Vivendi Acquires Pay TV Business of Italy's Mediaset -- WSJ

April 09 2016 - 2:31AM

Dow Jones News

By Nick Kostov

PARIS -- Vivendi SA has agreed to acquire the pay-TV business of

Italy's Mediaset SpA as part of a broader alliance, as the French

media firm snaps up assets to create a European rival to U.S.

streaming-video giant Netflix Inc.

Under the terms of the deal, Vivendi and Mediaset will swap 3.5%

stakes, the companies said on Friday. Reflecting Vivendi's

much-larger market capitalization, the French company will take

control of Mediaset's 89% stake in pay-TV unit Mediaset

Premium.

As part of the deal, Vivendi is buying the remaining 11% of

Mediaset Premium from Spain's Telefónica SA. Some analysts value

the pay-TV unit, which isn't profitable, at about EUR900 million

($1.02 billion).

The alliance with Mediaset is a key step in Vivendi Chairman

Vincent Bolloré's project to build a multilingual, pan-European

group to challenge Netflix and pay-TV giant Sky PLC. Vivendi and

Mediaset also said they would work together on a new European

streaming service.

"When Netflix announced it was opening in France, Spain, Italy,

it was clear Vivendi as a media company would have to adapt," said

a person familiar with Vivendi's thinking, adding that it also has

its sights on the U.S. market.

Subscription video-on-demand services such as Netflix and Amazon

Inc.'s Prime have sent traditional broadcasters scrambling, as the

emerging services gain millions of customers each year and built

libraries of their own content.

Netflix, which launched in Italy, Spain and Portugal last fall,

said in January it was expanding its Internet TV network to another

130 countries around the world. But European viewers, most of whom

prefer watching programs in their local language, pose a challenge

for the Los Gatos, Calif.-based firm. While it has a well-stocked

library of movies and TV programs in the U.S., Netflix has limited

offering in its European countries, where the content rights have

often already been sold to other distributors.

Vivendi is betting that it can copy Netflix's streaming service

in Europe by simultaneously buying rights in several territories.

Traditionally, studios have sold the rights for TV shows country by

country.

Vivendi is also buying some independent studios, underscoring

its belief that local content in countries like France, Spain and

Italy will appeal to large audiences in Africa and Latin America

that speak the same languages. On Friday, it said it would work

jointly with Mediaset to create content.

"If we want to be serious we have to invest in original local

content -- that's what makes the difference," Dominique Delport,

president of Vivendi Content, said earlier in the week.

To be sure, Netflix's global expansion has continued apace even

as streaming competitors emerge. In the latest quarter, Netflix

added four million international customers, ending with a total of

75 million subscribers.

Moreover, Netflix has a bigger budget for content acquisition

than local competitors. While much of its spending on original

content has been for premium English-language entertainment, it has

also been investing in local-language series such as the coming

political drama "Marseille," its first French original

production.

Mr. Bolloré has been pushing Vivendi to transform itself since

taking the helm of the once-sprawling conglomerate in 2014.

In recent months, he has shaken up its French pay-TV unit Canal

Plus and put a multibillion-dollar cash chest to work, buying large

stakes in Telecom Italia SpA and two French videogame companies,

Ubisoft SA and Gameloft SE.

Vivendi's share price, which rose 85 European cents to EUR18.42

on Friday, has dropped more than 20% over the last 12 months as

shareholders complained of a lack of clarity in the company's

direction. In its latest annual report,Vivendi said it still had a

EUR6.4 billion cash pile.

"The Mediaset Premium acquisition is the first stage in

Vivendi's project to create a global media group with Latin roots,"

said Jerome Bodin, an analyst at Natixis. "They're trying to create

a cultural group that's sufficiently large and homogenous to exist

on the global stage."

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

April 09, 2016 02:16 ET (06:16 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

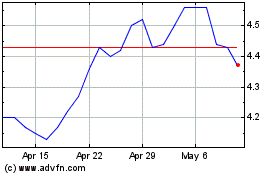

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

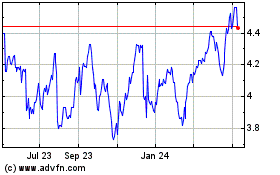

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024