UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

TEREX CORPORATION

(Exact name of Registrant as specified in its charter)

|

| | |

Delaware | 001-10702 | 34-1531521 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| |

200 Nyala Farm Road, Westport, Connecticut | 06880 |

(Address of Principal Executive Offices) | (Zip Code) |

|

| | |

Eric I Cohen, Esq. | | (203) 222-7170 |

(Name and telephone number, including area code, of the person to contact in connection with this report.) |

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

ý Rule 13p-1 under the Securities Exchange Act for the reporting period from January 1 to December 31, 2014.

Section 1 – Conflict Minerals Disclosure

Item 1.01 – Conflict Minerals Disclosure and Report

Terex Corporation (the "Company") evaluated its current product lines and determined that certain products the Company manufactures or contracts to manufacture contain tin, tungsten, tantalum and/or gold. The Company has filed a Conflict Minerals Report, which is attached as an exhibit in Item 2.01 and is also publicly available on the Company’s website at www.terex.com.

Item 1.02 - Exhibit

The Company has filed a Conflict Minerals Report as Exhibit 1.01 to this Form SD.

Section 2 – Exhibits

Item 2.01 – Exhibits

|

| |

Exhibit | Description |

1.01 | Conflict Minerals Report for 2014 |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 1, 2015

|

| | |

| TEREX CORPORATION |

| | |

|

By: /s/ Eric I Cohen |

| Eric I Cohen Senior Vice President, Secretary and General Counsel |

2

Exhibit 1.01

Terex Corporation

Conflict Minerals Report

For Calendar Year Ended December 31, 2014

Introduction

This report of Terex Corporation (the “Company” or “we”) for the year ended December 31, 2014 is presented to comply with Rule 13p-1 under the Securities Exchange Act of 1934 (“Rule”). The Rule was adopted by the Securities and Exchange Commission (“SEC”) to implement reporting and disclosure requirements related to conflict minerals as directed by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”). Conflict minerals are defined by the SEC as columbite-tantalite (coltan), cassiterite, gold, wolframite, or their derivatives, which are limited to tantalum, tin, tungsten and gold (“3TG”) for the purposes of this assessment. These requirements apply to registrants whatever the geographic origin of the conflict minerals and whether or not they fund armed conflict.

Company Overview

We are a lifting and material handling solutions company. We operate a diverse portfolio of specialized machinery manufacturing businesses that serve numerous end-use applications in several geographic markets. We design and manufacture aerial work platform equipment, construction equipment, cranes, material handling equipment, port equipment and materials processing equipment.

Supply Chain

Early in 2013 the Company determined that certain of its products were likely to contain 3TG. We completed an analysis of our global supply base, including an initial filter based on probability of having 3TG content and a segmentation based on expenditure and risk characteristics.

We rely on our direct suppliers to provide information on the origin of the 3TG contained in components and materials supplied to us – including sources of 3TG that are supplied to them from lower tier suppliers. Due to the depth of the supply chain, the Company is far removed from the sources of ore from which these minerals are produced and the smelters/refiners that process those ores. The efforts undertaken to identify the countries of origin of those ores reflect our circumstances and position in the supply chain. The amount of information available globally on the traceability and sourcing of these ores is limited at this time. We do not believe this situation is unique to the Company.

Agreements with our suppliers are frequently in force for multiple years and we cannot unilaterally impose new contract terms and flow-down requirements. As we enter into new agreements, we are including a clause to require suppliers to provide information about the source of 3TG in the products supplied to the Company.

Conflict Minerals Policy

The Company developed and published the following Conflict Minerals Policy on its website at www.terex.com under “About Terex” - “Corporate Citizenship”:

Background

In 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) requiring the Securities and Exchange Commission (SEC) to issue rules specifically relating to the use of “Conflict Minerals” within manufactured products. Conflict Minerals are defined by the U.S. State Department as tin, tantalum, tungsten and gold (also known as the 3TGs) and related derivatives originating from the Democratic Republic of the Congo (DRC) and adjoining countries (collectively, DRC Region). The SEC rules require all SEC registrants whose commercial products contain any 3TGs to determine whether the minerals originated from the DRC Region, and, if so, are they conflict free. By enacting this provision, Congress intends to further the humanitarian goal of ending the extremely violent conflict in the DRC Region, which has been partially financed by the exploitation and trade of Conflict Minerals originating in the DRC Region.

Commitment

Terex is committed to ethical practices and compliance with applicable laws and regulations wherever it does business. Terex is guided by its core beliefs and values as stated in Terex’s Code of Ethics and Conduct. Terex believes that its commitment to integrity and citizenship extends to its worldwide supply base. As a result, Terex has designed its conflict minerals reporting efforts to align and comply with Dodd-Frank’s conflict minerals reporting rules.

Expectations of Suppliers

Terex expects its suppliers to partner with it to comply with Dodd-Frank’s conflict minerals reporting rules. Terex expects its suppliers to:

(i) Complete Terex’s Conflict Minerals survey, identifying 3TG product they sell to Terex and the smelter that provided the original 3TG material (Terex’s direct suppliers may have to require successive upstream suppliers to complete Terex’s Conflict Minerals survey until the smelter is identified);

(ii) agree to cooperate with Terex in connection with any due diligence that Terex chooses to perform with respect to its country of origin inquiries; and

(iii) when Terex deems it necessary, provide reasonable proof of the due diligence performed by the supplier to support the country of origin certification provided by the supplier to Terex.

Due Diligence

Design of Due Diligence

The Company designed its overall conflict minerals procedures in conformity with the five step framework contained in the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-RiskAreas, Second Edition, and the supplements on tin, tantalum, tungsten and gold. Below is a brief summary of the Company’s due diligence framework.

2

Our conflict minerals due diligence process included: the development of a conflict minerals policy, establishment of governance structures with cross functional team members and senior executives, communication to, and engagement of, suppliers and supply chain surveying.

We stated last year that we believed it was not practicable for us to conduct a survey of all our suppliers and we thought a reasonable approach was to conduct a survey of the suppliers who represented approximately 50% of our direct material expenditures in 2013, with plans in place to increase the survey field up to 80% in 2014 and up to 100% in 2015. We continued to progress down this path and did in fact survey approximately 80% of our direct material expenditures in 2014. We also made material progress in preparing to be in a position to survey 100% of our direct materials expenditures in 2015. In addition, we included suppliers where the nature of the component, or the location of the supplier, indicated that those components were more likely to contain 3TG. We assessed our industry as well as others and confirmed that this risk and expenditure based approach was consistent with how many peer companies were approaching the conflict minerals due diligence process.

Internal Team

We have in place a management system for complying with the applicable rules. Our management system includes a Conflict Minerals Steering Committee led by our Senior Vice President, General Counsel and Senior Vice President, Chief Financial Officer, and a team of subject matter experts from relevant functions such as, supply chain, legal, information technology, audit and accounting. The team of subject matter experts is responsible for implementing our conflict minerals compliance strategy and is led by our Supply Management and Conflict Minerals Manager. Senior management has been briefed about the results of our compliance efforts on a regular basis. We have periodically reported to the Audit Committee of the Board of Directors with respect to our due diligence process and compliance obligations.

Escalation Procedure

We have longstanding grievance mechanisms whereby team members, suppliers, shareholders and others can report violations of the Company’s policies through the Terex helpline. In 2013, we added a category submission topic for conflict minerals in the Terex helpline.

Reasonable Country of Origin Inquiry

We conducted a survey of those suppliers described above using the template developed by the Electronic Industry Citizenship Coalition® (EICC®) and The Global e-Sustainability Initiative (GeSI), known as the CFSI Reporting Template (the “Template”). The Template was developed to facilitate disclosure and communication of information regarding smelters that provide material to a company’s supply chain. It includes questions regarding a company’s conflict-free policy, engagement with its direct suppliers, and a listing of the smelters the company and its suppliers use. In addition, the template contains questions about the origin of conflict minerals included in their products, as well as supplier due diligence. Written instructions and recorded training illustrating the use of the tool is available on EICC’s website. The Template is being used by many companies in their due diligence processes related to conflict minerals.

As stated above, we increased our survey field to approximately 80% of our direct material expenditures (from 50% in 2013). As we went deeper into our supply chain, our response rate decreased from over 50% to approximately 30%. This was not unexpected as the further we go into our supply chain the less likely our suppliers are to understand the conflict minerals reporting requirements and the more supplier training is needed. However, although the response rate in 2014 decreased, the overall supplier spend that responded to our survey increased in 2014. We made multiple follow-up inquiries to each supplier surveyed who did not respond to the initial survey. We reviewed the responses against criteria developed to grade supplier responses and determine which suppliers required a follow-up inquiry. These criteria included untimely or incomplete responses as well as inconsistencies within the data reported.

3

The Company has conducted a good faith reasonable country of origin inquiry and, although the Company has no reason to believe any of its suppliers have provided materials that contained 3TG from sources that may support conflict in the Democratic Republic of Congo or any adjoining country, at this time the Company is unable to determine the origin of all of the 3TG used in its products.

The Company has made statements in this Conflict Minerals Report that may constitute forward-looking statements about its plans to take additional actions or to implement additional policies or procedures with respect to its “reasonable country of origin inquiry” and due diligence to determine the origin of Conflict Minerals included in Company products. The Company undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. The Company’s reporting obligations under the Dodd-Frank Act may change in the future, and its ability to implement certain processes may differ materially from those anticipated or implied in this report. Additionally, the Company relies on its direct material suppliers, which may be many steps removed from smelters or refiners of Conflict Minerals in supply chains, for information required to meet its reporting obligations. There can be no assurance that the information received from its direct suppliers will be complete and accurate or that when the Company receives such information, it will be able to make a determination as to whether the products manufactured contain Conflict Minerals originating in certain countries in support of armed groups operating in those countries.

4

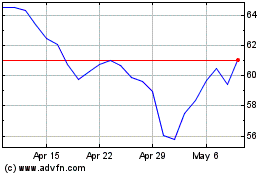

Terex (NYSE:TEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

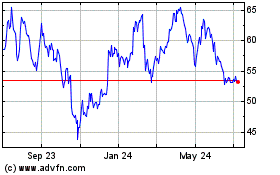

Terex (NYSE:TEX)

Historical Stock Chart

From Apr 2023 to Apr 2024