UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) July 30, 2015

TEREX CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

| | |

Delaware | 1-10702 | 34-1531521 |

(State or Other Jurisdiction | (Commission | (IRS Employer |

of Incorporation) | File Number) | Identification No.) |

|

| |

200 Nyala Farm Road, Westport, Connecticut | 06880 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code (203) 222-7170

|

|

NOT APPLICABLE |

(Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

□ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

□ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

□ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

□ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

Attached as Exhibit 99.1 to this Form 8-K of Terex Corporation (“Terex”) are the prepared statements of Terex from its July 30, 2015 conference call providing certain second quarter 2015 financial results. In addition, a replay of the teleconference is available on the Company’s website, www.terex.com, in the “Investor Relations” section.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

99.1 Prepared statements of Terex Corporation from its conference call held on July 30, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 30, 2015

|

| | |

| TEREX CORPORATION |

| | |

| By: /s/ Kevin P. Bradley |

| Kevin P. Bradley Senior Vice President and Chief Financial Officer |

Second Quarter 2015 Earnings Release Conference Call

July 30, 2015

Ron DeFeo - Terex Corporation - Chairman and Chief Executive Officer

Good morning ladies and gentlemen and thank you for your interest in Terex Corporation today. On the call with me is Kevin Bradley, Senior Vice President and Chief Financial Officer; Kevin O'Reilly, Vice President of Operational Finance; and Tom Gelston, Vice President of Investor Relations. Also participating on the call and available for your questions is the Terex leadership team, including our business segment presidents.

As usual, a replay of this call will be archived on the Terex website, www.terex.com, under Audio Archives in the Investor Relations section. I will begin with some overall commentary and highlights. Kevin will follow with a more detailed financial report. I will then provide some specific segment information and an overall summary before we open it up to your questions. We will be following the presentation that accompanied the earnings release and is available on our website. I would like to request that you ask one question and a follow-up in order to give everyone a chance to participate.

Let me direct your attention to page 2 of the presentation, which is the forward-looking statement and non-GAAP measures explanation. We encourage you to read this as well as other items in our disclosures because the information we will be discussing today does include forward-looking material.

Turning to page 3, the second quarter was a solid quarter for us, delivering on sales and profit targets despite an environment best described as challenging, but frankly it was as expected and we did perform reasonably well overall. Our Aerial Work Platforms (AWP) and Materials Processing (MP) businesses both returned to double digit operating margins, with 36% and 51% sequential incremental margins, respectively. This highlights some of the early successes our internal initiatives on cost and productivity are having on our results. Currency continues to have a meaningful impact on our year-over-year comparisons, in particular on net sales, where approximately 9% of the 11% percent decrease was a result of currency translation. From a capital structure perspective, the convertible notes matured and were retired, we repriced our European Term Loan and we entered into a securitization facility for our Terex Financial Services business, all continuing to mature our borrowing efficiency as a Company.

For our full year outlook, we continue to expect year-over-year improvement in operating results in the second half of 2015, namely from our AWP and MP businesses. But as mentioned in our press release, the environment isn’t without its challenges, and we have seen increasing pricing pressure in certain markets, as well as some mix shifts in products being sold versus our forecast. Conversely, we feel reasonably good about how we are performing against our established improvement plan, enough that we are communicating that we are ahead of plan in terms of implementation of these initiatives. And while we were hoping that better initiative performance would have created upside to our forecast, we are in a situation that all of the upside was needed to offset those challenges we see in the marketplace. Better implementation does help us minimize the downside risk during these times, and sets us up for more rapid profit expansion when markets do return to better levels. As for our outlook, we feel there is some uncertainty with how the second half will play out on the top line. As such, we are orienting our EPS expectations to the low end of our previous provided range. To be prudent we have provided a smaller range around the $2.00 EPS figure, so a new range of $1.90 to $2.10 per share.

With that, let me turn it over to Kevin who will walk you through the numbers.

Kevin Bradley - Terex Corporation - Senior Vice President and Chief Financial Officer

Thank you Ron and good morning everyone. I’ll be reviewing results for the second quarter of 2015, and comparing them to prior year results. Let’s turn to page 4 which bridges the change in both net sales and operating profit for the quarter. Net sales for the quarter of $1.83 billion decreased from the prior year by 11% or approximately $227 million. Operating profit for the quarter of $148 million decreased $13 million, or approximately 8%. Changes in foreign exchange rates accounted for roughly 80% of the decrease in both cases. Given the significance currency had on the year-over-year comparison, I will discuss net sales performance on a constant currency basis to provide a better understanding of the underlying performance in the business.

In our AWP segment, excluding the impact of currency, sales were down approximately 2%. AWP generated growth in many markets around the world including China, the Middle East and continued growth in Europe, to name a few. This growth, however, was more than offset by a decline in North America, primarily driven by the impact of oil and gas as large rental companies rebalanced their fleets. Continued softness in the Brazilian economy also contributed to the 2% decline. Sales for the Construction segment, excluding the impact of currency and the divestiture of the ASV business, are up year over year driven primarily by growth in our concrete mixer truck business. The Cranes segment, excluding the impact of a small acquisition in our Utilities business, is basically flat compared to second quarter

of 2014. Both our Material Handling & Port Solutions (MHPS) and MP businesses were essentially flat compared to the prior year quarter on a constant currency basis.

The bridge schedule on the bottom of the page provides a similar breakdown of our operating profit results for the quarter. For AWP, the primary driver of the operating profit decline was sales related. A less favorable product mix in our Cranes segment drove the decline in the quarter. MHPS and MP, despite lower sales, were generally at the same profitability levels as the prior year quarter. The year-over-year improvement in Corporate & Other for the quarter was driven primarily by three items of roughly equal weighting. The first being the positive performance in Terex Financial Services during the quarter as we continue to invest in and expand this business; the second related to lower spending levels at Corporate then originally forecasted. The third driver related to the change in intercompany eliminations.

Page 5 shows the comparative quarterly income statement. Gross margin increased 0.4 percentage points to 21% from the prior year driven largely by our AWP and MP businesses. SG&A as a percentage of sales was essentially flat at 12.9% for the quarter versus 12.8% in the prior year, but declined $27 million in line with our sales decline. Income from operations decreased $12.6 million compared to prior year. As a percentage of sales, operating margins increased from 7.8% to 8.1% for the quarter, driven by MP, improved performance at TFS and lower corporate spend than planned. Net interest and other expense decreased versus the prior year driven largely by lower rates under our new credit facility. The effective tax rate was 27.7% in Q2 compared to 31.2% in the prior year quarter. This difference was mainly due to the current period’s jurisdictional mix of profits and losses. We still see the full year tax rate in the 30% - 32% range.

For the quarter, EPS was $0.78 compared to EPS of $0.76 in the second quarter of 2014. EBITDA for the quarter was $183.0 million or 10% of net sales compared to $199.5 million or 9.7% in 2014. Net working capital as a percentage of annualized sales was 24.7%, up slightly from the prior year’s quarter of 24.5%. Return on Invested Capital decreased to 9.9% from 10.6% in the prior year.

Page 6 provides a bridge breaking down the $22 million decrease in liquidity for the quarter. Free Cash Flow (which we define as cash from operations less CapEx, but excluding the TFS investment) was $76 million and generally in line with our expectations. We paid $129 million to retire our convertible notes as they matured in June. During the quarter, we grew our TFS balance sheet by $114 million, but normal amortization and syndication activities, as well as our recently launched securitization facility resulted in a positive $73 million cash contribution from TFS in the quarter. Settlement on repurchased stock during the second quarter, combined with our dividend represented a use of $17 million. We completed M&A activity in our MP business during the quarter, representing a use of cash of approximately $33 million. And lastly, changes in the value of the U.S. Dollar versus other currencies positively impacted liquidity by $8 million. And with that, let me turn it back to Ron.

Ron DeFeo - Terex Corporation - Chairman and Chief Executive Officer

Thank you, Kevin. On page 7 we’ve presented our geographic footprint. Just to level set everyone, the arrow on the left highlights the change in reported net sales for the second quarter while the arrow on the right shows the change in net sales adjusted for currency to try to give you a more representative picture of the underlying business performance. Obviously, this has only been done because of the fairly dramatic changes in currency that we have experienced over the last six to nine months. Our largest market remains North America, which showed a decline of 8% for the quarter on a year-over-year basis, but makes up 46% of our revenue base. Most of the global markets were down on a reported basis, however Western Europe, Asia and Latin America were actually up when the impact of currency is removed. Europe continues to represent about 27% of our overall business, and Asia/Oceania grew slightly to 12% with the Rest of the World markets remaining stable at approximately 15% of total sales.

Now I’d like to take a few minutes to provide a quick review of each segment, starting with AWP on Page 8. AWP is well positioned going into the second half of the year with a slightly higher backlog than a year ago, at $436 million, even including the headwind from currency. As we mentioned last quarter, the order pattern from our customers this year had our major accounts placing their larger stocking orders in the fourth quarter, and expecting delivery late in Q1 and into Q2. While net bookings and the book to bill ratio in the quarter appears low compared to 2014, it is actually in line with our expectations given the amount of orders we have already received for Q3 delivery in previous quarters. This, combined with the impact of the improvement initiatives, is expected to lead to a noticeable margin improvement when comparing the second half of 2015 with that of 2014. However, from a net sales perspective, the current uncertainties in the marketplace cause us to be a little more cautious with our expectations for Q4 compared to three to six months ago. Additionally, we have a more competitive environment and a less favorable product mix than first anticipated. However, as we will discuss in a few minutes, our savings plans are being accelerated and look to offset much of this pressure.

Next, we cover our Construction business on page 9. Backlog for the business stands at $164 million, which is down from the $188 million achieved in the prior year’s second quarter. It’s important to remember that ASV, while not reported in our current results, is still included in the historic periods and is noted in the shaded portion of the graph. Adjusted for this, as well as the impact of currency in the backlog, the Construction business shows a modest improvement. As we look to the second half, the strength in our North American concrete truck business and dumper business is offset with weakness in our German and Indian compact equipment businesses.

On page 10, we show our Cranes business, which continues to operate in a fairly stable but muted demand environment. The Utilities business remains our most consistent performer in this segment and we expect that trend to continue into the second half of the year as we look to continue to grow this business as well as our North American services business. For our Cranes products, excluding the impact

of foreign exchange, backlog is down 11% from the second quarter of last year. Continued softness in the North American market driven by oil and gas and the Australian market driven by commodity prices has particularly impacted our rough terrain and pick and carry products. We see this continuing into the second half of the year, offset somewhat by improvements in our other product categories.

Turning to page 11, our MHPS business results for backlog reflect the delivery of the substantial port automation solutions projects in 2014. Our backlog is down versus the second quarter of 2014 by approximately 27%, 17% excluding foreign currency; however, much of that change can be isolated to the automation product order book, as is illustrated by the shaded part of the bar graphs on this page. Although our order book for mobile harbor cranes has picked up during the year it is not enough to offset the loss of the large automation projects. Our cost reduction initiatives are taking hold as most evident in our MH results as margins for this business expanded approximately 1.7 percentage points in the quarter which has helped to offset the margin impact of the decline from the automation business.

Lastly, on page 12 we discuss the MP business. The story for the MP business remains much the same from an orders perspective. The operating environment does not provide a lot of visibility and we continue to operate quarter to quarter with a high order conversion rate. We have continued to make small investments in this business building out Terex Washing Systems as well as Terex Environmental Equipment. The investment in these new product categories has helped offset some of the softness seen in the commodity driven markets such as Australia, Russia and South Africa. We believe our first half execution was positive, but we still see challenges in our markets that make us a bit cautious for the second half of the year.

Now turning to page 13, we will review the progress we are making with our improvement initiatives. You may recall in October last year, we communicated the launch of our improvement program that targeted $202 million of operating profit impact on a run rate basis leaving 2016. We were targeting approximately $50 million of benefit in 2015. We are pleased to report that we are ahead of schedule. In the first half of the year, we achieved approximately $40 million in benefits and we are pushing our targeted full year impact for 2015 up to $100 million.

These benefits were very important in the first half in helping us offset the various headwinds we have discussed. The broad-based improvement program includes about 50 specific projects across each of our segments and corporate as well. We are grouping them into five categories: Supply Chain, Productivity/Headcount, Restructuring/Footprint, New Products/Markets and Design/Product Simplification. We are making progress in all areas, but naturally some projects are moving more rapidly than others.

For example, we are seeing very good results across our supply chain initiatives. On the other hand, our productivity initiative at AWP for example is off to a slower start than anticipated; however, we are already seeing the rate of improvement increase and we expect to meet our goal by year end here. Restructuring and footprint reduction, which is predominantly within our MHPS segment at this time, is making progress in Europe and Brazil. Growing our North American service business and expanding our global Cranes customer and product support network is contributing to the new products/markets category. Another good example is our new Genie SX-150 super boom which allows customers to work safely at a height of up to 157 feet, even in extreme environments. That is a new size category for us and will be an important product in our line-up. The Material Handling v-girder industrial cranes, our North American Construction loader backhoe, among other new products, are also making strides and MP is starting to see the benefits of its global parts initiative. Finally, our design and engineering teams around the world are focused on making our products simpler so they are less expensive and easier to manufacture and, importantly, providing greater quality, ease of use and return on investment for our customers. A great example of this is our Challenger and Explorer lines of all-terrain cranes that are progressing through a structured, multi-stage simplification process. Just to give you an example of what we are starting to see, when the team got into the boom design and manufacturing process, some fairly simple changes cut 60 hours out of the fabrication time of our boom production. In other purchased fabrications we are seeing cost reductions as high as 23%. These types of improvements are already making a meaningful difference in the cost of those machines. As they did in the first half of the year, we expect the benefits from these initiatives to play an important part in the second half of the year to help us counteract some pretty challenging market conditions.

So in summary, on page 14, we expect AWP and MP to carry the profit momentum into the second half of 2015. As mentioned a few times on this call, we continue to be pleased with the execution on our internal initiatives, delivering more in 2015 than originally planned, allowing us to offset much of the pressure on our various businesses stemming from the market environment. In reviewing the full year, we felt the lower end of our previous guidance was more in line with our current expectation. Accordingly, we have established an EPS range around a mid-point of $2.00 down from a mid-point of $2.15.

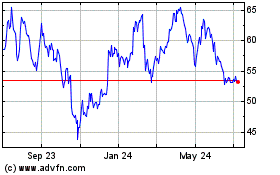

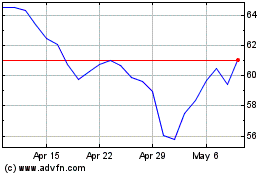

Terex (NYSE:TEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Terex (NYSE:TEX)

Historical Stock Chart

From Apr 2023 to Apr 2024