe. Chinese companies have done more than $84 billion

in deals since the start of the year, according to Dealogic,

setting them up to exceed the record $108 billion of Chinese

outbound acquisitions reached last year.

China National Chemical Corp.—known as ChemChina—announced

China's biggest overseas purchase earlier this year with a $43

billion deal to buy Swiss pesticide and seed company Syngenta AG.

Other big deals include Haier Group's $5.4 billion agreement to buy

General Electric's appliance unit and a $3.3 billion bid by Chinese

equipment maker Zoomlion Heavy Industry Science & Technology

Co. for U.S. crane maker Terex Corp.

Anbang's agreement to acquire Chicago-based Strategic Hotels

will give it a substantial presence in luxury hotels across the

U.S. Strategic Hotels' prime assets include luxury properties such

as the Essex House overlooking Manhattan's Central Park and the

Hotel del Coronado near San Diego. It owns a number of Four Seasons

properties, including hotels in Washington, D.C., and Austin,

Texas, and a resort in Jackson Hole, Wyo.

Once a provincial car insurer, Beijing-headquartered Anbang

Insurance has leapt onto the global stage with several high-profile

deals, including its purchase of the Waldorf Astoria New York hotel

for $1.95 billion in February 2015 from Hilton Worldwide Holdings

Inc., which counts Blackstone as its largest shareholder. The

property will continue to be managed by Hilton under a 100-year

management agreement.

The Waldorf Astoria New York sale carried the steepest price tag

ever for a U.S. hotel at the time, brokers said, although it wasn't

the highest on a per-room basis.

Chinese investors have sought to buy U.S. properties that cary

prestige, like the Waldorf Astoria, and will benefit from a growing

number of Chinese travelers abroad. Many Chinese companies are also

seeking to acquire U.S. businesses that can help China upgrade its

domestic industries with better technology.

Anbang has also cut a number of deals in the insurance world. It

agreed to buy U.S. insurer Fidelity & Guaranty Life for $1.57

billion last year. It paid around $1 billion for a majority stake

in a South Korean insurer and has purchased insurance companies in

Belgium and the Netherlands.

Bloomberg News first reported that Anbang had agreed to purchase

Strategic Hotels from Blackstone Group.

Write to Kane Wu at Kane.Wu@wsj.com

(END) Dow Jones Newswires

March 13, 2016 20:55 ET (00:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

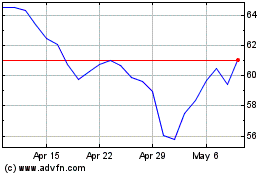

Terex (NYSE:TEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

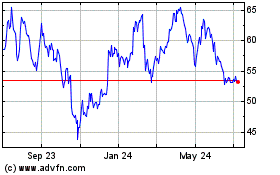

Terex (NYSE:TEX)

Historical Stock Chart

From Apr 2023 to Apr 2024